Steve Hirsch – Chief Data Officer and Chief Architect XLDB Conference, 10/6/10

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the Matter of New York Stock Exchange LLC, and NYSE Euronext

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES EXCHANGE ACT OF 1934 Release No. 67857 / September 14, 2012 ADMINISTRATIVE PROCEEDING File No. 3-15023 In the Matter of ORDER INSTITUTING ADMINISTRATIVE AND CEASE-AND-DESIST PROCEEDINGS New York Stock Exchange LLC, and PURSUANT TO SECTIONS 19(h)(1) AND 21C NYSE Euronext, OF THE SECURITIES EXCHANGE ACT OF 1934, MAKING FINDINGS AND IMPOSING Respondents. SANCTIONS AND A CEASE-AND-DESIST ORDER I. The Securities and Exchange Commission (“Commission”) deems it appropriate and in the public interest that public administrative and cease-and-desist proceedings be, and hereby are, instituted pursuant to Sections 19(h)(1) and 21C of the Securities Exchange Act of 1934 (“Exchange Act”) against the New York Stock Exchange LLC (“NYSE”) and NYSE Euronext (collectively, “Respondents”). II. In anticipation of the institution of these proceedings, Respondents have submitted Offers of Settlement (the “Offers”) that the Commission has determined to accept. Solely for the purpose of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party, and without admitting or denying the findings herein, except as to the Commission’s jurisdiction over them and the subject matter of these proceedings, which are admitted, Respondents consent to the entry of this Order Instituting Administrative and Cease-and-Desist Proceedings Pursuant to Sections 19(h)(1) and 21C of the Securities Exchange Act of 1934, Making Findings and -

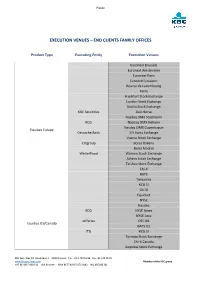

Execution Venues – End Clients Family Offices

Public EXECUTION VENUES – END CLIENTS FAMILY OFFICES Product Type Executing Entity Execution Venues Euronext Brussels Euronext Amsterdam Euronext Paris Euronext Lissabon Bourse de Luxembourg Xetra Frankfurt Stock Exchange London Stock Exchange Dublin Stock Exchange KBC Securities Oslo Borse Nasdaq OMX Stockholm KCG Nasdaq OMX Helsinki Nasdaq OMX Copenhague Equities Europe Deutsche Bank SIX Swiss Exchange Vienna Stock Exchange Citigroup Borsa Italiana Bolsa Madrid Winterflood Warsaw Stock Exchange Athens Stock Exchange Tel Aviv Stock Exchange Chi-X BATS Turquoise KCG SI Citi SI Equiduct NYSE Nasdaq KCG NYSE Amex NYSE Arca Jefferies OTC BB Equities US/Canada BATS US ITG KCG SI Toronto Stock Exchange Chi-X Canada Aequitas Stock Exchange KBC Securities NV Havenlaan 2 – 1080 Brussels Tel. +32 2 429 16 86 Fax +32 429 98 39 www.kbcsecurities.com Member of the KBC group VAT BE 0437.060.521 RLP Brussels IBAN BE77 4096 5474 0142 BIC KREDBE BB Public Product Type Executing Entity Execution Venues Tokyo Stock Exchange Instinet Hong Kong Stock Exchange Singapore Stock Exchange Equities Asia/Afrika Jefferies Sydney Stock Exchange Chi-X Johannesburg Stock Exchange Euronext Brussels KBC Securities Euronext Amsterdam Structured products Deutsche Bank Euronext Paris Banca IMI Frankfurt Stock Exchange Borsa Italiana Euronext Brussels KBC Securities Euronext Amsterdam Euronext Paris Listed Bonds Frankfurt Stock Exchange Banca IMI Bourse de Luxembourg Borsa Italiana Bloomberg MTF OTC Bonds KBC Bank Banca IMI Listed NAV-funds KBC Securities Euronext Amsterdam OTC NAV-funds Transfer Agents Euronext Brussels Euronext Amsterdam Euronext Paris KBC Securities Eurex Intercontinental Exchange Societe Generale AMEX Listed derivatives BATS AFS Boston Stock Exchange CBOE Merrill Lynch ISE Nasdaq NYSE Arca Philadelphia Stock Exchange KBC Securities NV Havenlaan 2 – 1080 Brussels Tel. -

NYSE Arca, Inc

NYSE Arca, Inc. Equity Trading Permit Application and Contracts TABLE OF CONTENTS Page Application Process 2 Application Checklist & Fees 3 Explanation of Terms 4 Application for Equity Trading Permit (Sections 1-6) 6 - 11 Individual Registration & Key Personnel (Section 7) 12-13 Designated Examining Authority (DEA) Applicant ETP (Section 8) 15 NYSE Arca ETP Application - October 2019 1 APPLICATION PROCESS Filing Requirements Prior to submitting the Application for Equity Trading Permit (“ETP”), an Applicant Broker-Dealer must file a Uniform Application for Broker-Dealer Registration (Form-BD) with the Securities and Exchange Commission and register with the FINRA Central Registration Depository (“Web CRD®”). Checklist Applicant Broker-Dealer must complete and submit all applicable materials addressed in the Application Checklist (page 4) to [email protected]. Note: All application materials sent to NYSE Arca will be reviewed by NYSE Arca’s Client Relationship Services (“CRS”) Department for completeness. The applications are then submitted to FINRA who performs the application approval recommendation. All applications are deemed confidential and are handled in a secure environment. CRS or FINRA may request applicants to submit documentation in addition to what is listed in the Application Checklist during the application review process, pursuant to NYSE Arca Rule 2.4. If you have questions on completing the application, you may direct them to: Client Relationship Services: Email: [email protected] or (212) 896-2830. Application Process • Following submission of the Application for Equity Trading Permit and supporting documents to NYSE Arca, Inc. (“NYSE Arca”), the application will be reviewed for accuracy and regulatory or other disclosures. NYSE Arca will submit the application to FINRA for review and approval recommendation. -

Thomson One Symbols

THOMSON ONE SYMBOLS QUICK REFERENCE CARD QUOTES FOR LISTED SECURITIES TO GET A QUOTE FOR TYPE EXAMPLE Specific Exchange Hyphen followed by exchange qualifier after the symbol IBM-N (N=NYSE) Warrant ' after the symbol IBM' When Issued 'RA after the symbol IBM'RA Class 'letter representing class IBM'A Preferred .letter representing class IBM.B Currency Rates symbol=-FX GBP=-FX QUOTES FOR ETF TO GET A QUOTE FOR TYPE Net Asset Value .NV after the ticker Indicative Value .IV after the ticker Estimated Cash Amount Per Creation Unit .EU after the ticker Shares Outstanding Value .SO after the ticker Total Cash Amount Per Creation Unit .TC after the ticker To get Net Asset Value for CEF, type XsymbolX. QRG-383 Date of issue: 15 December 2015 © 2015 Thomson Reuters. All rights reserved. Thomson Reuters disclaims any and all liability arising from the use of this document and does not guarantee that any information contained herein is accurate or complete. This document contains information proprietary to Thomson Reuters and may not be reproduced, transmitted, or distributed in whole or part without the express written permission of Thomson Reuters. THOMSON ONE SYMBOLS Quick Reference Card MAJOR INDEXES US INDEXES THE AMERICAS INDEX SYMBOL Dow Jones Industrial Average .DJIA Airline Index XAL Dow Jones Composite .COMP AMEX Computer Tech. Index XCI MSCI ACWI 892400STRD-MS AMEX Institutional Index XII MSCI World 990100STRD-MS AMEX Internet Index IIX MSCI EAFE 990300STRD-MS AMEX Oil Index XOI MSCI Emerging Markets 891800STRD-MS AMEX Pharmaceutical Index -

Nyse Group Announces 2020, 2021 and 2022 Holiday and Early Closings Calendar

INVESTORS NYSE GROUP ANNOUNCES 2020, 2021 AND 2022 HOLIDAY AND EARLY CLOSINGS CALENDAR Released : 09 December 2019 NEW YORK, December 9, 2019 -- NYSE Group announced today the 2022 holiday calendar and early closing dates for its cash equity markets: New York Stock Exchange, NYSE American, NYSE Arca Equities, NYSE Chicago, and NYSE National, as well as the NYSE American Options, NYSE Arca Options and NYSE Bonds markets. The 2020 and 2021 holiday and early closing dates are also set forth below. HOLIDAY 2020 2021 2022 New Year’s Day Wednesday, January 1 Friday, January 1 -- Martin Luther King, Jr. Day Monday, January 20 Monday, January 18 Monday, January 17 Washington's Birthday Monday, February 17 Monday, February 15 Monday, February 21 Good Friday Friday, April 10 Friday, April 2 Friday, April 15 Memorial Day Monday, May 25 Monday, May 31 Monday, May 30 Independence Day Friday, July 3 Monday, July 5 Monday, July 4 (July 4 holiday observed) (July 4 holiday observed) Labor Day Monday, September 7 Monday, September 6 Monday, September 5 Thanksgiving Day Thursday, November 26* Thursday, November 25* Thursday, November 24* Christmas Day Friday, December 25** Friday, December 24 Monday, December 26 (Christmas holiday observed) (Christmas holiday observed) * Each market will close early at 1:00 p.m. (1:15 p.m. for eligible options) on Friday, November 27, 2020, Friday, November 26, 2021, and Friday, November 25, 2022 (the day after Thanksgiving). Crossing Session orders will be accepted beginning at 1:00 p.m. for continuous executions until 1:30 p.m. on these dates, and NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 pm. -

NYSE Euronext and APX to Establish NYSE Bluetm, a Joint Venture Targeting Global Environmental Markets

NYSE Euronext and APX to Establish NYSE BlueTM, a Joint Venture Targeting Global Environmental Markets • NYSE Euronext will contribute its ownership in BlueNext in return for a majority interest in the joint venture; • APX, a leading provider of operational infrastructure and services for the environmental and energy markets, will contribute its business in return for a minority interest in the venture; • NYSE Blue will focus on environmental and sustainable energy initiatives, and will further NYSE Euronext’s efforts to increase its presence in environmental markets globally while attracting new partners and customers. New York, September 7, 2010 -- NYSE Euronext (NYX) today announced plans to create NYSE BlueTM, a joint venture that will focus exclusively on environmental and sustainable energy markets. NYSE Blue will include NYSE Euronext’s existing investment in BlueNext, the world’s leading spot market in carbon credits, and APX, Inc., a leading provider of regulatory infrastructure and services for the environmental and sustainable energy markets. NYSE Euronext will be a majority owner of NYSE Blue and will consolidate its results. Shareholders of APX, which include Goldman Sachs, MissionPoint Capital Partners, and ONSET Ventures, will take a minority stake in NYSE Blue in return for their shares in APX. Subject to customary closing conditions, including APX shareholder approval and regulatory approvals, the APX transaction is expected to close by the end of 2010. NYSE Blue will provide a broad offering of services and solutions including integrated pre-trade and post-trade platforms, environmental registry services, a front-end solution for accessing the markets and managing environmental portfolios, environmental markets reference data, and the BlueNext trading platform. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Execution Venues Equities and Fixed Income

UBS AG London Branch 5 Broadgate London EC2M 2QS United Kingdom UBS Europe SE OpernTurm Bockenheimer Landstraße 2-4 60306 Frankfurt am Main Germany www.ubs.com/ibterms Execution venues Equities and fixed income Version: December 2020 For information about our investment bank entities, visit www.ubs.com/ibterms Execution venues This is a non-exhaustive list of the main execution venues that we use outside UBS and our own systematic internalisers. We will review and update it from time to time in accordance with our UK and EEA MiFID Order Handling & Execution Policy. We may use other execution venues where appropriate. Equities Cash Equities Direct access Aquis Exchange Europe Aquis Exchange PlcAthens Stock Exchange BATS Europe, a CBOE Company Borsa Italiana CBOE NL CBOE UK Citadel Securities (Europe) Limited SI Deutsche Börse Group - Xetra Euronext Amsterdam Stock Exchange Euronext Brussels Stock Exchange Euronext Lisbon Stock Exchange Euronext Paris Stock Exchange Instinet Blockmatch Euronext DublinITG Posit London Stock Exchange Madrid Stock Exchange Nasdaq Copenhagen Nasdaq Helsinki Nasdaq Stockholm Oslo Bors Sigma X Europe Sigma X MTFTower Research Capital Europe Limited SI Turquoise Europe TurquoiseUBS Investment Bank UBS MTF Vienna Stock Exchange Virtu Financial Ireland Limited Warsaw Stock Exchange Via intermediate broker Budapest Stock Exchange Cairo & Alexandria Stock Exchange Deutsche Börse - Frankfurt Stock Exchange Istanbul Stock Exchange Johannesburg Stock Exchange Moscow Exchange Prague Stock Exchange SIX Swiss Exchange Tel Aviv Stock Exchange Structured Products Direct access Börse Frankfurt (Zertifikate Premium) Börse Stuttgart (EUWAX) Xetra SIX Swiss Exchange SeDeX Milan Euronext Amsterdam London Stock Exchange Madrid Stock Exchange NASDAQ OMX Stockholm JSE Johannesburg Stock Exchange OTC matching CATS-OS Fixed Income Cash bonds Via Bond Port Bloomberg EuroTLX Euronext ICE (KCG) BondPoint Market Axess MOT MTS BondsPro 1 © UBS 2020. -

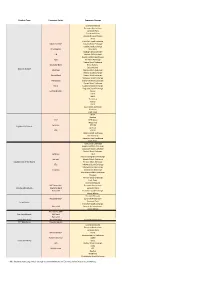

Product Type Executing Entity Execution Venues

Product Type Executing Entity Execution Venues Euronext Brussels Euronext Amsterdam Euronext Paris Euronext Lisbon Bourse de Luxembourg Xetra Frankfurt Stock Exchange KBC Securities* London Stock Exchange Dublin Stock Exchange Credit Suisse Oslo Borse Nasdaq OMX Stockholm ITG Nasdaq OMX Helsinki Nasdaq OMX Copenhague KCG SIX Swiss Exchange Vienna Stock Exchange Deutsche Bank Borsa Italiana Bolsa Madrid Equities Europe Citigroup Warsaw Stock Exchange Athens Stock Exchange Winterflood Prague Stock Exchange Budapest Stock Exchange Intercapital Bucharest Stock Exchange Zagreb Stock Exchange Patria Ljubljana Stock Exchange Belgrade Stock Exchange Lombard Odier Micex Chi-X BATS Turquoise KCG SI Citi SI Aquis Stock Exchange Equiduct Dark Pools NYSE Nasdaq KCG NYSE Amex NYSE Arca Jefferies OTC BB Equities US/Canada BATS US ITG KCG SI Toronto Stock Exchange Chi-X Canada Aequitas Stock Exchange Dark Pools Tokyo Stock Exchange Hong Kong Stock Exchange Singapore Stock Exchange Sydney Stock Exchange Jefferies Chi-X Johannesburg Stock Exchange Instinet Istanbul Stock Exchange Equities Rest of the World Tel Aviv Stock Exchange ITG Indonesia Stock Exchange Malaysia Stock Exchange Citigroup Korea Stock Exchange New Zealand Stock Exchange Bovespa Mexican Stock Exchange Dark Pools Euronext Brussels KBC Securities* Euronext Amsterdam Structured products Deutsche Bank Euronext Paris Banca IMI Frankfurt Stock Exchange Borsa Italiana Euronext Brussels KBC Securities* Euronext Amsterdam Euronext Paris Listed Bonds Frankfurt Stock Exchange Banca IMI Bourse de Luxembourg Borsa Italiana Bloomberg MTF Non-listed Bonds KBC Bank Banca IMI Listed NAV-funds KBC Securities* Euronext Amsterdam OTC NAV-funds Transfer Agents Euronext Brussels Euronext Amsterdam Euronext Paris KBC Securities* Eurex Intercontinental Exchange Societe Generale AMEX Listed derivatives BATS AFS Boston Stock Exchange CBOE Merrill Lynch ISE Nasdaq NYSE Arca Philadelphia Stock Exchange * = KBC Securities executing directly through its own membership on Euronext and on Bourse de Luxembourg. -

NYSE Arca Options Fee Schedule

Arca Options NYSE Arca Options Fees and Charges Effective Date: September 1, 2021 NYSE Arca GENERAL OPTIONS and TRADING PERMIT (OTP) FEES OTP TRADING PARTICIPANT RIGHTS Office or Clearing Firms1 $1,000 per month per OTP Floor Broker1 $500 per month per OTP NYSE Arca Market Makers1 Number of Option Issues Permitted in Market Monthly Fee Per OTP Maker’s Assignment $6,000 for 1st OTP Up to 175 option issues $5,000 for the 2nd OTP Up to 350 option issues $4,000 for the 3rd OTP Up to 1,000 option issues $3,000 for the 4th OTP All option issues traded on the Exchange $1,000 for the 5th and additional OTPs All option issues traded on the Exchange $175 for Reserve OTP N/A Average National Daily Monthly Issue Fee Customer Contracts 0 to 100 $25 Lead Market Maker Rights2 101 to 1,000 $35 1,001 to 2,000 $75 2,001 to 5,000 $200* 5,001 to 15,000 $750* 15,001 to 100,000 $1,500* Over 100,000 $3,000* *Discount to Lead Market Maker (“LMM”) Rights Fee: An LMM may earn a discount applied to issues in the four highest activity tiers. The discount is based on the amount of monthly (i) total electronic volume and/or (ii) total posted volume executed in the Market Maker range relative to other Market Makers appointed in that issue. For each issue, each month, the following will apply: LMM Ranking Discount to LMM Rights Fee 1st in total electronic volume 50% 2nd in total electronic 40% volume 3rd in total electronic volume 30% 4th or lower ranking in total N/A electronic volume 1st in total posted volume 50% 2nd in total posted volume 40% 3rd in total posted volume 30% 4th or lower ranking in total N/A posted volume The discounts are cumulative and the same LMM is eligible to achieve the discount for each monthly volume category. -

The NYSE Arca China Index (CZH)

NYSE ARCA The NYSE Arca China Index (CZH) Index Description percent (57%) of the Index. The bottom five securities are equally weighted to represent The NYSE Arca China Index (“Index”) is a ten percent (10%) of the Index or two percent modified equal weighted index comprised of each (2%). The securities not in the top five or selected publicly traded stocks and American bottom five are equally weighted to represent Depositary Receipts (“ADRs”) of companies thirty-three percent (33%) of the Index. with significant exposure to the Chinese economy. The Index divisor was initially Index Level determined to yield a benchmark value of The official closing level of the index is 100.00 at the close of trading on December calculated each day using the official 19, 2003. The Index is calculated and closing price from the primary listing maintained by the NYSE Arca (“NYSE Arca”). exchange of each index constituent. If no Similar to other stock indices calculated by official closing price is available due to the the NYSE Arca, the value of the Index will following reasons, the respective course of be disseminated every 15 seconds over the action will be taken: Consolidated Tape Association’s Network B 1. Trading of index component is between the hours of approximately 9:30am suspended before market close and and 4:15pm. remains suspended through market close Eligibility Criteria for – The index will use the last traded price of the current day from the primary listing Index Components exchange in calculating the current day’s The Index includes companies whose official closing level. -

Understanding the Market for U.S. Equity Market Data

Understanding the Market for U.S. Equity Market Data Charles M. Jones1 August 31, 2018 1 Robert W. Lear Professor of Finance and Economics, Columbia Business School. I am solely responsible for the contents of this paper. I thank Larry Glosten, Frank Hatheway, Terry Hendershott, Stewart Mayhew, Jonathan Sokobin, and Chester Spatt for helpful discussions on these topics. I currently serve on FINRA’s Economic Advisory Committee and on Nasdaq’s Quality of Markets Committee, and I served as Visiting Economist at the New York Stock Exchange (“NYSE”) in 2002–2003. The NYSE provided financial support for this research. I. Executive Summary A stock exchange facilitates share trading, in large part by developing computer systems, rules, and processes that allow buyers and sellers to submit orders, trade with each other, and determine a market price for shares listed on those exchanges. In the current market environment, this results in a vast amount of data, which market participants of all types rely on to make investment and trading decisions. Exchanges provide some of this market data to market participants at prices that vary depending on the type of data as well as how the data is used. This paper provides an analysis of the market for equity market data in the United States. Unlike other data sources, U.S. equity market data is highly regulated by the Securities and Exchange Commission (“SEC”), and recently the SEC has been lobbied by entities arguing that exchanges charge too much. These entities have written comment letters and filed a number of proceedings with the SEC in an effort to reduce the prices of equity market data.