NYSE Euronext and APX Complete Transaction and Form NYSE Blue℠

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the Matter of New York Stock Exchange LLC, and NYSE Euronext

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES EXCHANGE ACT OF 1934 Release No. 67857 / September 14, 2012 ADMINISTRATIVE PROCEEDING File No. 3-15023 In the Matter of ORDER INSTITUTING ADMINISTRATIVE AND CEASE-AND-DESIST PROCEEDINGS New York Stock Exchange LLC, and PURSUANT TO SECTIONS 19(h)(1) AND 21C NYSE Euronext, OF THE SECURITIES EXCHANGE ACT OF 1934, MAKING FINDINGS AND IMPOSING Respondents. SANCTIONS AND A CEASE-AND-DESIST ORDER I. The Securities and Exchange Commission (“Commission”) deems it appropriate and in the public interest that public administrative and cease-and-desist proceedings be, and hereby are, instituted pursuant to Sections 19(h)(1) and 21C of the Securities Exchange Act of 1934 (“Exchange Act”) against the New York Stock Exchange LLC (“NYSE”) and NYSE Euronext (collectively, “Respondents”). II. In anticipation of the institution of these proceedings, Respondents have submitted Offers of Settlement (the “Offers”) that the Commission has determined to accept. Solely for the purpose of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party, and without admitting or denying the findings herein, except as to the Commission’s jurisdiction over them and the subject matter of these proceedings, which are admitted, Respondents consent to the entry of this Order Instituting Administrative and Cease-and-Desist Proceedings Pursuant to Sections 19(h)(1) and 21C of the Securities Exchange Act of 1934, Making Findings and -

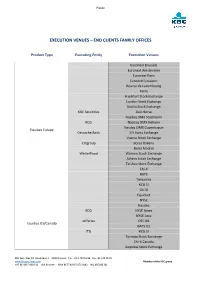

Execution Venues – End Clients Family Offices

Public EXECUTION VENUES – END CLIENTS FAMILY OFFICES Product Type Executing Entity Execution Venues Euronext Brussels Euronext Amsterdam Euronext Paris Euronext Lissabon Bourse de Luxembourg Xetra Frankfurt Stock Exchange London Stock Exchange Dublin Stock Exchange KBC Securities Oslo Borse Nasdaq OMX Stockholm KCG Nasdaq OMX Helsinki Nasdaq OMX Copenhague Equities Europe Deutsche Bank SIX Swiss Exchange Vienna Stock Exchange Citigroup Borsa Italiana Bolsa Madrid Winterflood Warsaw Stock Exchange Athens Stock Exchange Tel Aviv Stock Exchange Chi-X BATS Turquoise KCG SI Citi SI Equiduct NYSE Nasdaq KCG NYSE Amex NYSE Arca Jefferies OTC BB Equities US/Canada BATS US ITG KCG SI Toronto Stock Exchange Chi-X Canada Aequitas Stock Exchange KBC Securities NV Havenlaan 2 – 1080 Brussels Tel. +32 2 429 16 86 Fax +32 429 98 39 www.kbcsecurities.com Member of the KBC group VAT BE 0437.060.521 RLP Brussels IBAN BE77 4096 5474 0142 BIC KREDBE BB Public Product Type Executing Entity Execution Venues Tokyo Stock Exchange Instinet Hong Kong Stock Exchange Singapore Stock Exchange Equities Asia/Afrika Jefferies Sydney Stock Exchange Chi-X Johannesburg Stock Exchange Euronext Brussels KBC Securities Euronext Amsterdam Structured products Deutsche Bank Euronext Paris Banca IMI Frankfurt Stock Exchange Borsa Italiana Euronext Brussels KBC Securities Euronext Amsterdam Euronext Paris Listed Bonds Frankfurt Stock Exchange Banca IMI Bourse de Luxembourg Borsa Italiana Bloomberg MTF OTC Bonds KBC Bank Banca IMI Listed NAV-funds KBC Securities Euronext Amsterdam OTC NAV-funds Transfer Agents Euronext Brussels Euronext Amsterdam Euronext Paris KBC Securities Eurex Intercontinental Exchange Societe Generale AMEX Listed derivatives BATS AFS Boston Stock Exchange CBOE Merrill Lynch ISE Nasdaq NYSE Arca Philadelphia Stock Exchange KBC Securities NV Havenlaan 2 – 1080 Brussels Tel. -

NYSE Arca, Inc

NYSE Arca, Inc. Equity Trading Permit Application and Contracts TABLE OF CONTENTS Page Application Process 2 Application Checklist & Fees 3 Explanation of Terms 4 Application for Equity Trading Permit (Sections 1-6) 6 - 11 Individual Registration & Key Personnel (Section 7) 12-13 Designated Examining Authority (DEA) Applicant ETP (Section 8) 15 NYSE Arca ETP Application - October 2019 1 APPLICATION PROCESS Filing Requirements Prior to submitting the Application for Equity Trading Permit (“ETP”), an Applicant Broker-Dealer must file a Uniform Application for Broker-Dealer Registration (Form-BD) with the Securities and Exchange Commission and register with the FINRA Central Registration Depository (“Web CRD®”). Checklist Applicant Broker-Dealer must complete and submit all applicable materials addressed in the Application Checklist (page 4) to [email protected]. Note: All application materials sent to NYSE Arca will be reviewed by NYSE Arca’s Client Relationship Services (“CRS”) Department for completeness. The applications are then submitted to FINRA who performs the application approval recommendation. All applications are deemed confidential and are handled in a secure environment. CRS or FINRA may request applicants to submit documentation in addition to what is listed in the Application Checklist during the application review process, pursuant to NYSE Arca Rule 2.4. If you have questions on completing the application, you may direct them to: Client Relationship Services: Email: [email protected] or (212) 896-2830. Application Process • Following submission of the Application for Equity Trading Permit and supporting documents to NYSE Arca, Inc. (“NYSE Arca”), the application will be reviewed for accuracy and regulatory or other disclosures. NYSE Arca will submit the application to FINRA for review and approval recommendation. -

Nyse Euronext Announces Implementation Team for New European Clearing Houses

CONTACT - Media: CONTACT - Investor Relations: nyx.com Amsterdam +31.20.550.4488 Brussels +32.2.509.1392 New York +1.212.656.5700 Please follow us at: Lisbon +351.217.900.029 London +44.20.7379.2789 Paris +33.1.49.27.58.60 Exchanges blog New York +1.212.656.2411 Paris +33.1.49.27.11.33 Facebook Twitter NYSE EURONEXT ANNOUNCES IMPLEMENTATION TEAM FOR NEW EUROPEAN CLEARING HOUSES LONDON, PARIS Wednesday 17 November 2010. Following its May announcement that it plans to launch two purpose-built clearing houses in London and Paris before the end of 2012, NYSE Euronext (NYX) today announced the leadership team which will be engaging with our customers and partners on the delivery of the project. Mark Ibbotson, formerly the Chief Operating Officer of NYSE Euronext’s Global Derivatives segment, will lead the implementation team as Executive Vice President, Global Clearing, reporting to Duncan Niederauer, the Group Chief Executive Officer. Reporting to Mr. Ibbotson will be Declan Ward, Executive Director of NYSE Liffe Clearing in London, and Michel Favreau, the Company’s Clearing Project Director in Paris. Mr. Niederauer said : “Our new European Clearing Houses will be central to our strategy of expanding our community, delivering value to customers and diversifying the business mix of NYSE Euronext. This initiative will substantially extend our post-trade capabilities and build on our existing London NYSE Liffe Clearing operations as well as our launch of NYPC in the U.S. early next year. Mark Ibbotson and his team have an exciting task ahead to develop new and innovative clearing solutions for our customers which will enable further growth in our trading franchises and open up new opportunities in clearing.” Mark Ibbotson added: “This is a very exciting opportunity to work with our customers and the wider community to develop purpose-built clearing houses in London and Paris which will deliver genuine added value to the marketplace. -

Thomson One Symbols

THOMSON ONE SYMBOLS QUICK REFERENCE CARD QUOTES FOR LISTED SECURITIES TO GET A QUOTE FOR TYPE EXAMPLE Specific Exchange Hyphen followed by exchange qualifier after the symbol IBM-N (N=NYSE) Warrant ' after the symbol IBM' When Issued 'RA after the symbol IBM'RA Class 'letter representing class IBM'A Preferred .letter representing class IBM.B Currency Rates symbol=-FX GBP=-FX QUOTES FOR ETF TO GET A QUOTE FOR TYPE Net Asset Value .NV after the ticker Indicative Value .IV after the ticker Estimated Cash Amount Per Creation Unit .EU after the ticker Shares Outstanding Value .SO after the ticker Total Cash Amount Per Creation Unit .TC after the ticker To get Net Asset Value for CEF, type XsymbolX. QRG-383 Date of issue: 15 December 2015 © 2015 Thomson Reuters. All rights reserved. Thomson Reuters disclaims any and all liability arising from the use of this document and does not guarantee that any information contained herein is accurate or complete. This document contains information proprietary to Thomson Reuters and may not be reproduced, transmitted, or distributed in whole or part without the express written permission of Thomson Reuters. THOMSON ONE SYMBOLS Quick Reference Card MAJOR INDEXES US INDEXES THE AMERICAS INDEX SYMBOL Dow Jones Industrial Average .DJIA Airline Index XAL Dow Jones Composite .COMP AMEX Computer Tech. Index XCI MSCI ACWI 892400STRD-MS AMEX Institutional Index XII MSCI World 990100STRD-MS AMEX Internet Index IIX MSCI EAFE 990300STRD-MS AMEX Oil Index XOI MSCI Emerging Markets 891800STRD-MS AMEX Pharmaceutical Index -

The Dynamics of Stock Market Development in the United States of America

Risk governance & control: financial markets & institutions / Volume 3, Issue 1, 2013, Continued - 1 THE DYNAMICS OF STOCK MARKET DEVELOPMENT IN THE UNITED STATES OF AMERICA Sheilla Nyasha*, NM Odhiambo** Abstract This paper highlights the origin and development of the stock market in the United States of America. The country consists of several stock exchanges, with the three largest being the NYSE Euronext (NYX), National Association of Securities Dealers Automated Quotation (NASDAQ), and the Chicago Stock Exchange. Stock market reforms have been implemented since the stock market crash of 1929; and the exchanges responded positively to some of these reforms, but not so positively to some of the reforms. As a result of the reforms, the U.S. stock market has developed in terms of market capitalisation, the total value of stocks traded, and the turnover ratio. Although the U.S. stock market has developed over the years, its market still faces wide-ranging challenges. Keywords: United States of America, New York Stock Exchange Euronext, NASDAQ, Stock Market, Reforms *Department of Economics, University of South Africa, P.O Box 392, UNISA, 0003, Pretoria, South Africa Email: [email protected] **Corresponding author. Department of Economics, University of South Africa, P.O Box 392, UNISA, 0003, Pretoria, South Africa Email: [email protected], [email protected] 1 Introduction investors, but they also facilitate the inflow of foreign financial resources into the domestic economy; and Stock market development is an important component they promote risky, entrepreneurial investments of financial sector development, and it supplements through their risk-sharing and monitoring functions. the role of the banking system in economic Even the most recent studies have confirmed the vital development. -

Nyse Group Announces 2020, 2021 and 2022 Holiday and Early Closings Calendar

INVESTORS NYSE GROUP ANNOUNCES 2020, 2021 AND 2022 HOLIDAY AND EARLY CLOSINGS CALENDAR Released : 09 December 2019 NEW YORK, December 9, 2019 -- NYSE Group announced today the 2022 holiday calendar and early closing dates for its cash equity markets: New York Stock Exchange, NYSE American, NYSE Arca Equities, NYSE Chicago, and NYSE National, as well as the NYSE American Options, NYSE Arca Options and NYSE Bonds markets. The 2020 and 2021 holiday and early closing dates are also set forth below. HOLIDAY 2020 2021 2022 New Year’s Day Wednesday, January 1 Friday, January 1 -- Martin Luther King, Jr. Day Monday, January 20 Monday, January 18 Monday, January 17 Washington's Birthday Monday, February 17 Monday, February 15 Monday, February 21 Good Friday Friday, April 10 Friday, April 2 Friday, April 15 Memorial Day Monday, May 25 Monday, May 31 Monday, May 30 Independence Day Friday, July 3 Monday, July 5 Monday, July 4 (July 4 holiday observed) (July 4 holiday observed) Labor Day Monday, September 7 Monday, September 6 Monday, September 5 Thanksgiving Day Thursday, November 26* Thursday, November 25* Thursday, November 24* Christmas Day Friday, December 25** Friday, December 24 Monday, December 26 (Christmas holiday observed) (Christmas holiday observed) * Each market will close early at 1:00 p.m. (1:15 p.m. for eligible options) on Friday, November 27, 2020, Friday, November 26, 2021, and Friday, November 25, 2022 (the day after Thanksgiving). Crossing Session orders will be accepted beginning at 1:00 p.m. for continuous executions until 1:30 p.m. on these dates, and NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 pm. -

Monthly Short Sales Client Specification

Document title MONTHLY SHORT SALES CLIENT SPECIFICATION NYSE MONTHLY SHORT SALES NYSE AMERICAN MONTHLY SHORT SALES NYSE ARCA MONTHLY SHORT SALES NYSE NATIONAL MONTHLY SHORT SALES (April 30, 2018) Version Date 1.2b February 5, 2018 © Copyright 2017 Intercontinental Exchange, Inc. ALL RIGHTS RESERVED. INTERCONTINENTAL EXCHANGE, INC. AND ITS AFFILIATES WHICH INCLUDE THE NEW YORK STOCK EXCHANGE, (“ICE” AND “NYSE”) MAKE NO WARRANTY WHATSOEVER AS TO THE PRODUCT DESCRIBED IN THESE MATERIALS EXPRESS OR IMPLIED, AND THE PRODUCT IS PROVIDED ON AN “AS IS” BASIS. ICE AND NYSE EXPRESSLY DISCLAIM ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. NEITHER ICE, NYSE NOR THEIR RESPECTIVE DIRECTORS, MANAGERS, OFFICERS, AFFILIATES, SUBSIDIARIES, SHAREHOLDERS, EMPLOYEES OR AGENTS MAKE ANY WARRANTY WITH RESPECT TO, AND NO SUCH PARTY SHALL HAVE ANY LIABILITY FOR (i) THE ACCURACY, TIMELINESS, COMPLETENESS, RELIABILITY, PERFORMANCE OR CONTINUED AVAILABILITY OF PRODUCT, OR (ii) DELAYS, OMISSIONS OR INTERRUPTIONS THEREIN. ICE AND NYSE DO NOT, AND SHALL HAVE NO DUTY OR OBLIGATION TO, VERIFY, MONITOR, CONTROL OR REVIEW ANY INFORMATION IN RELATION TO THE PRODUCT. ICE/NYSE MONTHLY SHORT SALES CLIENT SPECIFICATION V1.2B PREFACE DOCUMENT HISTORY The following table provides a description of all changes to this document. VERSION DATE CHANGE DESCRIPTION NO. 1.0 01/02/2012 Approved version for release 1.1 6/13/2012 Updated references to NYSE MKT 08/03/2012 Document rebranded with new NYSE Technologies template 1.2 02/24/2017 Rebranded to ICE -

NYSE Euronext and APX to Establish NYSE Bluetm, a Joint Venture Targeting Global Environmental Markets

NYSE Euronext and APX to Establish NYSE BlueTM, a Joint Venture Targeting Global Environmental Markets • NYSE Euronext will contribute its ownership in BlueNext in return for a majority interest in the joint venture; • APX, a leading provider of operational infrastructure and services for the environmental and energy markets, will contribute its business in return for a minority interest in the venture; • NYSE Blue will focus on environmental and sustainable energy initiatives, and will further NYSE Euronext’s efforts to increase its presence in environmental markets globally while attracting new partners and customers. New York, September 7, 2010 -- NYSE Euronext (NYX) today announced plans to create NYSE BlueTM, a joint venture that will focus exclusively on environmental and sustainable energy markets. NYSE Blue will include NYSE Euronext’s existing investment in BlueNext, the world’s leading spot market in carbon credits, and APX, Inc., a leading provider of regulatory infrastructure and services for the environmental and sustainable energy markets. NYSE Euronext will be a majority owner of NYSE Blue and will consolidate its results. Shareholders of APX, which include Goldman Sachs, MissionPoint Capital Partners, and ONSET Ventures, will take a minority stake in NYSE Blue in return for their shares in APX. Subject to customary closing conditions, including APX shareholder approval and regulatory approvals, the APX transaction is expected to close by the end of 2010. NYSE Blue will provide a broad offering of services and solutions including integrated pre-trade and post-trade platforms, environmental registry services, a front-end solution for accessing the markets and managing environmental portfolios, environmental markets reference data, and the BlueNext trading platform. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Ice Global Network & Colocation Us

ICE GLOBAL NETWORK & COLOCATION US US LIQUIDITY CENTER OPERATING POLICIES & PROCEDURES August 2021 STATUS Version 23 © NYSE Technologies Connectivity, Inc. 2021 NYSE Technologies Connectivity – USLC Operating Policies & Procedures About This Document The following documents should be read in conjunction with this document: • SFTI® Americas Acceptable Use Policy • ICE Global Network Colo US Technical Specifications • NYSE Technologies Connectivity Master Services Agreement • NYSE Technologies Connectivity Master Service Provider Agreement These documents, and additional product information, are available at https://www.theice.com/data-services/global-network Contact Information For commercial or product questions: Contact Telephone Email ICE Global Network & 1-770-661-0010 - Option 3 [email protected] Colocation Sales For technical or operations related questions: Contact Telephone Email Network Operations 1-770-661-0010 - Option 1 [email protected] USLC Data Center Operations 1-770-661-0010 - Option 2 - Sub-Option 2 [email protected] (“DCO”) Global Security Division 212-656-7197 [email protected] For shipping and receiving: Contact Telephone Email Shipping and Receiving Queries: Main Dept 1-212-656-5011 NYSE-USShipping&[email protected] Site Manager 1-212-656-5032 (desk) NYSE-USShipping&[email protected] © NYSE Technologies Connectivity, Inc. 2021 Page 1 NYSE Technologies Connectivity – USLC Operating Policies & Procedures Terms The following terms used in these Operating Policies and Procedures have the following meanings: • an “Authorized Trading Center” is any Trading Center authorized by NYSE Technologies Connectivity or its affiliates to occupy space in the US Liquidity Center. The NYSE Authorized Trading Centers are the NYSE Markets. • the “Colocation Hall” is the designated space for colocation services within the US Liquidity Center. -

Steve Hirsch – Chief Data Officer and Chief Architect XLDB Conference, 10/6/10

Managing and Analyzing “XL” Data at Market Speed Steve Hirsch – Chief Data Officer and Chief Architect XLDB Conference, 10/6/10 © NYSE Euronext. All Rights Reserved. NYSE Euronext Profile NYSE Euronext (NYX) is the world’s most diverse exchange group, offering a broad and growing array of financial products and services in Europe and the United States that include cash equities, futures, options, exchange-traded products, bonds, market data, and commercial technology solutions. With over 8,000 listed issues globally, NYSE Euronext's equities markets -- the New York Stock Exchange, Euronext, NYSE Arca, and NYSE Amex -- represent nearly 40% of the world's cash equities trading volume, the most liquidity of any global exchange group. NYSE Euronext also operates NYSE LIFFE, the leading European derivatives business and the world’s second largest derivatives business by value of trading. NYSE Euronext is part of the S&P 500 index and the only exchange operator in the S&P 100 index. NYSE Euronext has rich historical roots dating back to 1792 in the United States (NYSE) and to 1602 in Europe (Amsterdam Stock Exchange) 2 Market Capitalization and Value of Share Trading Value of Share Trading $38.7 Trillion ($38.7 x 1012) In 2008 the United States Gross Domestic Product was $14.347 Trillion Underlying Data Source: World Federation of Exchanges (www.world-exchanges.org) 3 Financial Markets and the Latency Race to Zero Trading System Order “Ack” Times are now below 1ms Data Center Client Site Customer Matching Engine Gateway Applications Secure Network Client Application Start Ack Co-Located Measure Client Application Stop Ack Measure NYX fastest trading markets transact orders in less than 500 microseconds with the NYSE at 3 milliseconds.