Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2015

Annual Report 2015 The Way Forward At Bank Alfalah, we’ve never chosen the well-trodden path just because it’s the easiest option. We’ve always been different and defined our own rule of success. We are younger and more dynamic than the rest, and we’re drawn to people who share the same attitude. OUR WAY CUSTOMER CONNECT We want to inspire and help you find your own way in going after what you want, just as we have. We do all we can to understand and anticipate what will help you achieve your ambitions. LET’S INNOVATE We constantly question the status quo to find new and better ways to do things. With fresh eyes, we seek out new ways to meet your needs and help you shape your own path, through innovative products, insightful advice and a ‘can-do’ attitude. INSPIRING LEADERSHIP We foster leadership, inspiring employees and customers to do things differently and to succeed while delivering sustainable results. We inspire and recognise young, emerging talent in the country and provide them with opportunities to showcase their work. THE WAY FORWARD CONTENTS 01 Bank Alfalah Our Company 03 Vision, Mission and Values 04 Company Information 05 Directors’ Profile 07 Management Committee 11 Chairman’s Message 13 Directors’ Report 15 The Way Forward Customer Connect 27 Let’s Innovate 39 Inspiring Leadership 45 Corporate Information 51 Financial Information Financial Performance (Including Six Years Financial Summary) 63 Notice of the Annual General Meeting 73 Statement of Compliance with the Code of Corporate Governance (CCG) 75 Auditors’ Review -

Global Global Securities Pakistan Limited Draft Offer for Sale of Shares

INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THE OFFER FOR SALE DOCUMENT, ESPECIALLY THE RISK FACTORS HIGHLIGHTED IN PARA 4.12, BEFORE MAKING ANY INVESTMENT DECISION OFFER FOR SALE OF 88,025,000 SHARES OF KOT ADDU POWER COMPANY LIMITED At an Offer Price of PKR 30/- per share (Including Premium of PKR 20/- per share) By Privatisation Commission, Government of Pakistan On behalf of Pakistan Water and Power Development Authority Public Subscription From xxx, 2005 to xxx, 2005 Date of Publication of this Offer for Sale Document is xxx, 2005 THIS IS NOT A PROSPECTUS BY KOT ADDU POWER COMPANY LIMITED (THE COMPANY) BUT AN OFFER FOR SALE BY THE PRIVATISATION COMMISSION, GOVERNMENT OF PAKISTAN ON BEHALF OF WAPDA (THE OFFERER) OUT OF WAPDA’S SHAREHOLDING IN THE COMPANY Lead Manager to the Offer Global Global Securities Pakistan Limited Draft Offer for Sale of Shares GLOSSARY OF TECHNICAL TERMS AND ABBREVIATIONS 2 CDA Central Depository Act,1997 CDC The Central Depository Company of Pakistan Limited CDS Central Depository System CEGB Central Electricity DraftGenerating Board, UK Offer for Sale of Shares Company Kot Addu Power Company Limited CPP Capacity Purchase Price, means an element of tariff payable by WAPDA to KAPCO as defined in the “Power Purchase Agreement” DISCOs Distribution Companies EPP Energy Purchase Price, means an element of tariff payable by WAPDA to KAPCO as defined in the “Power Purchase Agreement” Escalable Means indexed to the US Consumer Price Index and Rupee-US Dollar Exchange Rate -

Download 309.24 KB

ASIAN DEVELOPMENT BANK RRP: PAK 32146 REPORT AND RECOMMENDATION OF THE PRESIDENT TO THE BOARD OF DIRECTORS ON PROPOSED LOANS TO THE ISLAMIC REPUBLIC OF PAKISTAN FOR THE ENERGY SECTOR RESTRUCTURING PROGRAM November 2000 CURRENCY EQUIVALENTS (as of 15 November 2000) Currency Unit − Pakistan Rupee (PRe/PRs) PRe1.00 = $0.0178 $1.00 = PRs56.25 Pakistan maintains a managed floating rate system under which the rupee is fixed on a daily basis in terms of the US dollar. ABBREVIATIONS ADB − Asian Development Bank ATM − automated teller machine DISCO − distribution company ESAF − Enhanced Structural Adjustment Facility FAC − fuel adjustment charges FATA − federally administered tribal areas GDP − gross domestic product GENCO − generation company HUBCO − Hub Power Company IMF − International Monetary Fund IPP − independent power producer KAPCO − Kot Addu Power Company KESC − Karachi Electric Supply Corporation LPG − liquefied petroleum gas MOF − Ministry of Finance and Economic Affairs NEPRA − National Electric Power Regulatory Authority NTDC − National Transmission and Dispatch Company PEPCO − Pakistan Electric Power Company PRGF − poverty reduction growth facility SAL − structural adjustment loan SNGPL − Sui Northern Gas Pipeline Company Limited SOE − State-owned enterprise SSGC − Sui Southern Gas Pipeline Company TA − technical assistance T&D − transmission and distribution WAPDA − Water and Power Development Authority WEIGHTS AND MEASURES GWh - gigawatt-hour (1,000 megawatt-hours) km - kilometer kV - Kilovolt (1,000 volt) kWh - kilowatt-hour (1,000 watt-hours) mmcfd - million cubic feet per day MW - megawatt (1,000 kilowatts) NOTES (i) The fiscal year (FY) of the Government ends on 30 June. FY before a calendar year denotes the year in which the FY ends. -

BANK ALFALAH LIMITED 02 Corporate Information

In the Name Of Allah The Most Gracious, The Most Merciful 01 Contents Corporate Information ...............................................................................2 Notice of the 14th Annual General Meeting.................................................3 Directors’ Report to the Shareholders ........................................................5 Statement of Compliance with the Best Practices of Corporate Governance to the Members..................................................9 Review Report to the Members on Statement of Compliance with Best Practices of Code of Corporate Governance..............................11 Statement of Internal Controls .................................................................12 Auditors’ Report to the Members.............................................................13 Balance Sheet.........................................................................................14 Profit and Loss Account ..........................................................................15 Cash Flow Statement ..............................................................................16 Statement of Changes in Equity ...............................................................17 Notes to the Financial Statements............................................................18 Consolidated Annual Accounts of Bank and its Subsidiary Companies......57 Pattern of Shareholding .........................................................................103 Branch Network ....................................................................................107 -

Pakistan Strategic Allocation Fund Contents

PAKISTAN STRATEGIC ALLOCATION FUND CONTENTS Funds Information 157 Report of the Directors of the Management Company 158 Condensed Interim Statement of Assets and Liabilities 159 Condensed Interim Income Statement (Un-audited) 160 Condensed Interim Distribution Statement (Un-audited) 161 Condensed Interim Statement of Movement in Unit Holders Funds (Un-audited) 162 Condensed Interim Cash Flow Statement (Un-audited) 163 Notes to and forming part of the Condensed Interim Financial Statements (Un-audited) 164 FUNDS INFORMATION Management Company Arif Habib Investments Limited 8th Floor, Techno City, Corporate Tower, Hasrat Mohani Road, Karachi Board of Directors of the Management Company Mian Mohammad Mansha Chairman(subject to the approval of SECP) Mr. Nasim Beg Executive Vice Chairman Mr. Yasir Qadri Chief Executive Officer (subject to the approval of SECP) Syed Salman Ali Shah Director (subject to the approval of SECP) Mr. Haroun Rashid Director (subject to the approval of SECP) Mr. Ahmed Jahangir Director (subject to the approval of SECP) Mr. Samad A. Habib Director Mr. Mirza Mahmood Ahmad Director (subject to the approval of SECP) Audit Committee Mr. Haroun Rashid Chairman Mr. Nasim Beg Member Mr. Samad A. Habib Member Mr. Ali Munir Member Human Resource Committee Dr. Salman Shah Chairman Mr. Nasim Beg Member Mr. Haroun Rashid Member Mr. Ahmed Jehangir Member Mr. Yasir Qadri Member Company Secretary & CFO of the Management Company Mr. Muhammad Saqib Saleem Trustee Central Depository Company of Pakistan Limited CDC House, 990B, Block B, S.M.C.H.S, Main Shahrah-e-Faisal, Karachi-74400 Bankers Bank AL Habib Limited MCB Bank Limited Habib-Metro Bank Limited Auditors M. -

Teaming up for Success

. Real business . Real people . Real experience Teaming Up for Success Reward Advisory Services AFGHANISTAN: Remuneration Benchmarking Survey 2007 February 2007 A. F. Ferguson & Co. , A member firm of Chartered Accountants 2 AFGHANISTAN Remuneration Benchmarking Survey 2007 PwC would like to invite your organization to participate in the Remuneration Benchmarking Survey 2007 which will be conducted once every year. This survey will cover all multinational organizations and local companies in AFGHANISTAN, regardless of any particular industry/ sector. This effort is being formulated so as to bring organizations at par with other players in market-resulting by bringing sanity to management and HRM practice in Afghanistan especially during reconstruction era. The survey will comprise of two parts: • Part A – remuneration to personnel in managerial and executive cadres (excluding CEOs/ Country Heads) • Part B – remuneration to CEOs/ Country Heads (international and local nationals separately) • Part C – remuneration to non-management cadre Each report is prepared separately, and participants may choose to take part in either one or all three sections of the survey. Job benchmarking and data collection from the participating organizations will be done through personal visits by our consultants. A structured questionnaire will be used to record detailed information on salaries, allowances, all cash and non-cash benefits and other compensation policies. The collected information will be treated in strict confidence and the findings of the survey will be documented in the form of a report, which will be coded. Each participating organization will be provided a code number with which they can identify their own data and the report will only be available to the participant pool. -

List of Companies

List of Companies S.No. Company Name S.No. Company Name 1 3M Pakistan Pvt. Limited 41 Bayer Pakistan (Pvt) Ltd. (G) 2 A.F.Ferguson & Co. 42 Berger Paints Pakistan Ltd 3 Abacus Consulting (Pvt) Ltd 43 Bestway Cement 4 Abbott Laboratories (Pakistan) Limited 44 BHP Billiton 5 ACE Insurance Limited Pakistan 45 Bosch Pharmaceuticals Pvt Limited 6 Adamjee Insurance Company Limited (Nishat Group) 46 BP Pakistan Exploration & Production, Inc. 7 Agha Khan Group 47 British Council 8 Aitchison College 48 Brookes Pharmaceutical Laboratories (Pakistan) Limited 9 Akzo Nobel Pakistan Limited 49 Buxly Paints 10 Al Ghazi Tractors Ltd ( offices in service area only ) 50 Central Depository Company 11 Albarka Bank 51 Century Paper & Board Mills 12 Alcatel Pakistan Limited 52 Century Publications Private Limited 13 Ali Institute of Education 53 China Mobile (Zong) 14 All Abu Dhabi Group Companies 54 CitiBank 15 All Embassies & Consulates in Pakistan 55 Civil Services Academy 16 All Organizations of United Nations 56 Civil Aviation Authority 17 Allama Iqbal Medical College 57 Clariant Pakistan Ltd 18 Allied Bank Limited 58 Clover Pakistan Ltd. 19 Anjum Asim Shahid Rahman & Co. 59 Coca Cola Beverages Pak. Ltd. 20 Arif Habib Securities Ltd 60 Coca Cola Export Corp. – Lhr 21 Armed Forces 61 Colgate Palmolive Ltd. 22 Army Welfare Trust & Affiliate Companies 62 College of Physicians & Surgeons 23 Asian Development Bank 63 Continental Biscuits – LU 24 Askari Bank Limited 64 Descon Engineering 25 Askari General Insurance Co.Ltd 65 DG Khan Cement Company Limited (Nishat -

List of Acronyms

List of Acronyms A ABL Allied Bank Limited ACP Annual Credit Plan ACAC Agriculture Credit Advisory Committee ACD Agriculture Credit Department ADs Authorized Dealers ADB Asian Development Bank ADF Asian Development Fund ADP Annual Development Plan AFS Available For Sale ARPU Average Revenue per User ASEAN Association of South East Asian Nations ARPU Average Revenue per User B BHU Basic Health Unit BISP Benazir Income Support Programme BOC Bank of China BMR Balancing Modernization and Replacing BOP Balance of Payment BPO Business Process Outsourcing BPRD Banking Policy Regulation Department BSC Bahbood Saving certificates, Benazir Smart Cards BSE Bombay Stock Exchange BSD Banking Surveillance Department Bt Bacillus thuringiensis C CAD Current Account Deficit CAB Current Account Balance CAGR Compound Annual Growth Rate CAR Capital Adequacy Ratio CBR Central Board of Revenue CBR Crude Birth Rate CBD Conventions on Biodiversity CITES Convention on International Trade in Endangered Species of Wild CBU CompletelyFauna and Flora Built Unit CDR Crude Death Rate CCC Climate Change Convention CDC Central Depository Company CDNS Central Directorate of National Saving CDs Certificate of Deposits CDWA Clean drinking Water for All CDWI Clean Drinking Water Initiative CFS Continuous Funding System CFSMK-II Continuous Funding System Mark II CIB Credit Information Bureau CiC Currency in Circulation CKD Completely Knocked Down CNG Compressed Natural Gas CO2 Carbon Dioxide CPS Country Partnership Strategy CPI Consumer Price Index CRR Cash Reserve Ratio CRPID -

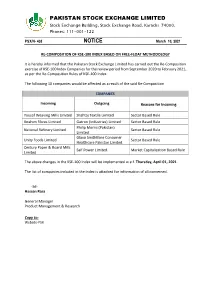

Recomposition of KSE-100 Index

PAKISTAN STOCK EXCHANGE LIMITED Stock Exchange Building, Stock Exchange Road, Karachi-74000, Phones: 111-001-122 PSX/N- 438 NOTICE March 10, 2021 RE-COMPOSITION OF KSE-100 INDEX BASED ON FREE-FLOAT METHODOLOGY It is hereby informed that the Pakistan Stock Exchange Limited has carried out the Re-Composition exercise of KSE-100 Index Companies for the review period from September 2020 to February 2021, as per the Re-Composition Rules of KSE-100 Index. The following 10 companies would be affected as a result of the said Re-Composition. COMPANIES Incoming Outgoing Reasons for Incoming Yousaf Weaving Mills Limited Shahtaj Textile Limited Sector Based Rule Ibrahim Fibres Limited Gatron (Industries) Limited Sector Based Rule Philip Morris (Pakistan) National Refinery Limited Sector Based Rule Limited. Glaxo SmithKline Consumer Unity Foods Limited Sector Based Rule Healthcare Pakistan Limited. Century Paper & Board Mills Saif Power Limited. Market Capitalization Based Rule Limited The above changes in the KSE-100 Index will be implemented w.e.f. Thursday, April 01, 2021. The list of companies included in the Index is attached for information of all concerned. -Sd- Hassan Raza General Manager Product Management & Research Copy to: Website-PSX PAKISTAN STOCK EXCHANGE LIMITED Stock Exchange Building, Stock Exchange Road, Karachi-74000, Phones: 111-001-122 REVISED / RECOMPOSED LIST OF KSE-100 INDEX COMPANIES TO BE IMPLEMENTED W.E.F. April 01, 2021 CLOSE – END MUTUAL FUNDS CEMENT TRANSPORT 01. HBL Growth Fund – A * 36. Cherat Cement Company Ltd 70. Pakistan International Bulk Term. Ltd. * 37. D. G. Khan Cement Co. Ltd MODARABA 38. Fauji Cement Company Ltd. -

June 30, 2015 Together with Directors' and Auditors' Reports Thereon

A N N U A L R DAWOOD EQUITIES LIMITED E P O R T 2015 DAWOOD EQUITIES LIMITED Contents Page Corporate Objective............................................................................................ 2 Our Vision........................................................................................ 2 Our Mission...................................................................................... 2 Company information....................................................................................... 3 Notice of Annual General Meeting (AGM-X).................................................. 4 Directors Report............................................................................................. 5 Pattern of Share Holding................................................................................... 9 Financial Highlights.......................................................................................... 12 Statement of Compliance With the Code Of Corporate Governance................... 13 Auditors Report................................................................................................ 15 Review Report To The Member On Statement Of Compliance With Best Practice Of Code Of Corporate Governance...................................... 16 Financial Statement Balance Sheet......................................................................................... 17 Profit & Loss Account............................................................................ 18 Statement of Comprehensive Income ................................................... -

Daily Market Insights

DAILY MARKET INSIGHTS 11-Dec-2020 Change Index points KSE 100 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KSE 100 Index 165 42,470 Contributing shares Closing Price - Rs. Oil & Gas Development Company Limited 2.87 2.87 43.45 102.77 MCB Bank Limited (3.40) (1.87) (32.30) 178.57 TRG Pakistan Limited (2.66) (3.42) (28.25) 75.03 KSE 100 INDEX VOLUMES Today 303 5 days average 248 230 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Banks / DFI Foreign Corporates Amount (Net) 286,639,849 (765,545,598) Buying / Selling sector wise composition Commercial Banks 37.56% 87.06% Oil and Gas Marketing Companies 24.50% 0.00% Power Generation and Distribution 12.46% 0.00% Oil and Gas Exploration Companies 0.00% 5.13% Technology and Communication 2.05% 4.26% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today (862) (306) 5 days average (545) 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION M/s Shandong Yongtai Paper Mills Limited (SYPML), a shareholder of M/s Roshan Sun Tao Paper Mills (Private) Limited has made an offer to sell their 40% stake in the Roshan Sun Tao Paper Mills (Private) Limited (subsidiary), to Roshan Packages Limited (RPL). Roshan Packages Limited RPL currently holds 60% shares in its subsidiary and after acquisition of the above stake of 40%, Roshan Sun Tao Paper Mills (Private) Limited will become 100% owned subsidiary of RPL. -

National Clearing Company of Pakistan Limited 8Th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi NCCPL/SLB/MARCH-12/16 March 30, 2012

National Clearing Company of Pakistan Limited 8th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi NCCPL/SLB/MARCH-12/16 March 30, 2012 List of Securities Lending and Borrowing (SLB) Eligible Securities Based on the Revised Criteria Dear Clearing Members, We are pleased to inform you that the existing eligibility criteria for the selection of Securities Lending and Borrowing (“SLB”) Eligible Securities have been revised. Accordingly, we are enclosing herewith the revised list of SLB Eligible Securities based on the following revised criteria: A. SLB Eligible Securities - Category A for Short-Selling: 1. Security has been traded at least 80% of the trading days during the review period of last 6 months. 2. Average Impact Cost of the security will not be greater than 2% as calculated based on daily Impact Costs of the review period of last 6 months. 3. Average Daily Traded Volume of security during review period of last six months in the Ready Market selected based on above criteria will not be less than 0.5% of its Free Float or 100,000 shares, whichever is lower. 4. The security is in book entry form. 5. The issuer of security is not placed on the defaulter's counter of the Exchange B. SLB Eligible Securities - Category B for any other: 1. The Listed security is in book entry form. 2. The issuer of security is not placed on the defaulter's counter of the Exchange. List of SLB Eligible Securities for both Categories A & B is attached herewith as Annexure A & B respectively.. Please note that the revised list of SLB Eligible Securities will be effective from Monday April 02, 2012.