North Sea, Hype Or Hydrocarbons?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Economic Impacts of CO 2 Enhanced Oil Recovery for Scotland Final Report

Economic impacts of CO Economic Economic impacts of CO 2 enhanced If you require this publication in an alternative format and/or language please contact the oil recovery for Scotland Scottish Enterprise Helpline on 0845 607 8787 to discuss your needs. Scottish Enterprise Final report Atrium Court 50 Waterloo Street 2 Glasgow Scotland for oil recovery enhanced G2 6HQ Helpline: 0845 607 8787 Led by: with and E-mail: [email protected] Element Energy Limited Dundas Consultants The Institute of 78 Margaret Street 7 Queens Gardens Petroleum Engineering www.scottish-enterprise.com London W1W 8SZ Aberdeen Heriot Watt University Tel: 01223 852496 AB15 4YD Edinburgh EH14 4AS Final report SE/3669/Oct12 Authors Harsh Pershad and Emrah Durusut (Element Energy) Alan Crerar and David Black (Dundas Consultants) Eric Mackay and Peter Olden (Heriot Watt University) For comments or queries please contact: Dr. Harsh Pershad [email protected] +44 (0)1223 852 496 Mr. Emrah Durusut [email protected] +44 (0)330 119 0982 Caveat While the authors consider that the data and opinions in this report are sound, all parties must rely on their own judgement and skill when using it. The authors do not make any representation or warranty, expressed or implied, as to the accuracy or completeness of the report. There is considerable uncertainty around the development of oil markets, CCS technology, and CO2-EOR specifically. The available data and models on sources and sinks are extremely limited and the analysis is therefore based on purely hypothetical scenarios. Any maps, tables and graphs are provided for high-level illustrative purposes only; no detailed location-specific studies have been carried out and no oil company has provided detailed decision-making inputs. -

Coos County Gas Pipeline Minimal Infrastructure

CURZON ENERGY PLC 2 IMPORTANT NOTICE By attending this presentation and/or accepting these slides you agree to be bound by the following conditions and It is not intended that the Presentation Materials be distributed or passed on, directly or indirectly, to anyone other will be taken as having represented and undertaken that you have agreed to do so. These presentation slides and than a Relevant Person. Persons of any other description, including those that do not have professional experience in accompanying verbal presentation (“Presentation Materials”) have been prepared by Curzon Energy PLC (“Company”) matters relating to investment, should not rely or act upon the Presentation Materials. Any investment, investment in relation to (i) the proposed acquisition by the Company of Coos Bay Energy LLC, a Nevada corporation which owns activity or controlled activity to which the Presentation Materials may ultimately relate is available only to Relevant coalbed methane gas accumulations in Coos Bay County, Oregon, USA; (ii) the proposed admission of the ordinary Persons and will be engaged in only with such Relevant Persons. share capital of the Company to the Official List (by way of Standard Listing under Chapter 14 of the Listing Rules) and The Presentation Materials are confidential and being supplied to you for your own information and may not be to trading on the London Stock Exchange’s main market for listed securities and (iii) the proposed placing of ordinary reproduced, further distributed, passed on, or the contents otherwise divulged, directly or indirectly, to any other shares in the capital of the Company. The Presentation Materials do not comprise an admission document, listing person or published, in whole or in part, for any purpose whatsoever. -

Petroleum Geology of Northwest Europe: Proceedings of the 4Th Conference Volume 1 Petroleum Geology of Northwest Europe: Proceedings of the 4Th Conference

Petroleum Geology of Northwest Europe: Proceedings of the 4th Conference Volume 1 Petroleum Geology of Northwest Europe: Proceedings of the 4th Conference held at the Barbican Centre, London 29 March-1 April 1992 Volume 1 edited by J. R. Parker Shell UK Exploration and Production, London with I. D. Bartholomew Oryx UK Energy Company, Uxbridge W. G. Cordey Shell UK Exploration and Production, London R. E. Dunay Mobil North Sea Limited, London O. Eldholm University of Oslo A. J. Fleet BP Research, Sunbury A. J. Fraser BP Exploration, Glasgow K. W. Glennie Consultant, Ballater J. H. Martin Imperial College, London M. L. B. Miller Petroleum Science and Technology Institute, Edinburgh C. D. Oakman Reservoir Research Limited, Glasgow A. M. Spencer Statoil, Stavanger M. A. Stephenson Enterprise Oil, London B. A. Vining Esso Exploration and Production UK Limited, Leatherhead T. J. Wheatley Total Oil Marine pic, Aberdeen - 1993 Published by The Geological Society London THE GEOLOGICAL SOCIETY The Society was founded in 1807 as The Geological Society of London and is the oldest geological society in the world. It received its Royal Charter in 1825 for the purpose of 'investigating the mineral structure of the Earth'. The Society is Britain's national learned society for geology with a membership of 7500 (1992). It has countrywide coverage and approximately 1000 members reside overseas. The Society is responsible for all aspects of the geological sciences including professional matters. The Society has its own publishing house which produces the Society's international journals, books and maps, and which acts as the European distributor for publications of the American Association of Petroleum Geologists and the Geological Society of America. -

A Personal Journey Presentation by Tony Craven Walker to Scottish Oil Club – Edinburgh 16 May 2019

FIFTY YEARS IN THE NORTH SEA: A PERSONAL JOURNEY PRESENTATION BY TONY CRAVEN WALKER TO SCOTTISH OIL CLUB – EDINBURGH 16 MAY 2019 Ladies and Gentlemen. I am delighted to be here today. As we are in Scotland, the home of whisky, I was tempted to call this talk “Tony Walker – Started 1965 - Still Going Strong”. Then I read about Algy Cluff’s retirement last week described as “The Last Man Standing” so I was tempted to call it “The Last Man Still Standing”. But I decided on FIFTY YEARS IN THE NORTH SEA: A PERSONAL JOURNEY. With around one hour allotted that works out at around one year per minute so I had better get a move on! Actually it has been 54 years since I joined the oil industry but what a journey it has been. One which is not over just yet as far as I am concerned and one which has given me great challenges and great pleasure. Before diving into things I thought it might be fun to mention that Anton Ziolkowski, your President, and I go back way into the 1950’s when we were neighbours living next door to each other as small boys in London. It is curious and always amazing how the world works to find that we are in the same industry and he has invited me to speak today. I will keep to myself some of the pranks that Anton and I got up to as youngsters, “tin-can tommy” and “mud-ball sling” spring to mind, as I certainly don’t want to embarrass your president. -

Economic Impact of Aberdeen Harbour Nigg Bay Development

BiGGAR Economics Economic impact of Aberdeen Harbour Nigg Bay Development A final report to Scottish Enterprise th 19 December 2013 BiGGAR Economics Midlothian Innovation Centre Pentlandfield Roslin, Midlothian EH25 9RE 0131 440 9032 [email protected] www.biggareconomics.co.uk CONTENTS Page 1 EXECUTIVE SUMMARY ....................................................................................... 1 2 INTRODUCTION ................................................................................................... 4 3 POLICY CONTEXT AND PROJECT DESCRIPTION ........................................... 7 4 ECONOMIC AND MARKET CONTEXT .............................................................. 13 5 APPROACH ........................................................................................................ 23 6 BASELINE ECONOMIC ANALYSIS ................................................................... 26 7 ASSUMPTIONS ABOUT FUTURE DEVELOPMENT ......................................... 37 8 REFERENCE CASE ............................................................................................ 47 9 FULL DEVELOPMENT SCENARIO ................................................................... 50 10 BASIC DEVELOPMENT SCENARIO ............................................................... 53 11 SUMMARY AND CONCLUSIONS .................................................................... 57 12 APPENDIX 1 - SENSITIVITY ANALYSIS ......................................................... 60 13 APPENDIX 2 – GLOSSARY ............................................................................ -

Organizational Restructuring Within the Royal Dutch Shell Group

CTAC08 4/13/07 17:23 Page 121 case Organizational 8 Restructuring within the Royal Dutch Shell Group At the beginning of 2000, the Royal Dutch Shell Group of Companies (Shell) was emerging from one of the most ambitious and far-reaching organizational re- structurings of its 93-year history. The restructuring had involved the shift from a geographically based to a business sector-based structure, the elimination of over 1,000 corporate positions, the sale of much of its London headquarters, and the redesign of its systems of coordination and control. The restructuring had been precipitated by the realization that Shell would need to change the way it did business if it was to retain its position as the world’s largest petroleum company and offer an adequate return to shareholders in an increasingly turbulent indus- try environment. By the end of 1999, it was clear that the changes were bearing fruit. Head office costs had been reduced and the increased coordination and control that the new sector-based organization permitted were helping Shell to control costs, focus capital expenditure, and prune the business portfolio. Return on capital employed (ROCE) and return on equity (ROE) for 1999 were their highest for ten years. However, much of the improvement in bottom-line performance was the result of the recovery in oil prices during the year. Once the benefits of higher oil prices were stripped out, Shell’s improvements in financial performance looked much more modest. At the same time, Shell’s competitors were not standing still. BP, once government-owned and highly bureaucratized, had become one of the world’s most dynamic, profitable, and widely admired oil majors. -

JUSTIN WELBY of Secular and Sacred

career PROFILE: JUSTIN WELBY Of secular and sacred JUSTIN WELBY TELLS PETER WILLIAMS HOW HE HAS GONE FROM BEING GROUP TREASURER OF ENTERPRISE OIL TO THE NEXT BISHOP OF DURHAM. 42 THE TREASURER JULY | AUGUST 2011 career PROFILE: JUSTIN WELBY rom senior corporate treasurer to senior cleric. It doesn’t rank Nigeria, the North Sea and major assets such as shipping. Later he as the most obvious career move but it is one the Very returned to the UK to run treasury for Elf’s UK subsidiary. His long Reverend Justin Welby has accomplished with apparent ease association with the ACT started at that time, with Welby joining the and much success. In early June Welby was named as the next fledgling body in 1983 following an interview. No exams in those FBishop of Durham, making him the fourth most senior cleric in the days. Sadly, he can’t remember who he talked to. “It was a very long Church of England, after the Archbishops of Canterbury and York and time ago,” he says. the Bishop of London. In 1984 he was recruited by Enterprise Oil as group treasurer – no Welby may have given up on Mammon for God but he still doubt ACT membership helped to secure the role – running all long- manages to keep an insightful eye on the world of business. Ask him term and short-term finance and insurance for the company. Treasury what it means to be Dean of Liverpool Cathedral and he says he is taught him much and he remains familiar with the knowledge, using chief executive of a business – a vital one, providing hope in the it in what he calls “quasi-consulting roles”, for which the Church, not tangible form of employment for people and wealth generation in the Dean, is paid. -

Scottish Ports: Gateways for Growth

Scottish Ports: Gateways for Growth 1 Scottish Ports: Gateways for Growth Contents Gateways for Growth 3 Brexit 13 Scottish Ports Group 3 Crown Estate Scotland 14 Highlands and Islands Enterprise 3 Scottish Enterprise 3 About the Industry 15 Keeping Scotland Supplied 4 Cargo 15 Keeping Scotland Connected 4 Offshore Energy – Oil and Gas 16 Brexit and Scottish Ports 4 Offshore Wind and Marine Renewables 17 Providing Quality Jobs 5 Decommissioning 18 Port Connectivity 6 Scottish Energy Ports Initiative 19 Fishing 20 Port Ownership and Governance 8 Ferries 21 Trust Ports 8 Shipbuilding and Repair 21 Privatised Ports 8 Cruise 22 Local Authority Ports 8 Leisure and Tourism 22 Other Ports 8 Scottish Ports Group 24 Port Activities 9 Scottish Ports Group Priorities and Challenges Conservancy and Navigation 9 for Government 25 Pilotage 9 Directory for BPA Scottish Ports Group Safety 10 Members 26 Port Marine Safety Code 10 Port Skills and Safety 10 British Ports Association 48 Sustainable Development 11 Marine Planning 11 Marine Protected Areas 12 EcoPorts 12 Highlands and Islands Enterprise and Scottish Enterprise have supported the production of this document. The views expressed are those of the British Ports Association and Scottish Ports Group. 2 Scottish Ports: Gateways for Growth Gateways for Growth Scottish ports are fundamental to the Scottish and UK economies. They play a unique role, not only providing a base for trade and employment, but in connecting communities. They also provide the landside gateways for vital industries such as offshore energy, fishing and cruise sectors. Scotland has a rich coastal heritage and ports provide Highlands and Islands Enterprise important bases for maximising the opportunities presented from a number of economic activities. -

Rockhopper Exploration Plc (Incorporated and Registered in England and Wales with Registered No

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the contents of this document or as to what action you should take, you are recommended to seek your own financial advice immediately from an independent financial adviser who is authorised for the purposes of the Financial Services and Markets Act 2000 and who specialises in advising on the acquisition of shares and other securities in the United Kingdom. The whole of the text of this document should be read. Prospective investors should carefully consider the section entitled “Risk Factors” in Part II of this document before taking any action. This Document is an admission document and has been drawn up in accordance with the requirements of the AIM Rules. A copy of this document has been delivered to the London Stock Exchange as an admission document in respect of the Ordinary Shares, but a copy has not been filed with the Registrar of Companies in England and Wales. Application has been made for the Enlarged Share Capital to be admitted to trading on the Alternative Investment Market of the London Stock Exchange plc (“AIM”) (“Admission”). It is expected that Admission will become effective and that dealings will commence in the Ordinary Shares on 15 August 2005. AIM is a market designed primarily for emerging or smaller companies to which a higher investment risk tends to be attached than to larger or more established companies. AIM securities are not admitted to the official list of the United Kingdom Listing Authority (the “Official List”). A prospective investor should be aware of the risks of investing in such companies and should make the decision to invest only after careful consideration and, if appropriate, consultation with an independent financial adviser. -

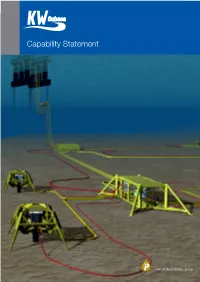

Capability-Statement-KW.Pdf

Capability Statement CAPABILITY STATEMENT I INTRODUCTION Who we are… KW was founded in 1999 as a niche high-technology consultant • Subsea systems solving problems associated with subsea pipelines. Over the • Pipelines and flowlines • Subsea structures years we have grown our capability and services across the broader subsea sector providing design engineering at all phases Flow assurance of projects, whilst also enhancing our reputation as a leading Architecture layout consultant. Execution and installation schedules Project cost estimates We often engage in projects that are situated in extreme environmental Upheaval buckling and OOS areas, in deep waters, challenging seabed terrains and soils as well as high Lateral buckling and pipeline walking pressure, high temperature reservoirs and corrosive fluids. We strive to Pipe-in-pipe challenge and extend the traditional design approaches, enabling marginal Manifolds, RBS, SSIV, PLET and FLET projects, but always with safety as a priority and through solutions that are Controls and umbilicals designed for installation and construction economically. Geotechnical engineering, soils and foundations Trenching and burial In 2012 KW became part of the Petrofac Group – one of the major Installation engineering oil services companies in the world. We continue to operate as an Survey and routeing independent company with the vision of being ‘the engineer of choice for Riser design and reassessment global subsea developments’. Component qualifications Advanced engineering: FE analysis We can also integrate our services with the larger engineering resource Carbon capture and gas storage and skills base of Petrofac to jointly undertake larger and more complex oil and gas developments which involve other offshore facilities such as Covering… jackets, topsides, FPSO’s as well as onshore plants. -

Petroleum Geology of Northwest Europe: Proceedings of the 5Th Conference

Petroleum Geology of Northwest Europe: Proceedings of the 5th Conference Volume 1 Petroleum Geology of Northwest Europe: Proceedings of the 5th Conference held at the Barbican Centre, London, 26-29 October 1997 Volume 1 edited by A. J. Fleet The Natural History Museum, London and S. A. R. Boldy Amerada Hess Norge A/S, Oslo with S. D. Burley BG Technology, Loughborough R.E. Dunay Mobil North Sea Limited, London S. S. Flint University of Liverpool S. I. Fraser Amerada Hess Ltd, London A. Hurst University of Aberdeen H. D. Johnson Imperial College, London B. Levell Petroleum Development Oman, Muscat J. W. Munns Oil and Gas Division, UK Department of Trade and Industry P.M. Shannon University College, Dublin A. M. Spencer Statoil, Stavanger M. Thompson BP Exploration Operating Company Ltd, Uxbridge J. R. Underhill University of Edinburgh 1999 Published by The Geological Society London THE GEOLOGICAL SOCIETY The Geological Society of London was founded in 1807 and is the oldest geological society in the world. It received its Royal Charter in 1825 for the purpose of 'investigating the mineral structure of the Earth' and is now Britain's national society for geology. Both a learned society and a professional body, the Geological Society is recognized by the Department of Trade and Industry (DTI) as the chartering authority for geoscience, able to award Chartered Geologist status upon appropriately qualified Fellows. The Society has a membership of 8600, of whom about 1500 live outside the UK. Fellowship of the Society is open to persons holding a recognized honours degree in geology or a cognate subject and who have at least two years' relevant postgraduate experience, or not less than six years' relevant experience in geology or a cognate subject. -

THE LONDON GAZETTE, Sorn AUGUST 1985 11979

THE LONDON GAZETTE, SOrn AUGUST 1985 11979 DEPARTMENT OF ENERGY PETROLEUM PRODUCTION LICENCES The Secretary of State for Energy, hereby gives notice that he has consented to the assignment of interest m the undermentioned production licences Licence number Previous holders Present holders P141 Kewanec Oil Company (UK) Limited Kewance Oil Company (UK) Limited 21/7a Transoccan Oil (UK) Limited Transocean Oil (UK) Limited 21/14a Chieftain Exploration (UK) Limited Chieftain Exploration (UK) Limited 21/14b Baytrust Oil Explorations Limited Baytrust Oil Explorations Limited GAO (UK) Limited Phillips Petroleum Company United Kingdom Limited Marathon Oil Exploration (UK) Limited Marathon Oil Exploration (UK) Limited Tanks Offshore Investments Limited Enterprise Oil (TO1) Limited North Sea Operators Limited North Sea Operators Limited Petrolex UK Limited Petrolcx UK Limited Berkeley Exploration and Production pic Berkeley Exploration and Production pic Sunlitc Oil Company (UK) Limited Sunlite Oil Company (UK) Limited Tanks North Sea Limited Enterprise Oil (TNS) Limited Unilon Oil Explorations Limited Unilon Oil Explorations Limited Petro-Canada (UK) Limited Pctro-Canada (UK) Limited Home Oil (UK) Limited Home Oil (UK) Limited Bow Valley Exploration (UK) Limited Bow Valley Exploration (UK) Limited Tricentrol Exploration UK Limited Tricentrol Exploration UK Limited Industrial Scotland Energy pic Industrial Scotland Energy pic BP Petroleum Development Limited BP Petroleum Development Limited P 305 Charterhouse Petroleum Development Limited Charterhouse