Stock Volume Greater Than 90000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Symbol Company Market Maker Market Maker Type Effective Date ACB AURORA CANNABIS INC. Canaccord Genuity Corp. (#033) Full 12/13/2016 ASO AVESORO RESOURCES INC

Symbol Company Market Maker Market Maker Type Effective Date ACB AURORA CANNABIS INC. Canaccord Genuity Corp. (#033) Full 12/13/2016 ASO AVESORO RESOURCES INC. J Canaccord Genuity Corp. (#033) Full 12/13/2016 CNL CONTINENTAL GOLD INC. J Canaccord Genuity Corp. (#033) Full 12/13/2016 ECN ECN CAPITAL CORP. Canaccord Genuity Corp. (#033) Full 12/13/2016 FF FIRST MINING FINANCE CORP. Canaccord Genuity Corp. (#033) Full 12/13/2016 GCM GRAN COLOMBIA GOLD CORP. J Canaccord Genuity Corp. (#033) Full 12/13/2016 LAC LITHIUM AMERICAS CORP. J Canaccord Genuity Corp. (#033) Full 12/13/2016 LUC LUCARA DIAMOND CORP. J Canaccord Genuity Corp. (#033) Full 12/13/2016 NYX NYX GAMING GROUP LIMITED Canaccord Genuity Corp. (#033) Full 12/13/2016 SWY STORNOWAY DIAMOND CORPORATION J Canaccord Genuity Corp. (#033) Full 12/13/2016 USA AMERICAS SILVER CORPORATION J Canaccord Genuity Corp. (#033) Full 12/13/2016 WEED CANOPY GROWTH CORPORATION J Canaccord Genuity Corp. (#033) Full 12/13/2016 XRE ISHARES S&P/TSX CAPPED REIT INDEX ETF UN Canaccord Genuity Corp. (#033) Full 12/13/2016 CCX CANADIAN CRUDE OIL INDEX ETF CL 'A' UN CIBC World Markets Inc. (#079) Full 6/13/2017 CGL ISHARES GOLD BULLION ETF HEDGED UNITS CIBC World Markets Inc. (#079) Full 6/13/2017 CIC FIRST ASSET CANBANC INCOME CLASS ETF CIBC World Markets Inc. (#079) Full 6/13/2017 CMR ISHARES PREMIUM MONEY MARKET ETF UNITS CIBC World Markets Inc. (#079) Full 6/13/2017 DXM 1ST ASST MORNSTAR CDA DIV TARGET 30IDX ETF UN CIBC World Markets Inc. -

OSC Bulletin

The Ontario Securities Commission OSC Bulletin September 15, 2016 Volume 39, Issue 37 (2016), 39 OSCB The Ontario Securities Commission administers the Securities Act of Ontario (R.S.O. 1990, c. S.5) and the Commodity Futures Act of Ontario (R.S.O. 1990, c. C.20) The Ontario Securities Commission Published under the authority of the Commission by: Cadillac Fairview Tower Thomson Reuters 22nd Floor, Box 55 One Corporate Plaza 20 Queen Street West 2075 Kennedy Road Toronto, Ontario Toronto, Ontario M5H 3S8 M1T 3V4 416-593-8314 or Toll Free 1-877-785-1555 416-609-3800 or 1-800-387-5164 Contact Centre – Inquiries, Complaints: Fax: 416-593-8122 TTY: 1-866-827-1295 Office of the Secretary: Fax: 416-593-2318 The OSC Bulletin is published weekly by Thomson Reuters Canada, under the authority of the Ontario Securities Commission. Subscriptions to the print Bulletin are available from Thomson Reuters Canada at the price of $868 per year. The eTable of Contents is available from $148 to $155. The CD-ROM is available from $1392 to $1489 and $314 to $336 for additional disks. Subscription prices include first class postage to Canadian addresses. Outside Canada, the following shipping costs apply on a current subscription: 440 grams US – $5.41 Foreign – $18.50 860 grams US – $6.61 Foreign – $10.60 1140 grams US – $7.64 Foreign – $14.70 Single issues of the printed Bulletin are available at $20 per copy as long as supplies are available. Thomson Reuters Canada also offers every issue of the Bulletin, from 1994 onwards, fully searchable on SecuritiesSource™, Canada’s pre-eminent web-based securities resource. -

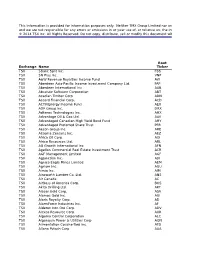

This Information Is Provided for Information Purposes Only. Neither

This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies represents, warrants or guarantees the accuracy or completeness of the information contained in this document and we are not responsible for any errors or omissions in or your use of, or reliance on, the information provided. © 2014 TSX Inc. All Rights Reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. Root Exchange Name Ticker TSX 5Banc Split Inc. FBS TSX 5N Plus Inc. VNP TSX A&W Revenue Royalties Income Fund AW TSX Aberdeen Asia-Pacific Income Investment Company Ltd. FAP TSX Aberdeen International Inc. AAB TSX Absolute Software Corporation ABT TSX Acadian Timber Corp ADN TSX Accord Financial Corp. ACD TSX ACTIVEnergy Income Fund AEU TSX ADF Group Inc. DRX TSX Adherex Technologies Inc. AHX TSX Advantage Oil & Gas Ltd. AAV TSX Advantaged Canadian High Yield Bond Fund AHY TSX Advantaged Preferred Share Trust PFR TSX Aecon Group Inc. ARE TSX AEterna Zentaris Inc. AEZ TSX Africa Oil Corp. AOI TSX Africo Resources Ltd. ARL TSX AG Growth International Inc AFN TSX Agellan Commercial Real Estate Investment Trust ACR TSX AGF Management Limited AGF TSX AgJunction Inc. AJX TSX Agnico Eagle Mines Limited AEM TSX Agrium Inc. AGU TSX Aimia Inc. AIM TSX Ainsworth Lumber Co. Ltd. ANS TSX Air Canada AC TSX AirBoss of America Corp. BOS TSX Akita Drilling Ltd. AKT TSX Alacer Gold Corp. ASR TSX Alamos Gold Inc. AGI TSX Alaris Royalty Corp. AD TSX AlarmForce Industries Inc. AF TSX Alderon Iron Ore Corp. -

Lumina Gold Corp (TSXV: LUM) - Initiating Coverage: Ross Beaty Backed 8.5 Moz Gold Project in Ecuador

Siddharth Rajeev, B.Tech, MBA, CFA May 22, 2019 Lumina Gold Corp (TSXV: LUM) - Initiating Coverage: Ross Beaty Backed 8.5 Moz Gold Project in Ecuador Sector/Industry: Junior Resource www. luminagold.com Market Data (as of May 22, 2019) Investment Highlights Current Price C$0.57 Lumina Gold Corp. (“LUM”, “company”) is advancing its 100% owned Fair Value C$0.93 Cangrejos project in Ecuador, with an inferred resource estimate of 8.5 Moz Rating* BUY gold (0.65 gpt) and 1.03 Blbs copper (0.11%) - making Cangrejos one of the Risk* 5 largest undeveloped gold deposits held by a junior globally . A 2018 Preliminary Economic Assessment (“PEA”) showed an After Tax – 52 Week Range C$0.46 – C$0.82 Net Present Value (“AT-NPV) at 5% of $920 million at $1,300 per oz gold, Shares O/S 309,529,893 and $528 million at $1,170 per oz gold. The current Enterprise Value (“EV”) Market Cap C$ 176.43 mm of Lumina is just C$166 million. Current Yield N/A The total initial CAPEX has been estimated at approximately $831 million, P/E (forward) N/A and a very low life-of-mine (“LOM”) cash cost of $523 per oz. P/B 7.6 x We believe that, Cangrejos, with a potential to produce over 300 Koz YoY Return -26.0 % per year gold, and CAPEX under $1 billion, will be attractive for YoY TSXV -22.5 % acquirers. *see back of report for rating and risk definitions. Recent tax reforms in Ecuador, and several other initiatives taken by the * All figures in US$ unless otherwise specified. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

Tsx Tsxv Issuers

This information is provided for information purposes only. Neither TMX Group Limited nor an and we are not responsible for any errors or omissions in or your use of, or reliance on, the inf © 2014 TSX Inc. All Rights Reserved. Do not copy, distribute, sell or modify this document wit Root Exchange Name Ticker TSX 5Banc Split Inc. FBS TSX 5N Plus Inc. VNP TSX A&W Revenue Royalties Income Fund AW TSX Aberdeen Asia-Pacific Income Investment Company Ltd. FAP TSX Aberdeen International Inc. AAB TSX Absolute Software Corporation ABT TSX Acadian Timber Corp ADN TSX Accord Financial Corp. ACD TSX ACTIVEnergy Income Fund AEU TSX ADF Group Inc. DRX TSX Adherex Technologies Inc. AHX TSX Advantage Oil & Gas Ltd. AAV TSX Advantaged Canadian High Yield Bond Fund AHY TSX Advantaged Preferred Share Trust PFR TSX Aecon Group Inc. ARE TSX AEterna Zentaris Inc. AEZ TSX Africa Oil Corp. AOI TSX Africo Resources Ltd. ARL TSX AG Growth International Inc AFN TSX Agellan Commercial Real Estate Investment Trust ACR TSX AGF Management Limited AGF TSX AgJunction Inc. AJX TSX Agnico Eagle Mines Limited AEM TSX Agrium Inc. AGU TSX Aimia Inc. AIM TSX Ainsworth Lumber Co. Ltd. ANS TSX Air Canada AC TSX AirBoss of America Corp. BOS TSX Akita Drilling Ltd. AKT TSX Alacer Gold Corp. ASR TSX Alamos Gold Inc. AGI TSX Alaris Royalty Corp. AD TSX AlarmForce Industries Inc. AF TSX Alderon Iron Ore Corp. ADV TSX Alexco Resource Corp. AXR TSX Algoma Central Corporation ALC TSX Algonquin Power & Utilities Corp AQN TSX Alimentation Couche-Tard Inc. -

BLG Has Been Involved in Many Mergers, Acquisitions, Divestitures, Spin-Offs and Restructurings

Mergers & Acquisitions Mergers and acquisitions are inherently complex. It’s crucial to have an experienced legal team who not only embrace complexity, but can anticipate and manage any issue. Our M&A team's vast experience keeps us at the forefront of this multifaceted field. Our lawyers handle domestic and cross-border M&A transactions across a broad range of industries involving listed and other public entities, as well as the acquisition and disposition of closely-held businesses. Our team includes lawyers who focus on negotiating and executing both public and private M&A transactions and those whose expertise is key to M&A, including tax, securities, competition, foreign investment review, litigation, labour and employment, regulatory, intellectual property, information technology and environmental law. We leverage this combined expertise to offer responsive, targeted advice. Our expertise includes: take-over bids amalgamations and mergers plans of arrangement reorganizations, spin-offs and divestitures going private transactions share and asset purchases and sales We represent: buyers sellers investment banks Boards of Directors Special Committees commercial and merchant banks providing acquisition financing institutional investors buyout funds activist investors Boards of Directors and Special Committees often face multiple layers of complexity in M&A situations. We help them navigate their fiduciary duties, including preserving privilege and undertaking appropriate processes. In this regard, we apply our experience with competitive bidding situations, and court and securities regulatory proceedings. Experience BLG has been involved in many mergers, acquisitions, divestitures, spin-offs and restructurings. Set out below is a selection of recent representative transactions, where we acted as or represented the following: K+S Aktiengesellschaft in the US$1.47 billion sale of its Canadian salt business, including Windsor Salt, to Stone Canyon Industries Holdings LLC and affiliates. -

Pei Reporting Issuer List - Last Update January 13, 2017

PEI REPORTING ISSUER LIST - LAST UPDATE JANUARY 13, 2017 @rgentum Canadian L/S Equity Portfolio @rgentum U.S. Market Neutral Portfolio 01 Communique Laboratory Inc. 130/30 Mining LP 1322256 Alberta Ltd. (formerly Inex Pharmaceuticals Corporation) 1608557 Ontario Inc. 180 Connect Exchangeco Inc. 360networks inc. 407 International Inc. 49 North 2008 Resource Flow-Through Limited Partnership 49 North 2009 Resource Flow-Through Limited Partnership 49 North Resources Inc. (formerly 49 North Resource Fund Inc.) 5Banc Split Inc. 5N Plus Inc. 6550568 Canada Inc. Aastra Technologies Limited Abacus Mining & Exploration Corp. Aberdeen G7 Trust Aberdeen SCOTS Trust Aberdeen Asia-Pacific Income Investment Company Limited AbitibiBowater Inc. Acadian Core International Equity Fund Acasta Enterprises Inc. ACE Aviation Holdings Inc. Acerus Pharmaceuticals Corporation (Formerly Trimel Pharmaceuticals Corporation) Action Energy Inc. ACTIVEnergy Income Fund Acuity 2007 Flow-Through Limited Partnership Acuity All Cap 30 Canadian Equity Class Acuity Canadian Balanced Fund Acuity Canadian Equity Class Acuity Canadian Equity Fund Acuity Canadian Small Cap Class Acuity Diversified Income Class (formerly Acuity Global Dividend Class) Acuity Diversified Income Fund (formerly Acuity Money Market Fund) Acuity Dividend Fund Acuity EAFE Equity Fund Acuity Focused Total Return Trust Acuity Global Dividend (Currency Neutral) Fund Acuity Global Dividend Fund Acuity Global Equity (Currency Neutral) Fund Acuity Global Equity Fund Acuity Global High Income (Currency Neutral) Fund Acuity Global High Income Fund Acuity Growth & Income Trust Acuity High Income Class Acuity Money Market Fund Acuity Natural Resource Class Acuity Natural Resource Fund Acuity Pure Canadian Equity Fund Acuity Short Term Income Class Acuity Small Cap Corporation Acuity Social Values Global Equity Fund Acuity Social Values Portfolio Adaltis Inc. -

Stock Volume Greater Than 90000

Stock Volume Greater Than 90,000 ---> Price Greater Than $2 For Quarter Ending 30 Sep 2016 TICKER_SYMBOL NAME VOLUME AAR.UN Pure Industrial Un 38,006,678 AAV Advantage Oil & Gas 40,605,998 ABT Absolute Software J 3,046,445 ABX Barrick Gold Corp 245,857,965 AC Air Canada Vote & VV 74,269,983 ACO.X ATCO Ltd. Cl I NV 10,941,878 ACQ AutoCanada Inc. 5,016,541 ACR.UN Agellan Commercl Un 3,517,283 AD Alaris Royalty Corp. 11,045,716 ADC.UN 1st Asset CdnConv Un 125,502 ADN Acadian Timber Corp. 666,865 ADW.A Andrew Peller A NV 395,354 AEM Agnico Eagle Mines 41,411,903 AEU.UN ACTIVEnergy Incm Un 2,535,334 AEZ AEterna Zentaris Inc 748,062 AF AlarmForce Ind J 978,201 AFN Ag Growth Int'l Inc. 2,134,095 AFN.DB.A Ag Growth IntlConvDb 4,169,000 AFN.DB.B Ag Growth Intl ExtDb 1,408,000 AFN.DB.C Ag Growth Intl2020Db 2,771,000 AGF.B AGF Management B NV 5,647,768 AGI Alamos Gold Inc. J 55,446,689 AGT AGT Food&Ingredients 4,093,146 AGU Agrium Inc. 20,957,253 AHF.DB.A Aston HillFin 6.5DbJ 6,234,519 AHY.UN Advntg Cdn HiYld Bnd 268,402 AI Atrium Mtg Invest 1,140,326 AI.DB Atrium Mtg Inv5.25Db 348,000 AIF Altus Group Limited 8,287,323 AIM Aimia Inc. 13,674,873 AIM.PR.A Aimia Inc. Ser 1 Pr 276,926 AIM.PR.C Aimia Inc. -

5N Plus 5N Plus A&W Revenue Royalties Aberdeen Asia-Pacific Inc

Toronto Stock Exchange - The Globe and Mail - December 29, 2017 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield 5N Plus VNP.DB 100.300 101.750 88.990 11.14 24497 na 0.0 5N Plus VNP 3.000 3.710 1.620 72.41 16032 na 0.0 A&W Revenue Royalties AW.UN 33.690 42.160 30.110 -8.97 3949 24.24 4.8 Aberdeen Asia-Pacific Inc Inve FAP 4.550 4.870 4.350 3.41 10367 15.69 8.6 Aberdeen International Inc. AAB 0.190 0.210 0.110 18.75 32021 1.73 10.8 Absolute Software ABT 6.880 8.820 6.300 8.69 16631 na 4.7 Acadian Timber Corp. ADN 19.500 20.120 17.000 6.85 2394 22.41 5.7 Acasta Enterprises AEF 5.990 10.290 4.600 -40.63 8324 na 0.0 Acasta Enterprises AEF.WT 0.550 1.450 0.250 -59.26 10110 na 0.0 Accord Financial ACD 9.200 9.550 8.400 2.34 418 11.95 3.8 Acerus Pharmaceuticals Corp. ASP 0.290 0.520 0.095 107.14 77908 na 0.0 ACTIVEnergy Income Fund AEU.UN 4.230 5.190 4.200 -16.57 1310 na 5.7 ADF Group DRX 2.150 3.030 1.900 -25.09 789 71.67 0.9 Advantage Oil & Gas AAV 5.400 9.310 4.840 -40.85 154893 15.43 0.0 Advantaged Cdn High Yd Bond AHY.UN 7.620 7.870 7.250 5.10 421 na 6.0 Aecon Group ARE 19.940 20.040 14.130 30.67 92573 32.16 2.5 Aecon Group ARE.DB.B 101.750 106.250 101.030 -1.69 83480 164.11 0.0 AEterna Zentaris (D) AEZS 2.980 5.440 1.100 -37.92 14533 na 0.0 Africa Oil Corp. -

Vancouver Newsletter 2011-08.Pub

vancouver President’s Report chapter August 2011 Greetings to all! We hope you are enjoying your summer! We are eagerly anticipating the beginning of another year, starting with our AGM, and September Kick-Off event, scheduled for September 21st at the Vancouver Aquarium. Please refer to the Events section of this newsletter for more details. While we have assembled an enthusiastic team to lead the charge this year, we still have two Board positions available for the coming year. If you would like to get more involved at the Board level, please contact myself, Brad Bardua or Peter Ballachey. It’s a great opportunity to participate with a great team in shaping the future for the Chapter! We would also like to take this opportunity to express our appreciation to Estelle Lo, who has accepted a new opportunity (refer to the Members in the News section). Despite serving on the Board for a short period of time, Estelle made a huge impact on the team. We wish Estelle all the best in her new role. Once again, we hope you enjoy the rest of your summer, and look forward to seeing you on September 21st. All the Best, Brad Cruickshank Page 2 vancouver Membership chapter Committee Report I hope you’ve had a wonderful summer! As we get closer to our first event in the Fall, you will be seeing a lot of new faces. In June, we had a whopping 18 new members, who joined the FEI Vancouver Chapter. This is by far the larg- est number of new members, who have ever joined our Chapter in a single month. -

Growing the Green Economy Addressing the Sustainability Challenges and Opportunities Growing the Green Economy Introduction

GROWING THE GREEN ECONOMY ADDRESSING THE SUSTAINABILITY CHALLENGES AND OPPORTUNITIES GROWING THE GREEN ECONOMY INTRODUCTION The severe warnings on climate change are starkly documented. The Report by the Intergovernmental Panel on Climate Change (IPCC), and other reports demonstrate why urgent action to meet the goals of the Paris Agreement is needed. Almost every day new stories appear on how climate change is affecting our planet, from huskies swimming in arctic meltwater to wild fires in California. The public are taking notice and taking action, as exemplified in the protests by global school children started by Greta Thunberg and the Extinction Rebellion. Indeed, the term Climate Emergency has entered the common lexicon. However, while environmental risks have taken centre stage there is a growing recognition and understanding that the net must be cast wider – action to protect the planet and facilitate the transition to the low/zero carbon economy must take into consideration social goals, such as access to education, housing, and jobs, and must be sustainable and “just” in the broadest sense. Governments, legislators and regulators understand this and are beginning to respond accordingly. Not surprisingly much of the legislative effort to date has been focused on the financial system and facilitating at pace the transition to a low carbon and sustainable economy. The European Union has taken the lead on this, and review and analysis of its Sustainable Finance Action Plan is included in a number of articles in this publication. The creation of a sustainable “taxonomy” forms the centrepiece of this plan. However, there is an increasing emphasis on non-financial entities and the requirements that are beginning to be expected of them; in particular, much more detailed disclosure on how environmental, social and governance (ESG) factors are monitored, how these are incorporated into corporate strategies and how they impact on financial performance.