Reference Document 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ðə Məʊˈbɪlɪtɪ ˈkʌmpənɪ

/ ðə məʊˈbɪlɪtɪ ˈkʌmpənɪ / Since 1853. Best known as Transdev. To be the mobility company is very ambitious but also very modest: to bring and build THE solution for clients, only the result counts! The commitment is to be the company that operates the best daily mobility options, in a spirit of open partnership serving communities and people, and with innovation and sustainability in mind at all times. 2 transdev.com THANK YOU TO OUR CONTRIBUTORS. Publication director: Pascale Giet. Photo credits: A. Acosta, W. Beaucardet, CDGVal, Connexxion, O. Desclos, J.-F. Deroubaix, Focke Strangmann, Fotopersbureau HCA/P. Harderwijk, P. Fournier, GettyImages/Westend61, Groupeer, T. Itty, Joel, S. van Leiden, Lizafoto/L. Simonsson, J. Locher, J. Lutt, U. Miethe, J. Minchillo, Mobike, Moovizy Saint-Etienne, Rouen Normandie Autonomous Lab, RyanJLane, Schiphol, T. Schulze, Service photographique The mobility company The mobility de Mulhouse Alsace Agglomération, SkyScans/D. Hancock, A. Oudard Tozzi, Transdev Australasia, Transdev Australia, Transdev et Lohr, Transdev North Holland, Transdev Sweden, Transdev USA, Transport de l’agglomération Nîmoise, Urbis Park, R. Wildenberg. This document is printed on FSC-certifi ed paper made from 100% recycled pulp by an Imprim’Vert-labelled professional. Partner of the Global Compact Design-production-editing: / Publication May 2019. TRANSDEV 10 Our people at the heart of Transdev’s value proposition 14 Meeting the expectations of our clients and passengers 28 Responsibility means being a local economic and social actor 32 Personalized 34 Autonomous 36 Connected 38 Electric 40 & Eco-friendly The mobility company The mobility TRANSDEV 2 Transdev ID* As an operator and global integrator of mobility, Transdev gives people the freedom to move whenever and however they choose. -

Comfortdelgro Corporation Limited Annual Report 2008

ComfortDelGro Corporation Limited Annual Report 2008 Driven Our Vision To be the undisputed global leader in land transport. Contents 1 Our Mission 2 Key Messages 6 Global Footprint 8 Chairman’s Statement 12 Group Financial Highlights 14 Board of Directors 18 Key Management 24 Green Statement 26 Operations Review 47 Corporate Governance 53 Directories 57 Financial Statements 57 Report of the Directors 63 Independent Auditors’ Report 64 Balance Sheets 66 Consolidated Profi t and Loss Statement 67 Consolidated Statement of Changes in Equity 68 Consolidated Cash Flow Statement 70 Notes to the Financial Statements 138 Statement of Directors 139 Share Price Movement Chart 140 Shareholding Statistics 141 Notice of Annual General Meeting Proxy Form Corporate Information Globally we are No.2 with a presence in 7 countries, 26 cities, and a total fl eet of 45,000 vehicles. 33,600 taxis 7, 8 0 0 buses 41 km of rail track Our Mission To be the world’s number one land transport operator in terms of fl eet size, profi tability and growth. Five-Year Compound Annual Growth Rate (CAGR) +8.9% +8.4% Group Turnover Net Profi t was S$3.1 billion in 2008, was S$200.1 million in 2008, up from S$2.0 billion in 2003 up from S$133.9 million in 2003 +13.1% +1.7% Overseas Turnover EBITDA* was S$1.3 billion in 2008, was S$541.7 million in 2008, up from S$706.2 million in 2003 up from S$498.9 million in 2003 +5.8% +3.8% Group Operating Profi t Net Asset Value Per was S$278.0 million in 2008, Ordinary Share up from S$209.6 million in 2003 was 74.7 cents in 2008, up from 62.0 cents in 2003 +24.1% +18.5% Overseas Operating Profi t Total Shareholder was S$129.8 million in 2008, Return up from S$44.1 million in 2003 * Refers to earnings before interest, taxation, depreciation and amortisation 1 ComfortDelGro Corporation Limited Annual Report 2008 Our Mission We aim to be No.1 Nothing is impossible. -

Multimodal Pricing and the Optimal Design of Bus Services: New Elements and Extensions

Multimodal Pricing and the Optimal Design of Bus Services: New Elements and Extensions Alejandro Andrés Tirachini Thesis submitted in partial fulfilment of the requirements for the degree of Doctor of Philosophy in the Business School, University of Sydney, Australia July 2012 Institute of Transport and Logistics Studies The University of Sydney Business School The University of Sydney NSW 2006 Australia Abstract This thesis analyses the pricing and design of urban transport systems; in particular the optimal design and efficient operation of bus services and the pricing of urban transport. Five main topics are addressed: (i) the influence of considering non-motorised travel alternatives (walking and cycling) in the estimation of optimal bus fares, (ii) the choice of a fare collection system and bus boarding policy, (iii) the influence of passengers’ crowding on bus operations and optimal supply levels, (iv) the optimal investment in road infrastructure for buses, which is attached to a target bus running speed and (v) the characterisation of bus congestion and its impact on bus operation and service design. Total cost minimisation and social welfare maximisation models are developed, which are complemented by the empirical estimation of bus travel times. As bus patronage increases, it is efficient to invest money in speeding up boarding and alighting times. Once on-board cash payment has been ruled out, allowing boarding at all doors is more important as a tool to reduce both users and operator costs than technological improvements on fare collection. The consideration of crowding externalities (in respect of both seating and standing) imposes a higher optimal bus fare, and consequently, a reduction of the optimal bus subsidy. -

State Transit Authority 2001 - 2002

State Transit Authority 2001 - 2002 Sydney Buses Sydney Ferries Newcastle Bus & Ferry Services annual reportannual annual reportannual www.sta.nsw.gov.au STATE TRANSIT AUTHORITY OF NEW SOUTH WALES ANNUAL REPORT 2001 - 2002 1 STATE TRANSIT AUTHORITY OF NEW SOUTH WALES ANNUAL REPORT 2001 - 2002 2 Table of Contents About State Transit 4 Performance Highlights 7 Year in Review 8 CEO’s and Chairman’s Foreword 9 Review of Operations 11 Reliability 12 Convenience 17 Safety and security 22 Efficiency 26 Courtesy - Customer Service 32 Comfort 38 Sydney Ferries Reform 41 Financial Statements 46 Appendices 81 Index 117 STATE TRANSIT AUTHORITY OF NEW SOUTH WALES ANNUAL REPORT 2001 - 2002 3 About State Transit - FAQ’s State Transit manages the largest bus and ferry operation in Australia. State Transit operates 4 businesses: Sydney Buses, Sydney Ferries, Newcastle Bus and Ferry Services and Western Sydney Buses (Liverpool-Parramatta Transitway). Bus Fleet · At year end, State Transit’s bus fleet totalled 1,935 buses: - 750 are air-conditioned (38.8% of fleet), - 579 are low floor design (30% of fleet), - 468 buses are fully wheelchair accessible (24.2% of fleet) - 368 buses are CNG powered (21% of the Sydney fleet) and - 360 buses have Euro 2 diesel engines (18.6% of the fleet). Ferry Fleet · 32 ferries operate services in Sydney Harbour and 2 ferries operate on Newcastle Harbour. · The ferry fleet consists of four Freshwater class vessels, three Lady class, eleven First Fleeters, three JetCats, seven RiverCats, two HarbourCats and four SuperCats. · Sydney Ferries operates across the length and breadth of Sydney Harbour and along the length of the Parramatta River into Parramatta. -

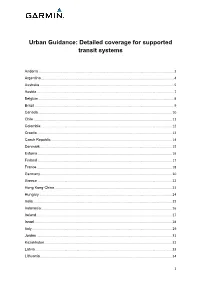

Urban Guidance: Detailed Coverage for Supported Transit Systems

Urban Guidance: Detailed coverage for supported transit systems Andorra .................................................................................................................................................. 3 Argentina ............................................................................................................................................... 4 Australia ................................................................................................................................................. 5 Austria .................................................................................................................................................... 7 Belgium .................................................................................................................................................. 8 Brazil ...................................................................................................................................................... 9 Canada ................................................................................................................................................ 10 Chile ..................................................................................................................................................... 11 Colombia .............................................................................................................................................. 12 Croatia ................................................................................................................................................. -

State Transit Annual Report 2000-2001

STATE TRANSIT ANNUAL REPORT 2000-2001 SYDNEY BUSES | SYDNEY FERRIES | NEWCASTLE SERVICES Table of Contents About State Transit 1 Performance Highlights 4 Year in Review 5 CEO’s and Chairman’s Foreword 6 Review of Operations 8 Reliability 9 Covenience 13 Efficiency 16 Courtesy – Customer service 19 Comfort 22 Safety and security 24 Sydney Ferries Reform 27 Financial Statements 28 Appendices 108 Index 135 About State Transit - FAQs State Transit manages one of the largest bus and ferry operations of any city in the world. State Transit manages one of the largest bus and ferry operations of any city in the world. State Transit operates 3 businesses: Sydney Buses, Sydney Ferries and Newcastle Bus and Ferry Services. Bus Fleet I 1,926 buses in Sydney and Newcastle. In this fleet State Transit has - • 492 low floor buses, 25.5% of the fleet • 381 fully wheelchair accessible buses, 19.8% of the fleet • 664 air-conditioned buses, 34.5% of the fleet • 283 CNG powered buses, 14.7% of the fleet Ferry Fleet I 32 ferries in run services in Sydney Harbour and 2 ferries operate on Newcastle Harbour. I The ferry fleet consists of four Freshwater class vessels, three Lady class, eleven First Fleeters, three JetCats, seven RiverCats, two HarbourCats and four SuperCats. I Sydney Ferries operates across the length and breadth of Sydney Harbour and along the length of the Parramatta River into Parramatta. I Newcastle Ferries operates services between Newcastle and Stockton. Patronage I State Transit carries 222 million passengers every year. I Every working day State Transit operates more than 15,000 services carrying more than 600,000 passengers to their destinations. -

Using the Trip Planner School Bus Timetables Transport NSW Trip

Transport NSW Trip Planner Information Using the trip planner You can use the trip planner to plan your trip to school on: • All school buses in Sydney, the Blue Mountains, Central Coast, Hunter, Illawarra and Southern Highlands. • Regular bus, train, ferry and light rail services. To plan your trip to school on a school bus using the trip planner: • Enter your location in the 'From' field, such as your home address • Enter your destination in the ‘To’ field, such as your school name • Set the date and time you wish to travel, e.g. 8.00am • Select ‘School bus’ under the ‘More options’ tab to see school buses. • To narrow down your results to only school buses, untick the checkboxes for the other transport modes. • Look for the school bus icon in your trip plan results. Not all schools have dedicated school bus services. Using the trip planner, you can see your trip options on any mode - train, bus, ferry or light rail - operating near your school and home. School bus timetables If you know your school route number, you can check timetables and maps for all school buses in Sydney, the Blue Mountains, Central Coast, Hunter, Illawarra and Southern Highlands. To search for a timetable: 1. Select the ‘Bus’ tab 2. Enter your full route number and ensure you tick ‘Include school buses’. Note: All State Transit buses and some private operators use a suffix letter in their school route. If you don’t know your school route number, you can find out by planning a trip to your school using the trip planner, or contacting your school or school bus operator. -

Crowding in Public Transport Systems: Effects on Users, Operation and Implications for the Estimation of Demand

Transportation Research Part A 53 (2013) 36–52 Contents lists available at SciVerse ScienceDirect Transportation Research Part A journal homepage: www.elsevier.com/locate/tra Crowding in public transport systems: Effects on users, operation and implications for the estimation of demand a, b,1 b,1 Alejandro Tirachini ⇑, David A. Hensher , John M. Rose a Transport Engineering Division, Civil Engineering Department, Universidad de Chile, Santiago, Chile b Institute of Transport and Logistics Studies (ITLS), The University of Sydney Business School, The University of Sydney, NSW 2006, Australia article info abstract Article history: The effects of high passenger density at bus stops, at rail stations, inside buses and trains Received 9 November 2012 are diverse. This paper examines the multiple dimensions of passenger crowding related to Received in revised form 24 June 2013 public transport demand, supply and operations, including effects on operating speed, Accepted 24 June 2013 waiting time, travel time reliability, passengers’ wellbeing, valuation of waiting and in- vehicle time savings, route and bus choice, and optimal levels of frequency, vehicle size and fare. Secondly, crowding externalities are estimated for rail and bus services in Sydney, Keywords: in order to show the impact of crowding on the estimated value of in-vehicle time savings Crowding and demand prediction. Using Multinomial Logit (MNL) and Error Components (EC) mod- Standing Travel time els, we show that alternative assumptions concerning the threshold load factor that trig- Waiting time gers a crowding externality effect do have an influence on the value of travel time Reliability (VTTS) for low occupancy levels (all passengers sitting); however, for high occupancy lev- Wellbeing els, alternative crowding models estimate similar VTTS. -

Privatisation of Sydney Buses: the Real Story

PRIVATISATION OF SYDNEY BUSES: THE REAL STORY The privatisation of public buses in Sydney’s Inner West, or Region 6 of the metropolitan bus network, represents a major change to Sydney’s public transport system. There are 233 routes in Region 6, with commuters taking more than 42 million trips on those routes every year. Around 1,300 workers are based in the four depots to be privatised – at Tempe, Kingsgrove, Burwood and Leichhardt. WHY IS THE STATE GOVERNMENT WHY DID BUS DRIVERS TAKE PRIVATISING SYDNEY BUSES? INDUSTRIAL ACTION? Transport Minister Andrew Constance Transport Minister Andrew Constance says says it’s because there were 12,000 drivers were told to strike by “union bosses”. complaints about Sydney Buses in the Inner West in one year. This number is too The reality is that bus drivers in the Inner much, so it had no choice than to privatise West overwhelmingly decided to give the service. passengers a fare free day, take strike action and have a uniform ban. They did so knowing The reality is that buses in the Inner West they would lose a big chunk of pay and risk recorded only 3.21 complaints per 1,000 potential fines. trips – which is lower than other regions, including privately-operated services in Workers at Sydney Buses are concerned the South West (3.36) and Outer West about their jobs and the future of local bus (3.38) regions. (Source: The Guardian) services. What’s more, late-running buses in the Inner West are not caused by poor drivers or bad management, they are caused by the crippling inner city traffic congestion. -

Bus Contracts, Competitive Tendering, Negotiated Contracts, Buses, Emissions, Zero Emission, Electric, Hydrogen, Hybrids, Infrastructure Needs

The compelling case for returning to or continuing with negotiated contracts under the transition to a green fleet in Australia David A. Hensher Institute of Transport and Logistics Studies (ITLS), The University of Sydney Business School [email protected] 8 March 2021 Abstract Bus operators in the public and private sector are increasingly subject to competitive tendering and a requirement to operate under a gross cost contract. This contract sets out in detail the requirements of the operator including the levels of service as well as infrastructure required to deliver the contracted services. Buses acquired by operators in many jurisdictions in Australia have until very recently been essentially diesel fuelled and available from a panel approved set of buses compliant with Euro 6 standards. The predictability of the cost profiles of vehicles and associated costs of maintenance and repairs is well known and used in tendered offers. With the growing requirement of switching to a green fleet with varying timetabled transition rates, the future costs of providing bus services are going to be subject to significant unknowns. These unknowns are associated not only with the fast changing vehicle technology associated with a range of fuel sources (notably standard battery and fuel cell battery (i.e., hydrogen)), but also the impact this will have of the top-to-bottom change in the operations of bus fleets affecting operating and capital expenditure including depot infrastructure, timetabling, maintenance, labour skills and access to efficient electricity charging or hydrogen facilities. With such great uncertainty, the challenge of how to structure future contracts to allow for such volatility in cost commitments becomes of paramount importance to both the regulator and the bus operator. -

Inquiry Into Electric Buses in NSW Public Transport Networks

Inquiry into electric buses in NSW public transport networks 20 December 2019 BusNSW is the peak body for the NSW private bus and coach industry. Our members provide essential services and provide a key interface with the travelling public. BusNSW’s mission is to foster the efficient and sustainable growth of public transport in NSW, and to promote the benefits of bus travel. Buses play a vital role in delivering public transport in NSW and carry around 332 million passengers annually, including almost 580,000 students travelling to and from school each day. More passengers are carried by bus in NSW than by any other mode including rail. The flexibility offered by buses, their ability to operate at short notice along a myriad of routes and with a minimum of infrastructure spending, and their capacity to carry a variable passenger load make them an ideal solution to meet a range of transport needs. BusNSW Members provide bus services under Transport for NSW contracts in Sydney metropolitan and outer-metropolitan areas, and in NSW rural and regional areas. They also provide “non-contracted” services in the long distance, tourist and charter sector. BusNSW also represents a wide range of bus manufacturers and other industry suppliers as Associate Members. Traditionally our members have been at the forefront of innovation, embracing new technology to provide the highest standards of safety and customer experience. Governments around the world are taking action to prepare for and accelerate the adoption of Electric Vehicle technologies, in recognition of the economic, social and environmental benefits. BusNSW acknowledges that the NSW Government has published an Electric and Hybrid Vehicle Plan to reflect the growing focus on future mobility and technology innovations which will modernise transport for the community and businesses across New South Wales. -

Submission: Inquiry Into the Investment of Commonwealth And

To: The Chairman, Rural and Regional Affairs and Transport Committee The Australian Senate 3 March 2009 Re: Inquiry into Investment of Commonwealth and State Funds in Public Passenger Transport Infrastructure and Services Dear Sir, With regard to the Terms of Reference for the above Inquiry, I would wish to make a number of points, using Sydney as a case study to illustrate more general issues which apply t all the State Capital cities. Term of Reference (a) Audit of State of Public Transport With regard to an audit of the state of public transport in Australia, I would suggest that this include such issues as: • Overall travel patterns and trends, with specific reference to recent trends (which have shown a strong increase in public transport use in moist cities) as well as to patterns of travel within cities (since these vary substantially from the average for a given city) • Data on passenger-kms of use, not simply trips. This is important for a full understanding of the role of different modes. • Data on capacity and utilisation of different systems (e.g. seat-kms versus passenger kms; maximum network capacity (for rail) based on use of all potentially available train paths etc. This is important to gain an understanding of the scope for increasing services and patronage before major infrastructure upgrades are required. • Infrastructure and rollingstock audit, including such issues as average ages of different types of infrastructure, percentage of fleet with air conditioning etc. These are important indicators of the quality of a network and of potential upgrade costs. • Service quality indicators including not only basic data such as percentage of services on time, but other data such as average speed of services.