Global Proxy Voting Records

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEACHERS' RETIREMENT SYSTEM of the STATE of ILLINOIS 2815 West Washington Street I P.O

Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Performed as Special Assistant Auditors for the Auditor General, State of Illinois Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Table of Contents Schedule Page(s) System Officials 1 Management Assertion Letter 2 Compliance Report Summary 3 Independent Accountant’s Report on State Compliance, on Internal Control over Compliance, and on Supplementary Information for State Compliance Purposes 4 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 8 Schedule of Findings Current Findings – State Compliance 10 Supplementary Information for State Compliance Purposes Fiscal Schedules and Analysis Schedule of Appropriations, Expenditures and Lapsed Balances 1 13 Comparative Schedules of Net Appropriations, Expenditures and Lapsed Balances 2 15 Comparative Schedule of Revenues and Expenses 3 17 Schedule of Administrative Expenses 4 18 Schedule of Changes in Property and Equipment 5 19 Schedule of Investment Portfolio 6 20 Schedule of Investment Manager and Custodian Fees 7 21 Analysis of Operations (Unaudited) Analysis of Operations (Functions and Planning) 30 Progress in Funding the System 34 Analysis of Significant Variations in Revenues and Expenses 36 Analysis of Significant Variations in Administrative Expenses 37 Analysis -

2021 Annual General Meeting and Proxy Statement 2020 Annual Report

2020 Annual Report and Proxyand Statement 2021 Annual General Meeting Meeting General Annual 2021 Transocean Ltd. • 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT • 2020 ANNUAL REPORT CONTENTS LETTER TO SHAREHOLDERS NOTICE OF 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT COMPENSATION REPORT 2020 ANNUAL REPORT TO SHAREHOLDERS ABOUT TRANSOCEAN LTD. Transocean is a leading international provider of offshore contract drilling services for oil and gas wells. The company specializes in technically demanding sectors of the global offshore drilling business with a particular focus on ultra-deepwater and harsh environment drilling services, and operates one of the most versatile offshore drilling fleets in the world. Transocean owns or has partial ownership interests in, and operates a fleet of 37 mobile offshore drilling units consisting of 27 ultra-deepwater floaters and 10 harsh environment floaters. In addition, Transocean is constructing two ultra-deepwater drillships. Our shares are traded on the New York Stock Exchange under the symbol RIG. OUR GLOBAL MARKET PRESENCE Ultra-Deepwater 27 Harsh Environment 10 The symbols in the map above represent the company’s global market presence as of the February 12, 2021 Fleet Status Report. ABOUT THE COVER The front cover features two of our crewmembers onboard the Deepwater Conqueror in the Gulf of Mexico and was taken prior to the COVID-19 pandemic. During the pandemic, our priorities remain keeping our employees, customers, contractors and their families healthy and safe, and delivering incident-free operations to our customers worldwide. FORWARD-LOOKING STATEMENTS Any statements included in this Proxy Statement and 2020 Annual Report that are not historical facts, including, without limitation, statements regarding future market trends and results of operations are forward-looking statements within the meaning of applicable securities law. -

Chapter 11 ) VALARIS PLC, Et Al.,1 ) Case No

Case 20-34114 Document 16 Filed in TXSB on 08/19/20 Page 1 of 63 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) VALARIS PLC, et al.,1 ) Case No. 20-34114 (MI) ) Debtors. ) (Jointly Administered) ) (Emergency Hearing Requested) DEBTORS’ EMERGENCY APPLICATION FOR ENTRY OF AN ORDER AUTHORIZING THE RETENTION AND APPOINTMENT OF STRETTO AS CLAIMS, NOTICING, AND SOLICITATION AGENT EMERGENCY RELIEF HAS BEEN REQUESTED. A HEARING WILL BE CONDUCTED ON THIS MATTER ON AUGUST 20, 2020 AT 2:00 PM IN COURTROOM 404, 4TH FLOOR, 515 RUSK AVENUE, HOUSTON, TX 77002. YOU MAY PARTICIPATE IN THE HEARING EITHER IN PERSON OR BY AUDIO/VIDEO CONNECTION. AUDIO COMMUNICATION WILL BE BY USE OF THE COURT’S DIAL-IN FACILITY. YOU MAY ACCESS THE FACILITY AT (832) 917-1510. YOU WILL BE RESPONSIBLE FOR YOUR OWN LONG-DISTANCE CHARGES. ONCE CONNECTED, YOU WILL BE ASKED TO ENTER THE CONFERENCE ROOM NUMBER. JUDGE ISGUR’S CONFERENCE ROOM NUMBER IS 954554. YOU MAY VIEW VIDEO VIA GOTOMEETING. TO USE GOTOMEETING, THE COURT RECOMMENDS THAT YOU DOWNLOAD THE FREE GOTOMEETING APPLICATION. TO CONNECT, YOU SHOULD ENTER THE MEETING CODE “JUDGEISGUR” IN THE GOTOMEETING APP OR CLICK THE LINK ON JUDGE ISGUR’S HOME PAGE ON THE SOUTHERN DISTRICT OF TEXAS WEBSITE. ONCE CONNECTED, CLICK THE SETTINGS ICON IN THE UPPER RIGHT CORNER AND ENTER YOUR NAME UNDER THE PERSONAL INFORMATION SETTING. HEARING APPEARANCES MUST BE MADE ELECTRONICALLY IN ADVANCE OF THE HEARING. TO MAKE YOUR ELECTRONIC APPEARANCE, GO TO THE SOUTHERN DISTRICT OF TEXAS WEBSITE AND SELECT “BANKRUPTCY COURT” FROM THE TOP MENU. -

E-Learning Most Socially Active Professionals

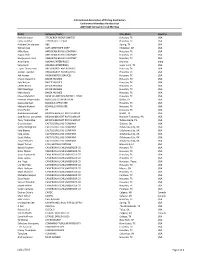

The World’s Most Socially Active Oil & Energy Professionals – September 2020 Position Company Name LinkedIN URL Location Size No. Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 Rystad Energy https://www.linkedin.com/company/572589 Norway 201-500 282 87 30.85% 2 Comerc Energia https://www.linkedin.com/company/2023479 Brazil 201-500 327 89 27.22% 3 International Energy Agency (IEA) https://www.linkedin.com/company/26952 France 201-500 426 113 26.53% 4 Tecnogera Geradores https://www.linkedin.com/company/2679062 Brazil 201-500 211 52 24.64% 5 Cenit Transporte y Logística de Hidrocarburos https://www.linkedin.com/company/3021697 Colombia 201-500 376 92 24.47% 6 Moove https://www.linkedin.com/company/12603739 Brazil 501-1000 250 59 23.60% 7 Evida https://www.linkedin.com/company/15252384 Denmark 201-500 246 57 23.17% 8 Dragon Products Ltd https://www.linkedin.com/company/9067234 United States 1001-5000 350 79 22.57% 9 Kenter https://www.linkedin.com/company/10576847 Netherlands 201-500 246 54 21.95% 10 Repower Italia https://www.linkedin.com/company/945861 Italy 501-1000 444 96 21.62% 11 Trident Energy https://www.linkedin.com/company/11079195 United Kingdom 201-500 283 60 21.20% 12 Odfjell Well Services https://www.linkedin.com/company/9363412 Norway 501-1000 250 52 20.80% 13 XM Filial de ISA https://www.linkedin.com/company/2570688 Colombia 201-500 229 47 20.52% 14 Energi Fyn https://www.linkedin.com/company/1653081 Denmark 201-500 219 44 20.09% 15 Society of Petroleum Engineers International https://www.linkedin.com/company/23356 United States 201-500 1,477 294 19.91% 16 Votorantim Energia https://www.linkedin.com/company/3264372 Brazil 201-500 443 86 19.41% 17 TGT Oilfield Services https://www.linkedin.com/company/1360433 United Arab Emirates201-500 203 38 18.72% 18 Motrice Soluções em Energia https://www.linkedin.com/company/11355976 Brazil 201-500 214 40 18.69% 19 GranIHC Services S.A. -

Halliburton Company

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A (RULE 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material under §240.14a-12 HALLIBURTON COMPANY (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: To Our Valued Shareholders: April 7, 2020 “Turning to 2020, . -

United States Bankruptcy Court Southern District of Texas Houston Division

Case 20-34114 Document 528 Filed in TXSB on 10/19/20 Page 1 of 58 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) VALARIS PLC, et al.,1 ) Case No. 20-34114 (MI) ) Debtors. ) (Jointly Administered) ) GLOBAL NOTES, METHODOLOGY, AND SPECIFIC DISCLOSURES REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS Introduction Valaris plc (“Valaris”) and its debtor affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases (collectively, the “Debtors”), with the assistance of their advisors, have filed their respective Schedules of Assets and Liabilities (the “Schedules”) and Statements of Financial Affairs (the “Statements,” and together with the Schedules, the “Schedules and Statements”) with the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”), under section 521 of title 11 of the United States Code (the “Bankruptcy Code”), Rule 1007 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”), and Rule 1007-1 of the Bankruptcy Local Rules for the Southern District of Texas (the “Local Rules”). These Global Notes, Methodology, and Specific Disclosures Regarding the Debtors’ Schedules of Assets and Liabilities and Statements of Financial Affairs (the “Global Notes”) pertain to, are incorporated by reference in, and comprise an integral part of all of the Debtors’ Schedules and Statements. The Global Notes should be referred to, considered, and reviewed in connection with any review of the Schedules and Statements. The Schedules and Statements do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), nor are they intended to be fully reconciled with the financial statements of each Debtor. -

Conference Roster V4.Xlsx

International Association of Drilling Contractors Conference Attendees Handout List 2019 IADC Annual General Meeting Name Company Name City, State Country Niels Meissner 3T ENERGY GROUP LIMITED Houston, TX USA Lizzie Fletcher 7TH DISTRICT TEXAS Houston, TX USA Andrew Christensen ABS Spring, TX USA William Lee ALPS WIRE ROPE CORP Chidester, AR USA Mike Borg AMERICAN BLOCK COMPANY Houston, TX USA Rajani Shah AMERICAN BLOCK COMPANY Houston, TX USA Rocquee Johnson AMERICAN BLOCK COMPANY Houston, TX USA Arun Karle ASKARA ENTERPRISES Mumbai India Sang Karle ASKARA ENTERPRISES Sugar Land, TX USA Espen Thomassen AXESS NORTH AMERICA INC Houston, TX USA Jostein Tverdal AXESS NORTH AMERICA INC Houston, TX USA Jeff Hunter AXON ENERGY SERVICES Houston, TX USA Chuck Chauviere BAKER HUGHES Houston, TX USA Kyle Nelson BAKER HUGHES Houston, TX USA Lester Bruno BAKER HUGHES Houston, TX USA Matt Boerlage BAKER HUGHES Houston, TX USA Mike Bowie BAKER HUGHES Houston, TX USA Chase Mulvehill BANK OF AMERICA MERRILL LYNCH Houston, TX USA Herman Vizcarrondo BESTOLIFE CORPORATION Dallas, TX USA Jessica Bertsch BOSKALIS OFFSHORE Houston, TX USA Michele Richard BOSKALIS OFFSHORE Houston, TX USA Chris Parker BP Houston, TX USA Andrew Hernandez BRIDON‐BEKAERT ROPES GROUP Haslet, TX USA Jose Ramon Cervantes BRIDON‐BEKAERT ROPES GROUP Hanover Township, PA USA Tony Tarabochia BRIDON‐BEKAERT ROPES GROUP Wilkes‐Barre, PA USA Greg Hudson CACTUS DRILLING COMPANY Guthrie, OK USA Kathy Willingham CACTUS DRILLING COMPANY Oklahoma City, OK USA Kyle Blevins CACTUS DRILLING COMPANY -

Core Laboratories N.V. 2020 Remuneration Report

Core Laboratories N.V. 2020 Remuneration Report INTRODUCTION The Board of Supervisory Directors, on recommendation of the Compensation Committee, determines the remuneration of the key management personnel or Named Executive Officers (“NEOs”). During the Annual General Meeting of Shareholders on 20 May 2020, the remuneration policy presented for the Management Board and Supervisory Board was adopted and approved by the shareholders, and the remuneration report was approved, on an advisory basis. Compensation Committee’s Principal Functions The Compensation Committee's principal functions, which are discussed in more detail in its charter, include a general review of our compensation and benefit plans to ensure that they are properly designed to meet corporate objectives. The Compensation Committee reviews and approves the compensation of our Chief Executive Officer and our senior executive officers, granting of awards under our benefit plans and adopting and changing major compensation policies and practices. The Compensation Committee also regularly discusses a succession plan for the Chief Executive Officer and other senior executive management. In addition to establishing the compensation for the Chief Executive Officer, the Compensation Committee reports its recommendations to the Supervisory Board for review and approve awards made pursuant to our Long-Term Incentive Plan (“LTIP”). Pursuant to its charter, the Compensation Committee has the authority to delegate its responsibilities to other persons. The Compensation Committee held six meetings in 2020. The Compensation Committee periodically retains a consultant to provide independent advice on executive compensation matters and to perform specific project-related work. The Compensation Committee communicates to the consultant the role that management has in the analysis of executive compensation, such as the verification of executive and Company information that the consultant requires. -

Customer Margins for Onechicago Futures

#45633 TO: ALL CLEARING MEMBERS DATE: September 13, 2019 SUBJECT: Customer Margins for OneChicago Futures Each month OCC updates OneChicago scan ranges used in the OCX SPAN parameter file. The frequency of the updates is intended to keep the futures customer margin rates more closely aligned with clearing margins, while maintaining regulatory minimums related to security futures. This month’s new rates will be effective on Tuesday 9/24. To receive email notification of these rate changes, which includes an attached file of the rate changes, please subscribe to the ONE Updates list from the OFRA webpage: https://www.theocc.com/risk- management/ofra/, or contact [email protected]. The following scan ranges will be updated, and all others will not change: Commodity Name Current Scan Code Scan Range Range Effective 9/24 AAL American Airlines Group Inc. 29.4 30.1 ABMD ABIOMED INCCOM 29.0 20.0 ACAD ACADIA PHARMACEUTICALS 29.1 53.7 ACIA ACACIA COMMUNICATIONS INCCOM 24.4 23.7 AGIO AGIOS PHARMACEUTICALS INCCOM 23.1 22.1 AKCA AKCEA THERAPEUTICS INCCOM 29.2 28.9 AKRX AKORN INCCOM 23.7 30.1 ALGN ALIGN TECHNOLOGY INCCOM 39.7 20.0 AMAG AMAG Pharmaceuticals Inc 23.4 20.0 AMBA AMBARELLA INCSHS 20.0 22.3 AMCR AMCOR PLC 23.9 22.8 AMD ADVANCED MICRO DEVICES INC 27.1 20.0 ANGI ANGI Homeservices Inc. 84.8 20.0 APEI AMERICAN PUBLIC EDUCATION INCOM 35.8 20.0 APHA APHRIA INCCOM 38.7 31.9 AR ANTERO RES CORPCOM 22.0 25.3 BITA BITAUTO HLDGS LTDSPONSORED ADS 21.0 20.4 BKEP BLUEKNIGHT ENERGY PARTNERS LCOM UNIT 22.5 22.7 BLUE BLUEBIRD BIO INCCOM 23.6 23.2 CARA CARA THERAPEUTICS INCCOM 25.8 25.4 CBL CBL & ASSOC PPTYS INCCOM 26.3 65.4 CCO Clear Channel Outdoor Holdings, Inc. -

Negativliste. Fossil Energi

Negativliste. Fossil energi Maj 2021 Udstedende selskab 1 ABJA Investment Co Pte Ltd 2 ABM Investama Tbk PT 3 Aboitiz Equity Ventures Inc 4 Aboitiz Power Corp 5 Abraxas Petroleum Corp 6 Abu Dhabi National Energy Co PJSC 7 AC Energy Finance International Ltd 8 Adams Resources & Energy Inc 9 Adani Electricity Mumbai Ltd 10 Adani Power Ltd 11 Adani Transmission Ltd 12 Adaro Energy Tbk PT 13 Adaro Indonesia PT 14 ADES International Holding PLC 15 Advantage Oil & Gas Ltd 16 Aegis Logistics Ltd 17 Aenza SAA 18 AEP Transmission Co LLC 19 AES Alicura SA 20 AES El Salvador Trust II 21 AES Gener SA 22 AEV International Pte Ltd 23 African Rainbow Minerals Ltd 24 AGL Energy Ltd 25 Agritrade Resources Ltd 26 AI Candelaria Spain SLU 27 Air Water Inc 28 Akastor ASA 29 Aker BP ASA 30 Aker Solutions ASA 31 Aksa Akrilik Kimya Sanayii AS 32 Aksa Enerji Uretim AS 33 Alabama Power Co 34 Alarko Holding AS 35 Albioma SA 36 Alexandria Mineral Oils Co 37 Alfa Energi Investama Tbk PT 38 ALLETE Inc 1 39 Alliance Holdings GP LP 40 Alliance Resource Operating Partners LP / Alliance Resource Finance Corp 41 Alliance Resource Partners LP 42 Alliant Energy Corp 43 Alpha Metallurgical Resources Inc 44 Alpha Natural Resources Inc 45 Alta Mesa Resources Inc 46 AltaGas Ltd 47 Altera Infrastructure LP 48 Altius Minerals Corp 49 Altus Midstream Co 50 Aluminum Corp of China Ltd 51 Ameren Corp 52 American Electric Power Co Inc 53 American Shipping Co ASA 54 American Tanker Inc 55 AmeriGas Partners LP / AmeriGas Finance Corp 56 Amplify Energy Corp 57 Amplify Energy Corp/TX 58 -

Harga Sewaktu Wak Jadi Sebelum

HARGA SEWAKTU WAKTU BISA BERUBAH, HARGA TERBARU DAN STOCK JADI SEBELUM ORDER SILAHKAN HUBUNGI KONTAK UNTUK CEK HARGA YANG TERTERA SUDAH FULL ISI !!!! Berikut harga HDD per tgl 14 - 02 - 2016 : PROMO BERLAKU SELAMA PERSEDIAAN MASIH ADA!!! EXTERNAL NEW MODEL my passport ultra 1tb Rp 1,040,000 NEW MODEL my passport ultra 2tb Rp 1,560,000 NEW MODEL my passport ultra 3tb Rp 2,500,000 NEW wd element 500gb Rp 735,000 1tb Rp 990,000 2tb WD my book Premium Storage 2tb Rp 1,650,000 (external 3,5") 3tb Rp 2,070,000 pakai adaptor 4tb Rp 2,700,000 6tb Rp 4,200,000 WD ELEMENT DESKTOP (NEW MODEL) 2tb 3tb Rp 1,950,000 Seagate falcon desktop (pake adaptor) 2tb Rp 1,500,000 NEW MODEL!! 3tb Rp - 4tb Rp - Hitachi touro Desk PRO 4tb seagate falcon 500gb Rp 715,000 1tb Rp 980,000 2tb Rp 1,510,000 Seagate SLIM 500gb Rp 750,000 1tb Rp 1,000,000 2tb Rp 1,550,000 1tb seagate wireless up 2tb Hitachi touro 500gb Rp 740,000 1tb Rp 930,000 Hitachi touro S 7200rpm 500gb Rp 810,000 1tb Rp 1,050,000 Transcend 500gb Anti shock 25H3 1tb Rp 1,040,000 2tb Rp 1,725,000 ADATA HD 710 750gb antishock & Waterproof 1tb Rp 1,000,000 2tb INTERNAL WD Blue 500gb Rp 710,000 1tb Rp 840,000 green 2tb Rp 1,270,000 3tb Rp 1,715,000 4tb Rp 2,400,000 5tb Rp 2,960,000 6tb Rp 3,840,000 black 500gb Rp 1,025,000 1tb Rp 1,285,000 2tb Rp 2,055,000 3tb Rp 2,680,000 4tb Rp 3,460,000 SEAGATE Internal 500gb Rp 685,000 1tb Rp 835,000 2tb Rp 1,215,000 3tb Rp 1,655,000 4tb Rp 2,370,000 Hitachi internal 500gb 1tb Toshiba internal 500gb Rp 630,000 1tb 2tb Rp 1,155,000 3tb Rp 1,585,000 untuk yang ingin -

The US in South Korea

THE U.S. IN SOUTH KOREA: ALLY OR EMPIRE? PERSPECTIVES IN GEOPOLITICS GRADE: 9-12 AUTHOR: Sharlyn Scott TOPIC/THEME: Social Studies TIME REQUIRED: Four to five 55-minute class periods BACKGROUND: This lesson examines different perspectives on the relationship between the U.S. and the Republic of Korea (R.O.K. – South Korea) historically and today. Is the United States military presence a benevolent force protecting both South Korean and American interests in East Asia? Or is the U.S. a domineering empire using the hard power of its military in South Korea solely to achieve its own geopolitical goals in the region and the world? Are there issues between the ROK and the U.S. that can be resolved for mutually beneficial results? An overview of the history of U.S. involvement in Korea since the end of World War II will be studied for context in examining these questions. In addition, current academic and newspaper articles as well as op-ed pieces by controversial yet reliable sources will offer insight into both American and South Korean perspectives. These perspectives will be analyzed as students grapple with important geopolitical questions involving the relationship between the U.S. and the R.O.K. CURRICULUM CONNECTION: This unit could be used with regional Geography class, World History, as well as American History as it relates to the Korean War and/or U.S. military expansion OBJECTIVES AND STANDARDS: The student will be able to: 1. Comprehend the historical relationship of the U.S. and the Korean Peninsula 2. Demonstrate both the U.S.