2021 Annual General Meeting and Proxy Statement 2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEACHERS' RETIREMENT SYSTEM of the STATE of ILLINOIS 2815 West Washington Street I P.O

Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Performed as Special Assistant Auditors for the Auditor General, State of Illinois Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Table of Contents Schedule Page(s) System Officials 1 Management Assertion Letter 2 Compliance Report Summary 3 Independent Accountant’s Report on State Compliance, on Internal Control over Compliance, and on Supplementary Information for State Compliance Purposes 4 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 8 Schedule of Findings Current Findings – State Compliance 10 Supplementary Information for State Compliance Purposes Fiscal Schedules and Analysis Schedule of Appropriations, Expenditures and Lapsed Balances 1 13 Comparative Schedules of Net Appropriations, Expenditures and Lapsed Balances 2 15 Comparative Schedule of Revenues and Expenses 3 17 Schedule of Administrative Expenses 4 18 Schedule of Changes in Property and Equipment 5 19 Schedule of Investment Portfolio 6 20 Schedule of Investment Manager and Custodian Fees 7 21 Analysis of Operations (Unaudited) Analysis of Operations (Functions and Planning) 30 Progress in Funding the System 34 Analysis of Significant Variations in Revenues and Expenses 36 Analysis of Significant Variations in Administrative Expenses 37 Analysis -

Transocean Ltd. Provides Quarterly Fleet Status Report

Transocean Ltd. Provides Quarterly Fleet Status Report STEINHAUSEN, Switzerland—February 12, 2021—Transocean Ltd. (NYSE: RIG) today issued a quarterly Fleet Status Report that provides the current status of, and contract information for, the company’s fleet of offshore drilling rigs. As of February 12, the company’s total backlog is approximately $7.8 billion. This quarter’s report includes the following updates: Deepwater Corcovado – Customer exercised a 680-day option in Brazil; Deepwater Mykonos – Customer exercised a 815-day option in Brazil; Development Driller III – Awarded a one-well contract extension in Trinidad; Development Driller III – Awarded a one-well contract, plus a one-well option in Trinidad; Transocean Norge – Awarded a one-well contract in Norway; Transocean Barents – Awarded a three-well contract in Norway; Paul B Loyd, Jr. – Awarded a 78-day contract extension in the U.K. North Sea; Dhirubhai Deepwater KG1– Customer exercised a seven-well option in India; and Deepwater Nautilus – Customer provided notice of termination of its drilling contract in Malaysia. Additionally, the company has retired the Leiv Eiriksson. The rig is classified as held for sale. The report can be accessed on the company’s website: www.deepwater.com. About Transocean Transocean is a leading international provider of offshore contract drilling services for oil and gas wells. The company specializes in technically demanding sectors of the global offshore drilling business with a particular focus on ultra-deepwater and harsh environment drilling services, and operates one of the most versatile offshore drilling fleets in the world. Transocean owns or has partial ownership interests in, and operates a fleet of, 37 mobile offshore drilling units consisting of 27 ultra-deepwater floaters and 10 harsh environment floaters. -

Supplemental Prospectus COMPULSORY ACQUISITION OF

Supplemental Prospectus COMPULSORY ACQUISITION OF SHARES IN Songa Offshore SE by Transocean Ltd. Supplemental information to the prospectus dated 16 February 2018 (the “Prospectus”) concerning the Compulsory Acquisition of all remaining shares in Songa Offshore SE (“Songa Offshore,” and together with its consolidated subsidiaries, the “Songa Group”) not owned by Transocean Ltd. (“Transocean” or the “Company”). The Compulsory Acquisition is governed by article 36 of the Cyprus Takeover Bids Law. The Compulsory Acquisition has been initiated following completion of the Voluntary Tender Offer resulting in Transocean acquiring shares of Songa Offshore representing 97.67% (on a fully diluted basis as of 30 January 2018) of the voting rights in Songa Offshore. Neither the U.S. Securities Exchange Commission (the “SEC”) nor any U.S. state securities commission has approved or disapproved of the securities to be issued in connection with the Compulsory Acquisition or passed upon the adequacy or accuracy of the Prospectus or this document. Any representation to the contrary is a criminal offense. Information about the Compulsory Acquisition is contained in this document and the Prospectus, which we urge you to read. In particular, we urge you to read Section 2 “Risk Factors” beginning on page 17 of the Prospectus. Financial Advisor and Settlement Agent 7 March 2018 2 IMPORTANT INFORMATION This supplemental prospectus (the “Supplemental Prospectus”) is a supplement to the Prospectus dated 16 February 2018, which has been prepared by Transocean -

Empirical Inference of Related Trading Between Two Securities: Detecting Pairs Trading, Merger Arbitrage, and Strategy Rules*

Empirical inference of related trading between two securities: Detecting pairs trading, merger arbitrage, and strategy rules* Keith Godfrey The University of Western Australia Working paper: 5 September 2013 The traditional approach to studying pairs trading is to simulate profitability using ex-post historical prices. I study the actual trades reported anonymously in security pairs and build statistical inferences of related trading. The approach is based on the time differences between trades. It can distinguish intrinsically related securities from pseudo-random sets, find stocks involved in merger arbitrage in massive sets of paired index constituents, and infer dominant trading rules of mean reversion algorithms. Empirical inference of related trading can enable further studies into pairs trading, strategy rules, merger arbitrage, and insider trading. Keywords: Inferred trading, empirical inference, pairs trading, merger arbitrage. JEL Classification Codes: G00, G10, C10, C40, C60 The availability of intraday trading or “tick” data with time resolution of a millisecond or finer is opening many avenues of research into financial markets. Analysis of two or more streams of tick data concurrently is becoming increasingly important in the study of multiple-security trading including index tracking, pairs trading, merger arbitrage, and market-neutral strategies. One of the greatest challenges in empirical trading research is the anonymity of reported trades. Securities exchanges report the dates, times, prices, and volumes traded, without identifying the traders. In studies of a single security, this introduces uncertainty of whether each market order that caused a trade was the buy or sell order, and there are documented approaches of inference such as Lee and Ready (1991). -

To Arrive at the Total Scores, Each Company Is Marked out of 10 Across

BRITAIN’S MOST ADMIRED COMPANIES THE RESULTS 17th last year as it continues to do well in the growing LNG business, especially in Australia and Brazil. Veteran chief executive Frank Chapman is due to step down in the new year, and in October a row about overstated reserves hit the share price. Some pundits To arrive at the total scores, each company is reckon BG could become a take over target as a result. The biggest climber in the top 10 this year is marked out of 10 across nine criteria, such as quality Petrofac, up to fifth from 68th last year. The oilfield of management, value as a long-term investment, services group may not be as well known as some, but it is doing great business all the same. Its boss, Syrian- financial soundness and capacity to innovate. Here born Ayman Asfari, is one of the growing band of are the top 10 firms by these individual measures wealthy foreign entrepreneurs who choose to make London their operating base and home, to the benefit of both the Exchequer and the employment figures. In fourth place is Rolls-Royce, one of BMAC’s most Financial value as a long-term community and environmental soundness investment responsibility consistent high performers. Hardly a year goes past that it does not feature in the upper reaches of our table, 1= Rightmove 9.00 1 Diageo 8.61 1 Co-operative Bank 8.00 and it has topped its sector – aero and defence engi- 1= Rotork 9.00 2 Berkeley Group 8.40 2 BASF (UK & Ireland) 7.61 neering – for a decade. -

News Release +1 713-232-7551

Transocean Ltd. Investor Relations and Corporate Communications Analyst Contacts: Thad Vayda News Release +1 713-232-7551 Diane Vento +1 713-232-8015 Media Contact: Pam Easton FOR RELEASE: June 22, 2015 +1 713-232-7647 TRANSOCEAN LTD. PROVIDES FLEET UPDATE SUMMARY ZUG, SWITZERLAND—June 22, 2015—Transocean Ltd. (NYSE: RIG) (SIX: RIGN) today issued a monthly Fleet Update Summary, which includes new contracts, changes to existing contracts, and changes in estimated planned out-of-service time of 15 or more days since the May 18, 2015 Fleet Update Summary. The total value of new contracts since the last report is approximately $109 million. The report includes the following: Transocean Andaman – Awarded a one year contract extension offshore Thailand at a dayrate of $115,000 ($42 million estimated backlog). Deepwater Champion – Awarded a three month contract extension in the U.S. Gulf of Mexico at a dayrate of $395,000 ($36 million estimated backlog). GSF Galaxy II – Awarded a one well contract extension in the U.K. sector of the North Sea at a dayrate of $190,000 ($17 million estimated backlog). Sedco Express – Awarded a 45 day contract offshore Nigeria at a dayrate of $300,000 ($14 million estimated backlog). The company has amended its construction contracts with Sembcorp Marine’s subsidiary, Jurong Shipyard, to delay the delivery of its two newbuild, ultra-deepwater drillships by 24 months. The two drillships are now expected to be delivered in the second quarter of 2019 and the first quarter of 2020, respectively. The GSF Monarch and Transocean Spitsbergen are idle. The Spitsbergen’s well program concluded 45 days early due to efficient performance of the rig; the contract provides for a payment to the company in the event of an early termination. -

Dr. Kenneth Peters

Petroleum Systems and Exploration/Development Geochemistry - Instructor Instructor: Dr. Kenneth Peters ◆ Science Advisor (Petroleum Geochemistry) I am excited by the challenge of combining the least expensive yet most effective technology to solve practical exploration and production problems for our clients, while gaining trust, credibility, and profitable business associations for Schlumberger. I also enjoy teaching bright young students and 'giving back' to our science. ◆ Assignment History /Experience • 2008 Sep-present Science Advisor (Petroleum Geochemistry) WG Houston Technology Center • 2002-2008 Research Geologist, Western Region Earth Surface Processes Energy Team, U.S. Geological Survey, Menlo Park, CA. • 1999-2002 Senior Research Associate, Geochemistry and Migration, Trap, and Charge Groups, Hydrocarbon Systems Analysis Division; ExxonMobil Upstream Research Company, Houston, TX. • 1996-2000 Instructor (concurrent with Mobil and ExxonMobil) Oil and Gas Consultants International, Tulsa, OK. • 1993-1999 Associate Geochemical Advisor and Senior Geochemical Research Advisor, Basin Analysis Group, Mobil Technology Company, Dallas, TX. • 1990-1993 Biomarker Coordinator, Exploration Evaluation Group, Chevron Overseas Petroleum Inc., San Ramon, CA. • 1989-1990 Geochemical Coordinator, Chevron U.S.A., San Ramon, CA. • 1986-1989 Senior Research Geochemist, Biomarker Group, Chevron Richmond Refinery, Richmond, CA. • 1978-1986 Research Geochemist and Senior Research Geochemist, Chevron Oil Field Research Company, La Habra, CA. Professional Experience ◆ Education • 1972 B.A. in Geology, University of California at Santa Barbara, Santa Barbara, California • 1975 M.A. in Geology, University of California at Santa Barbara, Santa Barbara, California • 1978 Ph.D. in Geochemistry, University of California at Los Angeles, Los Angeles, California Petroleum Systems and Exploration/Development Geochemistry - Instructor ◆ Honors - Awards • Best Paper Award - Organic Geochemistry Div., Geochemical Society 1978 (pub. -

2019 Global Stewardship Report Schlumberger Limited Contents

2019 Global Stewardship Report Schlumberger Limited Contents Governance and Ethics 4 Environment and Climate 11 Social and Community 21 Index and Data 47 Corporate Governance 4 Managing Environmental Risk 12 Education 22 Frameworks 48 Ethics and Compliance 7 Environmental Performance Data 16 Health and Safety 24 Global Reporting Initiative Standards (GRI) 48 Key Environmental Issues 17 Human Rights 38 Sustainability Accounting Standards Board (SASB) 50 Technology Advantage 19 Stakeholder Engagement 41 Task Force on Climate-Related Schlumberger New Energy 20 Employment and Human Capital 43 Financial Disclosures (TCFD) 52 United Nations Sustainable Development Goals Mapping (UN SDGs) 53 Performance Data 56 Our Sustainability Focus The energy industry is changing, and Schlumberger’s vision is to define and drive high performance, sustainably. Our core competence is to enable our customers to operate safely, efficiently, effectively, and in an environmentally responsible manner. Our Global Stewardship program addresses: .» identifying and managing opportunities and risks associated with the energy transition and climate change .» protecting the environment .» investing in and engaging with the communities where we and our customers live and work .» respecting human rights and promoting diversity 1 GOVERNANCE ENVIRONMENT SOCIAL INDEX Introduction 2019 Global Stewardship Report Message from the CEO Schlumberger’s vision is to define and drive high performance, sustainably. We are focused on our purpose: creating amazing technology that unlocks -

Nabors Industries Ltd

ISS PROXY ADVISORY SERVICES ISS QuickScore Meeting Type: Annual Meeting Date: 2 June 2015 GOVERNANCE Nabors Industries Ltd. Record Date: 6 April 2015 Meeting ID: 970579 Key Takeaways New York Stock Exchange: NBR At last year's annual meeting, three directors received WITHHOLD votes from 10 Index: S&P 500 more than 50 percent of votes cast. The board has not sufficiently addressed Sector: Oil & Gas Drilling the issues that led to this outcome. GICS: 10101010 Scores indicate decile Cautionary support for the say-on-pay proposal is advised this year. The rank relative to index Primary Contacts company responded to shareholder feedback following its fourth failed vote or region. A decile Marc Goldstein, JD score of 1 indicates Enver Fitch – ESG Research in 2014, by increasing transparency around short- and long-term incentive lower governance risk, [email protected] while a 10 indicates program goals. Also, the CEO's pay package was at its lowest level since he higher governance risk. assumed that post, consistent with the company's negative TSR for the year. However, questions remain with respect to both transparency and goal rigor under the equity incentive program, which may concern some shareholders and indicate a need for continued close monitoring of the program and related board decisions. In light of the company's weak stock ownership guidelines and history of problematic compensation issues, support is warranted for non-binding shareholder proposals seeking a rigorous stock retention requirement and shareholder approval of specific performance metrics. Support for the shareholder proposal seeking corporate sustainability reporting is warranted, as the information provided in a comprehensive sustainability report would aid shareholders in assessing the company's sustainability performance and its management of related risks and opportunities. -

Shenoute Paper Draft

Mimetic Devotion and Dress in Some Monastic Portraits from the Monastery of Apa Apollo at Bawit* Thelma K. Thomas For the monastery of Apa Apollo at Bawit in Middle Egypt there is good archaeological documentation, a wealth of primary written sources mainly in the form of inscriptions, and a long history of scholarship illuminating both the site and the paintings at the center of this study.1 The archaeological site (figure 1) is extensive, and densely built. The many paintings, usually dated to the sixth and seventh centuries, survive in varying states of preservation from a range of functional contexts, however in this discussion I focus on * I am grateful to Hany Takla for inviting me to present a version of this article at the Twelfth St. Shenouda-UCLA Conference of Coptic Studies in July 2010. I owe thanks as well to Jenn Ball, Betsy Bolman, Jennifer Buoncuore, Mariachiara Giorda, Tom Mathews, and Maged Mikhail. Many of the issues considered here will be addressed more extensively in a book-length study, Dressing Souls, Making Monks: Monastic Habits of the Desert Fathers. 1 The main archaeological publications include: Jean Clédat, Le monastère et la nécropole de Baouit, Institut français d’archéologie orientale du Caire, Memoires, vol. 12 (Cairo: Institut français d’archéologie orientale du Caire, 1904); Jean Clédat, Le monastère et la nécropole de Baouit, Institut français d’archéologie orientale du Caire, Memoires, vol. 39 (Cairo: Institut français d’archéologie orientale, 1916); Jean Maspéro, “Fouilles executées à Baouit, Notes mises en ordre et éditées par Etienne Drioton,” Institut français d’archéologie orientale du Caire, Memoires, vol. -

Dr. Walter Cruickshank Acting Director Bureau of Ocean Energy Management 1849 C Street, NW Washington, D.C. 20240 March 9, 2018

Dr. Walter Cruickshank Acting Director Bureau of Ocean Energy Management 1849 C Street, NW Washington, D.C. 20240 March 9, 2018 Re: Comments on the 2019 – 2024 National Outer Continental Shelf Oil and Gas Leasing Draft Proposed Program [BOEM-2017-0074] – Opposition to New Leasing Dear Dr. Cruickshank: On behalf of Heal the Bay, an environmental nonprofit dedicated to making the coastal waters and watersheds of greater Los Angeles safe, healthy, and clean, we are strongly opposed to the expansion of oil and gas activities in the Pacific and other regions listed in the Draft Proposed 2019-2024 National Outer Continental Shelf Oil and Gas Leasing Program (Draft Proposed Program). Heal the Bay respectfully urges the Bureau of Ocean Energy Management to abandon its wasteful scoping and planning efforts for the Draft Proposed Program and related Programmatic Environmental Impact Statement (PEIS). We are opposed to new leasing in the Pacific (2 lease sales each for Northern California, Central California, and Southern California, and 1 for Washington/Oregon), the Atlantic (3 lease sales each for the Mid- and South Atlantic, 2 for the North Atlantic, and 1 for the Straits of Florida), the Gulf of Mexico (2 lease sales), and all waters off Alaska (19 lease sales) and urge you to offer no new oil and gas leases in federal waters. The Administration’s proposal to expand offshore drilling to nearly all U.S. waters, encompassing over 90% of total Outer Continental Shelf acreage – the largest number of potential offshore lease sales ever proposed – is shortsighted and reckless. Offshore oil and gas drilling is inherently dangerous, and threatens the nation’s ocean economy and environment. -

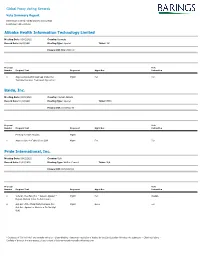

Global Proxy Voting Records

Global Proxy Voting Records Vote Summary Report Date range covered: 03/01/2021 to 03/31/2021 Location(s): All Locations Alibaba Health Information Technology Limited Meeting Date: 03/01/2021 Country: Bermuda Record Date: 02/23/2021 Meeting Type: Special Ticker: 241 Primary ISIN: BMG0171K1018 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Approve Revised Annual Cap Under the Mgmt For For Technical Services Framework Agreement Baidu, Inc. Meeting Date: 03/01/2021 Country: Cayman Islands Record Date: 01/28/2021 Meeting Type: Special Ticker: BIDU Primary ISIN: US0567521085 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction Meeting for ADR Holders Mgmt 1 Approve One-to-Eighty Stock Split Mgmt For For Pride International, Inc. Meeting Date: 03/01/2021 Country: USA Record Date: 12/01/2020 Meeting Type: Written Consent Ticker: N/A Primary ISIN: US74153QAJ13 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Vote On The Plan (For = Accept, Against = Mgmt For Abstain Reject; Abstain Votes Do Not Count) 2 Opt Out of the Third-Party Releases (For = Mgmt None For Opt Out, Against or Abstain = Do Not Opt Out) * Instances of "Do Not Vote" are normally owing to: - Share-blocking - temporary restriction of trading by the Sub-Custodian following vote submission - Client restrictions - Conflicts of Interest. For any queries, please contact [email protected] Global Proxy Voting Records Vote Summary Report Date range covered: 03/01/2021 to 03/31/2021 Location(s): All Locations The