(2386 HK) Sinopec Refining, Chems, LNG Capex Tailwind

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Annual General Meeting and Proxy Statement 2020 Annual Report

2020 Annual Report and Proxyand Statement 2021 Annual General Meeting Meeting General Annual 2021 Transocean Ltd. • 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT • 2020 ANNUAL REPORT CONTENTS LETTER TO SHAREHOLDERS NOTICE OF 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT COMPENSATION REPORT 2020 ANNUAL REPORT TO SHAREHOLDERS ABOUT TRANSOCEAN LTD. Transocean is a leading international provider of offshore contract drilling services for oil and gas wells. The company specializes in technically demanding sectors of the global offshore drilling business with a particular focus on ultra-deepwater and harsh environment drilling services, and operates one of the most versatile offshore drilling fleets in the world. Transocean owns or has partial ownership interests in, and operates a fleet of 37 mobile offshore drilling units consisting of 27 ultra-deepwater floaters and 10 harsh environment floaters. In addition, Transocean is constructing two ultra-deepwater drillships. Our shares are traded on the New York Stock Exchange under the symbol RIG. OUR GLOBAL MARKET PRESENCE Ultra-Deepwater 27 Harsh Environment 10 The symbols in the map above represent the company’s global market presence as of the February 12, 2021 Fleet Status Report. ABOUT THE COVER The front cover features two of our crewmembers onboard the Deepwater Conqueror in the Gulf of Mexico and was taken prior to the COVID-19 pandemic. During the pandemic, our priorities remain keeping our employees, customers, contractors and their families healthy and safe, and delivering incident-free operations to our customers worldwide. FORWARD-LOOKING STATEMENTS Any statements included in this Proxy Statement and 2020 Annual Report that are not historical facts, including, without limitation, statements regarding future market trends and results of operations are forward-looking statements within the meaning of applicable securities law. -

To Arrive at the Total Scores, Each Company Is Marked out of 10 Across

BRITAIN’S MOST ADMIRED COMPANIES THE RESULTS 17th last year as it continues to do well in the growing LNG business, especially in Australia and Brazil. Veteran chief executive Frank Chapman is due to step down in the new year, and in October a row about overstated reserves hit the share price. Some pundits To arrive at the total scores, each company is reckon BG could become a take over target as a result. The biggest climber in the top 10 this year is marked out of 10 across nine criteria, such as quality Petrofac, up to fifth from 68th last year. The oilfield of management, value as a long-term investment, services group may not be as well known as some, but it is doing great business all the same. Its boss, Syrian- financial soundness and capacity to innovate. Here born Ayman Asfari, is one of the growing band of are the top 10 firms by these individual measures wealthy foreign entrepreneurs who choose to make London their operating base and home, to the benefit of both the Exchequer and the employment figures. In fourth place is Rolls-Royce, one of BMAC’s most Financial value as a long-term community and environmental soundness investment responsibility consistent high performers. Hardly a year goes past that it does not feature in the upper reaches of our table, 1= Rightmove 9.00 1 Diageo 8.61 1 Co-operative Bank 8.00 and it has topped its sector – aero and defence engi- 1= Rotork 9.00 2 Berkeley Group 8.40 2 BASF (UK & Ireland) 7.61 neering – for a decade. -

UK/Netherlands SNS Hackathon Output Report

UK/Netherlands SNS Hackathon Output Report April 2019 Contents Foreword ............................................................................................................................................................. 3 Executive Summary ............................................................................................................................................. 4 Introduction ......................................................................................................................................................... 4 How Does a Hackathon Event Work? ................................................................................................................... 5 Findings ............................................................................................................................................................... 6 Operator Challenges ............................................................................................................................................ 7 Operator 1: Shell .......................................................................................................................................... 7 Operator2: Oranje Nassau Energie B.V. ........................................................................................................ 8 Operator 3: Spirit Energy .............................................................................................................................. 9 Operator 4: Neptune Energy ...................................................................................................................... -

United States Bankruptcy Court Southern District of Texas Houston Division

Case 20-34114 Document 528 Filed in TXSB on 10/19/20 Page 1 of 58 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) VALARIS PLC, et al.,1 ) Case No. 20-34114 (MI) ) Debtors. ) (Jointly Administered) ) GLOBAL NOTES, METHODOLOGY, AND SPECIFIC DISCLOSURES REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS Introduction Valaris plc (“Valaris”) and its debtor affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases (collectively, the “Debtors”), with the assistance of their advisors, have filed their respective Schedules of Assets and Liabilities (the “Schedules”) and Statements of Financial Affairs (the “Statements,” and together with the Schedules, the “Schedules and Statements”) with the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”), under section 521 of title 11 of the United States Code (the “Bankruptcy Code”), Rule 1007 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”), and Rule 1007-1 of the Bankruptcy Local Rules for the Southern District of Texas (the “Local Rules”). These Global Notes, Methodology, and Specific Disclosures Regarding the Debtors’ Schedules of Assets and Liabilities and Statements of Financial Affairs (the “Global Notes”) pertain to, are incorporated by reference in, and comprise an integral part of all of the Debtors’ Schedules and Statements. The Global Notes should be referred to, considered, and reviewed in connection with any review of the Schedules and Statements. The Schedules and Statements do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), nor are they intended to be fully reconciled with the financial statements of each Debtor. -

Petrofac Limited

Petrofac Limited INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS 30 June 2020 Petrofac Limited CONTENTS Group financial highlights 2 Business review 3 Interim condensed consolidated income statement 15 Interim condensed consolidated statement of comprehensive income 16 Interim condensed consolidated balance sheet 17 Interim condensed consolidated statement of cash flows 18 Interim condensed consolidated statement of changes in equity 19 Notes to the interim condensed consolidated financial statements 20 Appendices 40 Statement of Directors’ responsibilities 46 Shareholder information 47 US$2,103 million US$129 million Revenue EBITDA 1,2 Six months ended 30 June 2019: US$2,821 million Six months ended 30 June 2019: US$305 million US$21 million US$(78) million Business performance net profit 1,3 Reported net loss 3 Six months ended 30 June 2019: US$154 million Six months ended 30 June 2019: US$139 million profit nil 6.2 cents Interim dividend per share Diluted earnings per share 1,3 Six months ended 30 June 2019: 12.7 cents Six months ended 30 June 2019: 44.9 cents US$(13) million US$29 million Free cash flow 4 Net debt Six months ended 30 June 2019: US$123 million At 31 December 2019: US$15 million net cash US$6.2 billion 14% Backlog 6 Return on capital employed 1,5 At 31 December 2019: US$7.4 billion 12 months ended 30 June 2019: 26% 1 Business performance before exceptional items and certain 4 Free cash flow is defined as net cash flows generated from re-measurements. This measurement is shown by Petrofac operating activities and investing activities, less interest paid and as a means of measuring underlying business performance. -

Bowleven PLC to Discuss Etinde Farm-Out Agreement Signed with LUKOIL and Newage Call

THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT BLVN.L - Bowleven PLC to Discuss Etinde Farm-out Agreement Signed with LUKOIL and NewAge Call EVENT DATE/TIME: JUNE 24, 2014 / 9:45AM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2014 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. JUNE 24, 2014 / 9:45AM, BLVN.L - Bowleven PLC to Discuss Etinde Farm-out Agreement Signed with LUKOIL and NewAge Call CORPORATE PARTICIPANTS Kevin Hart Bowleven plc - CEO CONFERENCE CALL PARTICIPANTS Rafal Gutaj BofA Merrill Lynch - Analyst Alessandro Pozzi Barclays - Analyst David Farrell Macquarie Research - Analyst Will Forbes Edison - Analyst Charles Vaughan Dundee Securities - Analyst Divaji Hosseini Tudor Pickering Holt - Analyst David Round BMO - Analyst Mark Henderson Westhouse Securities Ltd. - Analyst PRESENTATION Operator Good morning ladies and gentlemen, and welcome to the Bowleven call on the Etinde farm-out transaction. For your information, this conference is being recorded. This morning's call will be led by Kevin Hart, Chief Executive of Bowleven. (Operator Instructions). At the time, I would like to turn the call over to Mr. Kevin Hart, please go ahead sir. Kevin Hart - Bowleven plc - CEO Morning, everybody. First of all, apologies, if I start yawning, I'm not bored. It's the fact I've just flown in Cameroon and on the bounciest flight ever, so I'm running on no sleep at the moment and no caffeine, which is never good. -

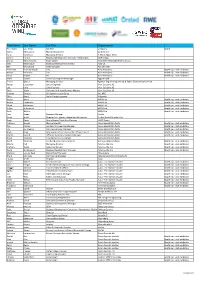

First Name Last Name Job Title Organisation

First Name Last Name Job Title Organisation First Name Last Name Job Title Company Booth Vasilis Markatselis Market Researcher 4C Offshore Ilaria Valtimora Managing Director A Word About Wind Emma Harrick Business Development Manager - Renewables A&P Group Morag McCorkindale Team Leader Aberdeen Renewable Energy Group Neil Etherington Business Development Director Able UK Ben Drummond Sales Manager ACE Winches Peter Kurt Fromme-Knoch CEO Aero Enterprise Booth rep - visit exhibition Robert Hörmann CEO Aero Enterprise Booth rep - visit exhibition Sonja Riegert BD Aero Enterprise Booth rep - visit exhibition Mark Squires Sector Development Manager Aggreko Ltd Fraser Gibson Managing Director Agiletek Engineering Limited & Ryder Geotechnical Limited Petter Carstensen Senior Engineer Aker Solutions AS Leif Høie Chief Engineer Aker Solutions AS Chris Taylor Commercial & New Business Models Aker Solutions AS Andrew Dickson UK Operations and Sales ALL NRG Chris Bond Senior Design Engineer Allspeeds Rachel Antill APEM Ltd Booth rep - visit exhibition Ashley Cordingley APEM Ltd Booth rep - visit exhibition Steph McGovern APEM Ltd Booth rep - visit exhibition Gillian Sutherland APEM Ltd Booth rep - visit exhibition Keith Walker APEM Ltd Booth rep - visit exhibition Lucy Green Business Manager Apollo David Smith Director Port Agency, Operations & Logistics Arthur Smith (Grimsby) Ltd Craig Revie Group Energy Transition Manager ASCO Group Anthony Brooks Marine Scientist Associated British Ports Booth rep - visit exhibition Dan Cooper Assistant Commercial -

Third Quarter 2020 Financial Statements and Review

Third quarter 2020 Financial statements and review Third quarter 2020 review Equinor third quarter 2020 results Equinor reports adjusted earnings of USD 0.78 billion and USD 0.27 billion after tax in the third quarter of 2020. IFRS net operating income was negative USD 2.02 billion and the IFRS net income was negative USD 2.12 billion, following net impairments of USD 2.93 billion mainly due to reduced future price assumptions. • Solid results from operations in a low-price environment • On track to deliver on USD 3 billion action plan to strengthen financial resilience • Strong value creation from renewables • Net debt ratio(1) increased to 31.6%, due to net impairments and payment for government share of share buy-back “Our financial results are impacted by weak prices as regions across the world are still severely affected by the pandemic. We see the results of our forceful response to the market turmoil, with significant cost improvements and strict financial discipline. Net impairments in the quarter are mainly due to reduced price assumptions. Significant uncertainty remains around the future commodity price development underlining the importance of increased competitiveness and financial resilience,” says Eldar Sætre, President and CEO of Equinor ASA. “We deliver solid operational results in the quarter with an underlying production growth of nine percent. We progress our competitive project portfolio, supported by the tax policy measures in Norway, with the delivery of Plan for Development and Operation of the Breidablikk field. Our specialised organisation for late-life production at the Norwegian continental shelf had a successful start-up showing improved production efficiency and reduced cost,“ says Sætre. -

Schedule 14A Information Schlumberger Nv

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934 (Amendment No. ) Filed by the Registrant Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material under §240.14a-12 SCHLUMBERGER N.V. (SCHLUMBERGER LIMITED) (Name of Registrant as Specified in Its Charter) Name of Person(s) Filing Proxy Statement if other than the Registrant) Payment of Filing Fee (Check the appropriate box): No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: Notice of 2020 Annual General Meeting of Stockholders April 1, 2020 10:00 a.m. -

Oil and Gas Europe

Oil and Gas Europe Buyer Members Powered by Achilles JQS and FPAL, Oil and Gas Europe brings together two communities to provide buyers with a regional, searchable network of qualified suppliers within the European oil and gas supply chain. Below is a list of the buyers from Achilles JQS and FPAL with access to the Oil and Gas Europe Network. Company Name Petrofac Facilities 4c Solutions AS ESSAR OIL (UK) Ltd Management 4Subsea Evry Premier Oil A.S Nymo Expro Group Prosafe Abyss Subsea AS Fairfield Energy Ltd Prosafe Offshore Ltd Advokatfirmaet Simonsen Vogt Wiig AS Faroe Petroleum PSE Kinsale Energy Limited Advokatfirmaet Thommessen AS Furmanite AS. Ramboll Oil & Gas (No) Af Gruppen Norge AS Gassco Randaberg Technology AGR Well Management Limited Glencore Red Rock Power Ltd Repsol Sinopec Resources UK Aibel AS GLT-PLUS VOF Ltd Aker Solutions Norway Gulf Marine Services Rever Offshore Halliburton Manufacturing & Services Aker Solutions UK Ltd Rosenberg Worleyparsons Alpha Petroleum Resources Limited Halliburton Norway Sasol Upstream Oil & Gas Altus Intervention AS Hammertech AS Scottish Enterprise Apache North Sea Limited Hess Seadrill Management Apply Sørco AS Ikm Group Senergy Wells Ltd Archer Norge AS Ineos Denmark Servogear AS. International Recarch Institute Of Awilco Drilling Stavanger IRIS Sevan Marine Baker Hughes Norway Inventura AS Shell U.K Ltd Baker Hughes UK IV Oil and Gas b.v. Siccar Point Energy Karachaganak Petroleum Operating BV Beerenberg Corp (KPO) Siem Offshore AS Bluewater Services Kca Deutag Drilling Norge AS Sintef -

Oilfield Services Companies' Response to Low Oil Prices

April 2020 Oilfield services companies’ response to low oil prices Unprecedented is how many oilfield However, oilfield services companies are services executives have described focusing most of their actions on lowering current oil market conditions. Several operating costs. Staff are being furloughed oilfield services companies have withdrawn or asked to take unpaid leave and financial guidance issued less than a contractors are being demobilized. Layoffs month earlier, as work backlogs begin to are becoming more widespread across the be impacted by cutbacks in customers’ sector. Job reductions have been largest in spending. These companies promised to the US, where short-cycle projects can be provide new and more detailed guidance quickly scaled-back. The number impacted in Q1 2020 earnings calls scheduled to be globally runs into the tens of thousands. held in April and May. Several C-suite executives are voluntarily Oilfield services Their clients have reacted quickly to the freezing or reducing their base salary market volatility by announcing significant and suspending variable pay schemes companies have cuts in capital expenditure. Oil and gas for a temporary period – an important announced companies have cut capital spending for demonstration that senior executives 2020 by at least $75.8bn, with several are also feeling the pinch alongside capex cuts having already announced further their employees. The announced salary totalling $2.6bn reductions (you can see our recent note on reductions range from 5% up to 25%. this here). Projects are being deferred and The compensation for board directors is in 2020 contracts cancelled as discretionary spend also being lowered in line with executive is curtailed. -

EIC Newsbrief – China June 2012

EIC Newsbrief – China June 2012 Oil & Gas – Upstream & Downstream China’s crude run fell by 0.7% in May China’s crude run in May fell by 0.7% year-on-year to 38.3 million tons due to maintenance at some major refineries and weak demand. Ethylene output reached 1.27 million tons in May, down 7.1% year-on-year. From January to May, China’s natural gas output totaled 45bcm, up 7.2% year on year. “Stimulus 2.0”? According to China Daily Newspaper, from April to May, the National Development and Reform Commission (NDRC) has approved four new airports or airport relocations, about 100 clean-energy projects and the construction of three major steel mills worth more than 130 billion yuan (USD 20.57 billion) in total. Moving at what the Chinese-language business press called a "markedly faster" speed the country’s economy, the government has green-lighted more investment in fixed assets - new factories and infrastructure. Overall Development Plan for CNOOC’s Lishui 36-1 gas field submitted to NDRC China National Offshore Oil Corp.’s (CNOOC) has moved a step closer to tapping the estimated 4.9 billion cubic meter of recoverable gas reserves at the Lishui offshore gas project. CNOOC’s partner in the project, Primeline Energy Holdings Inc., announced in early June that the overall development plan (ODP) for the Lishui (LS) 36-1 field has been filed with China’s National Development and Reform Commission (NDRC). “Major construction contracts have been signed and fabrication of the platform and work on the pipeline are proceeding smoothly,” said Primeline Chief Executive Ming Wang.