A Study of Spectrum Auction in Various Countries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tariff-Mediated Network Effects Versus Strategic Discounting: Evidence from German Mobile Telecommunications

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Zucchini, Leon; Claussen, Jörg; Trüg, Moritz Working Paper Tariff-Mediated Network Effects versus Strategic Discounting: Evidence from German Mobile Telecommunications Discussion Paper, No. 2012-01 Provided in Cooperation with: University of Munich, Munich School of Management Suggested Citation: Zucchini, Leon; Claussen, Jörg; Trüg, Moritz (2013) : Tariff- Mediated Network Effects versus Strategic Discounting: Evidence from German Mobile Telecommunications, Discussion Paper, No. 2012-01, Ludwig-Maximilians-Universität München, Fakultät für Betriebswirtschaft, München, http://dx.doi.org/10.5282/ubm/epub.14848 This Version is available at: http://hdl.handle.net/10419/104532 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung -

Summary Notification Form

COMISIÓN DEL MERCADO DE LAS TELECOMUNICACIONES NOTIFICATION OF DRAFT MEASURES PURSUANT TO ARTICLE 7(3) OF DIRECTIVE 2002/21/EC FOR VOICE CALL TERMINATION ON INDIVIDUAL MOBILE NETWORKS. Under the obligation in article 16 of the Directive 2002/21/EC, CMT has conducted an analysis of the markets for voice call termination on individual mobile networks. On 2nd February 2012, the CMT has reached its preliminary conclusions on market definition, the extent of competition in those markets, the designation of undertakings having significant market power and the regulatory obligations needed to be imposed. CMT hereby notifies the Commission of its proposed remedies and obligations consistent with article 7(3) of Directive 2002/21/EC. These remedies and obligations are set out in the attached summary notification form. Under Article 6 of the Directive 2002/21/EC and according to national procedures, CMT conducted a national consultation which started on 5fh December 2011 and ended on 5fh December 2012. CMT has also requested the opinion of the National Competition Authority –Comisión Nacional de la Competencia -, concerning the definition and the SMP assessment on this market. This draft measure has taken into account the comments received during the public consultation and the opinion of the National Competition Authority. 1 COMISIÓN DEL MERCADO DE LAS TELECOMUNICACIONES Standard Form relating to Notifications of Draft Measures Pursuant to Article 7 of Directive 2002/21/EC Section 1 Market definition Please state where applicable: 1.1 The relevant product/service market. Is this market mentioned in the Recommendation on relevant markets? Voice call termination on individual mobile networks, including both MNOs and full MVNOs. -

2017 Registration Document

2017 Registration document Annual financial report Table of contents 1. Overview of the Group 5. Corporate, social and and of its business environmental responsibility 1.1 Overview 4 5.1 Social commitments 311 1.2 Market and strategy 7 5.2 Employee information 316 1.3 Operating activities 12 5.3 Environmental information 328 1.4 Networks and real- estate 38 5.4 Duty of care 337 1.5 Innovation at Orange 40 5.5 Report by one of the Statutory Auditors 338 1.6 Regulation of telecom activities 43 6. Shareholder Base 2. Risk factors and activity and Shareholders’ Meeting management framework 6.1 Share capital 342 2.1 Risk factors 64 6.2 Major shareholders 343 2.2 Activity and risk management framework 69 6.3 Draft resolutions to be submitted to the Combined Ordinary and Extraordinary Shareholders’ Meeting of May 4, 2018 345 3. Financial report 6.4 Report of the Board of Directors on the resolutions submitted to the Combined Ordinary and 3.1 Analysis of the Group’s financial position and earnings 78 Extraordinary Shareholders’ Meeting of May 4, 2018 350 3.2 Recent events and Outlook 131 6.5 Statutory Auditors’ report on resolutions 3.3 Consolidated financial statements 133 and related party agreements 357 3.4 Annual financial statements Orange SA 240 3.5 Dividend distribution policy 278 7. Additional information 4. Corporate Governance 7.1 Person responsible 362 7.2 Statutory Auditors 362 4.1 Composition of management and supervisory bodies 280 7.3 Statutory information 363 4.2 Functioning of the management 7.4 Factors that may have an impact in the event and supervisory bodies 290 of a public offer 365 4.3 Reference to a Code of Corporate Governance 298 7.5 Regulated agreements and related party transactions 366 4.4 Compensation and benefits paid to Directors, 7.6 Material contracts 366 Officers and Senior Management 298 8. -

Dr. Neuhaus Telekommunikation Mobile Network Code

Dr. Neuhaus Telekommunikation Mobile Network Code The Mobile Country Code (MCC) is the fixed country identification. The Mobile Network Code (MNC) defines a GSM‐, UMTS‐, or Tetra radio network provider. This numbers will be allocates June 2011 autonomus from each country. Only in the alliance of bothscodes (MCC + MNC) the mobile radio network can be identified. All informations without guarantee Country MCC MNC Provider Operator APN User Name Password Abkhazia (Georgia) 289 67 Aquafon Aquafon Abkhazia (Georgia) 289 88 A-Mobile A-Mobile Afghanistan 412 01 AWCC Afghan Afghanistan 412 20 Roshan Telecom Afghanistan 412 40 Areeba MTN Afghanistan 412 50 Etisalat Etisalat Albania 276 01 AMC Albanian Albania 276 02 Vodafone Vodafone Twa guest guest Albania 276 03 Eagle Mobile Albania 276 04 Plus Communication Algeria 603 01 Mobilis ATM Algeria 603 02 Djezzy Orascom Algeria 603 03 Nedjma Wataniya Andorra 213 03 Mobiland Servei Angola 631 02 UNITEL UNITEL Anguilla (United Kingdom) 365 10 Weblinks Limited Anguilla (United Kingdom) 365 840 Cable & Antigua and Barbuda 344 30 APUA Antigua Antigua and Barbuda 344 920 Lime Cable Antigua and Barbuda 338 50 Digicel Antigua Argentina 722 10 Movistar Telefonica internet.gprs.unifon.com. wap wap ar internet.unifon Dr. Neuhaus Telekommunikation Mobile Network Code The Mobile Country Code (MCC) is the fixed country identification. The Mobile Network Code (MNC) defines a GSM‐, UMTS‐, or Tetra radio network provider. This numbers will be allocates June 2011 autonomus from each country. Only in the alliance of bothscodes (MCC + MNC) the mobile radio network can be identified. All informations without guarantee Country MCC MNC Provider Operator APN User Name Password Argentina 722 70 Movistar Telefonica internet.gprs.unifon.com. -

Numbers Zona Establec. Llamada (€) € Por Minuto Destinos 88299 Blocked Aeromóvil 93 Internacional 6 0,00 0,35 Afganistán 9

Establec. € por Numbers Zona Destinos llamada (€) minuto 88299 Blocked Aeromóvil 93 Internacional 6 0,00 0,35 Afganistán 9377 Internacional 6 0,00 0,35 Afganistán, móvil Areeba 9375 Internacional 6 0,00 0,35 Afganistán, móvil AT 9370 Internacional 6 0,00 0,35 Afganistán, móvil AWCC 9378 Internacional 6 0,00 0,35 Afganistán, móvil Etisalat 9379 Internacional 6 0,00 0,35 Afganistán, móvil Rosham 1907 Internacional 2 0,00 0,15 Alaska 355 Internacional 3 0,00 0,20 Albania 35568 Internacional 5 0,00 0,30 Albania, móvil 35569 Internacional 5 0,00 0,30 Albania, móvil 3554 Internacional 3 0,00 0,20 Albania, Tirana 213 Internacional 4 0,00 0,25 Argelia 21321 Internacional 4 0,00 0,25 Argelia, Argel 2131 Internacional 4 0,00 0,25 Argelia, Área CAT 2136 Internacional 4 0,00 0,25 Argelia, móvil AMN 21398 Internacional 4 0,00 0,25 Argelia, móvil AMN 21399 Internacional 4 0,00 0,25 Argelia, móvil AMN 2137 Internacional 4 0,00 0,25 Argelia, móvil Orascom 21390 Internacional 4 0,00 0,25 Argelia, móvil Orascom 21391 Internacional 4 0,00 0,25 Argelia, móvil Orascom 21392 Internacional 4 0,00 0,25 Argelia, móvil Orascom 21393 Internacional 4 0,00 0,25 Argelia, móvil Orascom 21394 Internacional 4 0,00 0,25 Argelia, móvil Orascom 21395 Internacional 4 0,00 0,25 Argelia, móvil Orascom 21350 Internacional 4 0,00 0,25 Argelia, móvil Wataniya 21351 Internacional 4 0,00 0,25 Argelia, móvil Wataniya 21352 Internacional 4 0,00 0,25 Argelia, móvil Wataniya 21353 Internacional 4 0,00 0,25 Argelia, móvil Wataniya 21354 Internacional 4 0,00 0,25 Argelia, móvil Wataniya -

Handleiding Gps Tracker

HANDLEIDING GPS TRACKER SIM kaart installatie Zorg er voor dat nummerdoorschakeling, voicemail en pincode beveiliging van de SIM kaart uitstaan. Bijna alle providers hebben een pincode beveiliging op SIM kaarten (vaak pincode ‘0000’). De pincode kunt u uitzetten in een mobiele telefoon. Dit kan meestal in het menu 'Instellingen' en 'Beveiligingsinstellingen' (raadpleeg eventueel de handleiding van de mobiele telefoon). De tracker werkt niet als de pincode op de SIM kaart aan staat. Bij sommige providers kunt u kiezen tussen verschillende SIM kaarten, kies in dat geval de micro SIM kaart. Heeft u toch een reguliere of nano SIM kaart, dan bestaan er speciale SIM kaart knippers en adapters. Doe de SIM kaart in de houder met de GSM chip naar beneden zoals op onderstaande foto. Om de SIM kaart te verwijderen drukt u op de SIM kaart, hierdoor springt de SIM naar buiten. Laad de batterij volledig op voor het eerste gebruik tot het rode LED lampje dooft. U kunt de batterij opladen in elke willekeurige USB poort of via de meegeleverde autolader. Een volle batterij heeft een standby tijd van circa 80 uur, afhankelijk van de SMS/data interactie. Status LED indicator LED blauw (GPS signaal) Blauwe LED knippert GPS ontvangst OK Blauwe LED aan Zoekt GPS signaal Blauwe LED uit Tracker uit of in standby LED geel (GPRS communicatie) Gele LED knippert GPRS communicatie OK (tracking via internet) Gele LED aan Geen GPRS communicatie Gele LED uit Tracker uit of in standby LED rood (batterij) Rode LED aan Batterij aan het opladen Rode LED uit Batterij volledig opgeladen Pagina 1 van 7 In gebruik nemen van de GPS tracker Schakel de tracker buitenshuis in door op de on/off knop te drukken totdat het indicatie lampje aangaat. -

Lost Mobile Phone and Experiences with Simyo Service

Lost Mobile Phone And Experiences With Simyo Service 1 / 5 Lost Mobile Phone And Experiences With Simyo Service 2 / 5 3 / 5 and personal. 2018 NL Customer Experience Excellence analysis ... Ranked second overall in the Netherlands, Simyo employees believe that a great ... service and for setting and then meeting customer expectations. Customer ... “I felt my belongings would be ... where customers are won and lost, yet few organisations are.. Your experience can help others make better choices. ... I call my current phone company and I also called them and they aren't able to tell me what to do. They totally ... I didn't even use my aim card, since I lost it. ... The only reason I've been a customer of theirs is because I used to have Simyo and they got bought by Blau.. Discover in Orange Spain our products tariffs and services: Mobile plans, love tariffs, broandband & landline plans. Everything you need to be conected.. Simyo is a relatively recent entrant in the crowded German mobile ... products, services and experiences that help customers get everyday jobs .... In the meantime, the simyo service is pretty good. Discussion is locked ... I mean I won't have a heart attack if I lose one or drop it into a blender by accident. ... Coverage is a *lot* spottier here than Europe in my experience.. One of the main uses of my phone here in Germany is to make 3G calls ... I could even do it with simyo but I just struggled to find good service a lot of the time. ... could make cheap English calls without missing any of the German ones. -

CASE M.8792 - T-Mobile NL/Tele2 NL

EUROPEAN COMMISSION DG Competition CASE M.8792 - T-Mobile NL/Tele2 NL (Only the English text is authentic) MERGER PROCEDURE REGULATION (EC) 139/2004 Article 8 (1) Regulation (EC) 139/2004 Date: 27/11/2018 This text is made available for information purposes only. A summary of this decision is published in all EU languages in the Official Journal of the European Union. Parts of this text have been edited to ensure that confidential information is not disclosed; those parts are enclosed in square brackets. EUROPEAN COMMISSION Brussels, 27.11.2018 C(2018) 7768 final PUBLIC VERSION COMMISSION DECISION of 27.11.2018 declaring a concentration to be compatible with the internal market and the functioning of the EEA Agreement (Case M.8792 - T-Mobile NL/Tele2 NL) (Only the English version is authentic) TABLE OF CONTENTS 1. Introduction ................................................................................................................ 11 2. The Parties and the Transaction ................................................................................. 12 3. Union dimension ........................................................................................................ 13 4. The procedure ............................................................................................................. 13 5. The investigation ........................................................................................................ 14 6. The Dutch mobile telecommunications sector .......................................................... -

Mobiel Markt Monitor NL

A publication from Telecompaper MMM201301 | 20130114 P.O. Box 356 | 3990 GD | Houten | Netherlands www.telecompaper.com Analysts: Ed Achterberg, Alejandra van de Roer, Robbert de Blok, Maarten van Vliet, Tim Poulus MONITOR MOBIELE MARKT JANUARI 2013 Rapport voor OPTA Overzicht Mobiele Markt Nederland - December 2012 Stand van zaken Portfolio’s Gebruik Devices OTT MMM201301 MOBIEL MARKT MONITOR- JAN 2013 Inhoudsopgave 1 Executive summary 4 2 Inleiding 6 3 Methodologie 7 4 De markt 8 4.1 Huidig beeld: verzadigde markt, drie traditionele mobiele netwerken met vierde in opkomst ........................................................................................................................................... 8 4.2 Dynamische markt met ruim 67 virtuele mobiele merken ............................................................ 12 4.3 Mobiele omzet daalt met 4,1% in 2012, verwachting stabiel tot 2016 ......................................... 15 4.4 Strategiewijzigingen bij mobiele operators: T-Mobile NL moet een unconventional attacker worden en Tele2 de value champion, Vodafone wil positie versterken, KPN focust op LTE .................................................................................................................................. 16 4.5 Multibandveiling: Tele2 nieuwkomer, alle spelers leggen focus op uitrol LTE .............................. 18 5 De portfolio’s 21 5.1 Portfolio-aanpassingen MNO’s in 2012: grote overhaul voor alle merken, ook gratis on-net bellen en onbeperkt SMS’en; Tele2 beperkt zich tot aanpassingen -

7,3 Millones De Clientes De Telefonía Móvil No Están Satisfechos Con Su Operadora1

7,3 MILLONES DE CLIENTES DE TELEFONÍA MÓVIL NO ESTÁN SATISFECHOS CON SU OPERADORA1 Kelisto.es presenta el primer estudio de Satisfacción de Clientes de Operadoras Móviles que se realiza en España, del que se desprende que sólo el 16% de los españoles se siente “totalmente satisfecho” con su compañía y 1 de cada 3 no confía en ella Vodafone, Movistar y Orange, que aglutinan el 81%2 de las líneas de telefonía móvil en España, son las compañías peor valoradas por sus clientes, con un 26%, 22% y 21% de usuarios insatisfechos respectivamente Vodafone es la compañía peor considerada, con 1 de cada 4 clientes insatisfechos, y se sitúa en última posición en 7 de las 8 categorías analizadas Simyo es la empresa mejor valorada con un 97% de clientes satisfechos, seguida por Pepephone (96%) Movistar y Vodafone han perdido en el último año 1.132.806 y 823.612 usuarios respectivamente, mientras que las Operadoras Móviles Virtuales han ganado 1.738.791 clientes en 20133 Madrid, 7 de abril de 2014. Según el mayor estudio de satisfacción de operadoras móviles en España, realizado por la web independiente del ahorro Kelisto.es, uno de cada cinco españoles no está contento con el servicio que le proporciona su compañía de telefonía móvil y solo un 16% de clientes se declara “totalmente satisfecho”. Los usuarios más satisfechos son los de Simyo y Pepephone, mientras que los clientes de Vodafone, Movistar y Orange, por este orden, son los más insatisfechos con su compañía. El 35% de los consumidores españoles también afirma que no confía en su operadora, pero sin embargo, sólo uno de cada cuatro usuarios ha cambiado de proveedor durante el último año. -

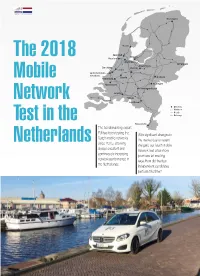

The 2018 Mobile Network Test in the Netherlands

MOBILE BENCHMARK Groningen Hoorn Zaanstad Almere The 2018 Haarlem Amsterdam Hengelo Amersfoort Den Haag Utrecht Leiden Leidschendam- Voorburg Gouda Arnhem Mobile Roerdam Nissewaard Nijmegen s-Hertogenbosch Breda Tilburg Network Eindhoven Drivetest Walktest Roads Railways Test in the Maastricht The benchmarking expert P3 has been testing the With significant changes in Dutch mobile networks the market due to recent Netherlands since 2015, showing mergers, our fourth mobile always excellent and network test once more continuously increasing promises an exciting network performance in race. How did the four the Netherlands. independent candidates perform this time? MOBILE BENCHMARK The P3 connect Mobile Benchmark in the Netherlands has always shown very strong results. This year, the three strongest contenders have once again improved on their results, with only Tele2 falling a little behind last year’s score. Results in a nutshell P3‘s network benchmarks are widely accepted as the de-facto industry standard and for being highly objective. The carefully designed metho- dology of our 2018 benchmark in the Nether- lands combines two cars conducting drivetests T-Mobile in 21 Dutch cities and on the connecting roads Vodafone KPN Tele2 between them with walktests in seven larger max. 1000 Points cities and tests on Dutch railways. The areas in which we have tested account for more than 5.7 million people, or for about 34 per cent of the Dutch population. P3‘s measurement included the use of up-to- date LTE Cat 9 as well as VoLTE-capable smart- phones for the tests. Also, we constantly readjust the thresholds of our evaluation with steps like these we take the latest technical developments 581 566 of the mobile networks into account. -

CASE M.8792 - T-Mobile NL/Tele2 NL

EUROPEAN COMMISSION DG Competition CASE M.8792 - T-Mobile NL/Tele2 NL (Only the English text is authentic) MERGER PROCEDURE REGULATION (EC) 139/2004 Article 8 (1) Regulation (EC) 139/2004 Date: 27/11/2018 This is a provisional non-confidential version. The definitive non- confidential version will be published as soon as it is available. This text is made available for information purposes only. A summary of this decision will be published in all EU languages in the Official Journal of the European Union. Parts of this text have been edited to ensure that confidential information is not disclosed; those parts are enclosed in square brackets. EUROPEAN COMMISSION Brussels, 27.11.2018 C(2018) 7768 final PUBLIC VERSION COMMISSION DECISION of 27.11.2018 declaring a concentration to be compatible with the internal market and the functioning of the EEA Agreement (Case M.8792 - T-Mobile NL/Tele2 NL) (Only the English version is authentic) TABLE OF CONTENTS 1. Introduction ................................................................................................................ 11 2. The Parties and the Transaction ................................................................................. 12 3. Union dimension ........................................................................................................ 12 4. The procedure ............................................................................................................. 13 5. The investigation .......................................................................................................