IMPORTANT NOTICE IMPORTANT: You Must Read the Following Disclaimer Before Continuing. the Following Disclaimer Applies to the At

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HSBC Investdirect Plus Terms & Conditions

C M Y K HSBC InvestDirect Plus PMS ??? PMS ??? PMS ??? PMS ??? Sharedealing and Investment Non-printing Terms and Conditions Colours Non-print 1 Non-print 2 These terms are effective for all InvestDirect JOB LOCATION: PRINERGY 3 Plus customers on and from 13 January 2018. HSB-MCP49730.indd 1 28/12/2017 10:08 2 Part F – Ending the Service 47 Contents Page Section 1 – How you end the Service 47 Introduction 3 Section 2 – How we end the Service 48 Glossary 4 Section 3 – Set-off (using money in one account to meet a debt on another account) 50 Part A – Introducing the Service 8 Section 4 – Dormancy 51 Section 1 – Protecting yourself 8 General Information 52 Section 2 – Contacting you 8 Annex A: Important information about Investment dealing 54 Part B – Your Investment Account 9 Annex B: Important information about using our website 55 Section 1 – Key features of Investment dealing 9 Annex C: Best Execution Disclosure Statement 56 Section 2 – Dealing in Investments 11 Annex D: Our Conflicts of interest policy in relation to our Investment services 58 Section 3 – Settling orders 13 Need to contact us? 59 Section 4 – Best Execution 15 Section 5 – Operating your Investment Account 16 Section 6 – Corporate Actions 19 Section 7 – Tax and reporting of income 21 Introduction Part C – Your Cash Account 23 This document sets out the general terms and conditions which govern the HSBC InvestDirect Plus Service (the Service) we provide to you. It may be supplemented by other documents including: Section 1 – Key features of your Cash Accounts 23 • the Key Features Document and the Rates and Fees Page; Section 2 – Making payments from your Cash Account 23 • our Online Banking Terms and Conditions; Section 3 – Domestic payments 27 • a Trading Reserve Facility Letter; and Section 4 – International payments 28 • documents confirming any other additional items and conditions we introduce in accordance Section 5 – Receiving money into your Cash Account 29 with the change provisions set out elsewhere in this document. -

Consolidated Approved Company List

Consolidated approved company list CONSOLIDATED APPROVED COMPANY LIST CONSOLIDATED APPROVED COMPANY NORMS STATE INSTITUTE ACTION UNIQUE COMPANY LIST CATEGORY ID CODE 3M INDIA LIMITED ELITE E00001 ABB INDIA LIMITED ELITE E00519 ACCENTURE SOLUTIONS PRIVATE ELITE EXCEPTION CATEGORY S05819 LIMITED CHANGE ADANI ENTERPRISES LIMITED ELITE E00002 (FORMERLY ADANI EXPORTS LIMITED) ADANI PORTS AND SPECIAL ECONOMIC ELITE E00003 ZONE LIMITED ADITYA BIRLA FINANCE LIMITED ELITE E00006 ADITYA BIRLA FINANCIAL SERVICES ELITE E00007 GROUP ADITYA BIRLA GROUP POWER PROJECTS ELITE E00008 ADITYA PHARMACARE PRIVATE LIMITED ELITE NAME E00011 (formerly ADITYA PHARMA PRIVATE CHANGE LIMITED) AKZO NOBEL INDIA LIMITED ELITE E00013 ALKALOIDA CHEMICAL COMPANY ZRT. ELITE E00014 ALKEM LABORATORIES LIMITED ELITE E00015 ALLAHABAD BANK ELITE E00016 AMARA RAJA BATTERIES LIMITED ELITE E00020 AMAZON DEVELOPMENT CENTRE (INDIA) ELITE CATEGORY S00220 PRIVATE LIMITED CHANGE AMBUJA CEMENTS LIMITED ELITE E00021 AMDOCS DEVELOPMENT CENTER INDIA ELITE CATEGORY S00230 LLP CHANGE AMERICAN EXPRESS(INDIA) PRIVATE ELITE CATEGORY S00236 LIMITED CHANGE ANDHRA BANK ELITE E00022 ANZ OPERATIONS AND TECHNOLOGY ELITE CATEGORY S00280 PRIVATE LIMITED CHANGE APOLLO HOSPITALS ENTERPRISE ELITE E00023 LIMITED CATEGORY S05823 ARVIND LIMITED ELITE CHANGE CATEGORY P01165 ASEA BROWN BOVERI(PABBL) ELITE CHANGE ASHOK LEYLAND LIMITED ELITE E00025 ASIAN PAINTS LIMITED ELITE E00026 ASSOCIATED BUILDING COMPANY ELITE E00027 ASSOCIATED CEMENT COS LIMITED ELITE E00028 (ACC LIMITED) ATOS INDIA PRIVATE LIMITED ELITE -

S.No. Broker Code Broker Name Contact Person Phone No. Mobile

Broker S.no. Broker Name Contact Person Phone No. Mobile No. Add 1 Add 2 Add 3 Pin Email Code [email protected]; RUCHIKA RAINA SINGH, 9899636606, 25, C BLOCK [email protected]; 011-45675504, 1 001 SPA CAPITAL ADVISORS LTD. VARUN KAUSHIK, 9873486360, COMMUNITY JANAK PURI NEW DELHI 110058 [email protected]; 45675588,45675528 SANJAY JAIN 9910234032 CENTRE [email protected]; [email protected]; HARISH 9999114500, SABHARWAL 5TH 97, NEHRU [email protected];aparnarazdan@ba 2 002 BAJAJ CAPITAL LTD. HARISH SABHARWAL 011-41693000 NEW DELHI 110019 9811121101 FLOOR, BAJAJ PLACE jajcapital.com HOUSE [email protected]; [email protected]; J. M. FINANCIAL SERVICES PRADYUMNA 022-30877349, PALM COURT, 4TH LINK ROAD [email protected]; 3 003 MUMBAI 400064 PVT LTD SATPATHY 30877000, 67617000 FLOOR, M WING MALAD WEST [email protected]; [email protected]; [email protected] 105-108, CONNAUGHT [email protected]; 011-61127438, 040- 9989836349, 19, BARAKHAMBA 4 004 KARVY STOCK BROKING LTD. B V R NAIDU ARUNACHAL PLACE, NEW 110001 [email protected]; [email protected]; 44677536 9177401508 ROAD BUILDING DELHI [email protected] R. R. FINANCIAL RAJEEV SAXENA, S K 47 M M ROAD, RANI [email protected]; [email protected]; 5 005 011-23636362-63 9717553830 JHANDEWALAN NEW DELHI 110055 CONSULTANTS LTD. SINGH JHANSI MARG [email protected] [email protected]; HSBC SECURITIES AND 52/60 M. G. ROAD [email protected]; 6 006 SHWETANK DEV 022-40854280 9811374741 MUMBAI 400001 CAPITAL MARKETS (I) P LTD FORT [email protected]; [email protected] MR. -

Filed by the Lion Electric Company Pursuant to Rule 425 of The

Filed by The Lion Electric Company pursuant to Rule 425 of the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a-12 under the Securities and Exchange Act of 1934, as amended Subject Company: Northern Genesis Acquisition Corp. Commission File No. 001-39451 The following communication was made available by The Lion Electric Company (the “Company”) on its website at https://www.thelionelectric.com/, directing viewers to a webpage on Northern Genesis Acquisition Corp.’s (“NGA”) website at https://www.northerngenesis.com/, on March 24, 2021: The following communication was made available by NGA on its website at http://www.northerngenesis.com/ on March 24, 2021: Your vote matters We encourage you to vote in favor of the business combination with Lion Electric today! Voting is Simple Every vote is important. Regardless of the number of shares you hold, we encourage you to vote and make your voice heard. If you owned Northern Genesis (NYSE: NGA) stock as of the close of business on March 18, 2021, you are entitled to vote and are urged to vote as soon as possible before April 23, 2021. Voting online or via telephone are the easiest ways to vote – and they are both free: Vote Online (Highly recommended): Follow the instructions provided by your broker, bank or other nominee on the Voting Instruction Form mailed (or e-mailed) to you. To vote online, you will need your voting control number, which is included on the Voting Instruction Form. CHECK YOUR EMAIL FOR VOTING! If you hold at Robinhood or Interactive Brokers from g Proxydocs.com For all others check for an email from g Proxyvote.com Vote by Telephone: Follow the instructions provided by your broker, bank or other nominee on the Voting Instruction Form mailed (or e-mailed) to you. -

HSBC Investdirect Self-Directed Online Investing Float Like a Butterfly, Trade Like a Bee

HSBC InvestDirect Self-directed Online Investing Float like a butterfly, trade like a bee. *Terms and conditions apply. 1 HSBC InvestDirect is a division of HSBC Securities (Canada) Inc., a wholly owned subsidiary of, but separate entity from, HSBC Bank Canada. HSBC Securities (Canada) Inc. is a Member of the Canadian Investor Protection Fund. HSBC InvestDirect does not provide investment advice or recommendations regarding any investment decisions or securities transactions. No investment advice is provided or suitability review conducted on accounts held at HSBC InvestDirect. 2 Options may involve a high degree of risk and may not be suitable for all investors. Read the Risk Disclosure Statement for Futures and Options before applying to trade in options (http://www.hsbc.ca/1/ PA_ES_Content_Mgmt/content/canada4/pdfs/personal/terms-conditions-en.pdf). 3 To qualify for HSBC InvestDirect Active Trader pricing of $4.88, customers must: have an active HSBC InvestDirect accounts and trade 150+ times per quarter. Active Trader pricing applies to qualified and filled online trades only. Qualified trades are defined, for this purpose, as equity, ETF’s and option orders executed on the North American exchanges and markets. Regular commission schedule rates will continue to apply to trades on International markets, telephone trades, option assignments and exercises. 4 About DALBAR Inc.: As the world’s premier financial services strategy and operations research firm, DALBAR Inc. helps leading enterprises develop, build, and operate strong businesses that deliver sustained shareholder value growth. DALBAR’s proprietary business design techniques, combined with its specialized industry knowledge and behavioural research expertise, enable companies to anticipate changes in customer priorities and the competitive environment, and then design their businesses and improve operations to seize opportunities created by those changes. -

Send2press Blue Online

Send2Press BLUE Level Online Sites 2007 1 Destination URL Note: all points subject to change, most sites pull news based on content - so automobile sites don't pull medical news, etc. For latest pub lists: www.Send2Press.com/lists/ .NET Developer's Journal (SYS-CON Media) http://www.dotnet.sys-con.com 123Jump.com, Inc. http://www.123jump.com/ 1960 Sun http://www.the1960sun.com 20/20 Downtown http://www.abcnews.com/Sections/downtown/index.html 24x7 Magazine (Ascend Media) http://www.24x7mag.com 50 Plus Lifestyles http://www.50pluslifestylesonline.com A Taste of New York Network http://www.tasteofny.com ABC http://www.abc.com ABC News http://www.abcnews.com ABC Radio http://abcradio.go.com/ Aberdeen Group (aka Aberdeen Asset Managemehttp://www.aberdeen.com Abilene Reporter-News http://reporter-news.com/ ABN Amro http://www.abnamro.com About.com http://about.com/ aboutREMEDIATION http://www.aboutremediation.com AboutThatCar.com http://www.aboutthatcar.com ABSNet http://www.absnet.net/ Accountants World LLC (eTopics) http://www.accountantsworld.com Accutrade (TD AMERITRADE, Inc.) http://www.accutrade.com Acquire Media Corp. http://www.acquiremedia.com Activ Financial http://www.activfinancial.com Adelante Valle http://www.adelantevalle.com/ ADP ADP Clearing & Outsourcing Services (fka US Clehttp://www.usclearing.com Advance Internet http://www.advance.net Advance Newspapers (Advance Internet) http://www.advancenewspapers.com/ Advanced Imaging Magazine (Cygnus Interactive http://www.advancedimagingpro.com Advanced Packaging Magazine (PennWell) http://ap.pennnet.com/ Advanced Radio Network http://www.graveline.com www.send2press.com/lists/ Send2Press BLUE Level Online Sites 2007 2 Advanstar Communications Inc http://www.advanstar.com/ Advertising Age http://www.adage.com ADVFN Advanced Financial Network http://www.advfn.com Advisor Insight http://www.advisorinsight.com Advisor Media Inc. -

All Figures - Rs

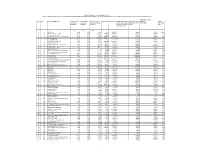

Franklin Templeton Asset Management ( I ) Pvt. Ltd. Disclosure of Commission and expenses paid to Distributors identified by AMFI (based on SEBI circular dated August 22, 2011 and additional disclosure as per SEBI circular dated September 13, 2012) for the Financial Year 2016 - 17 All figures - Rs. in Lacs Sr. No. ARN Name of the ARN Holder Total Commission Total Expenses Total Commission + Gross Inflows Net Inflows Whether the distributor Averge Assets under AUM as on AUM to paid during paid during Expenses paid during is an associate or group Management for FY 31-Mar-2017 Gross Inflows FY 2016-17 FY 2016-17 FY 2016-17 compnay of the sponsors 2016-17 Ratio of the Mutual Fund A B A+B 1 1 BNP Paribas 29.13 0.00 29.13 10.74 -4988.62 No 8298.97 4203.36 391.24 2 2 JM Financial Services Limited 320.40 0.00 320.40 116991.90 8829.67 No 64747.65 66123.31 0.57 3 3 Aditya Birla Money Mart Ltd 325.13 0.00 325.13 14736.63 1877.81 No 46167.61 44197.83 3.00 4 4 Cholamandalam Distribution Services Limited 51.86 0.00 51.86 261084.60 -5676.05 No 10091.80 7546.59 0.03 5 5 HDFC Bank Limited 1673.88 0.00 1673.88 159786.61 31920.60 No 198112.34 240390.52 1.50 6 6 SKP Securities Limited 60.30 0.00 60.30 3189.51 72.12 No 7743.32 7464.18 2.34 7 7 SPA Capital Services Limited 257.44 0.00 257.44 206838.62 -21389.76 No 57230.72 44218.34 0.21 8 8 AXIS CAPITAL LIMITED 13.07 0.00 13.07 5815.91 3373.09 No 13595.81 0.00 0.00 9 9 Way2Wealth Securities Private Limited 76.30 0.00 76.30 2838.75 192.07 No 11697.09 12512.21 4.41 10 10 Bajaj Capital Ltd. -

Commercial Banking Clients As Also to a Fast Growing Personal Banking Customer Base

HSBC's origins in India date back to 1853, when the Mercantile Bank of India was established in Mumbai. The Bank has since, steadily grown in reach and service offerings, keeping pace with the evolving banking and financial needs of its customers. In India, the Bank offers a comprehensive suite of world-class products and services to its corporate and commercial banking clients as also to a fast growing personal banking customer base. Commercial Banking The Hongkong and Shanghai Banking Corporation Limited (HSBC) Personal Banking HSBC offers a wide range of personal financial services, including personal lending and deposit products, through its branch network in Ahmedabad, Bangalore, Chennai, Chandigarh, Coimbatore, Gurgaon, Hyderabad, Jaipur, Kochi, Kolkata, Ludhiana, Mumbai, New Delhi, Noida, Pune, Thane, Trivandrum and Visakhapatnam. Also offered branch-wide are international Gold and Classic credit cards from VISA and MasterCard and debit cards from Visa. Customers have access to 24-hour banking services through an extensive network of automated teller machines (ATMs), an integrated Call Centre, and internet banking - online@hsbc . Non Resident Indian Banking HSBC's Non Resident Indian Banking (NRI) centres located in Asia-Pacific, the Middle East, Europe and North America, together with HSBC's offices worldwide, provide the international Indian Diaspora access to a range of products and services. These include NRI related investment (both international and domestic), transactional and deposit products, together with a full range of personal and private banking products in India and overseas. Internet banking also provides easy access to HSBC's services. Financial Planning Services Services include investment and custodian management and access to stock broking and insurance services, which are offered to resident as well as non-resident Indians. -

HSBC Canadian Money Market Fund

HSBC Canadian Money Market Fund Interim Management Report of Fund Performance for the six months ended June 30, 2019 HSBC Canadian Money Market Fund Management Discussion of Fund Performance In this document, you and your refer to the unitholder of the Fund’s benchmark. Over the first six months of the year, we Fund; we, us and our refer to HSBC Global Asset Management targeted the Fund’s duration at its blended 45-day benchmark (Canada) Limited; and the Fund refers to the HSBC Canadian after the Bank of Canada kept rates on hold and stated that any Money Market Fund. future rates changes would be contingent on incoming data. We are the manager, trustee and primary investment advisor of Recent Developments the Fund. The Bank of Canada maintained its policy rate at 1.75% during Introduction the first six months of 2019. The Bank stated that any future rate This Interim Management Report of Fund Performance contains moves would be highly data dependent and that it would be financial highlights but does not contain either the semi-annual closely monitoring developments in household spending, oil financial report or annual financial statements of the investment markets and global trade policy. The Bank also highlighted at its fund. You may obtain a copy of the Fund’s semi-annual financial May 2019 meeting that the slowdown in the latter part of 2018 report or annual financial statements at your request, at no cost, and the early part of 2019 was temporary and that the economy by calling us toll-free at 1-888-390-3333, by visiting our website was expected to pick up in the second half of the year. -

Annual Report December 31, 2009 | Matthewsasia.Com

Matthews Asia Funds | Annual Report December 31, 2009 | matthewsasia.com ASIA GROWTH AND INCOME STRATEGIES Matthews Asian Growth and Income Fund Matthews Asia Dividend Fund Matthews China Dividend Fund ASIA GROWTH STRATEGIES Matthews Asia Pacific Fund Matthews Pacific Tiger Fund Matthews China Fund Matthews India Fund Matthews Japan Fund Matthews Korea Fund ASIA SMALL COMPANY STRATEGY Matthews Asia Small Companies Fund ASIA SPECIALTY STRATEGY Matthews Asian Technology Fund '09 Merrill Corp - Matthews Web-Ready Annual Report [Funds] 12-31-2009 ED | dbaker | 01-Mar-10 14:43 | 10-1483-4.aa | Sequence: 2 CHKSUM Content: 10938 Layout: 53506 Graphics: No Graphics CLEAN Performance and Expenses Through December 31, 2009 2009 Gross 2008 Gross Average Annual Total Return Annual Annual Since Inception Operating Operating 1 year 5 years 10 years Inception Date Expenses Expenses ASIA GROWTH AND INCOME STRATEGIES Matthews Asian Growth and Income Fund 41.44% 10.77% 13.76% 11.18% 9/12/94 1.18% 1.16% Matthews Asia Dividend Fund 47.59% n.a. n.a. 11.00% 10/31/06 1.28% 1.35% After Fee Waiver, Reimbursement and Recoupment 1.30%1 1.32%1 Matthews China Dividend Fund n.a. n.a. n.a. 1.80%2 11/30/09 10.05% n.a. After Fee Waiver, Reimbursement and Recoupment 1.50%3 n.a. ASIA GROWTH STRATEGIES Matthews Asia Pacific Fund 44.82% 7.18% n.a. 9.86% 10/31/03 1.28% 1.23% Matthews Pacific Tiger Fund 75.37% 14.50% 11.55% 9.13% 9/12/94 1.13% 1.12% Matthews China Fund 78.30% 22.23% 17.18% 13.53% 2/19/98 1.21% 1.23% Matthews India Fund 97.25% n.a. -

The New Capital Accord a Strategic Analysis Of' the Impact on a Schedule 2 Bank

BASEL 11: THE NEW CAPITAL ACCORD A STRATEGIC ANALYSIS OF' THE IMPACT ON A SCHEDULE 2 BANK Kevin Gerard Mathias, B.Com., AICB PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION EMBA Program in the FACULTY OF BUSINESS ADMINISTRATION O Kevin Gerard Mathias 2004 SIMON FRASER UNIVERSITY August 2004 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author APPROVAL Name: Kevin Gerard Mathias Degree: Masters of Business Administration Base1 11: The New Capital Accord Title of Project: A Strategic Analysis of the Impact on a Schedule 2 Bank Examining Committee: Dr Steve Globerman Senior Supervisor Adjunct Professor Jill Shepard Second Reader Assistant Professor Date Approved: 14 Partial Copyright Licence The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further agreed that permission for multiple copying of this work for scholarly purposes may be granted by either the author or the Dean of Graduate Studies. It is understood that copying or publication of this work for financial gain shall not be allowed without the author's written permission. The original Partial Copyright Licence attesting to these terms, and signed by this author, may be found in the original bound copy of this work, retained in the Simon Fraser University Archive. -

1 BNP Paribas 2.72 2 JM Financial Services Pvt. Ltd. 40.22 3 Aditya

Commission and Expenses paid to distributors for the period 01 April 2010 - 31 March 2011 Sr. No. Name of Distributor Rs in lakhs 1 BNP Paribas 2.72 2 JM Financial Services Pvt. Ltd. 40.22 3 Aditya Birla Money Mart Ltd 36.35 4 Cholamandalam Distribution Services Ltd 10.74 5 HDFC Bank Ltd 101.04 6 SKP Securities Limited 7.78 7 SPA Capital Services Ltd 18.10 8 Enam Securities Private Limited 9.04 9 Way2Wealth Securities Pvt Ltd 8.03 10 Bajaj Capital Ltd 73.67 11 SBICAP Securities Ltd. 0.42 12 Shubhangi Gopal Pai 0.93 13 Chetan Jaysingh Bhatia 0.23 14 Bluechip Corporate Investment Centre Ltd 20.54 15 Stock Holding Corporation of India Ltd 2.28 16 Karvy Stock Broking Limited 51.58 17 Axis Bank Limited 14.18 18 ICICI Bank Limited 38.96 19 Tata Securities Limited 2.03 20 Hongkong & Shanghai Banking Corporation Ltd 774.75 21 HSBC Investdirect Securities India Ltd 11.09 22 EFG Wealth Management (India) Private Limited. 1.33 23 Eastern Financiers Ltd 18.10 24 RR Investors Capital Services Pvt Ltd 20.58 25 ARN-0033 0.00 26 Bluechip Capital Services Pvt Ltd 6.38 27 Sanjeev Anand 0.08 28 CITIBANK NA 48.59 29 IDBI Bank Ltd 24.35 30 Chadha Investments 0.58 31 Geojit BNP Paribas Financial Services Limited 7.52 32 ITI Financial Services Limited 4.51 33 DSP Merrill Lynch Ltd. 11.67 34 NJ India Invest Pvt Ltd 59.59 35 Mata Securities India Private Limited 2.26 36 Ramkumar Harkishorbhai Barchha 0.23 37 Kotak Securities Limited 2.98 38 Zeenath S Jagan 1.82 39 Hexagon Capital Advisors Pvt Ltd 0.06 40 Anand Rathi Financial Services Ltd 18.61 41 Hero Honda Finlease Limited 0.05 42 Allegiance Advisors Pvt.