Commercial Banking Clients As Also to a Fast Growing Personal Banking Customer Base

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HSBC BANK in LEEDS © by Tina Staples the HSBC Bank, Like Most Banks, Has a Long History of Mergers, Frequently with a Resulting Change of Name

From Oak Leaves, Part 3, Summer 2002 - published by Oakwood and District Historical Society [ODHS] HSBC BANK IN LEEDS © By Tina Staples The HSBC Bank, like most banks, has a long history of mergers, frequently with a resulting change of name. Many new banks were founded in the second half of the nineteenth century in response to the need for ever more finance for the booming growth of business in Victorian times. HSBC plc acquired the Midland Bank in 1992. Since 1836, the first year that "Midland" was included in the title there have been the following changes of name. 1836 Birmingham & Midland Bank. 1850 Birmingham & Midland Bank Ltd. 1891 London & Midland Bank Ltd. 1898 London City & Midland Bank Ltd. 1918 London Joint City & Midland Bank Ltd. 1923 Midland Bank Ltd. 1982 Midland Bank pic. 1999 HSBC pic. HSBC has many historic connections with the City of Leeds. The earliest link is with the private banking firm of Perfect and Co, which was established in Pontefract in about 1800 and opened an office in Leeds in 1814. This firm was acquired in 1834 by the newly established Yorkshire District Bank, which used the Perfect and Co. premises in City Square as its head office. In 1843 the bank was reconstructed as the Yorkshire Banking Company, which was acquired by the London City & Midland in 1901. The HSBC network also incorporates the business of the Exchange and Discount Bank and the Leeds & County Bank. Mr. John James Cousins founded the Exchange and Discount Bank in 1860. He was the first banker to set up in business in Park Row and according to one local historian 'His staff was one small boy in buttons' Nearby, the Leeds & County Bank had been established in 1862 and had opened a number of branches in the Leeds area. -

Inspection Copy Inspection Copy

INSEAD First Direct: Branchless Banking INSPECTIONNot For Reproduction COPY 01/97-4660 This case was prepared by Delphine Parmenter, Research Associate, under the supervision of Jean- Claude Larréché, Alfred H. Heineken Professor of Marketing, and Christopher Lovelock, Visiting Professor, at INSEAD. It is intended to be used as a basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative situation. Copyright © 1997 INSEAD, Fontainebleau, France. INSPECTIONNot For Reproduction COPY INSEAD 1 4660 In October 1996, seven years after it first opened outside Leeds, England, First Direct was still attracting attention as an innovator that operated a bank with no branches. Intrigued by its success, financial service providers wanted to understand how unseen customers conducted business around the clock over the telephone. An article in the New York Times reported: Representatives from banks around the world are making the pilgrimage to this industrial city in the north of England for a glimpse of what might be their stagnant industry’s equivalent of a miraculous cure. For not only is First Direct the world’s leading telephone-only bank, it is the fastest growing bank in Britain. In just six years, it has signed up 2% of Britain’s notoriously set-in-their-ways banking subjects, who call its rows of bankers 24 hours a day, seven days a week, toNot pay bills, For buy Reproduction stock, and arrange mortgages. September 3, 1996 INSPECTIONSuccess not only put First Direct COPY in the media limelight but it also helped to maintain high levels of enthusiasm, pride, and motivation internally. -

HSBC Investdirect Plus Terms & Conditions

C M Y K HSBC InvestDirect Plus PMS ??? PMS ??? PMS ??? PMS ??? Sharedealing and Investment Non-printing Terms and Conditions Colours Non-print 1 Non-print 2 These terms are effective for all InvestDirect JOB LOCATION: PRINERGY 3 Plus customers on and from 13 January 2018. HSB-MCP49730.indd 1 28/12/2017 10:08 2 Part F – Ending the Service 47 Contents Page Section 1 – How you end the Service 47 Introduction 3 Section 2 – How we end the Service 48 Glossary 4 Section 3 – Set-off (using money in one account to meet a debt on another account) 50 Part A – Introducing the Service 8 Section 4 – Dormancy 51 Section 1 – Protecting yourself 8 General Information 52 Section 2 – Contacting you 8 Annex A: Important information about Investment dealing 54 Part B – Your Investment Account 9 Annex B: Important information about using our website 55 Section 1 – Key features of Investment dealing 9 Annex C: Best Execution Disclosure Statement 56 Section 2 – Dealing in Investments 11 Annex D: Our Conflicts of interest policy in relation to our Investment services 58 Section 3 – Settling orders 13 Need to contact us? 59 Section 4 – Best Execution 15 Section 5 – Operating your Investment Account 16 Section 6 – Corporate Actions 19 Section 7 – Tax and reporting of income 21 Introduction Part C – Your Cash Account 23 This document sets out the general terms and conditions which govern the HSBC InvestDirect Plus Service (the Service) we provide to you. It may be supplemented by other documents including: Section 1 – Key features of your Cash Accounts 23 • the Key Features Document and the Rates and Fees Page; Section 2 – Making payments from your Cash Account 23 • our Online Banking Terms and Conditions; Section 3 – Domestic payments 27 • a Trading Reserve Facility Letter; and Section 4 – International payments 28 • documents confirming any other additional items and conditions we introduce in accordance Section 5 – Receiving money into your Cash Account 29 with the change provisions set out elsewhere in this document. -

The Assessment of Borrowers by Bank Managements at the Turn of the Twentieth Century

Trust and virtue in banking: the assessment of borrowers by bank managements at the turn of the twentieth century Article Accepted Version Newton, L. (2000) Trust and virtue in banking: the assessment of borrowers by bank managements at the turn of the twentieth century. Financial History Review, 7 (2). pp. 177- 199. doi: https://doi.org/10.1017/S096856500000010X Available at http://centaur.reading.ac.uk/68211/ It is advisable to refer to the publisher’s version if you intend to cite from the work. See Guidance on citing . Published version at: https://www.cambridge.org/core/journals/financial-history-review/article/trust-and-virtue-in- english-banking-the-assessment-of-borrowers-by-bank-managements-at-the-turn-of-the-nineteenth- century/E5DA3D524B679A673661165B88D94F7E To link to this article DOI: http://dx.doi.org/10.1017/S096856500000010X Publisher: Cambridge University Press All outputs in CentAUR are protected by Intellectual Property Rights law, including copyright law. Copyright and IPR is retained by the creators or other copyright holders. Terms and conditions for use of this material are defined in the End User Agreement . www.reading.ac.uk/centaur CentAUR Central Archive at the University of Reading Reading’s research outputs online Trust and virtue in banking: the assessment of borrowers by bank managements at the turn of the twentieth century1 First secure an independent income, then practice virtue. (Greek proverb) Silver and gold are not the only coin: virtue too passes current all over the world. (Euripides, 5th century BC) Banks are financial intermediaries who mediate between those in financial surplus and those in financial deficit, and between those making and receiving payments. -

Consolidated Approved Company List

Consolidated approved company list CONSOLIDATED APPROVED COMPANY LIST CONSOLIDATED APPROVED COMPANY NORMS STATE INSTITUTE ACTION UNIQUE COMPANY LIST CATEGORY ID CODE 3M INDIA LIMITED ELITE E00001 ABB INDIA LIMITED ELITE E00519 ACCENTURE SOLUTIONS PRIVATE ELITE EXCEPTION CATEGORY S05819 LIMITED CHANGE ADANI ENTERPRISES LIMITED ELITE E00002 (FORMERLY ADANI EXPORTS LIMITED) ADANI PORTS AND SPECIAL ECONOMIC ELITE E00003 ZONE LIMITED ADITYA BIRLA FINANCE LIMITED ELITE E00006 ADITYA BIRLA FINANCIAL SERVICES ELITE E00007 GROUP ADITYA BIRLA GROUP POWER PROJECTS ELITE E00008 ADITYA PHARMACARE PRIVATE LIMITED ELITE NAME E00011 (formerly ADITYA PHARMA PRIVATE CHANGE LIMITED) AKZO NOBEL INDIA LIMITED ELITE E00013 ALKALOIDA CHEMICAL COMPANY ZRT. ELITE E00014 ALKEM LABORATORIES LIMITED ELITE E00015 ALLAHABAD BANK ELITE E00016 AMARA RAJA BATTERIES LIMITED ELITE E00020 AMAZON DEVELOPMENT CENTRE (INDIA) ELITE CATEGORY S00220 PRIVATE LIMITED CHANGE AMBUJA CEMENTS LIMITED ELITE E00021 AMDOCS DEVELOPMENT CENTER INDIA ELITE CATEGORY S00230 LLP CHANGE AMERICAN EXPRESS(INDIA) PRIVATE ELITE CATEGORY S00236 LIMITED CHANGE ANDHRA BANK ELITE E00022 ANZ OPERATIONS AND TECHNOLOGY ELITE CATEGORY S00280 PRIVATE LIMITED CHANGE APOLLO HOSPITALS ENTERPRISE ELITE E00023 LIMITED CATEGORY S05823 ARVIND LIMITED ELITE CHANGE CATEGORY P01165 ASEA BROWN BOVERI(PABBL) ELITE CHANGE ASHOK LEYLAND LIMITED ELITE E00025 ASIAN PAINTS LIMITED ELITE E00026 ASSOCIATED BUILDING COMPANY ELITE E00027 ASSOCIATED CEMENT COS LIMITED ELITE E00028 (ACC LIMITED) ATOS INDIA PRIVATE LIMITED ELITE -

S.No. Broker Code Broker Name Contact Person Phone No. Mobile

Broker S.no. Broker Name Contact Person Phone No. Mobile No. Add 1 Add 2 Add 3 Pin Email Code [email protected]; RUCHIKA RAINA SINGH, 9899636606, 25, C BLOCK [email protected]; 011-45675504, 1 001 SPA CAPITAL ADVISORS LTD. VARUN KAUSHIK, 9873486360, COMMUNITY JANAK PURI NEW DELHI 110058 [email protected]; 45675588,45675528 SANJAY JAIN 9910234032 CENTRE [email protected]; [email protected]; HARISH 9999114500, SABHARWAL 5TH 97, NEHRU [email protected];aparnarazdan@ba 2 002 BAJAJ CAPITAL LTD. HARISH SABHARWAL 011-41693000 NEW DELHI 110019 9811121101 FLOOR, BAJAJ PLACE jajcapital.com HOUSE [email protected]; [email protected]; J. M. FINANCIAL SERVICES PRADYUMNA 022-30877349, PALM COURT, 4TH LINK ROAD [email protected]; 3 003 MUMBAI 400064 PVT LTD SATPATHY 30877000, 67617000 FLOOR, M WING MALAD WEST [email protected]; [email protected]; [email protected] 105-108, CONNAUGHT [email protected]; 011-61127438, 040- 9989836349, 19, BARAKHAMBA 4 004 KARVY STOCK BROKING LTD. B V R NAIDU ARUNACHAL PLACE, NEW 110001 [email protected]; [email protected]; 44677536 9177401508 ROAD BUILDING DELHI [email protected] R. R. FINANCIAL RAJEEV SAXENA, S K 47 M M ROAD, RANI [email protected]; [email protected]; 5 005 011-23636362-63 9717553830 JHANDEWALAN NEW DELHI 110055 CONSULTANTS LTD. SINGH JHANSI MARG [email protected] [email protected]; HSBC SECURITIES AND 52/60 M. G. ROAD [email protected]; 6 006 SHWETANK DEV 022-40854280 9811374741 MUMBAI 400001 CAPITAL MARKETS (I) P LTD FORT [email protected]; [email protected] MR. -

Filed by the Lion Electric Company Pursuant to Rule 425 of The

Filed by The Lion Electric Company pursuant to Rule 425 of the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a-12 under the Securities and Exchange Act of 1934, as amended Subject Company: Northern Genesis Acquisition Corp. Commission File No. 001-39451 The following communication was made available by The Lion Electric Company (the “Company”) on its website at https://www.thelionelectric.com/, directing viewers to a webpage on Northern Genesis Acquisition Corp.’s (“NGA”) website at https://www.northerngenesis.com/, on March 24, 2021: The following communication was made available by NGA on its website at http://www.northerngenesis.com/ on March 24, 2021: Your vote matters We encourage you to vote in favor of the business combination with Lion Electric today! Voting is Simple Every vote is important. Regardless of the number of shares you hold, we encourage you to vote and make your voice heard. If you owned Northern Genesis (NYSE: NGA) stock as of the close of business on March 18, 2021, you are entitled to vote and are urged to vote as soon as possible before April 23, 2021. Voting online or via telephone are the easiest ways to vote – and they are both free: Vote Online (Highly recommended): Follow the instructions provided by your broker, bank or other nominee on the Voting Instruction Form mailed (or e-mailed) to you. To vote online, you will need your voting control number, which is included on the Voting Instruction Form. CHECK YOUR EMAIL FOR VOTING! If you hold at Robinhood or Interactive Brokers from g Proxydocs.com For all others check for an email from g Proxyvote.com Vote by Telephone: Follow the instructions provided by your broker, bank or other nominee on the Voting Instruction Form mailed (or e-mailed) to you. -

HSBC Investdirect Self-Directed Online Investing Float Like a Butterfly, Trade Like a Bee

HSBC InvestDirect Self-directed Online Investing Float like a butterfly, trade like a bee. *Terms and conditions apply. 1 HSBC InvestDirect is a division of HSBC Securities (Canada) Inc., a wholly owned subsidiary of, but separate entity from, HSBC Bank Canada. HSBC Securities (Canada) Inc. is a Member of the Canadian Investor Protection Fund. HSBC InvestDirect does not provide investment advice or recommendations regarding any investment decisions or securities transactions. No investment advice is provided or suitability review conducted on accounts held at HSBC InvestDirect. 2 Options may involve a high degree of risk and may not be suitable for all investors. Read the Risk Disclosure Statement for Futures and Options before applying to trade in options (http://www.hsbc.ca/1/ PA_ES_Content_Mgmt/content/canada4/pdfs/personal/terms-conditions-en.pdf). 3 To qualify for HSBC InvestDirect Active Trader pricing of $4.88, customers must: have an active HSBC InvestDirect accounts and trade 150+ times per quarter. Active Trader pricing applies to qualified and filled online trades only. Qualified trades are defined, for this purpose, as equity, ETF’s and option orders executed on the North American exchanges and markets. Regular commission schedule rates will continue to apply to trades on International markets, telephone trades, option assignments and exercises. 4 About DALBAR Inc.: As the world’s premier financial services strategy and operations research firm, DALBAR Inc. helps leading enterprises develop, build, and operate strong businesses that deliver sustained shareholder value growth. DALBAR’s proprietary business design techniques, combined with its specialized industry knowledge and behavioural research expertise, enable companies to anticipate changes in customer priorities and the competitive environment, and then design their businesses and improve operations to seize opportunities created by those changes. -

Send2press Blue Online

Send2Press BLUE Level Online Sites 2007 1 Destination URL Note: all points subject to change, most sites pull news based on content - so automobile sites don't pull medical news, etc. For latest pub lists: www.Send2Press.com/lists/ .NET Developer's Journal (SYS-CON Media) http://www.dotnet.sys-con.com 123Jump.com, Inc. http://www.123jump.com/ 1960 Sun http://www.the1960sun.com 20/20 Downtown http://www.abcnews.com/Sections/downtown/index.html 24x7 Magazine (Ascend Media) http://www.24x7mag.com 50 Plus Lifestyles http://www.50pluslifestylesonline.com A Taste of New York Network http://www.tasteofny.com ABC http://www.abc.com ABC News http://www.abcnews.com ABC Radio http://abcradio.go.com/ Aberdeen Group (aka Aberdeen Asset Managemehttp://www.aberdeen.com Abilene Reporter-News http://reporter-news.com/ ABN Amro http://www.abnamro.com About.com http://about.com/ aboutREMEDIATION http://www.aboutremediation.com AboutThatCar.com http://www.aboutthatcar.com ABSNet http://www.absnet.net/ Accountants World LLC (eTopics) http://www.accountantsworld.com Accutrade (TD AMERITRADE, Inc.) http://www.accutrade.com Acquire Media Corp. http://www.acquiremedia.com Activ Financial http://www.activfinancial.com Adelante Valle http://www.adelantevalle.com/ ADP ADP Clearing & Outsourcing Services (fka US Clehttp://www.usclearing.com Advance Internet http://www.advance.net Advance Newspapers (Advance Internet) http://www.advancenewspapers.com/ Advanced Imaging Magazine (Cygnus Interactive http://www.advancedimagingpro.com Advanced Packaging Magazine (PennWell) http://ap.pennnet.com/ Advanced Radio Network http://www.graveline.com www.send2press.com/lists/ Send2Press BLUE Level Online Sites 2007 2 Advanstar Communications Inc http://www.advanstar.com/ Advertising Age http://www.adage.com ADVFN Advanced Financial Network http://www.advfn.com Advisor Insight http://www.advisorinsight.com Advisor Media Inc. -

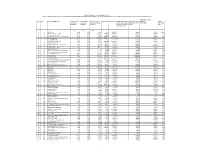

All Figures - Rs

Franklin Templeton Asset Management ( I ) Pvt. Ltd. Disclosure of Commission and expenses paid to Distributors identified by AMFI (based on SEBI circular dated August 22, 2011 and additional disclosure as per SEBI circular dated September 13, 2012) for the Financial Year 2016 - 17 All figures - Rs. in Lacs Sr. No. ARN Name of the ARN Holder Total Commission Total Expenses Total Commission + Gross Inflows Net Inflows Whether the distributor Averge Assets under AUM as on AUM to paid during paid during Expenses paid during is an associate or group Management for FY 31-Mar-2017 Gross Inflows FY 2016-17 FY 2016-17 FY 2016-17 compnay of the sponsors 2016-17 Ratio of the Mutual Fund A B A+B 1 1 BNP Paribas 29.13 0.00 29.13 10.74 -4988.62 No 8298.97 4203.36 391.24 2 2 JM Financial Services Limited 320.40 0.00 320.40 116991.90 8829.67 No 64747.65 66123.31 0.57 3 3 Aditya Birla Money Mart Ltd 325.13 0.00 325.13 14736.63 1877.81 No 46167.61 44197.83 3.00 4 4 Cholamandalam Distribution Services Limited 51.86 0.00 51.86 261084.60 -5676.05 No 10091.80 7546.59 0.03 5 5 HDFC Bank Limited 1673.88 0.00 1673.88 159786.61 31920.60 No 198112.34 240390.52 1.50 6 6 SKP Securities Limited 60.30 0.00 60.30 3189.51 72.12 No 7743.32 7464.18 2.34 7 7 SPA Capital Services Limited 257.44 0.00 257.44 206838.62 -21389.76 No 57230.72 44218.34 0.21 8 8 AXIS CAPITAL LIMITED 13.07 0.00 13.07 5815.91 3373.09 No 13595.81 0.00 0.00 9 9 Way2Wealth Securities Private Limited 76.30 0.00 76.30 2838.75 192.07 No 11697.09 12512.21 4.41 10 10 Bajaj Capital Ltd. -

Marine Midland Bank 11/4/96 PE

GENERAL INFORMATION The Community Reinvestment Act (CRA) requires each federal financial supervisory agency to use its authority when examining financial institutions subject to its supervision, to assess the institution's record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. Upon conclusion of such examination, the agency must prepare a written evaluation of the institution's record of meeting the credit needs of its community. This document is an evaluation of the Community Reinvestment Act (CRA) performance of Marine Midland Bank prepared by the Federal Reserve Bank of New York, the institution's supervisory agency, as of November 4, 1996. The agency evaluates performance in assessment area(s), as they are delineated by the institution, rather than individual branches. This assessment area evaluation may include the visits to some, but not necessarily all of the institution's branches. The agency rates the CRA performance of an institution consistent with the provisions set forth in Appendix A to 12 CFR Part 228. The new CRA regulation will be phased in over a two year period beginning July 1, 1995. During that period, banks with total assets greater than $250 million will be examined under the current regulation with its twelve assessment factors until July 1, 1997. However, to comply with the requirements of Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, this evaluation includes conclusions with respect to overall performance as well as the bank=s performance in each Metropolitan Statistical Area and Non-Metropolitan Statistical Area which the bank has delineated for CRA purposes 96CAE28\Marine\ect\D#50 DSBB No. -

18 U.S.C. § 371

Case 0:19-cr-60359-RKA Document 8-2 Entered on FLSD Docket 12/10/2019 Page 25 of 76 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA CASE NO. 19-60359-CR-ALTMAN/HUNT 18 u.s.c. § 371 UNITED STATES OF AMERICA v. HSBC PRIVATE BANK (SUISSE) SA, Defendant. _____________! STATEMENT OF FACTS I. BACKGROUND 1. HSBC Private Bank (Suisse) SA ("'HSBC Switzerland") is incorporated and domiciled in Switzerland, with its headquarters in Geneva. HSBC Switzerland is an operating bank subsidiary of HSBC Private Bank Holdings (Suisse) SA, a Swiss-based holding company. 1 At all relevant times, HSBC Switzerland had its own Board of Directors, Chief Executive Officer, Management Executive Committee, and Legal and Compliance functions. 2. HSBC Switzerland was incorporated in 2001. It is the product of a series of acquisitions and mergers. In 1999, HSBC acquired Republic National Bank of New York ("Republic Bank") and Safra Republic Holdings SA. In 2009, HSBC Switzerland merged with HSBC Guyerzeller Bank Ltd. ("'HSBC Guyerzeller"). 3. HSBC Guyerzeller was a Swiss private bank that was wholly owned by HSBC Private Bank Holdings (Suisse) SA. HSBC acquired a majority share of HSBC Guyerzeller in 1992 as part of its acquisition of Midland Bank, a U.K.-based bank that owned HSBC Guyerzeller. In 2002, HSBC integrated HSBC Guyerzeller with Credit Commercial de France (Suisse) SA and Handelsfinanz-CCF Bank, the private Swiss bank businesses of Credit Commercial de France, which HSBC had acquired in 2000. HSBC Guyerzeller maintained a head office in Zurich, and branches in Geneva and Lugano, as well as representative offices in Hong Kong and Istanbul.