Chapter 7 Land Revenue

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Madhya Pradesh

Analysis of National Flagship Programme National Rural Health Mission (For the Years: 2009-10, 2010-2011 and 2011-12) District: Chhatarpur State: Madhya Pradesh Supported by UNICEF Under GoI – UN Joint Programme on Convergence 1 Disclaimer With Technical support from Randstad India Limited for designing of tools, data analysis and drafting of the report. Data collection was carried out from the districts by the UNICEF supported District Facilitators under GoI-UN joint programme on convergence 2 Acronyms ANM Auxiliary Nurse Midwife ANC Ante Natal Care ARSH Adolescent Reproductive and Sexual Health ASHA Accredited Social Health Activist AYUSH Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homeopathy BPM Block Programme Manager BEmONC Basic Emergency Obstetric and Newborn Care CEmONC Comprehensive Emergency Obstetric and Newborn Care CHC Community Health Centre DH District Hospital DHAP District Health Action Plan DHS District Health Society DOT Directly Observed Therapy DPM District Programme Manager DPMU District Programme Management Unit FGD Focused Group Discussion GP Gram Panchayat HIV Human Immunodeficiency Virus HMIS Health Management Information System ICDS Integrated Child Development Services IPHS Indian Public Health Standards JSY Janani Suraksha Yojana LHV Lady Health Visitor NBCC New Born Care Corner PCPNDT Pre-Conception Pre Natal Diagnostic Act PRI Panchayat Raj Institute PHC Primary Health Centre PNC Post Natal Care RKS Rogi Kalyan Samiti RTI Reproductive Tract Infection STI Sexually Transmitted Infection SHC Sub-Health Centre TT Tetanus Toxoid VHND Village Health and Nutrition Day VHSC Village Health and Sanitation Committee VHSNC Village Health, Sanitation and Nutrition Committee 3 Contents A. Background……………………………………………………………………………………………………..…………………………..5 B. Objectives…………………………………………………………………………………………………..…………………………....….5 C. Material and Methodology……………………………………………………………………..………………………………......5 D. -

English Advt 8.Indd

Hindustan Petroleum Corporation Limited proposes to appoint Retail Outlet Dealers in Madhya Pradesh, as per following details: Fixed 1 2 3 4 5 6 7 8 9a 9b 10 11 12 ESTIMATED Fee / MIN Finance to be Security Within 1.5 Km BPC Petrol Pump MONTHLY TYPE Minimum SR REVENUE TYPE DIMENSION OF arranged by the Mode of Deposit 79 in Chadangaon, on Kanad Agar Regular 105 ST CC-2 CFS 35 35 NA NA Draw of Lots NA 5 LOCATION SALES CATEGORY OF Bid Shajapur Road NO DISTRICT OF RO SITE applicant Selection (` in POTENTIAL SITE amount Within 3 Km from Chhaoni Tiraha (In Metres)* (` in Lakhs) Lakhs) 80 Agar Regular 180 Open CC 25 20 25 NA Bidding 30 5 (KL P.M)# (` in towards Ujjain Lakhs) Within 3 Km from BPC Petrol Pump 81 in Susner Near Amlanankar, Susner- Agar Regular 105 Open DC 35 35 25 45 Draw of Lots 15 5 1 2 3 4 5 6 7 8 9a 9b 10 11 12 Agar Road, Susner Regular/ MS+HSD SC CC / Frontage Depth For Estimated Draw of Lots / Tanodiya, Between Km Stone 82 Agar Regular 110 OBC DC 35 35 25 45 Draw of Lots 15 5 Rural in Kls SC CC-1 DC / eligibility fund Bidding Agar "16" to Agar "18" SC CC-2 CL / required for Within 2 Km from Mungawali Bus ST CFS development 83 Stand on Mungaoli Ashoknagar Ashoknagar Regular 105 Open DC 35 35 25 45 Draw of Lots 15 5 ST CC-1 of Road ST CC-2 infrastructure Within 3 Km from IOC Petrol OBC for RO 84 Pump in Isagarh, on Isagarh Ashoknagar Regular 110 Open DC 35 35 25 45 Draw of Lots 15 5 OBC CC-1 Chanderi Road, OH SH-10 OBC CC-2 Village- Saraskhedi, on OPEN 85 Ashoknagar Isagarh Road on Ashoknagar Regular 110 ST CFS 35 35 NA NA -

Madhya Pradesh Administrative Divisions 2011

MADHYA PRADESH ADMINISTRATIVE DIVISIONS 2011 U T KILOMETRES 40 0 40 80 120 T N Porsa ! ! ! Ater Ambah Gormi Morena ! P Bhind P A ! BHIND MORENA ! Mehgaon! A ! Ron Gohad ! Kailaras Joura Mihona Sabalgarh ! ! P ! ! Gwalior H ! Dabra Seondha ! GWALIOR ! Lahar R Beerpur Vijaypur ! ! Chinour Indergarh Bhitarwar DATIA Bhander ! T SHEOPUR Datia ! Sheopur Pohri P P P ! ! Narwar R Karahal Shivpuri A ! Karera Badoda P SHIVPURI ! S ! N!iwari D D ! ! Pichhore Orchh!a Gaurihar ! D Nowgong E ! Prithvipur Laundi Kolaras ! Chandla Jawa ! D TIKAMGARHPalera ! ! ! ! Teonthar A ! ! Jatara ! ! Maharajpur Khaniyadhana ! Sirmour Bad!arwas Mohangarh P ! Ajaigarh ! Naigarhi S ! ! Majhgawan ! REWA ! ! ! Chhatarpur Rajnagar ! Semaria ! ! Khargapur Birsinghpur Mangawan Hanumana Singoli Bamori Isagarh Chanderi ! CHHATARPUR (Raghurajnagar) ! Guna ! P Baldeogarh P Kotar (Huzur) Maugan!j Shadhora Panna P ! Raipur-Karchuliyan ! Chitrangi ! ASHOKNAGAR Tikamgarh Bijawar ! Rampur P ! J Jawad P ! ! DevendranagarNago!d !Gurh Sihawal ! ! P Baghelan ! Churhat GUNA Bada Malhera ! ! P H NEEMUCH Bhanpura Ashoknagar ! !Gunnor (Gopadbanas) ! I Raghogarh N Ghuwara D ! SATNA I ! ! A P ! Manasa ! Mungaoli PANNA Unchahara !Amarpatan Rampur Naikin Neemuch ! ! ! Amanganj SINGRAULI ! Aron ! Shahgarh Buxwaha ! Pawai SIDHI ! Kumbhraj Bina ! ! Ram!nagar !Majhauli Deosar Jiran Malhargarh Garoth Hatta ! ! Kurwai ! Shahnagar Maihar P ! ! Maksoodanga!rh Malthon Batiyagarh ! MANDSAUR ! ! ! Beohari Singrauli Mandsaur Shamgarh Jirapur ! Chachaura Lateri Sironj Khurai Raipura ! ! ! A ! P ! ! ! ! -

Nagar Palika Parishad Badamalhera District- Chhatarpur (M.P) City Base

79°16'0"E 79°16'30"E 79°17'0"E 79°17'30"E 79°18'0"E 79°18'30"E 79°19'0"E 79°19'30"E 79°20'0"E 79°20'30"E N " 0 ' 6 3 ° 4 2 Nagar Palika Parishad Badamalhera N " 0 ' 6 3 ° 4 2 District- Chhatarpur (M.P) r u p r a t a h h C o T Map Title:- City Base Map of Badamalhera District- Chhatarpur N " 0 3 ' 5 3 ° 4 2 Tahsildar Office N " # 0 3 ' MA PEETAMBARA COMPUTER 5 Parmar Filling Station 3 # ° # 4 To Nadiya 2 Legend # ImportantLandmarks # Girls Hostal Culvert Ayush Hotel Full Veg 10 # Drains NationalHighway 11 To G MajorRoad ar kh N u " w 0 ' a 5 n 3 ° 4 OtherRoad 2 N " 0 ' 5 3 ° 4 2 MunicipalBoundary # BPCL Bharat Petroleum# MunicipalWardBoundary WaterBodies # Chandan Hotel N " 0 3 ' 4 3 ° 4 2 µ N " 0 3 ' Bajaj Finance 4 3 # ° 4 12 2 S.S. TRADERS Bada Malehra# # Vidhyut Mandal 11 KV Scale 1:10,000 0 0.25 0.5 1 1.5 2 Saas Bahu Beti Shree Shoroom 9 # # Laxmi Auto Parts Badamalehra Kilometers Patan M#andir # RAHUL AUTO PARTS ohalla hia M Lo ITI College To # Ganj Road # NEW Modi Vastralay Sas Bahu Beti saree showroom Project Title State Bank #of India Drongiri Bhavan Govt Junior Girls Hostel Sagar Vale Kirana Store # # # N " 0 ' 7 4 3 ° 4 2 oad agiri R N Dron Doob dai " Om Sai Marketing Brashbhan 0 # ' Preparation of Property Tax Register based on GIS and Revenue # Malehra Bus Stop 4 3 # ° Shiv Mandir 4 # 2 Survey with Technical Handholding Support - Cluster HH22 Shobha Kirana# Store 6 Malhera Taal Raju Electronic's a # ar w hu G o 5 T AMAN JEWELLE#RS GOLD SHOP y Ganesh Auto Repairing Center w # H r a g a S - r u 4 8 p n a Agrawal Medical Agencies Bada Malhera K # 13 Maharaja Chhatrasal College of Computer Science Ba # ##Government Hospital # Post Office Sulabh Sochalaya 01 # District-Chhatarpur 3 S.B.N. -

Journal Volume 16 2020 Final

A DOUBLE BLIND PEER REVIEWED JOURNAL OF APG AND ISPER INDIA INDEXED IN SCOPUS VOLUME 16 ISSN- 0973–3485 OCTOBER 2020 PUNJAB GEOGRAPHER : ISSN- 0973–3485 Volume 16 October 2020 INFRASTRUCTURAL DEVELOPMENT IN BUNDELKHAND REGION: A MICRO-LEVEL ANALYSIS P. K. Sharma Abstract Infrastructure development is one of the driving forces to attain swift economic growth. It plays an important role in the reduction of poverty, improvements in standard of living and leads to sustained development of a region. This study is an attempt to analyse the micro- regional disparities in infrastructural development across 40 blocks of Bundelkhand region of Madhya Pradesh. The study is based on secondary sources of data, obtained from various government agencies for the year, 2011. In order to find out the level of infrastructural development, composite score method has been used by considering 12 variables at the block level. The study reveals widespread micro-regional infrastructural disparity, ranging from highest score of 1.34 for Nowgong block to lowest of -0.95 for Buxwaha block. On the basis of Principal Component Analysis, four dominant factors governing the level of infrastructural development in the region have been identified. These key factors may be addressed on priority basis to enhance the living condition of the people and to reduce micro regional disparities. Keywords: Infrastructure, Bundelkhand, Development, Disparities, Region, Facilities. Introduction condition for the overall development of a In the long path of planned region (Bagchi, 2017). The better infra- development in India, wide spread regional structure provides better living conditions and disparities are still one of the major concerns easy availability of services to the public. -

ANSWERED ON:26.04.2012 PROPOSALS from MADHYA PRADESH Tomar Shri Narendra Singh

GOVERNMENT OF INDIA RAILWAYS LOK SABHA UNSTARRED QUESTION NO:3623 ANSWERED ON:26.04.2012 PROPOSALS FROM MADHYA PRADESH Tomar Shri Narendra Singh Will the Minister of RAILWAYS be pleased to state: (a) the details of proposals for railway projects received by the Railways from Madhya Pradesh Government during the period of 2004 to 2011; (b) the details of proposals approved and the details of proposals lying pending with the Railways; and (c) the time by which a decision on the pending proposals is likely to be taken? Answer MINISTER OF STATE IN THE MINISTRY OF RAILWAYS (SHRI K.H. MUNIYAPPA) (a) to (c): A Statement is laid on the Table of the House. STATEMENT REFERRED TO IN REPLY TO PART (a) TO (c) OF UNSTARRED QUESTION NO.3623 BY SHRI NARENDRA SINGH TOMAR TO BE ANSWERED IN LOK SABHA ON 26.04.2012 REGARDING PROPOSALS FROM MADHYA PRADESH (a) to (c): As per records, details of Railway proposals received from Government of Madhya Pradesh from 2004 onwards is not available. However, on 15.11.2011 Chief Minister, Madhya Pradesh had sent a list of Railway projects in Madhya Pradesh and their status is as under:- S. No. Name of the Project Present Status 1. Gauge Conversion of On this project, Gondia-Balaghat (422 km) Jabalpur-Gondia rail line and Balaghat-Katangi (47 km) has been completed and commissioned. Contracts for earthwork and bridges in Balaghat- Nainpur-Jabalpur awarded but work is held up for want of forestry clearance. 2. New rail line from Makroniya A survey for construction of a new BG RS of Sagar to Khajuraho via line from Chhindwara-Gadarwara-Udaipur- Karrapur-Dabanga-Dalpatpur- Jaisinagar-Saugor-Banda Badamalhara Shahgarh-Heerapur-Bada Malhera Khajuraho Rail line included in Budget 2012-13. -

Action Plan for Municipal Solid Waste Management in Madhya Pradesh

l3J MADHYA PRAI)ESII POLLTJ'I'ION CONTIIOL BoARI) -462016 # PatyqworaspaMaL E:5-4!9ra lE'o lonl Uhopal \l7t (0755)246,1428. 24661 9l lrax: (0755)2'161742 E-mailiit'mppcb'rlrcdillinail'com l6aj Bhopcl. Ddlcd 17,08 /lli l8 No i II()/MSWi N4PPCI}/]OI X lo. l'hc Membcr Secrelxn'. (-cntral Pollulion Conlrol Board. Parivash Bhawan. CBD curr oltice Cornplex' llast Ariun Nagar..l)clhi Ll00l2 ol'Solid Wasle Managomcnl Rrrlo\' ]0 I ()' Subi /\nnual liepofl 1br )car 20 I 7- I 8 on Implementrlion Sir. Managcrncnt Rulcs l0l6' ,\s per the provision of thc rulc 24 (ll) ol'Solid Wastc year 2017-18 on Solid Wa\lu Mltna':ctrcnr in PI,-'0sc find cnclosed herc\\ith the Annual lleport Ibr liom (\') tbr your inlbrmation & neccssary action plcase' subrrission ol Anrlual llenons- l he d'iir 'l hc report is dcla)'cd as TJADD is nol regular in O{llccs ol'M l']'lL( prcsenlsd irr the report have bccn galhered through Regional 'll' lrncl i As abole i\h ral S((rrlx r t tl7Y Bh,'Fal. l)atcd l7 /U8 'l(rl 8 I)rdl.No. n ro/MSW/MPPClli 2018 Cop\ to :- Itousing & Dcptl- C(}vl. {l1' \1 l' t. Prir(ipcl \((r.lar\. I rhdn D(\LIrplnurll \tintraldlc. Bh,\pll lbr inll'rmallon plca'(' 1br upload thc sanrc on Wch Si{c ()1. 2. tl M.P. PollLrtion Conlrol Board llhopal M PPf] B. |nc| | r\s ahovc olc \9( Form - V lsco rulc 2,1(.3)l Annurl rcport ol Municipal Solicl Wdste i\lxnaiacmcnt oflladhla I,radcsh PART - A l'o, The Chairman Central Pollution Control Bo{rd Parivesh Bhawan, llast Arjun Nagar Dr.].HI- I100032 . -

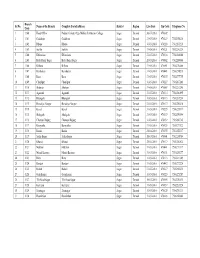

Sr No. Branch Code Name of the Branch Complete Postal Address

Branch Sr No. Name of the Branch Complete Postal Address District Region Live Date Pin Code Telephone No. Code 1 1100 Head Office Poddar Colony, Opp. Mahila Polytecnic College Sagar Damoh 30-07-2010 470002 2 1101 Gadakota Gadakota Sagar Damoh 31-05-2010 470229 7585258238 3 1102 Dhana Dhana Sagar Damoh 31-05-2010 470228 7582285218 4 1103 Surkhi Surkhi Sagar Damoh 31-05-2010 470221 7582280224 5 1104 Khimalasa Khimalasa Sagar Damoh 31-05-2010 470118 7581284348 6 1105 Bada Bazar Sagar Bada Bazar Sagar Sagar Damoh 20-03-2010 470002 7582249046 7 1106 Bilhara Bilhara Sagar Damoh 31-05-2010 470051 7584270408 8 1107 Barokalan Barokalan Sagar Damoh 31-05-2010 470441 7581274213 9 1108 Bara Bara Sagar Damoh 31-05-2010 470335 7583277755 10 1109 Chandpur Chandpur Sagar Damoh 31-05-2010 470227 7585287241 11 1110 Shahpur Shahpur Sagar Damoh 31-05-2010 470669 7582282288 12 1111 Agasaud Agasaud Sagar Damoh 31-05-2010 470114 7580280895 13 1112 Bhangarh Bhangarh Sagar Damoh 31-05-2010 470113 7580283234 14 1113 Barodiya Nongar Barodiya Nongar Sagar Damoh 31-05-2010 470117 7581290410 15 1114 Kesali Kesali Sagar Damoh 31-05-2010 470235 7586224314 16 1115 Shahgarh Shahgarh Sagar Damoh 31-05-2010 470339 7583259194 17 1116 Chanaua Bujurg Chanaua Bujurg Sagar Damoh 31-05-2010 470232 7585290725 18 1117 Barayatha Barayatha Sagar Damoh 31-05-2010 470335 7583277122 19 1118 Banda Banda Sagar Damoh 28-04-2010 470335 7583252237 20 1119 Sadar Sagar Sadar Sagar Sagar Damoh 18-03-2010 470001 7582238764 21 1120 Khurai Khurai Sagar Damoh 28-04-2010 470117 7581240824 22 1121 -

Alphabetical List of Towns and Their Population

ALPHABETICAL LIST OF TOWNS AND THEIR POPULATION MADHYA PRADESH 1. Agar (M) [ MP, Population: 31207, Class - III ] 2. Ajaygarh (NP) [ MP, Population: 13997, Class - IV ] 3. Akoda (NP) [ MP, Population: 11035, Class - IV ] 4. Akodia (NP) [ MP, Population: 10421, Class - IV ] 5. Alampur (NP) [ MP, Population: 9350, Class - V ] 6. Alirajpur (M) [ MP, Population: 25164, Class - III ] 7. Alot (NP) [ MP, Population: 21513, Class - III ] 8. Amanganj (NP) [ MP, Population: 11609, Class - IV ] 9. Amarkantak (NP) [ MP, Population: 7082, Class - V ] 10. Amarpatan (NP) [ MP, Population: 16371, Class - IV ] 11. Amarwara (NP) [ MP, Population: 12096, Class - IV ] 12. Ambada (CT) [ MP, Population: 6892, Class - V ] 13. Ambah (M) [ MP, Population: 36435, Class - III ] 14. Amla (M) [ MP, Population: 29553, Class - III ] 15. Anjad (NP) [ MP, Population: 22882, Class - III ] 16. Antari (NP) [ MP, Population: 9535, Class - V ] 17. Anuppur (NP) [ MP, Population: 16403, Class - IV ] 18. Aron (NP) [ MP, Population: 21178, Class - III ] 19. Ashoknagar (M) [ MP, Population: 57705, Class - II ] 20. Ashta UA [ MP, Population: 40628, Class - III ] 21. Babai (NP) [ MP, Population: 14591, Class - IV ] 22. Bada -Malhera (NP) [ MP, Population: 15044, Class - IV ] 23. Badagaon (NP) [ MP, Population: 7723, Class - V ] 24. Badagoan (NP) [ MP, Population: 6561, Class - V ] 25. Badarwas (NP) [ MP, Population: 10409, Class - IV ] 26. Badawada (NP) [ MP, Population: 7655, Class - V ] 27. Badi (NP) [ MP, Population: 16094, Class - IV ] 28. Badnagar UA [ MP, Population: 34088, Class - III ] List of towns: Census of India 2001 Madhya Pradesh – Page 1 of 14 MADHYA PRADESH (Continued): 29. Badnawar (NP) [ MP, Population: 17746, Class - IV ] 30. Badod (NP) [ MP, Population: 11764, Class - IV ] 31. -

Super Rishtey Lucky Draw Results Zone - I

AAIYE RISHTEY BANAYE, SWAD KE - SUPER RISHTEY LUCKY DRAW RESULTS ZONE - I MAHA BUMPER PRIZE MARUTI SWIFT LD CARS I-171 SATNA BUMPER PRIZE HERO MOTORCYCLES CD DAWN I-260 BHIND I-898 CHATARPUR I-315 LAUDHI I-241 NIWADI I-71 REWA WASHING MACHINES TOP LOAD 6KG I-462 GARHI MALHERA I-251 GWALIOR I-605 NOWGAON STEEL DINNER SET 66PCS I-85 CHAKGHAT I-478 HARPALPUR I-636 JATARA I-648 JATARA I-163 SATNA ELECTRIC RICE COOKER I-918 BHANDER I-98 CHAKGHAT I-749 CHATARPUR I-814 CHATARPUR I-255 GWALIOR I-642 JATARA I-26 KATNI I-415 KHUJRAHO I-402 KHUJRAHO I-109 MANGAWA I-654 MAUGANJ I-650 MAUGANJ 1 AAIYE RISHTEY BANAYE, SWAD KE - SUPER RISHTEY LUCKY DRAW RESULTS I-606 NOWGAON I-369 PALERA I-264 SABALGARH I-521 TIKAMGARH MICROWAVE DINNER SET 32PCS I-504 AJAYGARH I-284 AMANGANJ I-257 BHIND I-533 BIJAWAR I-91 CHAKGHAT I-93 CHAKGHAT I-103 CHAKGHAT I-89 CHAKGHAT I-738 CHATARPUR I-888 CHATARPUR I-786 CHATARPUR I-876 CHATARPUR I-709 CHATARPUR I-733 CHATARPUR I-804 CHATARPUR I-850 CHATARPUR I-762 CHATARPUR I-860 CHATARPUR I-710 CHATARPUR I-745 CHATARPUR I-728 CHATARPUR I-787 CHATARPUR I-902 CHATARPUR I-731 CHATARPUR I-705 CHATARPUR I-842 CHATARPUR I-699 CHATARPUR I-872 CHATARPUR I-793 CHATARPUR I-817 CHATARPUR I-49 CHAUKHANDI I-220 CHITRAKOOT I-206 CHITRAKOT I-227 CHITRAKOT I-229 CHITRAKOT I-456 GARHI MALHERA I-463 GARHI MALHERA I-469 HARPALPUR I-495 HARPALPUR I-488 HARPALPUR I-15 KATNI I-12 KATNI 2 AAIYE RISHTEY BANAYE, SWAD KE - SUPER RISHTEY LUCKY DRAW RESULTS I-17 KATNI I-30 KATNI I-406 KHUJRAHO I-400 KHUJRAHO I-411 KHUJRAHO I-424 KHUJRAHO I-418 KHUJRAHO -

Sq.Km.) Phuphkalan Total Population – 72 627 (In Thousand) Gormi Bhind Districts – 51 Akoda of MADHYA PRADESH Morena Mehgaon Tehsil – 367

74°10'0"E 75°11'0"E 76°12'0"E 77°13'0"E 78°14'0"E 79°15'0"E 80°16'0"E 81°17'0"E 82°18'0"E FACTS OF MADHYA PRADESH SH 2 UV UVS H URBAN LOCAL BODY MAP Ambah 2 Porsa Geographical Area – 308 (Thousand Sq.Km.) Phuphkalan Total Population – 72 627 (In Thousand) Gormi Bhind Districts – 51 Akoda OF MADHYA PRADESH Morena Mehgaon Tehsil – 367 UV S UV H S Bhind Blocks – 313 Gohad H 2 1 Jhundpura 9 ULB WISE AREA (Sq.Km) Joura Tribal Blocks – 89 Kailaras S.No. ULB Name Area(SQ.KM) S.No. ULB Name Area(SQ.KM) S.No. ULB Name Area(SQ.KM) Mihona Town (Census 2011) – 476 1 Agar 5.29 101 Dhamnod 13.10 201 Majholi 3.03 Mau 2 Ajaygarh 6.03 102 Dhamnod 14.40 202 Makdon 14.90 Sabalgarh 3 Akoda 1.28 103 Dhanpuri 20.90 203 Maksi 11.20 Gwalior Total Villages – 54903 4 Akodia 10.30 104 Dhar 24.80 204 Malanjkhand 81.20 N 23 Morena 5 Alampur 6.45 105 Dharampuri 4.26 205 Malhargarh 1.08 H Lahar S N " 6 Alirajpur 23.80 106 Dindori 10.30 206 Manasa 8.43 Nagar Nigam (July, 2015) – 16 UV " 7 Alot 3.57 107 Dongar Parasia 5.72 207 Manawar 9.57 Seondha 0 8 Amanganj 5.47 108 Gadarwara 18.50 208 Mandav 25.20 ' 9 Amarkantak 47.20 109 Gairatganj 12.70 209 Mandideep 56.80 0 Nagar Palika – 98 ' 0 10 Amarpatan 5.09 110 Ganj Basoda 6.58 210 Mandla 3.10 0 ° 11 Amarwara 11.80 111 Garhakota 3.32 211 Mandla 2.67 Vijaypur 9 12 Ambah 3.43 112 Garhi Malhera 20.00 212 Mandleshwar 1.09 1 Nagar Parishad – 272 ° H 6 Bilaua 13 Amla 4.81 113 Garoth 10.70 213 Mandsaur 34.50 Gwalior S 14 Anjad 8.17 114 Gohad 12.80 214 Mangawan 9.73 UV Daboh 6 2 15 Antari 5.49 115 Gormi 2.69 215 Manpur 4.25 Gram -

202 Annexure-IV

Annexure-IV LIST OF VILLAGES FALLING UNDER COMMAND AND NON COMMAND AREA IN SEMI CRITICAL, CRITICAL AND OVER EXPLOITED BLOCKS OF MADHYA PRADESH District No Block Category Villages under the Block Command area of Block Non Command area of Block Morena 1 Porsa Semi critical Chuneta, Amleha, Rachhed, Bijlipura, Kasmada, Higithiyai, Pancholi, Porsa, Budhara, Bhajpura, Kothar kala, Tarsama, Mehdon, Kothar Vijaygarh, Mahua, Chandrapura, Sigholi, Dhardu, khurd, Nand ka pura, Rohrenda, Shahpura, Bhatiapura, Aron, Sikhara, Prithvipura, Khochla, Jotai, Samrukhpura, Kherlipura, Reha, Kichol, Dondri, Tahera, Rajodha, Chakmadhopur, Sherpura, Khadiaporsa, Sahi, Bahodpura, Lalpura, Nagra porsa, Silawali, Pardukapura, Rapura, Ranhera, Jagatpur, Karsan, Hamirpur, Bandhkila, Kuraitha, Kudola, Bicholi, Shyampur kala, Sendrabadai, Ajheda, Pali, Halpura, Senthra badai, Shyampur kala, Torkumbh, Narlai, Ruar, Dharamgarh, Aghanpur, Ajheda. Ratanbasai, Ruar, Rijhora, Ludhawali, Usaid, Dhora, Bhadawali, Dhogat. 2 Morena Semi critical Morena, Jigni, Kheda mewda, Jevra kheda, Shikarpur, Joura, Masudpur, Jaitpur, Chambal,Piprai,Bhanpur, Rithora hurd, Gorkha, Morena gaon Mungawali, Jori, Hasai nevda, Kaithoda, Nibi, Higona ghan,Badokhar,Bhodrl, Chonda,Dompur,Jagatpur, Kishanpur, kala, Higona khurd, Jaladar, Gopalpura, Jarah, Kaithri, Bindva Nagra,Kirar,Dongarpur, Surjanpur,Rasalpur, Ajnodha,Basaiya, Chambal, Husainpur, Holipura, Bagha, Pachokhar, Sikrod, Deori, Hargawan, Kajibasai,Sirmili, Ghurdhan, Dongarpur lodha, Piparsa, Dikhatpur, Piparkheda, Hetampur, Nayakpura,