Retendering of Term Contract Outcome of Bid

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

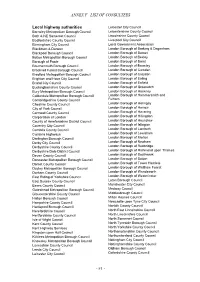

Annex F –List of Consultees

ANNEX F –LIST OF CONSULTEES Local highway authorities Leicester City Council Barnsley Metropolitan Borough Council Leicestershire County Council Bath & NE Somerset Council Lincolnshire County Council Bedfordshire County Council Liverpool City Council Birmingham City Council Local Government Association Blackburn & Darwen London Borough of Barking & Dagenham Blackpool Borough Council London Borough of Barnet Bolton Metropolitan Borough Council London Borough of Bexley Borough of Poole London Borough of Brent Bournemouth Borough Council London Borough of Bromley Bracknell Forest Borough Council London Borough of Camden Bradford Metropolitan Borough Council London Borough of Croydon Brighton and Hove City Council London Borough of Ealing Bristol City Council London Borough of Enfield Buckinghamshire County Council London Borough of Greenwich Bury Metropolitan Borough Council London Borough of Hackney Calderdale Metropolitan Borough Council London Borough of Hammersmith and Cambridgeshire County Council Fulham Cheshire County Council London Borough of Haringey City of York Council London Borough of Harrow Cornwall County Council London Borough of Havering Corporation of London London Borough of Hillingdon County of Herefordshire District Council London Borough of Hounslow Coventry City Council London Borough of Islington Cumbria County Council London Borough of Lambeth Cumbria Highways London Borough of Lewisham Darlington Borough Council London Borough of Merton Derby City Council London Borough of Newham Derbyshire County Council London -

Becoming Collaborative: Enhancing the Understanding of Intra-Organisational Relational Dynamics

BECOMING COLLABORATIVE: ENHANCING THE UNDERSTANDING OF INTRA-ORGANISATIONAL RELATIONAL DYNAMICS by Eloise Grove A Doctoral Thesis submitted in partial fulfilment of the requirements for the award of the Engineering Doctorate (EngD) degree, of Loughborough University July 2018 © by Eloise Grove (2018) Centre for Innovative and Collaborative Engineering (CICE) Department of Architecture, Civil & Building Engineering Loughborough University Loughborough Leics, LE11 3TU Acknowledgements ACKNOWLEDGMENTS I would first like to thank all the people at my Sponsoring organisation who have participated directly and indirectly in this research over the years. Not only have you provided me with the valuable material necessary but you have offered friendship that has made your place of work such an enjoyable place for me to be. Your candid contributions never cease to amaze me and for your trust I am truly grateful. Thanks to my supervisors at Loughborough University for their words of wisdom and encouragement. I’ve been connected to the School of Architecture, Building and Civil Engineering on and off since 2008. Whilst I’ve never been permanently based there I have always felt like I belong. I therefore extend this thanks to the wider team at ACBE – you make it a special place to learn. Thank you to all my industrial supervisors (there have been many) for their guidance, with special thanks to Lisa for, in her words, being the best industrial supervisor in the history of industrial supervisors. She’s kind of a big deal. For the hours upon hours of proof reading, not only throughout the years of this study but for all the homework, assignments, applications and papers that have got me to this stage in my life. -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

A Vision Shared the Movement for Innovation Second Anniversary Report

A Vision Shared The Movement for Innovation Second Anniversary Report November 2000 Board & Team Members M4I Board Alan Crane* Chairman Rab Bennetts* Bennetts Associates Ltd. Bill Bolsover Aggregate Industries UK Ltd. Mike Burt European Career Systems Clive Cain Defence Estates Organisation John Connaughton Davis Langdon Consultancy Martin Davis Drake & Scull Eng. Ltd. Deryk Eke OGC Construction Team John Emery Hammerson Plc David Fison* Skanksa Construction Colin Harding George & Harding Ltd. Shonagh Hay* Amey Plc John Hobson DETR Tony Ingle-Finch Railtrack Plc John Kerman The Highways Agency Zara Lamont Construction Best Practice Programme Peter Lobban* Construction Industry Training Board Roderick Macdonald Buro Happold Allan McDougall Shepherd Engineering Services Ltd. Robin Nicholson Edward Cullinan Architects Abena Nsia National Housing Forum Richard Ogden McDonald’s Restaurants Kate Priestley* NHS Estates Robert Shed Bovis Lend Lease Stef Stefanou* John Doyle Group Plc Martin Sykes DETR Brian Thompson Babtie Electrical and Mechanical David Trapnell Etex Group Bob White* Mace Ltd. Andrew Wolstenholme* BAA The M4I Team David Crewe* Executive Director Ian Pannell Deputy Director Adrian Blumenthal Crown House Engineering Wayne Callender Drake & Scull Eng. Ltd. Charles Gjertsen Wates Construction Ali Mafi M4I Team Member John Mead Construction Industry Council Tim Penrose Mace Ltd. Neil Rennison Taylor Woodrow Peter Runacres M4I Team Member Charles Stirling BRE Scotlab Adrian Terry CITB Tim Warren Buro Happold Jane Mitchell Administrator * Members of the Executive Management Group (EMG) Contents Chairman’s Review. 2 Demonstration Projects . 9 • Purpose . 9 • Process . 10 • Regional Clusters . 11 • Performance Measurement . 13 • Statistical Review . 15 A Structured Review of Demonstration Projects (University of Reading Interim Report) . -

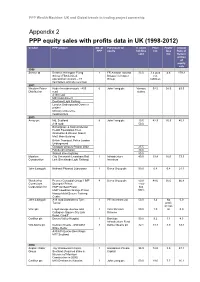

Appendix 2 PPP Equity Sales with Profits Data in UK (1998-2012)

PPP Wealth Machine: UK and Global trends in trading project ownership Appendix 2 PPP equity sales with profits data in UK (1998-2012) Vendor PPP project No. of Purchaser of % share Price Profit/ Annual PPP equity holding £m loss Rate of sold £m Return at time of equity sale 1998 Serco Ltd Defence Helicopter Flying 1 FR Aviation Ltd and 33.0 3.4 plus 4.6 179.3 School (FBS Limited, Bristow Helicopter net operational contract – 47 Group liabilities helicopters and site services) 2001 Western Power Hyder Investments plc - A55 6 John Laing plc Various 92.5 58.5 63.3 Distribution road stakes A130 road M40 road project Dockland Light Railway London Underground Connect project Ministry of Defence headquarters 2003 Amey plc M6, Scotland 8 John Laing plc 19.5 42.9 25.9 45.2 A19 road 50.0 Birmingham & Solihull Mental Health Foundation Trust (Erdington & Winson Green) MoD Main Building British Transport Police London Underground Glasgow schools-Project 2002 25.5 Edinburgh schools 30.0 Walsall street lighting 50.0 Mowlem City Greenwich Lewisham Rail 1 Infrastructure 40.0 19.4 16.0 73.3 Construction Link (Docklands Light Railway) Investors John Laing plc National Physical Laboratory 1 Serco Group plc 50.0 0.8 0.4 21.1 Wackenhut Premier Custodial Group: HMP 4 Serco Group plc 50.0 48.6 35.0 66.8 Corrections Dovegate Prison - now Corporation Inc HMP Ashfield Prison has HMP Lowdham Grange Prison 100% Hassockfield Secure Training Centre John Laing plc A19 road Dishforth to Tyne 1 PFI Investors Ltd 50.0 3.4 No 0.0 Tunnel profit or loss Vinci plc Lloyd George -

DCFL Insights

DCFL Insights UK Facilities Management transactions by subsector UK Facilities Management transactions Facilities management 2011-2013by subsector 2011-2013 by quarter by quarter sector in UK 100% 90% Facilities management is a multi-faceted profession, 80% 70% which has been created out of a need to provide 60% professionally managed and critical support services. 50% 40% Overview 30% Facilities Management (FM) includes a broad spectrum of services, 20% from ‘hard’ (such as building maintenance) services, to many 10% 0% ‘soft’ (such as security and cleaning) services that are contracted 2011 2011 2011 2011 2012 2012 2012 2012 2013 out to third party companies. Examples of facilities management Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 include Catering, Technical, Security, Cleaning as broader heads. Other Hard FM Maintenance/Fit-out Hygiene It includes services like building maintenance & services, guarding, office cleaning, waste cleaning, reception, security, mechanical and Utilities Other Soft FM Cleaning engineering, storage and landscaping. M&E Security Catering Source: Zephyr The market for UK facilities management sector has grown to Deals £106.3 billion in 2012 and is forecasted to reach £117.2 billion by In 2011 Linbrook Services Limited (a leading provider of 2017. That is a 9% increase in FM services contracted out and 17% responsive repairs and maintenance services to the affordable growth in take-up of total FM (TFM) services. housing sector) were acquired by Wates Group Limited.Source: Market Zephyr consolidation has seen many large FM groups bolster market M&A in 2013 positions, such as Carillion plc’s acquisitions of Mowlem and EAGA The flow of mergers and acquisitions in the UK’s FM sector remains and Compass Group’s acquisitions of VSG and ICM. -

Highways England Design Review Panel Motorway at Night © Krzych-34

Highways England Design Review Panel Motorway at night © krzych-34 Design Council Cabe | January 2018 Highways England Design Review Panel The Highways England Design Review Panel are a group of 36 Built Environment Experts, including a Chair and two Vice-Chairs, appointed by Design Council to meet the specific range of disciplines and skills required by Highways England in providing an independent, expert Design Review service. Design Review meeting © Haarala Hamilton Highways England Design Review Panel | January 2018 2 John Lyall John is one of our most experienced Chairs. Recently John has chaired a series of reviews and He has a background as an architect and has workshops for the Lake Lothing Third Crossing designed a range of infrastructure buildings and Bridge in Suffolk and the review of the A14 installations such as the Crossness Sludge Cake Highways England road scheme. Both of these Building and the Old Ford Water Treatment schemes have benefited from John’s ability to Plant. In his Cabe chairing role he has delivered set the tone for the day as a positive engaging multiple reviews as co-chair of the Thames experience for the design teams and other Tideway review panel. The panel has been stakeholders. A critical part of a successful review looking at the key locations along the Thames is for John as Chair of the panel to encourage the and away from the river where this grand design team to share their design thinking and be engineering project comes to the surface. It will able to discuss challenging issues in a supportive create new public spaces or provide new built environment. -

Annual Report and Accounts 2006

ANNUAL REPORT AND ACCOUNTS 2006 MAKING TOMORROW A BETTER PLACE Report Section 01 Our Mission, Vision, Values and Strategy Section 02 A Year of Good Progress 02 Financial Highlights 03 Chairman’s Statement Section 03 What We Do 04 At a glance Section 04 Operating and Financial Review 06 Chief Executive’s Review 10 Markets and Outlook Defence/Education/Health Facilities Management and Services/Building Roads and Civil Engineering/Rail Middle East/Canada and the Caribbean 18 Financial Review 22 Corporate Social Responsibility Section 05 A Strong Team 24 Board of Directors Section 06 Accountability 26 Corporate Governance Report 31 Remuneration Report 39 Report of the Directors 42 Statement of Directors’ Responsibilities in Respect of the Annual Report and Financial Statements 43 Independent Auditors’ Report to the Members of Carillion plc Section 07 Financial Statements 44 Consolidated Income Statement 45 Consolidated Statement of Recognised Income and Expense 46 Consolidated Balance Sheet 47 Consolidated Statement of Cash Flows 48 Notes to the Consolidated Financial Statements 82 Company Balance Sheet 83 Notes to the Company Our mission Financial Statements Making tomorrow a better place. Section 08 Further Information Our vision 89 Five Year Review To be the leader in delivering integrated 91 Principal Subsidiary Undertakings, Jointly Controlled Entities and solutions for infrastructure, buildings Jointly Controlled Operations and services. 92 Shareholder Information IBC Advisers For the latest information, including Investor Relations and Sustainability, visit our website any time. www.carillionplc.com Cover – Restoration art The Ikon Gallery, Birmingham is now housed in a former neo-gothic school restored by Carillion to its former architec- tural glory. -

Supply Chains: Building Ecosystems for Local Growth

THE BUSINESS SERVICES ASSOCIATION Supply chains: Building ecosystems for local growth May 2016 ABOUT THE BSA The BSA is a policy and research organisation. It brings together all those who are interested in delivering efficient, flexible and cost‑effective service and infrastructure projects across the private and public sectors. Research conducted by Oxford Economics, commissioned by the BSA, shows that outsourced service providers make a huge contribution to jobs and prosperity in every part of Britain. The sector accounts for 9.3 per cent of gross value added to the economy and provides 3.3 million jobs, equivalent to over 10 per cent of all UK workforce jobs. The Business Services Association 2nd Floor 130 Fleet Street London EC4A 2BH 020 7822 7420 www.bsa-org.com The Business Services Association Limited is registered in England No. 2834529 Registered office as above. CONTENTS Foreword 2 Summary of recommendations 3 Behind the UK’s drive for devolution 4 Putting SMEs at the heart of local growth 4 Building sustainable local networks 6 Supply chain best practice 10 Supporting SMEs through partnership models 13 Sharing resources and expertise with supply chain partners 14 Overcoming barriers to participation 17 The role of government in supporting SME participation 18 Appendix – List of BSA members 20 2 FOREWORD Mark Fox BSA Chief Executive May 2016 BSA members are major providers of business services across the private and public sector. Their supply chains include over a quarter of a million SMEs and span the length and breadth of the UK. Working with supply chain partners in a responsible, inclusive and collaborative way is vital. -

Preliminary Regeneration and Development Impact Assessment

SILVERTOWN TUNNEL SUPPORTING TECHNICAL DOCUMENTATION PRELIMINARY REGENERATION AND DEVELOPMENT IMPACT ASSESSMENT October 2015 This report sets out how the Scheme would impact on economic activity at a local, sub-regional, and London level. It draws on a number of strands of evidence and analysis to assess the likely economic and regeneration impacts that could result from the Scheme. This report forms part of the Preliminary Outline Business Case (OBC). This report forms part of a suite of documents that support the statutory public consultation for Silvertown Tunnel in October – November 2015. This document should be read in conjunction with other documents in the suite that provide evidential inputs and/or rely on outputs or findings. The suite of documents with brief descriptions is listed below:- Preliminary Case for the Scheme o Preliminary Monitoring and Mitigation Strategy Preliminary Charging Report Preliminary Transport Assessment Preliminary Design and Access Statement Preliminary Engineering Report Preliminary Maps, Plans and Drawings Preliminary Environmental Information Report (PEIR) o Preliminary Non Technical Summary o Preliminary Code of Construction Practice o Preliminary Site Waste Management Plan o Preliminary Energy Statement Preliminary Sustainability Statement Preliminary Equality Impact Assessment Preliminary Health Impact Assessment Preliminary Outline Business Case o Preliminary Distributional Impacts Appraisal o Preliminary Social Impacts Appraisal o Preliminary Economic Assessment Report o Preliminary -

Report on Highways Budgets to Resources and Governance

Manchester City Council Item 8 Resources and Governance Overview and Scrutiny Committee 18 November 2010 Manchester City Council Report for Resolution Report To: Resources and Governance Overview and Scrutiny Committee – 18 November 2010 Subject: 2010/11 Highway Services Budget Breakdown and Overview Report of: Head of Highway Services, Pele Bhamber Summary This report aims to provide RAGOS with a clear breakdown on the 2010/11 Highways budgets, including: • List of available funding sources making up capital and revenue budgets; • For each budget heading, information on what it is used for and constraints on spending; • For both revenue and capital budgets, provision of staff costs; • Information on contracts in place delivering the highways services. Recommendations To note the information given regarding this year’s Highways Services budget breakdown and overview. Wards Affected: All Contact Officers: Name: Ella Davies Position: Highway Client Service Manager Telephone: 0161 600 7733 E-mail: [email protected] Name/position: Maria Gil - Strategy and Performance Manager Name/position: Nadeem Mohammed - Programme and Contracts Manager Telephones: 0161 600 7759/7771 E-mail: [email protected] or [email protected] Background documents (available for public inspection): The Local Transport Plan 2 (LTP2) and the South East Manchester Multi Modal Study (SEMMMS) which set out the strategic objectives for the capital programme and are available for information. 49 Manchester City Council Item 8 Resources and Governance Overview and Scrutiny Committee 18 November 2010 Background document 1. 2010/11 Highway services capital budget with information on what it is used for / constraints and contractors used. -

Annex A: Organisations Consulted

Annex A: Organisations consulted This section lists the organisations who have been directly invited to respond to this consultation: Administrative Justice and Tribunals Service Advanced Transport Systems AEA Technology Plc Aggregate Industries Alcan Primary Metal Europe Alcan Smelting & Power UK Alstom Transport Ltd Amey Plc Angel Trains Arriva Trains Wales ASLEF Association of Chief Police Officers in Scotland Association of Community Rail Partnerships Association of London Government Association of Railway Industry Occupational Physicians Association of Train Operating Companies Atkins Rail Avon Valley Rail Axiom Rail BAA Rail Babcock Rail Bala Lake Railways Balfour Beatty plc Bluebell Railway PLC Bombardier Transportation BP Oil UK Ltd Brett Aggregates Ltd British Chambers of Commerce British Gypsum British International Freight Association British Nuclear Fuels Ltd British Nuclear Group Sellafield Ltd British Ports Association British Transport Police BUPA Buxton Lime Industries Ltd c2c Rail Ltd Cabinet Office Campaign for Better Transport Carillion Rail Cawoods of Northern Ireland Cemex UK Cement Ltd Channel Tunnel Safety Authority Chartered Institute of Logistics & Transport Chiltern Railways Company Ltd City of Edinburgh Council Civil Aviation Authority Colas Rail Ltd Commission for Integrated Transport Confederation of British Industry Confederation of Passenger Transport UK Consumer Focus Convention of Scottish Local Authorities Correl Rail Ltd Corus Construction & Industrial CrossCountry Crossrail Croydon Tramlink Dartmoor