Shopping Centres

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

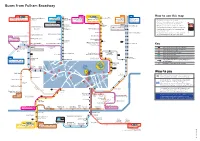

Buses from Fulham Broadway

Buses from Fulham Broadway 295 28 414 14 11 N11 Green Park towards Ladbroke Grove Sainsbury’s Shepherd’s Bush towards Kensal Rise Notting towards Maida Hill towards towards towards for Westeld from stops A, F, H Hill Gate Chippenham Road/ Russell Square Liverpool Street Liverpool Street from stops C, D, F, H Shirland Road Appold Street Appold Street from stops E, L, U, V N28 from stops E, L, U, V from stop R from stops B, E, J, R towards Camden Town Kensington Park Lane 211 Hyde Park Victoria SHEPHERD’S from stops A, F, H Church Street Corner towards High Street Waterloo BUSH Kensington Knightsbridge from stops B, E, J, L, U, V Harrods Buses from295 Fulham Broadway Victoria Coach Station Shepherd’s Bush Road KENSINGTON Brompton Road 306 HAMMERSMITH towards Acton Vale Hammersmith Library 28 N28 Victoria & Albert from stops A, F, H Museum Hammersmith Kensington 14 414 High Street 11 211 N11 295 Kings Mall 28 414 14 South Kensington 11 N11 Kensington Olympia Green Park Sloane Square towards Ladbroke GroveShopping Sainsbury’s Centre HammersmithShepherd’s Bush towards Kensal Rise Notting towards Maida Hill for Natural Historytowards and towards towards Busfor West Stationeld 306 from stops A, F, H Hill Gate Chippenham Road/ ScienceRussell Museums Square Liverpool Street Liverpool Street from stops C, D, F, H Shirland Road Appold Street Appold Street Hammersmith from stops E, L, U, V Hammersmith 211 Road N28 from stops E, L, U, V from stop R from stops B, E, J, R Town Hall from stops C, D, F, M, W towards Camden Town Park Lane 306 Kensington -

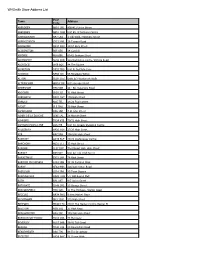

Venue Id Venue Name Address 1 City Postcode Venue Type

Venue_id Venue_name Address_1 City Postcode Venue_type 2012292 Plough 1 Lewis Street Aberaman CF44 6PY Retail - Pub 2011877 Conway Inn 52 Cardiff Street Aberdare CF44 7DG Retail - Pub 2006783 McDonald's - 902 Aberdare Gadlys Link Road ABERDARE CF44 7NT Retail - Fast Food 2009437 Rhoswenallt Inn Werfa Aberdare CF44 0YP Retail - Pub 2011896 Wetherspoons 6 High Street Aberdare CF44 7AA Retail - Pub 2009691 Archibald Simpson 5 Castle Street Aberdeen AB11 5BQ Retail - Pub 2003453 BAA - Aberdeen Aberdeen Airport Aberdeen AB21 7DU Transport - Small Airport 2009128 Britannia Hotel Malcolm Road Aberdeen AB21 9LN Retail - Pub 2014519 First Scot Rail - Aberdeen Guild St Aberdeen AB11 6LX Transport - Local rail station 2009345 Grays Inn Greenfern Road Aberdeen AB16 5PY Retail - Pub 2011456 Liquid Bridge Place Aberdeen AB11 6HZ Retail - Pub 2012139 Lloyds No.1 (Justice Mill) Justice Mill Aberdeen AB11 6DA Retail - Pub 2007205 McDonald's - 1341 Asda Aberdeen Garthdee Road Aberdeen AB10 7BA Retail - Fast Food 2006333 McDonald's - 398 Aberdeen 1 117 Union Street ABERDEEN AB11 6BH Retail - Fast Food 2006524 McDonald's - 618 Bucksburn Inverurie Road ABERDEEN AB21 9LZ Retail - Fast Food 2006561 McDonald's - 663 Bridge Of Don Broadfold Road ABERDEEN AB23 8EE Retail - Fast Food 2010111 Menzies Farburn Terrace Aberdeen AB21 7DW Retail - Pub 2007684 Triplekirks Schoolhill Aberdeen AB12 4RR Retail - Pub 2002538 Swallow Thainstone House Hotel Inverurie Aberdeenshire AB51 5NT Hotels - 4/5 Star Hotel with full coverage 2002546 Swallow Waterside Hotel Fraserburgh -

High Streets & Town Centres: Adaptive Strategies Guidance

HIGH STREETS & TOWN CENTRES ADAPTIVE STRATEGIES GOOD GROWTH BY DESIGN A BUILT ENVIRONMENT FOR ALL LONDONERS A BUILT ENVIRONMENT FOR ALL LONDONERS CONTENTS Mayor's Foreword 7 Introduction 9 About this guidance 1. Investing in high streets 15 The value in London's high streets Cross-cutting areas for intervention A case for investment 2. Adapting to the challenges 29 High street challenges 3. Learning from London's high streets 79 Harlesden, LB Brent – The high street experience 85 West End, LB Westminster – Retail retrofit 95 Old Kent Road, LB Southwark – Intense mixed uses 111 Church Street, LB Westminster – Retaining community value 123 Dalston High Street, LB Hackney – Data insights 137 Tottenham High Road, LB Haringey – Social value 151 Stratford High Street, LB Newham – High road to high street 167 Sutton High Street, LB Sutton – Place of work 181 Walthamstow, LB Waltham Forest – Civic and cultural institution 193 South Norwood, LB Croydon – Sustainable community network 203 4. Developing adaptive strategies 217 Adaptive strategies The mission Principles and practices Structure of an adaptive high street strategy Appendices – published online at london.gov.uk Appendix 1: Evaluation and monitoring Appendix 2: Relevant data sources Appendix 3: Relevant literature MAYOR'S FOREWORD London’s high streets and town centres have shaped the fabric of our great city. They are a focal point for our culture, communities and everyday economies. They support the most sustainable models of living and working, including active travel and shorter commutes. And they are where new ideas, new ways of living, new businesses and new experiences are made. Our high streets and town centres face many challenges, but our research shows how much Londoners value them as places to meet, socialise, access services, shop, work and live. -

Property Investor Profiles

ACC Property Investor Profiles Accrue Capital Ltd Addington Capital 11 Hill Street, London W1J 5LG 6 Heddon Street, London W1B 4BT Tel: 020 7318 4700 Fax: 020 7409 0052 Tel: 020 7042 9250 Email: [email protected] Email: [email protected] Web: www.accruecap.com Web: www.addingtoncapital.com Contacts Contacts Stephen Webster (Chairman) Martin Roberts (Managing Director) Brian Quinn (Structured Finance) Matthew Allen (Director) Comment Alex Wagstaff (Retail Asset Management) 10/14 - Accrue Capital acquired a retail portfolio for £22.2m, at a Comment yield of 8.71%. The acquired portfolio comprises 10 fully-let assets, Martin Roberts, formerly of CIT, formed Addington in April 2010. the majority of which are retail properties — including a retail park, a neighbourhood shopping centre, a hotel, high street retail and 10/12 - Addington Capital purchased a 563 asset residential offices. portfolio from Lloyds Banking Group and Grainger for £39.1m. The The unexpired lease term is over eight years, with more than 72% properties are mainly converted houses that are privately let to of the income secured on leases in excess of five years. students across UK cities such as Edinburgh, Newcastle, Bristol, Assets include: part of Hough Retail Park, Stafford; Kingsway Manchester and Nottingham. Retail Park, Lancaster; the Fylde Road site in Southport; and Pelham Street, Nottingham. 07/14 - Addington Capital was appointed asset management partner by Tristan Capital Partners for the Tree Portfolio. The Ace Liberty & Stone Plc Portfolio was acquired -

Newriver REIT Plc Annual Report and Accounts 2018

& Annual Report 2018 Accounts and NewRiver REIT plc Annual Report and Accounts 2018 NewRiver REIT plc (‘NewRiver’) is a Premium Listed REIT on the Main Market of the London Stock Exchange and a constituent of the FTSE 250 and EPRA indices. Founded in 2009, we specialise in buying, managing, developing and recycling convenience-led, community-focused retail and leisure assets. Our high-quality and conveniently located portfolio provides value for money on essential goods and services to consumers across the UK, and our affordable rents and high footfall locations create desirable and profitable trading opportunities for our occupiers. It is our fundamental belief that affordability for occupiers, and not lease length, means sustainability for our business. With an experienced management team and proven business model, we have a track record of delivering growing and sustainable cash returns to our shareholders and creating thriving communities across the UK. CONTENTS Strategic Report Financial Highlights IFC Our Business at a Glance 04 Chairman’s Review 08 Our Business Model 10 Our Marketplace 12 Leveraging our Key Relationships 16 CEO Review 18 OUR FINANCIAL HIGHLIGHTS Our Strategy 24 Our KPIs 26 Property Review 32 Gross income Funds From Operations Financial Review 56 (proportionally consolidated) Our People 68 ESG Report 69 Risk Management Report 74 £107.0m £60.3m Governance FY17: £106.7m FY17: £58.2m Board of Directors 78 Corporate Governance Report 80 Audit Committee Report 85 FFO per share Ordinary dividend per share Nomination Committee -

Retail Investment 2020

Q3 2020 Retail Investment knightfrank.com/research 2020 The dust begins to settle? RETAIL INVESTMENT REPORT RETAIL INVESTMENT REPORT WHAT YOU NEED Key Transactions - 2020 TO KNOW… Property Sector Purchaser Vendor Price NIY Broadwalk, Edgware Shopping Centre Ballymore Aberdeen Standard Investments* £71m 4.90% Project Rock Portfolio Shopping Centre MDSR Aviva Finance £80m 10.50% Clifton Down, Bristol Shopping Centre Sovereign Housing Association Blackrock* £27m 7.40% Retail Warehousing Shopping Centres High Street Waitrose Portfolio Foodstore London Metric Waitrose £62m 4.30% Countercyclical strategy to Significant capital and rental value Reasonable liquidity in smaller Waitrose Portfolio Foodstore Supermarket Income REIT Waitrose £74m 4.40% attract investors correction underway lot sizes Sainsbury's Portfolio Foodstore Supermarket Income REIT British Land £102m - Demand in the South East/London All schemes rebasing to potentially Demand returning for historic prime/ RDI Portfolio Retail Warehouse M7 RDI £157m 7.50% more resilient attractive new levels rent-paying tenants Acquisitions underwritten by Relevant schemes – prime New level of pricing accounting for Tritax Portfolio Retail Warehouse Tritax Aberdeen Standard Investments £290m 7.25% high income return or alternative experiential and local convenience – overrent Pentavia Retail Park, London Retail Warehouse Amazon Meadow Partners £65m - use values will stabilise first New use class “E” to improve 1-8 The Broadway, Ealing High Street Investra Capital PGIM £34m 5.00% Foodstore demand red hot Repositioning opportunity increasing flexibility Union Gate, Bristol High Street AEW Hunter REIM* £10m 7.30% as values tumble *Advised by Knight Frank THE YEAR SO FAR… Key Transactions - 2020 At the start of 2020 we were starting processes. -

TOWN DESCRIPTION RETAILER NAME HOUSE NOSTREET DISTRICT POSTCODE ABERDEEN W H Smith Ltd WHS ABERDEEN ST NICHOLAS ST

TOWN DESCRIPTION RETAILER NAME HOUSE NOSTREET DISTRICT POSTCODE ABERDEEN W H Smith Ltd WHS ABERDEEN ST NICHOLAS ST. NICHOLAS CENTRE AB10 1HW ACCRINGTON W H Smith Ltd WHS ACCRINGTON UNIT 14 CORNHILL BB5 1EX ARBROATH W H Smith Ltd WHS ARBROATH 196 HIGH STREET DD11 1HY BARNSLEY W H Smith Ltd WHS BARNSLEY 11-13 CHEAPSIDE TOWN END S70 1RQ BATLEY W H Smith Ltd WHS BIRSTALL ***** HOLDEN ING WAY BIRSTALL WF17 9AE BEDFORDSHIRE W H Smith Ltd WHSR BEDFORD 1414 HARPUR CENTRE BEDFORD MK40 1TG BERKSHIRE W H Smith Ltd WHSR MAIDENHEAD 4778 51 NICHOLSON WALK MAIDENHEAD SL6 1LL BERKSHIRE W H Smith Ltd WHSR NEWBURY 5192 87-89 NORTHBROOK STREET NEWBURY RG14 1AE BERKSHIRE W H Smith Ltd WHSR READING 5842 39 BROAD STREET READING RG1 2AD BERKSHIRE W H Smith Ltd WHSR SLOUGH 6430 HIGH STREET SLOUGH SL1 1JN BERWICK-UPON-TWEED W H Smith Ltd WHS BERWICK 60-75 MARYGATE TD15 1BA BEVERLEY W H Smith Ltd WHS BEVERLEY 39-41 TOLL GAVEL HU17 9AA BIRMINGHAM W H Smith Ltd WHSR BIRMINGHAM HIGH ST 1 29 UNION ST B2 4LR BIRMINGHAM W H Smith Ltd WHSR THE FORT PARKWAY 328 FORT SHOPPING PARK FORT PARKWAY B24 9FP BLACKPOOL W H Smith Ltd WHS RETAIL CLEVELEYS 31 VICTORIA ROAD CLEVELEYS FY5 1AG BOURNEMOUTH W H Smith Ltd WHSR BOURNEMOUTH 1708 9-13 Old Christchurch Road The Square BH1 1DY BOURNEMOUTH W H Smith Ltd WHSR BOURNEMOUTH CASTLE P Unit P East Mall East Mall Castlepoint Castle Lane West BH8 9UZ BRACKNELL W H Smith Ltd WHSR BRACKNELL 1724 SERVICE YARD E 10 PRINCESS SQUARE RG12 1XW BRADFORD W H Smith Ltd WHS BRADFORD 10-11 DARLEY MALL KIRKGATE CENTRE BD1 1QP BRENTWOOD W H Smith Ltd WHS BRENTWOOD BAYTREE CENTRE X CM14 4RW BRIDGEWATER W H Smith Ltd WHSR BRIDGWATER 1810 14-15 Cornhill TA6 3BU BRIDPORT W H Smith Ltd WHSR BRIDPORT 1818 12 East Street DT6 3LF BRIERLEY HILL W H Smith Ltd WHSR MERRY HILL 5018 STORE D MERRYHILL CENTRE DY5 1SL BRIGHTON W H Smith Ltd WHSR BRIGHTON 1836 37-37A LONDON ROAD BN1 4JB BRIGHTON W H Smith Ltd WHSR BRIGHTON 1840 . -

Whsmith Store Address List

WHSmith Store Address List Post Town Address Code ABERDEEN AB10 1PD 408/412 Union Street ABERDEEN AB10 1HW Unit E5, St Nicholas Centre ABERGAVENNY NP7 5AG 1 Cibi Walk, Frogmore Street ABERYSTWYTH SY23 2AB 36 Terrace Road ABINGDON OX14 3QX 13/14 Bury Street ACCRINGTON BB5 1EX 14 Cornhill AIRDRIE ML6 6BU 60-62 Graham Street ALDERSHOT GU11 1DB 12a Wellington centre, Victoria Road ALDRIDGE WS9 8QS 44 The Square ALFRETON DE55 7BQ Unit B, Institute Lane ALNWICK NE66 1JD 56 Bondgate Within ALTON GU34 1HZ Units 6/7 Westbrook Walk ALTRINCHAM WA14 1SF 8/12 George Street AMERSHAM HP6 5DR 48 - 50, Sycamore Road ANDOVER SP10 1LJ 31 High Street ARBROATH DD11 1HY 196 High Street ARNOLD NG5 7EL 24/26 Front Street ASCOT SL5 7HG 39 High Street ASHBOURNE DE6 1GH 4 St John Street ASHBY DE LA ZOUCHE LE65 1AL 28 Market Street ASHFORD TN24 8TB 70/72 High Street ASHTON-UNDER-LYNE OL6 7JE Unit 30, Arcade Shopping Centre AYLESBURY HP20 1SH 27/29 High Street AYR KA7 1RH 198/200 High Street BANBURY OX16 5UE 23/24 Castle Quay Centre BANCHORY AB31 5TJ 33 High Street BANGOR LL57 1NY The Market Hall, High Street BARNET EN5 5XY Unit 22 111 High Street BARNSTAPLE EX31 1HP 76 High Street BARROW-IN-FURNESS LA14 1DB 38-42 Portland Walk BARRY CF63 4HH 126/128 Holton Road BASILDON SS14 1BA 29 Town Square BASINGSTOKE RG21 7AW 5/7 Old Basing Mall BATH BA1 1RT 6/7 Union Street BATHGATE EH48 1PG 23 George Street BEACONSFIELD HP9 1QD 11 The Highway, Station Road BECCLES NR34 9HQ 9 New Market Place BECKENHAM BR3 1EW 172 High Street BEDFORD MK40 1TG 29/31 The Harpur Centre, Harpur -

Latest Brochure

THE AIRCRAFT FACTORY 100 CAMBRIDGE GROVE, HAMMERSMITH W6 0LE OFFICES TO LET IN A CAMPUS ENVIRONMENT FURNISHED AND WORK READY OPTIONS THE AIRCRAFT FACTORY 100 CAMBRIDGE GROVE, HAMMERSMITH W6 0LE CAMPUS OFFICES TO LET F R O M 500 sq ft – 73,000 sq ft The site of the Alliance Aeroplane Company, — Comprehensive refurbishment in 2016 The Aircraft Factory is a converted factory — Character, warehouse offices structure with full ceiling heights in a campus — High ceilings office environment with on-site coffee bar and — VRV Air-Conditioning gardens. The Aircraft Factory is comprised of — Fresh air ventilation three inter-connecting blocks up to five storeys in — WiFi across all common areas height on a site totalling approximately 1.30 acres — Pendant energy efficient lighting (0.52 hectares). — Wood or metal deck raised flooring — Excellent natural light — Quiet, green, environment just five minutes walk from the stations of Hammersmith — Communal inside and outside seating for informal meetings — On site coffee bar — Immediate phone/data connectivity to all offices with 1 GB high speed internet — Cycling bays and showers — Electric car points — Car parking available on separate licence — All occupiers have access to communal gardens THE AIRCRAFT FACTORY The landlords offer a fit out package as part of their Capsule transaction model THE AIRCRAFT FACTORY www.theaircraftfactory.com The Aircraft Factory, 100 Cambridge Grove, Hammersmith W6 0LE 01 THE BUILDING PAST During 1918 Samuel Waring, the owner of the furniture manufacturer Waring & Gillow and the Nieuport & General Aircraft Company, formed the Alliance Aeroplane Company. The factory was located at Cambridge Grove, Hammersmith and they built several hundred biplanes and triplanes for the de Havilland and Handley-Page aircraft companies. -

020 7924 4476 | [email protected] | Www

COMMERCIAL AGENTS LONDON COMMERCIAL PROPERTY SALES/LETTINGS CONSULTANCY VALUATIONS PLANNING Wandsworth office Wimbledon office Houston Lawrence Our clients Armila Capital Cube Real Estate Real Estate Investment Management Art Estates Delancey Real Estate Reef Estates Auster Ltd DTZ Investors Rocco Homes Avenue Investments Ltd Fraser Developments Ltd Safestore Ltd Axa Real Estate Galliard Homes Schroder Real Estate Battersea Power Station Development Grainger Plc Shanly Homes Ltd Baylight Properties Ltd Helical Bar Plc St James Group Ltd Berkeley Group Henley Homes Taylor Wimpey South Thames Burleigh Estates Hermes Real Estate TH Real Estate Capital Industrial IPSUS Ltd TR Property Investment Trust Capsticks Knight Frank Investment Management Travelodge CBRE Global Investors London & Argyll Group Urb Group Chancerygate Marchmont Investment Management Verve Properties Cherwell Group Marston Properties Westbrook Partners City & Provincial Plc Motcomb Estates Limited Woodcock Holdings Columbia Threadneedle Investments Osiers Commercial Ltd Workspace Group Houston Lawrence About us Formed in , Houston Lawrence is a fi rm of chartered surveyors specialising in South West London area. Operating from our Wandsworth and our new Wimbledon offi ce, we off er both commercial property for sale and to let. Since its inception, Houston Lawrence has been instructed to sell/let a large number of offi ce, retail and industrial schemes on behalf of UK funds and private property companies. Houston Lawrence Commercial instructions Battersea Studios Kennington Park Business Centre – Garratt Lane Silverthorne Road, SW London SW Tooting, SW Client: Schroder Real Estate Client: Workspace Group Client: Rateneed Ltd Instruction: Instructed to let , sq . of studio Instruction: Instructed to let refurbished o ce studios Instruction: Instructed to market ground and lower ground space within high quality designed space con gured over comprising , sq . -

Town Store Name Address Post Code Town Store Name Address Post Code

TOWN STORE NAME ADDRESS POST CODE TOWN STORE NAME ADDRESS POST CODE ABERDEEN ST NICHOLAS ABERDEEN UNIT E5 AB1 1HW MAIDENHEAD MAIDENHEAD 51 NICHOLSON'S WALK SL6 1LL AYLESBURY AYLESBURY 27/29 HIGH STREET HP20 1SH MAIDSTONE MAIDSTONE 38/42 WEEK STREET ME14 1RP BEXLEYHEATH BEXLEYHEATH 89 THE BROADWAY DA6 7JN MANCHESTER ARNDALE MANCHESTER ARNDALE CENTER M4 3AD BIRMINGHAM BIRMINGHAM 29 UNION STREET B2 4LR MANSFIELD MANSFIELD FOUR SEASONS SHOPPING CENTRE NG18 1SN BIRMINGHAM FORT RETAIL PARK UNIT 1,THE FORT SHOPPING PARK B24 9FP MILTON KEYNES MILTON KEYNES 126 MIDSUMMER ARCADE MK9 3BA BRADFORD BRADFORD KIRKGATE 10/11 DARLEY MALL BD1 1TG NEWBURY NEWBURY 87/89 NORTHBROOK STREET RG14 1AE BRIGHTON BRIGHTON 69 CHURCHILL SQUARE BN1 2ET NEWCASTLE UPON TYNE NEWCASTLE 36 NORTHUMBERLAND STREET NE1 7DE BRISTOL BRISTOL GALLERIES THE GALLERIES BS1 3XB NEWPORT NEWPORT GWENT 166/167 COMMERCIAL STREET NP20 1QY CAMBRIDGE CAMBRIDGE 14/15 MARKET STREET CB2 3PE NEWPORT NEWPORT I OF W 55/56 HIGH STREET PO30 1SB CARDIFF CARDIFF 83/85 QUEEN STREET CF10 2NX NORTHAMPTON NORTHAMPTON 14 NEWLAND WALK NN1 2EW CHELTENHAM CHELTENHAM HIGH 192/194 HIGH STREET GL50 1EP NOTTINGHAM NOTTINGHAM VICTORIA 124/126 VICTORIA CENTRE NG1 3QD CHESTERFIELD CHESTERFIELD 4 MIDDLE PAVEMENT S40 1PA ORPINGTON HIGH ST ORPINGTON 189/193 HIGH STREET BR6 0PF CHESTER CHESTER 5/7 FOREGATE STREET CH1 1HH OXFORD OXFORD 22 CORNMARKET STREET OX1 3HE COLCHESTER COLCHESTER 19 CULVER WALK CO1 1LX PERTH PERTH 91-97 HIGH STREET PH1 5TJ CROYDON CROYDON 34 NORTH END CR0 1UB PETERBOROUGH PETERBOROUGH 32/36 BRIDGE -

The Uk's Most Active Agents 2019

DTheeals Competition 2019 THE UK’S MOST ACTIVE AGENTS 2019 CBRE has made it four years in a row as the UK’s most active agent, establishing itself as the country’s pre-eminent dealmaker in what has been a turbulent period for the industry. The latest fi gures from Radius Data Exchange, which are based purely on deals numbers, offer an extensive breakdown of where the industry stands at national and regional levels as well as on a sector-by-sector basis. Interestingly, the only use type CBRE fi nished top in is retail where, despite all the high profi le occupier casualties, transaction volumes for the top fi ve agents remain higher than for their counterparts in the buoyant industrial sector, suggesting reports of retail’s collapse are somewhat exaggerated. Indeed, many of the regional winners got there largely by their focus on retail. But nationwide it is in offi ces where volumes are highest and this sector is topped by JLL, helping it to maintain its second place overall. Cushman & Wakefi eld remains in third while Knight Frank is a new entrant into the top fi ve after outperforming everyone in investments and fi nishing strongly in offi ces. In leisure and hotels, Fleurets has made it three wins in a row. Perhaps the biggest surprise can be found north of the border, where Shepherd Commercial has knocked Ryden from the overall top spot for the fi rst time in almost two decades. In Wales, meanwhile, Jenkins Best now rules the roost after edging past Lambert Smith Hampton in terms of overall transactions.