Chapter 1: Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kamarooka Mallee Version Has Been Prepared for Web Publication

#27 This Action Statement was first published in 1992 and remains current. This Kamarooka Mallee version has been prepared for web publication. It retains the original text of Eucalyptus froggattii the action statement, although contact information, the distribution map and the illustration may have been updated. © The State of Victoria, Department of Sustainability and Environment, 2003 Published by the Department of Sustainability and Environment, Victoria. Kamarooka Mallee (Eucalyptus froggattii) Distribution in Victoria (DSE 2002) 8 Nicholson Street, (Illustration by Anita Barley) East Melbourne, Victoria 3002 Australia Description and Distribution sites, generally in the north, and mostly on This publication may be of Kamarooka Mallee (Eucalyptus froggattii) private land (Franklin et al. 1983). It also assistance to you but the grows to 6 m as a multi-stemmed mallee or occurs in restricted areas to the north and State of Victoria and its to 9 m as a tree. Its bark is rough and west of Wedderburn, and in the Mount employees do not guarantee fibrous, grey to grey-brown on lower stems Arapiles area south-west of Horsham. New that the publication is populations within these areas continue to be without flaw of any kind or or its trunk, which then becomes smooth, found. is wholly appropriate for grey-green and peeling in strips higher up. your particular purposes Adult leaves are alternate, thick, shining Many of the stands of Kamarooka Mallee in and therefore disclaims all green, 7.5 cm long, 1.2-2 cm wide; the the Whipstick area are on uncleared private liability for any error, loss lateral veins are faint, marginal vein land, although some are protected within the or other consequence which prominent and up to 3 mm from the Kamarooka State Park. -

SCG Victorian Councils Post Amalgamation

Analysis of Victorian Councils Post Amalgamation September 2019 spence-consulting.com Spence Consulting 2 Analysis of Victorian Councils Post Amalgamation Analysis by Gavin Mahoney, September 2019 It’s been over 20 years since the historic Victorian Council amalgamations that saw the sacking of 1600 elected Councillors, the elimination of 210 Councils and the creation of 78 new Councils through an amalgamation process with each new entity being governed by State appointed Commissioners. The Borough of Queenscliffe went through the process unchanged and the Rural City of Benalla and the Shire of Mansfield after initially being amalgamated into the Shire of Delatite came into existence in 2002. A new City of Sunbury was proposed to be created from part of the City of Hume after the 2016 Council elections, but this was abandoned by the Victorian Government in October 2015. The amalgamation process and in particular the sacking of a democratically elected Council was referred to by some as revolutionary whilst regarded as a massacre by others. On the sacking of the Melbourne City Council, Cr Tim Costello, Mayor of St Kilda in 1993 said “ I personally think it’s a drastic and savage thing to sack a democratically elected Council. Before any such move is undertaken, there should be questions asked of what the real point of sacking them is”. Whilst Cr Liana Thompson Mayor of Port Melbourne at the time logically observed that “As an immutable principle, local government should be democratic like other forms of government and, therefore the State Government should not be able to dismiss any local Council without a ratepayers’ referendum. -

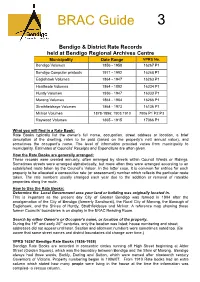

BRAC Guide 3

BRAC Guide 3 Bendigo & District Rate Records held at Bendigo Regional Archives Centre Municipality Date Range VPRS No. Bendigo Volumes 1856 - 1958 16267 P1 Bendigo Computer printouts 1971 - 1992 16268 P1 Eaglehawk Volumes 1864 - 1947 16263 P1 Heathcote Volumes 1864 - 1892 16334 P1 Huntly Volumes 1936 - 1947 16333 P1 Marong Volumes 1864 - 1964 16266 P1 Strathfieldsaye Volumes 1864 - 1973 16136 P1 McIvor Volumes 1878-1896; 1903;1910 7006 P1 P2 P3 Raywood Volumes 1865 - 1915 17066 P1 What you will find in a Rate Book: Rate Books typically list the owner’s full name, occupation, street address or location, a brief description of the dwelling, rates to be paid (based on the property’s nett annual value), and sometimes the occupant’s name. The level of information provided varies from municipality to municipality. Estimates of Councils’ Receipts and Expenditure are often given. How the Rate Books are generally arranged: These records were created annually, often arranged by streets within Council Wards or Ridings. Sometimes streets were arranged alphabetically, but more often they were arranged according to an established route taken by the Council’s Valuer. In the latter case, it is common for entries for each property to be allocated a consecutive rate (or assessment) number which reflects the particular route taken. The rate numbers usually changed each year due to the addition or removal of rateable properties along the route. How to Use the Rate Books: Determine the Local Government area your land or building was originally located in. This is important as the present day City of Greater Bendigo was formed in 1994 after the amalgamation of the City of Bendigo (formerly Sandhurst), the Rural City of Marong, the Borough of Eaglehawk, and the Shires of Huntly, Strathfieldsaye and McIvor. -

Approximately 75 Per Cent of State Government

AUDITOR-GENERAL Wednesday, 30 March 1994 ASSEMBLY 679 Wednesday, 30 March 1994 The university commenced operation on 1 January 1994 and I would be grateful if you would arrange as soon as possible for a joint sitting at which members could be recommended for appointment according to this provision. The SPEAKER (Hon. J. E. Oelzoppo) took the chair at 10.05 a.m. and read the prayer. Yours sincerely HAOOON STOREY, QC, MLC AUDITOR-GENERAL Minister for Tertiary Education and Training Special report no. 30 I have received another letter from the Minister for Tertiary Education and Training, which reads as The SPEAKER presented special report no. 30 on follows: grants and subsidies to non-government organisations. Dear Speaker, Laid on table. Section 7(2)(J) of the Victoria University of Technology Act 1990 provides for the council of the university to Ordered to be printed. include: PAPERS three persons appointed by the Governor in Council who are members of the Parliament of Laid on table by Oerk: Victoria recommended for appointment by a joint sitting of the members of the Legislative Council Statutory Rule under the following Acts: and Legislative Assembly conducted in accordance with rules adopted for the purpose by the Magistrates' Court Act 1989 - S.R. No. 31 members present at the sitting. Wildlife Act 1975 - S.R. No. 30 Section 8(1) of the act provides that the term of such Wildlife Act 1975 - Notice of closure to areas to hunting appointment shall be for three years. pursuant to section 86. The Hon. Joan Kimer, MP, was appointed to the JOINT SITI1NG OF PARLIAMENT Council of Victoria University of Technology for a three-year term from 1 July 1993 to 30 June 1996. -

Municipal Employment Contracts and Appointments Consultative

MUNICIPAL EMPLOYMENT CONTRACTS AND APPOINTMENTS Thursday. 19 May 1994 COUNCIL 667 Thursday, 19 May 1994 The Office of Local Government investigated the appointment of senior officers and subsequent contracts in the City of Waverley, the Borough of Eaglehawk and the Rural City of Marong. Additionally, investigation took place into The PRESIDENT (Hon. B. A. Chamberlain) took appointments of chief executive officers in the cities the chair at 10.02 a.m. and read the prayer. of Ballarat, Benalla, Box Hill and Horsham, and the shires of Benalla, Gordon, Mirboo, Numurkah and MUNICIPAL EMPLOYMENT Charlton. The results of those investigations and CONTRACTS AND APPOINTMENTS certain recommendations to the government are contained in the body of the report. Hon. R. M. HALLAM (Minister for Local Government) presented report of investigation I commend the report to the house. into senior staff employment contracts and appointments in Victorian municipalities, Laid on table. May 1994. Ordered to be printed. Hon. R. M. HALLAM (Minister for Local Government) (By leave) - I should like to make a Ordered to be considered next day on motion of brief statement. On 28 December 1993 I gave a Hon. PAT POWER Oika Jika). direction to the Office of Local Government to investigate reports of alleged irregular practices in CONSULTATIVE COUNCIL ON the placement of municipal staff on contract OBSTETRIC AND PAEDIATRIC arrangements. The decision to undertake the MORTALITY AND MORBIDITY investigation was not taken lightly, but resulted from serious allegations made by a number of Hon. R. I. KNOWLES (Minister for Housing) individual councillors, ratepayers and, in one case, a presented report of Consultative Council on trade union. -

Thematic Environmental History & Associated Tasks

THEMATIC ENVIRONMENTAL HISTORY & ASSOCIATED TASKS OVERVIEW REPORT Prepared for City of Greater Bendigo FINAL REPORT June 2013 Adopted by City of Greater Bendigo Council July 31, 2013 1.0 Introduction 2 1.1 What is a ‘Thematic Environmental History?’ 2 1.2 Background 2 1.3 Heritage places 2 1.4 Project tasks 3 1.5 Acknowledgements 3 2.0 Preparation of the Thematic Environmental History 3 2.1 Secondary sources 4 3.0 Community consultation 4 3.1 Consultation with the Indigenous community 5 4.0 Identification of places of heritage significance 5 5.0 Mapping of places of potential heritage significance 5 6.0 Statement of significance for the municipality 6 7.0 Summary history document 6 8.0 Recommendations for future work 6 8.1 Localities/discrete areas 6 8.2 Twentieth century development 7 8.3 Industrial heritage places 7 8.4 Aboriginal heritage places 8 8.5 Places on public land 8 8.6 Other ‘gaps’ 8 APPENDIX A PLACES OF HERITAGE SIGNIFICANCE & POTENTIAL HERITAGE SIGNIFICANCE A1 APPENDIX B PLACES OF HERITAGE SIGNIFICANCE & POTENTIAL HERITAGE SIGNIFICANCE B1 APPENDIX C STATEMENT OF SIGNIFICANCE C1 APPENDIX D SUMMARY HISTORY D1 LOVELL CHEN 2013 1 1.0 Introduction This ‘Overview Report’ has been prepared for the City of Greater Bendigo. It describes and summarises the methodology, tasks and outputs of the recently completed ‘Thematic Environmental History’ (TEH) project. Lovell Chen was assisted in the preparation of the TEH by sub-consultants Dr Robyn Ballinger and Dr Colin Pardoe; Dr Ballinger was also involved in the community workshops and identification of potential heritage places. -

Attachment 1

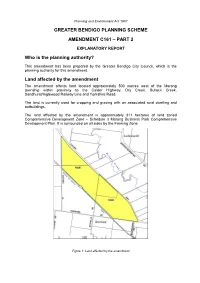

Planning and Environment Act 1987 GREATER BENDIGO PLANNING SCHEME AMENDMENT C161 – PART 2 EXPLANATORY REPORT Who is the planning authority? This amendment has been prepared by the Greater Bendigo City Council, which is the planning authority for this amendment. Land affected by the amendment The amendment affects land located approximately 500 metres west of the Marong township within proximity to the Calder Highway, Dry Creek, Bullock Creek, Sandhurst/Inglewood Railway Line and Yorkshire Road. The land is currently used for cropping and grazing with an associated rural dwelling and outbuildings. The land affected by the amendment is approximately 311 hectares of land zoned Comprehensive Development Zone – Schedule 3 Marong Business Park Comprehensive Development Plan. It is surrounded on all sides by the Farming Zone. Figure 1: Land affected by the amendment The affected land is: Address Parcel details 20 Yorkshire Road, Wilsons Hill Lot 1 TP215794 104 Carters Lane, Marong Lot 1 TP952938 Lot 2 TP952938 Lot 1 TP119927 CA 87, TP764719 CA 86, TP764719 CA 84, TP308026 CA 86A1, TP589221 CA 83B1, TP589221 CA 83, TP783012 2 unmade government road reserves What the amendment does The amendment applies a Public Acquisition Overlay (PAO) – Schedule 6 to the above described land. The purpose of the Overly is to identify land to be acquired by Greater Bendigo City Council for the future development of the Marong Business Park. Specifically the amendment proposes to: • Apply Schedule 6 to Clause 45.01 (Public Acquisition Overlay) to land at 20 Yorkshire Road, Wilsons Hill and part of 104 Carters Lane, Marong, and 2 unmade government road reserves for the proposed Marong Business Park. -

City of Greater Bendigo

Case study City of Greater Bendigo The Challenge Highlights The City of Greater Bendigo was looking to upgrade its TechnologyOne Enterprise Content Management (ECM) system, streamline business processes and improve user adoption across 100,000 the organisation. residents “We really liked what we’d seen of TechnologyOne’s Ci Land area of Anywhere ECM solution at the Evolve 2014 user conference, and loved the look and feel. We came back really excited about 3,048km² implementing the new functionality,” said City of Greater Bendigo’s System Administrator Michelle Stewart. Saved up to $35,000 in third party licensing costs The Solution Streamlining The council implemented TechnologyOne ECM on Ci Anywhere. Built on TechnologyOne’s proven Connected Intelligence (Ci) business processes platform, Ci Anywhere introduces an exciting new era of enterprise software, allowing organisations to embrace smart Information at their fingertips, mobile devices as part of their enterprise solution. ECM enables from any device Council employees to capture and access information from any device, centralising the storage of all business documents. “Because Ci Anywhere is so The Outcome intuitive and user friendly it The City of Greater Bendigo has embraced ECM on Ci Anywhere across the organisation, with the system’s simplicity and ease of has been easy to roll out, as use driving user adoption. it doesn’t require extensive “Staff have found ECM easier to use, which has been a huge benefit,” said Ms Stewart. training to learn how to use it.” “Because Ci Anywhere is so intuitive and user friendly it has been Michelle Stewart, easy to roll out, as it doesn’t require extensive training to learn System Administrator how to use it. -

29 March 1994 to 27 April 1994]

VICTORIA PARLIAMENTARY DEBATES (HANSARD) FIFTY-SECOND PARLIAMENT AUTUMN SESSION 1994 Legislative Council VOL. 416 [From 29 March 1994 to 27 April 1994] By Authority: VICTORIAN GOVERNMENT PRISTER The Governor His Excellency the Honourable RICHARD E. McGARVIE The Lieutenant-Governor His Excellency the Honourable SIR JOHN McINTOSH YOUNG, AC, KCMG The Ministry [as from 9 november 1992] Premier, and Minister for Ethnic Affairs ...... The Hon. J.G. Kennett, MP Deputy Premier, Minister for Police and ...... The Hon. PJ. McNamara, MP Emergency Services, Minister for Corrections, Minister for Tourism Minister for Industry and Employment.. ...... The Hon. P.A. Gude, MP Minister for Roads and Ports ........................ The Hon. W.R. Baxter, MLC Minister for Conservation and Environment, The Hon. M.A. Birrell, MLC and Minister for Major Projects Minister for Public Transport ....................... The Hon. AJ. Brown, MP Minister for Natural Resources ..................... The Hon. C.G. Coleman, MP Minister for Regional Development, ............. Minister for Local Government The Hon. R.M. Hallam, MLC Minister for Education ................................. The Hon. D.K. Hayward, MP Minister for Small Business, and Minister.... The Hon. v.P. Heffeman, OAM, MP responsible for Youth Affairs Minister for Community Services, and ........ The Hon. Michael John, MP Minister responsible for Aboriginal Affairs Minister for Housing, and Minister for ........ The Hon. R.I. Knowles, MP Aged Care Minister for Agriculture ............................... The Hon. W.D.McGrath, MP Minister for Planning .................................. ,. The Hon. R.R.e. Maclellan, MP Minister for Industry Services ...................... The Hon. Roger Pescott, MP Minister for Energy and Minerals, and ......... The Hon. SJ. Plowman, MP Minister Assisting the Treasurer on State Owned Enterprises Minister for Sport, Recreation and Racing ... -

7 October 1993 ASSEMBLY 1019

LAND (FURTHER AMENDMENT) BILL Thursday, 7 October 1993 ASSEMBLY 1019 was being exceedingly ill mannered. I am entitled to Mr DOLUS (Richmond) - I also suggest that the make that point, and it stands. Bill be withdrawn. As the shadow Treasurer stated, the opposition does not oppose the objectives of the The Minister has taken unto himself the divine right Bill. It understands the necessity for the Bill, but it to resolve those issues. Nowhere in public policy has a number of concerns about whether the legal making is that considered to be appropriate. The rights of the Melbourne Central walkway could Minister has also taken unto himself - the language create a number of issues that Parliament may have he uses in his second-reading speech is particularly to deal with at some time in the future. interesting - the right to get rid of compensation claims. There is no provision for members who feel Has the Minister for Finance received advice from aggrieved or injured and whose interests have been his colleague, the Minister for Planning, about the set aside or adversely affected to pick up effects of the Bill on the planning powers in this compensation. In his second-reading speech, the State? Will Ministerial powers contained in the Bill Minister makes the following point: override the powers in the Planning and Environment Act? The Minister is not paying The Bill also inserts into the Land Act 1958 proposed attention to my contribution. I wonder whether the section 412, which section alters or varies section 85 of Minister - hello! I am trying to ask the Minister a the Constitution Act 1975 to the extent necessary to fundamental question. -

Volume 1 Heritage Policy Citations Review C162 December 2011

Heritage Policy Citations Review December 2011 City of Greater Bendigo TABLE OF CONTENTS Project Team iii Acknowledgements iv 1.0 Introduction 1 1.1 Background to Citation Review 1 1.1.1 Previous studies 1 1.1.2 Clause 22.06 ‘Heritage Policy’ 2 2.0 Study area 3 2.1.1 Crown land 4 2.2 Some characteristics of the area 4 2.2.1 Patterns of settlement 4 2.2.2 Gold mining 5 2.2.3 Vernacular construction 7 2.2.4 Eucalyptus distilleries 8 3.0 Existing heritage listings 9 3.1 Victorian Heritage Register 9 3.2 Victorian Heritage Inventory 9 4.0 Methodology 10 4.1 Overview 10 4.1.1 Steering group 10 4.2 Guiding documents 10 4.2.1 Burra Charter 10 4.2.2 VPP Practice Note: Applying the Heritage Overlay 10 4.3 Limitations of study 11 4.3.1 Thematic Environmental History 11 4.3.2 Obscured properties 11 4.3.3 Outbuildings 12 4.3.4 Sites not recommended for the Heritage Overlay 12 4.4 Consultation 13 4.5 Study tasks 13 4.5.1 Historical research 13 4.5.2 Physical survey 13 4.5.3 Assessment 14 4.5.4 Mapping 17 4.6 Format of citations 17 5.0 Study group of properties 17 5.1.1 Properties for which citations have been prepared 19 LOVELL CHEN I 6.0 Recommendations 27 6.1 Sites recommended for nomination to the Victorian Heritage Register 27 6.2 Sites recommended for inclusion in the Victorian Heritage Inventory 27 6.3 Sites recommended for inclusion in the Greater Bendigo Heritage Overlay 27 6.4 Interpretation 27 6.5 Identification of additional places 28 6.6 Identification of further research 31 6.6.1 Vernacular construction technologies 31 6.6.2 Eucalyptus -

Transport Strategy

HOME AND COMMUNITY CARE Transport Strategy May 1998 PREPARED BY: TBA PLANNERS PTY LTD GRIMWOOD PTY LTD PLANNING INITIATIVES AND ANDREW O’BRIEN & ASSOCIATES For the Department Of Human Services and the Department of Infrastructure Disclaimer HOME AND COMMUNITY CARE TRANSPORT STRATEGY This report has been prepared by TBA Planners jointly for the Department of Human Services and the Department of Infrastructure. One of the objectives of this independent consultant study was to investigate how the required transport services are being delivered, and how this delivery could be made more effective and efficient. The report is not constrained by government policies or other planning or community goals, but provides an independent appraisal of how the delivery of community transport services may be improved. The views expressed in the report are the opinions of the consultants and do not necessarily reflect the views of either Department. The report has not been considered by Government and has no official status. Table of Contents ACKNOWLEDGMENTS........................................................................................................................I GLOSSARY OF ABBREVIATIONS..................................................................................................II A. EXECUTIVE SUMMARY.................................................................I B. RECOMMENDATIONS..................................................................1 C. REVIEW AND ANALYSIS OF EXISTING SYSTEM............................1 1. Study Background..........................................................................................................................1