Mfg Index.Pmd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1999 Annual Report

CORE Metadata, citation and similar papers at core.ac.uk Provided by Diposit Digital de Documents de la UAB Annual Report and Form 20-F 1999 Contents Page Strategy Statement 1 Corporate Highlights 2 Financial Highlights 3 1 Business Review 1999 5 2 Description of Business 23 3 Operating and Financial Review 33 4 Report of the Directors 57 5 Financial Record 77 6 Financial Statements 83 7 Shareholder Information 131 Glossary 141 Cross reference to Form 20-F 142 Index 144 The images used within this Annual Report and Form 20-F are taken from advertising campaigns and websites which promote our brands worldwide. They demonstrate how we communicate the appeal of our brands in a wide range of markets. “Sunkist” is a registered trademark of Sunkist Growers, Inc. This is the Annual Report and Form 20-F of Cadbury Schweppes public limited company for the year ended 2 January 2000. It contains the annual report and accounts in accordance with UK generally accepted accounting principles and regulations and incorporates the annual report on Form 20-F for the Securities and Exchange Commission in the US. A Summary Financial Statement for the year ended 2 January 2000 has been sent to all shareholders who have not elected to receive this Annual Report and Form 20-F. The Annual General Meeting will be held on Thursday, 4 May 2000. The Notice of Meeting, details of the business to be transacted and arrangements for the Meeting are contained in the separate Annual General Meeting booklet sent to all shareholders. The Company undertook a two for one share split in May 1999. -

Item # Description Pk Ships Gf Nf Tnf Sf V Df K Lf Vegan

J. POLEP'S ALLERGEN FREE LISTING KEY GF = Gluten free NF = Nut Free TNF = Tree Nut Free SF = Soy Free V = Vegetarian DF = Dairy Free K = Kosher LF = Lactose Free Vegan = Vegan L=Local ITEM # DESCRIPTION PK SHIPS GF NF TNF SF V DF K LF VEGAN LOCAL NON-GMO BEVERAGES - REFRIGERATED 738708 FAIRLIFE CHOC MILK 2% 11.5OZ 12 REFER 738682 FAIRLIFE MILK 2% 11.5 OZ 12 REFER 737056 POM COCONUT DRINK 12 OZ 6 REFER X X 737072 POM HULA DRINK 12 OZ 6 REFER X X 737064 POM MANGO DRINK 12 OZ 6 REFER X X 719948 POM POMEGRANATE JUICE 16 OZ 6 REFER X X X X X X 723809 POM POMEGRANATE JUICE 8 OZ 8 REFER X X X X X X 725051 SIMPLY APPLE JUICE 340 ML 12 REFER X X X X X X 730028 SIMPLY CRANBERRY 340 ML 12 REFER X X X X X X 739037 SIMPLY FRUIT PUNCH 340ML 12 REFER 725085 SIMPLY LEMONADE 340 ML 12 REFER X X X X X X 725044 SIMPLY LIMEADE 340 ML 12 REFER X X X X X X 725036 SIMPLY ORANGE CALCIUM 340 ML 12 REFER X X X X X X 725069 SIMPLY ORANGE JUICE 340 ML 12 REFER X X X X X X 730267 SIMPLY ORANGE JUICE 59 OZ 6 REFER 728220 SIMPLY ORANGE MANGO 340 ML 12 REFER X X X X X X 725077 SIMPLY RASP LEMONADE 340 ML 12 REFER X X X X X X 739045 SIMPLY TROPICAL 340 ML 12 REFER Page 1 of 78 J. -

Portland Daily Press: July 13,1892

PORTLAND DAILY PRESS. ESTABLISHED JUNE 23, 1862—VOL. 31. PORTLAND, MAINE, WEDNESDAY MORNING, JULY 13, 1892. PRICE THREE CENTS. NEWS. MISCELLANEOUS. THIS MORNING’S bill that was every presented and hunt- ing of Messrs. Craw did O’Donnell, Coon, A TEMPERANCE TALK. ing up some who not care to make ford, Scliuckman and 1. out Clifford, represent- AWAKENED TO DIE. Page any bill, thus proving that he be- ing the Amalgamated Association advi- lieved in with Weather indications. dealing squarely all. To- sory committee and the citizens. Mr. the was Seneral Telegraphic news. day elephant captured and Coon was the spokesman. He stated hitched but when he he a. got ready, again that lie represented the association and Page the started, fastenings being insecure. the citizens. On their part he welcomed Seneral sporting news. Mr. Tells the Senate About the Again he has been found and is Frye enjoying the troops to the town and offered the co Tourists at St. Gervais news. himself in a as he would Crushed Telegraphic swamp in his operation of the citizens i n or- 3. native It is not preserving Page Maine Law. jungle. known what der. Beneath a course he will now pursue but one Glacier. History of the Pinkertons. thing General Snowden said: “I thank yov is has a live Maine towns. sure, Bucksport elephant on Provost Patrol in Place of for the welcome, but do not need its hands. y’oui Heavy warships of today. co-operation, The only way good citizen* can with' us is to Page 4. MR. -

Cadenza Document

VGM Club Report Date: Jul 2019 Contracted Manufacturer Report Mfr Name Has Rebate Has Pricing 3M Y Y Abbott Nutrition Y N ACH Food Companies Y N Advance Food Products LLC AFP Y Y AdvancePierre Y Y Agro Farma Inc Y Y Ajinomoto Windsor Inc (formerly Windsor Frozen Foods) Y N Allied Buying Corporation (ABC) Y N All Round Foods Bakery Products Y N Alpha Baking/National Baking Y N American Licorice Co Y N American Metalcraft Y N American Roland Food Corp Y N Amplify Snack Brands Y N Amy's Kitchen Inc Y N Anchor Packaging Y Y Antonio Mozzarella Factory Y N Appetizers And Inc Y Y Apple & Eve Y Y Argo Tea Y Y Arizona Tea - Hornell Brewing Company Y Y Armanino Foods Y Y Armour-Eckrich Meats LLC DBA Carando Y N Armour Eckrich - Smithfield Y Y Ateeco/Mrs T's Pierogies Y Y Atlantic Mills Co Y Y Awake Chocolate Y N Azar Nut Company Y N Bagcraft Packaging LLC Y N Bake N Joy Inc Y N Bakery De France Y Y Ballard Brands Y Y BarFresh Corporation Inc Y Y Barilla America Inc Y Y Basic American Food Co Y Y Bay Valley Foods LLC Y N Belgioioso Cheese Inc Y N Bel Kaukauna Cheese Co Y Y Berks Packing Co Inc Y N Berry Plastics Diet Kits Y N Berry Plastics Liners Y Y Beverage Air Y N Page 1 Of 9 VGM Club Report Date: Jul 2019 Contracted Manufacturer Report Mfr Name Has Rebate Has Pricing Beyond Meat Y Y B&G Foods Inc Y Y Big City Reds /American Foods Y N Big Red Inc Y Y BioSelect N Y Biscomerica Corp. -

Snack, Cereal and Nutrition Bars in the United States

International Markets Bureau MARKET ANALYSIS REPORT | SEPTEMBER 2013 Snack, Cereal and Nutrition Bars in the United States Source: Mintel GNPD. Source: Mintel GNPD. Snack, Cereal and Nutrition Bars in the United States EXECUTIVE SUMMARY INSIDE THIS ISSUE Total health and wellness food and beverage sales in the Executive Summary 2 United States are on the rebound, growing by 2% from 2011 to 2012 (and 6% from 2010 to 2012), despite the economic Market Snapshot 3 slowdown that the U.S. experienced these past 5 years. It now appears that with a recovering economy, Americans are again Snack Bars Market Sizes 4 receptive to buying health foods. However, future growth may be hampered by the frugality that American consumers have Health and Wellness Snack 5 adopted, meaning that consumers may be more price-sensitive Bars Market in shopping for healthy options. Organic Snack Bars 6 U.S. packaged food as a whole is recovering from the economic downturn; U.S. organic packaged food sales are also Energy and Nutrition Bars 7 recovering. Organic products are sub-category of the health and wellness sector. Organic products carry a higher price Consumer Trends 8 than their conventional counterparts, so it is not surprising that sales were affected by the economic slowdown. Before the Claims Analysis 11 recession of 2008, organic packaged food value sales enjoyed double-digit growth before plunging. Now organic packaged Market Shares by Brand 12 food value sales are recovering again; they increased by 2.1% and Company between 2011 and 2012, to reach US$12.2 billion. Distribution Channels 13 Snack, cereal and nutrition bars continued their growth in 2012, with an ever-expanding array of flavours and healthy varieties. -

GETRÄNKEKARTE List of Beverages

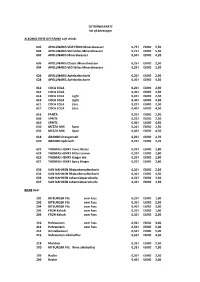

GETRÄNKEKARTE list of beverages ALKOHOLFREIE GETRÄNKE soft drinks 602 APOLLINARIS SELECTION Mineralwasser 0,75 l EURO 5,50 603 APOLLINARIS VIO Stilles Mineralwasser 0,75 l EURO 5,50 607 APOLLINARIS Mineralwasser 0,50 l EURO 4,20 605 APOLLINARIS Classic Mineralwasser 0,25 l EURO 2,50 604 APOLLINARIS VIO Stilles Mineralwasser 0,25 l EURO 2,50 626 APOLLINARIS Apfelsaftschorle 0,20 l EURO 2,50 628 APOLLINARIS Apfelsaftschorle 0,40 l EURO 4,50 612 COCA COLA 0,20 l EURO 2,50 613 COCA COLA 0,40 l EURO 4,50 614 COCA COLA Light 0,20 l EURO 2,50 615 COCA COLA Light 0,40 l EURO 4,50 611 COCA COLA Zero 0,20 l EURO 2,50 617 COCA COLA Zero 0,40 l EURO 4,50 616 FANTA 0,20 l EURO 2,50 606 SPRITE 0,20 l EURO 2,50 610 SPRITE 0,40 l EURO 4,50 630 MEZZO MIX Spezi 0,20 l EURO 2,50 632 MEZZO MIX Spezi 0,40 l EURO 4,50 618 GRANINI Orangensaft 0,20 l EURO 2,70 620 GRANINI Apfelsaft 0,20 l EURO 2,70 622 THOMAS HENRY Tonic Water 0,20 l EURO 2,80 624 THOMAS HENRY Bitter Lemon 0,20 l EURO 2,80 623 THOMAS HENRY Ginger Ale 0,20 l EURO 2,80 627 THOMAS HENRY Spicy Ginger 0,20 l EURO 2,80 636 VAN NAHMEN Rhabarbersaftschorle 0,20 l EURO 2,50 634 VAN NAHMEN Rhabarbersaftschorle 0,40 l EURO 4,50 636 VAN NAHMEN Johannisbeerschorle 0,20 l EURO 2,50 637 VAN NAHMEN Johannisbeerschorle 0,40 l EURO 4,50 BIERE beer 201 BITBURGER Pils vom Fass 0,20 l EURO 1,90 202 BITBURGER Pils vom Fass 0,30 l EURO 2,50 204 BITBURGER Pils vom Fass 0,40 l EURO 3,00 205 FRÜH Kölsch vom Fass 0,20 l EURO 1,90 206 FRÜH Kölsch vom Fass 0,30 l EURO 2,50 210 Hefeweizen vom Fass 0,30 l EURO 3,00 212 Hefeweizen -

Bottled Water in the US Through 2022

Bottled Water in the U.S. through 2022 2018 Edition (Published August 2018. Data through 2017. Market projections through 2022.) More than 325 pages, with extensive text analysis, graphs, charts and more than 125 tables. This definitive U.S. bottled water market report looks at the For A Full largest beverage category by volume and considers every aspect of this resilient category and its competitive circumstances. Its Catalog of detailed analysis of the industry covers regional and state Reports and markets as well as packaging, quarterly category growth, Databases, distribution, advertising, demographics and more. Go To bmcreports.com INSIDE: REPORT OVERVIEW AVAILABLE FORMAT & A brief discussion of key PRICING features of this report. 2 Direct Download TABLE OF CONTENTS Word & PDF format report and Quarterly Category and sub- A detailed outline of this category updates ((for 3 quarters) delivered via select access to report’s contents and data BMC’s DrinkTell database) tables. 6 $4,995 SAMPLE TEXT AND To learn more, to place an advance order or to inquire about INFOGRAPHICS additional user licenses call: Charlene Harvey +1 212.688.7640 A few examples of this ext. 1962 [email protected] report’s text, data content layout and style. 14 HAVE Contact Charlene Harvey: 212-688-7640 x 1962 ? QUESTIONS? [email protected] Beverage Marketing Corporation 850 Third Avenue, 13th Floor, New York, NY 10022 Tel: 212-688-7640 Fax: 212-826-1255 The answers you need Bottled Water in the U.S. through 2022 provides in-depth data and market analysis, shedding light on various aspects of the market through reliable data and discussions of what the numbers really mean. -

2020 Financial Results

Coca-Cola European Partners Preliminary Unaudited Results for the Full-Year Ended 31 December 2020 Resilient performance despite the challenging backdrop; well-positioned for a digital & green led future 11 February 2021 CHANGE VS 2019 FY 2020 METRIC1 AS REPORTED COMPARABLE COMPARABLE AS REPORTED COMPARABLE FX-NEUTRAL VOLUME (M UNIT CASES)2 2,277 2,277 (9.5)% (10.0)% REVENUE (]M) 10,606 10,606 (11.5)% (11.5)% (11.0)% COST OF SALES (]M) 6,871 6,809 (7.5)% (8.5)% (7.5)% OPERATING EXPENSES (]M) 2,922 2,603 (4.0)% (11.0)% (10.0)% OPERATING PROFIT (]M) 813 1,194 (47.5)% (29.0)% (28.5)% PROFIT AFTER TAXES (]M) 498 821 (54.5)% (30.5)% (30.5)% DILUTED EPS (]) 1.09 1.80 (53.0)% (29.0)% (28.5)% REVENUE PER UNIT CASE (]) 4.69 (1.5)% COST OF SALES PER UNIT CASE (]) 3.01 2.5% FREE CASH FLOW (]M) 924 CAPITAL RETURNS: DIVIDEND PER SHARE3 (]) 0.85 Maintained dividend payout ratio of c.50% 2020 SHARE BUYBACK (]M) c.130 Damian Gammell, Chief Executive Officer, said: “2020 was a challenging year like no other, and I am very proud of how well we have managed through such a rapidly changing environment. That is down to the extraordinary work and commitment of our colleagues, supporting each other as well as our customers and communities, to all of whom, I am sincerely grateful. “The crisis also reinforced the power of our relationship with The Coca-Cola Company and our other brand partners. Our collective belief in continuing to invest in our core brands has served us well, gaining share4 both in the home channel and online. -

25000000 Needed for K. of C War Work Till July, 1919

$25,000,000 Needed for K. of C . War Work Till July, 1919 CATHOLIC PRESS DAY ADDS BOARD OF DIRECTORS Pray for the Pray for the MANY SUBSCRIBERS; PASSES Success of the Coming of a TOLD ARCHBISHOPS EXPECTATION OF REGISTER Catholic Press mm Just Peace STAND RIGHT BACK PROVING GLORIOUS SUCCESS OF ORDER’S DOINGS Reddin Returns After Meeting Banner Parish So Far is St. Elizabeth’s; Held Sunday in Chicago. Others Make Splendid Showing MULLIGAN H M S ACTIVITY Col. Callahan Resigns; Many PRIESTS GIVE FINE BOOSTS VOL. XIII. NO. 42. DENVER, COLO., THURSDAY. MAY 30, 1918. $2 PER YEAR. Recruits for Overseas Duty. Catholic Press Day, observed last Sun his influence were the chief factors in The Supreme Board of Directors of the day ill Colorado for the first time, proved the success of Press Day. We thank the EVERY SHIP CARRIES Knights of Columbus, at a meeting in a greater success than the publishers of good Bishop and the zealous pas Protestant Woman Has Chicago last Sunday, decided that it The Register had dared to anticipate. tors of the Diocese from ' the bottom would take 25 million dollars for the war Present indications are that there was of our hearts. From every place comes K.-C. WAR WORKERS work under the auspices of the order about a 20 per cent increase in the circu word of the splendid sermons delivered, until July 1, 1919. This includes the lation of this new.spaper. Tlie champion chiefly in our behalf. Tlie workers who money spent so far. John H. -

![Bottled Water Recalls, Field Corrections, Violations [As of July 24, 2006]](https://docslib.b-cdn.net/cover/6453/bottled-water-recalls-field-corrections-violations-as-of-july-24-2006-1966453.webp)

Bottled Water Recalls, Field Corrections, Violations [As of July 24, 2006]

Information Supplement to “Bottled and Sold: The Story Behind Our Obsession with Bottled Water” (published by Island Press, April 2010) Bottled Water Recalls, Field Corrections, Violations [As of July 24, 2006] History of Contamination Recalls and “Field Corrections.” Recall Date Product Manufacturer Class of Reason1 Volume Locations Notice Recall Recalled Date 2/28/90 February 1990 Sparkling Perrier Group, II Contaminated with 0.5 million Nationwide and water Paris, France benzene cases remain on U.S. territories market as of recall date 4/25/90 January 1990 Spring Pocono II Kerosene/petroleum- 1,960 cases (6 New Jersey, New water Artesian like odor gallons per York Waters case) Company 4/25/90 February 1990 Spring Triton Water III Contaminated with Unknown North Carolina, water Company, mold Pennsylvania, Burlington, Virginia, West North Carolina Virginia 7/18/90 April 1990 Spring West Lynn II Fish smell or 125 cases (12 Vermont water Creamery, taste/burning bottles per 1 As described by the U.S. FDA Recall Notice. Lynn, sensation due to case) Massachusetts sodium hydroxide contamination 12/19/90 October 1990 Bottled Southern III Contaminated with 20,000 gallon Georgia, South drinking Beverage mold bottles and 817 Carolina, North water Packers, cases of 16 Carolina Augusta, ounce Georgia containers were distributed 2/27/91 December 1990 Drinking Hinckley & II contaminated with unknown Illinois, water, Schmitt, Inc., styrene Wisconsin Distilled Chicago, water, Illinois Nursery water 3/20/91 December 1990 Distilled Newton II with a chemical odor 2,540 cases (6 Wisconsin, drinking Valley, Ltd., and taste gallons/case) Illinois. water; Manitowoc, Artesian Wisconsin water 7/10/91 April 1990 Bottled Famous II Contaminated with Approximately Hawaii, drinking Ramona Water algae and 13,621 cases California Water Company, Pseudomonas Ramona, Aeruginosa. -

“The Coca-Cola Company” Annual Economic Report for the Fiscal Year Ended at December 31, 2006

“THE COCA-COLA COMPANY” ANNUAL ECONOMIC REPORT FOR THE FISCAL YEAR ENDED AT DECEMBER 31, 2006 CONTENTS 1. General………………………………………………………………………………………….2 2. Operating Segments……………………………………………………………………………2 3. Products and Distribution……………………………………………………………………..3 4. Seasonality……………………………………………………………………………………...6 5. Competition…………………………………………………………………………………….6 6. Raw Materials………………………………………………………………………………….7 7. Patents, Copyrights, Trade Secrets and Trademarks……………………………………….7 8. Employees………………………………………………………………………………………8 9. Risk Factors…………………………………………………………………………………….8 10. Management’s Discussion and Analysis of Financial Condition and Results of Operations…………………………………………………………………………………...14 10. 1 Overview…………………………………………………………………………………………14 10. 2 Our Business…………………………………………………………………………………….15 10.2.1 General………………………………………………………………………...…………..15 10.2.2 The Nonalcoholic Beverages Segment of the Commercial Beverages Industry..……..16 10.2.3 Our Objective……………………………………………………………………………..16 10.2.4 Areas of Focus…………………………………………………………………………….16 10.2.4.1 Consumer Marketing………………………………………………..………..16 10.2.4.2 Customer and Commercial Leadership…………………………………..….16 10.2.4.3 Franchise Leadership……………………………………………….………...16 10.2.5 Challenges and Risks…………………………………………….……………………….17 10.3 Critical Accounting Policies and Estimates……………………………………………………18 10.3.1 Basis of Presentation and Consolidation…………………………………………..…….18 10.3.2 Revenue Recognition…………………………………………………………..………….18 10.3.3 Income Taxes………………….…………………………………………………………..18 10.4 Operations Review……………………………………………………………………………….19 -

1998 Annual Report

Managing for Value Annual Report and Form 20-F 1998 Results Summary % Change As At constant 1998 1997 reported exchange rates Sales (a) £4,106m £4,173m –2% +4% Trading profit before exceptional items and restructuring costs (a) £642m £624m +3% +8% Trading margin before exceptional items (a) 15.3% 14.5% +0.8pts +0.8pts Profit before tax, exceptional items and disposals £609m £575m +6% +11% Basic earnings per share 35.0p 68.7p N/A N/A Underlying earnings per share (b) 39.4p 37.2p +6% +11% Net dividend per share 19.0p 18.0p +6% +6% Capital expenditure (a) £162m £209m –22% –18% Marketing expenditure (a) £726m £706m +3% +6% Free cash flow £157m £157m Nil N/A Total Group employees 38,656 41,320 – 6% N/A (a) From continuing operations (b) Represents Basic earnings per share adjusted to exclude exceptional items and gains and losses on disposals of subsidiaries and investments Contents Page 1 Letter to Shareowners 3 2 Description of Business 21 3 Operating and Financial Review 31 4 Report of the Directors 57 5 Financial Record 77 6 Financial Statements 83 7 Shareholder Information 135 Glossary 147 Cross reference to Form 20-F 148 Index 150 This is the Annual Report and Form 20-F for the year ended 2 January 1999. It contains the annual report and accounts in accordance with UK generally accepted accounting principles and regulations and incorporates the annual report on Form 20-F for the Securities and Exchange Commission in the US. A Summary Financial Statement for the year ended 2 January 1999 has been sent to all shareholders who have not elected to receive this Annual Report and Form 20-F.