2020 Financial Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In Healthy Beverages Y

And, We Have Been Winning with Integrity 20 Net, Net, We Have Made Great Progress Over the Past Five Years Performance Net Assessment Assessment Workplace + Marketplace + + Community + Integrity + 21 At a High Level, Our Strategies Going Forward Are Clear 22 We Believe in the "Winning" Power of a Focused Food Company Focus Areas Categories Geographies Key Countries Simple Meals North America U.S./Canada Baked Snacks Europe Germany/France/Belgium Healthy Beverages Asia-Pacific Australia Emerging Markets Russia/China Divestitures • Godiva • Snack Foods • U.K. / Ireland • Other 23 As We Have Increased Our Focus, We Have Improved Performance Simple Baked Healthy Meals Snacks Beverages Perfd*formance Trend* Net Sales Growth Consumer Takeaway and Share Trend EBIT Growth * FY'02-'04 to FY'05-'09 24 To Win in the Marketplace With A Focused Food Company There Are Six Important Criteria 1. Large Growing Categories 2. Leading Brands 3. Regional Scale 4. World Class Product Technologies 5. Financial Strength 6. Organization Excellence 25 We Believe We Can Win Over Time in Our Three Areas of Focus Criteria Simple Baked Healthy Meals Snacks Beverages 1. Large Growing Categories 2. Leading Brands + + + 3. Regional Scale + + + 4. WldClPdWorld Class Product Technologies + + + 5. Financial Strength + + + 6. Organization Excellence + + + 26 Within Simple Meals, There are Two Segments Where We Want to Win Meal-Makers Meals Characteristics Less Complete Meals, More More Complete Meals, Less Preparation Required Preparation Required Campbell’s Portfolio • Campbell’s Condensed • Campbell’s Condensed Cooking Soups Eating Soups • Swanson Broth • Ready-To-Serve Soups • Prego Pasta Sauce – Chunky • Pace Mexican Sauces – Select Harvest • Kimball Sauces – V8 • D&L Sauces – Erasco • Domashnya Klassica – Leibig • Touch of Taste • Instant Dry Soups • More . -

Wie Viel Zucker Enthalten Die Getränke?

Wie viel Zucker enthalten die Getränke? Aufgabe: Berechne den Zuckergehalt der Getränke. Verwende dazu die Sipcan- Getränkeliste! 4g Zucker= 1 Würfelzucker Zuckergehalt gesamter Anzahl der Getränk in g/100 ml Zuckergehalt Würfelzucker in Gramm Coca Cola (500ml) Pepsi Cola (500ml) Fanta Orange (500ml) Rauch Eistee Zitrone (500ml) Rauch Happy Day Orange (330ml) Cappy Apfel gespritzt (500ml) Pago Erdbeere (330ml) Römerquelle Emotion Birne Melisse (500ml) Dreh & Trink Kirsche (200ml) Capri Sun Multivitamin (200ml) Almdudler Original (500ml) Mezzo Mix (500ml) Red Bull Organics Bitterlemon (250ml) Köse Mualla Als Faustregel gilt: Getränke sollten maximal 6,7 g Zucker pro 100 ml enthalten ! Zutatenliste: Hier gilt: Je weiter vorne eine Zutat in der Zutatenliste angeführt ist, desto größer ist ihr Anteil im Produkt. Als Faustregel gilt: Je niedriger der Fruchtanteil, desto mehr Zucker wird bei süßen Getränken zugesetzt. ! Hinweis: Mehr Fruchtanteil bedeutet auch mehr Gehalt an Vitaminen und Mineralstoffen. Nicht umsonst zählt 1 Glas 100%-iger Fruchtsaft auch als Obstportion und eigentlich nicht als Getränk. Getränke nach Alphabet sortiert Aufgrund des großen Angebots an verschiedenen Produkten, in denen unterschiedliche Mengen an Zucker enthalten sind, soll die Getränkeliste eine einfache Orientierungshilfe zur Produktauswahl bieten. Bei der Getränkeliste, die vom unabhängigen vorsorgemedizinischen Institut SIPCAN – Initiative für ein gesundes Leben erstellt wurde, handelt es sich um einen Praxisleitfaden. Neben dem Zuckergehalt bietet die Liste auch Informationen, ob ein Produkt Süßstoffe oder Koffein enthält. Weitere Informationen, wie über den Fruchtanteil, oder ob ein Produkt biologisch ist, finden Sie, sofern auf der jeweiligen Produktverpackung erwähnt, in der Online-Checkliste auf www.sipcan.at oder in unserer kostenlosen App (Suchbegriff „SIPCAN“). -

Plan De Desarrollo Urbano Del Municipio De Monterrey 2013-2025

Plan de Desarrollo Urbano del Municipio de Monterrey 2013-2025 0 Plan de Desarrollo Urbano del Municipio de Monterrey 2013-2025 PARTE I SITUACIÓN ACTUAL 1 Plan de Desarrollo Urbano del Municipio de Monterrey 2013-2025 CONTENIDO Págs. 1. Introducción............................................................................................................................................................. 3 2. Enfoque, Alcances y Metodología de Planeación................................................................................................... 5 3. Antecedentes.......................................................................................................................................................... 7 3.1. Históricos. 3.1.1 El Proceso de Urbanización en el Estado. 3.2. De Planeación. 4. Motivación y Fundamentación Jurídica del Plan..................................................................................................... 10 5. Delimitación Municipal............................................................................................................................................ 11 6. Diagnóstico y Pronóstico Integrado........................................................................................................................ 14 6.1. Del Medio Natural............................................................................................................................................ 14 6.1.1. Topografía. 6.1.2. Hidrología. 6.1.3. Geología. 6.1.4. Edafología. 6.1.5. Vegetación. 6.1.6. -

Coca-Cola Enterprises, Inc

A Progressive Digital Media business COMPANY PROFILE Coca-Cola Enterprises, Inc. REFERENCE CODE: 0117F870-5021-4FB1-837B-245E6CC5A3A9 PUBLICATION DATE: 11 Dec 2015 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Coca-Cola Enterprises, Inc. TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 Business Description .....................................................................................................4 History .............................................................................................................................5 Key Employees ...............................................................................................................8 Key Employee Biographies .........................................................................................10 Major Products & Services ..........................................................................................18 Revenue Analysis .........................................................................................................20 SWOT Analysis .............................................................................................................21 Top Competitors ...........................................................................................................25 -

National Kidney Foundation of Michigan

National Kidney Foundation of Michigan PEACH Evaluation Report Year 4 United Way Social Innovation Fund Grant NKFM Evaluation Team: Sarah Wesolek-Greenson, Nicole Waller, Ken Resnicow, Art Franke, Crystal D’Agostino, Robert Schwarzhaupt, Adrienne Cocci, and Nanhua Zhang 01/31/2017 Table of Contents Executive Summary 1 Section I: Introduction 3 o Problem Definition o Prior Research o Program Background o Program Development o Contribution of the Study . Overview of the Study . Previous and Target Level of Evidence . Level of Evidence Achieved . Strengths and Limitations to the Study o Research Questions . Impact Questions . Implementation Questions . Findings to Date Year 1 Year 2 Year 3 . Program Changes . Use of Previous Findings to Evolve Evaluation Section II: Study Approach and Methods 18 o Implementation Evaluation Design o Impact Evaluation Design o Sampling . Selection . Baseline Equivalence Analysis o Measures and Instruments . Regie’s Rainbow Adventure Parent Surveys . Regie’s Rainbow Adventure Teacher Surveys . The NAP SACC . Healthy Families Start with You Chats . Media Toolkit Analytics . Data Collection Regie’s Rainbow Adventure NAP SACC and HFSY . RRA Data Collection Timing . HFSY and NAP SACC Data Collection Timing . Secondary Data Sources . Data Protocol RRA Data NAP SACC and HFSY Data o Sample Retention and Attrition . Addressing Attrition and Treatment of Missing Data Section III: Statistical Analysis of Impacts 35 o Analysis Approach o Unit of Assignment and Analysis o Formation of Matched Groups o Analysis Model . Coding of Variables . Assumptions . Power Analyses Section IV: Findings, Lessons Learned, and Next Steps 40 o Fidelity o Satisfaction with Program Delivery o Media Toolkit . Monthly Trends . General Page Analysis o RRA Effect Sizes o Previous Program Analysis Approaches . -

1999 Annual Report

CORE Metadata, citation and similar papers at core.ac.uk Provided by Diposit Digital de Documents de la UAB Annual Report and Form 20-F 1999 Contents Page Strategy Statement 1 Corporate Highlights 2 Financial Highlights 3 1 Business Review 1999 5 2 Description of Business 23 3 Operating and Financial Review 33 4 Report of the Directors 57 5 Financial Record 77 6 Financial Statements 83 7 Shareholder Information 131 Glossary 141 Cross reference to Form 20-F 142 Index 144 The images used within this Annual Report and Form 20-F are taken from advertising campaigns and websites which promote our brands worldwide. They demonstrate how we communicate the appeal of our brands in a wide range of markets. “Sunkist” is a registered trademark of Sunkist Growers, Inc. This is the Annual Report and Form 20-F of Cadbury Schweppes public limited company for the year ended 2 January 2000. It contains the annual report and accounts in accordance with UK generally accepted accounting principles and regulations and incorporates the annual report on Form 20-F for the Securities and Exchange Commission in the US. A Summary Financial Statement for the year ended 2 January 2000 has been sent to all shareholders who have not elected to receive this Annual Report and Form 20-F. The Annual General Meeting will be held on Thursday, 4 May 2000. The Notice of Meeting, details of the business to be transacted and arrangements for the Meeting are contained in the separate Annual General Meeting booklet sent to all shareholders. The Company undertook a two for one share split in May 1999. -

Atlas De Riesgos Naturales Del Municipio De General Escobedo, N.L.2014

Atlas de Riesgos Naturales de General Escobedo, N.L. 2014 MDT ATLAS DE RIESGOS NATURALES DEL MUNICIPIO DE GENERAL ESCOBEDO, N.L.2014 GGC Fecha 02 de junio 2015 Versión final Número de expediente: DNL/01131/2014 Numero de obra: IA-819021985-N13-2014 General Escobedo, Nuevo León. Gutiérrez Guevara Construcciones, S.A. de C.V. Fray Antonio Margil de Jesús No.236, Col. El Roble, San Nicolás de los Garza, Nuevo León, C.P. 66450, Tel. (81) 80336563, e-mail: [email protected] ESTE PROGRAMA ES DE CARÁCTER PÚBLICO, NO ES PATROCINADO NI PROMOVIDO POR PARTIDO POLÍTICO ALGUNO Y SUS RECURSOS PROVIENEN DE LOS IMPUESTOS QUE PAGAN TODOS LOS CONTRIBUYENTES. ESTA PROHIBIDO EL USO DE ESTE PROGRAMA CON FINES POLÍTICOS, ELECTORALES, DE LUCRO Y OTROS DISTINTOS A LOS ESTABLECIDOS. QUIEN HAGA USO INDEBIDO DE LOS RECURSOS DE ESTE PROGRAMA DEBERÁ SER DENUNCIADO Y SANCIONADO DE ACUERDO CON LA LEY APLICABLE Y ANTE LA AUTORIDAD COMPETENTE. Atlas de Riesgos Naturales del municipio de General Escobedo, Nuevo León 2015 (Informe final) CAPÍTULO I. Introducción y Antecedentes 1.1. Introducción 1.2. Antecedentes 1.3. Objetivo 1.3.1. Objetivos específicos 1.4. Alcances 1.5. Metodología 1.6. Productos finales 1.6.1. Estructurales 1.6.1.1. Falla El Topo 1.6.1.2. Falla Almazán 1.6.2. Pendientes 1.6.2.1. Mapa de peligros en el Cerro del Topo Chico 1.6.2.2. Mapa de riesgos en el Cerro del Topo Chico 1.7. Contenidos del Atlas CAPÍTULO II. Determinación de niveles de análisis y escalas de representación cartográfica 2.1. -

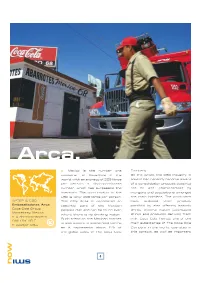

Mexico Is the Number One Consumer of Coca-Cola in the World, with an Average of 225 Litres Per Person

Arca. Mexico is the number one Company. consumer of Coca-Cola in the On the whole, the CSD industry in world, with an average of 225 litres Mexico has recently become aware per person; a disproportionate of a consolidation process destined number which has surpassed the not to end, characterised by inventors. The consumption in the mergers and acquisitions amongst USA is “only” 200 litres per person. the main bottlers. The producers WATER & CSD This fizzy drink is considered an have widened their product Embotelladoras Arca essential part of the Mexican portfolio by also offering isotonic Coca-Cola Group people’s diet and can be found even drinks, mineral water, juice-based Monterrey, Mexico where there is no drinking water. drinks and products deriving from >> 4 shrinkwrappers Such trend on the Mexican market milk. Coca Cola Femsa, one of the SMI LSK 35 F is also evident in economical terms main subsidiaries of The Coca-Cola >> conveyor belts as it represents about 11% of Company in the world, operates in the global sales of The Coca Cola this context, as well as important 4 installation. local bottlers such as ARCA, CIMSA, BEPENSA and TIJUANA. The Coca-Cola Company These businesses, in addition to distributes 4 out of the the products from Atlanta, also 5 top beverage brands in produce their own label beverages. the world: Coca-Cola, Diet SMI has, to date, supplied the Coke, Sprite and Fanta. Coca Cola Group with about 300 During 2007, the company secondary packaging machines, a worked with over 400 brands and over 2,600 different third of which is installed in the beverages. -

Portland Daily Press: July 13,1892

PORTLAND DAILY PRESS. ESTABLISHED JUNE 23, 1862—VOL. 31. PORTLAND, MAINE, WEDNESDAY MORNING, JULY 13, 1892. PRICE THREE CENTS. NEWS. MISCELLANEOUS. THIS MORNING’S bill that was every presented and hunt- ing of Messrs. Craw did O’Donnell, Coon, A TEMPERANCE TALK. ing up some who not care to make ford, Scliuckman and 1. out Clifford, represent- AWAKENED TO DIE. Page any bill, thus proving that he be- ing the Amalgamated Association advi- lieved in with Weather indications. dealing squarely all. To- sory committee and the citizens. Mr. the was Seneral Telegraphic news. day elephant captured and Coon was the spokesman. He stated hitched but when he he a. got ready, again that lie represented the association and Page the started, fastenings being insecure. the citizens. On their part he welcomed Seneral sporting news. Mr. Tells the Senate About the Again he has been found and is Frye enjoying the troops to the town and offered the co Tourists at St. Gervais news. himself in a as he would Crushed Telegraphic swamp in his operation of the citizens i n or- 3. native It is not preserving Page Maine Law. jungle. known what der. Beneath a course he will now pursue but one Glacier. History of the Pinkertons. thing General Snowden said: “I thank yov is has a live Maine towns. sure, Bucksport elephant on Provost Patrol in Place of for the welcome, but do not need its hands. y’oui Heavy warships of today. co-operation, The only way good citizen* can with' us is to Page 4. MR. -

City Wide Wholesale Foods

City Wide Wholesale Foods City Wide Wholesale Foods WWW: http://www.citywidewholesale.com E-mail: [email protected] Phone: 713-862-2530 801 Service St Houston, TX. 77009 Sodas 24/20oz Classic Coke 24/20 Coke Zero 24/20 Cherry Coke 24/20 Vanilla Coke 24/20 Diet Coke 24/20 25.99 25.99 25.99 25.99 25.99 Sprite 24/20 Sprite Zero 24/20 Fanta Orange 24/20 Fanta Strawberry 24/20 Fanta Pineapple 24/20 25.99 25.99 22.99 22.99 22.99 Minute Maid Fruit Punch Minute Maid Pink Lemonade Pibb Xtra 24/20 Barqs Root Beer 24/20 Minute Maid Lemonade 24/20 24/20 24/20 22.99 22.99 22.99 22.99 22.99 Fuze Tea w/Lemon 24/20 Delaware Punch 24/20 Dr Pepper 24/20 Cherry Dr Pepper 24/20 Diet Cherry Dr Pepper 24/20 22.99 25.99 24.99 24.99 24.99 Diet Dr Pepper 24/20 Big Red 24/20 Big Blue 24/20 Big Peach 24/20 Big Pineapple 24/20 24.99 24.99 24.99 24.99 24.99 Sunkist Orange 24/20 Diet Sunkist Orange 24/20 Sunkist Grape 24/20oz Sunkist Strawberry 24/20oz 7-Up 24/20 21.99 21.99 21.99 21.99 21.99 Page 2/72 Sodas 24/20oz Diet 7-Up 24/20 Cherry 7-Up 24/20 Squirt 24/20 Hawaiian Punch 24/20 Tahitian Treat 24/20 21.99 21.99 21.99 21.99 21.99 RC Cola 24/20 Ginger Ale 24/20 A&W Root Beer 24/20 Diet A&W Root Beer 24/20 A&W Cream Soda 24/20 21.99 21.99 21.99 21.99 21.99 Pepsi Cola 24/20 Diet Pepsi 24/20 Lipton Brisk Tea 24/20 Lipton Green Tea 24/20 Manzanita Sol 24/20 23.99 23.99 23.99 23.99 23.99 Sodas 24/12oz Mountain Dew 24/20 Diet Mountain Dew 24/20 Classic Coke 2/12 Coke Zero 2/12 Cherry Coke 2/12 23.99 23.99 9.99 9.99 9.99 Vanilla Coke 2/12 Diet Coke 2/12 Sprite -

Lean Six Sigma Brings Outstanding Customer Service to Coca-Cola Enterprises

BSI Case Study Coca-Cola Enterprises Ltd Lean Six Sigma Lean Six Sigma brings outstanding Customer Service to Coca-Cola Enterprises “Our recent experience Customer objectives Customer benefits of working closely with • Boost consumer and customer • Climbed 39 places in “UK top BSI to deliver bespoke, in- satisfaction 50 Call Centres”, from 47th to company training has been 8th place 2010-2011 excellent. The commitment • To improve employee skills and enthusiasm shown by • Achieved 3rd place for most • To maintain the highest level of the BSI team to understand improved UK Call Centre standards and processes our business and then design • Improved end to end customer the training package was • Ensure the consistent quality experience commendable. The trainers of products were knowledgeable, friendly • A clearer understanding of and they adapted their style process bottlenecks thanks to according to the group. The Lean tools post training support to embed the learning has also been outstanding.” Vikas Joshi, Continuous Improvement Manager, Coca-Cola Enterprises BSI Case Study Coca-Cola Enterprises Ltd Lean Six Sigma Company background Coca-Cola Enterprises, Inc. is the world’s third-largest independent Coca-Cola bottler. Coca-Cola Enterprises is the sole licensed bottler for products of The Coca-Cola Company (TCCC) in Belgium, continental France, Great Britain, Luxembourg, Monaco, the Netherlands, Norway, and Sweden. Coca-Cola Enterprises makes, sells and © BSI Group BSI/UK/321/TR/1113/en/BLD delivers the following products in GB for The Coca-Cola Company (TCCC): Coca-Cola, diet Coke, Coke Zero, Fanta, Dr Pepper, Sprite, Schweppes, Schweppes Abbey Well, glacéau, Relentless, Powerade, Oasis BSI’s role and 5 Alive. -

UC San Diego UC San Diego Electronic Theses and Dissertations

UC San Diego UC San Diego Electronic Theses and Dissertations Title Myth-Making and Mineral Water: Identity, Industry, and Indigeneity in Monterrey, Mexico Permalink https://escholarship.org/uc/item/4mq7s1qv Author Turtletaub, Nancy Ann Publication Date 2018 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California UNIVERSITY OF CALIFORNIA SAN DIEGO Myth-Making and Mineral Water: Identity, Industry, and Indigeneity in Monterrey, Mexico A Thesis submitted in partial satisfaction of the requirements for the degree Master of Arts in Latin American Studies by Nancy Ann Turtletaub Committee in charge: Professor Nancy Postero, Chair Professor Gloria Chacón Professor Matthew Vitz 2018 Copyright Nancy Ann Turtletaub, 2018 All rights reserved. The Thesis of Nancy Ann Turtletaub is approved, and it is acceptable in quality and form for publication on microfilm and electronically: _____________________________________________________________ _____________________________________________________________ _____________________________________________________________ University of California San Diego 2018 iii TABLE OF CONTENTS Signature Page........................................................................................................................... iii Table of Contents....................................................................................................................... iv List of Figures............................................................................................................................