View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

271 Filed 01/06/21 Page 1 of 5

Case 20-13076-BLS Doc 271 Filed 01/06/21 Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, Case No. 20-13076 (BLS) 1 : et al., : : Debtors. Jointly Administered : : Re: D.I. 45, 266 ------------------------------------------------------------ x NOTICE OF POTENTIAL ASSUMPTION AND ASSIGNMENT OF EXECUTORY CONTRACTS OR UNEXPIRED LEASES AND CURE AMOUNTS PLEASE TAKE NOTICE THAT: 1. The above-captioned debtors (collectively, the “Debtors”) each filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Court”) on December 3, 2020. 2. On December 4, 2020, the Debtors filed the Motion of Debtors for Entry of Orders (I)(A) Approving Bidding Procedures for Sale of Substantially All of the Debtors’ Assets, (B) Approving Process for Designation of Stalking Horse Bidder and Provision of Bid Protections, (C) Scheduling Auction for, and Hearing to Approve, Sale of Substantially All of the Debtors’ Assets, (D) Approving Form and Manner of Notices of Sale, Auction and Sale Hearing, (E) Approving Assumption and Assignment Procedures and (F) Granting Related Relief and (II)(A) Approving Sale of Substantially All of the Debtors’ Assets Free and Clear of All Liens, Claims, Interests and Encumbrances, (B) Approving Assumption and Assignment of Executory Contracts and Unexpired Leases -

Brookfield Properties' Retail Group Overview

Retail Overview Brookfield Properties’ Retail Group Overview We are Great Gathering Places. We embrace our cultural core values of Humility, Attitude, Do The Right Thing, H Together and Own It. HUMILITY Brookfield Properties’ retail group is a company focused A ATTITUDE exclusively on managing, leasing, and redeveloping high- quality retail properties throughout the United States. D DO THE RIGHT THING T TOGETHER O HEADQUARTERS CHICAGO OWN IT RETAIL PROPERTIES 160+ STATES 42 INLINE & FREESTANDING GLA 68 MILLION SQ FT TOTAL RETAIL GLA 145 MILLION SQ FT PROFORMA EQUITY MARKET CAP $20 BILLION PROFORMA ENTERPRISE VALUE $40 BILLION Portfolio Map 2 7 1 4 3 5 3 6 2 1 2 1 1 2 1 3 3 3 1 1 2 4 1 2 1 3 2 1 1 10 4 2 5 1 4 10 2 3 3 1 48 91 6 5 6 2 7 6 4 5 11 7 4 1 1 1 2 2 2 5 7 1 2 1 2 1 1 1 1 6 1 3 5 3 4 15 19 2 14 11 1 1 3 2 1 2 1 1 3 6 2 1 3 4 18 2 17 3 1 2 1 3 2 2 5 3 6 8 2 1 12 9 7 5 1 4 3 1 2 1 2 16 3 4 13 3 1 2 6 1 7 9 1 10 5 4 2 1 4 6 11 5 3 6 2 Portfolio Properties 1 2 3 3 3 1 7 4 Offices 13 12 2 Atlanta, GA 7 3 1 1 Chicago, IL Baltimore, MD 8 5 2 Dallas, TX 4 Los Angeles, CA 6 New York, NY 8 2 9 5 Property Listings by State ALABAMA 7 The Oaks Mall • Gainesville 3 The Mall in Columbia • Columbia (Baltimore) 9 Brookfield Place • Manhattan WASHINGTON 8 Pembroke Lakes Mall • Pembroke Pines 4 Mondawmin Mall • Baltimore 10 Manhattan West • Manhattan 1 Riverchase Galleria • Hoover (Birmingham) 1 Alderwood • Lynnwood (Seattle) 5 Towson Town Center • Towson (Baltimore) 11 Staten Island Mall • Staten Island 2 The Shoppes at Bel Air • Mobile (Fort Lauderdale) -

Jonesboro Redevelopment Resources Guide

Redevelopment Resources Guide September, 2019 This guide is designed to facilitate developers and businesses in the redevelopment of blighted buildings in Jonesboro, and other high priority real estate development. A separate Resources Guide for manufacturing, distribution, and technology service businesses is available. Contact Jonesboro Unlimited, www.jonesborounlimited.com or 870-336-9080. Table of Contents Contacts 3 Jonesboro Economy Mike Downing CEcD, Chief of Staff, City of Jonesboro 6 Demographics 870-336-7207, [email protected] Services: Opportunity Zones; Partnerships with area developers; Tax issues; Demographics. 8 Developer Resources: Local developers, realtors, banks, CPAs, Derrel Smith, Planning Director, City of Jonesboro attorneys. 870-932-0406, [email protected] Services: Permits and zoning procedures/process. 10 Development Process in Jonesboro Jonathan Smith, Director, City of Jonesboro Land 11 Property Clean-up Bank 870-336-7180, [email protected] Services: Land bank and city-owned properties. 12 Incentives and Financing Kevan Inboden, Special Projects Administrator 19 State and Local Taxes Jonesboro City Water and Light (870) 930-3325, [email protected] 20 Utilities, Airports Services: Utility service assistance. 21 Boards and Commissions Lindsay Wingo, Executive Director Downtown Jonesboro Association (870) 919-6176, [email protected] 22 Maps Services: Available properties in downtown; Downtown events and promotional activities. 2 Jonesboro’s Strong and Growing Economy The population of the City of Jonesboro for 2018 is 76,789, compared to 67,263 in 2010 for an annual growth rate of 1.8%. US growth rate during that period was 0.7%. Craighead County has grown from 96,443 in 2010 to 110,082 in 2018. -

FRANCESCA's HOLDINGS CORPORATION, Et Al.,1

Case 20-13076-BLS Doc 351 Filed 01/18/21 Page 1 of 14 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: Chapter 11 Case No. 20-13076 (BLS) FRANCESCA’S HOLDINGS CORPORATION, et (Jointly Administered) al.,1 Debtors. Obj. Deadline: Jan. 18, 2021 @ 5:00 p.m. Sale Hearing: Jan. 21, 2021 @ 11:00 a.m. Re: Docket Nos. 45, 262, 266, 271 and 295 LIMITED OBJECTION OF BROOKFIELD PROPERTIES RETAIL, INC., HINES GLOBAL REIT, JONES LANG LASALLE AMERICAS, INC., QIC PROPERTIES US, INC., REGENCY CENTERS L.P., TANGER FACTORY OUTLET CENTERS, INC., TEACHER’S INSURANCE AND ANNUITY ASSOCIATION OF AMERICA, TURNBERRY ASSOCIATES AND THE WOODMONT COMPANY TO CURE AMOUNTS, INCLUDING STUB RENT AMOUNTS, AND PROPOSED ASSUMPTION AND ASSIGNMENT OF LEASES Brookfield Properties Retail, Inc., Hines Global REIT, Jones Lang Lasalle Americas, Inc., QIC Properties US, Inc., Regency Centers L.P., Tanger Factory Outlet Centers, Inc., Teacher’s Insurance and Annuity Association of America, Turnberry Associates and The Woodmont Company (collectively, the “Landlords”) submit this limited objection (the “Objection”) to the potential assumption and assignment of their Leases (as defined below) by the above-captioned debtors (the “Debtors”). In support of this Objection, the Landlords respectfully state as follows: PRELIMINARY STATEMENT 1. The Landlords do not object to the assumption and assignment of the Leases to a qualified operator per se, but file this limited Objection to address two key issues: cure amounts must include all amounts due and owing under the Leases, and the Debtors must 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Francesca’s Holdings Corporation (4704), Francesca’s LLC (2500), Francesca’s Collections, Inc. -

613 W Nettleton Ave. Jonesboro, AR 72401

613 W Nettleton Ave. Jonesboro, AR 72401 Property Offering NNN Gas Station For Sale (Business is not for sale, building only.) 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Executive Summary Location Highlights: • 613 W. Nettleton Ave. Jonesboro, AR 72401 • High Traffic Count • Corner lot with Traffic Signal Intersection • Frontage on Nettleton Avenue and Flint Street • NNN Gas Station For Sale (Business is not for sale, building only.) 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Jonesboro Labor Data 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Jonesboro Labor Data 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Cost of Living Index 2015 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Trade Area 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Map 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Traffic Count Report 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Retail Trade Area Population 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Demographics and Income 2704 S. Culberhouse, Suite A –Jonesboro, Arkansas- 870-919-7995 Moin J Kazi Mall at Turtle Creek in Jonesboro The Mall at Turtle Creek is an enclosed shopping mall located in Jonesboro, Arkansas, United States. -

IN the UNITED STATES BANKRUPTCY COURT for the DISTRICT of DELAWARE ------X in Re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, : Case No

Case 20-13076-BLS Doc 493 Filed 02/24/21 Page 1 of 4 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x In re: : Chapter 11 : FRANCESCA’S HOLDINGS CORPORATION, : Case No. 20-13076 (BLS) et al.,1 : Debtors. : Jointly Administered : : Re: D.I. 384 ------------------------------------------------------------ x NOTICE OF BUYER’S DESIGNATION OF EXECUTORY CONTRACTS AND UNEXPIRED LEASES AS ASSUMED CONTRACTS, RETAINED CONTRACTS, AND REJECTED CONTRACTS AS OF CLOSING DATE OF SALE OF SUBSTANTIALLY ALL OF THE DEBTORS’ ASSETS PLEASE TAKE NOTICE that, on January 22, 2021, the United States Bankruptcy Court for the District of Delaware entered the Order (A) Approving the Purchase Agreement; (B) Authorizing the Sale of Substantially All of the Debtors’ Assets Free and Clear of All Liens, Claims, Encumbrances and Interests; (C) Authorizing the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases; and (D) Granting Related Relief [D.I. 384] (the “Sale Order”),2 which, among other things, authorized Francesca’s Holdings Corporation and its affiliated debtors and debtors in possession (collectively, the “Debtors”) to consummate the Sale to Buyer pursuant to the terms of the Purchase Agreement. PLEASE TAKE FURTHER NOTICE that the closing of the transactions contemplated by the Purchase Agreement occurred on January 30, 2021 (the “Closing”). 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Francesca’s Holdings Corporation (4704), Francesca’s LLC (2500), Francesca’s Collections, Inc. (4665), and Francesca’s Services Corporation (5988). The address of the Debtors’ corporate headquarters is 8760 Clay Road, Houston, Texas 77080. -

Biggest Deals of 2012

Biggest Deals of 2012 Announced transactions valued or believed to be valued at $9 million or more, ranked by value (in millions) Buyer Seller Month City City Price Description Announced ABB Ltd. Thomas & Betts Corp. $3,900.0 Purchase by Swiss power and technology group ABB, which bought Baldor January Zurich Memphis Electric Co. of Fort Smith in 2010, of Thomas & Betts, maker of electrical 1 products. Baxter International Inc. Gambro AB $2,760.0 Purchase by drug and medical device manufacturer Baxter International of December Deerfield, IL Lund, Sweden Gambro, which makes dialysis products. Baxter has a manufacturing facility 2 in Mountain Home. Murphy Oil Corp. $1,500.0 Sale of bonds to help fund a special dividend and share buyback. November 3 El Dorado Southwestern Energy Co. $1,100.0 Investment in Fayetteville Shale Play. February 4 Houston Walgreen Co. Stephen L. Lafrance Holdings, Inc. $438.0 Purchase of regional chain that includes 144 drugstores operated under the July Deerfield, IL Pine Bluff USA Drug, Super D Drug, May's Drug, Med-X and Drug Warehouse stores in 5 Arkansas, Kansas, Mississippi, Missouri, New Jersey, Oklahoma and Tennessee. Stephens Inc. and others Knight Capital Group Inc. $400.0 Participation (with the Jefferies Group, Blackstone, Getco, Stifel Nicolaus August Little Rock Jersey City, NJ and TD Ameritrade) in the $400 million purchase of a 73 percent interest in 6 a trading firm whose computer software error led to stock market confusion that cost the firm $440 million. Middleby Corp. Viking Range Corp. $380.0 Purchase of Viking Range, a maker of ovens and other kitchen equipment, December Elgin, IL Greenwood, MS whose shareholders were affiliated with Stephens Inc. -

Engineering Better Outcomes

Synovus Bank Headquarters, Columbus, Georgia Crawford, McWilliams, Hatcher Architects, Inc. STRUCTURAL DESIGN GROUP Engineering Better Outcomes 700 CENTURY PARK SOUTH, SUITE 114 • BIRMINGHAM, ALABAMA • 35226 PHONE: 205-824-5200 FAX: 205-824-5280 BACKGROUND Structural Design Group (SDG) Engineers are leading professionals in many areas of concrete design including post-tensioned concrete, long span concrete structures, and advanced analysis of shell and arch concrete structures. SDG has Engineers who serve on several national code-setting bodies for concrete design; making SDG a regional leader in state-of-the-art concrete design. In fact within the last 17 years, the majority of two-way post-tensioned slab projects in Alabama were designed by current SDG employees. Vestavia Hills City Center, Birmingham, Alabama We have expertise in areas such as: post-tensioned Williams Blackstock Architects slabs on grade, nationally recognized expertise in tilt- up concrete, and extensive experience with industrial floor slabs. We have substantial experience with all types of parking decks totaling over 15,000 parking spaces and including cast-in-place and precast construction. We also have experience designing cost-effective, quality steel parking structures. SDG Engineers have experience designing multi-level buildings of fifteen or more floors. We provide experience with projects involving progressive collapse or anti Pilot Medical Park Building 100, Birmingham, AL -terrorist requirements, Williams Blackstock Architects including government projects using the latest DoD, UPC, or, GSA requirements. Structural Design Group has completed more than 2,300 projects in the last ten years. EXPERIENCED SENIOR STAFF Stewart Lee, P.E., 26 Years Mike Jones, P.E., 20 Years Craig Winn, P.E., 17 Years Michael Davis, P.E., 13 Years Jason Partain, P.E. -

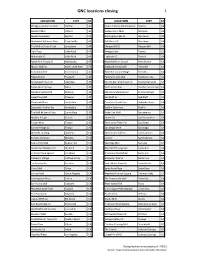

GNC Locations Closing 1

GNC locations closing 1 LOCATION CITY ST LOCATION CITY ST Wiregrass Commons Mall Dothan AL Shops at Dunes On Monterey Marina CA Quintard Mall Oxford AL Vintage Faire Mall Modesto CA Benton Commons Benton AR Huntington Oaks SC Monrovia CA Northwest Arkansas Plaza Fayetteville AR Del Monte SC Monterey CA The Mall at Turtle Creek Jonesboro AR Morgan Hill SC Morgan Hill CA Park Plaza Little Rock AR Vintage Oaks Novato CA Mabelvale SC Little Rock AR Esplande SC Oxnard CA North Park Village SC Monticello AR Westfield Palm Desert Palm Desert CA Mccain Mall SC North Little Rock AR Antelope Valley Mall Palmdale CA Cottonwood SC Cottonwood AZ Town & Country Village Palo Alto CA Flagstaff Mall Flagstaff AZ Panorama City Mall Panorama City CA Arrowhead Town Ctr Glendale AZ Rancho Bernardo Town Ctr Rancho Bernardo CA Superstition Springs Mesa AZ Victoria Gardens Rancho Cucamonga CA Paradise Valley Mall Phoenix AZ Monterey Marketplace Rancho Mirage CA Desert Sky Mall Phoenix AZ Red Bluff SC Red Bluff CA Grayhawk Plaza Scottsdale AZ Galleria at South Bay Redondo Beach CA Scottsdale Fashion Sq Scottsdale AZ Rocklin Commons Rocklin CA The Mall @ Sierra Vista Sierra Vista AZ Arden Fair Mall Sacramento CA Madera Village Tucson AZ Inland Ctr San Bernardino CA Tucson Mall Tucson AZ Tierrasanta Town Ctr San Diego CA Sunrise Village SC Tucson AZ San Diego Mcrd San Diego CA Alameda Landing Alameda CA Stonestown Galleria San Francisco CA Brawley Gateway Brawley CA City Ctr San Francisco CA Buena Park Mall Buena Park CA Eastridge Mall San Jose CA Rancho Marketplace -

Downtown Jonesboro Pedestrian / Bicycle Safety Study

City of Jonesboro, Arkansas Downtown Jonesboro Pedestrian / Bicycle Safety Study Improving mobility for pedestrian and bicyclist while maintaining the current function of vehicular traffic. LANDSCAPE ARCHITECTURE ARCHITECTURE ENGINEERING PLANNING WWW.LOSEASSOC.COM People Cyclists Vehicles THIS PAGE LEFT INTENTIONALLY BLANK. Acknowledgements The Lose & Associates, Inc. and RPM Transportation Consultants, LLC. research and design team would like to thank all the elected officials, board members, commissioners, Arkansas State Highway & Transportation Department, North Jonesboro Neighborhood Initiative (NJNI), Jonesboro staff and citizens who participated in the development of this plan. Through your commitment and dedication to the City of Jonesboro, we were able to develop this plan to guide the delivery of recreation services to the citizens of the City of Jonesboro, Arkansas Special thanks to: Honorable Mayor Harold Perrin Jonesboro MPO Policy Committee Jonesboro City Engineering Department Council Member John Street Chief Engineer: Craig Light, P.E. Mayor Darrell Kirby Staff Members: Mayor Kenneth Jones Michael Morris Mayor Harold Perrin Josh Bettis Mayor Dan Shaw Mark Nichols County Judge Ed Hill Tracey Cooper Council Member Ann Williams Roger Gibson Mr. Paul Simms, AHTD Mr. Walter McMillan, AHTD Russel McAllister Rev. Charlene Johnson, JETS Advisory Denise Hester Board Joe McKeel Scott Crisp Jonesboro Metropolitan Planning Adrian Hancock Organization (MPO) Cliff Nash Director: Patrick J.Dennis Assistant MPO Director: Erica Tait Arkansas -

CARAWAY PLAZA 1221 S Caraway Rd., Jonesboro, AR 72401

CARAWAY PLAZA 1221 S Caraway Rd., Jonesboro, AR 72401 Gross Leasable Area 161,538 SF Current Occupancy 97.5% Year Built/Renovated 1969/2002/2018 13,000 Additional SF Approved for Outparcel Tenants CARAWAY PLAZA 1221 S Caraway Rd., Jonesboro, AR 72401 LIST PRICE: $22,900,000 NET OPERATING INCOME: $1,694,788 CAP RATE: 7.4% INCOME CURRENT PROFORMA CASH FLOW AVERAGE Base Rent $1,721,375 $1,767,251 Vacant Rent $60,000 Percentage Rent $30,447 $30,447 Gross Leasable Area 161,538 SF Expense Reimbursements $212,584 $218,126 Year Built/Renovated 1969/2002/2018 Vacancy Factor ($48,000) ($0) Effective Gross Income $1,962,281 $2,015,823 Lot Size 18.00 AC Total Expenses $267,493 $267,493 Current Occupancy 97.5% www.HalseyThrasherHarpole.com | O: 870.972.9191 | F: 870.972.9220 | 301 West Washington Avenue, Suite 200 | Jonesboro, Arkansas 72401 CARAWAY PLAZA 1221 S Caraway Rd., Jonesboro, AR 72401 ABOUT THE LOCATION Caraway Plaza has established itself as the premier open-air shopping center in the entire Northeast Arkansas region; boasting the largest assemblage of national retail tenants outside The Mall at Turtle Creek. It is located at the highly trafficked intersection of South Caraway Road and Nettleton Avenue (42,000 vehicles per day). Anchor tenants include TJ Max, Old Navy, Natural Grocers, Petco, Rackroom Shoes and Five Below. Each unit is equipped with ample parking, great visibility and high exposure. Caraway Road has recently reemerged in the Jonesboro market with tremendous growth since the relocation of Kroger Marketplace, and the addition of Burlington and Planet Fitness. -

FIELD GUIDE About Us

BROOKFIELD PROPERTIES FIELD GUIDE About us Brookfield Properties ranks among the strategic and operational guidance largest retail real estate companies in to retail start-ups, emerging brands, the United States. Our retail group’s and Fortune 500 companies in need extensive portfolio of mall properties of curated direction while leasing spans the nation, encompassing retail space. We understand the 162 locations across 42 states and key challenges that brands face in representing over 146 million square shopping centers and can help craft feet of retail space. We’re focused a clear roadmap for growth. As exclusively on managing, leasing, vested and long-term partners, we and redeveloping high-quality offer unparalleled insight along retail properties. the path toward accelerated and sustained value creation in our Our retail group’s Retail Development shopping centers. team is responsible for providing HEADQUARTERS CHICAGO Retail Properties 162 States 42 Inline & Freestanding GLA 56 million Total Retail GLA 120 million Properties in the Top 20 DMA’s 47 Our Specialties • Mobile Boutiques • Flagship Locations • Microstores • Pop-Up Shops • Experiential Events • Concept Stores / Retail Labs • Shoppable Walls Why brick and mortar? Curation is key Brookfield Properties owns over 98 Our Retail Development team The marketplace of the future will feature the right tenants to foster face-to-face million square feet of high-quality is capable of assisting all kinds of interactions via compelling shopping, dining, and entertainment experiences. retail real estate in the United States. retailers—from emerging brands We’ve carefully curated our portfolio to established companies—build FOOD & BEVERAGE PERSONAL CARE HOME FURNISHINGS of properties, exclusively owning A or renew their brick and mortar and B malls.