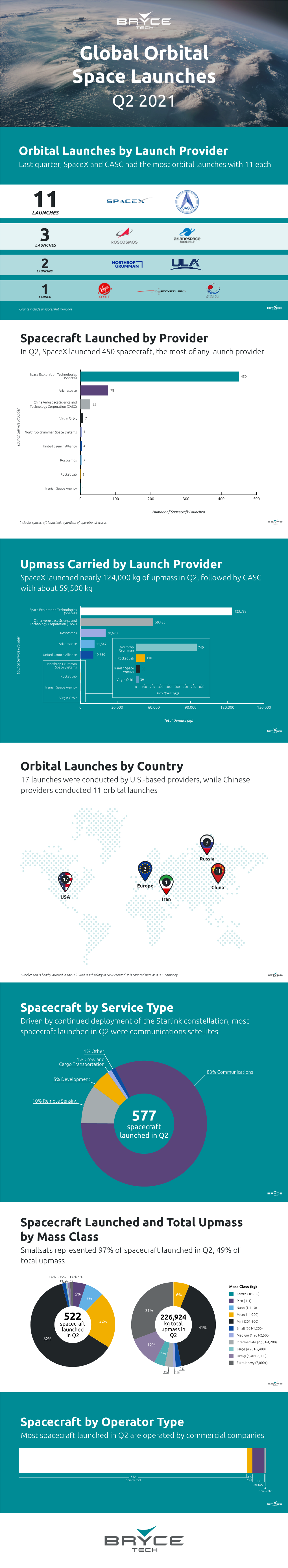

Global Orbital Space Launches Q2 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Russia's Posture in Space

Russia’s Posture in Space: Prospects for Europe Executive Summary Prepared by the European Space Policy Institute Marco ALIBERTI Ksenia LISITSYNA May 2018 Table of Contents Background and Research Objectives ........................................................................................ 1 Domestic Developments in Russia’s Space Programme ............................................................ 2 Russia’s International Space Posture ......................................................................................... 4 Prospects for Europe .................................................................................................................. 5 Background and Research Objectives For the 50th anniversary of the launch of Sputnik-1, in 2007, the rebirth of Russian space activities appeared well on its way. After the decade-long crisis of the 1990s, the country’s political leadership guided by President Putin gave new impetus to the development of national space activities and put the sector back among the top priorities of Moscow’s domestic and foreign policy agenda. Supported by the progressive recovery of Russia’s economy, renewed political stability, and an improving external environment, Russia re-asserted strong ambitions and the resolve to regain its original position on the international scene. Towards this, several major space programmes were adopted, including the Federal Space Programme 2006-2015, the Federal Target Programme on the development of Russian cosmodromes, and the Federal Target Programme on the redeployment of GLONASS. This renewed commitment to the development of space activities was duly reflected in a sharp increase in the country’s launch rate and space budget throughout the decade. Thanks to the funds made available by flourishing energy exports, Russia’s space expenditure continued to grow even in the midst of the global financial crisis. Besides new programmes and increased funding, the spectrum of activities was also widened to encompass a new focus on space applications and commercial products. -

REASONS to MIND ASTEROIDS with the Rapid Progress Made In

ASTEROID MINING & ITS LEGAL IMPLICATIONS Neil Modi & Devanshu Ganatra Presentation ID- IAC- 16.E7.IP.23.x32357 REASONS TO MINE ASTEROIDS With the rapid progress made in technology, humans are taking huge steps in space today. There is huge potential in space, and particularly in asteroid mining. ENERGY CRISIS RARE EARTH METALS • Non-renewable fossil fuels like coal, oil currently account for 81% of • Many of the metals widely used in almost all industrial products the world’s primary energy. were always limited and are now in SHORT SUPPLY leading to skyrocketing manufacturing costs. • EARLIER, renewable energy could not compete with non-renewable sources because it relied on metals in short supply. Resources found • These include Platinum Group Metals (PMGS) and others like on asteroids would solve this problem completely. gold, cobalt, iron, molybdenum etc. Image Credit-The U.S. Energy Image Credit- FuelSpace.org- ‘How Asteroids Can Information Administration Save Mankind’ PROJECTED SCARCITY OF RESOURCES ON EARTH Image Credit-Shackleton Energy Company Image Credit- Chris Clugston’s ‘An Oil Drum- An Analysis’ (2010) THE NEED FOR WATER 1. SUPPORT SYSTEM FOR ASTRONAUTS- Since the main constituents of water HYDRATION AND OXYGEN are hydrogen and oxygen, it is a source of oxygen for life support. TO ASTRONAUTS 2. PROTECTION FROM RADIATION- Water absorbs and blocks infrared radiation, which means that by storing heat it helps to maintain temperature. 3. ROCKET FUEL- Rocket propellant is hydrogen and oxygen based, with a large percentage of the weight of a spacecraft taken up by fuel. 4. SPACE EXPLORATION- A GAS STATION IN SPACE KEY TO SPACE BLOCKS EXPLORATION WATER RADIATION Today billions of dollars are spent in rocket fuel to sustain space explorations. -

2008 Estes-Cox Corp. All Rights Reserved

Estes-Cox Corp. 1295 H Street, P.O. BOX 227 Patent Pending Penrose, CO 81240-0227 ©2008 Estes-Cox Corp. All rights reserved. (9-08) PN 2927-8 TABLE OF CONTENTS HOW DO I START MY OWN ESTES ROCKET FLEET? The best way to begin model rocketry is with an Estes flying model rocket Starter Set or Launch Set. You can ® Index . .2 Skill Level 2 Rocket Kits . .30 either start with a Ready To Fly Starter Set or Launch Set that has a fully constructed model rocket or an E2X How To Start . .3 Skill Level 3 Rocket Kits . .34 Starter Set or Launch Set with a rocket that requires assembly prior to launching. Both types of sets come What to Know . .4 ‘E’ Engine Powered Kits . .36 complete with an electrical launch controller, adjustable launch pad and an information booklet to get you out Model Rocket Safety Code . .5 Blurzz™ Rocket Racers . .36 and flying in no time. Starter Sets include engines, Launch Sets let you choose your own engines (not includ- Ready To Fly Starter Sets . .6 How Model Rocket Engines Work . .38 ed). You’ll need four ‘AA’ alkaline batteries and perhaps glue, depending on which set you select. E2X® Starter Sets . .8 Model Rocket Engine Chart . .39 Ready to Fly Launch Sets . .10 Engine Time/Thrust Curves . .40 Launch Sets . .12 Model Rocket Accessories . .41 HOW EASY AND HOW MUCH TIME DOES IT TAKE TO BUILD MY ROCKETS? Ready To Fly Rockets . .14 Estes R/C Airplanes . .42 ® E2X Rocket Kits . .16 Estes Educator™ Products . -

IT's a Little Chile up Here

IT’s A Little chile up here Press Kit | NET 29 July 2021 LAUNCH INFORMATION LAUNCH WINDOW ORBIT 12-day launch window opening from 29 July 2021 600km DAILY LAUNCH OPPORTUNITY The launch timing for this mission is the same for each day of the launch window. SATELLITES Time Zone Window Open Window Close NZT 18:00 20:00 UTC 06:00 08:00 1 EDT 02:00 04:00 PDT 23:00 01:00 The launch window extends for 12 days. INCLINATION 37 Degrees LAUNCH SITE Launch Complex 1, Mahia, New Zealand CUSTOMER LIVE STREAM Watch the live launch webcast: USSF rocketlabusa.com/live-stream Dedicated mission for U.S. Space Force 2 | Rocket Lab | Press Kit: It’s A Little Chile Up Here Mission OVERVIEW About ‘It’s a Little Chile Up Here’ Electron will launch a research and development satellite to low Earth orbit from Launch Complex 1 in New Zealand for the United States Space Force COMPLEX 1 LAUNCH MAHIA, NEW ZEALAND Electron will deploy an Air Force Research Laboratory- sponsored demonstration satellite called Monolith. ‘It’s a Little Chile Up Here’ The satellite will explore and demonstrate the use of a deployable sensor, where the sensor’s mass is a will be Rocket Lab’s: substantial fraction of the total mass of the spacecraft, changing the spacecraft’s dynamic properties and testing ability to maintain spacecraft attitude control. Analysis from the use of a deployable sensor aims to th st enable the use of smaller satellite buses when building 4 21 future deployable sensors such as weather satellites, launch for Electron launch thereby reducing the cost, complexity, and development timelines. -

Global Exploration Roadmap

The Global Exploration Roadmap January 2018 What is New in The Global Exploration Roadmap? This new edition of the Global Exploration robotic space exploration. Refinements in important role in sustainable human space Roadmap reaffirms the interest of 14 space this edition include: exploration. Initially, it supports human and agencies to expand human presence into the robotic lunar exploration in a manner which Solar System, with the surface of Mars as • A summary of the benefits stemming from creates opportunities for multiple sectors to a common driving goal. It reflects a coordi- space exploration. Numerous benefits will advance key goals. nated international effort to prepare for space come from this exciting endeavour. It is • The recognition of the growing private exploration missions beginning with the Inter- important that mission objectives reflect this sector interest in space exploration. national Space Station (ISS) and continuing priority when planning exploration missions. Interest from the private sector is already to the lunar vicinity, the lunar surface, then • The important role of science and knowl- transforming the future of low Earth orbit, on to Mars. The expanded group of agencies edge gain. Open interaction with the creating new opportunities as space agen- demonstrates the growing interest in space international science community helped cies look to expand human presence into exploration and the importance of coopera- identify specific scientific opportunities the Solar System. Growing capability and tion to realise individual and common goals created by the presence of humans and interest from the private sector indicate and objectives. their infrastructure as they explore the Solar a future for collaboration not only among System. -

Press Release

Rocket Lab, an End-to-End Space Company and Global Leader in Launch, to Become Publicly Traded Through Merger with Vector Acquisition Corporation End-to-end space company with an established track record, uniquely positioned to extend its lead across a launch, space systems and space applications market forecast to grow to $1.4 trillion by 2030 One of only two U.S. commercial companies delivering regular access to orbit: 97 satellites deployed for governments and private companies across 16 missions Second most frequently launched U.S. orbital rocket, with proven Photon spacecraft platform already operating on orbit and missions booked to the Moon, Mars and Venus Transaction will provide capital to fund development of reusable Neutron launch vehicle with an 8-ton payload lift capacity tailored for mega constellations, deep space missions and human spaceflight Proceeds also expected to fund organic and inorganic growth in the space systems market and support expansion into space applications enabling Rocket Lab to deliver data and services from space Business combination values Rocket Lab at an implied pro forma enterprise value of $4.1 billion. Pro forma cash balance of the combined company of approximately $750 million at close Rocket Lab forecasts that it will generate positive adjusted EBITDA in 2023, positive cash flows in 2024 and more than $1 billion in revenue in 2026 Group of top-tier institutional investors have committed to participate in the transaction through a significantly oversubscribed PIPE of approximately $470 million, with 39 total investors including Vector Capital, BlackRock and Neuberger Berman Transaction is expected to close in Q2 2021, upon which Rocket Lab will be publicly listed on the Nasdaq under the ticker RKLB Current Rocket Lab shareholders will own 82% of the pro forma equity of combined company Long Beach, California – 1 March 2021 – Rocket Lab USA, Inc. -

2019 Nano/Microsatellite Market Forecast, 9Th Edition

2019 NANO/MICROSATELLITE MARKET FORECAST, 9TH EDITION Copyright 2018, SpaceWorks Enterprises, Inc. (SEI) APPROVED FOR PUBLIC RELEASE. SPACEWORKS ENTERPRISES, INC., COPYRIGHT 2018. 1 Since 2008, SpaceWorks has actively monitored companies and economic activity across both the satellite and launch sectors 0 - 50 kg 50 - 250kg 250 - 1000kg 1000 - 2000kg 2000kg+ Custom market assessments are available for all mass classes NANO/MICROSATELLITE DEFINITION Picosatellite Nanosatellite Microsatellite Small/Medium Satellite (0.1 – 0.99 kg) (1 – 10 kg) (10 – 100 kg) (100 – 1000 kg) 0 kg 1 kg 10 kg 100 kg 1000 kg This report bounds the upper range of interest in microsatellites at 50 kg given the relatively large amount of satellite development activity in the 1 – 50 kg range FORECASTING METHODOLOGY SpaceWorks’ proprietary Launch Demand Database (LDDB) Downstream serves as the data source for all satellite market Demand assessments ▪ Planned The LDDB is a catalogue of over 10,000+ historical and Constellations future satellites containing both public and non-public (LDDB) satellite programs Launch Supply SpaceWorks newly updated Probabilistic Forecast Model (PFM) is used to generate future market potential SpaceWorks PFM Model ▪ The PFM considers down-stream demand, announced/planed satellite constellations, and supply-side dynamics, among other relevant factors Expert Analysis The team of expert industry analysts at SpaceWorks SpaceWorks further interprets and refines the PFM results to create Forecast accurate market forecasts Methodology at a Glance 2018 SpaceWorks forecasted 2018 nano/microsatellite launches with unprecedented accuracy – actual satellites launched amounted to just 5% below our analysts’ predictions. In line with SpaceWorks’ expectations, the industry corrected after a record launch year in 2017, sending 20% less nano/microsatellites to orbit than in 2018. -

Human Spaceflight in Social Media: Promoting Space Exploration Through Twitter

Human Spaceflight in Social Media: Promoting Space Exploration Through Twitter Pierre J. Bertrand,1 Savannah L. Niles,2 and Dava J. Newman1,3 turn back now would be to deny our history, our capabilities,’’ said James Michener.1 The aerospace industry has successfully 1 Man-Vehicle Laboratory, Department of Aeronautics and Astro- commercialized Earth applications for space technologies, but nautics; 2Media Lab, Department of Media Arts and Sciences; and 3 human space exploration seems to lack support from both fi- Department of Engineering Systems, Massachusetts Institute of nancial and human public interest perspectives. Space agencies Technology, Cambridge, Massachusetts. no longer enjoy the political support and public enthusiasm that historically drove the human spaceflight programs. If one uses ABSTRACT constant year dollars, the $16B National Aeronautics and While space-based technologies for Earth applications are flourish- Space Administration (NASA) budget dedicated for human ing, space exploration activities suffer from a lack of public aware- spaceflight in the Apollo era has fallen to $7.9B in 2014, of ness as well as decreasing budgets. However, space exploration which 41% is dedicated to operations covering the Internati- benefits are numerous and include significant science, technological onal Space Station (ISS), the Space Launch System (SLS) and development, socioeconomic benefits, education, and leadership Orion, and commercial crew programs.2 The European Space contributions. Recent robotic exploration missions have -

Launcherone Success Opens New Space Access Gateway Guy Norris January 22, 2021

1/22/21 7:05 1/6 LauncherOne Success Opens New Space Access Gateway Guy Norris January 22, 2021 With San Nicolas Island far below, LauncherOne headed for polar orbit. Credit: Virgin Orbit Virgin Orbit had barely tweeted news of the successful Jan. 17 space debut of its LauncherOne vehicle on social media when new launch contracts began arriving in the company’s email inbox. A testament to the pent-up market demand for small-satellite launch capability, the speedy reaction to the long-awaited demonstration of the new space-access vehicle paves the way for multiple follow-on Virgin Orbit missions by year-end and a potential doubling of the rate in 2022. First successful privately developed air-launched, liquid-fueled rocket Payloads deployed for NASA’s Venture Class Launch Services program The glitch-free !ight of LauncherOne on its second demonstration test was a critical and much-welcomed milestone for the Long Beach, California-based company. Coming almost nine years a"er the air-launch concept was #rst unveiled by Virgin founder Richard Branson, and six years a"er the start of full-scale development, the !ight followed last May’s #rst demonstration mission, which ended abruptly when the rocket motor shut o$ a"er just 4 sec. 1/22/21 7:05 2/6 A"er an exhaustive analysis and modi#cations to beef up the oxidizer feed line at the heart of the #rst !ight failure, the path to the Launch Demo 2 test was then delayed until January 2021 by the COVID-19 pandemic. With the LauncherOne system now proven, design changes veri#ed and the #rst 10 small satellites placed in orbit, Virgin Orbit is already focusing on the next steps to ramp up its production and launch-cadence capabilities. -

Les Puissances Spatiales Qui Montent

SOMMAIRE Les puissances spatiales qui montent Par Philippe VOLVERT 1 SOMMAIRE 2 SOMMAIRE Les puissances spatiales qui montent Par Philippe VOLVERT 3 SOMMAIRE SOMMAIRE SOMMAIRE ..................................................................................................................................................... 4 INTRODUCTION ............................................................................................................................................. 5 L’ESPACE AU PAYS DU SOLEIL LEVANT ..................................................................................................... 6 LES AMBITIONS CHINOISES ........................................................................................................................ 14 L’INDEPENDANCE SPATIALE INDIENNE ................................................................................................... 24 L’ESPACE ET LE RESTE DU MONDE ........................................................................................................... 29 LES GRANDES DATES DE L’ASTRONAUTIQUE JAPONAISE .................................................................... 36 LES GRANDES DATES DE L’ASTRONAUTIQUE CHINOISE ....................................................................... 39 LES GRANDES DATES DE L’ASTRONAUTIQUE INDIENNE........................................................................ 41 LES VOLS HABITES ...................................................................................................................................... -

Redalyc.Status and Trends of Smallsats and Their Launch Vehicles

Journal of Aerospace Technology and Management ISSN: 1984-9648 [email protected] Instituto de Aeronáutica e Espaço Brasil Wekerle, Timo; Bezerra Pessoa Filho, José; Vergueiro Loures da Costa, Luís Eduardo; Gonzaga Trabasso, Luís Status and Trends of Smallsats and Their Launch Vehicles — An Up-to-date Review Journal of Aerospace Technology and Management, vol. 9, núm. 3, julio-septiembre, 2017, pp. 269-286 Instituto de Aeronáutica e Espaço São Paulo, Brasil Available in: http://www.redalyc.org/articulo.oa?id=309452133001 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative doi: 10.5028/jatm.v9i3.853 Status and Trends of Smallsats and Their Launch Vehicles — An Up-to-date Review Timo Wekerle1, José Bezerra Pessoa Filho2, Luís Eduardo Vergueiro Loures da Costa1, Luís Gonzaga Trabasso1 ABSTRACT: This paper presents an analysis of the scenario of small satellites and its correspondent launch vehicles. The INTRODUCTION miniaturization of electronics, together with reliability and performance increase as well as reduction of cost, have During the past 30 years, electronic devices have experienced allowed the use of commercials-off-the-shelf in the space industry, fostering the Smallsat use. An analysis of the enormous advancements in terms of performance, reliability and launched Smallsats during the last 20 years is accomplished lower prices. In the mid-80s, a USD 36 million supercomputer and the main factors for the Smallsat (r)evolution, outlined. -

The Annual Compendium of Commercial Space Transportation: 2017

Federal Aviation Administration The Annual Compendium of Commercial Space Transportation: 2017 January 2017 Annual Compendium of Commercial Space Transportation: 2017 i Contents About the FAA Office of Commercial Space Transportation The Federal Aviation Administration’s Office of Commercial Space Transportation (FAA AST) licenses and regulates U.S. commercial space launch and reentry activity, as well as the operation of non-federal launch and reentry sites, as authorized by Executive Order 12465 and Title 51 United States Code, Subtitle V, Chapter 509 (formerly the Commercial Space Launch Act). FAA AST’s mission is to ensure public health and safety and the safety of property while protecting the national security and foreign policy interests of the United States during commercial launch and reentry operations. In addition, FAA AST is directed to encourage, facilitate, and promote commercial space launches and reentries. Additional information concerning commercial space transportation can be found on FAA AST’s website: http://www.faa.gov/go/ast Cover art: Phil Smith, The Tauri Group (2017) Publication produced for FAA AST by The Tauri Group under contract. NOTICE Use of trade names or names of manufacturers in this document does not constitute an official endorsement of such products or manufacturers, either expressed or implied, by the Federal Aviation Administration. ii Annual Compendium of Commercial Space Transportation: 2017 GENERAL CONTENTS Executive Summary 1 Introduction 5 Launch Vehicles 9 Launch and Reentry Sites 21 Payloads 35 2016 Launch Events 39 2017 Annual Commercial Space Transportation Forecast 45 Space Transportation Law and Policy 83 Appendices 89 Orbital Launch Vehicle Fact Sheets 100 iii Contents DETAILED CONTENTS EXECUTIVE SUMMARY .