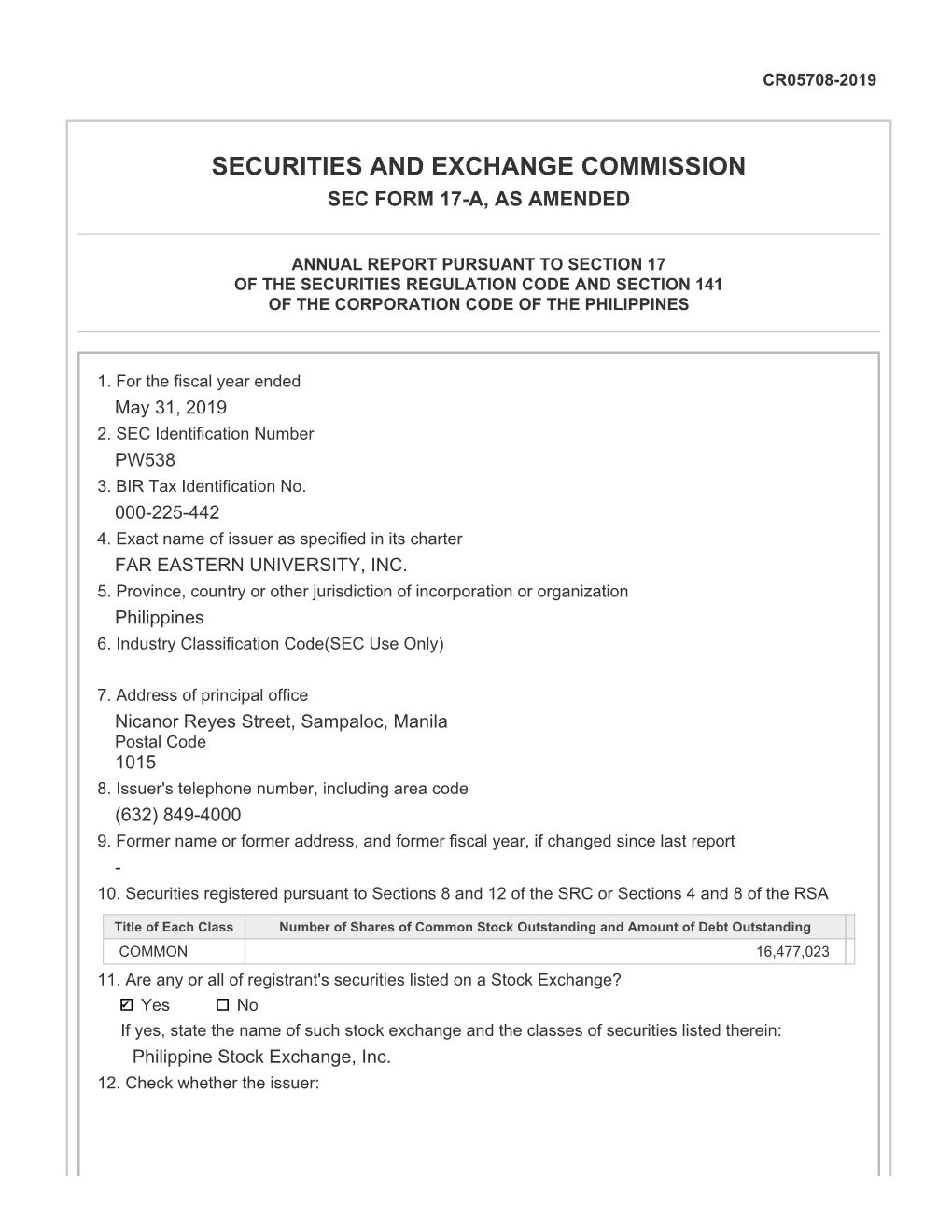

Securities and Exchange Commission Sec Form 17-A, As Amended

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Private Higher Education Institutions Faculty-Student Ratio: AY 2017-18

Table 11. Private Higher Education Institutions Faculty-Student Ratio: AY 2017-18 Number of Number of Faculty/ Region Name of Private Higher Education Institution Students Faculty Student Ratio 01 - Ilocos Region The Adelphi College 434 27 1:16 Malasiqui Agno Valley College 565 29 1:19 Asbury College 401 21 1:19 Asiacareer College Foundation 116 16 1:7 Bacarra Medical Center School of Midwifery 24 10 1:2 CICOSAT Colleges 657 41 1:16 Colegio de Dagupan 4,037 72 1:56 Dagupan Colleges Foundation 72 20 1:4 Data Center College of the Philippines of Laoag City 1,280 47 1:27 Divine Word College of Laoag 1,567 91 1:17 Divine Word College of Urdaneta 40 11 1:4 Divine Word College of Vigan 415 49 1:8 The Great Plebeian College 450 42 1:11 Lorma Colleges 2,337 125 1:19 Luna Colleges 1,755 21 1:84 University of Luzon 4,938 180 1:27 Lyceum Northern Luzon 1,271 52 1:24 Mary Help of Christians College Seminary 45 18 1:3 Northern Christian College 541 59 1:9 Northern Luzon Adventist College 480 49 1:10 Northern Philippines College for Maritime, Science and Technology 1,610 47 1:34 Northwestern University 3,332 152 1:22 Osias Educational Foundation 383 15 1:26 Palaris College 271 27 1:10 Page 1 of 65 Number of Number of Faculty/ Region Name of Private Higher Education Institution Students Faculty Student Ratio Panpacific University North Philippines-Urdaneta City 1,842 56 1:33 Pangasinan Merchant Marine Academy 2,356 25 1:94 Perpetual Help College of Pangasinan 642 40 1:16 Polytechnic College of La union 1,101 46 1:24 Philippine College of Science and Technology 1,745 85 1:21 PIMSAT Colleges-Dagupan 1,511 40 1:38 Saint Columban's College 90 11 1:8 Saint Louis College-City of San Fernando 3,385 132 1:26 Saint Mary's College Sta. -

1 2018 IEEE Republic of Philippines Section Report PART A

2018 IEEE Republic of Philippines Section Report PART A - SECTION SUMMARY A.1 EXECUTIVE SUMMARY IEEE Republic of Philippines Section List of Officers POSITION NAME Chairman Dr. Jennifer Dela Cruz Vice Chair (Awards & Recognition Dr. Argel Bandala Chair) Secretary Dr. Ryan Rhay Vicerra Treasurer (Conference Chair) Dr. Ryan Rhay Vicerra Auditor Dr. Susan Festin Public Relations Officer Engr. Edison Roxas Committee Member – Educational Dr. Rhandley Cajote Activities Chair Committee Member – Membership Engr. Josyl Mariela Rocamora Development Chair Committee Member – Professional Mr. Victor Gruet Activities Chair Committee Member – SIGHT Dr. Nestor Michael Tiglao Chair Committee Member – Student Mr. Neriah “BJ” Ato Activities Chair Committee Member - Newsletter Dr. Argel Bandala Editor Committee Member - Webmaster Dr. Argel Bandala Highlights IEEE Kapihan May 26,2018 IEEE Week 2018 Formation of IEEE YP Affinity Group 1 MEMBERSHIP DEVELOPMENT PROGRAMS IEEE REPUBLIC OF PHILIPPINES SECTION MEMBERSHIP (AS OF JUNE 2018) IEEE Grade Description Active Members (2018) Higher Grade Members 258 Student Members 109 TOTAL 367 IEEE Grade Description Active Members (2017) Higher Grade Members 240 Student Members 96 TOTAL 336 Summary and evidence of work done in the retention of members 6th IEEE Kapihan Dr. Jennifer Dela Cruz, Chair of IEEE PS, discussed the history of Kapihan along with the goals and objectives on why this event is happening. It was held on May 26, 2018 at Mapua University. B.3. Recognized Education Programs 6th IEEE Kapihan Members Gathering: Knowing More About Us May 26, 2018, AV2-AV3 Mapua University, Intramuros PROGRAMME 9:00 – 9:30 AM Registration 9:30 – 9:35 AM Invocation and National Anthem 9:35 – 10:15 AM Welcome and Opening Remarks Introduction of PS Officers 2018 IEEE PS Membership Status Jennifer Dela Cruz, Ph.D IEEE PS Chair, IEEE PS WIE Chair 2 10:15 – 10:30 AM General Data Protection Regulation (GDPR) Overview 10:30 – 11:00 AM Tutorials on Collabratec Engr. -

College Codes (Outside the United States)

COLLEGE CODES (OUTSIDE THE UNITED STATES) ACT CODE COLLEGE NAME COUNTRY 7143 ARGENTINA UNIV OF MANAGEMENT ARGENTINA 7139 NATIONAL UNIVERSITY OF ENTRE RIOS ARGENTINA 6694 NATIONAL UNIVERSITY OF TUCUMAN ARGENTINA 7205 TECHNICAL INST OF BUENOS AIRES ARGENTINA 6673 UNIVERSIDAD DE BELGRANO ARGENTINA 6000 BALLARAT COLLEGE OF ADVANCED EDUCATION AUSTRALIA 7271 BOND UNIVERSITY AUSTRALIA 7122 CENTRAL QUEENSLAND UNIVERSITY AUSTRALIA 7334 CHARLES STURT UNIVERSITY AUSTRALIA 6610 CURTIN UNIVERSITY EXCHANGE PROG AUSTRALIA 6600 CURTIN UNIVERSITY OF TECHNOLOGY AUSTRALIA 7038 DEAKIN UNIVERSITY AUSTRALIA 6863 EDITH COWAN UNIVERSITY AUSTRALIA 7090 GRIFFITH UNIVERSITY AUSTRALIA 6901 LA TROBE UNIVERSITY AUSTRALIA 6001 MACQUARIE UNIVERSITY AUSTRALIA 6497 MELBOURNE COLLEGE OF ADV EDUCATION AUSTRALIA 6832 MONASH UNIVERSITY AUSTRALIA 7281 PERTH INST OF BUSINESS & TECH AUSTRALIA 6002 QUEENSLAND INSTITUTE OF TECH AUSTRALIA 6341 ROYAL MELBOURNE INST TECH EXCHANGE PROG AUSTRALIA 6537 ROYAL MELBOURNE INSTITUTE OF TECHNOLOGY AUSTRALIA 6671 SWINBURNE INSTITUTE OF TECH AUSTRALIA 7296 THE UNIVERSITY OF MELBOURNE AUSTRALIA 7317 UNIV OF MELBOURNE EXCHANGE PROGRAM AUSTRALIA 7287 UNIV OF NEW SO WALES EXCHG PROG AUSTRALIA 6737 UNIV OF QUEENSLAND EXCHANGE PROGRAM AUSTRALIA 6756 UNIV OF SYDNEY EXCHANGE PROGRAM AUSTRALIA 7289 UNIV OF WESTERN AUSTRALIA EXCHG PRO AUSTRALIA 7332 UNIVERSITY OF ADELAIDE AUSTRALIA 7142 UNIVERSITY OF CANBERRA AUSTRALIA 7027 UNIVERSITY OF NEW SOUTH WALES AUSTRALIA 7276 UNIVERSITY OF NEWCASTLE AUSTRALIA 6331 UNIVERSITY OF QUEENSLAND AUSTRALIA 7265 UNIVERSITY -

Securities and Exchange Commission Sec Form 17-A, As Amended

CR05818-2018 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A, AS AMENDED ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE OF THE PHILIPPINES 1. For the fiscal year ended May 31, 2018 2. SEC Identification Number PW538 3. BIR Tax Identification No. 000-225-442 4. Exact name of issuer as specified in its charter FAR EASTERN UNIVERSITY, INC. 5. Province, country or other jurisdiction of incorporation or organization Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office Nicanor Reyes Street, Sampaloc, Manila Postal Code 1015 8. Issuer's telephone number, including area code (632) 849-4000 9. Former name or former address, and former fiscal year, if changed since last report - 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding COMMON 16,477,023 11. Are any or all of registrant's securities listed on a Stock Exchange? Yes No If yes, state the name of such stock exchange and the classes of securities listed therein: Philippine Stock Exchange, Inc. 12. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17.1 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports) Yes No (b) has been subject to such filing requirements for the past ninety (90) days Yes No 13. -

Corazon S. De La Paz- Bernardo

CORAZON S. DE LA PAZ- BERNARDO PROFESSIONAL CAREER . Consultant, Office of the Chairman, Social Security Commission August 1, 2008 to present . President and CEO, Social Security System August 2001 to July 31, 2008 . Vice Chairperson, Social Security Commission August 2001 to July 31, 2008 September 2004 to December . President, International Social Security Association 2010 . Chairman and Senior Partner, Joaquin Cunanan & Company/ July 1, 1981 to June 30, 2001 (PricewaterhouseCoopers – Philippines) . Member of the Board, Price Waterhouse World Firm Limited 1992 to 1995 EDUCATIONAL ATTAINMENT . Master in Business Administration, Cornell University 1965 Fulbright Grantee and University of the East Scholar . Bachelor of Business Administration, University of the East 1960 Magna Cum Laude . Certified Public Accountant 1962 First Place, 1960 Philippine CPA Board Examination . Rizal High School, Class Salutatorian 1956 PROFESSIONAL/OTHER AFFILIATIONS Board Member: . ASEAN Social Security Association 2001 to July 2008 . Philippine Social Security Association 2001 to July 2008 . Ayala Land Inc. 2006 to April 2010 President: . Social Security System 2001 to July 2008 . Cornell Club of the Philippines 1997 to 2001 . Philippine Fulbright Scholars Associations, Inc. 1995 to 2001 . Management Association of the Philippines (MAP) 1994 . Financial Executives Institute of the Philippines (FINEX) 1985 . Philippine Institute of Certified Public Accountants (PICPA) 1978 and 1979 . Association of The Outstanding Women in Nation's Service (TOWNS) 1986 to 1987 Awardees . Rizal High School Alumni Association 1989 and 1990 1 Chairman: . ISSA Committee on Management Review October 2001 to 2004 Appointed during the ISSA General Assembly in Stockholm 1994 . MAP Foundation, Inc. 1990 to 2001 . Committee on US-ASEAN Affairs, Philippine Chamber of Commerce & Industry . -

Community Students • Faculty • Officers • Personnel • Alumni Silangan

Reporting milestones about and for the April-May 2012 UE Vol. 2, No. 2 COMMUNITY Students • Faculty • Officers www.UE.edu.ph • Personnel • Alumni Silangan UE Nutrition-Dietetics Team Wins 1st Prize in National Nutrition Council Recipe Contest A TEAM OF UE NUTRITION and Dietetics students along with The Winning Nutrition Team: their faculty member-coach won (from left) Ms. the 1st Prize in a National Capital G. Maglalang, A. Region-level recipe development Besana, A. Bautista contest recently. and R. A. Gianan Specifically, in line with the celebration of the 38th National Nutrition Month Celebration in July (whose theme is “Pagkain ng Gulay Araw-Araw Itong Ihain”), the National Nutrition Council NCR Regional Office conducted a Regional Recipe Development Contest last April 27 at the San Juan Elementary School Gymnasium. The contest was aimed to develop low-cost, easy-to-prepare and nutritious vegetable dishes. Each recipe should use just five 2nd-year student Rose Ann Gianan, the Mandaluyong City government, other prize-winning concoctions, major ingredients and should be with faculty member Geraldine M. whose “Vegetable with Pineapple in a recipe book for distribution prepared in less than 30 minutes. Maglalang as their coach. The UE Coconut Sauce” was adjudged 3rd to the beneficiaries of the national About 35 recipes were submitted team prepared “Sweet Potato, Tofu Place; and consolation prize-winners government’s Pantawid Pamilya by different schools, universities and Snow Peas in Pineapple Sauce,” Manila Doctors College and Centro program. The recipe book will also and local government units. Recipes which garnered the contest-best Escolar University. -

Coes) and Centers of Development (Cods) As of May 2016

Table 8. List of Centers of Excellence (COEs) and Centers of Development (CODs) as of May 2016 Region Name of Higher Education Institution (HEI) Institutional Type Designation Program NCR - National Capital Region Adamson University Private HEIs COD Chemical Engineering Civil Engineering Computer Engineering Electrical Engineering Electronics Engineering Industrial Engineering Teacher Education AMA University Private HEIs COD Information Technology Asia Pacific College Private HEIs COD Computer Engineering COE Information Technology Ateneo de Manila University Private HEIs COD Communication Electronics Engineering Environmental Science History Literature(Kagawaran ng Filipino) Political Science COE Biology Business Administration Chemistry Entrepreneurship Information Technology Literature (Dept of English) Mathematics Philosophy Physics Psychology Sociology Centro Escolar University Private HEIs COD Business Administration Optometry COE Teacher Education De La Salle College of Saint Benilde Private HEIs COE Business Administration Hotel and Restaurant Management De La Salle University Private HEIs COD Computer Engineering History Literature Political Science Statistics COE Accountancy Biology Business Administration Chemical Engineering Chemistry Civil Engineering Electronics Engineering Entrepreneurship Page 1 of 9 Region Name of Higher Education Institution (HEI) Institutional Type Designation Program Industrial Engineering Information Technology Mathematics Mechanical Engineering Physics Teacher Education Far Eastern University Private -

COVER SHEET for INFORMATION STATEMENT

COVER SHEET for INFORMATION STATEMENT SEC Registration Number A S 0 9 3 0 4 3 6 9 Company Name L O P E Z H O L D I N G S C O R P O R A T I O N Principal Office (No./Street/Barangay/City/Town/Province) 1 6 / F N o r t h T o w e r , R o c k w e l l B u s i n e s s C e n t e r S h 1 e r i d a n , S h e r i d a n c o r n e r U n i t e d S t r e e t s , H i g h w a y H i l l s , M a n d a l u y o n g C i t y Form Type Department requiring the report Secondary License Type, If Applicable 2 0 I S C F D COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number www.lopez-holdings.ph 8878 0000 Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 8,022 August 5, 2021 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Ms. Maria Amina O. Amado [email protected] (02) 88780000 0917-8877138 Contact Person’s Address 16/F North Tower, Rockwell Business Center Sheridan, Sheridan corner United Streets, Highway Hills, Mandaluyong City 1550 Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

View/Download File

WK1$7,21$/&219(17,21 6HQLRU+LJK6FKRRO 6+6 3URJUDP8SGDWH,VVXHVDQG,PSOLFDWLRQVWR7HDFKHU(GXFDWLRQ 3$7()83'$7(+,6725< New challenges and demands brought about by the turn of the 21st Century spurred the birth of the Philippine Association for Teachers of Educational Foundations (PATEF) that would take up the responsibility of updating teachers across levels on emerging trends, theories and devel- opments in the educational landscape supported by a strong research base in the foundational disciplines of education. The organization was conceived by teacher educators, school adminis- trators and basic education teachers who attended the Seminar-Workshop held at the Philippine Normal University on “Theory, Values and Decision-Making: Focus on Foundations of Education in the Constructivist Perspective” on May 12-14, 2003. The participants saw the need to connect the foundation disciplines of Philosophy, Psychology, Guidance and Counseling, Research and Professional Ethics / Values to actual classroom practices so that these can be applied by learn- ers when dealing with varied issues and concerns in the context of diverse beliefs, cultures and practices. PATEF held its first National Convention on January 13, 2004 at the Philippine Normal Univer- sity with the following objectives: •To monitor issues, trends, developments, innovation and researches in the field of Educa- tional Foundations. •To disseminate and share research findings through conventions, seminar-workshops, publi- cations and other professional activities. •To assist members in their personal advancement and professional growth. A major concern during that period was the low performance of the test takers in the Licen- sure Examination for Teachers in the area of Educational Foundations which implies a lack of thorough grasp of the vital educational bases. -

(Coes) and Centers of Development (Cods) IV-A

List of Centers of Excellence (COEs) and Centers of Development (CODs) Region Name of School Designation Course Colegio de Dagupan COD Information Technology Don Mariano Marcos Mem. State University-Main COD Information Technology Don Mariano Marcos Mem. State University-North COD Agriculture Don Mariano Marcos Mem. State University-North COD Teacher Education Don Mariano Marcos Mem. State University-South COD Information Technology Don Mariano Marcos Mem. State University-South COD Teacher Education Lorma Colleges COD Information Technology Mariano Marcos State University-Main COD Agriculture I Mariano Marcos State University-Main COD Biology Mariano Marcos State University-Main COD Forestry Mariano Marcos State University-Main COD Information Technology Mariano Marcos State University-Main COE Teacher Education Pangasinan State University-Bayambang COE Teacher Education Pangasinan State University-Binmaley COE Fisheries St. Louis College COE Teacher Education University of Luzon COD Information Technology University of Luzon COD Teacher Education University of Northern Philippines COD Teacher Education Isabela State University-Cabagan COD Teacher Education Isabela State University-Cauayan COD Information Technology Isabela State University-Main COD Agriculture Isabela State University-Main COD Information Technology Nueva Vizcaya State University COD Agriculture Nueva Vizcaya State University COE Forestry II Philippine Normal University-North Luzon COE Teacher Education St. Mary's University COD Civil Engineering St. Mary's University -

Primer for College Secretaries

1 Introduction The Office of the College Secretary is the official keeper of records, overseer of registration and scholastic evaluation of students at the college level. The Office of the College Secretary serves as the liaison of the college to various offices in the University. It is in constant communication with sections of the Office of the University Registrar such as Admission and Registration Section (ARS), Computerized Registration and Student Records Section (CRSRS), Records Management and Appraisal Section (RMAS), and Publication and University Council Secretariat Section (PUCSS). Among the offices under the Office of the Vice Chancellor for Student Affairs, the Office of the College Secretary coordinates with the Office of Scholarship and Student Services, Office of Student Activities, Office of Counseling and Guidance, and Student Disciplinary Tribunal. Likewise, it coordinates with the Office of Extension Coordination under the Office of the Vice Chancellor for Academic Affairs. In some colleges especially in large colleges (e.g. College of Engineering, College of Science and the College of Social Sciences and Philosophy), the Office of Graduate Studies addresses solely matters related to graduate students from admission to graduation. It performs duties similar to that of the Office of the College Secretary throughout the Academic Year. It is headed by the Graduate Coordinator who is appointed by the Chancellor upon the recommendation of the Dean. University rules governing graduate students can be found in the “General Rules for Graduate Programs in UP Diliman” published by the Office of the Director of Instruction, Office of the Vice Chancellor for Academic Affairs in 1999. Over the years, many rules and regulations related to admission, progress and graduation have been instituted and amended. -

Alumnus Andrew Tan Conferred His First Honorary Degree 'Mega'

MVPs and Rookies of the Year Titles, Too! UE Fencers Earn 3 UAAP 74 Championships Story on page 6 Reporting milestones December 2011- about and for the February 2012 UE Vol. 1, No. 3 CommUNity Students • Faculty • officers www.UE.edu.ph • Personnel • Alumni Dr. Andrew Tan (2nd from right) at the conferment proper last December, flanked by (from left) UE President Ester Garcia, UE Vice Chairman Jaime Bautista and CHED Executive Director Julito Vitriolo ‘Mega’‘Mega’ AlumnusAlumnus AndrewAndrew TanTan ConferredConferred HisHis FirstFirst HonoraryHonorary DegreeDegree BusINEss TYCOON ANDREW L. Alliance Global Group, Inc. (AGI). Airport Terminal 3 in Pasay City. during UE’s Diamond Jubilee. Tan was honored by the University In the field of real estate, Dr. Tan Via Megaworld Foundation, Dr. Avelina A. De La Rea, Dean of the East with the degree of Doctor is best known as the Chairman and Dr. Tan undertakes various socio- of the UE Graduate School, presented of Humanities, Honoris Causa, President of Megaworld Corporation, economic development programs the honoree to the audience while on December 8, 2011, at the PICC one of the country’s foremost and supports projects contributing UE Caloocan Chancellor Zosimo M. Plenary Hall in Pasay City. The 2 residential developers and the name to the empowerment of the less Battad read the Address of Petition for p.m. event coincided with the 13th behind Eastwood City, McKinley privileged in Philippine society. Conferment. UE Manila Chancellor Midyear Commencement Rites of Hill and Newport City, to name Among their programs is the Linda P. Santiago read the Citation, UE Manila and UE Caloocan, and a few.