CBM-DC and CBM-DCL DISCOUNT CONTRACT INSTRUCTIONS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Beijing Subway Map

Beijing Subway Map Ming Tombs North Changping Line Changping Xishankou 十三陵景区 昌平西山口 Changping Beishaowa 昌平 北邵洼 Changping Dongguan 昌平东关 Nanshao南邵 Daoxianghulu Yongfeng Shahe University Park Line 5 稻香湖路 永丰 沙河高教园 Bei'anhe Tiantongyuan North Nanfaxin Shimen Shunyi Line 16 北安河 Tundian Shahe沙河 天通苑北 南法信 石门 顺义 Wenyanglu Yongfeng South Fengbo 温阳路 屯佃 俸伯 Line 15 永丰南 Gonghuacheng Line 8 巩华城 Houshayu后沙峪 Xibeiwang西北旺 Yuzhilu Pingxifu Tiantongyuan 育知路 平西府 天通苑 Zhuxinzhuang Hualikan花梨坎 马连洼 朱辛庄 Malianwa Huilongguan Dongdajie Tiantongyuan South Life Science Park 回龙观东大街 China International Exhibition Center Huilongguan 天通苑南 Nongda'nanlu农大南路 生命科学园 Longze Line 13 Line 14 国展 龙泽 回龙观 Lishuiqiao Sunhe Huoying霍营 立水桥 Shan’gezhuang Terminal 2 Terminal 3 Xi’erqi西二旗 善各庄 孙河 T2航站楼 T3航站楼 Anheqiao North Line 4 Yuxin育新 Lishuiqiao South 安河桥北 Qinghe 立水桥南 Maquanying Beigongmen Yuanmingyuan Park Beiyuan Xiyuan 清河 Xixiaokou西小口 Beiyuanlu North 马泉营 北宫门 西苑 圆明园 South Gate of 北苑 Laiguangying来广营 Zhiwuyuan Shangdi Yongtaizhuang永泰庄 Forest Park 北苑路北 Cuigezhuang 植物园 上地 Lincuiqiao林萃桥 森林公园南门 Datunlu East Xiangshan East Gate of Peking University Qinghuadongluxikou Wangjing West Donghuqu东湖渠 崔各庄 香山 北京大学东门 清华东路西口 Anlilu安立路 大屯路东 Chapeng 望京西 Wan’an 茶棚 Western Suburban Line 万安 Zhongguancun Wudaokou Liudaokou Beishatan Olympic Green Guanzhuang Wangjing Wangjing East 中关村 五道口 六道口 北沙滩 奥林匹克公园 关庄 望京 望京东 Yiheyuanximen Line 15 Huixinxijie Beikou Olympic Sports Center 惠新西街北口 Futong阜通 颐和园西门 Haidian Huangzhuang Zhichunlu 奥体中心 Huixinxijie Nankou Shaoyaoju 海淀黄庄 知春路 惠新西街南口 芍药居 Beitucheng Wangjing South望京南 北土城 -

Job-Worker Spatial Dynamics in Beijing: Insights from Smart Card Data

Published as: Huang, Jie, Levinson, D., Wang, Jiaoe, Jin, Haitao (2019) Job-worker spatial dynamics in Beijing: Insights from Smart Card Data. Cities 86, 89-93 https://doi.org/10.1016/j.cities.2018.11.021 1 Job-worker spatial dynamics in Beijing: insights from Smart 2 Card Data 3 Abstract: 4 As a megacity, Beijing has experienced traffic congestion, unaffordable housing 5 issues and jobs-housing imbalance. Recent decades have seen policies and projects 6 aiming at decentralizing urban structure and job-worker patterns, such as subway 7 network expansion, the suburbanization of housing and firms. But it is unclear 8 whether these changes produced a more balanced spatial configuration of jobs and 9 workers. To answer this question, this paper evaluated the ratio of jobs to workers 10 from Smart Card Data at the transit station level and offered a longitudinal study for 11 regular transit commuters. The method identifies the most preferred station around 12 each commuter’s workpalce and home location from individual smart datasets 13 according to their travel regularity, then the amounts of jobs and workers around each 14 station are estimated. A year-to-year evolution of job to worker ratios at the station 15 level is conducted. We classify general cases of steepening and flattening job-worker 16 dynamics, and they can be used in the study of other cities. The paper finds that (1) 17 only temporary balance appears around a few stations; (2) job-worker ratios tend to be 18 steepening rather than flattening, influencing commute patterns; (3) the polycentric 19 configuration of Beijing can be seen from the spatial pattern of job centers identified. -

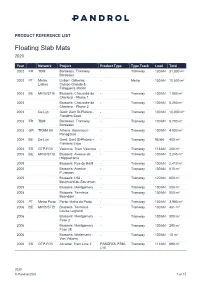

Floating Slab Mats 2020

PRODUCT REFERENCE LIST Floating Slab Mats 2020 Year Network Project Product Type Type Track Load Total 2002 FR TBM Bordeaux: Tramway - Tramway 100 kN 31,000 m² Bordeaux 2002 PT Metro Lisbon: Odivelas, - Metro 100 kN 10,000 m² Lisboa Campo Grande & Falagueira station 2003 BE MIVB/STIB Brussels: Chaussée de - Tramway 100 kN 1,800 m² Charleroi - Phase 1 2003 Brussels: Chaussée de - Tramway 100 kN 5,250 m² Charleroi - Phase 2 2003 De Lijn Gent: Gent St-Pieters - - Tramway 100 kN 10,000 m² Flanders Expo 2003 FR TBM Bordeaux: Tramway - Tramway 130 kN 9,700 m² Bordeaux 2003 GR TRAM SA Athens: Kasamouli - - Tramway 100 kN 4,000 m² Panagitsas 2004 BE De Lijn Gent: Gent St-Pieters - - Tramway 95 kN 400 m² Flanders Expo 2004 ES GTP-FGV Valencia: Tram Valencia - Tramway 113 kN 200 m² 2005 BE MIVB/STIB Brussels: Avenue de - Tramway 100 kN 2,245 m² l'Hippodrome 2005 Brussels: Rue du Bailli - Tramway 100 kN 2,410 m² 2005 Brussels: Avenue - Tramway 100 kN 610 m² P.Janson 2005 Brussels: L94 - - Tramway 120 kN 600 m² Boulevard du Souverain 2005 Brussels: Montgomery - Tramway 100 kN 250 m² 2005 Brussels: Terminus - Tramway 100 kN 550 m² Boondael 2005 PT Metro Porto Porto: Metro do Porto - Tramway 100 kN 3,900 m² 2006 BE MIVB/STIB Brussels: Terminus - Tramway 130 kN 481 m² Louise Legrand 2006 Brussels: Montgomery - Tramway 100 kN 300 m² Fase 2 2006 Brussels: Montgomery - Tramway 100 kN 290 m² Fase 2E 2006 Brussels: Wielemans - - Tramway 100 kN 15 m² Van Volxem 2006 ES GTP-FGV Alicante: Tram Line 2 PANDROL FSM- Tramway 113 kN 690 m² L10 2020 © Pandrol 2020 -

Beijing Railway Station 北京站 / 13 Maojiangwan Hutong Dongcheng District Beijing 北京市东城区毛家湾胡同 13 号

Beijing Railway Station 北京站 / 13 Maojiangwan Hutong Dongcheng District Beijing 北京市东城区毛家湾胡同 13 号 (86-010-51831812) Quick Guide General Information Board the Train / Leave the Station Transportation Station Details Station Map Useful Sentences General Information Beijing Railway Station (北京站) is located southeast of center of Beijing, inside the Second Ring. It used to be the largest railway station during the time of 1950s – 1980s. Subway Line 2 runs directly to the station and over 30 buses have stops here. Domestic trains and some international lines depart from this station, notably the lines linking Beijing to Moscow, Russia and Pyongyang, South Korea (DPRK). The station now operates normal trains and some high speed railways bounding south to Shanghai, Nanjing, Suzhou, Hangzhou, Zhengzhou, Fuzhou and Changsha etc, bounding north to Harbin, Tianjin, Changchun, Dalian, Hohhot, Urumqi, Shijiazhuang, and Yinchuan etc. Beijing Railway Station is a vast station with nonstop crowds every day. Ground floor and second floor are open to passengers for ticketing, waiting, check-in and other services. If your train departs from this station, we suggest you be here at least 2 hours ahead of the departure time. Board the Train / Leave the Station Boarding progress at Beijing Railway Station: Station square Entrance and security check Ground floor Ticket Hall (售票大厅) Security check (also with tickets and travel documents) Enter waiting hall TOP Pick up tickets Buy tickets (with your travel documents) (with your travel documents and booking number) Find your own waiting room (some might be on the second floor) Wait for check-in Have tickets checked and take your luggage Walk through the passage and find your boarding platform Board the train and find your seat Leaving Beijing Railway Station: When you get off the train station, follow the crowds to the exit passage that links to the exit hall. -

Development of High-Speed Rail in the People's Republic of China

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Haixiao, Pan; Ya, Gao Working Paper Development of high-speed rail in the People's Republic of China ADBI Working Paper Series, No. 959 Provided in Cooperation with: Asian Development Bank Institute (ADBI), Tokyo Suggested Citation: Haixiao, Pan; Ya, Gao (2019) : Development of high-speed rail in the People's Republic of China, ADBI Working Paper Series, No. 959, Asian Development Bank Institute (ADBI), Tokyo This Version is available at: http://hdl.handle.net/10419/222726 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. https://creativecommons.org/licenses/by-nc-nd/3.0/igo/ www.econstor.eu ADBI Working Paper Series DEVELOPMENT OF HIGH-SPEED RAIL IN THE PEOPLE’S REPUBLIC OF CHINA Pan Haixiao and Gao Ya No. -

Safety-First Culture Bringing MTR to Continuous & Global Excellence

Safety-First Culture Bringing MTR to Continuous & Global Excellence Dr. Jacob Kam Managing Director – Operations & Mainland Business 23 October 2017 Agenda ▪ Introducing MTR ▪ Safety First Culture ▪ Global Operational Safety ▪ Future Challenges MTR Corporation 1/15/2018 Page 2 MTR Operations in Hong Kong Heavy Rail Airport Express Light Rail Intercity Guangzhou-Shenzhen- Bus Hong Kong Express Rail Link To be opened in Q3 2018 MTR Corporation 1/15/2018 Page 3 MTR Network in HK is Expanding 1980 * 2016 Total Route Length in HK 14.8x 15.6 km 230.9 km MTR established in 1975 2 rail projects completed in 2016; MTR is present in all 18 districts in Hong Kong 2 rail projects totally 43km under construction * First network (Modified Initial System) commenced Source: MTR Sustainability Report in 1979 with its full line opening in 1980. MTR Corporation 1/15/2018 Page 4 MTR Network in HK is Expanding Source: MTR Annual Report 2016 MTR Corporation 1/15/2018 Page 5 MTR Network outside HK is also Expanding 2004 2016 Global Network 13.5x 88 km 1,192 km Stockholm Metro (MTR Tunnelbanen) MTR Tech (renamed from TBT) London Crossrail Stockholm Commuter Rail (MTR Pendeltågen) EM Tech AB South Western Railway MTR Express Beijing Line 4 Beijing Daxing Line Beijing Line 14 Beijing Line 16 (Phase 2 Sweden under construction) UK Beijing Hangzhou Line 1 + Extension Hangzhou Hangzhou Line 5 (being constructed) Shenzhen Shenzhen Line 4 Sydney Sydney Metro Northwest Melbourne As of 30 Jun 2017 Average Weekday Patronage Route Length (in operation) Mainland of China & Metro Trains Melbourne 5.79 M >2,000 km* International MTR Corporation 1/15/2018 Page 6 MTR Corporation 1/15/2018 Page 7 MTR Runs Very Well in HK – Safety Performance achieved a high level and continuous improvement in Operational Safety worse Fatalities per Billion Passenger Journeys better include suicide, accidents & illegal activities, 10-year average Source : CoMET 2016 Interim KPI Database AS – Asian Metros NA – North American Metros (2015 data). -

5G for Trains

5G for Trains Bharat Bhatia Chair, ITU-R WP5D SWG on PPDR Chair, APT-AWG Task Group on PPDR President, ITU-APT foundation of India Head of International Spectrum, Motorola Solutions Inc. Slide 1 Operations • Train operations, monitoring and control GSM-R • Real-time telemetry • Fleet/track maintenance • Increasing track capacity • Unattended Train Operations • Mobile workforce applications • Sensors – big data analytics • Mass Rescue Operation • Supply chain Safety Customer services GSM-R • Remote diagnostics • Travel information • Remote control in case of • Advertisements emergency • Location based services • Passenger emergency • Infotainment - Multimedia communications Passenger information display • Platform-to-driver video • Personal multimedia • In-train CCTV surveillance - train-to- entertainment station/OCC video • In-train wi-fi – broadband • Security internet access • Video analytics What is GSM-R? GSM-R, Global System for Mobile Communications – Railway or GSM-Railway is an international wireless communications standard for railway communication and applications. A sub-system of European Rail Traffic Management System (ERTMS), it is used for communication between train and railway regulation control centres GSM-R is an adaptation of GSM to provide mission critical features for railway operation and can work at speeds up to 500 km/hour. It is based on EIRENE – MORANE specifications. (EUROPEAN INTEGRATED RAILWAY RADIO ENHANCED NETWORK and Mobile radio for Railway Networks in Europe) GSM-R Stanadardisation UIC the International -

Students in Madrid Introduction to Our Guide

MADRID PRACTICAL GUIDE FOR INTERNATIONAL STUDENTS IN MADRID INTRODUCTION TO OUR GUIDE 1. DOCUMENTATION 1.1. Students from European Union countries. 1.1.1. What documentation is needed for Spanish residence. 1.1.2. Mandatory documentation for stays of over three months. 1.2. Students from other countries. 1.2.1. What documentation is needed for Spanish residence. cont 1.2.2. Mandatory documentation for stays of over three months. 1.3. Additional Documentation. 1.4. Useful links, addresses and telephone numbers. 2. ACCOMMODATION 2.1. If you study at the Villaviciosa de Odón Campus. 2.1.1. The Villaviciosa de Odón Campus Student Residence. 2.1.2. Renting an apartment or a room in a shared apartment. 2.1.2. a. Nearby areas recommended for renting. 2.2. If you study at the Alcobendas Campus. 2.2.1. Renting an apartment or a room in a shared apartment. 2.2.1 a. Nearby areas recommended for renting. 2.3. Rental contract. Contract types. 2.4. How to get a bank guarantee, if required. 2.5. What kind of advice you need. Where to get it. 2.6. Useful services and utilities when you rent an apartment. 2.6.1. Services you may need. 2.6.2. Utilities you need to contract. 2.7. Useful links, addresses and telephone numbers. 3. HEALTH CARE 3.1. If you are an EU citizen. 3.1.1. In your country. 3.1.2. How to get health care through the Public Health System of the Community of Madrid or the Spanish State. 3.1.3. -

Download Article (PDF)

Advances in Intelligent Systems Research (AISR), volume 160 3rd International Conference on Modelling, Simulation and Applied Mathematics (MSAM 2018) Anylogic Simulation-based Research on Emergency Organization of Mass Passenger Flow in Subway Station after Events Yan Xing*, Shuang Liu and Huiwen Wang Beijing Jiaotong University, Beijing 100044, China *Corresponding author Abstract—The sudden mass passenger after social events can Current research on mass passenger flow management and make huge impact on the normal operation of rail transit station. emergency evacuation of dangerous situations in urban rail This paper mainly studies on the influence of mass passenger transit are relatively complete. Their main research objects are flow after special events on the passenger organization of the the large passenger flow of the subway itself or the treatment of station nearby. Based on the investigation of station facilities and emergencies. However, there are few major issues particularly passenger flow data, this paper compares and analyzes the for large passenger flow causing by large-scale event. Taking characteristics of passenger flow and measures of passenger the Capital Stadium in Beijing and its nearby subway station organization on weekdays and the activity days. The station called National Library of China Station as an example, this facilities and pedestrian movement simulation models are built paper investigates and analyzes the passenger flow data after an using Anylogic. According to the congestion level and service level standard, this paper describes the influence of mass event to study the influence of the passenger flow on the passenger flow after special events on the subway station. Then operation organization of the subway station and uses Anylogic the optimized measures on operational organization are put to simulate the situation of the passenger flow in subway forward to simulate and compared with simulation platform. -

Comment Form for 2Nd Review Phase of IPBES Deliverable 3C) Fast-Track Methodological Assessment on Scenarios and Models Chapter 2 ‘Decision Making’

Comment form for 2nd Review Phase of IPBES Deliverable 3c) Fast-track methodological assessment on scenarios and models Chapter 2 ‘Decision making’ Review Editor: Jennifer Hauck Institute: Helmholtz Centre for Environmental Research - UFZ / Department of Environmental Politics Address: Permoserstraße 15 / 04318 Leipzig Email address: [email protected] Review Editor: Bojie Fu Institute: Research Center for Eco-Environmental Sciences, Chinese Academy of Sciences Address: 18 Shuangqing Rd, Haidian District, Beijing, China 100085 Email address: [email protected] Reviewers: Norbert Francois Tchouaffe Tchiadje German government David Cooper Mahmood Yekeh Yazdandoost Ralf Doering Fundisile Mketeni Alan Feest Peter Elias Dandan Yu Marcus Zisenis María Isabel Delgado Michael Bordt Geoff Hicks Diego Pacheco Brenda McAfee Alain Billionnet Brian Kastl Boris Stipernitz Werner Rolf Noelia C. Calamari UK government Marina Rosales Benites de Franco Jens Mutke Melanie Paschke Derek Tittensor Axel G. Rossberg Francisco Ramón Barbarán Shane Orchard Ministry of the Environment, Japan Fátima Lopes Alves Paula A Harrison Sandra Luque Thomas Brooks Cécile Leclere № Chapte From From Till Till Comment Reviewer Full What was done with the r page line page line Name comment 1 2 Gener Overall : Generally a good discussion. Suffers a little from Shane Orchard This comment was addressed al inconsistent use of terminology and some repetition. For example by undertaking a complete in Key recommendations, use of the term ‘policy modellers’ (pg review of terminology 203 line 9) and similar mash-up versions of the common terms throughout the chapter, elsewhere. A few typos were also spotted in the text. including alteration or removal of inconsistent or unnecessary terms. -

Issue #30, March 2021

High-Speed Intercity Passenger SPEEDLINESMarch 2021 ISSUE #30 Moynihan is a spectacular APTA’S CONFERENCE SCHEDULE » p. 8 train hall for Amtrak, providing additional access to Long Island Railroad platforms. Occupying the GLOBAL RAIL PROJECTS » p. 12 entirety of the superblock between Eighth and Ninth Avenues and 31st » p. 26 and 33rd Streets. FRICTIONLESS, HIGH-SPEED TRANSPORTATION » p. 5 APTA’S PHASE 2 ROI STUDY » p. 39 CONTENTS 2 SPEEDLINES MAGAZINE 3 CHAIRMAN’S LETTER On the front cover: Greetings from our Chair, Joe Giulietti INVESTING IN ENVIRONMENTALLY FRIENDLY AND ENERGY-EFFICIENT HIGH-SPEED RAIL PROJECTS WILL CREATE HIGHLY SKILLED JOBS IN THE TRANS- PORTATION INDUSTRY, REVITALIZE DOMESTIC 4 APTA’S CONFERENCE INDUSTRIES SUPPLYING TRANSPORTATION PROD- UCTS AND SERVICES, REDUCE THE NATION’S DEPEN- DENCY ON FOREIGN OIL, MITIGATE CONGESTION, FEATURE ARTICLE: AND PROVIDE TRAVEL CHOICES. 5 MOYNIHAN TRAIN HALL 8 2021 CONFERENCE SCHEDULE 9 SHARED USE - IS IT THE ANSWER? 12 GLOBAL RAIL PROJECTS 24 SNIPPETS - IN THE NEWS... ABOVE: For decades, Penn Station has been the visible symbol of official disdain for public transit and 26 FRICTIONLESS HIGH-SPEED TRANS intercity rail travel, and the people who depend on them. The blight that is Penn Station, the new Moynihan Train Hall helps knit together Midtown South with the 31 THAILAND’S FIRST PHASE OF HSR business district expanding out from Hudson Yards. 32 AMTRAK’S BIKE PROGRAM CHAIR: JOE GIULIETTI VICE CHAIR: CHRIS BRADY SECRETARY: MELANIE K. JOHNSON OFFICER AT LARGE: MICHAEL MCLAUGHLIN 33 -

Rigid Catenary March 2021

SECTOR REFERENCE LIST Rigid Catenary March 2021 Project Name Location Date Length Voltage Design (km) Speed (km/h) Metro Buenos Aires Line B Alem-Rosas Argentina 2014 25 600 V 90 Metro Buenos Aires Line E Bolívar-Retiro Argentina 2018 4 1,5 kV 90 Perth- Forestfield Airport link Australia 2019 15 25 kV 140 Melbourne Metro Rail Project Australia Design 1 1,5 kV 90 ÖBB Marchtrent-Traun Austria 1993 0.5 15 - SNCV Charleroi Belgium 1992 0.7 750 V 80 STIB Schaerbeek Depot Brussels Belgium 1998 0.77 750 V 20 STIB Rogier Tunnel Brussels Belgium 2008 0.5 750 V 80 STIB Haren Depot Belgium 2008 3 750 V 20 STIB Thomas Tunnel Brussels Belgium 2009 0.1 750 V 20 STIB Marconi depot Belgium 2016 5 750 V 20 STIB Simonis Belgium 2017 3.1 750 V 20 INFRABEL Tunnel Saint Martin Liege Belgium 2019 1.35 3 kV 80 INFRABEL Tunnel Pierreuse Belgium 2020 3.2 3 kV 80 Metro Sao Paulo Line 4 Brazil 2010 28 1.5 kV 110 Metro Sao Paulo Line 5 phase 1 Brazil 2013 2.3 1.5 kV 100 Metro Sao Paulo Line 5 phase 2 Brazil 2018 21 1.5 kV 100 Metro Sao Paulo Line 4 Extension Brazil 2021 4.5 1.5 kV 110 Metro Sofia Line 3 Bulgaria 2018-2019 23.04 1.5 kV 90 Toronto Saint Clair station Canada 2016 0.37 750 V 30 Ottawa Confederation Line Canada 2018 7.88 1.5 kV 90 Metro Santiago de Chine L3 & 6 Chile 2016 79.75 1.5 kV 80 Guangzhou China 1999 0.2 1.5 kV - MTR Hong Kong SIL-KTE China 2015 12 1.5 kV 90 MTR Hong Kong SCL China 2017 25 25 kV 130 March 2021 © Pandrol 2021 1 of 6 Rigid Catenary Helsinki-Vantaa Airport Finland 2012 16 25 kV 120 RATP Défense/Nation RER A France 1983 0.4 1.5 kV