Tax and Regulatory Conference 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Proposed Road Improvement Works in West Kowloon Reclamation Development Phase I

Proposed Road Improvement Works in West Kowloon Reclamation Development Phase I Project Profile (Report No. 276799/11.01/B) August 2011 Highways Department, HKSAR Government Proposed Road Improvement Works in West Kowloon276799 ReclamationTNI Development BRI 096/03 B P:\Hong Kong\ENL\PROJECTS\276799(BRI) West Kowloon Road Phase I Impr\reports\PP\Project Profile RevA doc 01 December 2009 Schemes H, I, J, Q (Interim Option) and Improvement Works at the Junction of Canton Road/ Ferry Street/ Jordan Road Project Profile August 2011 Highways Department 6/F., Homantin Government Offices, 88 Chung Hau Street, Homantin, Kowloon Mott MacDonald, 20/F, Two Landmark East, 100 How Ming Street, Kwun Tong, Kowloon, Hong Kong T +852 2828 5757 F +852 2827 1823 W www.mottmac.com.hk Phase I Project Profile Issue and revision record Revision Date Originator Checker Approver Description A June 2011 Various Eric Ching H. T. Cheng First Issue B August 2011 Various Eric Ching H. T. Cheng Second Issue This document is issued for the party which commissioned it We accept no responsibility for the consequences of this and for specific purposes connected with the above-captioned document being relied upon by any other party, or being used project only. It should not be relied upon by any other party or for any other purpose, or containing any error or omission used for any other purpose. which is due to an error or omission in data supplied to us by other parties This document contains confidential information and proprietary intellectual property. It should not be shown to other parties without consent from us and from the party which commissioned it. -

OFFICIAL RECORD of PROCEEDINGS Friday, 21 March

LEGISLATIVE COUNCIL ─ 21 March 2014 8755 OFFICIAL RECORD OF PROCEEDINGS Friday, 21 March 2014 The Council continued to meet at Nine o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE VINCENT FANG KANG, S.B.S., J.P. THE HONOURABLE WONG KWOK-HING, B.B.S., M.H. 8756 LEGISLATIVE COUNCIL ─ 21 March 2014 PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P., Ph.D., R.N. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, S.B.S., J.P. THE HONOURABLE RONNY TONG KA-WAH, S.C. THE HONOURABLE CYD HO SAU-LAN THE HONOURABLE STARRY LEE WAI-KING, J.P. DR THE HONOURABLE LAM TAI-FAI, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, J.P. THE HONOURABLE CHAN KIN-POR, B.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. DR THE HONOURABLE LEUNG KA-LAU THE HONOURABLE CHEUNG KWOK-CHE THE HONOURABLE WONG KWOK-KIN, B.B.S. -

Muk Ning Street) – Tai Kok Tsui (Island Harbourview

TRAFFIC ADVICE Introduction of Air-Conditioned Urban Kowloon Route No. 20 Kai Tak (Muk Ning Street) – Tai Kok Tsui (Island Harbourview) Members of the public are advised that Air-Conditioned Urban Kowloon Route No. 20 Kai Tak (Muk Ning Street) – Tai Kok Tsui (Island Harbourview) will start operating with effect from 29 April 2018 (Sunday). Details are as follows: Routeing * KAI TAK (MUK NING STREET) to TAI KOK TSUI (ISLAND HARBOURVIEW) : via Muk Ning Street Bus Terminus, Muk Ning Street, Muk On Street, Shing Kai Road, Concorde Road, Prince Edward Road East , Prince Edward Road West, Argyle Street, Waterloo Road, Ngo Cheung Road, Hoi Wang Road, Cherry Street, Sham Mong Road, Hoi Fai Road, Roundabout, Hoi Fai Road, Hoi Fan Road and Tai Kok Tsui (Island Harbourview). TAI KOK TSUI (ISLAND HARBOURVIEW) to KAI TA K (MUK NING STREET) : via Tai Kok Tsui (Island Harbourview), Hoi Fan Road, Hoi Fai Road, Roundabout, Hoi Fai Road, Sham Mong Road, Cherry Street, Tai Kok Tsui Road, Cherry Street, Hoi Wang Road, Lai Cheung Road, Waterloo Road, Argyle Street, Prince Edward Road West, Prince Edward Road East, Slip Road, Roundabout, Luk Hop Street, Tsat Po Street, Kai San Road, Concorde Road, Roundabout, Concorde Road, Shing Kai Road, Muk Hung Street, Muk Chui Street, Shing Kai Road, Muk On Street, Muk Ning Street and Muk Ning Street Bus Terminus. Fare Kai Tak (Muk Ning Street) to Tai Kok Tsui (Island Harbourview) Full fare: $4.60 per single journey Section fare from Hoi Wang Road to Tai Kok Tsui (Island Harbourview): $3.50 Tai Kok Tsui (Island Harbourview) to Kai Tak (Muk Ning Street) Full fare: $4.60 per single journey Section fare from Concorde Road to Kai Tak (Muk Ning Street): $4.10 Operating Hours Mondays to Satur days: Hours Headway From Kai Tak 5.40 a.m. -

Kowloon P P P

Branch ATM District Branch / ATM Address Voice Navigation ATM Prince Edward Branch 774 Nathan Road, Kowloon P P P Fuk Tsun Street Branch 32-40 Fuk Tsun Street, Tai Kok Tsui, Kowloon P P P P 4-4A Humphrey's Avenue, Tsim Sha Tsui, Humphrey's Avenue Branch P P Kowloon Mong Kok (Silvercorp Int'l Tower) Shop B, 707-713 Nathan Road, Mong Kok, P P P P Branch Kowloon 1/F, Sino Cheer Plaza, 23-29 Jordan Road, Jordan Road Branch P P Kowloon Mong Kok Branch 589 Nathan Road, Mong Kok, Kowloon P P Prince Edward Road West (Mong Kok) 116-118 Prince Edward Road West, Mong P P Branch Kok, Kowloon 24-28 Carnarvon Road, Tsim Sha Tsui, Tsim Sha Tsui Branch P P Kowloon Shanghai Street (Prince Edward) 689-693 Shanghai Street, Mong Kok, Kowloon P P Branch 73-77 Tai Kok Tsui Road, Tai Kok Tsui, Tai Kok Tsui Branch P P P P Kowloon Shop 19-20, 2/F, China Hong Kong City, 33 China Hong Kong City Branch P P Canton Road, Tsim Sha Tsui , Kowloon Mong Kok Road Branch 50-52 Mong Kok Road, Mong Kok, Kowloon P P P Shop 133, 1/F, Olympian City 2, 18 Hoi Ting Olympian City Branch P P Road, Kowloon Apartments A-B on G/F & 1/F, Holly Mansion, Kimberley Road Branch P P P P 37 Kimberley Road, Tsim Sha Tsui, Kowloon. Shop 1003-1004, 1/F, Elements, 1 Austin Road Elements Branch P P P West, Kowloon Mong Kok (President Commercial 608 Nathan Road, Mong Kok, Kowloon P P P Centre) Branch Yau Ma Tei Branch 471 Nathan Road, Yau Ma Tei, Kowloon P P P Shop 3,LG/F,Hilton Towers,96 Granville Tsim Sha Tsui East Branch P P Road,Tsim Sha Tsui East, Kowloon Cameron Road Wealth Management 30 -

The Arup Journal

KCRC EAST RAIL EXTENSIONS SPECIAL ISSUE 3/2007 The Arup Journal Foreword After 10 years' planning, design, and construction, the opening of the Lok Ma Chau spur line on 15 August 2007 marked the completion of the former Kowloon Canton Railway Corporation's East Rail extension projects. These complex pieces of infrastructure include 11 km of mostly elevated railway and a 6ha maintenance and repair depot for the Ma On Shan line, 7.4km of elevated and tunnelled route for the Lok Ma Chau spur line, and a 1 km underground extension of the existing line from Hung Hom to East Tsim Sha Tsui. Arup was involved in all of these, from specialist fire safety strategy for all the Ma On Shan line stations, to multidisciplinary planning, design, and construction supervision, and, on the Lok Ma Chau spur line, direct work for a design/build contractor. In some cases our involvement went from concept through to handover. For example, we were part of a special contractor-led team that carried out a tunnel feasibility study for the Lok Ma Chau spur line across the ecologically sensitive Long Valley. At East Tsim Sha Tsui station we worked closely with the KCRC and numerous government departments to re-provide two public recreation spaces - Middle Road Children's playground at the foot of the historic Signal Hill, and Wing On Plaza garden - examples that show the importance of environmental issues for the KCRC in expanding Hong Kong's railway network. This special issue of The Arup Journal is devoted to all of our work on the East Rail extensions, and our feasibility study for the Kowloon Southern Link, programmed to connect West Rail and East Rail by 2009. -

Hansard of This Council

LEGISLATIVE COUNCIL ─ 5 January 2011 4115 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 5 January 2011 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN IR DR THE HONOURABLE RAYMOND HO CHUNG-TAI, S.B.S., S.B.ST.J., J.P. THE HONOURABLE LEE CHEUK-YAN DR THE HONOURABLE DAVID LI KWOK-PO, G.B.M., G.B.S., J.P. THE HONOURABLE FRED LI WAH-MING, S.B.S., J.P. DR THE HONOURABLE MARGARET NG THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHEUNG MAN-KWONG THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE MRS SOPHIE LEUNG LAU YAU-FUN, G.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE PHILIP WONG YU-HONG, G.B.S. 4116 LEGISLATIVE COUNCIL ─ 5 January 2011 THE HONOURABLE LAU KONG-WAH, J.P. THE HONOURABLE MIRIAM LAU KIN-YEE, G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TIMOTHY FOK TSUN-TING, G.B.S., J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, S.B.S., J.P. THE HONOURABLE LI FUNG-YING, S.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE AUDREY EU YUET-MEE, S.C., J.P. THE HONOURABLE VINCENT FANG KANG, S.B.S., J.P. -

Transit Oriented Development and Value Capture – Hong Kong

UNESCAP Regional Expert Group Meeting on Sustainable and Inclusive Transport Development and 2nd Asia BRTS Conference, 29 Sep –1 Oct 2014, Ahmedabad Transit Oriented Development and Value Capture –Hong Kong Dr. Wing‐tat HUNG Associate Professor Department of Civil and Environmental Engineering The Hong Kong Polytechnic University 1 • 218 km • 84 MTR stations • 68 Light rail stations • 4.5 million passenger daily (40% of total public transport patronage) Source: Hong Kong Railway Development Strategy 2014 2 The Hong Kong Polytechnic University TOD ‐ Railway Development Strategy 2014 3 The Hong Kong Polytechnic University Proposed New Lines/ extensions up to 2031 2013 estimates (USD, billion) Northern Link and Kwu Tung Station 2.97 Tuen Mun South Extension 0.71 East Kowloon Line 3.55 Tung Chung West Extension 0.77 Hung Shui Kiu Station 0.39 South Island Line (West) 3.23 North Island Line 2.58 TOTAL 14.19 4 The Hong Kong Polytechnic University Transit Oriented Developments District centre “TOD” functions With High density private housing District road District open space and Traffic free high District centre low density land use density mixed housing functions With High density private housing 500m walk-in zone to station “3D” Principles: High Development Density Intensive and efficient land use within the station walk-in catchment area Land Use Diversity Enhance the life and vibrancy of the community High-Quality Community Design Seamless connection and interchange, segregation of pedestrian and vehicular traffic, Local road with greening -

Free Hong Kong Housing Guide

Housing Information Hong Kong 2020 Housing Information | Hong Kong 2 Content Before you start 3 Introduction 4 Important notes 5 Residential area overview 6 Neighborhoods 7 Hong Kong Island – Southside Hong Kong Island Kowloon New Territories Outlying islands What’s next? 14 Glossary of terms 15 Housing Information | Hong Kong 3 Before you start The following information is required to begin your home search: • Your contact details • Desired viewing dates • Budget • Area(s) of interest • Number of bedrooms required • Preference over a furnished or unfurnished property • Outdoor space requirements • Expected lease start date • Period of stay in Hong Kong • Assignment start and finish dates • Recreational facilities In addition, think about whether you require close proximity to: • Schools • Public transport • Sporting, shopping and medical facilities And whether you have any: • Pets – some buildings landlords may not allow pets • Any large items of furniture – some lifts in Hong Kong may not be able to accommodate large items such as grand pianos, king-sized beds and dining tables Remember, we can make your home search more efficient by narrowing down your viewings based on the information you have provided. Please provide as much detail as possible. Housing Information | Hong Kong 4 Introduction Welcome to Hong Kong As one of Asia’s leading relocation companies we’ve learned that the more you know – and the better prepared you are – the more likely you will make your relocation a success. This guide will help you with your forthcoming search for a new home. It explains how the home search process works and how to navigate the rental market in Hong Kong. -

How Much Development Can a Rail Station Lead? a Case Study of Hong Kong

CTBUH Research Paper ctbuh.org/papers Title: How Much Development Can a Rail Station Lead? A Case Study of Hong Kong Authors: Charlie Qiuli Xue, Department of Architecture & Civil Engineering, City University of Hong Kong Cong Sun, Department of Architecture & Civil Engineering, City University of Hong Kong Subjects: Building Case Study Civil Engineering Structural Engineering Urban Infrastructure/Transport Keywords: Development Infrastructure Master Planning Residential Retail Structural Engineering Transportation Urban Planning Publication Date: 2018 Original Publication: International Journal of High-rise Buildings Volume 7 Number 2 Paper Type: 1. Book chapter/Part chapter 2. Journal paper 3. Conference proceeding 4. Unpublished conference paper 5. Magazine article 6. Unpublished © Council on Tall Buildings and Urban Habitat / Charlie Qiuli Xue; Cong Sun International Journal of High-Rise Buildings International Journal of June 2018, Vol 7, No 2, 95-109 High-Rise Buildings https://doi.org/10.21022/IJHRB.2018.7.2.95 www.ctbuh-korea.org/ijhrb/index.php How Much Development Can a Rail Station Lead? A Case Study of Hong Kong Charlie Qiuli Xue† and Cong Sun Department of Architecture & Civil Engineering, City University of Hong Kong, Tat Chee Avenue, Kowloon, Hong Kong Abstract Since the concept was first introduced in the 1970s, transit-oriented-development (TOD) has greatly expanded in East Asian cities such as Hong Kong. Rail stations are built together with clusters of residential–commercial towers and government services to form a new style of living – a “rail village.” This paper examines the composition, scale, spatial form, organization and operation of several typical rail villages in Hong Kong. -

CWM Basic Document Template with Cover

Housing Information Hong Kong 2019 Housing Information | Hong Kong 2 Content Before you start 3 Introduction 4 Important notes 5 Residential area overview 6 Neighborhoods 7 Hong Kong Island – Southside Hong Kong Island Kowloon New Territories Outlying islands What’s next? 14 Frequently asked questions 15 Glossary of terms 18 Housing Information | Hong Kong 3 Before you start The following information is required to begin your home search: • Your contact details • Desired viewing dates • Budget • Area(s) of interest • Number of bedrooms required • Preference over a furnished or unfurnished property • Outdoor space requirements • Expected lease start date • Period of stay in Hong Kong • Assignment start and finish dates • Recreational facilities In addition, think about whether you require close proximity to: • Schools • Public transport • Sporting, shopping and medical facilities And whether you have any: • Pets – some buildings landlords may not allow pets • Any large items of furniture – some lifts in Hong Kong may not be able to accommodate large items such as grand pianos, king-sized beds and dining tables Remember, we can make your home search more efficient by narrowing down your viewings based on the information you have provided. Please provide as much detail as possible. Housing Information | Hong Kong 4 Introduction Welcome to Hong Kong As one of Asia’s leading relocation companies we’ve learned that the more you know – and the better prepared you are – the more likely you will make your relocation a success. This guide will help you with your forthcoming search for a new home. It explains how the home search process works and how to navigate the rental market in Hong Kong. -

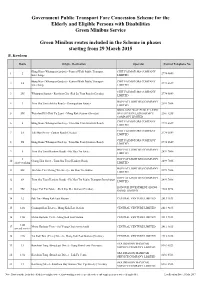

Route List of the Scheme (With Operators Info and Hotline)

Government Public Transport Fare Concession Scheme for the Elderly and Eligible Persons with Disabilities Green Minibus Service Green Minibus routes included in the Scheme in phases starting from 29 March 2015 B. Kowloon Route Origin - Destination Operator Contact Telephone No. Hung Hom (Whampoa Garden) - Festival Walk Public Transport CHIT FAI MOTORS COMPANY 1 2 2774 6649 Interchange LIMITED Hung Hom (Whampoa Garden) - Festival Walk Public Transport CHIT FAI MOTORS COMPANY 2 2A 2774 6649 Interchange LIMITED CHIT FAI MOTORS COMPANY 3 2M Whampoa Station - Kowloon City (Fuk Lo Tsun Road) (Circular) 2774 6649 LIMITED HOP FAT LIGHT BUS COMPANY 4 3 Tsim Sha Tsui (Ashley Road) - Cosmopolitan Estates 2499 7806 LIMITED BRILLIANT WAY PUBLIC LIGHT 5 5M Waterloo Hill (Hok Yu Lane) - Mong Kok Station (Circular) BUS (SCHEDULED) SERVICE 2361 1255 COMPANY LIMITED CHIT FAI MOTORS COMPANY 6 6 Hung Hom (Whampoa Garden) - Tsim Sha Tsui (Hankow Road) 2774 6649 LIMITED CHIT FAI MOTORS COMPANY 7 6A Tak Man Street - Canton Road (Circular) 2774 6649 LIMITED CHIT FAI MOTORS COMPANY 8 6X Hung Hom (Whampoa Garden) - Tsim Sha Tsui (Hankow Road) 2774 6649 LIMITED HOP FAT LIGHT BUS COMPANY 9 8 Tsim Sha Tsui (Hankow Road) - Ho Man Tin Estate 2499 7806 LIMITED 8 HOP FAT LIGHT BUS COMPANY 10 Chung Hau Street - Tsim Sha Tsui (Hankow Road) 2499 7806 short-working LIMITED HOP FAT LIGHT BUS COMPANY 11 8M Ho Man Tin (Sheung Wo Street) - Ho Man Tin Station 2499 7806 LIMITED HOP FAT LIGHT BUS COMPANY 12 8S Tsim Sha Tsui (Hankow Road) - Ho Man Tin Public Transport Interchange -

Silka West Kowloon Booklet.Pdf

Silka West Kowloon Hotel 西九龍 絲麗酒店 No. 48 Anchor Street, Tai Kok Tsui, Kowloon 1. Executive Summary 2-3 2. Investment Highlights 4-8 3. Hong Kong Hotel Market 9-13 4. Asset Summary 14-27 Table of Contents 5. Financial Summary 28-34 6. Deal Structure 35 7. Sales Process 36 1 EXECUTIVE SUMMARY Silka West Kowloon Hong Kong is a value hotel situated It is managed by Dorsett Hospitality International which in Tai Kok Tsui, Kowloon and this is just minutes away is an Asia-based hotel group headquartered in Hong from Hong Kong’s commercial, shopping and Kong. Dorsett owns and manages three brands - entertainment district of MongKok and Tsim Sha Tsui. d.Collection, Dorsett Hotels & Resorts, and Silka Hotels. Within the vicinity, popular spots include the Ladies Market on Tung Choi Street, Sportshoes Market on Fa Located in West Kowloon – a vibrant area that is under going Yuen Street, Night Market on Temple Street and the Jade huge urban regeneration. Market. West Kowloon will be benetted from new high-speed rail Silka West is a mere 35 minutes drive away from the link connecting to Guangzhou & Shenzhen. Hong Kong International Airport, 8 minutes to Mong Kok Kowloon has proved popular with growing numbers of East MTR Station, 10 minutes away from the China Hong Chinese mainland tourists. Kong Ferry Terminal and within close proximity to the vibrant district of Tsim Sha Tsui. 2 © 2015 CBRE Limited. We obtained the information above from sources we believe to be reliable. However, we have not veried its accuracy and make no guarantee, warranty or representation about it.