Tweed New Haven Airport Freight Cargo Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

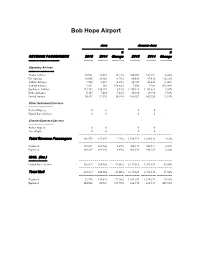

Bob Hope Airport

Bob Hope Airport June January-June --------------------------------------------- ------------------------------------------------ % % REVENUE PASSENGERS 2015 2014 Change 2015 2014 Change ---------------------------- --------- --------- ----------- --------- --------- ----------- Signatory Airlines ----------------------- Alaska Airlines 36,951 32,073 15.21% 200,092 187,921 6.48% US Airways 16,665 16,962 -1.75% 84,430 97,415 -13.33% JetBlue Airways 7,525 8,213 -8.38% 45,941 46,432 -1.06% SeaPort Airlines 1,651 169 876.92% 7,500 1,309 472.96% Southwest Airlines 247,282 246,217 0.43% 1,450,412 1,414,633 2.53% Delta Air Lines 6,507 7,028 -7.41% 36,310 39,398 -7.84% United Airlines 20,397 17,196 18.61% 106,027 102,328 3.61% Other Scheduled Carriers --------------------------- Federal Express 0 0 0 0 United Parcel Service 0 0 0 0 Charter/Contract Carriers ---------------------------- AirNet Express 0 0 0 0 Ameriflight 0 0 0 0 --------------- -------- -------- ---------------- Total Revenue Passengers 336,978 327,858 2.78% 1,930,712 1,889,436 2.18% =========================================================== Deplaned 167,091 163,706 2.07% 962,177 942,511 2.09% Enplaned 169,887 164,152 3.49% 968,535 946,925 2.28% MAIL (lbs.) ----------------- --------------- -------- -------- ---------------- United Parcel Service 136,817 164,968 -17.06% 2,137,615 1,391,816 53.58% --------------- -------- -------- ---------------- Total Mail 136,817 164,968 -17.06% 2,137,615 1,391,816 53.58% =========================================================== Deplaned -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

I APPENDIX Page Tweed-New Haven Airport

i APPENDIX Page Tweed-New Haven Airport Authority v. Tong, No. 17-3481-cv and No. 17-3918-cv, U.S. Court of Appeals for the Second Circuit, Judgment entered July 9, 2019 ................................................ 1a Tweed-New Haven Airport Authority v. Jepsen, Case No. 3.15cv01731 (RAR), U.S. District Court for the District of Connecticut, Judgment entered October 3, 2017 ...................... 24a Tweed-New Haven Airport Authority v. Jepsen, Case No. 3.15cv01731 (RAR), U.S. District Court for the District of Connecticut, Ruling on Defendant’s Motion to Dismiss entered December 9, 2016 .................................................. 68a Tweed-New Haven Airport Authority Act, C.G.S.A. § 15-120g et seq. ...................................... 88a Supremacy Clause of the United States Constitution, Article VI, Clause 2 ....................... 108a Connecticut Constitution, Article Tenth, § 1 ......... 108a Federal Aviation Act, 49 U.S.C.A. § 40103 ............. 109a 14 C.F.R. § 139.1 ..................................................... 111a 1a 930 F.3d 65 United States Court of Appeals, Second Circuit. TWEED-NEW HAVEN AIRPORT AUTHORITY, Plaintiff-Appellant, City of New Haven, Intervenor Plaintiff-Appellant, v. William TONG, in his official capacity as Attorney General for the State of Connecticut, Defendant-Appellee.* No. 17-3481-cv; 17-3918-cv | August Term 2018 | Argued: December 12, 2018; | Decided: July 9, 2019 Appeal from the United States District Court for the District of Connecticut, No. 15 Civ. 1731 (RAR), Robert A. Richardson, Magistrate Judge, Presiding. Attorneys and Law Firms Hugh I. Manke, John C. King, Christopher A. Klepps, Updike, Kelly & Spellacy, P.C., Hartford, Ct., for plaintiff-appellant Tweed-New Haven Airport Authority. John Rose, Jr., Corporation Counsel, New Haven Office of the Corporation Counsel, New Haven, Ct., for intervenor plaintiff-appellant Tweed-New Haven Airport Authority. -

Table of Contents

TABLE OF CONTENTS EXECUTIVE SUMMARY ........................................................................................................ ES1 1.0 INTRODUCTION ............................................................................................................. 1 1.1 Business Plan Process .................................................................................................. 2 1.2 Airport Profile .............................................................................................................. 3 2.0 EXISTING AIRPORT CHARACTERISTICS............................................................................ 5 2.1 Physical Characteristics ............................................................................................... 5 2.2 Existing Airport Tenants .............................................................................................. 6 2.3 Management Structure ............................................................................................... 7 2.4 Historical Airport Data ................................................................................................. 8 2.5 Baseline Financial Data ................................................................................................ 9 3.0 AIRPORT MARKET AREA .............................................................................................. 11 4.0 SWOT ANALYSIS FOR WATERBURY-OXFORD AIRPORT ................................................. 15 4.1 SWOT Components .................................................................................................. -

ACRP 03-31 Bibliography Last Update: June 15, 2016

ACRP 03-31 Bibliography Last Update: June 15, 2016 Contents Air Cargo ....................................................................................................................................................... 2 Air Service ..................................................................................................................................................... 5 Economic....................................................................................................................................................... 9 Environmental ............................................................................................................................................. 13 Finance ........................................................................................................................................................ 16 Land Use ..................................................................................................................................................... 18 Media Kit ..................................................................................................................................................... 19 Noise ........................................................................................................................................................... 21 Role of the Airport ....................................................................................................................................... 23 ACRP 03-31: Resources Bibliography Page -

Flight Operations Miami-Dade Aviation Department Aviation Statistics Flight

Miami-Dade Aviation Department Aviation Statistics Flight Ops - All Airlines Facility: MIA Units: Flight Operations Current Year:10/2002 -09/2003 Prior Year:10/2001 -09/2002 Domestic International % Domestic International Arrival Departure Arrival Departure Total Change Operator Total Arrival Departure Arrival Departure 38,855 39,530 26,999 26,191 131,575 3.82% American Airlines Inc 126,736 36,766 36,843 26,609 26,518 14,465 14,454 16 9 28,944 -3.31% Generic Cash and GA 29,935 14,618 14,792 357 168 Account 6,552 6,742 7,502 7,313 28,109 -12.57% Envoy Air Inc 32,152 9,235 9,215 6,844 6,858 4,951 5,038 4,755 4,658 19,402 0.37% Gulfstream International 19,330 5,734 5,627 4,062 3,907 Airlines 4,563 4,607 1,134 1,135 11,439 -13.82% United Airlines, Inc 13,274 4,732 4,800 1,873 1,869 3,985 3,985 918 918 9,806 3.86% Continental Airlines 9,442 3,936 3,936 785 785 4,180 4,180 30 30 8,420 -60.11% US Airways Inc 21,108 10,211 10,211 343 343 1,319 1,386 2,664 2,603 7,972 -9.76% United Parcel Service 8,834 1,413 1,585 3,000 2,836 3,727 3,727 0 0 7,454 0.40% Delta Air Lines Inc 7,424 3,712 3,712 0 0 0 0 3,064 3,065 6,129 6.70% Iberia LAE SA Operadora 5,744 0 0 2,872 2,872 3,043 2,994 14 14 6,065 37.22% Airtran Airways Inc 4,420 2,223 2,197 0 0 0 0 2,443 2,443 4,886 18.36% Bahamasair Holdings Ltd 4,128 0 0 2,077 2,051 2,425 2,429 0 0 4,854 -12.14% Northwest Airlines 5,525 2,467 2,465 296 297 391 344 1,951 1,922 4,608 0.26% Alpha Cargo Airlines dba 4,596 353 352 1,960 1,931 Alpha Cargo 0 0 2,227 2,375 4,602 -7.81% LATAM Airlines Group SA 4,992 0 0 2,427 2,565 14 14 1,821 1,821 3,670 8.26% Amerijet International 3,390 57 57 1,638 1,638 1,603 1,603 214 214 3,634 100.00% Mesa Air dba USAirways 0 0 0 0 0 Express 0 0 1,741 1,741 3,482 -8.46% TACA - Grupo TACA 3,804 0 0 1,900 1,904 0 0 1,722 1,722 3,444 37.54% Tampa Cargo S.A. -

Avion Burbank Brochure

Connect.Create.Innovate. A Proven Team Creative Office & Creative Industrial Retail MATTHEW HARGROVE BENNETT ROBINSON GEOFF MARTIN RYAN BURNETT 818 251 3601 818 907 4608 818 502 6739 818 502 6791 [email protected] [email protected] [email protected] [email protected] Lic.#00952137 Lic.#00984312 Lic.#01180819 Lic. #01481691 3 Future Hollywood Burbank Airport Terminal Tulare Ave. N Hollywood Way Property History Lockheed is born A tradition of creative industrial production United Aircraft and Transport Corporation Lockheed, under design lead Kelly Johnson, develops a twin purchases a parcel of 234 acres with surrounding engine, twin-boom interceptor aircraft, the P-38 Lightning steady winds and good drainage, developing 1937 fighter. More than 10,000 units were manufactured during WWII. 1928 United Airport, the largest commercial airport in Los Angeles until the opening of LAX 18 years later. A community of creative innovation A history of design firsts After the attack on Pearl Harbor, a giant camouflaging The Lockheed P-80 Shooting Star, the first effort takes place at Skunk Works to hide the building operational military jet engine plane, is the first of bombers. Artists, set designers, and painters from of many developed on site under the secret Burbank studios (e.g. Disney) successfully cloak military operation “Skunk Works.” At the height of the 1941-1945 production facilities to look like California suburbia. 1943-1989 war days, Lockheed employed more than 90,000 people and ran three shifts (24/7). Inspiring the future of aviation A great chapter of history closes At the “Skunk Works,” Lockheed creates the SR-71, Following its merger with Martin Marietta, Lockheed a.k.a. -

Chapter V: Transportation

Transportation CHAPTER V: TRANSPORTATION A. GENERAL CHARACTERISTICS Located at the junction of Interstate 91 and Interstate 95, as well as a key access point to the Northeast Corridor rail line, New Haven is the highway and rail gateway to New England. It is the largest seaport in the state and the region and also the first city in Connecticut to have joined the national complete streets movement in 2008 by adopting the City’s Complete Streets Design Manual, balancing the needs of all roadway users including pedestrians, bicyclists, and motorists. Journey to Work Data For a U.S. city of its size, New Haven has substantial share (45 Aerial view of New Haven seaport: largest in the state and the region. percent) of commuters who use a form of transportation other than driving alone. Approximately 15 percent of all commuters travel via carpool, close to 14 percent walk to work, while over 11 percent use a form of public transportation. Of the 10 largest cities in New England, only Boston has a higher percentage of residents who travel to work via non-motorized transportation. Also, out of this same group of cities, New Haven ranked highest in the percentage of people who walked to work. New Haven Vision 2025 V-1 Transportation Vehicular Circulation There are 255 miles of roadway in the city, ranging from Interstate highways to purely local residential streets. Of these roadways, 88 percent are locally-maintained public roads and 12 percent are state-maintained roads and highways. There are 43 locally- maintained bridges in the city. -

Opinion Letter to the Wicks Group PLLC on Aug. 22, 2009

U,S,Department Office of the Chief Counsel 800 Independence Ave., S,w. of Transportation Washington, D.C. 20591 Federal Aviation Administration Glenn P. Wicks, Esq. Roncevert D. Almond, Esq. AUG 222008 The Wicks Group PLLC 1215 17th Street, N.W. Sumner Square, Fourth Floor Washington, D.C. 20036 RE: Opinion on the Runway Safety Area Project at Tweed-New Haven Airport Dear Messrs. Wicks and Almond: This is in response to your request for an opinion on the power of non-proprietors to regulate airport development within the existing boundaries of an airport. In the context of the Town of East Haven's use of its zoning powers to prevent Tweed-New Haven Airport (Airport) from enlarging its runway safety areas' (RSAs) at each end of its air carrier runway, you ask specifically whether "a non-proprietor municipality's improper attempts to regulate the construction of an aviation safety project being carried out by the [Airport] Authority, an airport sponsor, entirely within the boundaries of the Airport and under the authority, approval, and supervision of the federal and state governments," would be federally preempted. Based upon the information in your letter and articulated below, our conclusion is that the Town of East Haven is federally preempted from using its police powers to prevent the Airport from attempting to comply with current FAA RSA standards, as recently mandated by Congress, through enlarging its sub-standard RSAs at either end of Runway 2/20 to meet those standards. 1. Background: The Tweed-New Haven Regional Airport Authority is the sponsor of the Tweed-New Haven Regional Airport (Airport). -

Hartford Brainard Airport Business Plan

AIRPORT BUSINESS PLAN Hartford-Brainard Airport Prepared for: Business Plan Executive Summary Prepared by: May 2012 TABLE OF CONTENTS EXECUTIVE SUMMARY ........................................................................................................ ES1 1.0 INTRODUCTION ............................................................................................................. 1 1.1 Business Plan Process .................................................................................................. 2 1.2 Airport Profile .............................................................................................................. 3 2.0 EXISTING AIRPORT CHARACTERISTICS............................................................................ 5 2.1 Physical Characteristics ............................................................................................... 5 2.2 Existing Airport Tenants .............................................................................................. 6 2.3 Management Structure ............................................................................................... 9 2.4 Historical Airport Data ............................................................................................... 10 2.5 Baseline Financial Data .............................................................................................. 11 3.0 AIRPORT MARKET AREA .............................................................................................. 13 4.0 SWOT ANALYSIS FOR HARTFORD-BRAINARD AIRPORT -

October 2012

international edition october 2012 Boeing predicts wide-body surge SPECIAL SECTION: TIACA Air Cargo Forum © 2012 United Air Lines, Inc. All rights reserved. Wherever you’re going... we’re there. Over 370 destinations throughout the world. And there. And there. And there. The truth is, with more than 150 wide body aircraft, linking 10 hubs and over 370 destinations throughout the world, chances are good that no matter where you’re headed, United Cargo has you covered. For more information, contact your local United Cargo Sales Representative or visit us at unitedcargo.com. Includes destinations served by United Air Lines, Inc. and United Express. JOB#: 12UA018 AD: DC PROOF#: BLUE CLIENT: United Cargo CW: KTG/UC Color Format 4/C process STUDIO#: Vantage TRAFFIC: JW FILE NAME: 12UA018 Air Cargo World MAR12.indd HEADLINE: Wherever you’re going... BLEED: .125 PUBLICATION: Air Cargo World TRIM: 8 x 10.875 PUBDATE: APRIL 2012 SAFETY: 7 x 10 October 2012 Volume 15, Number 9 Editor Jon Ross contents [email protected] • (770) 642-8036 Associate Editor Keri Forsythe [email protected] • (770) 642-8036 Back Pages special correspondent October 1958: “Getting ready for the jet age” Martin Roebuck 24 cOntributing Editors Roger Turney, Ian Putzger Region Focus cOntributing Photographer Geography, infrastructure propel Atlanta cargo Rob Finlayson 28 columnist Brandon Fried production Director Airports Ed Calahan 32 Fueled by cargo circulation Manager Nicola Mitcham [email protected] Special Section Art Director Central Communications -

Aviation & Airport Ground Access

TRANSPORTATION SYSTEM AVIATION AND AIRPORT GROUND ACCESS SOUTHERN CALIFORNIA ASSOCIATION OF GOVERNMENTS TECHNICAL REPORT ADOPTED ON SEPTEMBER 3, 2020 EXECUTIVE SUMMARY 1 INTRODUCTION 2 REGIONAL SIGNIFICANCE 3 REGULATORY FRAMEWORK 18 ANALYTICAL APPROACH 19 EXISTING CONDITIONS 23 STRATEGIES 31 NEXT STEPS 36 CONCLUSION 40 REFERENCES 41 TECHNICAL REPORT AVIATION AND AIRPORT GROUND ACCESS ADOPTED ON SEPTEMBER 3, 2020 connectsocal.org EXECUTIVE SUMMARY TRANSPORTATION SYSTEM The SCAG region is home to seven commercial airports with scheduled passenger service, seven government/military air fields, and over 30 reliever Aviation and Airport and general aviation airports. On a daily basis, the region’s airports provide service to hundreds of thousands of air passengers, and thousands of tons of cargo. Moreover, the airports in the SCAG region employ approximately 60,000 Ground Access people onsite. Therefore, thousands of passengers, employees, and goods are traveling the region’s roads, highways, and transit systems to get to and from the airports. As a metropolitan planning organization (MPO), SCAG does not have any regulatory, developmental, operational, or planning authority over the airports. Rather, SCAG is primarily a regional surface transportation planning agency that maintains a list of airport ground access projects and a consultative relationship with the airports. Therefore, SCAG is focused on air and passenger cargo activity from the perspective of how the traffic coming and going from the airports affects the region’s roads, highways, and transit system. One critical aspect of SCAG’s role in aviation systems and transportation planning is the Aviation Element of the 2020-2045 Regional Transportation Plan/Sustainable Communities Strategy (2020 RTP/SCS) (Connect SoCal).