2020 Annual Results Announcement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Le 17H00 26/11/2020

LE 17H00 26/11/2020 ATHLON FRANCE TRAVAILLE AU DÉPLOIEMENT D’UNE OFFRE DE MOBILITÉ Opérationnelle aux Pays-Bas, l’offre Athlon Flex, anciennement ChangeMyCar, sera testée en France en 2021 auprès d’un client pilote. « Athlon International avait conclu après une longue étude que les conducteurs avaient besoin de beaucoup plus de flexibilité, de pouvoir changer de voiture beaucoup plus souvent, alors que les contrats de LLD courent généralement sur trois ou quatre ans et bloquent tout changement sur cette période. Or il se trouve que la vie des conducteurs peut changer, ils peuvent par exemple avoir des enfants et avoir donc avoir besoin d’un véhicule plus grand », explique Gérard de Chalonge, directeur commercial et marketing d’Athlon France. L’idée centrale d’Athlon Flex est que les employés choisissent et modifient les solutions qui correspondent à leurs besoins de mobilité changeants. Un jeune diplômé qui commence tout juste son premier emploi peut combiner une voiture, un vélo et les transports en commun. Les employés peuvent conduire à une voiture électrique au quotidien tout en conservant la flexibilité nécessaire pour revenir à une voiture thermique pour les vacances. Les jeunes familles peuvent quant à elle passer à une voiture familiale pour s’adapter à leurs enfants. Il s’agit en quelque sorte d’un budget mobilité dernière génération qui repose sur une application mobile. La prochaine étape sera un déploiement sur le marché français. Gérard de Chalonge précise que l’offre sera testée en 2021 auprès d’un client pilote, l’objectif étant « d’adapter le dispositif à notre culture, au contexte et aux besoins locaux car la maturité des Pays-Bas sur les questions de mobilité est plus avancée que la nôtre ». -

Groupe Renault Sets Its New Strategy for China

PRESS RELEASE Groupe Renault sets its new Strategy for China • Groupe Renault will focus in China on light commercial vehicles (LCV) and electric vehicles (EV). • Groupe Renault will transfer its shares in Dongfeng Renault Automotive Company Ltd (DRAC) to Dongfeng Motor Corporation. DRAC will stop its Renault brand-related activities. • LCV business is operated through Renault Brilliance Jinbei Automotive Co., Ltd. (RBJAC), leveraging Jinbei legacy with Renault know-how. • EV business will be developed through the two existing joint ventures: eGT New Energy Automotive Co., Ltd (eGT) and Jiangxi Jiangling Group Electric Vehicle Co. Ltd (JMEV). Boulogne-Billancourt, April 14th, 2020 - Groupe Renault unveiled today its new strategy for the Chinese Market, building on two of its key pillars: Electric Vehicles (EV) and Light Commercial Vehicles (LCV). Within this new strategy, Groupe Renault activities in China will be driven as follow: About Chinese ICE Passenger Car Market Regarding ICE passenger car, Groupe Renault has entered into a preliminary agreement with Dongfeng Motor Corporation under which Renault transfers its shares to Dongfeng. DRAC will stop its Renault brand-related activities. Renault will continue to provide high quality aftersales service for its 300,000 customers through Renault dealers but also through Alliance synergies. Further development for Renault brand passenger cars will be detailed later within future new mid-term-plan Renault. Furthermore, Renault and Dongfeng will continue to cooperate with Nissan on new generation engines like components supply to DRAC and diesel license to Dongfeng Automobile Co., Ltd. Renault and Dongfeng will also engage in innovative cooperation in the field of intelligent connected vehicles. -

Chapter 2 China's Cars and Parts

Chapter 2 China’s cars and parts: development of an industry and strategic focus on Europe Peter Pawlicki and Siqi Luo 1. Introduction Initially, Chinese investments – across all industries in Europe – especially acquisitions of European companies were discussed in a relatively negative way. Politicians, trade unionists and workers, as well as industry representatives feared the sell-off and the subsequent rapid drainage of industrial capabilities – both manufacturing and R&D expertise – and with this a loss of jobs. However, with time, coverage of Chinese investments has changed due to good experiences with the new investors, as well as the sheer number of investments. Europe saw the first major wave of Chinese investments right after the financial crisis in 2008–2009 driven by the low share prices of European companies and general economic decline. However, Chinese investments worldwide as well as in Europe have not declined since, but have been growing and their strategic character strengthening. Chinese investors acquiring European companies are neither new nor exceptional anymore and acquired companies have already gained some experience with Chinese investors. The European automotive industry remains one of the most important investment targets for Chinese companies. As in Europe the automotive industry in China is one of the major pillars of its industry and its recent industrial upgrading dynamics. Many of China’s central industrial policy strategies – Sino-foreign joint ventures and trading market for technologies – have been established with the aim of developing an indigenous car industry with Chinese car OEMs. These instruments have also been transferred to other industries, such as telecommunications equipment. -

Sustainability Report 2016 Nissan Motor Corporation Sustainability Report 2016 01

SUSTAINABILITY REPORT 2016 NISSAN MOTOR CORPORATION SUSTAINABILITY REPORT 2016 01 CONTENTS VIEWING THIS REPORT 2 1 3 This Sustainability Report is an interactive PDF. You can easily access the information 5 7 you need by clicking on the navigation tabs and buttons. 4 6 8 ● Section Tabs BUILDING TOMORROW’S SUSTAINABLE CONTENTS INTRODUCTION CEO MESSAGE MOBILITY SOCIETY Sustainability Strategies Click the tabs to jump to the top page of each section. ● Navigation Buttons ● Link Buttons 02 16 Go back one page Jump to linked page Return to previously viewed page Jump to information on the web 03 43 Go forward one page Jump to information in CSR Data 04 53 ● Our Related Websites 07 62 14 70 ■ Editorial Policy ■ Third-Party Assurance Nissan publishes an annual Sustainability Report as a way of sharing Click the link at right to view the third-party assurance. information on its sustainability-related activities with stakeholders. 108 77 This year’s report reviews the progress and results achieved in fiscal page_136 2015, focusing on the concept of Building Tomorrow’s Sustainable Mobility Society and the eight sustainability strategies. ■ Forward-Looking Statements ■ Scope of the Report This Sustainability Report contains forward-looking statements 136 95 Period Covered: The report covers fiscal 2015 (April 2015 to March on Nissan’s future plans and targets and related operating 2016); content that describes efforts outside this period is indicated investment, product planning and production targets. There can in the respective sections. Organization: Nissan Motor Co., Ltd., be no assurance that these targets and plans will be achieved. foreign subsidiaries and affiliated companies in the Nissan Group. -

Social Responsibility Report of Nissan's Subsidiaries

2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA Introduction As the second social responsibility report released by Nissan Motor Company in China, and Dongfeng Motor Group Co., Ltd. in China), and Dongfeng Infiniti Automobile Co., 2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA Ltd., an independent wholly-owned subsidiary of Dongfeng Motor Company Limited. In (hereinafter referred to as “this Report” or “the Report”) mainly describes the social this Report, “Nissan's subsidiaries in China” refer to the companies above in general, responsibility performance of Nissan’s subsidiaries in China from January to December and “Nissan” refers to Nissan Motor Company. 2014, with part of the data and descriptions involving information before 2014. All the information and data in this Report are supplied by Nissan's subsidiaries in This Report covers Nissan’s wholly-owned subsidiary in China – Nissan (China) China. Nissan ensures that the materials related to this Report are authentic and reliable Investment Co., Ltd., two joint ventures – Dongfeng Nissan Passenger Vehicle Company and that no false record, major omission or misleading statement is contained here in and Zhengzhou Nissan Automobile Co., Ltd. (i.e., the subsidiary companies of this Report. In addition, all the amounts in this Report are denominated in RMB (Yuan) Dongfeng Motor Co., Ltd., a joint venture between Nissan (China) Investment Co., Ltd. unless specified otherwise. 01 2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA -

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013 Dongfeng Motor (489.HK) Automobile Sector 10 January 2013 Research Idea: Moving Up the Gears Target Price HK$15.00 We rate Dongfeng Motor (DFG) a Buy with 12-month target price of 12m Rating Buy HK$15.00. Its sales have dropped since Q3 2012 amid Sino-Japan tensions, 16% upside but we expect a recovery to pre-protest levels in Q1 2013 and growth to DFG – Price Chart (HK$) persist backed by a strong brand lineup. As one of the nation’s leading 22 Bull, HK$20.90 20 automakers, DFG is a good proxy for a secular sector growth story. 18 16 Base, HK$15.00 Three reasons to Buy: 14 12 10 . Sino-Japanese tensions have eased. DF Honda’s sales rebounded to 8 pre-protest levels while DF Nissan’s rebounded to 80% of pre-protest 6 Bear, HK$6.40 Jan12 May12 Sep12 Jan13 May13 Sep13 Jan14 levels in December, well above expectations. Consumer concerns about damage to vehicles should be offset by Sino-Japan auto JVs Price (HK$) 12.96 guaranteeing to repair damage caused during the recent unrest. We Mkt cap – HK$m (US$m) 112,354 (14,494) expect DFG’s sales volume growth to rebound from down 0.8% to +11% in FY13. Free float – % (H-share) 100.00 3M avg. t/o– HK$m (US$m) 299.5 (38.6) . Strong brand lineup can facilitate market-share gains. DFG has Major shareholder (%) three JVs and a comprehensive range of well-received models, which should help minimize sales fluctuations. -

2016 Annual Report

東風汽車集團股份有限公司 DONGFENG MOTOR GROUP COMPANY LIMITED Stock Code: 489 2016 Annual Report * For identification purposes only Contents Corporate Profile 2 Chairman’s Statement 3 Report of Directors 7 Management Discussion and Analysis 42 Profiles of Directors, Supervisors and Senior Management 51 Report of the Supervisory Committee 59 Corporate Governance Report 61 Independent Auditor’s Report 84 Consolidated Income Statement 91 Consolidated Statement of Comprehensive Income 92 Consolidated Statement of Financial Position 93 Consolidated Statement of Changes in Equity 95 Consolidated Statement of Cash Flows 97 Notes to the Financial Statements 100 Five Year Financial Summary 189 Corporate Information 191 Notice of Annual General Meeting and Relating Information 192 Definitions 208 Corporate Profile Dongfeng Peugeot Citroën Sales Co., Ltd. Dongfeng Peugeot Citroën Auto Finance Co., Ltd. Dongfeng (Wuhan) Engineering Consulting Co., Ltd. Dongfeng Motor Investment (Shanghai) Co., Ltd. Dongfeng Off-road Vehicle Co., Ltd. Dongfeng Motor Co., Ltd. Dongfeng Nissan Auto Finance Co., Ltd. China Dongfeng Motor Industry Import & Export Co., Ltd. Limited Dongfeng Motor Finance Co.,Ltd. Dongfeng Getrag Automobile Transmission Co., Ltd. Dongfeng Renault Automobile Co., Ltd. Dongfeng Liu Zhou Motor Co., Ltd. Dongvo (Hangzhou) Truck Co., Ltd. Honda Motor (China ) Investment Co.,Ltd. Motor Group Company Dongfeng Honda Auto Parts Co., Ltd. ), the predecessor of Dongfeng Motor Corporation and the parent of the the parent of Corporation and of Dongfeng Motor the predecessor ), Dongfeng Honda Engine Co., Ltd. Dongfeng Honda Automobile Co., Ltd. Dongfeng Dongfeng Peugeot Citroën Automobile Co., Ltd. Dongfeng Commercial Vehicle Co., Ltd. Dongfeng Electrical Vehicle Co., Ltd. 第二汽車製造廠 Dongfeng Special Purpose Commercial Vehicle Co., Ltd. -

Feasibility Study and Strategy Analysis of Low

E3S Web of Conferences 275, 02011 (2021) https://doi.org/10.1051/e3sconf/202127502011 EILCD 2021 Feasibility study and strategy analysis of low-carbon operation of large-scale sports events under the green development model: an example of building a "racing city" in Wuhan Yi Ke1,* 1School of Physical Education and Equestrian, Wuhan Business University, Wuhan, China Abstract. China emphasizes the need to establish a new development concept of innovation, coordination, green, openness and sharing, and to promote green and low-carbon transformation. Hubei Province is also accelerating the promotion of green and low-carbon development and continuously improving its sustainable development capacity. Wuhan, as the capital of Hubei province, is the city of car-making and the future city of racing. This paper mainly uses the literature method and fieldwork method to conduct the study and the author believes that under the green development model, through the low-carbon event operation means, the large-scale auto event will become a unique auto event brand IP, which will help expand the influence of the city, promote the low-carbon development of auto industry and sports industry, and lead the public to actively embrace the low-carbon and green lifestyle. 1 Introduction Table 1. Basic information of major passenger car enterprises In the general debate of the 75th session of the UN in Wuhan General Assembly, President Xi Jinping clearly Production and sales No. Passenger car OEMs proposed that "China will increase its national volume in 2020 contribution, adopt more vigorous policies and measures, strive to peak CO2 emissions by 2030, and strive to 1 Dongfeng Honda 850307 units achieve carbon neutrality by 2060, emphasizing that all 2 SAIC-GM Wuhan 482178 units countries should promote green and low-carbon Dongfeng Peugeot 3 50,267 units transformation to build a community of human destiny. -

France Carlos Tavares Défend À Nouveau Le Diesel

BRÈVES DE 10H30 2015/04/21 FRANCE CARLOS TAVARES DÉFEND À NOUVEAU LE DIESEL COMME SOLUTION À MOYEN TERME POUR LUTTER CONTRE LE RÉCHAUFFEMENT Interrogé sur le diesel par un groupe de journalistes en marge du Salon de Shanghaï, le président de PSA Peugeot Citroën Carlos Tavares a expliqué que tout le débat sur cette motorisation venait de Paris. Mme Hidalgo « nous dit qu’elle voudrait se débarrasser de l’énergie fossile, mais je pense que le vrai problème, c’est qu’elle a envie de se débarrasser des voitures à Paris […] Moi, je n’ai rien contre, mais il suffit de nous afficher clairement la couleur », a indiqué M. Tavares. « Ce qu’on a essayé d’expliquer aux députés : qu’il y ait une transition vers de la mobilité propre, c’est une évidence. La transition qui est en train de se dessiner qui serait moins de diesel et plus d’électrique, c’est tout à fait honorable, mais si on veut véritablement traiter la problématique du réchauffement climatique, la seule bêtise à ne pas faire c’est de tuer le diesel maintenant », a ajouté le dirigeant. (AFP) Par Alexandra Frutos BOUYGUES CONSTRUCTION RETIENT PSA ET RENAULT POUR SES 11 000 VOITURES DE FONCTION Bouygues Construction a annoncé a retenu PSA Peugeot Citroën et Renault pour le renouvellement de sa flotte de quelque 11 000 véhicules de fonction. Cette sélection est intervenue suite à un appel d’offres lancé, comme tous les trois ans, auprès de tous les constructeurs mondiaux présents en France, précise l’entreprise dans un communiqué. -

2020 Interim Report of the Group for Your Review

Contents Chairman's Statement 2 Corporate Information 5 Report of the Directors 6 Management Discussion and Analysis 17 Directors, Supervisors and Senior Management 25 Unaudited Interim Condensed Consolidated 27 Financial Statements and Notes Definitions 56 Chairman’s Statement Dear Shareholders, On behalf of the Board of Directors, I hereby present the 2020 interim report of the Group for your review. In the first half of 2020, affected by the COVID-19 epidemic and China’s economic downturn, China’s automotive industry sold approximately 10,257,000 units vehicles, representing a year-on-year decrease of 16.9%, of which passenger vehicle sales were 7,873,000 units, representing a year-on-year decrease of 22.4%, and commercial vehicle sales totalled 2,384,000 units vehicles, representing a year-on-year increase of 8.6%. Among which, in the first quarter, the impact of the COVID-19 epidemic was obvious, with the industry sales falling by 42.4% year on year; in the second quarter, the epidemic slowed down and was stimulated by consumption release and favourable policies, and therefore, the recovery of the Chinese auto market was accelerated. The development of the automobile industry in the first half of the year showed the following characteristics: 1. Passenger vehicles ended 22-month negative growth, and the sales growth rate in the second quarter turned from negative to positive, reaching 7.2% in May. Meanwhile, the market share of Japanese brands increased by 3.7%, while that of self-developed brands decreased by 5.2%. 2. Major passenger vehicle manufacturers extended their strategy from a single hot model to a product portfolio strategy, making their market response more flexible, with the products complementing each other, relying on the more effective strategy of product mixtures. -

2005-Global Partnerships Final Poster.Qxd 8/17/2005 3:54 PM Page 1

2005-global partnerships final poster.qxd 8/17/2005 3:54 PM Page 1 SPONSORED BY GGuuiiddee ttoo gglloobbaall aauuttoommoottiivvee ppaarrttnneerrsshhiippss FULL OWNERSHIP EQUITY STAKES VEHICLE ASSEMBLY ALLIANCES TECHNICAL/PARTS ALLIANCES BMW AG Owned by: Joint venture: Contract assembly: •DaimlerChrysler - gasoline engines - Brazil •Mini •Quandt family - 46.6% •BMW Brilliance •Magna Steyr, Austria •Land Rover - diesel engines - UK •Rolls-Royce Motor Cars Ltd. •Other shareholders - 53.4% Automotive Co., China •PSA/Peugeot-Citroen - gasoline engines - France & UK •Tritec Motors, Brazil •Toyota -diesel engines DAIMLERCHRYSLER AG Owns: Owned by: Joint venture: Contract assembly: •BMW - gasoline engines - Brazil •Chrysler group •McLaren Group - 40% •Deutsche Bank - 6.9% •Beijing Benz-DaimlerChrysler •Karmann, Germany •GM - hybrid drive system •Mercedes-Benz •Mitsubishi - 12.8% •Kuwait Investments - 7.2% Automotive, China •Magna Steyr, Austria •Hyundai/Mitsubishi - 4-cylinder engines (Mercedes-Benz owns 100% of Maybach and Smart) •Mitsubishi Fuso - 65% •Other shareholders - 85.9% •Fujian Motor Industry Group, China DONGFENG MOTOR CORP. Owns: Owned by: Joint venture: •Dongfeng Yueda Kia Dongfeng Motor Corp. •Dongfeng Liuzhou Motor Co. Ltd. •Dongfeng Automobile Co. - •Chinese central government - •Dongfeng Honda Automobile Co., China 70% 100% Automobile (Wuhan), China •Zhengzhou Nissan •Dongfeng Motor Co., China Automobile Co., China •Dongfeng Peugeot Citroen Automobile Co., China FIAT S.P.A. Owns: Owned by: Joint venture: Contract assembly: •General Motors - powertrains - Poland •Fiat Auto S.p.A. •Ferrari - 50% •Agnelli family - 22% •Nanjing Fiat - China •Pininfarina, Italy •Suzuki - diesel engines - India (Fiat Auto owns 100% of Alfa Romeo, Fiat and Lancia) •Other shareholders - 78% •SEVEL - Italy, France •Suzuki, Hungary •Maserati S.p.A. •Tofas - Turkey •Nissan, South Africa •Iveo Fiat - Brazil •Mekong Corp., Vietnam FIRST AUTOMOBILE WORKS GROUP Owns: Owned by: Joint venture: •FAW-Volkswagen First Automobile (FAW) •FAW Car Co. -

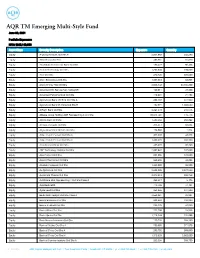

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300