2020 Interim Report of the Group for Your Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 2 China's Cars and Parts

Chapter 2 China’s cars and parts: development of an industry and strategic focus on Europe Peter Pawlicki and Siqi Luo 1. Introduction Initially, Chinese investments – across all industries in Europe – especially acquisitions of European companies were discussed in a relatively negative way. Politicians, trade unionists and workers, as well as industry representatives feared the sell-off and the subsequent rapid drainage of industrial capabilities – both manufacturing and R&D expertise – and with this a loss of jobs. However, with time, coverage of Chinese investments has changed due to good experiences with the new investors, as well as the sheer number of investments. Europe saw the first major wave of Chinese investments right after the financial crisis in 2008–2009 driven by the low share prices of European companies and general economic decline. However, Chinese investments worldwide as well as in Europe have not declined since, but have been growing and their strategic character strengthening. Chinese investors acquiring European companies are neither new nor exceptional anymore and acquired companies have already gained some experience with Chinese investors. The European automotive industry remains one of the most important investment targets for Chinese companies. As in Europe the automotive industry in China is one of the major pillars of its industry and its recent industrial upgrading dynamics. Many of China’s central industrial policy strategies – Sino-foreign joint ventures and trading market for technologies – have been established with the aim of developing an indigenous car industry with Chinese car OEMs. These instruments have also been transferred to other industries, such as telecommunications equipment. -

Sustainability Report 2016 Nissan Motor Corporation Sustainability Report 2016 01

SUSTAINABILITY REPORT 2016 NISSAN MOTOR CORPORATION SUSTAINABILITY REPORT 2016 01 CONTENTS VIEWING THIS REPORT 2 1 3 This Sustainability Report is an interactive PDF. You can easily access the information 5 7 you need by clicking on the navigation tabs and buttons. 4 6 8 ● Section Tabs BUILDING TOMORROW’S SUSTAINABLE CONTENTS INTRODUCTION CEO MESSAGE MOBILITY SOCIETY Sustainability Strategies Click the tabs to jump to the top page of each section. ● Navigation Buttons ● Link Buttons 02 16 Go back one page Jump to linked page Return to previously viewed page Jump to information on the web 03 43 Go forward one page Jump to information in CSR Data 04 53 ● Our Related Websites 07 62 14 70 ■ Editorial Policy ■ Third-Party Assurance Nissan publishes an annual Sustainability Report as a way of sharing Click the link at right to view the third-party assurance. information on its sustainability-related activities with stakeholders. 108 77 This year’s report reviews the progress and results achieved in fiscal page_136 2015, focusing on the concept of Building Tomorrow’s Sustainable Mobility Society and the eight sustainability strategies. ■ Forward-Looking Statements ■ Scope of the Report This Sustainability Report contains forward-looking statements 136 95 Period Covered: The report covers fiscal 2015 (April 2015 to March on Nissan’s future plans and targets and related operating 2016); content that describes efforts outside this period is indicated investment, product planning and production targets. There can in the respective sections. Organization: Nissan Motor Co., Ltd., be no assurance that these targets and plans will be achieved. foreign subsidiaries and affiliated companies in the Nissan Group. -

Social Responsibility Report of Nissan's Subsidiaries

2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA Introduction As the second social responsibility report released by Nissan Motor Company in China, and Dongfeng Motor Group Co., Ltd. in China), and Dongfeng Infiniti Automobile Co., 2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA Ltd., an independent wholly-owned subsidiary of Dongfeng Motor Company Limited. In (hereinafter referred to as “this Report” or “the Report”) mainly describes the social this Report, “Nissan's subsidiaries in China” refer to the companies above in general, responsibility performance of Nissan’s subsidiaries in China from January to December and “Nissan” refers to Nissan Motor Company. 2014, with part of the data and descriptions involving information before 2014. All the information and data in this Report are supplied by Nissan's subsidiaries in This Report covers Nissan’s wholly-owned subsidiary in China – Nissan (China) China. Nissan ensures that the materials related to this Report are authentic and reliable Investment Co., Ltd., two joint ventures – Dongfeng Nissan Passenger Vehicle Company and that no false record, major omission or misleading statement is contained here in and Zhengzhou Nissan Automobile Co., Ltd. (i.e., the subsidiary companies of this Report. In addition, all the amounts in this Report are denominated in RMB (Yuan) Dongfeng Motor Co., Ltd., a joint venture between Nissan (China) Investment Co., Ltd. unless specified otherwise. 01 2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA -

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013 Dongfeng Motor (489.HK) Automobile Sector 10 January 2013 Research Idea: Moving Up the Gears Target Price HK$15.00 We rate Dongfeng Motor (DFG) a Buy with 12-month target price of 12m Rating Buy HK$15.00. Its sales have dropped since Q3 2012 amid Sino-Japan tensions, 16% upside but we expect a recovery to pre-protest levels in Q1 2013 and growth to DFG – Price Chart (HK$) persist backed by a strong brand lineup. As one of the nation’s leading 22 Bull, HK$20.90 20 automakers, DFG is a good proxy for a secular sector growth story. 18 16 Base, HK$15.00 Three reasons to Buy: 14 12 10 . Sino-Japanese tensions have eased. DF Honda’s sales rebounded to 8 pre-protest levels while DF Nissan’s rebounded to 80% of pre-protest 6 Bear, HK$6.40 Jan12 May12 Sep12 Jan13 May13 Sep13 Jan14 levels in December, well above expectations. Consumer concerns about damage to vehicles should be offset by Sino-Japan auto JVs Price (HK$) 12.96 guaranteeing to repair damage caused during the recent unrest. We Mkt cap – HK$m (US$m) 112,354 (14,494) expect DFG’s sales volume growth to rebound from down 0.8% to +11% in FY13. Free float – % (H-share) 100.00 3M avg. t/o– HK$m (US$m) 299.5 (38.6) . Strong brand lineup can facilitate market-share gains. DFG has Major shareholder (%) three JVs and a comprehensive range of well-received models, which should help minimize sales fluctuations. -

2016 Annual Report

東風汽車集團股份有限公司 DONGFENG MOTOR GROUP COMPANY LIMITED Stock Code: 489 2016 Annual Report * For identification purposes only Contents Corporate Profile 2 Chairman’s Statement 3 Report of Directors 7 Management Discussion and Analysis 42 Profiles of Directors, Supervisors and Senior Management 51 Report of the Supervisory Committee 59 Corporate Governance Report 61 Independent Auditor’s Report 84 Consolidated Income Statement 91 Consolidated Statement of Comprehensive Income 92 Consolidated Statement of Financial Position 93 Consolidated Statement of Changes in Equity 95 Consolidated Statement of Cash Flows 97 Notes to the Financial Statements 100 Five Year Financial Summary 189 Corporate Information 191 Notice of Annual General Meeting and Relating Information 192 Definitions 208 Corporate Profile Dongfeng Peugeot Citroën Sales Co., Ltd. Dongfeng Peugeot Citroën Auto Finance Co., Ltd. Dongfeng (Wuhan) Engineering Consulting Co., Ltd. Dongfeng Motor Investment (Shanghai) Co., Ltd. Dongfeng Off-road Vehicle Co., Ltd. Dongfeng Motor Co., Ltd. Dongfeng Nissan Auto Finance Co., Ltd. China Dongfeng Motor Industry Import & Export Co., Ltd. Limited Dongfeng Motor Finance Co.,Ltd. Dongfeng Getrag Automobile Transmission Co., Ltd. Dongfeng Renault Automobile Co., Ltd. Dongfeng Liu Zhou Motor Co., Ltd. Dongvo (Hangzhou) Truck Co., Ltd. Honda Motor (China ) Investment Co.,Ltd. Motor Group Company Dongfeng Honda Auto Parts Co., Ltd. ), the predecessor of Dongfeng Motor Corporation and the parent of the the parent of Corporation and of Dongfeng Motor the predecessor ), Dongfeng Honda Engine Co., Ltd. Dongfeng Honda Automobile Co., Ltd. Dongfeng Dongfeng Peugeot Citroën Automobile Co., Ltd. Dongfeng Commercial Vehicle Co., Ltd. Dongfeng Electrical Vehicle Co., Ltd. 第二汽車製造廠 Dongfeng Special Purpose Commercial Vehicle Co., Ltd. -

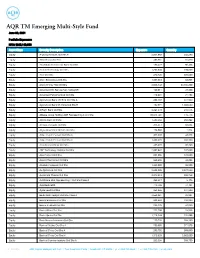

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

AS of 03-Sep-2021 Solactive China Automobile Performance-Index

FACTSHEET - AS OF 24-Sep-2021 Solactive China Automobile Performance-Index DESCRIPTION The Solactive China Automobile Index tracks the performance of the biggest Chinese Companies active in the automobile sector. The index is calculated as a total return index in Euro and adjusted annually. HISTORICAL PERFORMANCE 500 400 300 200 100 Jan-2011 Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Jan-2018 Jan-2019 Jan-2020 Jan-2021 Solactive China Automobile Performance-Index CHARACTERISTICS ISIN / WKN DE000SLA0CA9 / SLA0CA Base Value / Base Date 100 Points / 25.10.2010 Bloomberg / Reuters SOLCA Index / .SOLCA Last Price 417.28 Index Calculator Solactive AG Dividends Reinvested (Total Return Index) Index Type Industry / Sector Calculation 09:00am to 10:30pm (CET), every 60 seconds Index Currency EUR History Available daily back to 25.10.2010 Index Members 14 FACTSHEET - AS OF 24-Sep-2021 Solactive China Automobile Performance-Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -11.05% -10.11% 2.64% 46.01% -6.04% 315.08% Performance (p.a.) - - - - - 13.93% Volatility (p.a.) 29.21% 36.07% 31.25% 36.66% 34.70% 31.36% High 485.13 485.13 485.13 491.81 491.81 491.81 Low 417.28 417.28 363.82 285.78 363.82 56.41 Sharpe Ratio -2.58 -0.96 0.19 1.29 -0.22 0.46 Max. Drawdown -13.99% -13.99% -14.00% -26.02% -26.02% -50.32% VaR 95 \ 99 -57.3% \ -93.4% -49.5% \ -82.7% CVaR 95 \ 99 -76.9% \ -120.7% -70.2% \ -108.8% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES KY 46.7% HKD 80.2% CN 39.7% USD 19.8% US 13.6% TOP COMPONENTS AS OF 24-Sep-2021 -

Sustainability Report of Nissan's Subsidiaries in China

Sustainability Report of Nissan’s Subsidiaries in China About This Report Period Covered Reliability Assurance From January 1, 2017 to December 31, 2017. In order to improve data comparability, part of contents Nissan’s subsidiaries in China ensure that the materials disclosed in this Report are authentic and reliable is beyond this period. and that no false record, major omission or misleading statement is contained herein. Organizational Scope This Report covers Nissan (China) Investment Co., Ltd. (hereinafter referred to as “NCIC”), Nissan’s Report Preparation Process wholly-owned subsidiary in China; Dongfeng Motor Co., Ltd. (hereinafter referred to as “DFL”), Nissan’s joint venture in China, and Dongfeng Nissan Passenger Vehicle Company (hereinafter referred to as"DFN"), DFL’s subsidiary in charge of the passenger vehicle business; Zhengzhou Nissan Initial Report Content Design Feedback Automobile Co., Ltd. (hereinafter referred to as “ZNA”), also a joint venture of Nissan; and Dongfeng Preparation Writing Review Release and Plan Infiniti Motor Co., Ltd. (hereinafter referred to as “DFI”), a wholly-owned subsidiary of DFL. In this Report, “Nissan’s subsidiaries in China” refer to the companies above in general, and “Nissan” refers to Nissan Motor Corporation. ● Establishment of the ● Confirmation of report ● Confirmation of report ● Formation of report ● Collection of feedback from workgroup framework and content contents design draft stakeholders ● Peer benchmarking ● Report preparation ● Senior review of report ● Report release ● Adjustment and optimization analysis contents of further work plan Reporting Cycle ● Information collection ● Third-party assessment As an annual report, this Report is the first sustainability report released by Nissan Motor Corporation report in China. -

Financial Information 1.1MB

Financial Information as of March 31, 2019 (The English translation of the “Yukashoken-Houkokusho” for the year ended March 31, 2019) Nissan Motor Co., Ltd. Table of Contents Page Cover .......................................................................................................................................................................... 1 Part I Information on the Company .......................................................................................................... 2 1. Overview of the Company ......................................................................................................................... 2 1. Key financial data and trends ........................................................................................................................ 2 2. History .......................................................................................................................................................... 4 3. Description of business ................................................................................................................................. 6 4. Information on subsidiaries and affiliates ..................................................................................................... 7 5. Employees................................................................................................................................................... 13 2. Business Overview ..................................................................................................................................... -

DFMC2013SHZRNB.Pdf

东 风 汽 车 公 司 2013 社会责任报告 东风汽车公司社会责任报告 DFM CORPORATION SOCIAL RESPONSIBILITY REPORT 官方微博 官方微信 Dongfeng, the nurturing east wind Ⱋᒂ Contents ͚ప͉ᷓ䷻⋓ 㔲䉐ШڠDongfeng Nurturing China Dream ݖ⯷Ⱕ Stakeholders’ Responsibility 䪬ڞ㔲 ̻ڠȟч䉐Шጒ҉⤳ᔢ ⋓∪ݖ⯷Ⱕ ȟч䉐Ш͚㵹ߕ䃎ܿÿÿ⋓䃎ܿ ȟͧ㗎͉݈䕍Фթఋ្ ȟч䉐Ш㻳㻶㶕⣝ ȟͧঅጒᐧ䃫Ꭵ⺼უచ ȟч䉐Шノ⤳ಸ ȟͧᝤӈх䉕ϔ৮ ȟч䉐Ш䃛䷅䔶᠖ 䊏Ꭰझڞȟͧцѡᥚᐧ ȟч䉐Ш⇌䕇 Й̭䊤䔪ᄨ⮱͉䷻ᷓ ȟч䉐Ш㘪߈ᐧ䃫 Let’s Work Together to Pursue Dongfeng Dream ȟ䉐Ш㢐㾶 ȟ㦐θ䪬㜡䓋 ȟᕨ㏼⤳㜡䓋 ䷻Ⱪ͚⮱͉ڠȟݖ⯷Ⱕ थキϸڙȟ ⤳⇨थڙȟ ȟ㏱㏴ᱧᲱȟ ȟ䄇ԎႵ∂ Ԋ䃮Ю͇⽠֒ࣾᆂ ȟЮ͇᪴ࡃ ϔ ᐧ䃫֒Ꮴ䓽㥒⣜ධ⩌ڕȟႶ ȟ㜗݈ͨ ក䕍ℾ↪䒓৮❹ 䊝䔈͉䷻⮱̓⩹ ㏼≻䉐Ш Walk into the World of Dongfeng Economic Responsibility ㍮㢐ڞ㞟ప䃎ℾ⩌ ̻పუ⋓ ⯷䉐Шڙч Public Welfare Responsibility 䔈ₒڞ⯷θ͇ ̻чڙ㒻⋓ ⤳⯷ᙵノڙȟ ⯷䶦Ⱋڙȟ Ꭱᆂ᱈ Outlook 2014 ȟᠴᴴ㉏ᑂ ȟ្ॷ䃱㏔ λ᱙្ॷڠȟ ȟႹ⣜ධノ⤳ ȟᘼ㻮ࣺ亵㶕 ȟᐧ䃫㐬㞟ጒࢯ ȟᗲ㈨᪴ࡃθ͇ ȟ⩌ϔ⣜Ԋϔ৮ ȟᑂᄩ֒Ꮴ↪䒓᪴ࡃ ⣜ධ䉐Ш 䭱ᒂ Environment Responsibility ᪴ࡃ䉐Ш The Appendix Cultural Responsibility হ䄽ڞ㜗♣ ̻⣜ධͪ⋓ ࣾᆂڞ᪴ࡃ ̻᪴ᬻ⊥⋓ थч䉐Ш្ॷڙ䒓↪䷻͉ DFM CORPORATION SOCIAL RESPONSIBILITY REPORT 2013 ై͛ˇῨ℗ঌᔻ˝▚ཝ Let’sL Work Together to Pursue Dongfeng Dream ᒽᎠ XU PING ༁Γ䃝ڇथ㦐θ䪬Ƞڙ䒓↪䷻͉ Chairman of Board and Secretary of CPC Committee, DFM 㦐θ䪬㜡䓋 Chairman of Board थౕчڙहఋ䶫䓴̭ࣨᎡ͉䷻↪䒓ڞᓰȠᩜᠮȠԎШ͉䷻θ͇⮱ҍЙ喑ڠ䕇䓴Ȩч䉐Ш្ॷȩ̻̭Ⱑڡ䲋፥倅 㐅᱗Გ⮱ࣾᆂ̻ᷓᘠȡڞ䉐Шθ͇䲏ःᓄ⮱䔈ₒ喑ܳϘߌ⮱ૉᗓহᙌߕ喑 थ䨭ਜ਼↪䒓 ̴䒳喑ᅲڙᎡڕथಇᠮ⽠͚Ⅿ䔈喑ऱ䶦θ͇䓵̷⮱झ䭣喑θ͇ᵦധᰡߍ➏ధȡڙ䷻Ꭱ͉ 䲏倅䉕䛼ႹȡڕϬٰ喑㏼㥒䉕䛼ᓄݝ䔈̭ₒࡴ喑పߎ䮏ప䉱༁㔰ᵥᠴᴴ ڒ㵹͇すι喑⣝䨭ਜ਼ᩣ 㔲䉐ڠ㞟ᆒ㵹㏼≻䉐ШȠݖ⯷Ⱕܧ䉌䉐Ш⮱๛Ю喑͉䷻ᠶ⚔ч䉐Ш͚㵹ߕ䃎ܿÿÿĄ⋓ą䃎ܿ⮱䘕㒟喑ౕͧ҉ थч䉐Шڙह⮱ߗ߈̸喑ڞ⯷䉐ШȠ᪴ࡃ䉐Шぶ䲏⮱ᆒ䉐ጒ҉ȡౕЙڙШ⮱हᬣ喑⼜Ხᐭᆂ⣜ධ䉐ШȠч 㔲ą喑Ѻλ㵹͇ݺ݄喑Ꭳ㢐㣤Ą͚పЮ͇ч䉐Шࢀ䊷ąぶ㈨݄ᆒ䉐㢐㾶ȡٵĄ䶳ڒࣾᆂᠴ仃⁎ϻĄ䔪䊣㔲ą䔈 ᣕ䔈͉䷻Ąⷠڒ⌞ᄾᴀᢿᩫহ㘪⎽⊵㕄喑ߍᔘࣾᆂ㞯㘪̻㘪⎽↪䒓喑ۼФթ䨫㜡߈λڕ䓴̭ࣨᎡ喑Йౕ ᢿⰛᴴ喑ͧᲱᐧ⣜ධࣸສಸ↪䒓ч䉎⡛γ㜗ጞ⮱߈䛼ȡЙ䕇䓴Ą͉ۼᎠ㶎ą⩌ᔮ᳄ぶ䶦Ⱋ喑倅ᴴ۳ႹᎡᏓ㞯㘪 㠄㵹ߕąȠĄϟ֒Ꮴᔘ䒓ąȠĄᄦऐឣᤡᐧąぶ䶦Ⱋ喑ᎡᏓ㉜䃎䊍 ̴ٰ喑๔߈ᩜᠮౝ㏼≻⋓䷻ -

Renault Will Produce Locally in China

STORY April 15th, 2013 Renault will produce locally in China "China is a new frontier for Renault”, declared Carlos Ghosn, Chairman and Chief Executive Officer of Renault, on February 14, 2013 at the presentation of 2012 financial results. China, which recorded 600,000 car sales in 1999, has become the world’s largest car market, with about 18.5 million units sold: a key market. Renault is already stepping up its presence on the market for imported vehicles in this country and plans to start producing locally in China, before 2016, by benefiting from the Alliance with its partner Nissan. China is already Nissan's largest market. Renault and Dongfeng, the Chinese Nissan partner, signed a Memorandum Of Understanding (MOU) on the 1st semester 2012. The approbation from the Chinese Government should come in 2013. Koleos in Beijing - May 2012 Rights: internal and external use / media and general public excluding for commercial and advertising. Information and Image Department – Editorial Desk Isabelle Behar : +33 1 76 84 53 92 Page 1 of 4 Renault has long-standing presence and interest in China. It produced range-topping minibuses in China between 1995 and 2003, launched several joint ventures and started importing vehicles in 1999. In 2012, Renault sold 29,724 vehicles in China (+22.4%), thanks to the success of Koleos and a full range of Sedans, from Fluence to Talisman. At Shanghai motor show in april 2013, Renault presents New Fluence, a modern and dynamic sedan with a valorizing front face and a refreshed interior styling. The Group is also developping its network, set to grow from 95 dealers in 2012 to 170 dealers by 2014, and the strength of a brand image that emphasizes motor sports. -

Major Events in Nissan's History

4 Marine Business 5 Major Events in Nissan’s History Major Products Event Event 1933 Dec Jidosha Seizo Co., Ltd., predecessor of Nissan Motor 1971 Mar Construction of the Tochigi Plant is completed. Co., Ltd., is established in Yokohama with paid-in (Partial operations begin in October 1968.) capital of ¥10,000,000. Yoshisuke Aikawa is named Jul Nissan enters the marina business through such the new company’s president. operations as the construction of Sajima Marina. 1934 May Construction of the Yokohama Plant is completed. 1972 Sep Cumulative domestic production surpasses 10 million units. Production of tools commences. 1973 Oct Construction of the Sagamihara Parts Center is Jun The Company name is changed to Nissan Motor Co., completed. (Partial operations began in April 1972.) Ltd. The first Datsuns are exported to Asia and Central and 1974 Apr Nissan Science Foundation is established. South America, with shipments totaling 44 units. 1975 Jun Cumulative domestic sales surpass 10 million units. Sun Cruise-27 FB Wing Fisher-27 Joy Fisher-21EX Sun Fisher-33 II (Sun Cruise Series) (Wing Fisher Series) (Joy Fisher Series) (Sun Fisher Series) 1935 Apr The first car manufactured by a fully integrated 1976 Mar Nissan Motor Manufacturing Co. (Australia) Ltd. is assembly system rolls off the line at the Yokohama established and full-scale operation begins. Plant. Mar Commercialization of motorboats, utility boats, and May The corporate mark is chosen. fishing boats begins. 1940 Mar The first knockdown (KD) units are shipped to Dowa 1977 Jun Construction of the Kyushu Plant is completed. Jidosha Kogyo in Manchuria.