Dongfeng Motor Group Company Limited* 東風汽車集團股份有限公司

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 2 China's Cars and Parts

Chapter 2 China’s cars and parts: development of an industry and strategic focus on Europe Peter Pawlicki and Siqi Luo 1. Introduction Initially, Chinese investments – across all industries in Europe – especially acquisitions of European companies were discussed in a relatively negative way. Politicians, trade unionists and workers, as well as industry representatives feared the sell-off and the subsequent rapid drainage of industrial capabilities – both manufacturing and R&D expertise – and with this a loss of jobs. However, with time, coverage of Chinese investments has changed due to good experiences with the new investors, as well as the sheer number of investments. Europe saw the first major wave of Chinese investments right after the financial crisis in 2008–2009 driven by the low share prices of European companies and general economic decline. However, Chinese investments worldwide as well as in Europe have not declined since, but have been growing and their strategic character strengthening. Chinese investors acquiring European companies are neither new nor exceptional anymore and acquired companies have already gained some experience with Chinese investors. The European automotive industry remains one of the most important investment targets for Chinese companies. As in Europe the automotive industry in China is one of the major pillars of its industry and its recent industrial upgrading dynamics. Many of China’s central industrial policy strategies – Sino-foreign joint ventures and trading market for technologies – have been established with the aim of developing an indigenous car industry with Chinese car OEMs. These instruments have also been transferred to other industries, such as telecommunications equipment. -

Social Responsibility Report of Nissan's Subsidiaries

2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA Introduction As the second social responsibility report released by Nissan Motor Company in China, and Dongfeng Motor Group Co., Ltd. in China), and Dongfeng Infiniti Automobile Co., 2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA Ltd., an independent wholly-owned subsidiary of Dongfeng Motor Company Limited. In (hereinafter referred to as “this Report” or “the Report”) mainly describes the social this Report, “Nissan's subsidiaries in China” refer to the companies above in general, responsibility performance of Nissan’s subsidiaries in China from January to December and “Nissan” refers to Nissan Motor Company. 2014, with part of the data and descriptions involving information before 2014. All the information and data in this Report are supplied by Nissan's subsidiaries in This Report covers Nissan’s wholly-owned subsidiary in China – Nissan (China) China. Nissan ensures that the materials related to this Report are authentic and reliable Investment Co., Ltd., two joint ventures – Dongfeng Nissan Passenger Vehicle Company and that no false record, major omission or misleading statement is contained here in and Zhengzhou Nissan Automobile Co., Ltd. (i.e., the subsidiary companies of this Report. In addition, all the amounts in this Report are denominated in RMB (Yuan) Dongfeng Motor Co., Ltd., a joint venture between Nissan (China) Investment Co., Ltd. unless specified otherwise. 01 2015 SOCIAL RESPONSIBILITY REPORT OF NISSAN’S SUBSIDIARIES IN CHINA -

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013

Dongfeng Motor (489.HK) – Initiation of Coverage 10 January 2013 Dongfeng Motor (489.HK) Automobile Sector 10 January 2013 Research Idea: Moving Up the Gears Target Price HK$15.00 We rate Dongfeng Motor (DFG) a Buy with 12-month target price of 12m Rating Buy HK$15.00. Its sales have dropped since Q3 2012 amid Sino-Japan tensions, 16% upside but we expect a recovery to pre-protest levels in Q1 2013 and growth to DFG – Price Chart (HK$) persist backed by a strong brand lineup. As one of the nation’s leading 22 Bull, HK$20.90 20 automakers, DFG is a good proxy for a secular sector growth story. 18 16 Base, HK$15.00 Three reasons to Buy: 14 12 10 . Sino-Japanese tensions have eased. DF Honda’s sales rebounded to 8 pre-protest levels while DF Nissan’s rebounded to 80% of pre-protest 6 Bear, HK$6.40 Jan12 May12 Sep12 Jan13 May13 Sep13 Jan14 levels in December, well above expectations. Consumer concerns about damage to vehicles should be offset by Sino-Japan auto JVs Price (HK$) 12.96 guaranteeing to repair damage caused during the recent unrest. We Mkt cap – HK$m (US$m) 112,354 (14,494) expect DFG’s sales volume growth to rebound from down 0.8% to +11% in FY13. Free float – % (H-share) 100.00 3M avg. t/o– HK$m (US$m) 299.5 (38.6) . Strong brand lineup can facilitate market-share gains. DFG has Major shareholder (%) three JVs and a comprehensive range of well-received models, which should help minimize sales fluctuations. -

2016 Annual Report

東風汽車集團股份有限公司 DONGFENG MOTOR GROUP COMPANY LIMITED Stock Code: 489 2016 Annual Report * For identification purposes only Contents Corporate Profile 2 Chairman’s Statement 3 Report of Directors 7 Management Discussion and Analysis 42 Profiles of Directors, Supervisors and Senior Management 51 Report of the Supervisory Committee 59 Corporate Governance Report 61 Independent Auditor’s Report 84 Consolidated Income Statement 91 Consolidated Statement of Comprehensive Income 92 Consolidated Statement of Financial Position 93 Consolidated Statement of Changes in Equity 95 Consolidated Statement of Cash Flows 97 Notes to the Financial Statements 100 Five Year Financial Summary 189 Corporate Information 191 Notice of Annual General Meeting and Relating Information 192 Definitions 208 Corporate Profile Dongfeng Peugeot Citroën Sales Co., Ltd. Dongfeng Peugeot Citroën Auto Finance Co., Ltd. Dongfeng (Wuhan) Engineering Consulting Co., Ltd. Dongfeng Motor Investment (Shanghai) Co., Ltd. Dongfeng Off-road Vehicle Co., Ltd. Dongfeng Motor Co., Ltd. Dongfeng Nissan Auto Finance Co., Ltd. China Dongfeng Motor Industry Import & Export Co., Ltd. Limited Dongfeng Motor Finance Co.,Ltd. Dongfeng Getrag Automobile Transmission Co., Ltd. Dongfeng Renault Automobile Co., Ltd. Dongfeng Liu Zhou Motor Co., Ltd. Dongvo (Hangzhou) Truck Co., Ltd. Honda Motor (China ) Investment Co.,Ltd. Motor Group Company Dongfeng Honda Auto Parts Co., Ltd. ), the predecessor of Dongfeng Motor Corporation and the parent of the the parent of Corporation and of Dongfeng Motor the predecessor ), Dongfeng Honda Engine Co., Ltd. Dongfeng Honda Automobile Co., Ltd. Dongfeng Dongfeng Peugeot Citroën Automobile Co., Ltd. Dongfeng Commercial Vehicle Co., Ltd. Dongfeng Electrical Vehicle Co., Ltd. 第二汽車製造廠 Dongfeng Special Purpose Commercial Vehicle Co., Ltd. -

2020 Interim Report of the Group for Your Review

Contents Chairman's Statement 2 Corporate Information 5 Report of the Directors 6 Management Discussion and Analysis 17 Directors, Supervisors and Senior Management 25 Unaudited Interim Condensed Consolidated 27 Financial Statements and Notes Definitions 56 Chairman’s Statement Dear Shareholders, On behalf of the Board of Directors, I hereby present the 2020 interim report of the Group for your review. In the first half of 2020, affected by the COVID-19 epidemic and China’s economic downturn, China’s automotive industry sold approximately 10,257,000 units vehicles, representing a year-on-year decrease of 16.9%, of which passenger vehicle sales were 7,873,000 units, representing a year-on-year decrease of 22.4%, and commercial vehicle sales totalled 2,384,000 units vehicles, representing a year-on-year increase of 8.6%. Among which, in the first quarter, the impact of the COVID-19 epidemic was obvious, with the industry sales falling by 42.4% year on year; in the second quarter, the epidemic slowed down and was stimulated by consumption release and favourable policies, and therefore, the recovery of the Chinese auto market was accelerated. The development of the automobile industry in the first half of the year showed the following characteristics: 1. Passenger vehicles ended 22-month negative growth, and the sales growth rate in the second quarter turned from negative to positive, reaching 7.2% in May. Meanwhile, the market share of Japanese brands increased by 3.7%, while that of self-developed brands decreased by 5.2%. 2. Major passenger vehicle manufacturers extended their strategy from a single hot model to a product portfolio strategy, making their market response more flexible, with the products complementing each other, relying on the more effective strategy of product mixtures. -

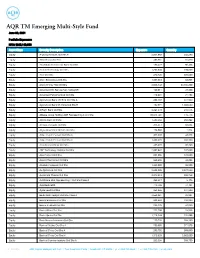

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

AS of 03-Sep-2021 Solactive China Automobile Performance-Index

FACTSHEET - AS OF 24-Sep-2021 Solactive China Automobile Performance-Index DESCRIPTION The Solactive China Automobile Index tracks the performance of the biggest Chinese Companies active in the automobile sector. The index is calculated as a total return index in Euro and adjusted annually. HISTORICAL PERFORMANCE 500 400 300 200 100 Jan-2011 Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Jan-2018 Jan-2019 Jan-2020 Jan-2021 Solactive China Automobile Performance-Index CHARACTERISTICS ISIN / WKN DE000SLA0CA9 / SLA0CA Base Value / Base Date 100 Points / 25.10.2010 Bloomberg / Reuters SOLCA Index / .SOLCA Last Price 417.28 Index Calculator Solactive AG Dividends Reinvested (Total Return Index) Index Type Industry / Sector Calculation 09:00am to 10:30pm (CET), every 60 seconds Index Currency EUR History Available daily back to 25.10.2010 Index Members 14 FACTSHEET - AS OF 24-Sep-2021 Solactive China Automobile Performance-Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -11.05% -10.11% 2.64% 46.01% -6.04% 315.08% Performance (p.a.) - - - - - 13.93% Volatility (p.a.) 29.21% 36.07% 31.25% 36.66% 34.70% 31.36% High 485.13 485.13 485.13 491.81 491.81 491.81 Low 417.28 417.28 363.82 285.78 363.82 56.41 Sharpe Ratio -2.58 -0.96 0.19 1.29 -0.22 0.46 Max. Drawdown -13.99% -13.99% -14.00% -26.02% -26.02% -50.32% VaR 95 \ 99 -57.3% \ -93.4% -49.5% \ -82.7% CVaR 95 \ 99 -76.9% \ -120.7% -70.2% \ -108.8% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES KY 46.7% HKD 80.2% CN 39.7% USD 19.8% US 13.6% TOP COMPONENTS AS OF 24-Sep-2021 -

DFMC2013SHZRNB.Pdf

东 风 汽 车 公 司 2013 社会责任报告 东风汽车公司社会责任报告 DFM CORPORATION SOCIAL RESPONSIBILITY REPORT 官方微博 官方微信 Dongfeng, the nurturing east wind Ⱋᒂ Contents ͚ప͉ᷓ䷻⋓ 㔲䉐ШڠDongfeng Nurturing China Dream ݖ⯷Ⱕ Stakeholders’ Responsibility 䪬ڞ㔲 ̻ڠȟч䉐Шጒ҉⤳ᔢ ⋓∪ݖ⯷Ⱕ ȟч䉐Ш͚㵹ߕ䃎ܿÿÿ⋓䃎ܿ ȟͧ㗎͉݈䕍Фթఋ្ ȟч䉐Ш㻳㻶㶕⣝ ȟͧঅጒᐧ䃫Ꭵ⺼უచ ȟч䉐Шノ⤳ಸ ȟͧᝤӈх䉕ϔ৮ ȟч䉐Ш䃛䷅䔶᠖ 䊏Ꭰझڞȟͧцѡᥚᐧ ȟч䉐Ш⇌䕇 Й̭䊤䔪ᄨ⮱͉䷻ᷓ ȟч䉐Ш㘪߈ᐧ䃫 Let’s Work Together to Pursue Dongfeng Dream ȟ䉐Ш㢐㾶 ȟ㦐θ䪬㜡䓋 ȟᕨ㏼⤳㜡䓋 ䷻Ⱪ͚⮱͉ڠȟݖ⯷Ⱕ थキϸڙȟ ⤳⇨थڙȟ ȟ㏱㏴ᱧᲱȟ ȟ䄇ԎႵ∂ Ԋ䃮Ю͇⽠֒ࣾᆂ ȟЮ͇᪴ࡃ ϔ ᐧ䃫֒Ꮴ䓽㥒⣜ධ⩌ڕȟႶ ȟ㜗݈ͨ ក䕍ℾ↪䒓৮❹ 䊝䔈͉䷻⮱̓⩹ ㏼≻䉐Ш Walk into the World of Dongfeng Economic Responsibility ㍮㢐ڞ㞟ప䃎ℾ⩌ ̻పუ⋓ ⯷䉐Шڙч Public Welfare Responsibility 䔈ₒڞ⯷θ͇ ̻чڙ㒻⋓ ⤳⯷ᙵノڙȟ ⯷䶦Ⱋڙȟ Ꭱᆂ᱈ Outlook 2014 ȟᠴᴴ㉏ᑂ ȟ្ॷ䃱㏔ λ᱙្ॷڠȟ ȟႹ⣜ධノ⤳ ȟᘼ㻮ࣺ亵㶕 ȟᐧ䃫㐬㞟ጒࢯ ȟᗲ㈨᪴ࡃθ͇ ȟ⩌ϔ⣜Ԋϔ৮ ȟᑂᄩ֒Ꮴ↪䒓᪴ࡃ ⣜ධ䉐Ш 䭱ᒂ Environment Responsibility ᪴ࡃ䉐Ш The Appendix Cultural Responsibility হ䄽ڞ㜗♣ ̻⣜ධͪ⋓ ࣾᆂڞ᪴ࡃ ̻᪴ᬻ⊥⋓ थч䉐Ш្ॷڙ䒓↪䷻͉ DFM CORPORATION SOCIAL RESPONSIBILITY REPORT 2013 ై͛ˇῨ℗ঌᔻ˝▚ཝ Let’sL Work Together to Pursue Dongfeng Dream ᒽᎠ XU PING ༁Γ䃝ڇथ㦐θ䪬Ƞڙ䒓↪䷻͉ Chairman of Board and Secretary of CPC Committee, DFM 㦐θ䪬㜡䓋 Chairman of Board थౕчڙहఋ䶫䓴̭ࣨᎡ͉䷻↪䒓ڞᓰȠᩜᠮȠԎШ͉䷻θ͇⮱ҍЙ喑ڠ䕇䓴Ȩч䉐Ш្ॷȩ̻̭Ⱑڡ䲋፥倅 㐅᱗Გ⮱ࣾᆂ̻ᷓᘠȡڞ䉐Шθ͇䲏ःᓄ⮱䔈ₒ喑ܳϘߌ⮱ૉᗓহᙌߕ喑 थ䨭ਜ਼↪䒓 ̴䒳喑ᅲڙᎡڕथಇᠮ⽠͚Ⅿ䔈喑ऱ䶦θ͇䓵̷⮱झ䭣喑θ͇ᵦധᰡߍ➏ధȡڙ䷻Ꭱ͉ 䲏倅䉕䛼ႹȡڕϬٰ喑㏼㥒䉕䛼ᓄݝ䔈̭ₒࡴ喑పߎ䮏ప䉱༁㔰ᵥᠴᴴ ڒ㵹͇すι喑⣝䨭ਜ਼ᩣ 㔲䉐ڠ㞟ᆒ㵹㏼≻䉐ШȠݖ⯷Ⱕܧ䉌䉐Ш⮱๛Ю喑͉䷻ᠶ⚔ч䉐Ш͚㵹ߕ䃎ܿÿÿĄ⋓ą䃎ܿ⮱䘕㒟喑ౕͧ҉ थч䉐Шڙह⮱ߗ߈̸喑ڞ⯷䉐ШȠ᪴ࡃ䉐Шぶ䲏⮱ᆒ䉐ጒ҉ȡౕЙڙШ⮱हᬣ喑⼜Ხᐭᆂ⣜ධ䉐ШȠч 㔲ą喑Ѻλ㵹͇ݺ݄喑Ꭳ㢐㣤Ą͚పЮ͇ч䉐Шࢀ䊷ąぶ㈨݄ᆒ䉐㢐㾶ȡٵĄ䶳ڒࣾᆂᠴ仃⁎ϻĄ䔪䊣㔲ą䔈 ᣕ䔈͉䷻Ąⷠڒ⌞ᄾᴀᢿᩫহ㘪⎽⊵㕄喑ߍᔘࣾᆂ㞯㘪̻㘪⎽↪䒓喑ۼФթ䨫㜡߈λڕ䓴̭ࣨᎡ喑Йౕ ᢿⰛᴴ喑ͧᲱᐧ⣜ධࣸສಸ↪䒓ч䉎⡛γ㜗ጞ⮱߈䛼ȡЙ䕇䓴Ą͉ۼᎠ㶎ą⩌ᔮ᳄ぶ䶦Ⱋ喑倅ᴴ۳ႹᎡᏓ㞯㘪 㠄㵹ߕąȠĄϟ֒Ꮴᔘ䒓ąȠĄᄦऐឣᤡᐧąぶ䶦Ⱋ喑ᎡᏓ㉜䃎䊍 ̴ٰ喑๔߈ᩜᠮౝ㏼≻⋓䷻ -

Healthy Dividend Growth Projected for Chinese Automakers

Healthy dividend growth projected for Chinese Automakers Thursday, April 26th, 2018 Aggregate dividends from Chinese automotive companies are expected to increase to HKD 16.2bn by 2020, up 76% from 2017 • Future dividend growth is expected to be sustained by projected higher sales volume and booming sales of new-energy vehicles. • Declared dividends from Chinese automotive companies grew by 25% year-on- year (YOY) to HKD 9.2bn for 2017. • Majority of the companies adopt performance-linked payout policies, and we noted that some have lifted their payout ratio in 2017. • Market competition however, could create some risks on forecasted dividends. According to the latest filings, the automotive industry in China reported aggregate dividends growth of 25% YOY in 2017. More than two-third of the companies paid higher dividends, which is offset by lower earnings and dividends reported by some key players like Great Wall Motor (“Great Wall”). IHS Markit expects Chinese automakers to continue growing their payouts, with a well-sustained healthy growth rate in the forthcoming years. Aggregate dividends from the industry are forecasted to increase to HKD 16.2bn by 2020, representing an increase of 76% from the amount declared for 2017. We expect this growth to be underpinned by higher vehicle sales and flourishing new-energy vehicles (NEV) market. Aggregate dividends from Chinese automotive sector (HKD bn) 18.0 16.2 16.0 14.2 14.0 11.7 12.0 10.0 9.2 7.4 8.0 6.0 4.8 5.1 4.0 2.0 0.0 2014 2015 2016 2017 2018E 2019E 2020E Source: IHS Markit, FactSet. -

China Annex VI

Annex I. Relations Between Foreign and Chinese Automobile Manufacturers Annex II. Brands Produced by the Main Chinese Manufacturers Annex III. SWOT Analysis of Each of the Ten Main Players Annex IV. Overview of the Location of the Production Centers/Offices of the Main Chinese Players Annex V. Overview of the Main Auto Export/Import Ports in China Annex VI. An Atlas of Pollution: The World in Carbon Dioxide Emissions Annex VII. Green Energy Vehicles Annex VIII. Further Analysis in the EV vehicles Annex IX. Shifts Towards E-mobility Annex I. Relations Between Foreign and Chinese Automobile Manufacturers. 100% FIAT 50% Mitsubishi Guangzhou IVECO 50% Beijing Motors 50% Hyundai 50% GAC Guangzhou FIAT GAC VOLVO 91.94% Mitsubishi 50% 50% 50% 50% 50% (AB Group) Guangzhou BBAC 50% Hino Hino Dongfeng DCD Yuan Beiqi 50% 50% NAVECO Invest Dongfeng NAC Yuejin 50% Cumins Wuyang 50% Guangzhou GAC Motor Honda 50% Yuejin Beiqi Foton Toyota 50% Cumins DET 50% 55.6% 10% 20% 50% Beiqi DYK 100% Guangzhou Group Motors 50% 70% Daimler Toyota 30% 25% 50% 65% Yanfeng SDS shanghai 4.25% 100% 49% Engine Honda sunwin bus 65% 25% visteon Holdings Auto 50% (China) UAES NAC Guangzhou 50% Beilu Beijing 34% Denway Automotive 50% Foton 51% 39% motorl Guangzhou 50% Shanghai Beiqi Foton Daimler 100% 30% 50% VW BAIC Honda Kolben 50% 90% Zhonglong 50% Transmission 50% DCVC schmitt Daimler Invest 100% 10% Guangzhou piston 49% DFM 53% Invest Guangzhou Isuzu Bus 100% Denway Beiqi 33.3% Bus GTE GTMC Manafacture xingfu motor 50% 20% SAIC SALES 100% 20% 100% 100% DFMC 100% Shanghai -

東 風 汽 車 集 團 股 份 有 限 公 司 Dongfeng Motor Group

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. * DONGFENG MOTOR GROUP COMPANY LIMITED 東風汽車集團股份有限公司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 489) ANNOUNCEMENT CONTINUING CONNECTED TRANSACTION INTRODUCTION Dongfeng Motor Group Company Limited (the “Company”) is pleased to announce that on 1 February 2021, the Company entered into the connected transactions framework agreement (the “Framework Agreement”) with Dongfeng Nissan Financial Leasing Co., Ltd., pursuant to which, both parties agree that (1) the Company and its subsidiaries sell whole vehicles to Dongfeng Nissan Financial Leasing Co., Ltd.; and (2) the Company and its subsidiaries provide entrusted loans to Dongfeng Nissan Financial Leasing Co., Ltd. LISTING RULES IMPLICATIONS As of the date of this announcement, Nissan (China) Investment Co., Ltd. holds 50% equity of Dongfeng Motor Co., Ltd., which is a jointly controlled entity of the Company and is also regarded as a subsidiary of the Company. Dongfeng Nissan Financial Leasing Co., Ltd. is a subsidiary of Nissan (China) Investment Co., Ltd., and is the associate of the substantial shareholders of the subsidiary of the Company, and therefore constitutes -

2020 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. DONGFENG MOTOR GROUP COMPANY LIMITED* 東風汽車集團股份有限公司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 489) 2020 ANNUAL RESULTS ANNOUNCEMENT The Board of Directors (the “Board”) of Dongfeng Motor Group Company Limited (the “Company”) is pleased to announce the audited consolidated results of the Company and its subsidiaries (the “Group” or the “Dongfeng Motor Group”) for the year ended 31 December 2020 together with the comparative figures in 2019. In this announcement, unless otherwise specified, all references to business, including manufacture, research and development, outputs and sales volume, market share, investment, sales network, employee, motivation, social responsibility, corporate governance include all relating to the Dongfeng Motor Group, subsidiaries, joint ventures and associates (including subsidiaries, joint ventures and associates of the Company in which the members of the Group have direct or indirect equity interests). DONGFENG MOTOR GROUP COMPANY LIMITED CONSOLIDATED INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2020 Year ended 31 December 2020 2019 Notes RMB million RMB million Revenue 4 107,964