Public Expenditure on Railways in Europe: a Cross-Country Comparison

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Study on Border Crossing Practices in International Railway Transport

STUDY ON BORDER CROSSING PRACTICES IN INTERNATIONAL RAILWAY TRANSPORT Bangkok, 2018 This study was prepared by Transport Division ESCAP. The draft of the study was prepared by Mr. Goran Andreev, Consultant, under the supervision of Mr. Sandeep Raj Jain, Economic Affairs Officer, Transport Facilitation and Logistics Section (TFLS), Transport Division. Overall guidance was provided by Mr. Li Yuwei, Director, Transport Division. The study extensively benefited from the visits made by the ESCAP study team to several border crossings (in chronological order): Sukhbaatar (Mongolia), Dong Dang (Viet Nam), Padang Besar (Malaysia), Sarkhas (Islamic Republic of Iran), Rezekne (Latvia). The assistance provided by the railways, customs and other authorities at these border crossings, their officers and staff for the study is duly appreciated. Acknowledgments are also extended to the representatives of Intergovernmental Organisation for International Carriage by Rail (OTIF) and Organisation for Co- operation between Railways (OSJD), for their constructive comments on the draft Study and the contribution in providing valuable inputs on the publication. The views expressed in this guide are those of the authors and do not necessarily reflect the views of the United Nations Secretariat. The opinions, figures and estimates set forth in this guide are the responsibility of the authors, and should not necessarily be considered as reflecting the views or carrying the endorsement of the United Nations. The designations employed and the presentation of the material in this study do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries. -

Belt and Road Transport Corridors: Barriers and Investments

Munich Personal RePEc Archive Belt and Road Transport Corridors: Barriers and Investments Lobyrev, Vitaly and Tikhomirov, Andrey and Tsukarev, Taras and Vinokurov, Evgeny Eurasian Development Bank, Institute of Economy and Transport Development 10 May 2018 Online at https://mpra.ub.uni-muenchen.de/86705/ MPRA Paper No. 86705, posted 18 May 2018 16:33 UTC BELT AND ROAD TRANSPORT CORRIDORS: BARRIERS AND INVESTMENTS Authors: Vitaly Lobyrev; Andrey Tikhomirov (Institute of Economy and Transport Development); Taras Tsukarev, PhD (Econ); Evgeny Vinokurov, PhD (Econ) (EDB Centre for Integration Studies). This report presents the results of an analysis of the impact that international freight traffic barriers have on logistics, transit potential, and development of transport corridors traversing EAEU member states. The authors of EDB Centre for Integration Studies Report No. 49 maintain that, if current railway freight rates and Chinese railway subsidies remain in place, by 2020 container traffic along the China-EAEU-EU axis may reach 250,000 FEU. At the same time, long-term freight traffic growth is restricted by a number of internal and external factors. The question is: What can be done to fully realise the existing trans-Eurasian transit potential? Removal of non-tariff and technical barriers is one of the key target areas. Restrictions discussed in this report include infrastructural (transport and logistical infrastructure), border/customs-related, and administrative/legal restrictions. The findings of a survey conducted among European consignors is a valuable source of information on these subjects. The authors present their recommendations regarding what can be done to remove the barriers that hamper international freight traffic along the China-EAEU-EU axis. -

Evaluation of Rail-Based Multimodal Transportation of Biofuels

Evaluation of Rail-based Multimodal Transportation of Biofuels Behzad Kordnejad a, Sebastiaan Meijer a a Department of Transport Science, KTH Royal Institute of Technology SE-10044, Teknikringen 72, Stockholm, Sweden E-mail: [email protected], Phone: +46 (0) 8 790 88 17 Abstract This paper aims to analyse the internal and external factors influencing rail-based multimodal transportation of wood biofuel i.e. wood raw materials e.g. chips and branches that are used for production of energy. The analysis is conducted for the Swedish market and by using a bi-sectional qualitative framework. First, a STEEP analysis is conducted in order to analyse the external factors affecting railway transportation of biofuel. STEEP is an acronym for: Social, Technological, Economical, Environmental and Political and it is used as a strategic tool to analyse external factors that influence a business. Second, the internal factors are evaluated through the three main dimensions of sustainability: environmental, economic and social. In essence, it is the factors affecting rail transportation of biofuel and the inherent capability of the rail mode that are addressed. Albeit the two methods are to their nature qualitative approaches, the evaluation is complemented by quantitative analysis of the niche market as well as a case study. A main conclusion from the qualitative analysis is that rail transportation of biofuel faces a number challenges that in many cases are related to a relatively high share of fixed costs and operational inflexibility. The main drivers for it are commonly associated with economies of scale and the relatively low environmental impact. Estimates from the case study show that the break-even distance i.e. -

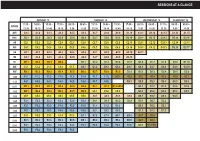

Sessions at a Glance

SESSIONS AT A GLANCE MONDAY 12 TUESDAY 13 WEDNESDAY 14 THURSDAY 15 11:15 - 14:00 - 15:30 - 17:00 - 08:15 - 09:45 - 11:15 - 14:00 - 15:30 - 17:00 - 08:15 - 09:45 - 11:15 - 08:15 - 09:45 - ROOM 12:30 15:15 16:45 18:15 9:30 11:00 12:30 15:15 16:45 18:15 9:30 11:00 12:30 9:30 11:00 AVII A1.1 A1.2 A1.3 A1.4 A1.5 A1.6 A1.7 A1.8 A1.9 A1.10 A1.11 A1.12 A1.13 A1.14 A1.15 AVIII D3.1 D3.2 D3.3 D3.4 D3.5 D3.6 D3.7 D3.8 D3.9 D3.10 D3.11 D3.12 D3.13 D3.14 D3.15 AII C2.1 C2.2 C2.3 C2.4 C2.5 C2.6 C2.7 C2.8 C2.9 C2.10 C2.11 C2.12 C2.13 C2.14 C2.15 AVI C4.1 C4.2 C4.3 C4.4 C4.5 C4.6 C4.7 C4.8 C4.9 C4.10 C4.11 C4.12 C4.13 D3.16 D3.17 5A A2.1 A2.2 A2.3 A2.4 A2.5 A2.6 A2.7 A2.8 A2.9 A2.10 A2.11 5B A4.1 A4.2 A4.3 A4.4 A4.5 A4.6 A4.7 A4.8 A4.9 A4.10 5C B5.1 B5.2 B5.3 B5.4 D1.1 D1.2 D1.3 D1.4 D1.5 D1.6 D1.7 D1.8 D1.9 D1.10 AIII C1.1 C1.2 C1.3 C1.4 C1.5 G4.1 G4.2 G4.3 G4.4 G4.5 G4.6 G4.7 G4.8 G4.9 G4.10 AIV B2.1 B2.2 B2.3 B2.4 B2.5 B2.6 B2.7 B2.8 B2.9 D2.1 D2.2 D2.3 D2.4 D2.5 D2.6 1.08 F1.1 F1.2 F1.3 F1.4 F1.5 F1.6 F1.7 F1.8 H2.1 H2.2 H2.3 H2.4 H2.5 H2.6 H2.7 1.13 F4.1 F4.2 F4.3 F4.4 F4.5 F4.6 F4.7 F4.8 G2.1 G2.2 G2.3 G2.4 G2.5 G2.6 0.07 B3.1 B3.2 B3.3 B3.4 B3.5 B3.6 B1.1 B1.2 B1.3+B5.5 G1.1 G1.2 G1.3 G1.4 G1.5 1.02 B4.1 B4.2 B4.3 B4.4 B4.5 B4.6 C6.1 C6.2 C6.3 G5.1 G5.2 G5.3 G5.4 G5.5 1.03 C5.1 C5.2 C5.3 C5.4 C5.5 C5.6 A3.1 A3.2 A3.3 A3.4 G3.1 G3.2 G3.3 G3.4 1.04 E3.1 E3.2 E3.3 E3.4 E3.5 E3.6 D4.1 D4.2 D4.3 D4.4 D5.1 D5.2 D5.3 1.05 F3.1 F3.2 F3.3 F3.4 F3.5 F3.6 E1.1 E1.2 E1.3 G6.1 G6.2 G6.3 1.06 F6.1 F6.2 F6.3 F6.4 F6.5 F6.6 E6.1 E6.2 E6.3 G7.1 G7.2 G7.3 1.07 -

PT. Kereta Api Indonesia and Statens Järnvägar (SJ) AB, Sweden

ANALYSIS OF TRAIN PASSENGER RESPONSES ON PROVIDED SERVICE Case study: PT. Kereta Api Indonesia and Statens Järnvägar (SJ) AB, Sweden ABADI DWI SAPUTRA Supervisor: Lars Haglund Service Science Program Karlstad University Spring 2010 ABSTRACT Railway is one of public transport mode on land transportation. Railways, as mass public transport modes, have unique characteristics. It has large capacity, high safety level, and free from traffic jam. Those characteristics make railway a primary public transportation. In fact, even railway transportation has a lot of benefits for society life but they still faced by the problem. Service quality level of Railways transportation is still low compared with other transportation modes. At present railways operation is still colored with the delay, limited condition vehicle, and unclear train travel information that often disadvantage passengers, and many other services offered fail to attract passengers. These conditions result in decreasing the quality of services and insufficient railways operation. The objective of this research is to analyze the relationship between customer satisfaction towards provided service with the desire to do a complaint and to find the factor from service quality that has significant influences to customer satisfaction towards PT KAI services. From that data, and also comparison study between PT Kereta Api Indonesia and Statens Järnvägar (SJ) AB, Sweden, we can recommend the service standards design, service guarantee and complaint handling system that need to be adjusted -

TM P2 2014 Standard Information for Traffic Management Overview

TMI_FinalDeliverable TM P2 2014 Standard information for Traffic Management Overview Version 2 Page 1 of 43 TMI_FinalDeliverable Content Foreword ........................................................................................................................................ 5 PART 1 – PROJECT REPORT ....................................................................................................... 6 PART 2 – OVERVIEW .................................................................................................................... 7 1 Introduction .............................................................................................................................. 7 2 General information – summaries ............................................................................................ 8 2.1 Border information .......................................................................................................... 12 2.2 Border agreements ......................................................................................................... 13 3 Traffic Management in case of disturbance ............................................................................ 14 3.1 Communication (ref. Guidelines under construction) ....................................................... 14 3.2 Operational scenarios ..................................................................................................... 14 4 Traffic restrictions.................................................................................................................. -

2012 Report on Combined Transport in Europe

2012 Report on Combined Transport in Europe December 2012 ISBN 978-2-7461-2130-0 Warning No part of this publication may be copied, reproduced or distributed by any means whatsoever, including electronic, except for private and individual use, without the express permission of the International Union of Railways (UIC). The same applies for translation, adaptation or transformation, arrangement or reproduction by any method or procedure whatsoever. The sole exceptions - noting the author’s name and the source -are «analyses and brief quotations justified by the critical, argumentative, educational, scientific or informative nature of the publication into which they are incorpo- rated» (Articles L 122-4 and L122-5 of the French Intellectual Property Code). © International Union of Railways (UIC) - Paris, 2012 December 2012 | 3 List of contents Foreword by the UIC Combined Transport Group Chairman ................ 5 1. Unaccompanied combined rail/road transport volumes ................. 7 1.1. Methodological remarks ........................................................................................7 1.2. Unaccompanied combined transport volumes 2011 v 2009 ................................9 1.3. Time series of unaccompanied combined transport until 2011 ..........................18 2. Accompanied combined rail/road transport volumes ................... 25 2.1. Size of market and statistical sources .................................................................25 2.2. Accompanied combined transport volumes 2011 v 2009...................................25 -

Gothenburg Inner City Freight Delivery

Master Degree Project in Logistics and Transport Management City Logistics Optimization: Gothenburg Inner City Freight Delivery Hyusein Erdinch and Chao Huang Supervisor: Ove Krafft Master Degree Project No. 2014:51 Graduate School ABSTRACT As number of freight vehicles and the volume handled steadily increase and negative effects of transport are being recognized, sustainable transport attracts more attention from both the researchers and transport stakeholders. Since conflicts of interest among stakeholders are not avoidable, it is important to seek for and keep the balance. This research conducts a qualitative method to discuss the optimization possibilities of the city logistics of non-chain stores in central Gothenburg, Sweden by focusing on two stakeholders: The administrators and the freight operators. Based on some of the best practices in urban logistics in other major cities in Europe, this paper tries to suggest new methods for the area in Gothenburg. To understand the subject better, relevant information is collected by the authors from different people involved in city logistics. After getting a clear idea, literature on the subject has been scanned to find the relevant theories. Based on the dynamics of the city, ideas which are not suitable and which could be suitable are discussed from the perspective of the three pillars of sustainability. Keywords: Gothenburg, Göteborg, city logistics, innovation, sustainability, non-chain stores I II ACKNOWLEDGEMENT Hereby, we would like to express our appreciation to our supervisor Ove Krafft, in the School of Business, Economics and Law at University of Gothenburg, for being a wonderful mentor for us. Your encouragement and advices have been priceless. -

List of Numeric Codes for Railway Companies (RICS

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/spip.php?article311 code short name full name country request date allocation date modified date begin of validity end of validity recent Freight Passenger Infra- structure Holding Integrated Other url 0001 0002 0003 0004 0005 01/02/2011 0006 StL Holland Stena Line Holland BV Netherlands 01/07/2004 x http://www.stenaline.nl/ferry/ 0007 0008 0009 0010 VR VR-Yhtymä Oy Finland x http://www.vr.fi/fi/ 0011 0012 TF Transfesa Spain 10/09/2013 x http://www.transfesa.com/ 0013 OSJD OSJD Poland 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits France x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance United Kingdom x http://www.rmf.co.uk/ 0016 RD RAILDATA Switzerland x http://www.raildata.coop/ 0017 ENS European Night Services Ltd United Kingdom x 0018 THI Factory THI Factory SA Belgium 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited United Kingdom x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' Russia 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways Belarus 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi Ukraine 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova Moldova x http://railway.md/ 0024 LG AB 'Lietuvos geležinkeliai' Lithuania 28/09/2004 24/11/2004 x http://www.litrail.lt/ 0025 LDZ Latvijas dzelzceļš Latvia 19/10/2004 24/11/2004 x http://www.ldz.lv/ 0026 EVR Aktsiaselts Eesti Raudtee Estonia x http://www.evr.ee/ 0027 KTZ Kazakhstan Temir Zholy Kazakhstan 17/05/2004 17/05/2004 x http://www.railway.ge/ 0028 GR Sakartvelos Rkinigza Georgia x http://railway.ge/ 0029 UTI Uzbekistan Temir Yullari Uzbekistan 17/05/2004 17/05/2004 x http://www.uzrailway.uz/ 0030 ZC Railways of D.P.R.K. -

Russian Railway Reform Programme

Russian Railway Reform Programme Bruce Murray Abstract The Russian rail system is one of the largest in the world in terms of the size of the network and the amount freight and passenger traffic carried. The railway is strategically important for the economy with a modal share of 85 per cent for freight, excluding pipelines, and 27 per cent for passengers. To set the context for the EBRD’s operations in the sector, this paper describes the Russian Railway Reform Programme, the progress made to date in implementing the reform agenda and some of the remaining challenges. Keywords: railway, Russia, reform, EBRD, restructuring Contact details: Keith Leonard, Evaluation Senior Adviser, One Exchange Square, London EC2A 2JN, UK. Phone: +44 20 7338 6721; email: [email protected]. This report was prepared under the supervision of Keith Leonard, Senior Adviser, EvD by an Evaluation Team consisting of Bruce Murray, Senior Evaluator/Team Leader, Andrei Evdokimov, Consultant/Senior Russian Railway Expert, Olga Mrinska, Consultant/Policy Evaluator and Chiara Bocci, EvD Evaluation Manager for Technical Cooperation. EvD’s Beatriz Pérez Timermans, Saeed Ibrahim, Natalia Lakshina and Stephanie Crossley, undertook research and provided analytical and administrative support. The working paper series has been produced to stimulate debate on the EBRD's Russian Railway Reform Programme. Views presented are those of the authors and not necessarily of the EBRD. Working Paper Prepared in June 2014 1 Abbreviations BRIC Brazil, Russia, India and China CIS Commonwealth -

Railway Reform in the ECE Region

Railway Reform in the ECE region RAILWAY REFORM IN THE ECE REGION Final report New York and Geneva, 2018 Note The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries. ECE/TRANS/261 Copyright © United Nations, 2017 All rights reserved. No part of this publication may, for sales purposes, be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, electrostatic, magnetic tape, mechanical, photocopying or otherwise, without prior permission in writing from the United Nations. UNITED NATIONS PUBLICATION eISBN: 978-92-1-363117-1 ACKNOWLEDGMENTS The Study on Railway Reform across the ECE region was prepared by the consultant Davide Ranghetti. It is based on desktop research and thanks to the kind contribution of speakers and delegates at the Workshop on Railway Reform held in conjunction with the seventy-first session of the Working Party on Rail Transport in November 2017, as well as speakers at previous session of SC.2, without whose commitment and input to this study would not have been possible. The United Nations Economic Commission for Europe, as well as other experts also provided valuable input into the preparation of the document. Disclaimer: Views expressed in this document are of the consultant and of the participants of the Workshop on Railway Reform in the ECE region held in conjunction with the seventy-first session of the Working Party on Rail Transport. -

Managing the Safety of Transport in Sweden

I Organizacja i zarządzanie Violetta JENDRYCZKA MANAGING THE SAFETY OF TRANSPORT IN SWEDEN The article shows the effectiveness of the Swedish safety systems in transport. The introduction of new methods of transport management has made it one of the safest in Europe. In the article shown to minimize the risk of a hazardous event and thus a significant reduction in the number of deaths due to effective management methods. achieve, the quality of the environment and better health. One of the INTRODUCTION main objectives of Sweden until 2030 year, is the independent fleet of cars on fossil fuels. In the national report for the United Nations, Sweden is the third largest country in Europe. The most im- Sweden postulates that, in order to achieve the best possible out- portant is safety, which is one of the most strongly felt needs in that comes transport, both public transport and private must be adapted country. This state is described as- Trygghet. to changes in society. For the Swedish transport and its liquidity Trygghet is understood not only as security, but also well- safety equivalent to many organs. The government is responsible being, and self-confidence. These values are the basis for the func- for meeting the basic needs and creating the appropriate conditions tioning of the entire country, which is the best shown in manage- for the coordination and development of transport. Another institu- ment of transport security. tion taking part in the shaping of transport is Trafikverk - Swedish Sweden, like other Scandinavian countries is an example of the Transport Administration, which started its operations on 1 April increasing problem of "culture," the risks that every day we have to 2010.