WIND RIVER SYSTEMS, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wind River Vxworks Platforms 3.8

Wind River VxWorks Platforms 3.8 The market for secure, intelligent, Table of Contents Build System ................................ 24 connected devices is constantly expand- Command-Line Project Platforms Available in ing. Embedded devices are becoming and Build System .......................... 24 VxWorks Edition .................................2 more complex to meet market demands. Workbench Debugger .................. 24 New in VxWorks Platforms 3.8 ............2 Internet connectivity allows new levels of VxWorks Simulator ....................... 24 remote management but also calls for VxWorks Platforms Features ...............3 Workbench VxWorks Source increased levels of security. VxWorks Real-Time Operating Build Configuration ...................... 25 System ...........................................3 More powerful processors are being VxWorks 6.x Kernel Compatibility .............................3 considered to drive intelligence and Configurator ................................. 25 higher functionality into devices. Because State-of-the-Art Memory Host Shell ..................................... 25 Protection ..................................3 real-time and performance requirements Kernel Shell .................................. 25 are nonnegotiable, manufacturers are VxBus Framework ......................4 Run-Time Analysis Tools ............... 26 cautious about incorporating new Core Dump File Generation technologies into proven systems. To and Analysis ...............................4 System Viewer ........................ -

Wind River Linux Subscription and Services Offerings

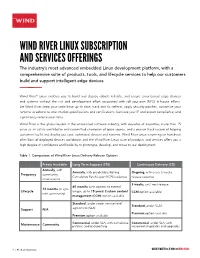

WIND RIVER LINUX SUBSCRIPTION AND SERVICES OFFERINGS The industry’s most advanced embedded Linux development platform, with a comprehensive suite of products, tools, and lifecycle services to help our customers build and support intelligent edge devices Wind River® Linux enables you to build and deploy robust, reliable, and secure Linux-based edge devices and systems without the risk and development effort associated with roll-your-own (RYO) in-house efforts. Let Wind River keep your code base up to date, track and fix defects, apply security patches, customize your runtime to adhere to strict market specifications and certifications, facilitate your IP and export compliance, and significantly reduce your costs. Wind River is the global leader in the embedded software industry, with decades of expertise, more than 15 years as an active contributor and committed champion of open source, and a proven track record of helping customers build and deploy use case–optimized devices and systems. Wind River Linux is running on hundreds of millions of deployed devices worldwide, and the Wind River Linux suite of products and services offers you a high degree of confidence and flexibility to prototype, develop, and move to real deployment. Table 1. Comparison of Wind River Linux Delivery Release Options Freely Available Long Term Support (LTS) Continuous Delivery (CD) Annually, with Annually, with predictable Rolling Ongoing, with every-3-weeks Frequency community Cumulative Patch Layer (RCPL) cadence release cadence maintenance 3 weeks, until next -

Mac Labs. More Creativity

Mac labs. More creativity. More engagement. More learning. Every Mac comes ready for 21st-century learning. Mac OS X Server creates the ultimate lab environment. Creativity and innovation are critical skills in the modern Mac OS X Server includes simplified tools for creating wikis and workplace, which makes them critical skills to teach today’s blogs, so students and staff can set up and manage them with students. Apple offers comprehensive lab solutions for your little or no help from IT. The Spotlight Server feature makes it school or university that will creatively engage students and easy for students collaborating on projects to find and view motivate them to take an interest in their own learning. The content stored anywhere on the network. Of course, access iLife ’09 suite of applications comes standard on every Mac, controls are built in, so they only get the search results they’re so students can immediately begin creating podcasts, editing authorised to see. Mac OS X Server also allows for real-time videos, composing music, producing photo essays and more. streaming of audio and video content, which lets everyone get right to work instead of waiting for downloads – saving major Mac or PC? Have both. storage across your network. Now one lab really can solve all your computing needs. Every Mac is powered by an Intel processor and features Launch careers from your Mac lab. Mac OS X – the world’s most advanced operating system. As an Apple Authorised Training Centre for Education, your Mac OS X comes with an amazing dual-boot feature called school can build a bridge between students and real-world Boot Camp that lets students run Windows XP or Vista natively careers. -

Vxworks Architecture Supplement, 6.2

VxWorks Architecture Supplement VxWorks® ARCHITECTURE SUPPLEMENT 6.2 Copyright © 2005 Wind River Systems, Inc. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without the prior written permission of Wind River Systems, Inc. Wind River, the Wind River logo, Tornado, and VxWorks are registered trademarks of Wind River Systems, Inc. Any third-party trademarks referenced are the property of their respective owners. For further information regarding Wind River trademarks, please see: http://www.windriver.com/company/terms/trademark.html This product may include software licensed to Wind River by third parties. Relevant notices (if any) are provided in your product installation at the following location: installDir/product_name/3rd_party_licensor_notice.pdf. Wind River may refer to third-party documentation by listing publications or providing links to third-party Web sites for informational purposes. Wind River accepts no responsibility for the information provided in such third-party documentation. Corporate Headquarters Wind River Systems, Inc. 500 Wind River Way Alameda, CA 94501-1153 U.S.A. toll free (U.S.): (800) 545-WIND telephone: (510) 748-4100 facsimile: (510) 749-2010 For additional contact information, please visit the Wind River URL: http://www.windriver.com For information on how to contact Customer Support, please visit the following URL: http://www.windriver.com/support VxWorks Architecture Supplement, 6.2 11 Oct 05 Part #: DOC-15660-ND-00 Contents 1 Introduction -

Integrated Step-Down Converter with SVID Interface for Intel® CPU

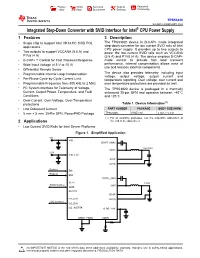

Product Order Technical Tools & Support & Folder Now Documents Software Community TPS53820 SLUSE33 –FEBRUARY 2020 Integrated Step-Down Converter with SVID Interface for Intel® CPU Power Supply 1 Features 3 Description The TPS53820 device is D-CAP+ mode integrated 1• Single chip to support Intel VR13.HC SVID POL applications step-down converter for low current SVID rails of Intel CPU power supply. It provides up to two outputs to • Two outputs to support VCCANA (5.5 A) and power the low current SVID rails such as VCCANA P1V8 (4 A) (5.5 A) and P1V8 (4 A). The device employs D-CAP+ • D-CAP+™ Control for Fast Transient Response mode control to provide fast load transient • Wide Input Voltage (4.5 V to 15 V) performance. Internal compensation allows ease of use and reduces external components. • Differential Remote Sense • Programmable Internal Loop Compensation The device also provides telemetry, including input voltage, output voltage, output current and • Per-Phase Cycle-by-Cycle Current Limit temperature reporting. Over voltage, over current and • Programmable Frequency from 800 kHz to 2 MHz over temperature protections are provided as well. 2 • I C System Interface for Telemetry of Voltage, The TPS53820 device is packaged in a thermally Current, Output Power, Temperature, and Fault enhanced 35-pin QFN and operates between –40°C Conditions and 125°C. • Over-Current, Over-Voltage, Over-Temperature (1) protections Table 1. Device Information • Low Quiescent Current PART NUMBER PACKAGE BODY SIZE (NOM) • 5 mm × 5 mm, 35-Pin QFN, PowerPAD Package TPS53820 RWZ (35) 5 mm × 5 mm (1) For all available packages, see the orderable addendum at 2 Applications the end of the data sheet. -

Introduction to Intel® FPGA IP Cores

Introduction to Intel® FPGA IP Cores Updated for Intel® Quartus® Prime Design Suite: 20.3 Subscribe UG-01056 | 2020.11.09 Send Feedback Latest document on the web: PDF | HTML Contents Contents 1. Introduction to Intel® FPGA IP Cores..............................................................................3 1.1. IP Catalog and Parameter Editor.............................................................................. 4 1.1.1. The Parameter Editor................................................................................. 5 1.2. Installing and Licensing Intel FPGA IP Cores.............................................................. 5 1.2.1. Intel FPGA IP Evaluation Mode.....................................................................6 1.2.2. Checking the IP License Status.................................................................... 8 1.2.3. Intel FPGA IP Versioning............................................................................. 9 1.2.4. Adding IP to IP Catalog...............................................................................9 1.3. Best Practices for Intel FPGA IP..............................................................................10 1.4. IP General Settings.............................................................................................. 11 1.5. Generating IP Cores (Intel Quartus Prime Pro Edition)...............................................12 1.5.1. IP Core Generation Output (Intel Quartus Prime Pro Edition)..........................13 1.5.2. Scripting IP Core Generation.................................................................... -

MIPS IV Instruction Set

MIPS IV Instruction Set Revision 3.2 September, 1995 Charles Price MIPS Technologies, Inc. All Right Reserved RESTRICTED RIGHTS LEGEND Use, duplication, or disclosure of the technical data contained in this document by the Government is subject to restrictions as set forth in subdivision (c) (1) (ii) of the Rights in Technical Data and Computer Software clause at DFARS 52.227-7013 and / or in similar or successor clauses in the FAR, or in the DOD or NASA FAR Supplement. Unpublished rights reserved under the Copyright Laws of the United States. Contractor / manufacturer is MIPS Technologies, Inc., 2011 N. Shoreline Blvd., Mountain View, CA 94039-7311. R2000, R3000, R6000, R4000, R4400, R4200, R8000, R4300 and R10000 are trademarks of MIPS Technologies, Inc. MIPS and R3000 are registered trademarks of MIPS Technologies, Inc. The information in this document is preliminary and subject to change without notice. MIPS Technologies, Inc. (MTI) reserves the right to change any portion of the product described herein to improve function or design. MTI does not assume liability arising out of the application or use of any product or circuit described herein. Information on MIPS products is available electronically: (a) Through the World Wide Web. Point your WWW client to: http://www.mips.com (b) Through ftp from the internet site “sgigate.sgi.com”. Login as “ftp” or “anonymous” and then cd to the directory “pub/doc”. (c) Through an automated FAX service: Inside the USA toll free: (800) 446-6477 (800-IGO-MIPS) Outside the USA: (415) 688-4321 (call from a FAX machine) MIPS Technologies, Inc. -

Introducing the New 11Th Gen Intel® Core™ Desktop Processors

Product Brief 11th Gen Intel® Core™ Desktop Processors Introducing the New 11th Gen Intel® Core™ Desktop Processors The 11th Gen Intel® Core™ desktop processor family puts you in control of your compute experience. It features an innovative new architecture for reimag- ined performance, immersive display and graphics for incredible visuals, and a range of options and technologies for enhanced tuning. When these advances come together, you have everything you need for fast-paced professional work, elite gaming, inspired creativity, and extreme tuning. The 11th Gen Intel® Core™ desktop processor family gives you the power to perform, compete, excel, and power your greatest contributions. Product Brief 11th Gen Intel® Core™ Desktop Processors PERFORMANCE Reimagined Performance 11th Gen Intel® Core™ desktop processors are intelligently engineered to push the boundaries of performance. The new processor core architecture transforms hardware and software efficiency and takes advantage of Intel® Deep Learning Boost to accelerate AI performance. Key platform improvements include memory support up to DDR4-3200, up to 20 CPU PCIe 4.0 lanes,1 integrated USB 3.2 Gen 2x2 (20G), and Intel® Optane™ memory H20 with SSD support.2 Together, these technologies bring the power and the intelligence you need to supercharge productivity, stay in the creative flow, and game at the highest level. Product Brief 11th Gen Intel® Core™ Desktop Processors Experience rich, stunning, seamless visuals with the high-performance graphics on 11th Gen Intel® Core™ desktop -

Intel® Omni-Path Architecture (Intel® OPA) for Machine Learning

Big Data ® The Intel Omni-Path Architecture (OPA) for Machine Learning Big Data Sponsored by Intel Srini Chari, Ph.D., MBA and M. R. Pamidi Ph.D. December 2017 mailto:[email protected] Executive Summary Machine Learning (ML), a major component of Artificial Intelligence (AI), is rapidly evolving and significantly improving growth, profits and operational efficiencies in virtually every industry. This is being driven – in large part – by continuing improvements in High Performance Computing (HPC) systems and related innovations in software and algorithms to harness these HPC systems. However, there are several barriers to implement Machine Learning (particularly Deep Learning – DL, a subset of ML) at scale: • It is hard for HPC systems to perform and scale to handle the massive growth of the volume, velocity and variety of data that must be processed. • Implementing DL requires deploying several technologies: applications, frameworks, libraries, development tools and reliable HPC processors, fabrics and storage. This is www.cabotpartners.com hard, laborious and very time-consuming. • Training followed by Inference are two separate ML steps. Training traditionally took days/weeks, whereas Inference was near real-time. Increasingly, to make more accurate inferences, faster re-Training on new data is required. So, Training must now be done in a few hours. This requires novel parallel computing methods and large-scale high- performance systems/fabrics. To help clients overcome these barriers and unleash AI/ML innovation, Intel provides a comprehensive ML solution stack with multiple technology options. Intel’s pioneering research in parallel ML algorithms and the Intel® Omni-Path Architecture (OPA) fabric minimize communications overhead and improve ML computational efficiency at scale. -

Intel® Arria® 10 Device Overview

Intel® Arria® 10 Device Overview Subscribe A10-OVERVIEW | 2020.10.20 Send Feedback Latest document on the web: PDF | HTML Contents Contents Intel® Arria® 10 Device Overview....................................................................................... 3 Key Advantages of Intel Arria 10 Devices........................................................................ 4 Summary of Intel Arria 10 Features................................................................................4 Intel Arria 10 Device Variants and Packages.....................................................................7 Intel Arria 10 GX.................................................................................................7 Intel Arria 10 GT............................................................................................... 11 Intel Arria 10 SX............................................................................................... 14 I/O Vertical Migration for Intel Arria 10 Devices.............................................................. 17 Adaptive Logic Module................................................................................................ 17 Variable-Precision DSP Block........................................................................................18 Embedded Memory Blocks........................................................................................... 20 Types of Embedded Memory............................................................................... 21 Embedded Memory Capacity in -

Using Virtualization to Implement a Scalable Trusted Execution Environment in Secure Socs

Using Virtualization to Implement a Scalable Trusted Execution Environment in Secure SoCs Document Number: MD00993 Revision 01.00 December 3, 2012 Unpublished rights (if any) reserved under the copyright laws of the United States of America and other countries. This document contains information that is proprietary to MIPS Tech, LLC, a Wave Computing company (“MIPS”) and MIPS’ affiliates as applicable. Any copying, reproducing, modifying or use of this information (in whole or in part) that is not expressly permitted in writing by MIPS or MIPS’ affiliates as applicable or an authorized third party is strictly prohibited. At a minimum, this information is protected under unfair competition and copyright laws. Violations thereof may result in criminal penalties and fines. Any document provided in source format (i.e., in a modifiable form such as in FrameMaker or Microsoft Word format) is subject to use and distribution restrictions that are independent of and supplemental to any and all confidentiality restrictions. UNDER NO CIRCUMSTANCES MAY A DOCUMENT PROVIDED IN SOURCE FORMAT BE DISTRIBUTED TO A THIRD PARTY IN SOURCE FORMAT WITHOUT THE EXPRESS WRITTEN PERMISSION OF MIPS (AND MIPS’ AFFILIATES AS APPLICABLE) reserve the right to change the information contained in this document to improve function, design or otherwise. MIPS and MIPS’ affiliates do not assume any liability arising out of the application or use of this information, or of any error or omission in such information. Any warranties, whether express, statutory, implied or otherwise, including but not limited to the implied warranties of merchantability or fitness for a particular purpose, are excluded. Except as expressly provided in any written license agreement from MIPS or an authorized third party, the furnishing of this document does not give recipient any license to any intellectual property rights, including any patent rights, that cover the information in this document. -

RISC-V Geneology

RISC-V Geneology Tony Chen David A. Patterson Electrical Engineering and Computer Sciences University of California at Berkeley Technical Report No. UCB/EECS-2016-6 http://www.eecs.berkeley.edu/Pubs/TechRpts/2016/EECS-2016-6.html January 24, 2016 Copyright © 2016, by the author(s). All rights reserved. Permission to make digital or hard copies of all or part of this work for personal or classroom use is granted without fee provided that copies are not made or distributed for profit or commercial advantage and that copies bear this notice and the full citation on the first page. To copy otherwise, to republish, to post on servers or to redistribute to lists, requires prior specific permission. Introduction RISC-V is an open instruction set designed along RISC principles developed originally at UC Berkeley1 and is now set to become an open industry standard under the governance of the RISC-V Foundation (www.riscv.org). Since the instruction set architecture (ISA) is unrestricted, organizations can share implementations as well as open source compilers and operating systems. Designed for use in custom systems on a chip, RISC-V consists of a base set of instructions called RV32I along with optional extensions for multiply and divide (RV32M), atomic operations (RV32A), single-precision floating point (RV32F), and double-precision floating point (RV32D). The base and these four extensions are collectively called RV32G. This report discusses the historical precedents of RV32G. We look at 18 prior instruction set architectures, chosen primarily from earlier UC Berkeley RISC architectures and major proprietary RISC instruction sets. Among the 122 instructions in RV32G: ● 6 instructions do not have precedents among the selected instruction sets, ● 98 instructions of the 116 with precedents appear in at least three different instruction sets.