Annual Report 2005

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Clearing Company of Pakistan Limited 8Th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi

National Clearing Company of Pakistan Limited 8th Floor, Karachi Stock Exchange Building, Stock Exchange Road, Karachi NCCPL/CM/APRIL-19/12 April 19, 2019 Eligibility Review of Margin Eligible Securities – as per Approved Amendments in the NCCPL Regulations, 2015 Dear Clearing Members, This is with reference to NCCPL circular NCCPL/CM/APRIL-19/10 dated April 17, 2019 on approved amendments in the NCCPL Regulations, 2015 pertaining to Introduction of Category “B” of Margin Eligible Securities (“MES”). In this regard, in accordance with Schedule III of Chapter 12 of NCCPL Regulations, 2015 following changes will be applicable in MES Category A and Category B respectively effective from April 22, 2019: Haircut for MES category “A” and “B” Applicable Haircut on daily Applicable Haircut on daily VaR based Margin closing rate in Ready Market - closing rate in Ready Market- Bucket Category “A” Category “B” 00.00% to < 12.50% 15.00% 22.50% 12.50% to < 15.00% 17.50% 25.00% 15.00% to < 20.00% 22.50% 30.00% 20.00% to < 25.00% 27.50% 35.00% 25.00% to < 30.00% 32.50% 40.00% 30.00% to < 40.00% 42.50% 50.00% Greater than 40% 60.00% 60.00% Acceptable Quantity for MES category “A” and “B” Maximum No of shares in a Maximum No of shares in a VaR Based Margin symbol that may be deposited symbol that may be deposited Percentage as Collateral Category -A as Collateral Category -B VaR ≤ 20% 2% of Free-Float 1% of Free-Float VaR > 20% 0.5% of Free-Float 0.25% of Free-Float The above mention criteria of Category – B, Haircut and Acceptable quantity are not applicable on MTS and SLB Market. -

Lt Gen Tariq Khan, HI (M) (Retd), Is Chief Executive & Managing

Lt Gen Tariq Khan, HI (M) (Retd) Lt Gen Tariq Khan, HI (M) (Retd), is Chief Executive & Managing Director of Fauji Fertilizer Company Limited, FFC Energy Limited and Fauji Fresh n Freeze Limited and also holds directorship on the Boards of following: Fauji Fertilizer Bin Qasim Limited Askari Bank Limited Fauji Foods Limited Philip Morris (Pakistan) Limited Fauji Meat Limited FFBL Foods Limited FFBL Power Company Limited Thar Energy Limited Pakistan Maroc Phosphore S.A. He is Chairman of Sona Welfare Foundation (SWF) and Fertilizer Manufacturers of Pakistan Advisory Council (FMPAC) and member of the Board of Governors of Foundation University, Islamabad. The General was commissioned in Pakistan Army in April1977 with the coveted Sword of Honour. During his illustrious service in the Army, he had been employed on various prestigious command, staff and instructional assignments including command of a Strike Corps. He is a graduate of Command and Staff College Quetta and National Defence University Islamabad. He also holds Master Degree in War Studies. He has served on the faculty of Command and Staff College Quetta and National Defence University Islamabad. Since his retirement, he is on the honorary faculty of renowned institutions including National Defence University as a senior mentor. The General possesses vast experience as adviser to the leading corporate entities. He has been awarded Hilal-e-Imtiaz (Military) and is also the first Pakistan Army General who has been conferred upon the U.S ‘Legion of Merit’ by the U.S Government for his meritorious services as a senior representative at U.S CENTCOM in Tampa, Florida. -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

Annual Report 2019 23

With a dream to shine and a goal to build a stronger tomorrow, we thrive to enhance sustainability, cost effectiveness, diversification and add value for the stakeholders while expanding global presence. We are committed to constantly improve our brand value, products, services and relationships with our stakeholders. Our forward destination is to expand on our existing portfolio while taking on new opportunities. By sustaining our velocity, we will make it possible to shape a stronger and brighter tomorrow. CONTENTS ORGANIZATION OVERVIEW AND STRATEGY AND RESOURCE EXTERNAL ENVIRONMENT ALLOCATION 6 Company and its Investments 70 Our Business Model 8 Key highlights 71 Strategic Objectives 10 Adoption and Statement of Adherence to IR Framework 72 Resource Allocation Plans to Implement the Strategy 11 Organization overview and external environment and Financial Capital Structure 12 Local and international markets 73 Key Performance Indicators KPIs 12 Export destinations 73 Significant Plans and Decisions 13 Quality assurance of products 74 HR Excellence 13 Diversification and wealth creation for its Shareholders 14 Core brands GOVERNANCE 15 Geographical locations 17 Vision, Mission 81 Chairman’s Profile 18 Culture 82 CEO’s Profile 18 Ethics 84 Directors’ Profiles 19 Core values 88 Executive Management 20 Code of Conduct 90 Senior Management 22 Road to success 91 Chairman’s Review Report 24 Company Profile 92 Board’s Function and Decision Making 36 Group Profile 93 Decisions Delegated to the Management 40 Company Information 93 Board’s Annual -

Pakistan Stock Exchange Limited

Pakistan Stock Exchange Limited Stock Exchange Building, Stock Exchange Road, Karachi-74000, Phones: UAN:111-001-122 Website: www.psx.com.pk Email: [email protected] April 27, 2021 3 1 Kot AdduPak s d} TODAY’S TURNOVER OF SHARES –366,802,075 For the year Dividend/ PROFIT/(LOSS) PROFIT/(LOSS) ANNUAL CLOSURE OF ended/Half year BEFORE AFTER EPS GENERAL SHARE Bonus/ C O M P A N Y ended/ Quarter TAXATION TAXATION (Rs.) MEETING TRANSFER BOOKS Right ended (Rs. In Million) (Rs. In Million) 1. Interloop Limited 31.03.2021 - 4947.757 4,601.326 5.28 (Unconsolidated) Nine Month 2. Interloop Limited 31.03.2021 4,851.409 4,497.586 5.16 (Consolidated) Nine Month 3. TPL Trakker 31.03.2021 (84.336) (156.051) (0.83) Limited Nine Month (Unconsolidated) 4. TPL Trakker 31.03.2021 (153.498) (225.213) (1.06) Limited Nine Month (Consolidated) 5. Sitara Energy 31.03.2021 (94.043) (95.675) (5.01) Limited Nine Month (Unconsolidated) 6. Sitara Energy 31.03.2021 (88.556) (92.688) (4.85) Limited Nine Month (Consolidated) 7. Oil & Gas 11.06.2021 31.03.2021 18%(iii) 96,892.349 66,346.125 15.43 To Development Nine Month Company Limited 17.06.2021 8. Pakistan Oilfields 31.03.2021 14,856.475 9,575.983 33.74 Limited Nine Month (Unconsolidated) 9. Pakistan Oilfields 31.03.2021 15,063.037 9,740.689 34.33 Limited Nine Month (Consolidated) 10. Dewan Textile 31.03.2021 (314.028) (302.209) (6.56) Mills Limited Nine Month 11. -

Akd of 2019.Fh10

Funds Managed by: AKD Investment Management Ltd. 1st Quarter Report September 30, 2019 (Un-audited) quarterly report OPPORTUNITY FUND INDEX TRACKER FUND CASH FUND AGGRESSIVE INCOME FUND AGGRESSIVEISLAMIC INCOME INCOME FUND FUND ISLAMIC STOCK FUND Partner with AKD Profit from the AKD Investment Experience Management Ltd. TABLETABLE OF OF CONTENTSCONTENTS 03 Corporate Information 04 Vision 05 Mission Statement 06 Report of the Directors of the Management Company 11 AKD Opportunity Fund - Financial Statements First Quarter FY20 37 AKD Index Tracker Fund - Financial Statements First Quarter FY20 63 AKD Cash Fund - Financial Statements First Quarter FY20 87 AKD Aggressive Income Fund - Financial Statements First Quarter FY20 115 AKD Islamic Income Fund - Financial Statements First Quater FY20 137 AKD Islamic Stock Fund - Financial Statements First Quarter FY20 MANAGEMENT COMPANY AKD Investment Management Limited 216-217, Continental Trade Centre, Block-8, Clifton, Karachi-74000 BOARD OF DIRECTORS OF THE MANAGEMENT COMPANY Chairman Mr. Abdul Karim Director & Chief Executive Officer Mr. Imran Motiwala Directors Ms. Anum Dhedhi Ms. Aysha Ahmed Mr. Ali Wahab Siddiqui Mr. Hasan Ahmed Mr. Saim Mustafa Zuberi CHIEF FINANCIAL OFFICER OF THE MANAGEMENT COMPANY Mr. Muhammad Munir Abdullah CHIEF OPERATING OFFICER AND COMPANY SECRETARY OF THE MANAGEMENT COMPANY Mr. Muhammad Yaqoob Sultan, CFA HEAD OF COMPLIANCE OF THE MANAGEMENT COMPANY Mr. Rashid Ahmed AUDIT COMMITTEE Mr. Ali Wahab Siddiqui (Chairman) Mr. Hasan Ahmed (Member) Mr. Saim Mustafa Zuberi (Member) Mr. Muhammad Yaqoob Sultan, CFA (Secretary) HUMAN RESOURCE AND REMUNERATION (HR & R) COMMITTEE CORPORATE Ms. Aysha Ahmed (Chairman) Mr. Abdul Karim (Member) Mr. Imran Motiwala (Member) Ms. Anum Dhedhi (Member) INFORMATION Mr. -

ICI PAKISTAN LIMITED Interim Dividend 78 (50%) List of Shareholders Whose CNIC Not Available with Company for the Year Ending June 30, 2015

ICI PAKISTAN LIMITED Interim Dividend 78 (50%) List of Shareholders whose CNIC not available with company for the year ending June 30, 2015 S.NO. FOLIO NAME ADDRESS Net Amount 1 47525 MS ARAMITA PRECY D'SOUZA C/O AFONSO CARVALHO 427 E MYRTLE CANTON ILL UNITED STATE OF AMERICA 61520 USA 1,648 2 53621 MR MAJID GANI 98, MITCHAM ROAD, LONDON SW 17 9NS, UNITED KINGDOM 3,107 3 87080 CITIBANK N.A. HONG KONG A/C THE PAKISTAN FUND C/O CITIBANK N.A.I I CHUNDRIGAR RD STATE LIFE BLDG NO. 1, P O BOX 4889 KARACHI 773 4 87092 W I CARR (FAR EAST) LTD C/O CITIBANK N.A. STATE LIFE BUILDING NO.1 P O BOX 4889, I I CHUNDRIGAR ROAD KARACHI 310 5 87147 BANKERS TRUST CO C/O STANDARD CHARTERED BANK P O BOX 4896 I I CHUNDRIGAR ROAD KARACHI 153 6 10 MR MOHAMMAD ABBAS C/O M/S GULNOOR TRADING CORPORATION SAIFEE MANZIL ALTAF HUSAIN ROAD KARACHI 64 7 13 SAHIBZADI GHULAM SADIQUAH ABBASI FLAT NO.F-1-G/1 BLOCK-3 THE MARINE BLESSINGS KHAYABAN-E-SAADI CLIFTON KARACHI 2,979 8 14 SAHIBZADI SHAFIQUAH ABBASI C/O BEGUM KHALIQUAH JATOI HOUSE NO.17, 18TH STREET KHAYABAN-E-JANBAZ, PHASE V DEFENCE OFFICERS HOUSING AUTHO KARACHI 892 9 19 MR ABDUL GHAFFAR ABDULLAH 20/4 BEHAR COLONY 2ND FLOOR ROOM NO 5 H ROAD AYESHA BAI MANZIL KARACHI 21 10 21 MR ABDUL RAZAK ABDULLA C/O MUHAMMAD HAJI GANI (PVT) LTD 20/13 NEWNAHM ROAD KARACHI 234 11 30 MR SUBHAN ABDULLA 82 OVERSEAS HOUSING SOCIETY BLOCK NO.7 & 8 KARACHI 183 12 50 MR MOHAMED ABUBAKER IQBAL MANZIL FLAT NO 9 CAMPBELL ROAD KARACHI 3,808 13 52 MST HANIFA HAJEE ADAM PLOT NO 10 IST FLOOR MEGHRAJ DUWARKADAS BUILDING OUTRAM ROAD NEAR PAKISTAN -

List of Companies

List of Companies S.No. Company Name S.No. Company Name 1 3M Pakistan Pvt. Limited 41 Bayer Pakistan (Pvt) Ltd. (G) 2 A.F.Ferguson & Co. 42 Berger Paints Pakistan Ltd 3 Abacus Consulting (Pvt) Ltd 43 Bestway Cement 4 Abbott Laboratories (Pakistan) Limited 44 BHP Billiton 5 ACE Insurance Limited Pakistan 45 Bosch Pharmaceuticals Pvt Limited 6 Adamjee Insurance Company Limited (Nishat Group) 46 BP Pakistan Exploration & Production, Inc. 7 Agha Khan Group 47 British Council 8 Aitchison College 48 Brookes Pharmaceutical Laboratories (Pakistan) Limited 9 Akzo Nobel Pakistan Limited 49 Buxly Paints 10 Al Ghazi Tractors Ltd ( offices in service area only ) 50 Central Depository Company 11 Albarka Bank 51 Century Paper & Board Mills 12 Alcatel Pakistan Limited 52 Century Publications Private Limited 13 Ali Institute of Education 53 China Mobile (Zong) 14 All Abu Dhabi Group Companies 54 CitiBank 15 All Embassies & Consulates in Pakistan 55 Civil Services Academy 16 All Organizations of United Nations 56 Civil Aviation Authority 17 Allama Iqbal Medical College 57 Clariant Pakistan Ltd 18 Allied Bank Limited 58 Clover Pakistan Ltd. 19 Anjum Asim Shahid Rahman & Co. 59 Coca Cola Beverages Pak. Ltd. 20 Arif Habib Securities Ltd 60 Coca Cola Export Corp. – Lhr 21 Armed Forces 61 Colgate Palmolive Ltd. 22 Army Welfare Trust & Affiliate Companies 62 College of Physicians & Surgeons 23 Asian Development Bank 63 Continental Biscuits – LU 24 Askari Bank Limited 64 Descon Engineering 25 Askari General Insurance Co.Ltd 65 DG Khan Cement Company Limited (Nishat -

List of Shareholders Whose Dividend Warrants Are Withheld

ICI PAKISTAN LIMITED FINAL DIVIDEND FOR THE YEAR ENDED JUNE 30, 2016 LIST OF WITHHELD DIVIDEND WARRANTS SNO FOLIO NAME ADDRESS GROSS_DIV C/O AFONSO CARVALHO 427 E MYRTLE CANTON ILL UNITED STATE OF 1 47525 MS ARAMITA PRECY D'SOUZA AMERICA 61520 USA 3,492.00 2 53621 MR MAJID GANI 98, MITCHAM ROAD, LONDON SW 17 9NS, UNITED KINGDOM 6,579.00 C/O M/S GULNOOR TRADING CORPORATION SAIFEE MANZIL ALTAF HUSAIN 3 10 MR MOHAMMAD ABBAS ROAD KARACHI 135.00 FLAT NO.F-1-G/1 BLOCK-3 THE MARINE BLESSINGS KHAYABAN-E-SAADI 4 13 SAHIBZADI GHULAM SADIQUAH ABBASI CLIFTON KARACHI 6,309.00 C/O BEGUM KHALIQUAH JATOI HOUSE NO.17, 18TH STREET KHAYABAN-E- 5 14 SAHIBZADI SHAFIQUAH ABBASI JANBAZ, PHASE V DEFENCE OFFICERS HOUSING AUTHO KARACHI 1,890.00 20/4 BEHAR COLONY 2ND FLOOR ROOM NO 5 H ROAD AYESHA BAI MANZIL 6 19 MR ABDUL GHAFFAR ABDULLAH KARACHI 45.00 7 21 MR ABDUL RAZAK ABDULLA C/O MUHAMMAD HAJI GANI (PVT) LTD 20/13 NEWNAHM ROAD KARACHI 495.00 8 30 MR SUBHAN ABDULLA 82 OVERSEAS HOUSING SOCIETY BLOCK NO.7 & 8 KARACHI 387.00 9 50 MR MOHAMED ABUBAKER IQBAL MANZIL FLAT NO 9 CAMPBELL ROAD KARACHI 8,064.00 PLOT NO 10 IST FLOOR MEGHRAJ DUWARKADAS BUILDING OUTRAM ROAD 10 52 MST HANIFA HAJEE ADAM NEAR PAKISTAN CHOWK KARACHI 9.00 FLAT NO.210 CHOWRANGI MAHAL BAHADUR YAR JUNG ROAD GURU MANDIR 11 54 MST JANEB BAI HAJI ADAM UBL BUILDING KARACHI 63.00 44-A BAITUL ADAMJI ADAMJEE NAGAR BLOCK-A KATHIAWAR CO-OP HOUSING 12 72 MR ABDUL AZIZ SOCIETY KARACHI 45.00 13 82 MST HANIFA ABOO ADHI 628-MUHAMMAD SHAH STREET JODIA BAZAR KARACHI 18.00 14 83 MR JAN MOHAMMED USMAN ADHI 3RD FLOOR -

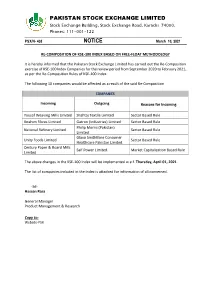

Recomposition of KSE-100 Index

PAKISTAN STOCK EXCHANGE LIMITED Stock Exchange Building, Stock Exchange Road, Karachi-74000, Phones: 111-001-122 PSX/N- 438 NOTICE March 10, 2021 RE-COMPOSITION OF KSE-100 INDEX BASED ON FREE-FLOAT METHODOLOGY It is hereby informed that the Pakistan Stock Exchange Limited has carried out the Re-Composition exercise of KSE-100 Index Companies for the review period from September 2020 to February 2021, as per the Re-Composition Rules of KSE-100 Index. The following 10 companies would be affected as a result of the said Re-Composition. COMPANIES Incoming Outgoing Reasons for Incoming Yousaf Weaving Mills Limited Shahtaj Textile Limited Sector Based Rule Ibrahim Fibres Limited Gatron (Industries) Limited Sector Based Rule Philip Morris (Pakistan) National Refinery Limited Sector Based Rule Limited. Glaxo SmithKline Consumer Unity Foods Limited Sector Based Rule Healthcare Pakistan Limited. Century Paper & Board Mills Saif Power Limited. Market Capitalization Based Rule Limited The above changes in the KSE-100 Index will be implemented w.e.f. Thursday, April 01, 2021. The list of companies included in the Index is attached for information of all concerned. -Sd- Hassan Raza General Manager Product Management & Research Copy to: Website-PSX PAKISTAN STOCK EXCHANGE LIMITED Stock Exchange Building, Stock Exchange Road, Karachi-74000, Phones: 111-001-122 REVISED / RECOMPOSED LIST OF KSE-100 INDEX COMPANIES TO BE IMPLEMENTED W.E.F. April 01, 2021 CLOSE – END MUTUAL FUNDS CEMENT TRANSPORT 01. HBL Growth Fund – A * 36. Cherat Cement Company Ltd 70. Pakistan International Bulk Term. Ltd. * 37. D. G. Khan Cement Co. Ltd MODARABA 38. Fauji Cement Company Ltd. -

RATING REPORT ICI Pakistan Limited (ICI)

VIS Credit Rating Company Limited www.vis.com.pk RATING REPORT ICI Pakistan Limited (ICI) REPORT DATE: April 09, 2021 Latest Rating Rating Category Long- Short- RATING ANALYST: term term Asfia Aziz Entity AA A-1+ [email protected] Rating Outlook Stable Rating Date April 09, 2021 Rating Action Initial COMPANY INFORMATION External auditors: EY Ford Rhodes Incorporated in 1952 Chartered Accountants Public Limited Company Chairman: Mr. Muhammad Sohail Tabba Key Shareholders (with stake 5% or more): CEO: Mr. Asif Jooma Lucky Cement Limited- 55% Yunus Textile Mills Limited- 11.95% Lucky Textile Mills Limited- 6.23% Gadoon Textile Mills Limited-7.21% APPLICABLE METHODOLOGY(IES) VIS Entity Rating Criteria (April 2019) https://s3-us-west-2.amazonaws.com/backupsqlvis/docs/Corporate-Methodology-201904.pdf Page 1 of 11 VIS Credit Rating Company Limited www.vis.com.pk ICI Pakistan Limited OVERVIEW OF THE INSTITUTIO RATING RATIONALE N ICI Pakistan Strong and diversified sponsor group is a key rating driver Limited (ICI) was incorporated in ICI Pakistan Limited (ICI) is a part of the Yunus Brother Group (YBG) which is a leading conglomerate 1952 as a public with strong financial profile and diverse presence across multiple sectors including power generation, limited company. building materials, real estate, textile, chemicals, pharmaceuticals, food and automotive sectors. The ICI is listed on Pakistan Stock group has an annual turnover of nearly Rs. 221.9b and an asset base of Rs. 319.2b at end-2019. Since Exchange Limited, their acquisition of ICI in 2012, sponsors have continued to invest in the expansion of the businesses, with the head demonstrating their long term commitment to the company. -

Post Event Report April 25, 2015

Post Event Report April 25, 2015 Organized by: www.solutions-inc.info Executive Summary . The Third Edition of Pakistan CIO Summit 2015 was held on March 31, 2015 at Marriott Hotel, Karachi . The theme of the summit was 'Solution for Tomorrow' and focused sessions on IT Governance, Cloud Computing: a way forward and Data Analytics – Big or Small? were included. The year 2015 also witnessed the launching of 1st IT Showcase Pakistan 2015, the allied expo in conjunction with 3rd Pakistan CIO Summit 2015 . The summit and expo provided immense opportunities for learning, sharing experiences and networking . Business Beam, Fast-NU, IOBM and PAF-KIET were the Knowledge Partners for the event while Cloud Security Alliance, ISACA Karachi Chapter, KPITB, MIT Enterprise Forum, P@SHA, PSEB, OPEN Karachi Chapter and PISA were the Supporters for 3rd Pakistan CIO Summit and Expo and 1st IT Showcase Pakistan . Rapid Computer was Session Sponsor while PTCL and GBM were Event Co-Sponsor. Dr. Professor Atta Ur Rehman, University of Karachi, was the Chief Guest for the show while Mrs. Farah Hamid Khan, Managing Director, KPITB was the Chairperson of the concluding session . 3rd Pakistan CIO Summit and Expo 2015 was attended by 296 delegates representing 180 Companies. This includes 202 CIOs, IT Heads, IT Managers from 131 Organizations while 94 delegates represented 49 Companies from the IT Industry. The delegates included CIOs, IT Heads, IT Managers, Industry Experts, Decision Makers, Policy Makers and Academia . 24 Exhibitors from all cities of Pakistan including Karachi, Lahore, Islamabad and Peshawar. And companies from Canada, US and Middle East (through their local agents), participated in 1st IT Showcase Pakistan and presented their products and services to the attending delegates of 3rd Pakistan CIO Summit.