Local Governments' Impact on Enterprises' Market Accessibility

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rehablitation of Mahatma Gandhi Setu in Patna

Rehablitation of Mahatma Gandhi Setu in Patna Contractor Name:- FPCC Ind. Ltd 1. Introduction The Mahatma Gandhi Bridge was constructed about 25 years ago over the Ganges River in order to connect patna to the other side of river. Once completed it was supposed to be the part of N.H 19 and comes directly under Central Government of India. It is one of the longest bridge in india. The bridge has 46 spans each with length 120m. Each span has two cantilever beams on both sides which are free to move at the ends. It has two lanes one upstream and the other downstream each with a width of around 6m. Both the lanes are also free from each other and are not connected anywhere. It was constructed by using 3 meter pre-casted parts being joined at both ends to complete the span. The Spans are connected by using a Protrusion which is free to move longitudinally also along the river flow. In upwards and downwards direction it is such that it allows vibration to transfer smoothly to the next span while vehicular movement without much discreteness. It is shown in fig. Due to heavy traffic movement and being the only bridge to cross ganges river the bridge is used heavily now. Hence it has started vibrating with a higher amplitude than it was designed to. Also in many spans the cantilever beams were found to have sagged at ends. 2. Rehabilitation Keeping the structural health prospective in mind it was decided for immediate rehabilitation of the bridge to provide extra strength to the spans so that it bear the existing vehicular load according to the IRC. -

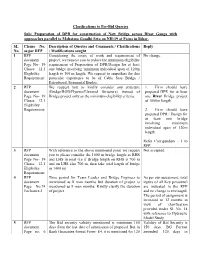

Clarifications to Pre-Bid Queries Sub: Preparation of DPR for Construction

Clarifications to Pre-Bid Queries Sub: Preparation of DPR for construction of New Bridge across River Ganga with approaches parallel to Mahatma Gandhi Setu on NH-19 at Patna in Bihar. SL Clause No. Description of Queries and Comments / Clarifications Reply No. as per RFP / Modifications sought 1 RFP Considering the scope of work and requirement of No change. document project, we request you to reduce the minimum eligibility Page No- 19 requirement of Preparation of DPR/Design for at least Clause 12.1 one bridge involving minimum individual span of 120m Eligibility length to 100 m length. We request to empathise for this Requirement; particular experience to be of Cable Stay Bridge / Extradosed /Segmental Bridge. 2 RFP We request you to kindly consider any structure 1. Firm should have document (Bridge/ROB/Flyover/Elevated Structure) instead of prepared DPR for at least Page No- 19 Bridge project only as the minimum eligibility criteria. one River Bridge project Clause 12.1 of 1000m length. Eligibility Requirement; 2. Firm should have prepared DPR / Design for at least one bridge involving minimum individual span of 120m length. Refer Corrigendum - I to RFP. 3 RFP With reference to the above mentioned point we request Not accepted. document you to please consider the 1000 m bridge length as RHS Page No- 19 and LHS in total (i.e if Bridge length on RHS is 700 m Clause 12.1 and on LHS also 700 m, then take total length of bridge Eligibility as 1400 m) Requirement; 4 RFP Time period for Team Leader and Bridge Engineer is As per our assessment, total document mentioned as 8 man months but duration of project is inputs of all Key personnel Page No.74 mentioned as 9 man months. -

The India Toy Fair Virtual-2021 27 Feb- 2 Mar-2021

THE INDIA TOY FAIR VIRTUAL-2021 27 FEB- 2 MAR-2021 1 THE INDIA TOY FAIR VIRTUAL-2021 27 FEB- 2 MAR-2021 PARTICIPANTS PROFILE 2Teeth Kidswear Address : 168, Arulandhanammalnagar, Pudukottai main Road, Thanjavur, Thanjavur - 613007 (TAMIL NADU) Contact Number : 8610225174, Email : [email protected] , Contact Person : Suganthan Product Category : Baby & Toddler Toys 3LININVOVATIONS Address : 448, BHARATHIYAR RD, PAPA NAICKENPALAYAM, COIMBATORE - 641037 (TAMIL NADU) Contact Number : 9791330359, Email : [email protected] , Contact Person : BALAJI Product Category : Action & Toy Figures 7 Star Toys Industrial Corportaion, Address : G1-1287, RIICO Industrial Area, Phase-V, Bhiwadi, Distt- Alwar, BHIWADI - 301019 (RAJASTHAN) Contact Number : 9873433143, Email : [email protected] , Contact Person : Mr MukulMehndiratta- Partner Product Category : Action & Toy Figures A K Enterprise Address : K 704 Maple Tree, B/s. Manichandra Bungalows, Nr. Surdhara Circle, Sal Hospital Road, Memnagar, Ahmedabad - (Gujarat) Contact Number : 9898812211, Email : [email protected], [email protected] , Contact Person : Kalpesh Bhatia Product Category : Bikes, Skates & Ride-Ons A STAR MARKETING PVT LTD Address : GALI NO 4, JAWAHAR COMPOUND 186, JAKARIA BUNDER RD, SHIWDI WEST, MUMBAI - 400015 (MAHARASHTRA) Contact Number : 9820644540, Email : [email protected] , Contact Person : DIPESH SAVLA Product Category : Action & Toy Figures A. JERALD SHOBAN Address : 29, Near Arul Theatre, Pookara Matha Kobil,Street, Tanjore- DCH - 613501 (TAMIL NADU) Contact Number : 9360936022, Email : [email protected] , Contact Person : A.Jerald Shoban Product Category : Traditional Toys 2 THE INDIA TOY FAIR VIRTUAL-2021 27 FEB- 2 MAR-2021 A2Z PAMTY DECCE PVT. LTD. Address : 25, 36 GOVIND NAGAR ,SODAULA LANE,BORAWALI EAST, MUMBAI - 400092 (MAHARASHTRA) Contact Number : 8104804075, Email : [email protected] , Contact Person : JAYESH M. -

A Report on the Survey of North Bihar In·Relation To

leAk A REPORT ON THE SURVEY OF NORTH BIHAR IN· RELATION TO ..~;EFFECTS OF GANDAK & KOSI RIVER VALLEY PROJECTS ON THE FISHERIES OF THE AREA SU"'VEY RE.PORT I JAN.19SS NO.-? _ CENTRAL INLAND FISHER.IES RESEARCH INSTITUTE (fNOIAN COUNCfL OF AGAICULTUAAL RESEARCH) aA~RACI(PORE • W£st BENGAL. INDIA A REpORT ON THE SURVEY OF NORTH BIHAR IN RELATION TO EFFECTS OF GA~JDAK AND KOSI RIVER VALLEY PROJECTS ON THE FISHERIES OF THE AREA ----------- by H.P.C. Shetty & J.C. Malhotra CENTRAL INLAND FISHERIES RESEARCH SUBSTATION ALLAHABAD ,i~~ .~- ~ ONTE NTS ''''i, L.. '~ Page 1. INTRODUCTION 1 " 2. FIELD SURV EY 2 2.1 Man 2 2.1.1 Champaran district 2 2.1.2 Muzaffarpur district 10 2.1.3 Other districts 10 2.2 Riverin8 fisheries 11 2.3 Tank and pond fisheries 14 3 DISCUSSION 16 3 •.1 Effect of river valley projects 16 3.2 Destruction of fry and fingerlings 18 f.rection of barriers ('bundhs') across inflow and outflow nalas 18 Effect of stagnant conditions due to lack of flushing 18 4 RE C OMf·'ENOA II ONS 18 5 ACKNOWLEDGEMENTS 23 6 REFERENCES 23 c. 1 INTRODUCTION Th~ Gandak and Kosi river ~yst~ms form an extensive network in North Bihar, in the districts of Saran, Champaran, MuzafTafpur, Sahersa, Darbhanga, Monghyr and Purnea. North Bihar as a whole may be treated as a vast inland delta, as all the principal rivers emer• ging from the Himalayas debouch in the plains and ultimately flow into the Ganga on the south. The process of this delta formation has been in pruYJ.:t;i:;;dlor -chousands of years by principal rivers like the Ghaghara, the Gandak, the Kamla and the Kosi by their h~avy silt and detritus load from the Himalayas. -

Physico-Chemical Analysis of Two Fresh Water Ponds of Hajipur, Vaishali District of Bihar

Bulletin of Pure and Applied Sciences Print version ISSN 0970 0765 Vol.39A (Zoology), No.1, Online version ISSN 2320 3188 January-June 2020: P.137-142 DOI 10.5958/2320-3188.2020.00016.9 Original Research Article Available online at www.bpasjournals.com Physico-chemical Analysis of Two Fresh Water Ponds of Hajipur, Vaishali District of Bihar Vijay Kumar* Abstract: The present study was conducted to assess the Author’s Affiliation: physico–chemical analysis of the two fresh water Associate Professor, Department of Zoology, ponds located in Hajipur, Vaishali, Bihar and R.N. College, Hajipur, Vaishali, Bihar 844101, effects of sewage pollution from the drains of India surrounding areas. The study was carried on from January 2018 to December 2018. The range *Corresponding author: of variation for some physico – chemical Vijay Kumar, Associate Professor, Department of parameters like dissolved O2, free CO2, Zoology, R.N. College, Hajipur, Vaishali, Bihar Carbonate, Bicarbonate, Alkalinity, Calcium, 844101, India Chloride Phosphate, Nitrate and BOD was studied for both the ponds. These parameters E-mail: show a marked difference between two fresh [email protected] water ponds depending upon the quality and nature of sewage pollution. Received on 23.01.2020 Accepted on 28.04.2020 Keywords: Water bodies, Sewage pollution, Hydrological Status, Dissolved Oxygen. INTRODUCTION Ponds are considered to be one of the most productive and biologically rich inland surface water ecosystems. It represents a complete self-maintaining and self-regulating ecosystem. The dominating characteristics of aquatic environment result from the physical properties of water. A water molecule is composed of oxygen atom which is slightly negatively charged bounded with two hydrogen atoms, which are slightly positive charged. -

North Bihar Power Distribution Company Limited, Patna

BEFORE THE HON’BLE BIHAR ELECTRICITY REGULATORY COMMISSION FILING OF THE PETITION FOR TRUE UP FOR FY 2016-17, ANNUAL PERFORMANCE REVIEW (APR) FOR FY 2017-18 AND ANNUAL REVENUE REQUIREMENT (ARR) FOR FY 2018-19 FILED BY, NORTH BIHAR POWER DISTRIBUTION COMPANY LIMITED, PATNA CHIEF ENGINEER (COMMERCIAL), NBPDCL 3rd FLOOR, VIDYUT BHAWAN, BAILEY ROAD, PATNA - 800 001 Petition for True up for FY 2016-17, APR for 2017-18 and ARR for FY 2018-19 BEFORE THE BIHAR ELECTRICITY REGULATORY COMMISSION, PATNA IN THE MATTER OF: Filing of the Petition for True up for FY 2016-17, Annual Performance Review (APR) for FY 2017-18, Annual Revenue Requirement (ARR) for FY 2018-19 under Bihar Electricity Regulatory Commission (Multi Year Distribution Tariff) Regulations, 2015 and its amendments thereof along with the other guidelines and directives issued by the BERC from time to time and under Section 45, 46, 47, 61, 62, 64 and 86 of The Electricity Act, 2003 read with the relevant guidelines. AND IN THE MATTER OF: North Bihar Power Distribution Company Limited (hereinafter referred to as "NBPDCL” or “Petitioner” which shall mean for the purpose of this petition the Licensee),having its registered office at Vidyut Bhawan, Bailey Road, Patna. The Petitioner respectfully submits as under: - 1. The Petitioner was formerly integrated as a part of the Bihar State Electricity Board (hereinafter referred to as “BSEB” or “Board”) which was engaged in electricity generation, transmission, distribution and related activities in the State of Bihar. 2. The Board is now unbundled into five (5) successor companies – Bihar State Power (Holding) Company Limited, Bihar State Power Generating Company Limited (hereinafter referred to as “BSPGCL”), Bihar State Power Transmission Company Limited (hereinafter referred to as “BSPTCL”), North Bihar Power Distribution Company Limited and South Bihar Power Distribution Company Limited (hereinafter referred to as “Discoms”) as per Energy Department, Government of Bihar Notification no: under The Bihar State Electricity Reforms Transfer Scheme 2012. -

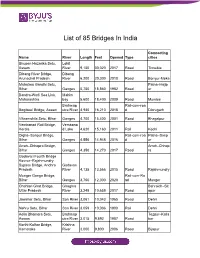

List of 85 Bridges in India

List of 85 Bridges In India Connecting Name River Length Feet Opened Type cities Bhupen Hazarika Setu, Lohit Assam River 9,150 30,020 2017 Road Tinsukia Dibang River Bridge, Dibang Arunachal Pradesh River 6,200 20,300 2018 Road Bomjur-Meka Mahatma Gandhi Setu, Patna–Hajip Bihar Ganges 5,750 18,860 1982 Road ur Bandra-Worli Sea Link, Mahim Maharashtra bay 5,600 18,400 2009 Road Mumbai Brahmap Rail-cum-roa Bogibeel Bridge, Assam utra River 4,940 16,210 2018 d Dibrugarh Vikramshila Setu, Bihar Ganges 4,700 15,400 2001 Road Bhagalpur Vembanad Rail Bridge, Vembana Kerala d Lake 4,620 15,160 2011 Rail Kochi Digha–Sonpur Bridge, Rail-cum-roa Patna–Sonp Bihar Ganges 4,556 14,948 2016 d ur Arrah–Chhapra Bridge, Arrah–Chhap Bihar Ganges 4,350 14,270 2017 Road ra Godavari Fourth Bridge Kovvur–Rajahmundry Bypass Bridge, Andhra Godavari Pradesh River 4,135 13,566 2015 Road Rajahmundry Munger Ganga Bridge, Rail-cum-Ro Bihar Ganges 3,750 12,300 2020 ad Munger Chahlari Ghat Bridge, Ghaghra Bahraich–Sit Uttar Pradesh River 3,249 10,659 2017 Road apur Jawahar Setu, Bihar Son River 3,061 10,043 1965 Road Dehri Nehru Setu, Bihar Son River 3,059 10,036 1900 Rail Dehri Kolia Bhomora Setu, Brahmap Tezpur–Kalia Assam utra River 3,015 9,892 1987 Road bor Korthi-Kolhar Bridge, Krishna Karnataka River 3,000 9,800 2006 Road Bijapur Netaji Subhas Chandra Kathajodi Bose Setu, Odisha River 2,880 9,450 2017 Road Cuttack Godavari Bridge, Andhra Godavari Rail-cum-roa Pradesh River 2,790 1974 d Rajahmundry Old Godavari Bridge Now decommissioned, Godavari Andhra Pradesh -

Muzaffarpur Vaishali Saran Samastipur

N " 0 84°30'0"E 85°0'0"E 85°30'0"E 86°0'0"E 86°30'0"E ' N 0 " 3 0 ° ' 6 0 2 3 ° 6 2 GEOGRAPHICAL AREA MUZAFFARPUR, VAISHALI,SARAN AND SAMASTIPUR DISTRICTS KEY MAP !( !( Ehiapur Minapur CA46 I2 !( !( !( ± CA42 CA45 AURAI Katai Jajuara !( !( Bishunpur !( MINAPUR !( SAHEB GANJ !( Kaili Madhopur Hazari Mahdaya I2 CA4!(7 CA43 !( Sahila Rampur !( !( !( !( Narma Hathauri KATRA BARURAJ(MOTIPUR) NariarPanapur !( Piprahan Asli !( Madhaipura !( !(Ali Neora Jhapaha !( !( !( I2 !( Matlap!(ur Mus!(tafapur !( Hussepur CA44 Ch!(aumukh !( I2 M U Z A F F A R P JUamalabaRdJhapaha !( !( CA48 Deogan Tehwara Bagha Khal urf Nabipur !( CA1 KANTI Mithan Sarai I2 BOC!( HAHA Arna !( PANA!(PUR !( Karanpur Shahbazpur Salem CA52 NH27 !( Dhenuki Patiasa ¤£ !( Anandpur Kharauni BIHAR Bahrauli !( !( Rasauli Bhagwanpur GAIGHAT Bhoraha CA41 !( !( !( !( !( Bhagwanpur I2!( CA49 !( !( CA2 Ginjas !( (! !( Jarang Ladaura !( !( !. I2 Phakuli PAROO Pokhraira Majithi urf Basatpur Majithi !( Bahdinpur CA39 !( !( MUSAHARI MAS!(HRAKH I2 Lachhman Nagar !( !( NH331 Bhikhan!(purI2a ¤£ Nawada !( MARWAN C!(A3 Janta Tok Chhapia Susta !( !( !(TA!(RAIYA CA6 !( Katsa CA4 KerwaPachbhinda CA40 CA51 N Banpura I2 !( LAHLADPUR !( " !( I2 !( CA!( 50 ISHUPUR SARAIYA !( BANDRA 0 Atarsan ' !( Bakhra !( !( Bahilwara Rupnath CA38 N !( !( DHOLI Barheta 0 !(Sat!(ua !( !( !( Kharsand CA7 CA5 Basatpur !( " ° Mirapur urf Gopalpur Moraul Chak Mahsi Rasulpur Sahwa !( !( Lauwa KalanSarea !( KURHANI !( 0 6 EKMA CA32 Kishunpur Madhuban !( Sadikpur Moraul !( Bak!(htiarpur ' 2 BANIAPUR Ku!(rhani !( !( !( CA53 0 !( Harpur MohamdaMalinagar ° I2!( !( (!I2 !( !( I2 CA13 Kurhani Sonbarsa Shah S A R A N PATERHI BELSAR CA37 6 Total Geographical Area (Sq Km) 10753 !( Ekm!(a KAYA!( LANPUR !( !( !( !( harpur !( !( 2 mohammadpur MAKER !( Ladaura Basantpur Raman Paighambarpur Narharpur!( !( CA31 Darsur !( Bharhopur !( CA11 !( Bhualpur Urf Bahadurpur SAKRA !( Mothaha !( CA12 Phulwaria !( !( !( !( Bariyarpur Kandh CA64 Jait!(pur Goraul Bhagwanpur !( !( Bangra VAISHALI !( !( Mobarakpur !( MARHAURA !( !( !( !( No. -

Master Plan for Patna - 2031

IMPROVING DRAFT MASTER PLAN FOR PATNA - 2031 FINAL REPORT Prepared for, Department of Urban Development & Housing, Govt. of Bihar Prepared by, CEPT, Ahmadabad FINAL REPORT IMPROVING DRAFT MASTER PLAN FOR PATNA-2031 FINAL REPORT IMPROVING DRAFT MASTER PLAN FOR PATNA - 2031 Client: Urban Development & Housing Department Patna, Bihar i Prepared by: Center for Environmental Planning and Technology (CEPT) University Kasturbhai Lalbhai Campus, University Road, Navrangpura, Ahmedabad – 380 009 Gujarat State Tel: +91 79 2630 2470 / 2740 l Fax: +91 79 2630 2075 www.cept.ac.in I www.spcept.ac.in CEPT UNIVERSITY I AHMEDABAD i FINAL REPORT IMPROVING DRAFT MASTER PLAN FOR PATNA-2031 TABLE OF CONTENTS TABLE OF CONTENTS i LIST OF TABLES v LIST OF FIGURES vii LIST OF MAPS viii LIST of ANNEXURE ix 1 INTRODUCTION 10 1.1 Introduction 11 1.2 Planning Significance of Patna as a City 12 1.3 Economic Profile 14 1.4 Existing Land Use – Patna Municipal Corporation Area 14 1.5 Previous Planning Initiatives 16 1.5.1 Master Plan (1961-81) 16 1.5.2 Plan Update (1981-2001) 17 1.5.3 Master Plan 2001-21 18 1.6 Need for the Revision of the Master Plan 19 1.7 Methodology 20 1.7.1 Stage 1: Project initiation 20 1.7.2 Stage 02 and 03: Analysis of existing situation & Future projections and Concept Plan 21 1.7.3 Stage 04: Updated Base Map and Existing Land Use Map 21 1.7.4 Stage 5: Pre-final Master Plan and DCR 24 2 DELINEATION OF PATNA PLANNING AREA 25 i 2.1 Extent of Patna Planning Area (Project Area) 26 2.2 Delineation of Patna Planning Area (Project Area) 27 2.3 Delineated -

DISTRICT : Vaishali

District District District District District Sl. No. Name of Husband's/Father,s AddressDate of Catego Full Marks Percent Choice-1 Choice-2 Choice-3 Choice-4 Choice-5 Candidate Name Birth ry Marks Obtained age (With Rank) (With Rank) (With Rank) (With Rank) (With Rank) DISTRICT : Vaishali 1 KIRAN KUMARIARVIND KUMAR kiran kumari c/o arvind 10-Dec-66 GEN 700 603 86.14 Muzaffarpur (1) Samastipur (1) Darbhanga (1) Vaishali (1) Champaran-E (1) kumar vill+po-parsara dis-muzaffarpur 2 SANDHYA SHRI JAY PRSHAK vill+po-mamudhpur,ps- 12-Jun-68 GEN 700 572 81.71 Saran (1) Siwan (1) Gopalganj (1) Vaishali (2) Patna (4) KUMARI UPADHIA mazi,dis-chapra (bihar)pin-841223 3 SUDHA KUMARISRI VIVEK RANJAN vill. + post. -top 10-Jan-86 MBC 700 570 81.43 Patna (5) Nalanda (5) Vaishali (3) Jahanabad (3) Bhojpur (1) SINHA thana - sahajapur, vaya - karaipasurai dist. patna - pin - 801304 4PREM LATA SHRI NAND LAL PD. village raj bigha, p.s. 10-Jan-79 MBC 700 566 80.86 Patna (7) Arwal (3) Jahanabad (4) Nalanda (6) Vaishali (4) KUMARI dhanarua p.o barni district patna pin code 804452 5 REENA SINHASRI DINESH SINGH dinesh singh, d/o- sita 31-Dec-76 BC 900 721 80.11 Siwan (2) Begusarai (3) Muzaffarpur (4) Samastipur (4) Vaishali (5) sharan singh, vill- ruiya, post- ruiya bangra, p.s.- jiradei, distt- siwan 6 CHANCHAL SRI JAMUNA SINGH w/o- sanjay kumar 14-Jan-73 BC 900 720 80 Vaishali (6) Jahanabad (7) Nalanda (8) Patna (9) Nawada (7) KUMARI sinha, vill- fatehpur, post- musadhi, p.s.- kray par sarai, distt- nalanda, pin- 801304 7 NEERU KUMARIKEDAR PANDEY vill-pusa sadpur 15-Jan-78 GEN 700 539 77 Muzaffarpur (8) Samastipur (6) Sitamarahi (1) Vaishali (7) Saran (5) po-sadpur dis-samastipur 8 MINTU KUMARISRI RAM PUJAN d/o- sri ram pujan singh, 01-Oct-71 GEN 500 385 77 Muzaffarpur (9) Vaishali (8) Saran (6) Samastipur (7) Darbhanga (3) SINGH vill+post- pratappur, via- gidadha, muzaffarpur 9 ARCHANA SHRI- BAKIL vill- ashiya chak , 15-Jun-79 BC 900 692 76.89 Patna (19) Vaishali (9) Saran (7) Bhojpur (4) Bhagalpur (24) KUMARI PRASAD SINGH. -

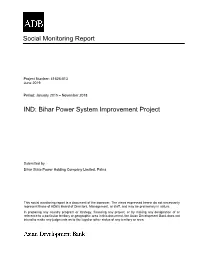

41626-013: Bihar Power System Improvement Project

Social Monitoring Report Project Number: 41626-013 June 2019 Period: January 2015 – November 2018 IND: Bihar Power System Improvement Project Submitted by Bihar State Power Holding Company Limited, Patna This social monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. Social Monitoring Report Loan 2681-IND Period: January 2015 – November 2018 IND: BIHAR POWER SYSTEM IMPROVEMENT PROJECT (BPSIP) Prepared by: Bihar State Power Holding Company Limited for Asian Development Bank Implementing Agencies: Bihar State Power Transmission Company Limited, North Bihar Power Distribution Company Limited, South Bihar Power Distribution Company Limited Executing Agency: Bihar State Power Holding Company Limited TABLE OF CONTENTS ABBREVIATIONS ADB Asian Development Bank AP Affected Person BPSIP Bihar Power System Improvement Project BSEB Bihar State Electricity Board BSPTCL Bihar State Power Transmission Co. Ltd BSPHCL Bihar State Power Holding Co. Ltd ESMU Environment & Social Management Unit GoB Government of Bihar GoI Government of India GRC Grievance Redress Committee GRM Grievance Redress Mechanism NBPDCL North Bihar Power Distribution Co. Ltd PD Project Director PMU Program Management Unit RF Resettlement Framework ROW Right of Way RP Resettlement Plan SBPDCL South Bihar Power Distribution Co. Ltd Project Fact Sheet Loan LOAN NO. -

Vaishali Introduction

DISTRICT PROFILE VAISHALI INTRODUCTION Vaishali district is one of the thirty-eight districts of the state of Bihar. It formed in 1972, separated from Muzaffarpur district. The district is surrounded by Muzaffarpur district in the North, Samastipur district in the East and Ganga River in South and Gandak River in West. The Vaishali district is a part of Tirhut division and the district headquarters are at Hajipur town. Hajipur is separated from the State’s biggest city Patna by a River Ganga. It is the second fastest growing city in the state. HISTORICAL BACKGROUND Vaishali got its name from King Vishal, a predecessor to Lord Ram. Vaishali finds reference in the Indian epics Ramayana. Vaishali was the capital of the Lichchavi State, considered as the First Republic in the World. It is said that the Lord Buddha, delivered his last semon and announced his Mahaparinirvana during his visit to Vaishali. 100 years after the Lord Buddha attained Mahaparinirvana, second Buddhist Council was held at Vaishali. Jain Tirthankar Lord Mahavir was said to be born at Vaishali to King Siddhartha and Queen Trishala. Amrapali the famous courtesan, has invited Lord Buddha to her house and Lord has visited her place. With Lord Buddha’s visit, Amrapali was purged with all impurities, she gifted her mango grove to the Sangh and joined Buddhism. Ananda, the favorite disciple of Buddha, attained Nirvana in the midst of Ganga outside Vaishali. ADMINISTRATIVE Hajipur City is the district headquarters. Vaishali district spread across 3 talukas: Mahnar, Hajipur, Mahua Vaishali district has been divided into 16 Municipal Blocks: o Mahnar o Hajipur o Chehrakala o Vaishali o Mahua o Premraj o Bidupur o Jandaha o Patedhi-Belshar o Goraul o Patepur o Desri o Raghopur o Sahadi buzurg o Lalganj o Bahgwanpur Total Number of Panchayats in Vaishali district 291.