Final List of Participants

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation

Investor Presentation Investor Relations 2020 Investor Presentation 2020 | stc group Index I. Macro Environment 3 II. KSA Telecom Market Overview 8 III. Saudi Telecom Company Profile 14 IV. Strategy Overview 28 V. Business Overview 31 VI. Financial Highlights 40 I. Macro Environment Domestic Macroeconomic Indicators Investor Presentation 2020 | stc group GDP & Government Budget: Saudi Unemployment Rate (15+): Data on 2019, real GDP showed that the economy expanded by 0.3% (Y-o-Y). During GaStat’s latest labor market release for Q3 2019 shows that unemployment 2019, the oil sector declined by 6% (31% share of GDP), whilst non-oil GDP rose by 4% declined to 12%, down from 12.3% in Q2 2019. Male unemployment declined to (non-oil private sector GDP was up 4.1% and government sector was up by 4.4%). 5.8%, down from 6% in Q2 2019, and female unemployment was also down from Bn (SAR) 31.1 to 30.8%, the lowest in 3 years. 3,500 13.2% 33.0% 33.1% 32.7% 32.5% 31.0% 30.9% 31.1% 30.9% 31.7% 31.1% 30.8% 34% 2,949 2,974 25% 3,000 2,760 2,800 2,836 12.8% 12.9% 12.9% 2,517 2,582 12.8% 12.8% 28% 2,454 2,419 12.8% 12.8% 2,500 12.7% 12.7% 15% 12.4% 12.5% 1,981 22% 2,000 12.3% 12.0% 16% 12.0% 1,500 5% 7.5% 7.6% 7.6% 7.5% 11.6% 7.2% 7.4% 7.4% 6.6% 6.6% 6.0% 5.8% 10% 1,000 -5% 11.2% 4% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 500 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 0 -15% Total Unemployment Rate Male Female 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 *Source: GaStat Nominal GDP (SAR) Nominal GDP % (Change) Real GDP (% Change) Consumer Price Index: *Source: GASTAT The general consumer price index (CPI) registered a Y-o-Y decline of 0.1% in Q4 According to the newly announced budget for the year of 2020, total expenditure is budgeted at 2019 and an increase of 0.3% compared to the third quarter of 2019 (with SAR 1,020 trillion ($272 billion), a slight fall in spending that reversed three years of expenditure communication sector registering a Y-o-Y decrease of 0.2%). -

By Submitted in Partial Fulfillment of the Requirements for the Degree Of

FROM DIWAN TO PALACE: JORDANIAN TRIBAL POLITICS AND ELECTIONS by LAURA C. WEIR Submitted in partial fulfillment of the requirements For the degree of Doctor of Philosophy Dissertation Adviser: Dr. Pete Moore Department of Political Science CASE WESTERN RESERVE UNIVERSITY January, 2013 CASE WESTERN RESERVE UNIVERSITY SCHOOL OF GRADUATE STUDIES We hereby approve the thesis/dissertation of Laura Weir candidate for the Doctor of Philosophy degree *. Pete Moore, Ph.D (chair of the committee) Vincent E. McHale, Ph.D. Kelly McMann, Ph.D. Neda Zawahri, Ph.D. (date) October 19, 2012 *We also certify that written approval has been obtained for any proprietary material contained therein. ii TABLE OF CONTENTS List of Tables v List of Maps and Illustrations viii List of Abbreviations x CHAPTERS 1. RESEARCH PUZZLE AND QUESTIONS Introduction 1 Literature Review 6 Tribal Politics and Elections 11 Case Study 21 Potential Challenges of the Study 30 Conclusion 35 2. THE HISTORY OF THE JORDANIAN ―STATE IN SOCIETY‖ Introduction 38 The First Wave: Early Development, pre-1921 40 The Second Wave: The Arab Revolt and the British, 1921-1946 46 The Third Wave: Ideological and Regional Threats, 1946-1967 56 The Fourth Wave: The 1967 War and Black September, 1967-1970 61 Conclusion 66 3. SCARCE RESOURCES: THE STATE, TRIBAL POLITICS, AND OPPOSITION GROUPS Introduction 68 How Tribal Politics Work 71 State Institutions 81 iii Good Governance Challenges 92 Guests in Our Country: The Palestinian Jordanians 101 4. THREATS AND OPPORTUNITIES: FAILURE OF POLITICAL PARTIES AND THE RISE OF TRIBAL POLITICS Introduction 118 Political Threats and Opportunities, 1921-1970 125 The Political Significance of Black September 139 Tribes and Parties, 1989-2007 141 The Muslim Brotherhood 146 Conclusion 152 5. -

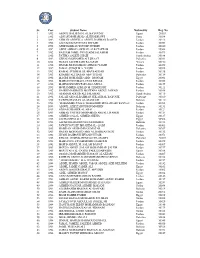

Sr. Year Student Name Nationality Reg. No. 1 1992 ABDUL HALEEM M

Sr. Year Student Name Nationality Reg. No. 1 1992 ABDUL HALEEM M. AL BAYOUMY Egypt 20053 2 1992 ADNAN MOHAMAD AL KHADRAWI Syria 30038 3 1992 AHMAD ABDULLA ABDUL RAHMAN DAOUD Jordan 30213 4 1992 ALI SALEM MUSTAFA DWAIRI Jordan 40051 5 1992 ATEF HABBAS YOUSEF HUSEIN Jordan 40040 6 1992 AWNI AHMAD AWWAD ALFATAFTAH Jordan 20064 7 1992 BASSAM JAMIL SWAILAIM SALAMEH Jordan 40073 8 1992 FATIMA SALEH GHAZI Saudi Arabia 30188 9 1992 GEHAD MOHAMED ALI SHAAT Palestine 30031 10 1992 HASAN SALEH SAID BAJAFAR Yemen 30150 11 1992 ISMAIL MOHAMMAD AHMAD YAGHI Jordan 40059 12 1992 JAMAL SUDQI M.A. YASIN Jordan 30028 13 1992 KAMAL SUBHI M. EL-HAJ BADDAR Jordan 30136 14 1992 KHAMIS ALI HASAN ABU TUHAH Palestine 30134 15 1992 MAGDI MOHAMED ABD - MONAM Egypt 20061 16 1992 MAHMOUD ISMAEL OUDI KHALIL Jordan 40028 17 1992 MAHMOUD MUSTAFA ESA MUSA Jordan 30157 18 1992 MOHAMMED AHMAD M. HAMSHARI Jordan 30111 19 1992 NAJEH MAHMOUD MOSTAFA ABDUL JAWAD Jordan 30058 20 1992 OSAMAH ADEEB ALI SALAMAH Saudi Arabia 30119 21 1992 SALAH ABD ALRAHMAN SHLASH AL BAYOUK Palestine 30010 22 1992 TAWFIQ HASSAN AL-MASKATI Bahrain 30110 23 1993 "MOHAMMED JUMA'A" MOHAMMED HUSSAIN ABU RAYYAN Jordan 40058 24 1993 ABDUL-AZIZ ZAINUDDIN MOHSIN Bahrain 30131 25 1993 ADNAN SHAHER AL'ARAJ Jordan 40121 26 1993 AHMAD YOUSEF MOHAMMD ABDALL HABEH Jordan 40124 27 1993 AHMED GALAL AHMED SHEHA Egypt 20137 28 1993 ALI HASHEM ALI Egypt 30306 29 1993 ALI MOHAMED HUSSN MOHAMED Bahrain 30183 30 1993 FAWZI YOUSEF IBRAHIM AL- QAISI Jordan 40003 31 1993 HAMDAN ALI HAMDAN MATAR Palestine 30267 32 1993 HASAN MOHAMED ABD AL RAHMAN BZEI Jordan 40132 33 1993 HUSNI BAHPOUH HUSAIN UTAIR Jordan 30071 34 1993 KHALIL GUMMA HEMDAN EL-MASRY Palestine 30007 35 1993 MAHMOUD ATYEH MOHD DAHBOUR Jordan 30079 36 1993 MOH'D ABDUL M. -

Saudi Telecom Company a Saudi Joint Stock Company

Saudi Telecom Company a Saudi Joint Stock Company Consolidated Financial Statements for the Year Ended December 31, 2015 Saudi Telecom Company (a Saudi Joint Stock Company) Index to the Consolidated Financial Statements for the Year Ended December 31, 2015 Page Auditors’ Report ……………………………. 2 Consolidated Statement of Financial Position ……………………………. 3 Consolidated Statement of Income ……………………………. 4 Consolidated Statement of Cash Flows ……………………………. 5 Consolidated Statement of Changes in Equity ……………………………. 6 Notes to the Consolidated Financial Statements ……………………………. 7 - 39 1 Saudi Telecom Company (a Saudi Joint Stock Company) Consolidated Statement of Financial Position as at December 31, 2015 (Saudi Riyals in thousands) Note 2015 2014 ASSETS Current assets: Cash and cash equivalents 3 4,504,046 5,467,121 Short-term investments 4 16,802,175 14,347,318 Accounts receivable, net 5 11,796,090 8,514,689 Prepayments and other current assets 6 3,886,566 2,740,175 Total current assets 36,988,877 31,069,303 Non-current assets: Investments accounted for under equity method and others 7 6,914,011 8,518,937 Investments held to maturity 8 6,474,751 6,787,047 Property, plant and equipment, net 9 40,487,591 38,228,697 Intangible assets, net 10 4,783,107 4,523,073 Other non-current assets 11 1,012,772 966,583 Total non-current assets 59,672,232 59,024,337 Total assets 96,661,109 90,093,640 LIABILITIES AND EQUITY Current liabilities: Accounts payable 12 3,796,511 2,070,158 Other credit balances – current 13 4,861,815 4,189,499 Accrued expenses 14 12,152,978 -

Telecoms in the Kingdom of Saudi Arabia — an Overview

CLIENT PUBLICATION CLIENT PUBLICATION TECHNOLOGY, MEDIA, & TELECOMMUNICATIONS | SEPTEMBER 2016 Telecoms in the Kingdom of Saudi Arabia — An Overview Sector Profile The Kingdom of Saudi Arabia has the largest information communication and technology market in the Middle East by both capital volume and spending.1 It is dominated by the Saudi Telecom Company (“STC”), Mobily and Zain, though new entrants to the market in the form of Mobile Virtual Network Operators (“MVNOs”) have begun to create additional competition. With 53 million subscribers to mobile phone services and a penetration rate of approximately 165%,2 competition in the industry is already fierce, but the demand for services is growing. It is a market quickly becoming one of the most coveted by local and international companies. In consideration of this, we outline in this article the Government entities, regulators and legal framework that underpin the sector and observe how the sector has been liberalised and is continuing to grow. Who are the Key Government Entities and Regulators? Ministry of Communications and Information Technology The Ministry of Communications and Information Technology is the Government body that oversees all information and communication technology in the Kingdom. It is responsible for planning and implementing the Government’s policies and strategies for the telecoms sector. Communications and Information Technology Commission The Communications and Information Technology Commission (“CITC”) is an independent Government agency with separate legal standing and financial and administrative independence. The CITC is responsible for licensing companies wishing to provide telecom and IT services in the Kingdom and for managing tariffs, content filtering and quality control. -

A N N U a L R E P O R T F I G U R E S & F a C T S

2 0 0 7 A n n u A l R e p o R t F i g u R e s & F A c t s Custodian of the Two Holy Mosques King Abdullah Bin Abdulaziz Al Saud His Royal Highness Crown Prince Sultan Bin Abdulaziz Al Saud The Deputy Premier & The Minister of Defence & Aviation & Inspector Table of Contents Chairman’s Statement >>> 7 Appendices Governor’s Statement >>> 9 Appendix (A): Board of Directors Decisions >>> 35 CITC Board >>> 11 Appendix (B): CITC Decisions >>> 36 Vision and Mission >>> 12 Appendix (C): Public Consultations >>> 37 1. Executive Summary >>> 13 Appendix (D): Licenses Issued >>> 38 2. ICT Sector in the Kingdom of Saudi Arabia >>> 14 Appendix (E): Spectrum Activities >>> 46 3. Organizational Structure and Manpower >>> 20 Appendix (F): CITC Financial Accounts >>> 47 4. Major Activities in year 2007 >>> 23 Appendix (G): Excerpts from the Code of Conduct >>> 48 5. Studies undertaken by the CITC >>> 31 6. Strategic Plan and 2008 Key Activities >>> 33 Chairman's Statement The information and communication technology (ICT) regulations and procedures, increase awareness of IT applications and benefits, and sector is a key element of the Saudi economy, with increasing promote its effective usage. impact on productivity and the gross domestic product. Liberalization of the telecommunications sector and the The Year 2007 saw the completion of an important stage towards full liberalization opening of markets to competition have contributed to the of the sector with the granting of the third license to provide mobile telecommunications revitalization of the national economy, increasing efficiency services, and with qualifications of three consortia for the award of new licenses for fixed and productivity, contributing to the higher rates of growth of telecommunications services, thus opening the fixed telephony market for competition for the national income and the development of human resources, first time in Saudi Arabia. -

2017 Initiates Alphabetical List

AMERICAN COLLEGE OF SURGEONS 2017 INITIATES ALPHABETICAL LIST 30 Hanser Antonio Abreu Quezada Khaled Sami Ahmad Ali Alaraj A Santiago, Dominican Republic Riyadh, Saudi Arabia Chicago, IL Amaar Awad Hussien Hussien Carlos Maria Abril Vega Siddique Ahmad Yakout Hameed Alaraji Aamery Abu Dhabi, United Arab Emirates Peshawar, Pakistan Dubai, United Arab Emirates Wolverhampton, United Kingdom Walid Abu Tahoun Usman Ahmad Nasrin Alavi Wesley M. Abadie Dhahran, Saudi Arabia Cleveland, OH Tehran, Iran, Islamic Republic of Williamsburg, VA Abdelrahman Hassan Abusabeib Azam S. Ahmed Marco Alfonso Albán Garcia Andrea M. Abbott Doha, Qatar Madison, WI Santiago, Chile Mount Pleasant, SC Jihad Achkar Tanveer Ahmed Hamdullah Hadi Al-Baseesee Abdel Rahman Abdel Fattah M. Beirut, Lebanon Dhaka, Bangladesh Najaf, Iraq Abdel Aal Doha, Qatar Alison Alden Acott Manish Ahuja Michael A. Albin Little Rock, AR Mumbai, India South Pasadena, CA Karim Sabry Abdel Samee Cairo, Egypt Badih Adada Naveen Kumar Ahuja Saleh Mohammad Aldaqal Weston, FL Hamilton, NJ Jeddah, Saudi Arabia Eltayib Yousif Abdelaleem Doha, Qatar Patrick Temi Adegun Begum Akay Saad A. A. A. Aldousari Ado-Ekiti, Nigeria Birmingham, MI Kuwait City, Kuwait Tamer Mohamed Said Abdelbaki Salama James Olaniyi Adeniran Hakkı Tankut Akay Matthew J. Alef Cairo, Egypt Ilorin, Kwara State, Nigeria Ankara, Turkey Winooski, VT Kareem R. AbdelFattah Adedoyin Adekunle Adesanya Raed Hatmal Akayleh Farzad Alemi Dallas, TX Lagos, Nigeria Amman, Jordan Kansas City, MO Khaled Mohamed Saad Obinna Ogochukwu Adibe Ahmet Akman Naif Abdullah Alenazi Mostafa Abdelgalel Chapel Hill, NC Ankara, Turkey Riyadh, Saudi Arabia Ajman, United Arab Emirates Farrell C. Adkins Mohamed Gomah Hamed Falih Mohssen Algazgooz Ahmed Mohamed Abdelkader Roanoke, VA Al Aqqad Basra, Iraq Dubai, United Arab Emirates Dubai, United Arab Emirates John Affuso Mohammed S. -

Stc Report 06072009.Pdf

2009 Saudi Telecom Company Tadawul Code 7010 PE (x) 9.7 Sector Telecom Close Price (SAR) 51.0 PBV (x) 2.7 Index PE 13.4 52 week high (SAR) 71.3 Div Yield (%) 7.4% Index PBV 1.8 52 week low (SAR) 33.7 Outstanding Shares (million) 2,000.0 Index Div Yield 3.9% YTD 2009 3.9% Market Cap (SAR million) 102,000.0 Sector PE 12.2 30 Day Avg Vol ('000) 5,801.8 % of TASI 9.7% Sector PBV 2.2 Beta 0.8 % of sector 70.0% Sector Div Yield 5.5% Financials (SAR '000) 2007 2008 2009E 2010E 2011E 2012E Revenues 34,457,807 47,469,368 49,368,143 50,849,187 52,374,663 54,469,649 EBITDA 16,544,500 18,449,868 19,129,699 20,994,796 22,007,345 22,726,293 Net Profit 12,021,733 11,037,846 11,274,566 12,733,383 13,349,276 13,726,933 Total Assets 68,811,246 99,762,135 100,986,513 104,038,296 106,539,013 114,325,180 Total Liabilities 32,919,364 57,200,258 55,716,384 54,311,483 52,139,953 55,121,693 Shareholders' Equity 35,876,253 37,637,978 40,346,230 44,802,914 49,475,161 54,279,587 EPS (SAR) 6.0 5.5 5.6 6.4 6.7 6.9 BVPS (SAR) 17.9 18.8 20.2 22.4 24.7 27.1 Ratio Analysis Profitability Ratios (%) Net Profit Margin 34.9% 23.3% 22.8% 25.0% 25.5% 25.2% EBIDTA Margin 46.9% 41.4% 39.7% 40.3% 40.0% 39.7% Return on Avg. -

Download Shortlist

Title Advertiser/Client Product/Service Entrant Company Country A01 Direction EXPLAINED TAKE 2 REHLAT REHLAT APPLICATION BEATTIE + DANE, Kuwait City KUWAIT OFFERS TO YOUR KNEES ORANGE EGYPT FOR TELECOMMUNICATIONS RECHARGE CARDS LEO BURNETT CAIRO EGYPT BE THE FUTURE AMERICAN UNIVERSITY IN CAIRO AMERICAN UNIVERSITY IN CAIRO J. WALTER THOMPSON CAIRO EGYPT BADYA THE CREATIVE CITY PALM HILLS DEVELOPMENTS BADYA FP7/CAI, Cairo EGYPT WHAT ARE WE ALLOWING? SAUDI TELECOM COMPANY 'TUBY' VIDEO APP FOR KIDS J. WALTER THOMPSON, Riyadh SAUDI ARABIA ELITE | THERE'S A WAFER HORREIA FOOD INDUSTRIES ELITE WAFER GOOD PEOPLE, Cairo EGYPT GOODBYE SON IKEA UAE IKEA MEMAC OGILVY, Dubai UNITED ARAB EMIRATES SARAH. THE GAME CHANGER SAUDI TELECOM COMPANY FIBER OPTICS J. WALTER THOMPSON, Riyadh SAUDI ARABIA THE WAITING ICRC LEBANON THE MISSING ICRC LEBANON, Beirut LEBANON A02 Script EXPLAINED TAKE 2 REHLAT REHLAT APPLICATION BEATTIE + DANE, Kuwait City KUWAIT HEKAYA FAMILY HOSPITAL ETISALAT MISR TARRIF FP7/CAI, Cairo EGYPT HEKAYA FAMILY LIVINGROOM ETISALAT MISR TARRIF FP7/CAI, Cairo EGYPT THAT CHEATER IKEA UAE IKEA MEMAC OGILVY, Dubai UNITED ARAB EMIRATES MAMA'S LITTLE BOY IKEA UAE IKEA MEMAC OGILVY, Dubai UNITED ARAB EMIRATES A03 Casting FISHEYE WART, UNDOUBTEDLY. VEZEETA.COM VEZEETA.COM KAIRO, Cairo EGYPT WHAT ARE WE ALLOWING? SAUDI TELECOM COMPANY 'TUBY' VIDEO APP FOR KIDS J. WALTER THOMPSON, Riyadh SAUDI ARABIA ELITE | THERE'S A WAFER HORREIA FOOD INDUSTRIES ELITE WAFER GOOD PEOPLE, Cairo EGYPT SHOWER MISHAP IKEA UAE IKEA MEMAC OGILVY, Dubai UNITED ARAB EMIRATES -

Download Spotlight

SPOTLIGHT Telco Mergers and Acquisitions Strategic Backgrounds, Use Cases and Future Developments This publication or parts there of may only be reproduced or copied with the prior written permission of Detecon International GmbH. Published by Detecon International GmbH. www.detecon.com Strategic Backgrounds, Use Cases and Future Developments I Detecon SPOTLIGHT Content What is it all about? 2 Telco M&A Trends 4 Summary 14 The Authors 15 The Company 16 Footnotes 17 05/2019 1 Detecon SPOTLIGHT I Telco Mergers and Acquisitions What is it all about? For years, we at Detecon have been actively supporting our clients in acquiring and integrating other organizations within the telecommunications industry. Thereby, our consultants have been observing worldwide transaction trends and mergers & acquisitions activities (M&A) in the global telecommunication markets. This “Telco Mergers and Acquisitions Spotlight” will highlight these observations from the past year and provide strategic insights into the most recent market developments, present selected use cases and explain the underlying rationale of those mergers. Finally, it will provide an outlook for possible M&A activities in 2019 and beyond. Mergers and acquisitions can be a valuable lever in building new digital business models or facilitating digital transformation. Furthermore, they are commonly used to generate growth, create synergies and reduce risk through diversification. Hence, it is not surprising that during a time characterized by increasing market uncertainty, the year 2018 has seen fewer transactions than in previous years. However, it was a record year for high-value M&A deals which can be seen in a comparison between 2017 and 2018 (Figure 1: Average deal value ($bn), 3Q17 vs. -

Country List for Cellular Plans

Campbell Scientific, Inc. Cellular Data Service World-Wide Coverage Plans Campbell Scientific Cellular Data Service is offered in the countries listed below. The list identifies the data plan code, associated cellular network carrier, and available countries. Orders for cellular data service need to indicate the desired plan. Service in other countries may be available. Contact Campbell Scientific if service is needed in a country not shown on the list. The customer is responsible to verify the modem is supported by the carrier. Cellular data service is subject to the Campbell Scientific, Inc., Cellular Data Service Plan Terms and Conditions and Customer Agreement found at www.campbellsci.com/cell-terms. Plan Country Operator IT1A Albania Eagle Mobile IT1A Albania Vodafone - Albania IT1B Anguilla Cable and Wireless (Anguilla) Ltd IT1B Antigua and Barbuda Cable & Wireless Antigua & Barbuda Ltd IT1B Argentina Telefónica Móviles Argentina S.A. IT1A Armenia Armenia Telephone Company (Armentel) Joint Venture IT1B Armenia UCOM LLC IT1B Aruba New Millennium Telecom Services NV IT1A Australia SingTel Optus Pty Limited IT1B Australia Telstra Corporation Limited IT1A Australia Vodafone Hutchison Australia Pty Limited IT1A Austria A1 Telekom Austria AG IT1A Austria T-Mobile Austria GmbH IT1A Azerbaijan Azercell Telecom LLC IT1A Bangladesh Banglalink Digital Communications Ltd. IT1B Bangladesh Grameenphone Ltd IT1B Barbados Cable & Wireless (Barbados) Ltd IT1A Belarus JLLC Mobile TeleSystems IT1A Belarus Unitary enterprise velcom IT1A Belgium ORANGE Belgium nv/SA IT1A Belgium Proximus PLC IT1A Belgium Telenet Group BVBA/SPRL IT1B Belize Belize Telemedia Limited IT1B Benin Etisalat Benin SA IT1A Bolivia (Plurinational State of) TIGO - Telefonica Celular de Bolivia S.A. -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Middle East 44 29 0 11 Afghanistan Total 30 0 0 Afghanistan Afghan Telecom (Aftel, incl. Salaam) 10 0 0 Afghan Wireless Communications Afghanistan Company (AWCC) 10 0 0 Afghanistan Etisalat Afghanistan 10 0 0 Bahrain Total 32 0 2 Bahrain Telecommunications Company Bahrain (Batelco) 11 0 1 Bahrain stc Bahrain (formerly Viva) 11 0 1 Bahrain Zain Bahrain 10 0 0 Cyprus Total 32 0 0 Cyprus Cytamobile‐Vodafone 11 0 0 Cyprus Epic (previously MTN Cyprus) 11 0 0 Cyprus PrimeTel (Cyprus) 10 0 0 Iran Total 42 0 0 Mobile Communication Company of Iran Iran (MCI) 11 0 0 Iran MTN Irancell 11 0 0 Iran Taliya Mobile 10 0 0 Iran Tamin Telecom (Rightel) 10 0 0 Iraq Total 10 0 0 Iraq Fastlink [Kurdistan Region] 10 0 0 Israel Total 64 0 0 Israel 018 Xfone (We4G) 10 0 0 Israel Cellcom 11 0 0 Israel Golan Telecom 10 0 0 Israel HOT Mobile 11 0 0 Israel Partner Communications Company 11 0 0 Israel Pelephone 11 0 0 Jordan Total 31 0 0 Jordan Orange Jordan 11 0 0 Jordan Umniah 10 0 0 Jordan Zain Jordan 10 0 0 Kuwait Total 33 0 3 Kuwait Ooredoo Kuwait 11 0 1 Kuwait STC Kuwait (formerly Viva) 11 0 1 Kuwait Zain Kuwait 11 0 1 Lebanon Total 22 0 0 Lebanon Alfa (MIC 1) 11 0 0 Lebanon Touch Lebanon (MIC 2) 11 0 0 Oman Total 22 0 0 Oman Telecommunications Company Oman (Omantel) 11 0 0 Oman Ooredoo Oman 11 0 0 Palestinian Territory Total 00 0 0 Qatar Total 22 0 2 Qatar Ooredoo Qatar 11 0 1 Qatar Vodafone Qatar 11 0 1 Saudi Arabia Total 54 0 2 Saudi Arabia Mobily (Etihad Etisalat) 21 0 0 Saudi Arabia Saudi Telecom Company (stc) 22 0 1 Saudi Arabia Zain Saudi Arabia 11 0 1 Syria Total 20 0 0 Syria MTN Syria 10 0 0 Syria SyriaTel 10 0 0 Turkey Total 33 0 0 Turkey TT Mobil (Turk Telekom) 11 0 0 Turkey Turkcell 11 0 0 Turkey Vodafone Turkey 11 0 0 United Arab Emirates Total 22 0 2 United Arab Du (Emirates Integrated Emirates Telecommunication Company, EITC) 11 0 1 United Arab Emirates Etisalat UAE 11 0 1 Yemen Total 00 0 0 5/15/2020.