ALFA S.A.B. DE C. V. Better Oil Price Perspectives Justify

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hoja Membretada

Informe Trimestral 4T15 Resultados y Hechos Relevantes del Cuarto Trimestre y Año Completo de 2015 Ventas Mismas Tiendas con crecimiento de 10.4% en el cuarto trimestre Incremento de 30.8% en el EBITDA del cuarto trimestre, logrando un margen de 15.3% Crecimiento de 74.3% en la Utilidad Neta del cuarto trimestre, alcanzando una utilidad por acción de 1.17 pesos 2,954 Unidades Totales en el portafolio, que incluye 170 unidades adicionales en comparación contra el año anterior MENSAJE DE LA DIRECCIÓN GENERAL Alberto Torrado, Presidente Ejecutivo de Alsea comentó: “Para Alsea, el 2015 fue un año positivo en donde continuamos consolidando nuestra presencia en los mercado donde operamos, mejorando el desempeño de nuestra operación y observando un entorno favorable en el consumo lo cual nos ayudó a mejorar el desempeño de la compañía, inclusive por encima de las expectativas que teníamos. Nuestro ADN innovador nos impulsa a seguir desarrollando distintos proyectos para estar a la vanguardia, no solo en términos tecnológicos, sino también en nuestra oferta de productos y servicios. Un claro ejemplo de lo anterior es el lanzamiento de las aplicaciones móviles de Domino’s Pizza y Burger King, al igual que nuestro programa de lealtad multi-marca “Wow Rewards” con el que estamos logrando un mayor acercamiento y comunicación a nuestros clientes, ofreciéndoles una forma sencilla para obtener beneficios inmediatos en nuestras tiendas.” Y agregó: “De cara al próximo año, continuaremos trabajando para seguir incrementando nuestra rentabilidad y enfocando todo nuestro esfuerzo en cumplir con el reto de mantener el ritmo de crecimiento para lograr las metas a 5 años que presentamos el pasado mes de noviembre durante nuestro primer día de Analistas e Inversionistas de Alsea.” Febrero, 2015 Informe Trimestral 4T15 México D.F. -

Disclaimer July 15, 2021 │ Update

Disclaimer July 15, 2021 │ Update The content here in has only informative purposes. It does not constitute a recommendation, advice, or personalized suggestion of any product and/or service that suggest you make investment decisions as it is necessary to previously verify the congruence between the client's profile and the profile of the financial product. SALES TRADING COMMENT, NOT RESEARCH OR HOUSE VIEW. The information contained in this electronic communication and any attached document is confidential, and is intended only for the use of the addressee. The information and material presented are provided for information purposes only. Please be advised that it is forbidden to disseminate, disclose or copy the information contained herein. If you received this communication by mistake, we urge you to immediately notify the person who sent it. Actinver and/or any of its subsidiaries do not guarantee that the integrity of this email or attachments has been maintained nor that it is free from interception, interference or viruses, so their reading, reception or transmission will be the responsibility of who does it. It is accepted by the user on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Equity Research Guide for recommendations on investment in the companies under coverage included or not, in the Mexican Stock Exchange main Price Index (S&P/BMV IPC) Our recommendations are set based on an expected projected return which, as any estimate, cannot be guaranteed. Readers should be aware that a number of subjective elements have also been taken into consideration in order to determine each analyst’s final decision on the recommendation. -

Panorama Bursátil. Voto De Confianza En Enero

15 de f ebrero de 2019 Octav io García Williams González Mesa de Análisis Ext. 10717 [email protected] Panorama Bursátil. Voto de confianza en enero Nuestra lectura del mercado ─ Optimismo en los mercados de EUA tras avances en las negociaciones comerciales con China. Las pláticas continuarán la próxima semana en Washington. En EUA el S&P 500 subió 2.3% y el DJIA 2.8%; mientras que México se ajustó 0.4% en pesos (-1.4% en dólares; el peso se depreció 0.9%). ¿Bolsa atractiva?…La renta fija dice que todavía no ─ Se comparó el rendimiento desde 2008 de las utilidades de la Bolsa en México (earnings yield o inverso del múltiplo P/U) contra el rendimiento o yield del Bono M a 10 años. El difícil entorno del mercado global en términos comerciales, las dudas en cuanto al crecimiento económico global, la política monetaria restrictiva la Fed, la incertidumbre interna, entre otros factores, hacen que rendimiento de las utilidades de la Bolsa en México no luzca su mejor versión, al ubicarse en 5.9% vs. ~8.5% del bono M a 10 años, aunque se reconoce que el diferencial entre ambos se ha recortado ~100pb en los últimos cinco meses. Flujos de extranjeros a la renta variable nacional ─ Tras el fuerte ajuste del mercado en 2018 (-15.6%), y apoyados por una menor aversión al riesgo en mercados emergentes, los extranjeros dieron el voto de confianza al mercado local al traer flujos por más de US$500 millones en enero que ayudaron al índice a subir 5.6% en el primer mes del año. -

Corporate Presentation May 2021 the Only Specialty Retail REIT in México

Credit Suisse: Mexico Investment Ideas 2021 Corporate Presentation May 2021 The only specialty retail REIT in México We own GLA of 543,432 sqm and manage in total 619,379 sqm, including the co-investments in projects the total managed is 767,237 thousand sqm. 19 shopping centers: 8FashionMalls 7PowerCenters 4 Community Centers Solid operational structure and corporate governance that guarantee transparency, efficiency and a sustainable and profitable growth model. FibraShop Managed Co-in vestments Portfolio location Community Center Properties Location UC Jurica Querétaro UC Juriquilla Querétaro UC Xalapa Xalapa UC Nima Shops Puerto Vallarta Power Center Properties Location Puerta Texcoco Texcoco Los Atrios Cuautla Galerías Tapachula Tapachula City Center Esmeralda State of Mexico Plaza Cedros Cuernavaca Cruz del Sur Puebla Sentura State of Mexico Fashion Mall Properties Location Plaza Cibeles Irapuato La Luciérnaga San Miguel de Allende Puerto Paraíso Cabo San Lucas Kukulcán Plaza Cancún Galerías Mall Sonora Hermosillo Las Misiones Juárez Puerta La Victoria Querérato La Perla * Guadalajara We are in 12 states of the Mexican Republic Total portfolio weighted average occupancy rate: 92.13%* Shopping center 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Plaza Cibeles 100 98 98 97 97 La Luciérnaga 100 100 99 98 97 Puerto Paraíso 9493928989 Kukulcán Plaza* 85 83 82 79 79 UC Jurica 92 90 89 84 84 UC Juriquilla 91 90 90 87 87 UC Xalapa 88 87 87 85 84 Puerta Texcoco 9896959493 UC Nima Shops 96 92 90 87 87 Plaza Los Atrios 99 99 99 99 100 Galerías Tapachula -

ALSEA Greater Than Expected Impact of the Pandemic @Analisis Fundam

Equity Research M exico ALSEA Quarterly Report May 4, 2021 www.banorte.com Greater than expected impact of the pandemic @analisis_fundam ▪ Alsea's report was weak, with the impact of the sanitary measures Consumer and Telecom being greater than expected. However, the recovery observed in March points to a more favorable outlook going forward Valentín Mendoza Senior Strategist, Equity [email protected] ▪ We believe the hardest times are behind us. The economic recovery and the progress in vaccine distribution should support the recovery, Juan Barbier, CFA Analyst which should be reflected in significant growth [email protected] ▪ We set a PT of MXN 39.00 (FV/EBITDA 2021E of 7.8x below current HOLD multiple). However, given a limited return after the recent rally, we Current Price $34.18 downgrade our rating to HOLD PT $39.00 Upside Potential 14.1% Max – Min LTM ($) 36.7 – 17.6 The pandemic impacted profitability in Europe more than expected. In the Market Cap (US$m) 1,429.4 face of the reinforced sanitary measures in all regions, implementing temporary Shares Outstanding (m) 838.6 Float 48.52% (and some permanent) unit closures, as well as time and capacity restrictions, Daily Turnover US$m 70.4 figures for the quarter were below our estimates. Revenues declined 15.6% y/y Valuation metrics LTM FV/EBITDA 13.0x to MXN 10.212 billion, as a result of a 13.3% y/y decline in consolidated SSS P/E N.A. (Mexico: -8.4%; Europe: -29.2%; South America: +4.9%), reflecting the effects MSCI ESG Rating* N.A. -

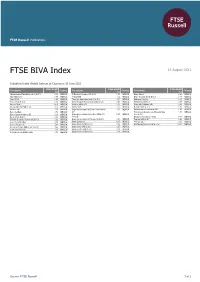

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

Striving to Overcome the Economic Crisis: Progress and Diversification of Mexican Multinationals’ Export of Capital

Striving to overcome the economic crisis: Progress and diversification of Mexican multinationals’ export of capital Report dated December 28, 2011 EMBARGO: The contents of this report cannot be quoted or summarized in any print or electronic media before December 28, 2011, 7:00 a.m. Mexico City; 8:00 a.m. NewYork; and 1 p.m. GMT. Mexico City and New York, December 28, 2011: The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Vale Columbia Center on Sustainable International Investment (VCC), a joint initiative of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Mexican multinationals today. 1 The survey is part of a long-term study of the rapid global expansion of multinational enterprises 2 (MNEs) from emerging markets. The present report focuses on data for the year 2010. Highlights In 2010, the top 20 Mexican MNEs had foreign assets of USDD 123 billion (table 1 below), foreign sales of USDD 71 billion, and employed 255,340 people abroad (see annex table 1 in annex I). The top two firms, America Movil and CEMEX, together controlled USDD 85 billion in foreign assets, accounting for nearly 70% of the assets on the list. The top four firms (including FEMSA and Grupo Mexico) jointly held USDD 104 billion, which represents almost 85% of the list’s foreign assets. Leading industries in this ranking, by numbers of MNEs, are non-metallic minerals (four companies) and food and beverages (another four companies). -

Presentación De Powerpoint

Sustainable Development Goals as a framework for climate investment London, 9 January 2018 (12:20 CET) Aaron Baker I European Fixed Income & Sustainable Markets | [email protected] | +44 (0) 207 397 7580 PLEASE SEE IMPORTANT DISCLOSURES ON THE LAST FIVE PAGES OF THIS REPORT. Sustainable Development Goals as a framework for climate investment / 9 January 2018 The United Nations has been the leading proponent of inclusive and sustainable economic growth “At its essence, sustainability means ensuring prosperity and environmental protection without compromising the ability of future generations to meet their needs” Ban Ki-moon, Former Secretary General, United Nations People Prosperity • End poverty and hunger in all forms • Ensure prosperous and fulfilling and ensure dignity and equality lives in harmony with nature Planet Partnership Peace • Protect our planet’s natural resources • Implement the agenda • Foster peaceful, just and climate for future through a solid global and inclusive societies generations partnership Sustainable Development Source: UN PLEASE SEE IMPORTANT DISCLOSURES ON THE LAST FIVE PAGES OF THIS REPORT. Page 2 Sustainable Development Goals as a framework for climate investment / 9 January 2018 Index What are the UN’s Sustainable 1 Sustainable Development Goals Development Goals? The relevance of these goals to investing Investor portfolio guidance using climate- 2 related goals How to use these goals to invest Sectoral selection using climate-related 3 goals PLEASE SEE IMPORTANT DISCLOSURES ON THE LAST FIVE PAGES OF THIS REPORT. Page 3 Sustainable Development Goals as a framework for climate investment / 9 January 2018 Section 1 What are the UN’s Sustainable Development Goals? The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations and adopted by all 193 members of the UN in September 2015. -

The Mexico Fund, Inc

The Mexico Fund, Inc. Monthly Summary Report July 2014 Prepared By: Impulsora del Fondo México, sc Investment Advisor to the Fund www.themexicofund.com The information presented in this report has been derived from the sources indicated. Neither The Mexico Fund, Inc. nor its Adviser, Impulsora del Fondo México, S.C., has independently verified or confirmed the information presented herein. July 31, 2014 I. THE MEXICO FUND DATA End of Month One Month Earlier One Year Earlier Total Net Assets1 (million US$) $411.11 $424.28 $406.97 NAV per share $27.44 $28.38 $29.93 Closing price NYSE2 $28.25 $28.28 $30.00 % Premium (Discount) 2.95% (0.35%) 0.23% Shares traded per month2 (composite figures) 971,408 758,797 983,513 Outstanding shares3 14,981,980 14,949,398 13,597,746 Shares on Short Interest Position2 25,827 16,434 69,640 Note: Past performance is no guarantee of future results. II. PERFORMANCE4 1 Month 3 Months 6 Months 1 Year Market price 2.41% 10.45% 7.86% 4.93% NAV per share -0.84% 6.07% 7.72% 2.20% Bolsa IPC Index 0.78% 6.93% 8.95% 5.25% MSCI Mexico Index 1.48% 7.80% 9.80% 6.49% 2 Years 3 Years 5 Years 10 Years Market price 36.82% 44.17% 148.21% 364.84% NAV per share 22.05% 25.16% 108.98% 315.05% Bolsa IPC Index 12.10% 13.42% 75.38% 348.21% MSCI Mexico Index 14.19% 17.76% 80.70% 314.10% III. -

Alsea Reaches a Successful Agreement to Obtain a Waiver on Its Credit Contracts

Avenida Revolución 1267 Piso 21 Col. Los Alpes, Álvaro Obregón C.P. 01040, Ciudad de México T +52 (55) 7583 2000 ALSEA REACHES A SUCCESSFUL AGREEMENT TO OBTAIN A WAIVER ON ITS CREDIT CONTRACTS Mexico City, July 2, 2020 — Alsea, S.A.B. de C.V. (BMV: ALSEA*) “Alsea”, the leading operator of quick service restaurants, coffee shops, casual and family dining establishments in Latin America and Europe, is providing the following update in light of the waiver agreement reached with its relationship banks. Alsea has reached agreements with all the banks with which it maintains relationship, to negotiate certain terms in the credit contracts, with the purpose of suspending from 29 June 2020 until 30 June 2021, the commitments originally made with the banks that, due to the impacts of the pandemic, have been affected (mainly those related to the Interest Coverage Ratio and Gross Leverage Ratio). This will put Alsea in a stronger position to manage the situation arising from COVID-19. Alsea has agreed to maintain a consolidated net equity of $8.5 billion pesos as well as certain minimum liquidity levels, which will be reviewed on a monthly basis. Derived from the agreements, the cost of interest and commissions will be temporarily increased during the suspension period. Additionally, Alsea has agreed with the banks to maintain a minimum level of CapEx, whilst always paying attention to the Company's liquidity. This was agreed to ensure the continuity of strategic projects and the operation of restaurants in optimal conditions, as well as to achieve an estimated organic growth of between 80 and 90 corporate units on 2021. -

Consolidated Third Quarter Results 2017

CONSOLIDATED THIRD QUARTER RESULTS 2017 FIBRASHOP ANNOUNCES CONSOLIDATED RESULTS FOR THE THIRD QUARTER OF 2017 FibraShop, in comparison with the market trends, recorded an increase in all of its operating and financial indicators, which translated into a NOI growth of 12.43%, a revenue increase of 9.93% and an annualized dividend distribution rate of 10.82%. Dividend grew 16.30% from the previous quarter, rising from 0.22625 per CBFI to 0.3053, and up 25.23% year-over-year, with the distribution rate increasing from 8.64% to 10.82%. Total operating revenues for the quarter (rent and maintenance) amounted to Ps. 277.15 million. This amount represents a 9.93% increase from the same quarter last year, and a 2.03% increase from 2Q17. Net operating income (NOI) for the quarter was Ps. 202.26 million, up 12.43% year-over-year, and 2.41% higher from 2Q17. Same-store sales (excluding acquisitions) rose 9.93%, or Ps. 25.03 million from the same quarter last year. This increment is above the rate announced by ANTAD for same-store sales during the same period of 4.53%. NOI margin over total operating revenues was 72.98%, representing an increase of 163 basis points when compared with the same quarter last year, and an increase of 28 basis points when compared to the previous quarter. It is worth noting that the NOI margin at the property level rose to 81.73%. EBITDA for the quarter amounted to Ps.185.78 million, an increase of 12.57% when compared to the same quarter last year, and 2.40% from the previous quarter. -

GRUPO TELEVISA, S.A.B. DE C.V. Increasing TP to MP 125.0 Per

Equity Research GRUPO TELEVISA, S.A.B. DE C.V. Media May 29, 2015 Increasing TP to MP 125.0 per CPO HOLD Change in Recommendation Change in T.P. Change in Estimates Quarterly Review Other Last Price: MP 116.27 Figures in millions of pesos TLEVISA CPO High Liquidity Price Target 2015: MP 125.00 7% Return 2014 L12M 2015e 2016e ■ We are increasing our target price for Televisa’s CPO’s to MP125.0 Sales 80,118 83,054 91,778 97,944 EBITDA 30,801 32,256 35,898 38,174 (USD41.70/ADR), from MP116.0 (USD38.70/ADR) after having updated our Margin 38.4% 38.8% 39.1% 39.0% sum-of-the-parts model. Growth YoY 7.4% 11.1% 16.5% 6.3% ■ We continue with a HOLD recommendation mainly because Televisa’s Net Profit 5,387 5,986 10,023 10,211 shares are currently trading at a 7% discount to their net asset value. Margin 6.7% 7.2% 10.9% 10.4% Growth YoY (30.5%) (20.5%) 86.1% 1.9% ■ In addition, Televisa’s shares trade at an adjusted EV/EBITDA of 9.9x Total Assets 226,894 242,891 245,851 257,891 (including the equity stake from Univision) for 2015 and 9.2x for 2016. Cash & T.I. 29,729 33,887 26,500 30,500 These multiples are aligned with those of its international peers, which on Total Liabilities 138,979 153,208 148,666 151,581 average trade a 9.9x and 9.2x, respectively.