2019 Databook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1.1.3 Helicopters

Information on the Company’s Activities / 1.1 Presentation of the Company 1.1.3 Helicopters Airbus Helicopters is a global leader in the civil and military The HIL programme, for which the Airbus Helicopters’ H160 rotorcraft market, offering one of the most complete and modern was selected in 2017, was initially scheduled for launch range of helicopters and related services. This product range in 2022 by the current military budget law. Launching the currently includes light single-engine, light twin-engine, medium programme earlier will enable delivery of the fi rst H160Ms to and medium-heavy rotorcraft, which are adaptable to all kinds of the French Armed Forces to be advanced to 2026. The H160 mission types based on customer needs. See “— 1.1.1 Overview” was designed to be a modular helicopter, enabling its military for an introduction to Airbus Helicopters. version, with a single platform, to perform missions ranging from commando infi ltration to air intercept, fi re support, and anti-ship warfare in order to meet the needs of the army, the Strategy navy and the air force through the HIL programme. The new fi ve-bladed H145 is on track for EASA and FAA Business Ambition certifi cation in 2020. To ensure these certifi cations, two fi ve- bladed prototypes have clocked more than 400 fl ight hours Airbus Helicopters continues to execute its ambition to lead the in extensive fl ight test campaigns in Germany, France, Spain, helicopter market, build end-to-end solutions and grow new Finland, and in South America. First deliveries of the new H145 VTOL businesses, while being fi nancially sound. -

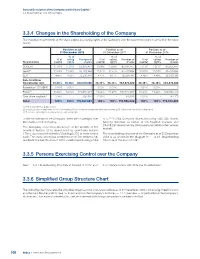

3.3.4 Changes in the Shareholding of the Company

General Description of the Company and its Share Capital / 3.3 Shareholdings and Voting Rights 3.3.4 Changes in the Shareholding of the Company The evolution in ownership of the share capital and voting rights of the Company over the past three years is set forth in the table below: Position as of Position as of Position as of 31 December 2018 31 December 2017 31 December 2016 % of % of % of % of voting Number of % of voting Number of % of voting Number of Shareholders capital rights shares capital rights shares capital rights shares SOGEPA 11.06% 11.06 % 85,835,477 11.08% 11.08% 85,835,477 11.11% 11.11% 85,835,477 GZBV(1) 11.04% 11.04 %85,709,82211.07% 11.07% 85,709,822 11.09% 11.09% 85,709,822 SEPI 4.16% 4.16 %32,330,381 4.17% 4.17% 32,330,381 4.18% 4.18% 32,330,381 Sub-total New Shareholder Agt. 26.26% 26.28% 203,875,680 26.32% 26.33% 203,875,680 26.38% 26.38% 203,875,680 Foundation “SOGEPA” 0.00% 0.00% 0 0.00% 0.00% - 0.00% 0.00% 0 Public(2) 73.66% 73.72% 571,855,277 73.66% 73.67% 570,550,857 73.60% 73.62% 568,853,019 Own share buyback(3) 0.08% - 636,924 0.02% - 129,525 0.02% - 184,170 Total 100% 100% 776,367,881 100% 100% 774,556,062 100% 100% 772,912,869 (1) KfW & other German public entities. -

Investor Guide FY 2019

Airbus - Investor Guide FY 2019 A Global Leader Key Financials Contact . A global leader in aeronautics, space and related services 2018 2019 Head of Investor Relations and Financial Communication: . 86% civil revenues, 14% defence . Three reportable segments: Airbus, Helicopters, Defence and Space Revenues (€ bn) 63.7 70.5 Thorsten Fischer [email protected] +33 5 67 19 02 64 . Robust and diverse backlog EBIT adjusted (€ bn) 5.8 6.9 Institutionals and Analysts: . Global footprint with European industrial roots RoSbased on EBIT adjusted 9.2% 9.9% 2019 Consolidated Airbus 2019 Consolidated Airbus EBIT reported (€ bn) 5.0 1.3 Mohamed Denden [email protected] +33 5 82 05 30 53 External Revenue by Division Order Book in value by Region Net Income/ loss (€ bn) 3.1 -1.4 Philippe Gossard [email protected] +33 5 31 08 59 43 EPS reported (€) 3.94 -1.75 Pierre Lu [email protected] +65 82 92 08 00 Dividend (€) 1.65 1.80* Net Cash Position (€bn) 13.3 12.5 Individual Investors : [email protected] +33 800 01 2001 FCF before M&A and Customer Financing (€bn) 2.9 3.5 € 70.5 bn € 471 bn t/o defence € 38 bn Further information on https://www.airbus.com/investors.html t/o defence € 10.1 bn Click here for guidance . * Board proposal to be submitted to the AGM 2020, subject to AGM approval. Airbus 2019 External Revenue Split 2019 Deliveries by Programme (units) 2019 Orders & Deliveries Airbus 77% Asia Pacific 31% Middle East 9% Key Financials Helicopters 8% Europe 28% Latin America 6% 2018 2019 Defence and Space 15% North America 18% Other 8% . -

ACI World AIRPORT DEVELOPMENT NEWS

Issue 01 – 2012 ACI World AIRPORT DEVELOPMENT NEWS A service provided by ACI World in cooperation with Momberger Airport Information www.mombergerairport.info Editor & Publisher: Martin Lamprecht [email protected] / Founding Editor & Publisher: Manfred Momberger EUROPE Great Britain: Plymouth Airport could become a GBP 25 million to 30 million ‘world-class international gateway’ under plans being worked on by a group of business people campaigning to save it. On 23 December 2011, the Viable group unveiled a vision for the Derriford site which would see the runway extended, a new terminal built, and land turned over for lucrative commercial use. Viable will discuss the plans with Plymouth City Council. The Sutton Harbour Group (SHG), which operates Plymouth on a 150-year-lease from Plymouth City Council, closed the airport on 23 December 2011 saying it is not economically sustainable. But Viable, which opposed the closure, disagrees with the suggestion that Plymouth cannot support a top-class aerodrome. Basing its design on London City Airport, Viable envisages a facility that could eventually handle up to 1 million passengers a year. The phased project would take up to ten years to fully realize, initially seeing the reopening of the airport with restricted operations and limited services. But the group said that after about three years, the operation could be expanded dramatically. Its vision is for the runway to be extended from 1160 m to its maximum 1390 m, so larger aircraft can be welcomed. A runway loop would mean aircraft can wait for take-off slots, diminishing delays. But ahead of this, a simple initial resurfacing of the runway would only cost GBP 500 000, Viable said, a quarter of the expected cost. -

Investor Guide Value Drivers 2017

Airbus SE - Investor Guide Value Drivers 2017 Market Outlook Portfolio Highlights Investment Case . The world’s passenger air traffic is set to grow at 4.4% per year between A world leading manufacturer of aircraft in the category of 100 seats and more . products through continuous innovation (A320neo, A330neo, Market leading 2017 and 2036 supporting strong aircraft demand. Best-selling single-aisle – A320 Family with New Engine Option (neo) entry A350 XWB) . 34,899 new deliveries between 2017-2036 into service 2016. Backlog of 6,141 aircraft (December 2017) . Record backlog supporting ramp-up plans . Single-aisle: 71% of units, Wide-bodies: 54% of value . Versatile and complementary wide-body A330 Family with neo version to Revenue visibility: backlog represents ~9 years of production at current production rates be delivered in summer 2018. Backlog of 317 aircraft (December 2017) . on family aircraft to 60 per month by mid-2019, 20 Years New Deliveries of Passenger and Freighter Aircraft (units) . New generation A350 XWB: designed to reduce operating costs, fuel burn Production rate increase A320 and CO2 emissions. Backlog of 712 aircraft (December 2017) on A350 XWB to 10 per month by end of 2018 . The world´s largest commercial aircraft – A380: in service with 13 . Partnership with Bombardier on C Series bringing together two complementary operators. Backlog of 95 aircraft (December 2017) product lines to rapidly extend our product offering into a fast growing market sector (subject to regulatory approvals) Commercial Aircraft Source: Airbus Global Market Forecast Passenger aircraft (≥ 100 seats) | Jet freight aircraft (>10 tonnes), Rounded figures to the nearest 10 A380 A330neo A350 XWB A321neo A global leader in the civil and military helicopter market . -

AED Fleet Contact List

AED Fleet Contact List September 2021 Make Model Primary Office Operations - Primary Operations - Secondary Avionics - Primary Avionics - Secondary Maintenance - Primary Maintenance - Secondary Air Tractor All Models MKC Persky, David (FAA) Hawkins, Kenneth (FAA) Marsh, Kenneth (FAA) Rockhill, Thane D (FAA) BadHorse, Jim (FAA) Airbus A300/310 SEA Hutton, Rick (FAA) Dunn, Stephen H (FAA) Gandy, Scott A (FAA) Watkins, Dale M (FAA) Patzke, Roy (FAA) Taylor, Joe (FAA) Airbus A318-321 CEO/NEO SEA Culet, James (FAA) Elovich, John D (FAA) Watkins, Dale M (FAA) Gandy, Scott A (FAA) Hunter, Milton C (FAA) Dodd, Mike B (FAA) Airbus A330/340 SEA Culet, James (FAA) Robinson, David L (FAA) Flores, John A (FAA) Watkins, Dale M (FAA) DiMarco, Joe (FAA) Johnson, Rocky (FAA) Airbus A350 All Series SEA Robinson, David L (FAA) Culet, James (FAA) Watkins, Dale M (FAA) Flores, John A (FAA) Dodd, Mike B (FAA) Johnson, Rocky (FAA) Airbus A380 All Series SEA Robinson, David L (FAA) Culet, James (FAA) Flores, John A (FAA) Watkins, Dale M (FAA) Patzke, Roy (FAA) DiMarco, Joe (FAA) Aircraft Industries All Models, L-410 etc. MKC Persky, David (FAA) McKee, Andrew S (FAA) Marsh, Kenneth (FAA) Pruneda, Jesse (FAA) Airships All Models MKC Thorstensen, Donald (FAA) Hawkins, Kenneth (FAA) Marsh, Kenneth (FAA) McVay, Chris (FAA) Alenia C-27J LGB Nash, Michael A (FAA) Lee, Derald R (FAA) Siegman, James E (FAA) Hayes, Lyle (FAA) McManaman, James M (FAA) Alexandria Aircraft/Eagle Aircraft All Models MKC Lott, Andrew D (FAA) Hawkins, Kenneth (FAA) Marsh, Kenneth (FAA) Pruneda, -

AN ECONOMIC ASSESSMENT of STOL AIRCRAFT POTENTIAL INCLUDING TERMINAL AREA ENVIRONMENTAL CONSIDERATIONS Volume I

NASA CONTRACTOR NASA CR-2424 REPORT CM AN ECONOMIC ASSESSMENT OF STOL AIRCRAFT POTENTIAL INCLUDING TERMINAL AREA ENVIRONMENTAL CONSIDERATIONS Volume I by H. L. Solomon and S. Sokolsky Prepared by THE AEROSPACE CORPORATION El Segundo, Calif. for Ames Research Center NATIONAL AERONAUTICS AND SPACE ADMINISTRATION • WASHINGTON, D. C. • MAY 1974 1. Report No. 2. Government Accession No. 3. Recipient's Catalog No. NASA CR -2b2k 4. Title and Subtitle 5. Report Date "An Economic Assessment of STOL Aircraft Potential Including MAY 197^ Terminal Area Environmental Considerations" Volume I 6. Performing Organization Code 7. Author(s) 8. Performing Organization Report No. H. L. Solomon and S. Sokolsky 10. Work Unit No. 9. Performing Organization Name and Address The Aerospace Corporation 11. Contract or Grant No. El Segundo; California NAS 2-6473 13. Type of Report and Period Covered Contractor Report 12. Sponsoring Agency Name and Address Final Report National Aeronautics and Space Administration Washington, D.C. .„ 14. Sponsoring Agency Code 1 5. Supplementary Notes 16. Abstract This report presents the results of an economic and environmental study of short haul airline systems using short takeoff and landing (STOL) aircraft. The STOL system characteristics were .optimized for maximum patronage at a specified return on investment, while maintaining noise impact compatibility with the terminal area. Supporting studies of aircraft air pollution and .hub airport icongestion relief were also performed. The STOL concept specified for this study was an Augmentor Wing turbofan aircraft having a field length capability of 2,000 ft. and an effective perceived noise level of 95 EPNdB at. 500 ft. -

2021 AHNA Options Catalogue

OPTIONS CATALOGUE 2021 Return to the Table of Contents Contact and Order Information U.S.A: +1 800-COPTER-1 [email protected] Canada: +1 800-267-4999 [email protected] © July 2021 Airbus Helicopters, all rights reserved. 002 | Options Catalogue 2021 Options Catalogue INTRODUCTION At Airbus Helicopters in North America, our engineering excellence and completions capability is an integral part of meeting your operating requirements. We are committed to providing OEM approved equipment modifications that further enhance your experience with our product line. This catalogue illustrates a grouping of our most important and interesting options available for the H125, H130, H135, and H145 aircraft families. Airbus Helicopters, Inc. is a certified “Design Approval Organization” by the Federal Aviation Administration. Airbus Helicopters Canada is a certified “Design Approval Organization” by Transport Canada. As customer centers, we have also been recognized as an Authorized Design Organization by the Airbus Helicopters Group (AH Group). For more information, please visit Airbus World or see contact information on the next page. Airbus Helicopters' Airbus World customer portal simplifies customers’ daily operations and allows them to focus on what really matters: their business. Air- bus World is an innovative online platform for accessing technical publications, placing orders and quotations, managing fleet data as well as warranty claims, and receiving quick responses to support and services questions. Airbus Helicopters reserves the right to make configuration and data changes at any time without notice. Information contained in this document is expressed in good faith and does not constitute any offer or contract with Airbus Helicopters. -

EN All Nippon Helicopter's H160 Completes First

All Nippon Helicopter’s H160 completes first flight #WeMakeItFly #H160ReasonsWhy Marignane, 14 January 2021 – All Nippon Helicopter’s (ANH) H160 has performed its first flight test, a 95-minute flight at the Marseille Provence Airport. This successful maiden flight paves the way for the aircraft’s entry into service in Japan. ANH deploys a helicopter fleet comprising six AS365s and five H135s for electronic news gathering for the TV stations across Japan. This H160 will replace one of its AS365s. “We are delighted to see the successful inaugural flight of Japan’s very first H160, and we are looking forward to this next-generation helicopter playing an important role in our nationwide missions,” said Jun Yanagawa, President of ANH. “Since the introduction of the AS365 helicopter three decades ago, the requirements of the electronic news gathering market is constantly evolving and has significantly improved. This state-of-the-art helicopter H160 is a timely welcome for our operations.” The H160 was granted its type certificate by the European Union Aviation Safety Agency (EASA) in July 2020, with the certification from the Japan Civil Aviation Bureau (JCAB) expected in early 2021. Upon delivery of the helicopter, specialised equipment installation and customisation will be performed at Airbus Helicopters’ Kobe facility, before its entry into service. “We are honoured to have ANH as our H160 launch customer in Japan, as they renew their fleet. This successful first flight is particularly meaningful during this unprecedented time for the industry. We thank our customer and the teams involved for devoting maximum efforts into this achievement. -

TMB-2019-H160M.Pdf

Introduction to H160M HELICOPTERS 1 Donauworth, November 4th 2019 Introduction to H160M Introduction to H160M Military version of the H160, 6-tonne class Benefitting from all innovations developed by Airbus Helicopters for the H160: A brand new platform with 68 new patents Developed with innovative tools and methods accelerating aircraft maturity at entry-into-service in 2020 Designed with accessibility in mind to ease maintenance: aircraft and engine maintenance plans fully aligned, aiming at high availability rates for reduced maintenance costs 2 Donauworth, November 4th 2019 Introduction to H160M One single platform = a true multi-role aircraft One single versatile platform for a wide range of missions Modular architecture for quick mission reconfiguration Fleet rationalization: one type of helicopter instead of several specialized types, aiming at reducing maintenance and training costs, and improving operational flexibility Typical missions: commando infiltration, national airspace protection, air intercept, search and rescue, anti-surface warfare, naval force protection, maritime security, maritime environment monitoring and intelligence, reconnaissance, special forces, C4I. e Designed with the French armed forces: configuration is the result of 10 years of joint e collaboration between Airbus Helicopters and the 3 different French Armed Forces 3 Donauworth, November 4th 2019 Introduction to H160M Key platform characteristics Platform key characteristics : Latest generation avionics from Thales (FlytX) Powered by latest-generation -

1.1 Presentation of the Company

Information on the Company’s Activities / 1.1 Presentation of the Company 1.1 Presentation of the Company 1.1.1 Overview Due to the nature of the markets in which the Company operates and the confi dential nature of its businesses, any statements with respect to the Company’s competitive position set out in paragraphs 1.1.1 through 1.1.5 below have been based on the Company’s internal information sources, unless another source has been specifi ed below. With consolidated revenues of € 63.7 billion in 2018, the Company expand the Airbus single-aisle family to cover the 100-150 seat is a global leader in aeronautics, space and related services. segment – and respond to a worldwide market demand for Airbus offers the most comprehensive range of passenger single-aisle jetliners in that segment. airliners. The Company is also a European leader providing tanker, combat, transport and mission aircraft, as well as one of the Despite challenges in the traditional helicopter market, Airbus world’s leading space companies. In helicopters, the Company Helicopters has shown resilient performance, keeping its market provides the most effi cient civil and military rotorcraft solutions leadership in the civil & parapublic segments. worldwide. In 2018, it generated 84.5% of its total revenues in the civil sector (compared to 85% in 2017) and 15.5% in the defence 2. Preserve our leading position in European Defence, Space sector (compared to 15% in 2017). As of 31 December 2018, the and Government markets by focusing on providing military Company’s active headcount was 133,671 employees. -

EUR ANP, Volume I August 2021 EUROPEAN (EUR) AIR NAVIGATION PLAN

EUROPEAN (EUR) AIR NAVIGATION PLAN VOLUME I EUR ANP, Volume I August 2021 EUROPEAN (EUR) AIR NAVIGATION PLAN VOLUME I EUR ANP, Volume I August 2021 Page i Working Copy This version of the Working Copy of the European (EUR) Air Navigation Plan Volume I (Doc 7754), includes the following approved amendment(s) which have not yet been published: P. f. Amdt. Originator Brief Description Date Approved EUR/NAT Serial No. by Council Notification SL 17- 17/01 AOP-SAR Ukraine To reflect Changes in Table AOP I-1 1Table SAR I-1 7 June 2017 0350.TEC SL 17- 17/04 AOP Israel To reflect Changes in Table AOP I-1 9th August 2017 0581.TEC SL 17- 17/06 AOP Poland To reflect Changes in Table AOP I-1 9th August 2017 0582.TEC Bulgaria, Croatia, 12th February 17/13 AOP To reflect Changes in Table AOP I-1 SL 18- Kazakhstan, 2018 0152.TEC Latvia 12th February SL 18- 17/15 AOP Finland To reflect Changes in Table AOP I-1 2018 0154.TEC 18/05 Russian SL 18- To reflect Changes in AOP I-1 and ATM I-1 22nd June 2018 AOP/ATM Federation 0372.TEC 18/08 SL 19- Finland To reflect Changes in GEN I-I, ATM I-1, SAR I-1 8 January 2019 GEN/ATM/SAR 0027.TEC 18/10 AOP Turkey To reflect Changes in Table AOP I-1 17 January 2019 SL 19- 0041.TEC Revoked by To reflect Changes in Table AOP I-1 17/04 AOP Israel Council on 4 16 May 2019 (Changes Removed From Table AOP I-1) February 2019 19/06 GEN AOP To reflect Changes in Table GEN I-1, Table AOP I-1, Ukraine 2 July 2019 4 July 2019 ATM Table ATM I-1 19/05 ICAO To reflect Changes in Table GEN I-1, Table AOP I-1, GEN/AOP/ATM Secretariat, 15 August 2019 20 August 2019 Table ATM I-1, Table SAR I-1 /SAR Kazakhstan 19/07 To reflect Changes in Table GEN I-1, Table ATM I-1, 2 September Norway 28 August 2019 GEN/ATM Charts ATM I-1 and ATM I-2.