Financing Terror Bit by Bit by Aaron Brantly FEATURE ARTICLE 1 Financing Terror Bit by Bit by Aaron Brantly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TASK FORCE the Donald C

HENRY M. JACKSON SCHOOL OF INTERNATIONAL STUDIES UNIVERSITY of WASHINGTON TASK FORCE The Donald C. Hellmann Task Force Program Preventing ISIL’S Rebirth Through a Greater Understanding of Radicalization: A Case Study of ISIL Foreign Fighters 2020 Preventing ISIL’s Rebirth Through A Greater Understanding of Radicalization: A Case Study of ISIL Foreign Fighters Evaluator Corinne Graff, Ph.D. Senior Advisor, Conflict Prevention and Fragility United States Institute of Peace (USIP) Faculty Advisor Denis Bašić, Ph.D. ~ Coordinator Orla Casey Editor Audrey Conrad Authors Orla Casey Audrey Conrad Devon Fleming Olympia Hunt Manisha Jha Fenyun Li Hannah Reilly Haley Rogers Aliye Volkan Jaya Wegner Our Task Force would like to express our gratitude towards Professor Denis Bašić, without whom this Task Force would not have been possible. Thank you for your guidance, expertise, and abundance of knowledge. We appreciate you always pushing us further towards a deeper understanding. TABLE OF CONTENTS Executive Summary……………………………………………………………………………….2 The Rise of ISIL and Foreign Fighters…………………………………………………………....3 Section I: Middle Eastern and North African ISIL Recruitment Saudi Arabia…………………………………………………………...………………………….7 Tunisia………………………………………………………………………………………...…13 Morocco………………………………………………………………………………………….15 Libya……………………………………………………………………………………………..17 Egypt……………………………………………………………………………………………..21 Jordan……………………………………………………………………………………………25 Lebanon………………………………………………………………………………………….30 Turkey……………………………………………………………………………………………34 Section II: South -

The Ruling Concerning Mawlid An-Nabawi

the ruling concerning Mawlidan-nabawi (celebration of the Prophet’sr birthday) by Shaikh Saleh ibn Fawzan al-Fawzan with additional quotes from 'Hukm al-Ihtifal bil-Mawlid war-Radd ala man ajaaz' by Shaikh Muhammad ibn Ibraheem Aal-Shaikh A Dialogue between Shaikh al-Albanee and a proponent of Mawlid translated by Shawana A. Aziz Published by Quran Sunnah Educational Programs www.qsep.com Index Introduction............................................................................................................01 The celebration of Mawlid an-Nabawi is prohibited and rejected due to several reasons.............................................................................................................0 7 1. The celebration of Mawlid is neither from the Sunnah of Allah's Messengerr nor his Caliphs.......................................................................... 08 2. Celebrating Mawlid (birthday) of Allah's Messengerr is an imitation of the Christians............................................................................... 09 3. Mawlid is also a means of exaggeration in the honor of Allah's Messengerr ...................................................................................................... 10 4. Celebrating the Bidah of Mawlid opens the door to other innovations........................................................................................................... 11 Clarifying Doubts Doubt 1: Celebration of Mawlid is honoring the Prophetr .....................14 Doubt 2: Mawlid is celebrated by a -

Desiring Postcolonial Britain: Genre Fiction Since the Satanic Verses

Desiring Postcolonial Britain: Genre Fiction sinceThe Satanic Verses Sarah Post, BA (Hons), MA Submitted in fulfilment of the requirements for the degree of Doctor of Philosophy November 2012 This thesis is my own work and has not been submitted in substantially the same form for the award of a higher degree elsewhere ProQuest Number: 11003747 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. uest ProQuest 11003747 Published by ProQuest LLC(2018). Copyright of the Dissertation is held by the Author. All rights reserved. This work is protected against unauthorized copying under Title 17, United States C ode Microform Edition © ProQuest LLC. ProQuest LLC. 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106- 1346 1 Acknowledgements The completion of this project would not have been possible without the academic, financial and emotional support of a great number of people. I would like to thank all those that offered advice on early drafts of my work at conferences and through discussions in the department. Special thanks go to the Contemporary Gothic reading group at Lancaster for engendering lively debate that fed into my understanding of what the Gothic can do today. Equally, I could not have finished the project without financial support, for which I am grateful to the Lancaster English Department for a fee waiver and to Dr. -

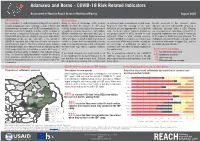

Adamawa and Borno - COVID-19 Risk Related Indicators

Adamawa and Borno - COVID-19 Risk Related Indicators Assessment of Hard-to-Reach Areas in Northeast Nigeria August 2020 Introduction Methodology The continuation of conflict in Northeast Nigeria has created a Using its Area of Knowledge (AoK) method, on settlement-wide circumstances in H2R areas. Results presented in this factsheet, unless complex humanitarian crisis, rendering sections of Borno and REACH monitors the situation in H2R areas Responses from KIs reporting on the same otherwise specified, represent the proportion of Adamawa states as hard to reach (H2R) for humanitarian actors. remotely through monthly multisector interviews in settlement are then aggregated to the settlement settlements assessed within a LGA. Findings Previous assessments illustrate how the conflict continues to accessible Local Government Area (LGA) capitals. level. The most common response provided by are only reported on LGAs where at least 5% of have severe consequences for people in H2R areas. People REACH interviews key informants (KIs) who 1) the greatest number of KIs is reported for each populated settlements and at least 5 settlements living in H2R areas, who are already facing severe and extreme are recently arrived internally displaced persons settlement. When no most common response in the respective LGA have been assessed. The humanitarian needs, are also vulnerable to the spread of (IDPs) who have left a H2R settlement in the last 3 could be identified, the response is considered as findings presented are indicative of broader trends COVID-19, especially due to the lack of health care services months, or 2) have been in contact with someone ‘no consensus’. While included in the calculations, in assessed settlements in August 2020, and are and information sources. -

How Boko Haram Became the Islamic State's West Africa

HOW BOKO HARAM BECAME THE ISLAMIC STATE’S WEST AFRICA PROVINCE J. Peter Pham ven before it burst into the headlines with its brazen April 2014 abduction of nearly three hundred schoolgirls from the town of Chibok in Nigeria’s northeast- Eern Borno State, sparking an unprecedented amount of social media communica- tion in the process, the Nigerian militant group Boko Haram had already distinguished itself as one of the fastest evolving of its kind, undergoing several major transformations in just over half a decade. In a very short period of time, the group went from being a small militant band focused on localized concerns and using relatively low levels of violence to a significant terrorist organization with a clearer jihadist ideology to a major insurgency seizing and holding large swathes of territory that was dubbed “the most deadly terrorist group in the world” by the Institute for Economics and Peace, based on the sheer number of deaths it caused in 2014.1 More recently, Boko Haram underwent another evolution with its early 2015 pledge of allegiance to the Islamic State and its subsequent rebranding as the “Islamic State West Africa Province” (ISWAP). The ideological, rhetorical, and operational choices made by Boko shifted consider- ably in each of these iterations, as did its tactics. Indeed the nexus between these three elements—ideology, rhetoric, and operations—is the key to correctly interpreting Boko Haram’s strategic objectives at each stage in its evolution, and to eventually countering its pursuit of these goals. Boko Haram 1.0 The emergence of the militant group that would become known as Boko Haram cannot be understood without reference to the social, religious, economic, and political milieu of J. -

Jihadism in Africa Local Causes, Regional Expansion, International Alliances

SWP Research Paper Stiftung Wissenschaft und Politik German Institute for International and Security Affairs Guido Steinberg and Annette Weber (Eds.) Jihadism in Africa Local Causes, Regional Expansion, International Alliances RP 5 June 2015 Berlin All rights reserved. © Stiftung Wissenschaft und Politik, 2015 SWP Research Papers are peer reviewed by senior researchers and the execu- tive board of the Institute. They express exclusively the personal views of the authors. SWP Stiftung Wissenschaft und Politik German Institute for International and Security Affairs Ludwigkirchplatz 34 10719 Berlin Germany Phone +49 30 880 07-0 Fax +49 30 880 07-100 www.swp-berlin.org [email protected] ISSN 1863-1053 Translation by Meredith Dale (Updated English version of SWP-Studie 7/2015) Table of Contents 5 Problems and Recommendations 7 Jihadism in Africa: An Introduction Guido Steinberg and Annette Weber 13 Al-Shabaab: Youth without God Annette Weber 31 Libya: A Jihadist Growth Market Wolfram Lacher 51 Going “Glocal”: Jihadism in Algeria and Tunisia Isabelle Werenfels 69 Spreading Local Roots: AQIM and Its Offshoots in the Sahara Wolfram Lacher and Guido Steinberg 85 Boko Haram: Threat to Nigeria and Its Northern Neighbours Moritz Hütte, Guido Steinberg and Annette Weber 99 Conclusions and Recommendations Guido Steinberg and Annette Weber 103 Appendix 103 Abbreviations 104 The Authors Problems and Recommendations Jihadism in Africa: Local Causes, Regional Expansion, International Alliances The transnational terrorism of the twenty-first century feeds on local and regional conflicts, without which most terrorist groups would never have appeared in the first place. That is the case in Afghanistan and Pakistan, Syria and Iraq, as well as in North and West Africa and the Horn of Africa. -

FEWS NET Special Report: a Famine Likely Occurred in Bama LGA and May Be Ongoing in Inaccessible Areas of Borno State

December 13, 2016 A Famine likely occurred in Bama LGA and may be ongoing in inaccessible areas of Borno State This report summarizes an IPC-compatible analysis of Local Government Areas (LGAs) and select IDP concentrations in Borno State, Nigeria. The conclusions of this report have been endorsed by the IPC’s Emergency Review Committee. This analysis follows a July 2016 multi-agency alert, which warned of Famine, and builds off of the October 2016 Cadre Harmonisé analysis, which concluded that additional, more detailed analysis of Borno was needed given the elevated risk of Famine. KEY MESSAGES A Famine likely occurred in Bama and Banki towns during 2016, and in surrounding rural areas where conditions are likely to have been similar, or worse. Although this conclusion cannot be fully verified, a preponderance of the available evidence, including a representative mortality survey, suggests that Famine (IPC Phase 5) occurred in Bama LGA during 2016, when the vast majority of the LGA’s remaining population was concentrated in Bama Town and Banki Town. Analysis indicates that at least 2,000 Famine-related deaths may have occurred in Bama LGA between January and September, many of them young children. Famine may have also occurred in other parts of Borno State that were inaccessible during 2016, but not enough data is available to make this determination. While assistance has improved conditions in accessible areas of Borno State, a Famine may be ongoing in inaccessible areas where conditions could be similar to those observed in Bama LGA earlier this year. Significant assistance in Bama Town (since July) and in Banki Town (since August/September) has contributed to a reduction in mortality and the prevalence of acute malnutrition, though these improvements are tenuous and depend on the continued delivery of assistance. -

Nigeria Update to the IMB Nigeria

Progress in Polio Eradication Initiative in Nigeria: Challenges and Mitigation Strategies 16th Independent Monitoring Board Meeting 1 November 2017 London 0 Outline 1. Epidemiology 2. Challenges and Mitigation strategies SIAs Surveillance Routine Immunization 3. Summary and way forward 1 Epidemiology 2 Polio Viruses in Nigeria, 2015-2017 Past 24 months Past 12 months 3 Nigeria has gone 13 months without Wild Polio Virus and 11 months without cVDPV2 13 months without WPV 11 months – cVDPV2 4 Challenges and Mitigation strategies 5 SIAs 6 Before the onset of the Wild Polio Virus Outbreak in July 2016, there were several unreached settlements in Borno Borno Accessibility Status by Ward, March 2016 # of Wards in % Partially LGAs % Fully Accessible % Inaccessible LGA Accessible Abadam 10 0% 0% 100% Askira-Uba 13 100% 0% 0% Bama 14 14% 0% 86% Bayo 10 100% 0% 0% Biu 11 91% 9% 0% Chibok 11 100% 0% 0% Damboa 10 20% 0% 80% Dikwa 10 10% 0% 90% Gubio 10 50% 10% 40% Guzamala 10 0% 0% 100% Gwoza 13 8% 8% 85% Hawul 12 83% 17% 0% Jere 12 50% 50% 0% Kaga 15 0% 7% 93% Kala-Balge 10 0% 0% 100% Konduga 11 0% 64% 36% Kukawa 10 20% 0% 80% Kwaya Kusar 10 100% 0% 0% Mafa 12 8% 0% 92% Magumeri 13 100% 0% 0% Maiduguri 15 100% 0% 0% Marte 13 0% 0% 100% Mobbar 10 0% 0% 100% Monguno 12 8% 0% 92% Ngala 11 0% 0% 100% Nganzai 12 17% 0% 83% Shani 11 100% 0% 0% State 311 41% 6% 53% 7 Source: Borno EOC Data team analysis Four Strategies were deployed to expand polio vaccination reach and increase population immunity in Borno state SIAs RES2 RIC4 Special interventions 12 -

Attack on Nasheed and the Rising Tide of Radicalisation in the Maldives

MP-IDSA Issue Brief Attack on Nasheed and the Rising Tide of Radicalisation in the Maldives Adil Rasheed May 20, 2021 Summary The attack on former Maldivian president and current parliamentary speaker Mohammad Nasheed on May 6, 2021 has led to speculation that the assassination bid was planned either by Islamist extremists or his political opponents. The Brief examines key aspects of the country's tenuous social and political fabric and situates the problem of radicalisation in a historical as well as the contemporary context. In closing, it proposes a few measures India may consider taking to help Maldives strengthen its political stability and security. ATTACK ON NASHEED AND THE RISING TIDE OF RADICALISATION IN THE MALDIVES At 8:39 pm on May 6, 2021, just before the COVID night-time curfew was to come into effect in Male, an IED blast struck the former President of Maldives and current Speaker of the Majlis (parliament), Mohammad Nasheed. The explosion also injured four other people accompanying him, including a British national. Reports noted that the home-made explosive device, packed with ball bearings to cause maximum damage, was planted on a motorbike parked near Nasheed's car.1 In the initial hours after the attack, the 53-year-old Nasheed was in a ‘critical condition’ and underwent multiple surgeries to his head, chest, abdomen and limbs.2 Thankfully, Anni, as he is affectionately called, recovered quickly and has now been flown to Germany for further treatment. In a tweet, External Affairs Minister S. Jaishankar wished him a speedy recovery and said that Nasheed can “never be intimidated.”3 Political Rivals, ISIS, or Islamists? The Maldivian police termed the attack a “deliberate act of terror”, although no terrorist group has so far taken responsibility. -

ETT Report No.107

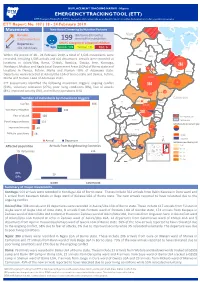

DISPLACEMENT TRACKING MATRIX - Nigeria DTM Nigeria EMERGENCY TRACKING TOOL (ETT) DTM Emergency Tracking Tool (ETT) is deployed to track and provide up-to-date information on sudden displacement and other population movements ETT Report: No. 107 | 18 - 24 February 2019 Movements New Arrival Screening by Nutri�on Partners Abadam Arrivals: Children (6-59 months) Niger Lake Chad 1,505 individuals screened for malnutri�on 23 Kukawa 199 Mobbar MUAC category of screened children Departures: Guzamala 101 individuals Green: 174 Yellow: 19 Red: 6 Gubio Monguno Within the period of 18 - 24 February 2019, a total of 1,606 movements were Nganzai recorded, including 1,505 arrivals and 101 departures. Arrivals were recorded at Marte Ngala loca�ons in Askira/Uba, Bama, Chibok, Damboa, Gwoza, Jere, Konduga, Magumeri Maiduguri 283 Maiduguri, Mobbar and Ngala Local Government Areas (LGAs) of Borno state and 36 9 Jere Mafa loca�ons in Demsa, Fufore, Maiha and Numan LGAs of Adamawa state. Dikwa Kala/Balge Departures were recorded at Askira/Uba LGA of Borno state and Demsa, Fufore, Borno Konduga Maiha and Numan LGAs of Adamawa state. Kaga ETT assessments iden�fied the following movement triggers: ongoing conflict 564 Bama 76 (53%), voluntary reloca�on (27%), poor living condi�ons (8%), fear of a�acks (8%), improved security (3%), and military opera�ons (1%) Gwoza 23 Damboa 39 Number of individuals by movement triggers Cameroon Chibok 7 Biu Madagali Conflict 856 Askira/Uba Michika Voluntary reloca�on 439 Kwaya Kusar 19 Bayo Hawul 308 Mubi North Fear of a�ack 128 -

Nigeria – Complex Emergency JUNE 7, 2021

Fact Sheet #3 Fiscal Year (FY) 2021 Nigeria – Complex Emergency JUNE 7, 2021 SITUATION AT A GLANCE 206 8.7 2.9 308,000 12.8 MILLION MILLION MILLION MILLION Estimated Estimated Number of Estimated Estimated Projected Acutely Population People in Need in Number of IDPs Number of Food-Insecure w of Nigeria Northeast Nigeria in Nigeria Nigerian Refugees Population for 2021 in West Africa Lean Season UN – December 2020 UN – February 2021 UNHCR – February 2021 UNHCR – April 2021 CH – March 2021 Major OAG attacks on population centers in northeastern Nigeria—including Borno State’s Damasak town and Yobe State’s Geidam town—have displaced hundreds of thousands of people since late March. Intercommunal violence and OCG activity continue to drive displacement and exacerbate needs in northwest Nigeria. Approximately 12.8 million people will require emergency food assistance during the June-to-August lean season, representing a significant deterioration of food security in Nigeria compared with 2020. 1 TOTAL U.S. GOVERNMENT HUMANITARIAN FUNDING USAID/BHA $230,973,400 For the Nigeria Response in FY 2021 State/PRM2 $13,500,000 For complete funding breakdown with partners, see detailed chart on page 7 Total $244,473,400 1 USAID’s Bureau for Humanitarian Assistance (USAID/BHA) 2 U.S. Department of State Bureau for Population, Refugees, and Migration (State/PRM) 1 KEY DEVELOPMENTS Violence Drives Displacement and Constrains Access in the Northeast Organized armed group (OAG) attacks in Adamawa, Borno, and Yobe states have displaced more than 200,000 people since March and continue to exacerbate humanitarian needs and limit relief efforts, according to the UN. -

Finding a Voice: Young Muslims, Music and Religious Change in Britain ______

Finding a Voice: Young Muslims, Music and Religious Change in Britain ___________________________________________________________________________ Carl Morris On a warm Sunday afternoon, in early September 2011, large crowds are strolling around the grounds of a 19th century non-conformist higher education college in Manchester. As the autumnal sunshine and leafy gardens are enjoyed by all, to the rear of the college, in an old peaked chapel that juts from the back of the bricked building, a man, dressed in a dark, buttoned-up suit and tie, moves across a small stage with microphone in hand. Smiling broadly as he scatters flowers to a swaying crowd, the man sings into the microphone. Supported by pre-recorded backing harmonies and percussion emitted from a temporary sound system, he gently unfolds lyrics praising Allah and the beauty of creation, attempting to evoke notions of love and compassion. This is the 2011 Eid Festival, at the British Muslim Heritage Centre, and the performer, Khaleel Muhammad, has travelled from London to perform a selection of English-language nasheeds (religious songs) for those at the celebration. He is just one of several celebrity performers that are here to contribute to the nasheed concert, while outside Muslim families enjoy the food stalls, the activity tents and the small funfair. In many respects, this celebration and similar events across the country are part of an emergent Islamic entertainment culture – a culture that incorporates music as a central, distinctive but rather ambiguous practice. The event was typical of its kind: organised by a Muslim civil society and staffed by young Muslim volunteers in jeans and t-shirts, it aimed to combine a religious celebration with the gaiety of a wholesome and popularised entertainment culture.