2001 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Neilson Dairy Sold to Saputo

www.independentfreepress.com Recipe ofTHE the week: INDEPENDENT Wheels & Car Care Spinach quiche special section Page 23 & FREE PRESS 8-Pages 50 cents (+GST) Circulation 22,500 Friday, October 24, 2008 56 Pages Halton Hills’ award-winning newspaper INSIDE Local workforce remains unchanged Neilson Dairy sold to Saputo LISA TALLYN Where did the Staff Writer downtown flowers go? George Weston Ltd. has sold its Neilson Dairy business to Saputo Inc. for $465 million. The Guelph St. Georgetown location is one of Page 7 two plants owned by Weston. The other plant is located in Ottawa and combined they employ 390 employees. Karine Vachon, a spokesperson for Saputo Inc., said under the agreed-upon deal, which is expected to close Nov. 24 subject to approval by the Competition Bureau, “Saputo will continue business as usual” at Neilson. “Work force and operations will remain the same,” said Vachon when asked if there would be any staff reductions at the Georgetown plant. Geoff Wilson, senior vice-president of George Weston Ltd., also said it was his “understanding Parenting everyone is moving over” and there would be no special impact to staff in Georgetown. According to Halton Hills Chamber of section Commerce the Georgetown plant employs 200 full-time and 150 part-time employees. 4-Pages Vachon said the “Neilson” brand would also remain the same. Wilson called the sale, “a great fit for Saputo and very good for Weston and its shareholders.” Editorial 6 “We believe this transaction allows Neilson Dairy to continue to grow under the national Calendar 10, 11 presence of Canada’s largest dairy processor,” said Entertainment 14 Wilson. -

ANNUAL INFORMATION FORM (For the Year Ended December 31, 2020)

ANNUAL INFORMATION FORM (for the year ended December 31, 2020) March 1, 2021 GEORGE WESTON LIMITED ANNUAL INFORMATION FORM TABLE OF CONTENTS I. FORWARD-LOOKING STATEMENTS 1 II. CORPORATE STRUCTURE 2 Incorporation 2 Intercorporate Relationships 2 III. GENERAL DEVELOPMENT OF THE BUSINESS 3 Overview 3 COVID-19 3 Loblaw 3 Retail Segment 3 Financial Services Segment 5 Choice Properties 5 Acquisition of Canadian Real Estate Investment Trust 5 Reorganization of Choice Properties 6 Acquisition, Disposition and Development Activity 6 Weston Foods 10 Acquisitions 10 Dispositions 10 Capital Investment 10 Restructuring Activities 10 Financial Performance 10 IV. DESCRIPTION OF THE BUSINESS 11 Loblaw 11 Retail Segment 11 Financial Services Segment 15 Labour and Employment Matters 15 Intellectual Property 15 Environmental, Social and Governance 15 Choice Properties 16 Retail Portfolio 16 Industrial Portfolio 16 Office Portfolio 16 Residential Portfolio 16 Acquisitions 17 Development 17 Competition 18 Employment 18 Environmental, Social and Governance 18 Weston Foods 18 Principal Products 18 Production Facilities 19 Distribution to Consumers 19 Competitive Conditions 19 Brands 19 Raw Materials 20 Intellectual Property 20 Seasonality 20 Labour and Employment Matters 20 Environmental, Social and Governance 20 Food Safety and Public Health 20 Research and Development and New Products 21 Foreign Operations 21 V. PRIVACY AND ETHICS 21 VI. OPERATING AND FINANCIAL RISKS AND RISK MANAGEMENT 22 Enterprise Risks and Risk Management 22 COVID-19 Risks and Risk Management 22 Operating Risks and Risk Management 23 Financial Risks and Risk Management 33 VII. CAPITAL STRUCTURE AND MARKET FOR SECURITIES 35 Share Capital 35 Trading Price and Volume 36 Medium-Term Notes and Debt Securities 37 Credit Ratings 37 Dominion Bond Rating Service 38 Standard & Poor’s 39 VIII. -

2020 Annual Report $2.8 Billion

2020 Annual Report $2.8 billion REVENUE FROM ONLINE SOURCES, AS WE SCALED E-COMMERCE, PROVIDING CUSTOMERS MORE FLEXIBILITY AND CHOICE THAN EVER BEFORE 25,026 TEMPORARY WORKERS HIRED AT THE PEAK OF THE PANDEMIC TO SUPPORT OUR STORES, COLLEAGUES AND CUSTOMERS 7,250 TEMPORARY WORKERS OFFERED PERMANENT EMPLOYMENT ONCE THE FIRST WAVE SUBSIDED 4,000 NUMBER OF PRODUCTS AVAILABLE AT SHOPPERSDRUGMART.CA, INCLUDING BEST SELLERS IN ELECTRONICS, BABY AND CHILD, HOME GOODS, OVER-THE-COUNTER AND EVERYDAY ESSENTIALS $445 million 2020 INVESTMENTS IN COVID- RELATED ADJUSTMENTS AND SAFETY MEASURES 2 million + FLU SHOTS ADMINISTERED IN OUR PHARMACIES IN 2020 285,000 NUMBER OF HOURS OUR STORES OPENED EXCLUSIVELY FOR SENIORS AND HEALTHCARE WORKERS A passion for customers fully ignited As a nation, and as an organization, 2020 was among the most stressful and anxious years in our history. Throughout this uncertainty, you – our colleagues – were there. As the country learned to deal with change, you brought comfort. As your friends and neighbours sought to meet their most fundamental of needs – for good food and good health – you opened your stores and your hearts to them. You truly helped Canadians Live Life Well®, and you can hold your heads high knowing that you helped a nation move forward. From the bottom of our hearts: thank you. Table of Contents 2 Our Stores, Our Colleagues, Our Strategy 4 Financial Highlights 5 Chairman’s Message 8 Our Divisions 10 Strategic Enablers 12 Corporate Social Responsibility 14 Corporate Governance Practices 16 Board of Directors 16 Leadership 17 Financial Review 2020 ANNUAL REPORT 1 LOBLAW COMPANIES LIMITED Our Stores Our Colleagues Our Strategy From the ground up, we exist to help Canadians Live Life Well.® This commitment factors into how we operate our stores and pharmacies day-to-day, and how we deliver on our long-term organizational strategy – known internally as the Strategic Compass. -

Final Transcript

FINAL TRANSCRIPT Loblaw Companies Limited Special Meeting of Shareholders Event Date/Time: October 18, 2018 — 11:00 a.m. E.T. Length: 28 minutes "Though CNW Group has used commercially reasonable efforts to produce this transcript, it does not represent or warrant that this transcript is error-free. CNW Group will not be responsible for any direct, indirect, incidental, special, consequential, loss of profits or other damages or liabilities which may arise out of or result from any use made of this transcript or any error contained therein." « Bien que CNW Telbec ait fait tous les efforts possibles pour produire cet audioscript, la société ne peut affirmer ou garantir qu’il ne contient aucune erreur. CNW Telbec ne peut être tenue responsable de pertes ou profits, responsabilités ou dommages causés par ou 1 découlant directement, indirectement, accidentellement ou corrélativement à l’utilisation de ce texte ou toute erreur qu’il contiendrait. » FINAL TRANSCRIPT October 18, 2018 — 11:00 a.m. E.T. Loblaw Companies Limited Special Meeting of Shareholders CORPORATE PARTICIPANTS Galen Weston Loblaw Companies Limited — Chairman and Chief Executive Officer CONFERENCE CALL PARTICIPANTS Leslie Dobus Shareholder Frank Sarosella Shareholder "Though CNW Group has used commercially reasonable efforts to produce this transcript, it does not represent or warrant that this transcript is error-free. CNW Group will not be responsible for any direct, indirect, incidental, special, consequential, loss of profits or other damages or liabilities which may arise out of or result from any use made of this transcript or any error contained therein." « Bien que CNW Telbec ait fait tous les efforts possibles pour produire cet audioscript, la société ne peut affirmer ou garantir qu’il ne contient aucune erreur. -

PRESS RELEASE Saputo Inc. Completes the Acquisition of The

PRESS RELEASE Saputo Inc. completes the acquisition of the activities of Neilson Dairy (Montréal, December 1, 2008) – Saputo Inc. completed today the transaction announced on October 22, 2008 and acquired the activities of Neilson Dairy, the dairy division of Weston Foods (Canada) Inc. which manufactures, sells and distributes, primarily in Ontario, fluid milk and dairy beverages, cream products and non dairy creamers, butter, yogurt, juices and drinks under the Neilson brand and other brands (Neilson Dairy). Neilson Dairy employs approximately 390 people at its two facilities located in Halton Hills and Ottawa, Ontario. It generates annual sales of approximately $600 million and annual earnings before interest, income taxes, depreciation and amortization of approximately $50 million. The purchase price of $465 million on a debt-free basis was paid in cash by drawing on available lines of credit and additional financing. This transaction will enable Saputo Dairy Products Division (Canada) to increase its presence in the Ontario fluid milk and cream market. Neilson Dairy primarily operates within the retail market segment and, as part of the transaction, Saputo inherits Neilson Dairy’s long term relationships with its customers. About Saputo Together, over the years, we have aspired to grow, exploring new opportunities while staying true to our culture. Our progress is owed to the continued dedication of our 9,500 employees, who, across 5 countries, team up every day to go further. They craft, market and distribute a wide range of high- quality products, including cheese, fluid milk, yogurt, dairy ingredients and snack-cakes. Saputo is the 15th largest dairy processor in the world, the largest in Canada, the third largest in Argentina, among the top three cheese producers in the United States, and the largest snack-cake manufacturer in Canada. -

Hi Everyone, Things Continue to Move Fast and Change Quickly. Earlier Today the Canadian Government Announced They Are Restricti

Hi Everyone, Things continue to move fast and change quickly. Earlier today the Canadian Government announced they are restricting our international borders to limit the impact of COVID-19. As each of us try to understand how that will affect our daily lives, our friends, and our families, I wanted to reach out again. Those who went shopping recently will have seen extraordinary numbers of people in stores, long lines, and aisles empty of product. This was a result of extreme levels of buying as millions of Canadians stocked up their kitchens and medicine cabinets. I’m sure the many photos of bare shelves on social media only increased your level of concern. First and foremost. Do not worry. We are not running out of food or essential supplies. Our supply chain and store teams are responding to the spikes in volume and quickly getting the most important items back on the shelf. Volumes are already normalizing somewhat, and we are catching up. There are a few items, like hand sanitizer, that may take longer to get back, but otherwise we are in good shape. Another concern you may have is that your supermarket or drugstore could raise prices on the items you and your family need most. Do not worry. This will not happen at our stores. We will not raise a single price on any item to take advantage of COVID-19. Some of you may also be worried that your local Shoppers Drug Mart or supermarket could close as part of shutting down certain stores and services. -

Woodgreen AR 7

Woodgreen AR 04 5 10/12/04 12:56 PM Page 2 WOODGREEN COMMUNITY SERVICES ANNUAL REPORT 2003/2004 WOODGREEN COMMUNITY SERVICES ANNUAL REPORT 2003/2004 Because Everyone WOODGREEN Deserves the COMMUNITY SERVICES 835 Queen Street East Essentials of Life Toronto, Ontario M4M 1H9 Tel: (416) 469-5211 www.woodgreen.org Charitable Registration No. 10822 0435 RR0002 Woodgreen AR 04 5 10/12/04 12:56 PM Page 4 Maintaining independence and dignity Mary is a retired professional with Alzheimer’s disease. Her husband, who works full time, could no longer leave her home alone during the day because Last year, WoodGreen provided she needed constant supervision. Mary’s essential services to more than husband did not want to admit her to 6,000 seniors and caregivers in the community. a long term care facility – he wanted to keep his wife at home and in their familiar neighbourhood. Mary and her husband turned to WoodGreen’s Adult love to hold the hand of our staff, go for a walk in Day Program so Mary could be in a safe environment the garden patio and participate in activities with during the day, where she could be helped to maintain other seniors in the program. the best physical and cognitive functioning possible. Thanks to WoodGreen, Mary is one of more By participating in the Adult Day Program, Mary has than 70 seniors in the Adult Day Program who are made friends and she has lots of opportunity for able to continue to live at home with their families social interaction. While she may have lost a lot in and loved ones – helping them maintain dignity terms of her cognitive functioning, she continues to and independence. -

Rana Plaza, Loblaw, and the Disconnect Between Legal Formality and Corporate Social Responsibility

Lost in Translation: Rana Plaza, Loblaw, and the Disconnect Between Legal Formality and Corporate Social Responsibility David J. Doorey* Abstract Canada’s largest retailer was a major buyer from factories in Bangladesh’s Rana Plaza when the building collapsed in 2013 killing 1,130 people. Most of the dead and injured were workers employed in factories that were never approved from garment production in a building not authorized for industrial production. Like other corporations sourcing from Rana Plaza, Loblaw had an impressive sounding corporate social responsibility (CSR) program that utterly failed to protect its supply chain workers from the largest industrial tragedy in history. This paper examines an interesting decision by an Ontario Court in a multi- 2018 CanLIIDocs 10590 billion dollar class action negligence lawsuit filed on behalf of Rana Plaza victims. The plaintiffs argued that, through its CSR program, Loblaw had accepted responsibility to take steps to protect workers in its supply chain from foreseeable harm and that it had failed to meet the standard of care required. In a lengthy decision, the Court dismissed the lawsuit on the basis that it was plain and obvious that the case was certain to fail. The paper explores how the Court’s discussion of the concepts of ‘responsibility’ and ‘control’ contrast sharply with the meanings ascribed to those concepts in the logic and discourse of CSR. The Court’s surprising conclusion that Loblaw should be commended for its CSR efforts, despite clear evidence that company ignored violations of its Code of Conduct, is explored and critiqued. Introduction I. Clear Warning Signs on the Road to Rana Plaza II. -

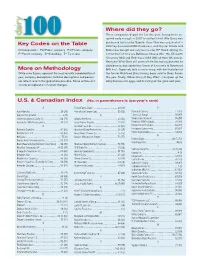

Key Codes on the Table More on Methodology Where Did They

Where did they go? Three companies depart the list this year, having been ac- quired early enough in 2007 to not be listed. Alto Dairy was Key Codes on the Table purchased last year by Saputo, Cass Clay was acquired at in 2007 by Associated Milk Producers, and Crystal Cream and C=Cooperative Pu=Public company Pr=Private company Butter was bought out early last year by HP Hood. Joining the P=Parent company S=Subsidiary T= Tie in rank list for the first time are BelGioso Cheese (No. 75), Ellsworth Creamery (84) and Roth Kase USA (96) all from Wisconsin. Next year Winn-Dixie will come off the list, having divested its dairy processing capabilities (some of it recently to Southeast More on Methodology Milk Inc.). Supervalu tells a similar story, with the final plant of While sales figures represent the most recently completed fiscal the former Richfood Dairy having been sold to Dean Foods year, company descriptions, facilities descriptions and person- this year. Finally, Wilcox Dairy of Roy, Wash., has given up the nel reflect recent changed where possible. Some entries will dairy business for eggs, and its listing will be gone next year. include an explanation of recent changes. U.S. & Canadian Index (No. in parentheses is last year’s rank) A Foster Farms Dairy ....................................... 50 (48) P Agri-Mark Inc. .............................................. 29 (29) Friendly Ice Cream Corp. ...............................55 (56) Parmalat Canada .........................................12 (13) Agropur Cooperative .........................................6 (9) G Perry’s Ice Cream ........................................ 97 (97) Anderson Erickson Dairy Co. ......................... 66 (71) Glanbia Foods Inc. ........................................ 23 (32) Plains Dairy Products ....................................95 (99) Associated Milk Producers Inc. -

2019 Annual Report

2019 Annual Report Report to Shareholders Fellow Shareholders, George Weston had a successful year in 2019, executing against its plan, delivering operational stability, and supporting each of its businesses in making steady progress against their strategic frameworks. Having completed ou rst full year of direct ownership in Choice Properties, we marked an important milestone in our transformation toward a more balanced portfolio with three strategic, complementary businesses in Retail, Real Estate and Consumer Goods. In Retail, Loblaw remains the market leader and is well-positioned to thrive amidst an evolving retail landscape. With more than 2,400 stores, and an offering of over 10,000 private label products including the top two consumer brands in the country, Loblaw is uniquely placed to serve its customers through the nation’s largest bricks and mortar store network and Canada’s most convenient online grocery service, PC Express. Additionally, a relentless focus on process and efficiencies has allowed Loblaw to continue to invest in its growth initiatives in E-Commerce, Healthcare, and Payments & Rewards, all while delivering earnings growth and generating more than $1.2 billion in free cash flow(1). In Real Estate, Choice Properties has refined its strategy following the successful merger with CREIT in 2018, and today represents Canada’s preeminent diversified REIT with 726 properties totaling 65.8 million square feet of retail, industrial, office, and residential assets, concentrated in Canada’s largest markets. With best in class occupancy rates of 97.7%, steady rent escalations and staggered lease maturities, Choice Properties benefits from a solid balance sheet that was further strengthened during 2019 following a $395 million equity issuance and $426 million of asset sales. -

UPDATED and RESTATED ANNUAL INFORMATION FORM June 2, 2014

UPDATED AND RESTATED ANNUAL INFORMATION FORM (for the year ended December 28, 2013; updated to June 2, 2014) June 2, 2014 LOBLAW COMPANIES LIMITED UPDATED AND RESTATED ANNUAL INFORMATION FORM (for the year ended December 28, 2013; updated to June 2, 2014) TABLE OF CONTENTS DATE OF INFORMATION .............................................................................................................................................................. 3 FORWARD-LOOKING STATEMENTS .......................................................................................................................................... 3 CORPORATE STRUCTURE .......................................................................................................................................................... 4 Incorporation ................................................................................................................................................................................... 4 Intercorporate Relationships ........................................................................................................................................................... 4 GENERAL DEVELOPMENT OF THE BUSINESS ........................................................................................................................ 5 Retail…. .......................................................................................................................................................................................... 6 Financial Services ........................................................................................................................................................................ -

Loblaws.Ca/Lclonline/Aboutus.Jsp

Great Food - About Us http://loblaws.ca/LCLOnline/aboutUs.jsp Loblaw Loblaws - Rideau St Sunday 12:00 AM - 12:00 AM Home About Us Who We Are Who We Are Loblaws Supermarkets: A Brief History 1919 - Theodore Pringle Loblaw and J. Milton Cork open the first Loblaw Groceterias in Toronto. They have a new concept in grocery retailing, combining self-serve and cash-and-carry. No longer will customers have to wait for a clerk to fetch items from behind a store counter. Loblaw and Cork are told it will never work. But sales grow as customers take advantage of better quality goods at lower prices. Charles B. Shields, another prominent Toronto grocer, soon joins the partnership. Within a decade, the Loblaw chain has grown to over 70 stores in Ontario alone. 1928 - Loblaws Groceterias expands throughout Ontario and into New York State, Pennsylvania, and Chicago, Illinois. With 69 stores, a new state-of-the-art Loblaw Head Office and Warehouse is unveiled at Fleet and Bathurst streets, along today's Lake Shore Blvd, Toronto. Hailed as a model of efficency, the Loblaw Warehouse includes its own electric tram railway, giant ovens for baking a ton of cakes and cookies a day, huge drums for blending tea, and 22 thousand feet of pipes for refrigeration. Warehouse employees have their own bowling lanes and an auditorium for putting on plays. 1933 - T. P. Loblaw, dubbed the "Merchant Prince" by the press, dies of complications from a minor sinus operation at age 60. When still a boy, with only a few dollars in his pocket, he arrived in Toronto determined to find work.