ORIX JREIT Inc. Announces Acquisition of Nihon Jisho Minami Aoyama Building

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Certified Facilities (Cooking)

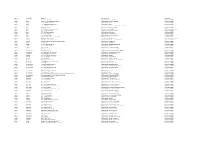

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

Statistics of Publishing in Japan

Statistics of Publishing in Japan Japan Book Publishers Association Contents Distribution Route of Publications ············································ 1 Japanese publishing Statistics in 2018 ····································· 2 The number of copies of books and magazines ························ 3 Sales of books ··············································································· 4 Sales of Magazines ······································································· 5 The number of new titles by categories ······························· 6 Sales of print books and e-books ············································· 7 Best sellers 2017-2018 ······································································ 8 Readers’ Trend ·············································································· 9 Main organizations related to the publishing industry ·········· 10 Members of Japan Book Publishers Association ······················ 11 Distribution Route of Publications Direct sales Wholesalers Bookstores Convenience stores University cooperatives ublishers P Netstores Newsstands (stations) Dealers Stands School textbook distributors Reading audience, including libraries, schools, members of university cooperatives and overseas readers overseas and cooperatives university of members schools, libraries, including audience, Reading Foreign publishers Dealers Bookstores - 1 - Japanese publishing Statistics in 2018 (1€=120 yen) Books Year-on Magazines Year-on Total Year-on -year % -year % -year % Number of -

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho -

Notice Concerning Transfer and Acquisition of Assets by Exchanging, and Related Cancellation of Lease and Leasing of Asset

September 15, 2017 For Immediate Release Real Estate Investment Trust Securities Issuer: NIPPON REIT Investment Corporation 1-18-1 Shimbashi, Minato-ku, Tokyo Hisao Ishikawa Executive Officer (Securities Code: 3296) Asset Management Company: Sojitz REIT Advisors K.K. Toshio Sugita President, Director & CEO Contact: Takahiro Ishii General Manager Corporate Planning Department Finance & Planning Division (TEL: +81-3-5501-0080) Notice Concerning Transfer and Acquisition of Assets by Exchanging, and Related Cancellation of lease and Leasing of Asset NIPPON REIT Investment Corporation (“NIPPON REIT”) announces that Sojitz REIT Advisors K.K. (“SRA”), which is entrusted to manage the assets of NIPPON REIT, today decided on the following transfer and acquisition of assets by exchanging (“the Exchanging”). This Exchanging intends to enhance unitholdes’ value over the medium- and long-term while increasing distribution to existing unitholdes’ in a balanced manner. We appropriate gains on transfer for reducing the book value of the properties to be acquired within the scope of the value reduction limit, and distributing the profit that will exceed the value reduction limit for this period by implementing the transfer of GreenOak Okachimachi and JS Progres Building, owned by NIPPON REIT, and the acquisition of Homat Horizon Building, Sannomiya First Building and Splendid Nanba, owned by Godo Kaisha Nicolas Capital 6, through exchange (in accordance with the provisions of the “Inclusion of Deductible Expenses of Reduced Amount of Assets Acquired through Exchange” in Article 50 of the Corporation Tax Act). NIPPON REIT shall exercise the first negotiation rights granted by Godo Kaisha Nicolas Capital 6 when NIPPON REIT acquired its silent partnership equity interest. -

Contents Page

目次 CONTENTS PAGE はじめに Foreword 2 協会の略史 A Brief History of JMTIA 3 協会の使命 JMTIA Mission 4 会員の種類 Member Categories 4 協会の主な業務と Main Business of JMTIA and 5 会員のメリット Membership Benefits 6 理事一覧 List of Directors 7 ホームページ JMTIA Web Site 7 会員リスト Members' List 8-15 会員別取扱いメーカー/商品一覧 Makers/Products, 17 distributed by each member ABC順メーカーリスト Maker Alphabetical Listing 35 製品別メーカー索引 Product Listing 47 1 はじめに ダイレクトリーの出版は当協会が金属加工業界の為に行う重要な事業の一つで、 1955年(昭和30年)協会が発足した際、各輸入業者とその取扱商品一覧表を制作 したのが始まりです。 当初「エージェンシーリスト」と呼ばれましたが、その後1998 年に「ダイレクトリー」と改称され、現在まで2年毎にエージェンシーリスト又はダイレク トリーを発行して参りました。 1999年12月には協会のホームページを開設し、 2004年には工作機器、付属品、工具の分類を一新して、 その内容をアップデートし ました。 更に、2012年には会員情報をデータベース化することにより、多様な情報 を検索できるように再構築いたしました。 最新版ダイレクトリーはそのホームページ の内容を基に制作致しました。 輸入工作機械・器具、附属品、工具、部品等の購入、 又はサービスの際に本誌がお役に立てば幸甚に存じます。 2014年8月 日本工作機械輸入協会 会長 千葉 雄三 Foreword Publication of the directory is one of the most important services provided by JMTIA for the metal working industries. When JMTIA was established in 1955, a list of members with their product lines was published. In the beginning it was called “Agency List” and in 1998, the name was changed to “Directory”. JMTIA has published “Agency List” or “Directory” every two years since 1955. In December, 1999 JMTIA opened its own website, which was renewed with new classification of machine accessories and tools in 2004. Furthermore, in 2012, JMTIA website recreated so that we can search a various kinds of information by utilizing the database of members’ information. The latest directory is edited based on the contents of JMTIA website. -

Directory 2007 2Nd Edition Nd Edition

아시아예술극장 아시아 공연예술 아시아예술극장 아시아 공연예술 Directory 2007 2 Directory Directory 2007 2nd Edition nd Edition 주최: 주관: 110-809 서울시 종로구 동숭동 1-50 보생빌딩 2∙4∙5층 전화 02-745-2052 팩스 02-745-2072 www.gokams.or.kr 아시아예술극장 아시아 공연예술 Directory 2007 2nd Edition CONTENTS 서론 I. 지원단체/협회 II. 축제/아트마켓 III. 공연장 IV. 공연단체 1. 기획의 배경 및 목적 4 호주 Austraila 12 호주 Austraila 56 호주 Austraila 82 1 무용 2. 수록범위 5 방글라데시 Bangladesh 17 방글라데시 Bangladesh 61 방글라데시 Bangladesh 93 호주 Austraila 140 대만 Taiwan 187 3. 조사방법 6 캄보디아 Cambodia 18 캄보디아 Cambodia 62 캄보디아 Cambodia 93 중국 China 143 태국 Thailand 193 4. 디렉토리북의 활용 7 중국 China 20 중국 China 63 중국 China 95 홍콩 Hong Kong 145 베트남 Vietnam 193 홍콩 Hong Kong 26 홍콩 Hong Kong 63 홍콩 Hong Kong 97 인도네시아 Indonesia 146 마카오 Macau 28 마카오 Macau 64 마카오 Macau 99 일본 Japan 147 3. 연극 인도 India 28 인도 India 65 인도 India 99 말레이시아 Malaysia 156 호주 Austraila 194 인도네시아 Indonesia 30 인도네시아 Indonesia 65 인도네시아 Indonesia 101 필리핀 Philippines 157 캄보디아 Cambodia 199 일본 Japan 30 일본 Japan 66 일본 Japan 101 싱가포르 Singapore 159 중국 China 200 라오스 Laos 43 말레이시아 Malaysia 73 말레이시아 Malaysia 127 대만 Taiwan 160 홍콩 Hong Kong 201 말레이시아 Malaysia 43 몽고 Mongolia 74 미얀마 Myanmar 128 베트남 Vietnam 165 인도네시아 Indonesia 202 몽고 Mongolia 44 네팔 Nepal 74 네팔 Nepal 128 일본 Japan 202 미얀마 Myanmar 44 파키스탄 Pakistan 75 파키스탄 Pakistan 128 2. -

Antique & Flea Markets in Tokyo 東京の骨董市・蚤の市

JNTO-TIC, Jan. 2011 Antique & Flea Markets in Tokyo 東京の骨董市・蚤の市 Open-air antique and flea markets will usually close if it rains. Dates and times are subject to change without notice. AT SHRINES / TEMPLES ●Arai Yakushi Temple 新井薬師アンティーク・フェア Jan.: 2nd Sun., 6 am – 3 pm Feb. – Dec.: 1st Sun., 5 am - 3:30 pm (Temple fairs or En-nichi are held on the 8th, 18th and 28th of each month, from around 11 am to dusk.) Address: 5-3-5 Arai, Nakano-ku, Tokyo Access: ・5 min. walk from Araiyakushi-mae Sta. on the Seibu-Shinjuku Line ・15 min. walk from Nakano Sta. (North Exit) on the JR Chuo Line Tel. : 03-3386-1355(Arai Yakushi Temple) (Only Japanese is spoken.) ●Nogi Shrine 乃木神社古民具骨董市 Every 2nd Sun. except Jan. & July, 6 am – around 3:30 pm Address: 8-11-27 Akasaka, Minato-ku, Tokyo Access: ・1 min. walk from Nogizaka Sta. (No. 1 Exit) on the Chiyoda Subway Line ・8 min. walk from Roppongi Sta. on the Hibiya Subway Line Tel. : 0426-91-4687 (Organizer) (Only Japanese is spoken.) ●Yasukuni Shrine 靖国神社青空骨董市 Every Sun., 8 am – around 3:30 pm Address: 3-1-1 Kudankita, Chiyoda-ku, Tokyo Access: ・5 min. walk from Kudanshita Sta. on the Tozai, Hanzomon and Toei Shinjuku Subway Lines ・10 min. walk from Iidabashi Sta. (West Exit) on the JR Chuo Line Tel. : 090-2723-0687 (Organizer) (Only Japanese is spoken.) ●Hanazono Shrine 花園神社青空骨董市 Every Sun., 6 am – around 3 pm (Antique markets will be closed during the “Reitai-sai” festival in May & the “Tori-no-ichi” fair in Nov.) Address: 5-17-3 Shinjuku, Shinjuku-ku, Tokyo Access: ・3 min, walk from Shinjuku-sanchome Sta. -

Tokyo City Map 1 Preview

A B C D E F G H J K L M N O P Q R S T U V 2#Takadanobaba Ueno- N# 0500m kľen 00.25miles Waseda Tokyo 2# Bľto-ike H Ko ľ UENO- Tokugawa Shľgun Rei-en a Keisei Ueno, Yanaka & Asakusa KOISHIKAWA H kusai-d Same scale as main map k Tokyo Iriya o ch A SAKURAGI A (Tokugawa J# u Tokyo University Ueno ng o IMADO s University 2# Shinobazu-d k Gyokurin-ji Gallery of Heiseikan Shľgun Cemetery) a Branch o 1 1 i ľ n r Kototoi-d y - - Hospital - Hľryu-ji ľ d d ľ a d ľ ľ Treasures ri #J y - ľ r r e e w ri i A Tokyo National Museum i i Shinobazu-ike NEZU Tokyo National r a A m Hyľkeikan ľ w ri m d A ľ ľ University of - - ri i ľ Fine Arts & Music k Ś Tokyo ľri E -d h Tľyľkan bazu Ameyoko Regional Ct S hino C ASAKUSA Arcade Tokyo Metropolitan A KyŚ Museum of Art Rinnľ-ji A KITA-UENO Traditional Crafts Yoshino-d #J Kasuga Iwasaki-teien #J Museum Sumida- #JYushima Ueno- J# kľen Kľrakuen Ueno-hirokľji Nezu A J# Hongľ okachimachi Ueno Zoo Ao YanakaInsetUeno, Asakusa & See J# ANational Museum of ri Sanchľme J# ľ 2# IKE-NO- Nature and Science d J# Ai 2 Ueno-kľenA! r 2 e ) Matsuzakaya Okachimachi HATA a Yushima A National Museum Hanayashiki #J iv Miyamaoto Ai Shuto Expwy No 1 Asakusa Sensľ-ji w Spa LaQua Ueno Tľshľ-gŚ Kappab isago- R a Tenjin of Western Art Kototo g K ashi Hon- View Hotel H A Five-Storey a - jA UENO o i-d id a ri Pagoda ľ d nc dľ Ai Asakusa-jinja ri m i Koishikawa h ri u m Aesop ľ R MATSUGAYA Awashima-dľ AA S u Kľrakuen Baseball Hall of Fame HONGĽ Tokyo d NISHI- A i (S Bridge A A Amuse Museum r Ko HIGASHI- KAGURAZAKA A & Museum Metropolitan -

WHAT Architect WHERE Notes Zone 1: Shinjuku *** Sky Building No.3

WHAT Architect WHERE Notes Zone 1: Shinjuku Built in 1970 as an office tower and is one of the jewels from the Metabolist movement. It features bolt-on units and balconies characteristic of Metabolism’s ideal of modularity. Its naval appearance 1-1-9 Okubo, Shinjuku *** Sky Building No.3 Makoto Sei Watanabe isn’t accidental as Watanabe, supposedly born on a US navy ship, 1-1-9大久保、新宿 borrowed techniques from submarine building. The theme culminates in the roof design which features a battleship deck-looking floor, with a defining submarine sail-like concrete structure. Built in 1993 as an office tower. The site was extremely constrained, 2-1-2 Kabukicho, with daylight a precious commodity in the narrow road onto which the Shinjuku ** Kabuki-cho Tower Richard Rogers building fronts. Although the building is small in scale, great attention 2-1-2歌舞伎町、 was paid to the detailing of the façade, using repetitive functional 新宿 elements to define the lightweight language of the building. Omoide Yokocho (lit. memory lane), also known under its more colorful nickname Piss Alley, is a small network of alleyways along the tracks Omoide Yokocho, northwest of Shinjuku Station. The narrow lanes are filled with dozens ***** Piss Alley/Memory - Shinjuku of tiny eateries serving ramen, soba, sushi, yakitori and kushiyaki. Lane 思い出横丁、新宿 Many restaurants consist of just one counter with some chairs, while others have a couple of tables. Built in 2008 as 3 different schools: Tokyo Mode Gakuen (fashion), HAL Tokyo (IT and digital contents) and Shuto Iko (medical treatments 1-7-3 Nishishinjuku, Mode Gakuen Cocoon and care). -

Kōrakuen & Akihabara

©Lonely Planet Publications Pty Ltd 136 Kōrakuen & Akihabara KŌRAKUEN & KUDANSHITA | KANDA & AKIHABARA | KAGURAZAKA Neighbourhood Top Five 1 Koishikawa Kōrakuen kart for a spin dressed in a selection of Japanese crafts (p138) Slipping into the Super Mario cosplay outfit. at this beneath-the-train- beautiful verdant world 3 3331 Arts Chiyoda tracks mall between Aki- of this classic traditional (p139) Encountering dino- habara and Ueno. garden with its central saurs made from old plastic 5 Akagi-jinja (p143) pond, charming bridges and toys amid the contemporary Threading your way seasonal flowerings. art galleries in this former through the stone-flagged 2 Akiba Kart (p146) Ex- school turned arts-and- streets of Kagurazaka, with periencing the blazing neon culture centre. its atmospheric shops and and wacky otaku (geek) vibe 4 2k540 Aki-Oka Artisan bars, to find this thoroughly of ‘Akiba’ while taking a go- (p144) Browsing a choice modern shrine. IKE-NO- Ueno- HATA kōen KOISHIKAWA ¦# HONGŌ Keisei £# Ueno Ueno # 0 1 km e0 0.5 miles Ueno- ¦#Kasuga Hongō- Yushima hirokōji Kōrakuen ¦# ¦# ¦# sanchōme ¦# £# Okachimachi BUNKYŌ-KU KAGURAZAKA 1##æ 5#æ YUSHIMA ¦# KŌRAKU Suehirochō Ōku 3#â# ¦# Kagurazaka bo-d HONGŌ 4##þ ōri ¦# Iidabashi Kuramaebashi-dōri ¦# Suidōbashi H Ushigome- £# on Iidabashi £# g ¦#Suehirochō ¦# kagurazaka Suidōbashi ō- dō M Ochanomizu ¦# i ri AKIHABARA r e ō ji WAKAMIYA- d r £# i- o Ochanomizu 2#Ø# r -dō MISAKI- Akihabara CHŌ o FUJIMI b r CHŌ KANDA- £# o i Shin- t o Ochanomizu ¦# AWAJICHŌ ICHIGAYA- S Jimbōchō TAMACHI ¦# Y Iwamotochō -

Financial Services Agency Kanto Local Finance Bureau(FIBO) No.16 AXA INVESTMENT MANAGERS JAPAN LTD

Financial Instruments Business Operators As of August 31, 2021 Type I Type II Investment Investment Securities- Financial Financial Advisory and Jurisdiction Registration numbers Name JCN Address Telephone Management Related Instruments Instruments Agency Business Business Business Business Business Financial Services Agency Kanto Local Finance Bureau(FIBO) No.16 AXA INVESTMENT MANAGERS JAPAN LTD. 4010401061149 1-17-3, Shirokane, Minato-ku, Tokyo 03-5447-3100 ○ ○ ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.18 Ichigo Estate Co., Ltd. 1010001125620 1-1-1,Uchisaiwai-cho,Chiyoda-ku,Tokyo 03-3502-5625 ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.44 SBI Securities CO., LTD. 3010401049814 1-6-1, Roppongi, Minato-ku, Tokyo 03-5562-7210 ○ ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.45 Japannext Co.,Ltd. 2010001139289 3-1-1, Roppongi, Minato-ku, Tokyo 03-4577-4040 ○ ○ Kanto Local Finance Bureau(FIBO) No.51 Yensai.com Co., Ltd. 8010001082954 1-16-1, Kanda-Nishikicho, Chiyoda-ku, Tokyo 03-3518-8011 ○ ○ Kanto Local Finance Bureau(FIBO) No.52 Okasan Online Securities Co.,Ltd 2010001097479 3-9-7, Ginza, Chuo-ku, Tokyo 03-3547-0100 ○ ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.53 OKASAN SECURITIES CO.,LTD. 5010001082560 1-17-6,Nihonbashi,Chuo-ku,Tokyo 03-3272-2211 ○ ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.57 Janus Henderson Investors (Japan) Limited 3010001012362 1-6-5,Marunouchi, Chiyoda-ku, Tokyo 03-5219-8000 ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.61 au Kabucom Securities Co., Ltd. 5010001066670 1-3-2, Otemachi, Chiyoda-ku, Tokyo 03-4221-3551 ○ ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.66 Credit Suisse Securities (Japan) Limited 2010401059260 1-6-1,Roppongi Minato-ku,Tokyo 03-4550-9000 ○ ○ ○ ○ ○ Kanto Local Finance Bureau(FIBO) No.69 Goldman Sachs Japan Co.,Ltd. -

Hulic Reit, Inc

The following is a summary English language translation of the original Asset Management Report available in Japanese on our website. No assurance or warranties are given with respect to the accuracy or completeness of this summary English language translation. The Japanese original shall prevail in the case of any discrepancies between this summary English language translation and the Japanese original. Hulic Reit, Inc. Asset Management Report Fiscal period ended February 29, 2020 (September 1, 2019 to February 29, 2020) I. To Our Unitholders First of all, I would like to convey my sincere appreciation to you, our unitholders, for your continued support of Hulic Reit, Inc. Hulic Reit, Inc. (“Investment Corporation”) was listed on the Real Estate Investment Trust Securities Market (J-REIT Market) of the Tokyo Stock Exchange in February 2014, and we have steadily built a track record since then. We have now successfully completed our 12th fiscal period (fiscal period ended February 29, 2020). This is entirely due to the strong support of our unitholders, and for this I would like to express my heartfelt gratitude. I am pleased to report here an overview of our asset management and our operating results for the 12th fiscal period (fiscal period ended February 29, 2020). During the 12th fiscal period (fiscal period ended February 29, 2020), we procured approximately ¥10.9 billion through the sixth public offering, etc. since our listing, and acquired Hulic Ginza 7 Chome Building (20% additional acquisition), Charm Suite Shinjukutoyama and Charm Suite Shakujiikoen in September 2019 with the proceeds of the offering and borrowings.