Determinationofmergern

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Supervalu: How a Brave Local Brand Defied the Forces of Globalisation

SuperValu: How a brave local brand defied the forces of globalisation DDFH&B COMPANY PROFILE AGENCY The DDFH&B Group consists of DDFH&B Advertising, Goosebump, The Reputations Agency, RMG and Mindshare Media – making it one of the largest Irish companies in creative advertising, media buying and customer relationship/digital marketing. Together, they provide channel-neutral, integrated marketing communications campaigns that deliver real, measurable results. They achieve this level of integration by working in a number of small, multi-disciplined teams, calling it ‘fun sizing’. They continue to be one of the most successful agencies in Ireland, working with clients such as Kerry Foods, SuperValu, The National Lottery, eir, Littlewoods, Lucozade and Molson Coors. CLIENT AWARD LONG TERM EFFECTIVENESS Sponsored by GOLD 1 SuperValu: How a brave local brand defied the forces of globalisation DDFH&B INTRODUCTION & BACKGROUND This is a story about long term effectiveness. It is a story about how a brave local retailer with daring ambition wrestled back leadership from Tesco and defied the forces of globalisation. SuperValu was founded in 1979 with a base of just 16 stores, mainly in Munster. While they had grown to 182 stores by 2004, and acquired Superquinn (another Irish retailer) in 2011, they were a retailer with two speeds, an urban speed and a rural speed. The urban speed was still reeling from the Superquinn takeover, when stores were rebranded to SuperValu in 2014. Superquinn had a more premium brand perception, much closer to the Waitrose proposition in the UK. Consumers were in a state of chassis as they felt they were paying convenience store prices in large supermarkets and were unfamiliar with the brand and mistrustful of its quality. -

The Abuse of Supermarket Buyers

The Abuse of Supermarket Buyer Power in the EU Food Retail Sector Preliminary Survey of Evidence Myriam Vander Stichele, SOMO & Bob Young, Europe Economics On behalf of: AAI- Agribusiness Accountability Initiative Amsterdam, March 2009 Colophon The Abuse of Supermarket Buyer Power in the EU Food Retail Sector Preliminary Survey of Evidence Myriam Vander Stichele (SOMO) & Bob Young (Europe Economics) March 2009 Funding: This publication is made possible with funding from The Dutch Ministry of Foreign Affairs via SOMO and DGOS (Belgian Directorate General for Development Cooperation) via Vredeseilanden (VECO). Published by: AAI - Agribusiness Action Initiatives, formerly called Agribusiness Accountability Initiative The authors can be contacted at: SOMO Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl This document is licensed under the Creative Commons Attribution-NonCommercial-NoDerivateWorks 2.5 License. The Abuse of Supermarket Buyer Power in the EU Food Retail Sector 2 Contents Contents ..........................................................................................................................3 Summary .........................................................................................................................4 Introduction.....................................................................................................................6 1. Abusive buyer power problems are being discussed in many fora while a comprehensive -

Lidl Expanding to New York with Best Market Purchase

INSIDE TAKING THIS ISSUE STOCK by Jeff Metzger At Capital Markets Day, Ahold Delhaize Reveals Post-Merger Growth Platform Krasdale Celebrates “The merger and integration of Ahold and Delhaize Group have created a 110th At NYC’s Museum strong and efficient platform for growth, while maintaining strong business per- Of Natural History formance and building a culture of success. In an industry that’s undergoing 12 rapid change, fueled by shifting customer behavior and preferences, we will focus on growth by investing in our stores, omnichannel offering and techno- logical capabilities which will enrich the customer experience and increase efficiencies. Ultimately, this will drive growth by making everyday shopping easier, fresher and healthier for our customers.” Those were the words of Ahold Delhaize president and CEO Frans Muller to the investment and business community delivered at the company’s “Leading Wawa’s Mike Sherlock WWW.BEST-MET.COM Together” themed Capital Markets Day held at the Citi Executive Conference Among Those Inducted 20 In SJU ‘Hall Of Honor’ Vol. 74 No. 11 BROKERS ISSUE November 2018 See TAKING STOCK on page 6 Discounter To Convert 27 Stores Next Year Lidl Expanding To New York With Best Market Purchase Lidl, which has struggled since anteed employment opportunities high quality and huge savings for it entered the U.S. 17 months ago, with Lidl following the transition. more shoppers.” is expanding its footprint after an- Team members will be welcomed Fieber, a 10-year Lidl veteran, nouncing it has signed an agree- into positions with Lidl that offer became U.S. CEO in May, replac- ment to acquire 27 Best Market wages and benefits that are equal ing Brendan Proctor who led the AHOLD DELHAIZE HELD ITS CAPITAL MARKETS DAY AT THE CITIBANK Con- stores in New York (26 stores – to or better than what they cur- company’s U.S. -

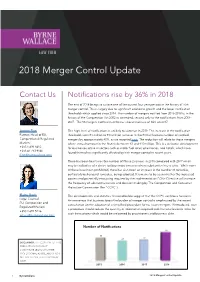

Merger Control Update 2018 Merger Control Update

Merger Control Update 2018 Merger Control Update Contact Us Notifications rise by 36% in 2018 The end of 2018 brings to a close one of the busiest four year periods in the history of Irish merger control. This is largely due to significant economic growth and the lower notification thresholds which applied since 2014. The number of mergers notified from 2015-2018 is, in the history of the Competition Act 2002 as amended, second only to the notifications from 2004- 2007. The 98 mergers notified in 2018 was also an increase of 36% on 2017. Joanne Finn This high level of notifications is unlikely to continue in 2019. The increase in the notification Partner, Head of EU, thresholds from €3 million to €10 million turnover in the ROI will reduce number of notified Competition & Regulated mergers by approximately 40%, as we reported here. The reduction will relate to those mergers Markets where annual turnover in the State is between €3 and €10 million. This is a welcome development +353 1 691 5412 for businesses active in sectors such as motor fuel retail, pharmacies, and hotels, which have +353 87 753 9160 found themselves significantly affected by Irish merger control in recent years. [email protected] There has been four times the number of Phase 2 reviews in 2018 compared with 2017 which may be indicative of a desire to focus more on cases where substantive issues arise. While none of these have been prohibited, there has also been an increase in the number of remedies, particularly behavioural remedies, being adopted. -

Multiple and Symbol Operators: the Battle for Market Leadership in the Irish Grocery Market

Technological University Dublin ARROW@TU Dublin Case Studies School of Retail and Services Management 2002-01-01 Multiple and Symbol Operators: the Battle for Market Leadership in the Irish Grocery Market Edmund O'Callaghan Technological University Dublin, [email protected] Mary Wilcox Technological University Dublin, [email protected] Follow this and additional works at: https://arrow.tudublin.ie/buschrsmcas Part of the Business Commons Recommended Citation O'Callaghan, E., Wilcox, M.:Multiple and Symbol Operators: The battle for Market Leadership in the Irish Grocery Market. Case Study. Irish Marketing Review VOL.14, No.2 This Article is brought to you for free and open access by the School of Retail and Services Management at ARROW@TU Dublin. It has been accepted for inclusion in Case Studies by an authorized administrator of ARROW@TU Dublin. For more information, please contact [email protected], [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-Share Alike 4.0 License Dublin Institute of Technology ARROW@DIT Articles School of Retail and Services Management 1-1-2002 Multiple and Symbol Operators: The battle for Market Leadership in the Irish Grocery Market Edmund O'Callaghan Dublin Institute of Technology, [email protected] Mary Wilcox Dublin Institute of Technology, [email protected] This Other is brought to you for free and open access by the School of Retail and Services Management at ARROW@DIT. It has been accepted for inclusion in Articles by an authorized administrator of ARROW@DIT. For more information, please contact [email protected]. -

Ireland's Most Vibrant Food, Drink, Hospitality and Retail Event

NEW! Ireland’s most vibrant food, drink, hospitality and retail event ”84% of visitors to the 2012 show went to see new suppliers and new products” Independent Research, big.ie SUPPORTER MEDIA SUPPORTERS www.foodhospitality.ie ORGANISED BY Food & Hospitality Ireland 2013, incorporating SHOP, will be the country’s most vibrant showcase of products and services dedicated to Ireland’s food, drink, hospitality and retail sector. Thousands of buyers will visit the Show looking for new products and innovative ideas. New attractions for 2013 include the Chef Demonstration area and the Spotlight Stage along with the popular Craft Butchers Awards. Food & Hospitality Ireland is organised by Irish Services Montgomery and the award winning Fresh Montgomery: ”first time for crosscare, Great response from food suppliers” Robbie Burns, CrossCare Other Fresh Montgomery shows include: 8-10SEPTEMBER www.foodhospitality.ie this was my fourth time exhibiting and this “year’s event was excellent. Generated some high quality leads and met with some new buyers. i have already signed up for 2013 Nigel Maxon, Managing Director, AIRLUX Lighting” we do a wide range of innovative jams, “chutneys, relish etc. and found this event fantastic to showcase our uniqueness Kieran Moran, Morans Homestore ” We are very excited to announce that the irish Quality food awards will take place alongside Food & Hospitality Ireland on the 18th September in a venue close to the RDS. In the UK, these are the most prestigious awards for food and drink products on sale in UK grocery outlets. Products shortlisted for the Awards will also be displayed at the Show. -

Campylobacter Risk the Threat of Campylobacter Infection Has Recently Been Highlighted by a Number of Research Studies

FOOD Campylobacter risk The threat of Campylobacter infection has recently been highlighted by a number of research studies. We review the findings and examine precautionary measures that can be taken by consumers and retailers Campylobacter is a naturally occurring Food Safety Authority (EFSA). A broiler established best practice. Seven hundred bacterium found in the intestinal tract of is a chicken that has been raised for its and eighty five samples, each consisting wild and domesticated birds and meat. The results of the study were of one swab from the exterior of the mammals. Campylobacter is the most published in March 2010 and showed chicken packaging and one swab from common cause of bacterial that there is a high level of the cabinet displaying that package, were gastroenteritis in Ireland and Europe. Campylobacter contamination in poultry taken by environmental health officers There were some 1,758 cases of carcasses in slaughter plants throughout (EHOs) from retail establishments in infections reported in Ireland in 2008 Europe (the EU prevalence was 75.8%), Ireland between September and and provisional data for 2009 shows with 98% of carcasses in Irish plants December 2008. that 1,823 cases were reported. having some level of contamination. The Almost two thirds of the packaging Human Campylobacter infections study took place from January to sampled by the FSAI was conventional cause intestinal inflammation leading to December 2008 and involved 10,132 (i.e. the plastic covering wrapped around acute gastroenteritis with diarrhoea and broiler batches sampled from 561 the tray and sealed underneath), while sometimes vomiting. The infection can slaughterhouses in 26 EU states, as well one third was leak-proof (i.e. -

Press Release 30Th January 2016 Major Jobs Announcement for Co

Press Release 30th January 2016 Major Jobs Announcement for Co. Mayo CBE, the Mayo based retail software company, have announced 40 new jobs due to major expansion in the UK and significant contract wins in Ireland. The Taoiseach Enda Kenny officially announced the jobs today (Saturday 30th January) at CBE’s international head office in Claremorris where the jobs will be primarily based. CBE develop and supply point of sale (POS) solutions for the retail and hospitality sectors. Set up in 1980, CBE have grown to become the largest retail IT company in Ireland and the fastest growing supplier of POS solutions in the UK. CBE’s global expansion continues as they now support installations in Canada, Australia, The Isle of Man, and Algeria and following significant market research are preparing to enter the US market. Gerard Concannon, CBE’s CEO says: “Innovation through continuous Research and Development has been the cornerstone of our business and it is through this that we have increased our market share in Ireland and significantly grown in our export markets year-on- year.” Selling mainly to the independent retail groups and hospitality markets, CBE’s client list includes; James Hall Group (UK), Sewell Retail (UK), Musgrave, SuperValu, Centra, BWG, Spar, Mace, Costcutter, Gala, Spar UK, Louis Fitzgerald Group, Aramark, Elior, Compass, IBM and Bewleys among others. Concannon explained, “The CBE solutions enable our clients to manage their business more effectively and streamline their operations. Our latest software solutions have been hugely successful, primarily in the UK, since launched last year. We have also recently formed a strategic partnership with NCR to supply self-checkout solutions to the independent retail sector in Ireland and the UK”. -

Irish Foodservice Market Directory

Irish Foodservice Market Directory NOVEMBER 2014 Growing the success of Irish food & horticulture www.bordbia.ie TABLE OF CONTENTS Page No. IRISH FOODSERVICE MARKET DIRECTORY 5 Introduction 5 How to use the Directory 5 Methodology 6 TOP 10 PRODUCER TIPS FOR BUILDING A SUCCESSFUL FOODSERVICE BUSINESS 7 FOODSERVICE MAP 9 COMMERCIAL CHANNELS 11 QUICK SERVICE RESTAURANTS (QSR) 13 AIL Group 14 Domino’s Pizza 18 McDonald’s 21 Subway 24 Supermac’s 26 FORECOURT CONVENIENCE 29 Applegreen 30 Topaz 32 FULL SERVICE RESTAURANTS (FSR) 35 Avoca Handweavers 36 Brambles 39 Eddie Rocket’s 42 Entertainment Enterprise Group 45 Itsa 49 Porterhouse Brewing Company 53 Wagamama 55 COFFEE SHOPS 59 BB’s Coffee and Muffins 60 Butlers Chocolate Café 62 Esquires Coffee House 64 Insomnia 66 MBCC Foods (Ireland) Ltd. T/A Costa Coffee *NEW 68 Quigleys Café, Bakery, Deli 70 streat Cafes (The) 72 HOTELS 75 Carlson Rezidor Hotel Group 76 Choice Hotels Ireland 80 Dalata Management Services 82 The Doyle Collection 87 Limerick Strand Hotel 89 Moran & Bewley’s Hotels 92 PREM Group 95 Talbot Hotel Group *NEW 98 Tifco Hotel Group 100 1 LEISURE/EVENTS 103 Dobbins Outdoor 104 Feast 106 Fitzers Catering Ltd 108 JC Catering 111 Masterchefs Hospitality 113 Prestige Catering Ltd 115 The Right Catering Company 117 With Taste 119 TRAVEL 123 Aer Lingus Catering 124 EFG Catering 128 Gate Gourmet Ireland 131 HMS Host Ireland Ltd 133 Irish Ferries 135 Rail Gourmet 138 Retail inMotion 140 SSP Ireland 142 INSTITUTIONAL (COST) CHANNELS 145 BUSINESS & INDUSTRY (B&I) 147 ARAMARK Ireland 148 Baxter Storey 151 Carroll Foodservices Limited 153 Compass Group Ireland 155 Corporate Catering Services Limited 157 Gather & Gather *NEW 160 KSG 162 Mount Charles Group *NEW 164 Premier Dining 167 Q Café Co. -

National Economic Context

3.0 INTRODUCTION In setting out this strategy it is important to assess the economic context at a national and regional level as current and projected economic growth can have a profound effect on factors such as expenditure change and thus on the nature and quantum of retail development that occurs. Indeed, the exceptional economic performance of the ‘Celtic Tiger’ coupled with continued immigration and falling unemployment rates has resulted in a broadening of the nation’s retail offer. As can be expected, this rapid expansion in the country’s retail market has been associated with the emergence of a number of distinct trends in retailing. One of the purposes of this chapter is to examine the principle retail trends which are likely to have an impact on the development of the retail sector in Longford. 3.1 ECONOMIC PERFORMANCE TO DATE Ireland has one of the world’s most globalised economies, with extensive external trade and investment links. It is also one of the world’s most dynamic, with annual growth rates well in excess of averages for the developed world. Ireland’s period of unprecedented economic growth began in the early 1990’s. Between 1990 and 1995 the economy grew at an annual average growth rate of 4.8% and, between 1995 and 2000, it averaged 9.5%. Growth rates have since been maintained in the 4-5% range, a level almost five times higher than the old EU15 average.1 The legacy of this ‘Celtic Tiger’ economy is substantial, in particular regarding the country’s transition from one of Europe’s poorest economies to one of its -

Exploring the Relationship Between Customer Loyalty and Electronic Loyalty Schemes: an Organisational Perspective

Technological University Dublin ARROW@TU Dublin Conference proceedings School of Retail and Services Management 2005-01-01 Exploring the Relationship Between Customer Loyalty and Electronic Loyalty Schemes: an Organisational Perspective Edmund O'Callaghan Technological University Dublin, [email protected] Joan Keegan Technological University Dublin, [email protected] Follow this and additional works at: https://arrow.tudublin.ie/buschrsmcon Part of the Sales and Merchandising Commons Recommended Citation O’Callaghan, E., Keegan, J.: Exploring the relationship between customer loyalty and Electronic loyalty schemes: An organisational perspective. AMA Conference Proceedings, Dublin, July, 2005. This Conference Paper is brought to you for free and open access by the School of Retail and Services Management at ARROW@TU Dublin. It has been accepted for inclusion in Conference proceedings by an authorized administrator of ARROW@TU Dublin. For more information, please contact [email protected], [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-Share Alike 4.0 License Dublin Institute of Technology ARROW@DIT Articles School of Retail and Services Management 1-1-2005 Exploring the relationship between Customer Loyalty and Electronic Loyalty Schemes: An organisational perspective Edmund O'Callaghan Dublin Institute of Technology, [email protected] Joan Keegan Dublin Institute of Technology, [email protected] This Conference Paper is brought to you for free and open access by the School of Retail and Services Management at ARROW@DIT. It has been accepted for inclusion in Articles by an authorized administrator of ARROW@DIT. For more information, please contact [email protected]. Exploring the relationship between Customer Loyalty and Electronic Loyalty Schemes: An organisational perspective Edmund O’ CALLAGHAN, School of Retail & Services Management, Faculty of Business, Dublin Institute of Technology, Aungier St. -

The Impact of the Internet on Traditional

AN EMPIRICAL STUDY: The Impact of the Internet on Traditional Marketing Principles, Strategies and Practices in the Financial and Retailing Sectors Annmarie Birkett 2004 AN EMPIRICAL STUDY: THE IMPACT OF THE INTERNET ON TRADITONAL MARKETING PRINCIPLES, STRATEGIES AND PRACTICES in the Financial and Retailing Sectors BY Annmarie Birkett A Masters of Business Studies Presented to the Galway-Mayo Institute of Technology Head o f School: Mr. Larry Elwood Research Supervisors: Mr. Kevin Heffeman and Ms. Andrea Moloney Internal Examiner: Mr. James McGivem External Examiner: Mr. Gerry Grinham ‘Submitted to the Higher Education and Training Awards Council, April 2004’. TABLE OF CONTENTS List of Tables (v) List of Figures (vi) List o f Appendices (Vi) Dedication (vii) Acknowledgements (viii) Abstract (ix) Chapter 1: Introduction to Thesis 1.1 Introduction 1 1.2 Primary Objectives 2 1.3 Secondary Objectives 2 1.4 Research Plan 2 1.5 Summary of Research Findings and Conclusions 4 1.6 Summary 4 Chapter 2: The Internet 2.1 Introduction 5 2.2 Introduction to the Internet 5 2.3 Evolution of the Internet 6 2.4 Internet Technology 9 2.5 Intranets 10 2.6 Extranets 11 2.7 Internet Tools 14 2.7.1 The World Wide Web 15 2.7.2 Electronic Mail (E-mail) 20 2.7.3 ListSERV 22 2.7.4 Telnet 23 2.7.5 Usenet 23 2.7.6 File Transfer Protocol (FTP) 24 2.7.7 Gopher, Archie and Wide Area Information Server (WAIS) 24 2.8 Internet Security 26 2.9 Internet Statistics in Ireland 27 2.10 Summary 33 2.11 Conclusions 34 Chapter 3: Marketing and the Internet 3.1 Introduction 36