Following Clarification/Rebuttal Was Issued to Business Recorder in Response to an Editorial Published on February 6, 2020 Entitled: ‘IMF Programme Needs Tweaking’

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![Pagina 1 Van 2 Business Recorder [Pakistan's First Financial Daily] 27](https://docslib.b-cdn.net/cover/5586/pagina-1-van-2-business-recorder-pakistans-first-financial-daily-27-1405586.webp)

Pagina 1 Van 2 Business Recorder [Pakistan's First Financial Daily] 27

Business Recorder [Pakistan's First Financial Daily] pagina 1 van 2 Friday March 27, 2009 Back Issues [From 2004-01-01] 2009-03-27 Get LATEST : Bomb at Khyber Agency mosque, at least 45 de- Top Stories . Business & Economy - Stocks & Bonds Monsanto may be allowed to introduce hybrid, Bt Jobs in pakistan General News cottonseed varieties Middle East Job Editorials ASMA RAZAQ Opportunities. Upload ISLAMABAD (March 19 2009): The Economic Co-ordination Articles & Letters your Resume now: Free! Committee (ECC) of the Cabinet may approve plan to allow www.Bayt.com Cotton & Textiles Monsanto introduce both hybrid and Bt cottonseed varieties in Pakistan. Reliable sources told Business Recorder here on Agriculture & Allied Wednesday that the Ministry of Food and Agriculture (Minfa) had Fuel & Energy decided to move a summary to ECC meeting on Thursday (March Karachi Hotels Money & Banking 19) for giving permission to Monsanto to introduce hybrid and the Bt cotton seed varieties in Pakistan. One-stop source to Telecommunication compare hotel room rates IT & Computers According to the sources, after the ECCs approval, an agreement from across the web. would be signed between the government and Monsanto. The www.OneTime.com Taxation government had signed a LoI with Monsanto a year ago to Company News collaborate in biotechnology. Monsanto cotton traits are currently approved in 13 countries of the world. Stock & Funds Rates & Schedules Research Sports Sources said that Monsanto had demanded 16 dollars per acre as Get Insights with Weather royalty, which, according to Pakistan, was a huge amount. The Morningstar. 4000 government was not ready to pay even a single penny to Monsanto Reports with Free 14 Day that is why even after signing the LoI, Pakistan has not finalised the The Rupee agreement with Monsanto. -

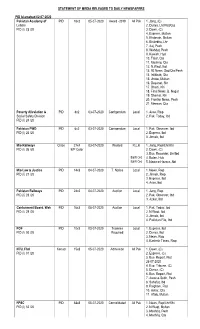

Statement of Media Released to Daily Newspapers Pid

STATEMENT OF MEDIA RELEASED TO DAILY NEWSPAPERS PID Islamabad 02-07-2020 Pakistan Academy of PID 18x2 05-07-2020 Award -2019 All Pak 1. Jang, (C) Letters 2. Dunya, Lhr/Fbd/Guj PID (I) 23 /20 3. Dawn, (C) 4. Express, Multan 5. Khabrain, Multan 6. Bhulekha, Lhr 7. Aaj, Pesh 8. Wahdat, Pesh 9. Kawish, Hyd 10. Talar, Qta 11. Mashriq, Qta 12. N.Waqt, Ibd 13. 92 News, Sgd/Qta/Pesh 14. Intikhab, Qta 15. Jhoke, Multan 16. Deyanat, Skr 17. Dharti, Khi 18. Final News, B. Nagar 19. Shamal, Khi 20. Frontier News, Pesh 21. Meezan, Qta Poverty Alleviation & PID 8x2 03-07-2020 Corrigendum Local 1. Asas, Rwp Social Safety Division 2. Pak. Today, Ibd PID (I) 24 /20 Pakistan PWD PID 6x2 03-07-2020 Corrigendum Local 1. Pak. Observer, Ibd PID (I) 25 /20 2. Express, Ibd 3. Jinnah, Ibd M/o Railways Circle 27x4 03-07-2020 Wanted R.L.K 1. Jang, Rwp/Lhr/Khi PID (I) 26 /20 B/P Color 2. Dawn, (C) 3. Bus. Recorder, Lhr/Ibd B&W Ord 4. Bolan, Hub B&W Ord 5. Nawa-e-Hazara, Abt M/o Law & Justice PID 14x3 04-07-2020 T. Notice Local 1. News, Rwp PID (I) 27 /20 2. Jinnah, Rwp 3. Express, Ibd 4. Asas, Ibd Pakistan Railways PID 24x2 04-07-2020 Auction Local 1. Jang, Rwp PID (I) 28 /20 2. Pak. Observer, Ibd 3. Azkar, Ibd Cantonment Board, Wah PID 16x3 08-07-2020 Auction Local 1. Pak. Today, Ibd PID (I) 29 /20 2. -

Cultural Scenario of Pakistan in Democratic and Military Eras (1947-2013)

South Asian Studies A Research Journal of South Asian Studies Vol. 32, No. 1, January – June 2017, pp.67 – 80 Cultural Scenario of Pakistan in Democratic and Military Eras (1947-2013) Saira Siddiqui Government College University, Faisalabad, Pakistan. Syeda Khizra Aslam Government College University, Faisalabad, Pakistan. Muhammad Rashid Khan University of the Punjab, Lahore, Pakistan. ABSTRACT This study investigates a politico-cultural mapping of leisure and life in Pakistan, a country in South Asia, with a political developmental period in historical perspective from its independence in 1947. A classification of ruling eras is done, and accordingly the paper carries its discussion. A few tables are presented to give the percentage of leisure-time spent, and leisure-activities pursued by Pakistani men and women. The data is from nationally represented samples of 2690 respondents in 2009, and 1294 respondents interviewed in 2012 by Gilani Research Foundation, Pakistan. The findings also include statistics from a research by the authors own empirical study of 2013, from a sample of 222 women respondents in Faisalabad City, Punjab, Pakistan. Key Words: Democratic and military eras, Pakistan, leisure and life, recreational facilities Introduction South Asia is one of the most heavily populated places in the world. The countries within its area are Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka (Cultural Geography of South Asia, 2002). Pakistan and Bangladesh in South Asia have Muslim influence, politico-cultural histories of political conflicts, and different civilizations. Pakistan has seen military rule and instability from time to time. The cultural histories of Nepal, Bhutan, Maldives, and Sri Lanka are different. -

The Role of Media in Pakistan Dr

Journal of South Asian and Middle Eastern Studies, 35 :4, Summer 2012. The Role of Media in Pakistan Dr. Nazir Hussain The explosion of information revolution and the proliferation of electronic media have virtually converted the world into a globalized village. Now, information, news and events have no barriers and control to reach anywhere around the world. These happenings reach to every living room instantaneously even before the governments can react and control it. The enhanced role of media has impacted the social, economic and political life. What one thinks, believes and perceives are based on the images shown on the media. It has penetrated the routine life of all individuals; commoners, elites, decision-makers and statesmen. States have often been inclined to use the media as a propaganda tool for political and military purposes. The decades of 1980s and 1990s have for instance witnessed the use of US media for politico-military ends. The projection of Soviet Union as an ‘Evil Empire’, the Saddam saga and the ‘Weapons of Mass Destruction’ and the Osama Bin Laden from ‘Freedom Fighter to a Terrorist’ are some of the examples. However, now the media has come out of the domain of the state controls, it is the financiers, the media houses and the media anchors that make heroes and villains, leaders and terrorists. Therefore, the role of media is growing from an observer to an active player in political decision making. The political leaders and government officials have become dependent to convey and defend their policies through the use of media. The media where ‘more anti-government will earn more business’ is considered a basic key to success. -

Bibliography

BIBLIOGRAPHY Abdul Hamid, Y., & Afzal, J. (2013). Gender, water and climate change: The case of Pakistan. Islamabad: Pakistan water partnership. Retrieved from http:// pwp.org.pk/wp-content/uploads/2014/05/Gender-Water-and-Climate- Change-The-Case-of-Pakistan.pdf. Abubakar, S. M. (2014, August 18). Climate communication. The News. Retrieved from http://www.thenews.com.pk/Todays-News-9-267715-Climate-communication. Ader, C. R. (1995). A longitudinal study of agenda setting for the issue of envi- ronmental pollution. Journalism & Mass Communication Quarterly, 72(2), 300–311. https://doi.org/10.1177/107769909507200204. Aftab, S. (1994). NGOs and the environment in Pakistan. Islamabad: Sustainable Development Policy Institute. Afzal, T. (2012, May 12). Role of media in Pakistan. Ilm Ki Duniya. Retrieved from http://www.ilmkidunya.com/articles/role-of-media-in-pakistan-1069.aspx. Agassi, J. (1960). Methodological individualism. The British Journal of Sociology, 11(3), 244–270. https://doi.org/10.2307/586749. Ahmad, F. (2012, April 22). Role of mass media in creating environmental aware- ness. Retrieved from http://tunza.eco-generation.org/ambassadorReport- View.jsp?viewID 9525. = Ahmad, M. (2013). Climate change, agriculture and food security in Pakistan: Adaptation options and strategies. International Development Research Centre. http://pide.org.pk/pdf/Advertisements/MPhil%20Fellowship%20 %2013%20Feb%2014.pdf. © The Editor(s) (if applicable) and The Author(s) 2018 245 I. Volkmer and K. Sharif, Risk Journalism between Transnational Politics and Climate Change, The Palgrave Macmillan Series in International Political Communication, https://doi.org/10.1007/978-3-319-73308-1 246 BIBLIOGRAPHY Ahmad, M. -

A Synopsis of the Curruculum Vitae of Dr

A SYNOPSIS OF THE CURRUCULUM VITAE OF DR. MUHAMMAD ASAD HASAN a) - Possess Post-Graduate qualifications in Faculties of Engineering, Science, Management and Law [Ph.D. & Post-Graduate Diploma in Chemical Engineering from the University of Leeds and Surrey (England), M.Sc. in Chemistry form University of Karachi, Post- Graduate Diploma in Management Studies from Derby (England) and LLB from University of Sindh], in addition of score of Certificate for technical and management courses from 11 abroad and 4 national organizations. Also registered as ISO-9000 Lead Auditor from I.R.C.A. (London) and qualified ISO-14000 Lead Auditor from British Standards Institution (England), (Annexure “A”). - LIFE MEMBER, PAK. ENG. COUNCIL, EX-M.A.I.CH.E. & M.A.S.Q.C. (U.S.A.) F.B.I.M. (U.K.). - Name was included in the Roaster of the Common Wealth Secretariat, London as an expert in Quality, Standardization, Testing etc., in 1998 (Ref:0071845) and in IRTI Information Center, Islamic Development Bank, Jeddah, Saudi Arabia. b) Represented the country abroad in ten International Seminars, Conference, Symposia at China, France, India, Japan, Singapore, South Korea, Thailand and Turkey and score of workshops etc., at national level, (Annexure “B”). c) Working as an Adjunct Professor in the department of Chemical Engineering, University of Karachi, since 2008. d) Worked as Professor in the Department of Chemical Engineering, Dawood College of Engineering Technology, Karachi (2007-2008) and as Adjunct Professor in the Department of Chemical Technology and Engineering, University of Karachi, after retirement (2004-2007). e) Possess about 40 years varied experiences [of premier Industries of Pakistan (with WPIDC and Pakistan Steel – 13 years) and Research & Development (with the University of Leeds, England and PCSIR – 6 years) in addition to 20 years experience with the Pakistan Standards Institution (PSI) and Pakistan Standards and Quality Control Authority (PSQCA)] (Anne. -

![Pagina 1 Van 2 Business Recorder [Pakistan's First Financial Daily] 25](https://docslib.b-cdn.net/cover/2663/pagina-1-van-2-business-recorder-pakistans-first-financial-daily-25-3792663.webp)

Pagina 1 Van 2 Business Recorder [Pakistan's First Financial Daily] 25

Business Recorder [Pakistan's First Financial Daily] pagina 1 van 2 Wednesday June 25, 2008 Back Issues [From 2004-01-01] 2008-06-25 Get LATEST : SC orde_ Top Stories . Business & Economy - Stocks & Bonds Bt cotton to be introduced next year: minister General News RECORDER REPORT ISLAMABAD (June 21 2008): Food and Agriculture Minister Nazar Editorials Muhammad Gondal has said that the government will formally Articles & Letters introduce Bt. cotton in the country next year. Concluding debate on Cotton & Textiles cut motions on agriculture demands in the National Assembly, he said that the sugar mills had paid most of the dues to sugarcane Agriculture & Allied growers. Fuel & Energy He said the government was working on war footing to control Money & Banking wheat shortage. It had already decided to import 5 million tons of Telecommunication wheat, he informed. The imported wheat would have positive impact on local market within one and a half months, he IT & Computers maintained. Taxation Company News The minister rejected the opposition assertion that the government was not providing any subsidy on urea. It had fixed Rs 6 billion for Rates & Schedules subsidy in this regard. The minister said that Pakistan Agriculture Sports Research Council (PARC) would provide seeds of different crops next year. The shortage of certified seeds would be resolved to a Weather large extent, he added. BR-Special Budgets & SROs He said that the government had slashed duties on agriculture equipment. Around 200 bulldozers and bore machines for Statistics agriculture sector development in Balochistan. He said the Documents government would announce support prices of the crops well in advance so that the growers could have better decision at sowing Yarn Prices time. -

Caught Between Five Extremes: Reporting Pakistan

Caught between five extremes: Reporting Pakistan Razeshta Sethna Thomson Reuters Fellow Hilary and Trinity Terms 2015 1 Acknowledgements The opportunity to learn at the University of Oxford is invaluable. I would like to thank the Thomson Reuters Foundation for their generosity, interest and faith, without which this research paper would not have been possible. Your excel- lence, commitment and passion to develop the best practices in journalism have contributed to the very best experience of my professional and academic life. My supervisor, Caroline Lees has been more than generous with her time and patience, and while doing so shown huge amounts of curiosity for my difficult world. Thank you, Caroline. You always make it appear easy to accomplish the most difficult of tasks. I would also like to thank James Painter and David Levy for their interest and encouragement; for making the Institute an oasis of diversity in the midst of a traditional center of learning. And a thank you to the wonderful Reuters staff for ensuring my two terms at Oxford were exciting, stimulating, and packed with excellent food. This study would not have been possible without the many conversations with writers, editors and reporters; and the stories told by brave, committed jour- nalists and friends who agreed to be interviewed; sometimes over cups of coffee and cake; sometimes over crackling connections on Skype and Facetime. Thank you, Ayesha Azfar and Bahzad. Thank you, Hameed Haroon and Nilofer. Not just for your interest in showing me the importance of debate, reading just about all I can get my hands on, but with trusting me and teaching me. -

Special Report PR Services/ Press Management

Special Report PR Services/ Press Management This report is prepared under USAID’s Public Outreach & Communications Activity (POCA) contract implemented by M&C Saatchi. PR Services / Press Management Summary Sep 2015- November 2018 Sr. Activities Numbers No 1. Media Tours 4 2. Talk shows 9 3. Morning Shows 9 4. Op-Ed 6 5. Print Stories 570 6. Electronic Media 88 Coverage 7. Human Interest Stories 27 8. Blogs/ Web stories 10 9. Features 8 Media Tours Peshawar Media Tour (March 2017) Peshawar Media Tour coverage in Daily Mashriq, Daily Khyber, Daily Khabrain, Jang, Nawai Waqt, Daily Azkaar, Daily Nayi Baat, Express Tribune, Parliament Times, The News, Daily Country News, Channel 5, Mashriq TV, Royal TV and ATV in March 2017. https://drive.google.com/file/d/0B9XDA0mIx1zma25GLVAwVm41T2s/view? usp=sharing10 Karachi Media Tour (April 2017) Karachi Media Tour coverage in Daily Times, The News, National Courier, Nawai Waqt, Daily Jurrat, Daily Amn, Daily Ausaaf, The Daily Basharat, Daily Itikhab, Daily Jahaan Pakistan, Daily Jiddat, Daily Azaad Riyasat, Daily Aghaaz, Daily Akhbar e Tehreer, Daily Eman, Daily Nayi Baat, Daily Pak News, Daily Parvaan, Waseb TV, ATV and News One in April 2017. https://drive.google.com/open?id=0B9XDA0mIx1zmd2xUNkFwdXZPWkU Lahore Media Tour (May 2017) Lahore Media Tour coverage in Daily Times, The Business, The Nation, Daily Ausaaf, Daily Nayi Baat, Daily Din, Daily Aman, Daily Kashmir Link, Daily Jurat, Daily Sarzameen, Daily Mashriq, Daily Nayi Adalat, Daily Sun News, Daily Azkaar, Daily City 42, Daily Din, Daily -

ISSUE NO. 01 September 2017

ISSUE NO. 01 September 2017 h News Corners LUMS and Library News Indexing of News Papers The News, Dawn, Business Recorder New Book List List of new arrivals Journal table of Contents Management, Marketing, Business, Economic, Law Indexing of SCOPUS Publications LUMS publications Book of the Month Barnes & Noble best seller book News Corner LUMS hosts regional research products showcasing event to celebrate 15 years of HEC Lahore University of Management Sciences (LUMS) hosted the Regional Research Products Showcasing Event for Central Punjab in collaboration with the Higher Education Commission (HEC) Regional Centre, Lahore, on Wednesday, September 27, 2017. Syed Raza Ali Gilani, Minister of Higher Education, Government of Punjab, inaugurated the ceremony. A total of 18 universities displayed innovative products and prototypes having a strong impact on society and economy. “HEC has played a significant role in developing a prosperous Pakistan through strengthening the basis for a knowledge-based economy and I endorse the efforts made by the organisation,” commented Mr. Gilani at the event. He particularly lauded the efforts of LUMS in organising such a grand event. A panel of independent judges nominated and shortlisted the top three products for participation in the mega showcasing event to be held later at Pak China Centre Islamabad on October 5, 2017, where the Prime Minister of Pakistan will inaugurate the ceremony. This showcasing event is part of a series of events being held to honour HEC for successfully completing 15 years of its services and to highlight its achievements in the higher education sector on different platforms. “Today’s event is about celebrating 15 years of existence of HEC in Pakistan and give people a glimpse of the innovative activities that are going on in our universities, how they are focusing on local and international problems and how the work that they are doing can actually make Pakistan a developed country,” said Prof. -

Media Workers

TENTATIVE LIST OF APPLICANTS WHO APPLIED IN MEMBERSHIP DRIVE PHASE - II QUOTA: MEDIA WORKERS DATE OF DATE OF MEMBERSHIP DRIVE S.NO CG NO CATEGORY APPLICANT NAME DESIGNTION DEPARTMENT MEMBERSHIP BIRTH DURATION STATION MANAGER 1 75178 I 4/14/2016 AMAN ULLAH 1/1/1965 STATION AVT KHYBER QUETTA 06-04-2015 to 13-05-2016 AVT KHYBER SENIOR STATION 2 72079 I 8/6/2015 SHEHARAM AHAHZAD 2/3/1979 GEO TV NETWORK 06-04-2015 to 13-05-2016 MANAGER CIRCULLATION DAILY NAWA I WAQT ZERO POINT G-7/1 3 5000 I 8/5/2015 MUHAMMAD HANIF 5/9/1960 06-04-2015 to 13-05-2016 MANAGER ISLAMMABAD ASSSISTAN GENRAL 4 57287 I 1/27/2016 ASIM KHAN EFFENDI 1/25/1969 06-04-2015 to 13-05-2016 NINAWALGER 5 59957 I 8/22/2015 EHSAN UL HAQ 7/20/1967 GENERAL MANEGER DAILY BALOCHISTAN TIME QUETA 06-04-2015 to 13-05-2016 SENIR STATION 6 77779 I 8/6/2015 SHEHARAM SHAHZAD 2/3/1979 GEO TV NAETWORK TECHNICAL 06-04-2015 to 13-05-2016 MANAGER 7 27937 I 8/6/2015 ALI RAZA 1/31/1968 C M MARKETING ADVENTISMENT 06-04-2015 to 13-05-2016 8 84763 I 5/13/2016 SYED INTISAR MEHDI 8/22/1978 DIRECTOR FINANCE MUNTAH E NOOR SACHAL TV PVT LTD 06-04-2015 to 13-05-2016 P.B.C HEAD QRS SHAHRAHE DASTUR 9 16965 I 5/5/2015 MIR BAHADAR KHAN 3/13/1958 CONTROLLER 06-04-2015 to 13-05-2016 ISLAMABAD MANAGER AGENCE FRANCE PRESS (NEW AGENCY) 10 27851 I 8/6/2015 SAJIDA WAJAHAT 11/14/1962 06-04-2015 to 13-05-2016 ADMINISTRATION 9-A ST 24 ,F-7/2 ISLAMMABAD 11 31702 I 12/31/2015 DUR MUHAMMAD KASI 3/10/1946 GENERAL MANAGER PTV QUETTA CENTR 06-04-2015 to 13-05-2016 12 60433 I 6/5/2015 AZHAR LATIF 3/18/1973 GM 06-04-2015 to 13-05-2016 -

December 16-31, 2019 January 16-31, 2021

December 16-31, 2019 January 16-31, 2021 SeSe 1 Table of Contents 1: January 16, 2021………………………………….……………………….…03 2: January 17, 2021………………………………….……………………….....06 3: January 18, 2021…………………………………………………………......07 4: January 19, 2021………………………………………………...…................16 5: January 20, 2021………………………………………………..…..........….. 17 6: January 21, 2021………………………………………………………….…..20 7: January 22, 2021………………………………………………………………23 8: January 23, 2021……………………………………….………………….......28 9: January 24, 2021……………………………………………...……………….32 10: January 25, 2021…………………………………………………….............35 11: January 26, 2021………………………………………………………….….37 12: January 27, 2021……………………………………………………………. 44 13: January 28, 2021…………………………………………………………..…52 14: January 29, 2021………………………………………………………..….....58 15: January 30, 2021……………………………………………….………..….. 63 16: January 31, 2021……………………………………………….………..….. 64 Data collected and compiled by Rabeeha Safdar, Maroosha Sarfraz and Zohaib Sultan Disclaimer: PICS reproduce the original text, facts and figures as appear in the newspapers and is not responsible for its accuracy. 2 January 16, 2021 Daily Times First Gwadar project gets power from national grid under CPEC Under the China-Pakistan Economic Corridor, two mega housing projects have been connected with the national grid in Gwadar. Electricity connections have been approved and installed at CPIC‟s projects International Port City and China Pak Golf Estates in Gwadar. These are the first residential communities in Gwadar‟s private sector where power connections have been successfully installed and are being dubbed a milestone in the development of the city. CPIC a leading international developer who are at the forefront of real estate development in Gwadar and promotion of the city globally are the first developer in the history of the city to complete their societies and handover plots to the buyers. Commenting on the achievement, Chief Engineer Waqas Moazzam said that this is another great milestone we have delivered in Gwadar by powering up our projects.