Big Move Implementation Economics: Revenue Tool Profiles

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Planning, Access, Levels of Care and Violence in Ontario's Long-Term Care

Planning, Access, Levels of Care and Violence in Ontario’s Long-Term Care January 21, 2019 15 Gervais Drive, Suite 201 Toronto, Ontario M3C 1Y8 Tel: 416-441-2502 www.ontariohealthcoalition.ca [email protected] Acknowledgments This paper would not have been possible without the assistance and input of the equivalent of a small town's worth of people. First and foremost, our erstwhile nursing student intern Esther Lee who is a joy and an inspiration and who contributed hundreds of research hours to this report. Devorah Goldberg, our Research and Campaigns Coordinator who shared with us her lovely combination of intelligence, attention to detail, good cheer, and a love for the subject matter. To our Board of Directors, all of whom gave lots of time and input that is gratefully appreciated, in particular Hugh Armstrong, Doug Allan (and OCHU), and Lawrence Walter who took extra time and raised important issues. Thank you. Our gratitude also to our Long- Term Care Committee members who also went through the report with a fine-tooth comb and helped to improve it greatly. We must in particular thank Jane Meadus for her time and advice, Dan Buchanan who is a font of information and has operated with courage and integrity in the public interest, and Mike Yam for his incredibly helpful input. We appreciate your wisdom and your expertise. To Concerned Friends, the organization for families and consumers whose advocacy over decades has helped to win improved inspections and enforcement, transparency and clearer rights for residents: thank you for working with us and lending your expertise. -

Volume 5 Has Been Updated to Reflect the Specific Additions/Revisions Outlined in the Errata to the Environmental Project Report, Dated November, 2017

DISCLAIMER AND LIMITATION OF LIABILITY This Revised Final Environmental Project Report – Volume 5 has been updated to reflect the specific additions/revisions outlined in the Errata to the Environmental Project Report, dated November, 2017. As such, it supersedes the previous Final version dated October, 2017. The report dated October, 2017 (“Report”), which includes its text, tables, figures and appendices) has been prepared by Gannett Fleming Canada ULC (“Gannett Fleming”) and Morrison Hershfield Limited (“Morrison Hershfield”) (“Consultants”) for the exclusive use of Metrolinx. Consultants disclaim any liability or responsibility to any person or party other than Metrolinx for loss, damage, expense, fines, costs or penalties arising from or in connection with the Report or its use or reliance on any information, opinion, advice, conclusion or recommendation contained in it. To the extent permitted by law, Consultants also excludes all implied or statutory warranties and conditions. In preparing the Report, the Consultants have relied in good faith on information provided by third party agencies, individuals and companies as noted in the Report. The Consultants have assumed that this information is factual and accurate and has not independently verified such information except as required by the standard of care. The Consultants accept no responsibility or liability for errors or omissions that are the result of any deficiencies in such information. The opinions, advice, conclusions and recommendations in the Report are valid as of the date of the Report and are based on the data and information collected by the Consultants during their investigations as set out in the Report. The opinions, advice, conclusions and recommendations in the Report are based on the conditions encountered by the Consultants at the site(s) at the time of their investigations, supplemented by historical information and data obtained as described in the Report. -

Supply of Diesel Fuel (For Action)

Item No. 5 For Action Supply of Diesel Fuel Date: November 12, 2019 To: TTC Board From: Chief Executive Officer Summary The purpose of this report is to obtain authorization to award a contract for the supply and delivery of gasoline and diesel fuel for up to a seven-year period. This procurement was a joint initiative with the City of Toronto, participating Agencies and other Public Bodies. The City plans to obtain approval to award its contract at its General Government and Licensing Committee meeting scheduled for November 18, 2019 (Award of Negotiable Request for Proposal No. 6907-19-0145 to Canada Clean Fuels Inc. for Supply of Various Fuels and Services) and subsequently the City Council Meeting scheduled for November 26, 2019 and November 27, 2019. Recommendations It is recommended that the TTC Board: 1. Authorize the award of a contract to Canada Clean Fuels Inc. for the supply and delivery of gasoline and diesel fuel on the basis of lowest-priced qualified proposal, in the total upset limit amount of $632,000,000 CDN (including applicable taxes), on terms and conditions satisfactory to the TTC’s General Counsel, for the five-year period from January 1, 2020 to December 31, 2024; and 2. Delegate authority to the CEO to add up to $280,000,000 CDN (including applicable taxes) to the contract with Canada Clean Fuels Inc. to cover the cost of fuel during the two-year optional period January 1, 2025 to December 31, 2026, as the contract allows TTC staff to exercise an extension option, under the same contract terms, up to a maximum of two years beyond the expiration of the initial five-year term. -

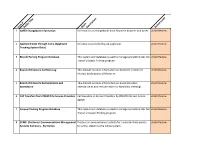

2020 Open Data Inventory

le n it tio T ip lic t r b s c u or e Item # P Sh D Access Level 1 AMEX Chargeback Information Information on chargebacks from Payment Acquirer and Amex Under Review 2 Applicant Data Through Taleo (Applicant Information provided by job applicants Under Review Tracking System Data) 3 Bicycle Parking Program Database This system and database is used to manage and administer GO Under Review Transit's Bicycle Parking program 4 Board of Directors Conflicts Log This dataset contains information on Directors' conflict of Under Review interest declarations at Metrolinx 5 Board of Directors Remuneration and This dataset contains information on Board Directors' Under Review Attendance attendance at and remuneration for Metrolinx meetings 6 Call Transfers from PRESTO to Service Providers Call transfers to Service Providers by PRESTO Contact Centre Under Review Agents 7 Carpool Parking Program Database This system and database is used to manage and administer GO Under Review Transit's Carpool Parking program 8 CCMS (Customer Communications Management Displays all announcement activity for a selected time period Under Review System) Summary - By Station for a line, station or the whole system. 9 CCMS (Customer Communications Management Displays number of messages (total) sent to each customer Under Review System) Summary by Channel channel over a time period. 10 CCMS (Customer Communications Management Displays all messages sent through CCMS for selected time Under Review System) Summary period. Shows what we sent as well as where it was sent and -

2012 Annual Report

2012 Annual Report Office of the Auditor General of Ontario Office of the Auditor General of Ontario To the Honourable Speaker of the Legislative Assembly In my capacity as the Auditor General, I am pleased to submit to you the 2012 Annual Report of the Office of the Auditor General of Ontario to lay before the Assembly in accordance with the provi- sions of section 12 of the Auditor General Act. Jim McCarter, FCA Auditor General Fall 2012 Copies of this report are available for $9.00 from Publications Ontario: (416) 326-5300 or toll-free long distance 1-800-668-9938. An electronic version of this report is available on the Internet at www.auditor.on.ca © 2012, Queen’s Printer for Ontario Ce document est également disponible en français. Cover photograph credits: ISSN 1719-2609 (Print) top right: Dick Hemingway Photographs ISBN 978-1-4606-0348-2 (Print, 2012 ed.) middle left: © Tetra Images/INMAGINE.com middle centre: © iStockphoto.com/ssuaphoto ISSN 1911-7078 (Online) bottom left: Office of the Auditor General of Ontario/Mariana Green ISBN 978-1-4606-0349-9 (PDF, 2012 ed.) bottom centre: © iStockphoto.com/mevens, HooRoo Graphics Table of Contents Chapter 1 Overview and Summaries of Value-for-money Audits and Reviews 5 Chapter 2 Public Accounts of the Province 27 Chapter 3 Reports on Value-for-money Audits and Reviews 45 Section 3.01 Cancer Screening Programs 46 Section 3.02 Criminal Prosecutions 65 Section 3.03 Diabetes Management Strategy 82 Section 3.04 Drive Clean Program 107 Section 3.05 Education of Aboriginal Students 129 Section -

Land Use Study: Development in Proximity to Rail Operations

Phase 1 Interim Report Land Use Study: Development in Proximity to Rail Operations City of Toronto Prepared for the City of Toronto by IBI Group and Stantec August 30, 2017 IBI GROUP PHASE 1 INTERIM REPORT LAND USE STUDY: DEVELOPMENT IN PROXIMITY TO RAIL OPERATIONS Prepared for City of Toronto Document Control Page CLIENT: City of Toronto City-Wide Land Use Study: Development in Proximity to Rail PROJECT NAME: Operations Land Use Study: Development in Proximity to Rail Operations REPORT TITLE: Phase 1 Interim Report - DRAFT IBI REFERENCE: 105734 VERSION: V2 - Issued August 30, 2017 J:\105734_RailProximit\10.0 Reports\Phase 1 - Data DIGITAL MASTER: Collection\Task 3 - Interim Report for Phase 1\TTR_CityWideLandUse_Phase1InterimReport_2017-08-30.docx ORIGINATOR: Patrick Garel REVIEWER: Margaret Parkhill, Steve Donald AUTHORIZATION: Lee Sims CIRCULATION LIST: HISTORY: Accessibility This document, as of the date of issuance, is provided in a format compatible with the requirements of the Accessibility for Ontarians with Disabilities Act (AODA), 2005. August 30, 2017 IBI GROUP PHASE 1 INTERIM REPORT LAND USE STUDY: DEVELOPMENT IN PROXIMITY TO RAIL OPERATIONS Prepared for City of Toronto Table of Contents 1 Introduction ......................................................................................................................... 1 1.1 Purpose of Study ..................................................................................................... 2 1.2 Background ............................................................................................................. -

Escale À Toronto

153 index 299 Queen Street West 69 Crocodile Rock 55 Devil’s Martini 55 A Drake Hotel Lounge 76 El Covento Rico 87 Aéroports Elephant & Castle 55 Billy Bishop Toronto City Airport 121 El Mocambo 96 Toronto Pearson International Airport 120 Insomnia 111 Alcools 150 Lee’s Palace 111 Alimentation 88 Library Bar 55 Ambassades 139 Madison Avenue Pub 111 Annex, The 106 Melody Bar 76 hébergement 134 Mitzi’s Sister 77 N’Awlins 55 Antiquités 58, 103 Orbit Room 88 Appartements 124 Panorama Lounge 103 Argent 140 Pauper’s Pub 112 Art & Design District 72 Polson Pier 30 Reservoir Lounge 66 Art et artisanat 31, 67 Sailor 95 Art Gallery of Ontario 80 Sneaky Dee’s 88 Auberges de jeunesse 124 Souz Dal 88 Autocar 122 The Bishop and The Belcher 103 Avion 120 The Communist’s Daughter 88 The Dakota Tavern 77 B The Fifth Social Club 55 The Garrison 88 Banques 140 The Guvernment 30 Bars et boîtes de nuit The Horseshoe Tavern 77 Bar Italia 87 The Imperial Pub 55 Beer Bistro 54 The Midtown 88 BierMarkt Esplanade 66 The Raq 77 Black Bull Tavern 76 The Rex Hotel Jazz Black Eagle 95 & Blues Bar 77 Bovine Sex Club 76 The Rivoli 77 Brunswick House 110 The Silver Dollar Room 96 Byzantium 95 This is London 56 Castro’s Lounge 116 Velvet Underground 77 C’est What? 66 Woody’s 95 Cheval 55 Baseball 148 Clinton’s 111 Basketball 148 College Street Bar 87 Bata Shoe Museum 106 http://www.guidesulysse.com/catalogue/FicheProduit.aspx?isbn=9782894645468 154 Beaches International Jazz E Festival 144 Eaton Centre 48 Beaches, The 112 Edge Walk 37 Bières 150 Électricité 145 Bières, -

Cultural Heritage Screen Report

Lincolnville Go Station Improvements: Cultural Heritage Screening Report Prepared for: Metrolinx 20 Bay Street, Suite 1800 Toronto ON M5J 2W3 ~ METROLINX Prepared by: Stantec Consulting Ltd. 300W-675 Cochrane Drive Markham ON L3R 0B8 () Stantec File No. 1135200010 October 12, 2017 LINCOLNVILLE GO STATION IMPROVEMENTS: CULTURAL HERITAGE SCREENING REPORT Project Personnel EA Project Manager: Alex Blasko, B.Sc. (Hon.) Heritage Consultant: Heidy Schopf, MES, CAHP Task Manager: Meaghan Rivard, MA, CAHP Report Writer: Heidy Schopf, MES, CAHP Laura Walter, MA GIS Specialist: Sean Earles Office Assistants: Carol Naylor Quality Review: Meaghan Rivard, MA, CAHP Independent Review: Tracie Carmichael, BA, B. Ed. () Stantec Sign-off Sheet This document was prepared by Stantec Consulting Ltd. (“Stantec”) for the account of Metrolinx (the “Client”). The material in it reflects Stantec’s professional judgment in light of the scope, schedule and other limitations stated in the document and in the contract between Stantec and the Client. The opinions in the document are based on conditions and information existing at the time the document was published and do not take into account any subsequent changes. The report has been prepared based, in part, on information provided by others as cited in the Reference section. Stantec has not verified the accuracy and / or completeness of third party information. Prepared by (signature) Heidy Schopf, MES, CAHP Cultural Heritage Specialist Reviewed by (signature) Signed by Tracie Carmichael on behalf of: Meaghan Rivard, -

Exhibition Place Master Plan – Phase 1 Proposals Report

Acknowledgments The site of Exhibition Place has had a long tradition as a gathering place. Given its location on the water, these lands would have attracted Indigenous populations before recorded history. We acknowledge that the land occupied by Exhibition Place is the traditional territory of many nations including the Mississaugas of the Credit, the Anishnabeg, the Chippewa, the Haudenosaunee and the Wendat peoples and is now home to many diverse First Nations, Inuit and Metis peoples. We also acknowledge that Toronto is covered by Treaty 13 with the Mississaugas of the Credit, and the Williams Treaties signed with multiple Mississaugas and Chippewa bands. Figure 1. Moccasin Identifier engraving at Toronto Trillium Park The study team would like to thank City Planning Division Study Team Exhibition Place Lynda Macdonald, Director Don Boyle, Chief Executive Officer Nasim Adab Gilles Bouchard Tamara Anson-Cartwright Catherine de Nobriga Juliana Azem Ribeiro de Almeida Mark Goss Bryan Bowen Hardat Persaud David Brutto Tony Porter Brent Fairbairn Laura Purdy Christian Giles Debbie Sanderson Kevin Lee Kelvin Seow Liz McFarland Svetlana Lavrentieva Board of Governors Melanie Melnyk Tenants, Clients and Operators Dan Nicholson James Parakh David Stonehouse Brad Sunderland Nigel Tahair Alison Torrie-Lapaire 4 - PHASE 1 PROPOSALS REPORT FOR EXHIBITION PLACE Local Advisory Committee Technical Advisory Committee Bathurst Quay Neighbourhood Association Michelle Berquist - Transportation Planning The Bentway Swinzle Chauhan – Transportation Services -

PRESTO Update – TTC/Metrolinx Settlement

2053.2 For Action with Confidential Attachment PRESTO Update – TTC/Metrolinx Settlement Date: May 12, 2021 To: TTC Board From: Chief Strategy and Customer Officer Reason for Confidential Information This reports contains information that is subject to solicitor-client privilege. This report is about litigation or potential litigation, including matters before administrative tribunals. This report contains information relating to a position, plan, procedure, criteria or instruction to be applied to any negotiations carried on or to be carried on by the TTC. Summary The purpose of this report is to provide an update on the progress made since the last TTC/Metrolinx PRESTO Settlement update in February 2021. This includes: . an update on the results of the Settlement and Arbitration for the current PRESTO contract with Metrolinx. Recommendations It is recommended that: 1. The TTC Board receive this report for information; and 2. The information in the Confidential Attachment remain confidential as it is subject to solicitor-client privilege. Financial Summary There are no financial implications arising from this report. The Interim Chief Financial Officer has reviewed this report and agrees with the financial impact information. PRESTO UPDATE: TTC/Metrolinx Settlement Page 1 of 5 Equity/Accessibility Matters As progress is being made through negotiations with PRESTO on closing out contract items and planning for the future, equity and accessibility continues to be imperative. The TTC is committed to meeting the Accessibility for Ontarians with Disabilities Act (AODA) requirements through continuing consultations with the Advisory Committee on Accessible Transit (ACAT), and introducing policies that promote equity and accessibility. Decision History At its meeting of June 12, 2019, the TTC Board received a comprehensive implementation update on PRESTO. -

Seasonal Guest Relations

SEASONAL GUEST RELATIONS Looking for a career with a dynamic organization that is committed to protecting wildlife? We are interested in dedicated individuals who are positive, enthusiastic and passionate about wildlife conservation and protecting our planet. Our Toronto Zoo is a mission-based, not-for-profit organization whose mission is connecting people, animals and conservation science to fight extinction. Our Toronto Zoo serves more than 1.2 million guests each year on over 500 acres and the foundation of all of our work is based on four cares: • We care about our animals • We care about our team • We care about our guests • We care about our community We strive to have this caring culture grounded in the principles of equity, diversity and inclusion. We commit to collaborating with our teams, guests and community to reflect and celebrate the rich diversity of Toronto and Canada. As a world class accredited zoo and part of the global conservation community we work with the World Association of Zoos and Aquariums and the International Union for the Conservation of Nature and collaborate with governmental agencies, conservation and science non-governmental organizations and corporate and academic partners to share our knowledge and learn from each other to enhance our collective impact. These positions provide the first experience for our guests arriving at the Zoo. These positions will assist guests in processing their admission and selling tickets, parking and more with a friendly and outgoing attitude. These positions will also assist and provide support in implementing the approved Strategic Plan. HOURS OF WORK: Up to 40 hours per week until Thanksgiving. -

ANNUAL REPORT 2011 Message from the Chair and CEO

2011 ANNUAL REPORT 2011 message from the Chair and CEO Welcome to unbeatable fun and adventure without leaving the GTA. With over 700 acres (283 hectares) to explore, the Toronto Zoo delivers action and excitement, and provides inspiration for people to love, respect and protect wildlife and wild spaces. governance changes In April, the City of Toronto adopted a new public appointments policy for its boards and agencies. The intent was to increase citizen engagement and to bring wider and deeper expertise to the City's boards. This resulted in an increase to the number of citizen members on the Zoo Board of Management. In September, City Council nominated six new citizen members to the Board including: Cal Bricker, Tonie Chaltas, Paul Doyle, Sabrina Fiorellino, Michael Ho and Joshua Vinegar. In the fall of 2011, the Board of Management began a process to review other operating models and best practices for the Zoo, to make it more financially sustainable, while continuing support of core programs in conservation, education and research. spreading Zoo spirit This year we shared Zoo spirit! Staff participated in not one, but two Canadian television series, raising funds for the Toronto Zoo Wildlife Health Centre through the glee club style talent show, Canada Sings , while the Toronto Zoo was also selected as the feature for the season premier and debut of Undercover Boss Canada . We joined the world of social media with the introduction of the first official Toronto Zoo Facebook page, where thousands of fans now share this spirit. We used this new media channel to help us launch our first “I love the Zoo campaign,” which bled into all areas of marketing and communications for fall 2011.