SUPPLEMENT NO. 1 DATED JULY 8, 2020 to PRELIMINARY OFFERING MEMORANDUM DATED JULY 1, 2020 Relating to $104,245,000* DREXEL UNIVE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Political Visions and Historical Scores

Founded in 1944, the Institute for Western Affairs is an interdis- Political visions ciplinary research centre carrying out research in history, political and historical scores science, sociology, and economics. The Institute’s projects are typi- cally related to German studies and international relations, focusing Political transformations on Polish-German and European issues and transatlantic relations. in the European Union by 2025 The Institute’s history and achievements make it one of the most German response to reform important Polish research institution well-known internationally. in the euro area Since the 1990s, the watchwords of research have been Poland– Ger- many – Europe and the main themes are: Crisis or a search for a new formula • political, social, economic and cultural changes in Germany; for the Humboldtian university • international role of the Federal Republic of Germany; The end of the Great War and Stanisław • past, present, and future of Polish-German relations; Hubert’s concept of postliminum • EU international relations (including transatlantic cooperation); American press reports on anti-Jewish • security policy; incidents in reborn Poland • borderlands: social, political and economic issues. The Institute’s research is both interdisciplinary and multidimension- Anthony J. Drexel Biddle on Poland’s al. Its multidimensionality can be seen in published papers and books situation in 1937-1939 on history, analyses of contemporary events, comparative studies, Memoirs Nasza Podróż (Our Journey) and the use of theoretical models to verify research results. by Ewelina Zaleska On the dispute over the status The Institute houses and participates in international research of the camp in occupied Konstantynów projects, symposia and conferences exploring key European questions and cooperates with many universities and academic research centres. -

THE CHRONICLE After WEDNESDAY

THE CHRONICLE after WEDNESDAY. NOVEMBER 4. 1992 DUKE UNIVERSITY DURHAM. NORTH CAROLINA CIRCULATION: 15.000 VOL 88, NO. 47 Clinton wins crusade for change Economy bedevils Democrat breaks Bush to bitter end Republican hold In the end, it was the faltering economy, Gov, Bill Clinton of Arkansas was elected which had bedeviled him all year, that did the 42nd president of the United States George Bush in. Tuesday, breaking a 12-year Republican From the New Hampshire primary in hold on the White House. February, through the party conventions Clinton shattered the Republicans' po this summer, to the start of the general- litical base with a promise of change to an election campaign on Labor Day, public electorate clearly discontented with Presi opinion held rem.arkably steady: three- dent Bush. quarters of the American people, accord Ross Perot, the Texas billionaire who ing to New York Times/CBS News polls, roiled this race throughout, finished third, disapproved ofthe way Bush was handling drawing roughly equally from both major the economy. party candidates, according to Voter Re Bush failed to change their minds with search & Surveys, the television polling his furious closing onslaught against Gov. consortium. Bill Clinton's character. More than seven Perot's share ofthe popular vote had the voters in 10 said in interviews as they left potential to exceed any third-party their polling places Tuesday that they con candidate's in more than half a century. sidered the economy not so good or poor, Clinton, capping an astonishing politi and a big majority of those opted in favor of cal comeback for the Democrats over the giving the Arkansas governor a chance to past 18 months, ran strongly in all regions turn things around. -

Anoth^^ Shipment! Sale

nUDAT* nTLTMb IMT lOTIlTEEW AYtrago Dolly Ctrcalattoa iKanrtri^Btpr Etmtftts If^ntlH ,.TI m W satiM r Fhr Bto Mmrth *8 d h M , t »42 FaraosM af 0. Bl aYaalkaz 1 iMinb«ra «< tb« L4#lon 9,255 Fair oM eiattoaii wana a». to the convontlon tomorrow Engaged to Wed Rank in G>rps day: Smday fMr aad eso About Town meet at th« tuition Horn*. Iw- Id o« Ihs Audit warm with asmporaaara sea . Mrean 11:4a and 12:00 o'clock, or 9t Ohreulattoas Me to today. ____s-Shen AidUMary, V. Imeet in Mew Hacan at the comer Is Permanent Sale W , wtU hold ■ food M l* t o m o r ^ and Sherman atraeta Mancheiter^-^A City of ViUofte Charm at Hato’a atoir beginninf that a'ifood repreaenta- o'clock Mi*. Dorothy MIlWi be on hand. Warrant Offirer Joseph VOL. LXVL, NO. 250 AdveiUalBg On Pag* A) the comwiittee, and the taleri?-’® - MANCHESTER, CONN., SATURDAY, JULY 26, 1947 (TEN PAGES) PRICK POUR CENTS the heneflt of *he orphan*' home rtiarie* McCarthy of Pmehurtti Orfilrili Has Been No* at Cedar Raplda, Iowa, Giwcery. with Mm. McCarthy and, tified of the Order- 30 Scholars Dead Leav6 Old Ben Mine Warrant Officer Joaeph _ M. ' Dispute May m Odd Fellow* hall liti^ead of the Fall*. Orfitelll, Mannn Corpa Reaefve, DRESSES Three Major Mpney of chH. L.».ph,r. n ..«.r will return to active duty for ah View Papers Block Balkan caoM at Memorial Field between j Kinney'* | Infantry refre«her course from | S a O d d Fellowaand the Center Im Klnjaton. -

Prominent and Progressive Americans

PROMINENTND A PROGRESSIVE AMERICANS AN ENCYCLOPEDIA O F CONTEMPORANEOUS BIOGRAPHY COMPILED B Y MITCHELL C. HARRISON VOLUME I NEW Y ORK TRIBUNE 1902 THEEW N YORK public l h:::ary 2532861S ASTIMI. l .;-M':< AND TILI'EN ! -'.. VDAT.ON8 R 1 P43 I Copyright, 1 902, by Thb Tribune Association Thee D Vinne Prem CONTENTS PAGE Frederick T hompson Adams 1 John G iraud Agar 3 Charles H enry Aldrich 5 Russell A lexander Alger 7 Samuel W aters Allerton 10 Daniel P uller Appleton 15 John J acob Astor 17 Benjamin F rankldi Ayer 23 Henry C linton Backus 25 William T . Baker 29 Joseph C lark Baldwin 32 John R abick Bennett 34 Samuel A ustin Besson 36 H.. S Black 38 Frank S tuart Bond 40 Matthew C haloner Durfee Borden 42 Thomas M urphy Boyd 44 Alonzo N orman Burbank 46 Patrick C alhoun 48 Arthur J ohn Caton 53 Benjamin P ierce Cheney 55 Richard F loyd Clarke 58 Isaac H allowell Clothier 60 Samuel P omeroy Colt 65 Russell H ermann Conwell 67 Arthur C oppell 70 Charles C ounselman 72 Thomas C ruse 74 John C udahy 77 Marcus D aly 79 Chauncey M itchell Depew 82 Guy P helps Dodge 85 Thomas D olan 87 Loren N oxon Downs 97 Anthony J oseph Drexel 99 Harrison I rwln Drummond 102 CONTENTS PAGE John F airfield Dryden 105 Hipolito D umois 107 Charles W arren Fairbanks 109 Frederick T ysoe Fearey Ill John S cott Ferguson 113 Lucius G eorge Fisher 115 Charles F leischmann 118 Julius F leischmann 121 Charles N ewell Fowler ' 124 Joseph. -

Dr. Joseph Belmonte Renowned Investment Strategist and Market Thinker Author of Buffett and Beyond

TM ©2019 All Rights Reserved Dr. Joseph Belmonte Renowned investment strategist and market thinker Author of Buffett and Beyond www.BuffettAndBeyond.com PB THE MEN WHO MOVED WALL STREET™ ©2019 1 THE MEN WHO MOVED WALL STREET DURING THE 2 THE MEN WHO MOVED WALL STREET™ ©2019 3 nchored by Wall Street, New York City has been tunities to swing the pendulum of control in their direction, called both, the most economically powerful city and through this, enabled the monetary system of America to and the leading financial center, being home to the lean in their direction, thus, obtaining methods for expansion, world’s two largest stock exchanges by total market momentum, and achievement of an empire so vast, it moved Acapitalization, the New York Stock Exchange and NASDAQ. Wall Street, and the world. Captains of finance and industry in the gilded age were Dow Jones, Barrons, Wall Street Journal, S&P 500, legendary icons enabling this country to become strong J.P.Morgan financial institutions, the largest insurance com- and independent. American industrialists and philanthro- panies in the world and the railroad reorganization meth- pists revolutionized industry and defined the structure of odology, all began with these men with tenacious business monetary gain. Many were deeply involved in developing dispositions and the wherewithal to connect the dots between and financing railroad empires by reorganizations and industry, human power, and money. consolidations, building a strong vision of an integrated They walked through the finest clubs in New York where transportation system. money was aged, and new money balanced on that noble Beginning in the 1870s, thanks to a modern corporate form money, became ripe. -

GNN Virtual Site Schedule for Web Revised.Xlsx

Sacramento Philadelphia London Shanghai Program Title and Description Metadata Research at the College of Computing & Informatics 6 a.m. 9 a.m. 2 p.m. 9 p.m. [Presenter online] Metadata is essential for intelligent and productive use of information by both humans and machines. Jane Greenberg, Alice B. Kroeger professor and director of the Metadata Research Center (MRC) at the College of Computing & Informatics, will introduce the concept of metadata, highlight two MRC research initiatives, and discuss the value of metadata in current and future information endeavors. Alumni Career Services: Why Every Entrepreneur Needs a Mentor 6:17 a.m. 9:17 a.m. 2:17 p.m. 9:17 p.m. [Presenter online] Good mentors can help aspiring entrepreneurs launch their ventures and can help seasoned entrepreneurs make their businesses even better. Chuck Sacco, MBA ’06, entrepreneur-in-residence and director of external relations at the Charles D. Close School of Entrepreneurship, and director of the Laurence A. Baiada Institute for Entrepreneurship, will lead a discussion with entrepreneurs Peter Schuette ‘16, Adria Bagdonavicius ‘12, and Baiada Center mentor Christopher Fried ’11, to explore the value of the practice for both mentors and their mentees. The group will share tips for finding great mentors and discuss the support that Drexel provides to aspiring entrepreneurs. 6:34 a.m. 9:34 a.m. 2:34 p.m. 9:34 p.m. The Power of Humor In Stressful Times The demands of our personal and professional lives often leave us with little time to laugh. “The Stress Less Shrink” Joel Schwartz, MD ’65, will share his advice for combating what he calls Adult Deficient Humor Disorder by injecting a bit of humor back into your daily life. -

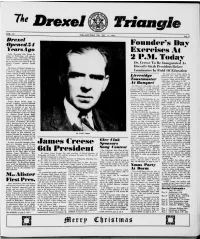

James Creese 0Th President Founder's Day Exercises at 2 P.M

D r e x e t n a n VO L. 21 PHILADELPHIA PA., DEC. 10 1945 No. 8 I f r e x e i O p e n e d 3 4 Founder’s Day Y e a r s A g o Exercises At Today, l)eceiiil)»*r 10th. Drexel In- 8titut(' of Teclinolopy will observe Founder’s Day- celehrating fifty-four years of echirational teacliing. a trib 2 P.M. Today ute to the trust and vision of the In stitute’s Founder, Anthony Joseph Dr. Creese To Be Inaugurated As I )re\el. D rexel’s Sixth President Before The liistory of Drexel Institute is a story of urowth. It is not often lliat a srho«d <»r collepe stands for half a l.uniinaries In Field O f Education century without essential niodifiration Dr. Janies (Creese today will be in- of purpose. When it does so stand, L irvrsitifiv augnralcd the sixth president of the instanre proves the permanence Drexel institute of Technology. The of the nee«l it serves. Its first pur TouHimaslvr ccreinony, which will be held in the pose has been single and steadfast: auditoriinn. will begin at 2 P.M. sound training in practical fields for A t Kuitquvi Pi'<‘sidenls ol more than a score of the benefit of the many. From the universilies and colleges will be day of its dedication, December 17, Dr. Horace I*. Liv*M>idgr, who will among tin* representatives of «»ver 1891, tlie object of Drexel training has act as loastnia.otiT at the inaugural fifty educational institutions and been t(» open for its students the way ltan<|ni-l lonight. -

Poland. Ministerstwo Spraw Zagranicznych Records

http://oac.cdlib.org/findaid/ark:/13030/tf4v19n70w No online items Register of the Poland. Ministerstwo Spraw Zagranicznych records Finding aid prepared by Zbigniew Leopold Stanczyk Hoover Institution Library and Archives © 1998 434 Galvez Mall Stanford University Stanford, CA 94305-6003 [email protected] URL: http://www.hoover.org/library-and-archives Register of the Poland. 59003 1 Ministerstwo Spraw Zagranicznych records Title: Poland. Ministerstwo Spraw Zagranicznych Date (inclusive): 1919-1947 Collection Number: 59003 Contributing Institution: Hoover Institution Library and Archives Language of Material: Polish Physical Description: 652 manuscript boxes, 10 oversize boxes, 13 envelopes(277.0 Linear Feet) Abstract: Correspondence, bulletins, memoranda, reports, studies, lists, financial records, and photographs, relating to Polish foreign relations during World War II, the Polish government in exile in London, Allied diplomacy during World War II, conditions in Poland during the war, deportation of Poles to the Soviet Union, Polish refugees, the Jewish holocaust in Poland, and Polish military operations. Includes some records of Polish foreign relations during the interwar period. A digital copy of this entire collection is available at http://szukajwarchiwach.pl/800/42/0/-/ . Creator: Poland. Ministerstwo Spraw Zagranicznych Access The collection is open for research; materials must be requested at least two business days in advance of intended use. Publication Rights For copyright status, please contact the Hoover Institution Library & Archives Preferred Citation [Identification of item], Poland. Ministerstwo Spraw Zagranicznych records, [Box no., Folder no. or title], Hoover Institution Library & Archives. Alternative Forms of Material Available Also available on microfilm (541 reels). Digital copy in Poland's National Digital Archive at http://szukajwarchiwach.pl/800/42/0/-/ . -

Angier Biddle Duke Interviewer: Frank Sieverts Date of Interview: April 7, 1964 Length: 17 Pages

Angier Biddle Duke, Oral History Interview—JFK#1, 4/7/1964 Administrative Information Creator: Angier Biddle Duke Interviewer: Frank Sieverts Date of Interview: April 7, 1964 Length: 17 pages Biographical Note Duke, Chief of Protocol for the White House and State Department (1961-1965), discusses informal and state visits to the White House during John F. Kennedy’s (JFK) presidency, including those of John G. Diefenbaker, Mohammad Zahir Shah, Kwame Nkrumah, and other dignitaries, and changes that Duke and JFK made to state visit policy and format, among other issues. Access Open. Usage Restrictions According to the deed of gift signed on February 5, 1965, copyright of these materials passed to the United States Government upon the death of the interviewee. Users of these materials are advised to determine the copyright status of any document from which they wish to publish. Copyright The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Under certain conditions specified in the law, libraries and archives are authorized to furnish a photocopy or other reproduction. One of these specified conditions is that the photocopy or reproduction is not to be “used for any purpose other than private study, scholarship, or research.” If a user makes a request for, or later uses, a photocopy or reproduction for purposes in excesses of “fair use,” that user may be liable for copyright infringement. This institution reserves the right to refuse to accept a copying order if, in its judgment, fulfillment of the order would involve violation of copyright law. -

2019 Drexel University Consolidated Financial Statements [PDF]

Drexel University and Subsidiaries Consolidated Financial Statements For the Years Ended June 30, 2019 and 2018 Drexel University and Subsidiaries Index June 30, 2019 and 2018 Page(s) Report of Independent Auditors ......................................................................................... 1–2 Consolidated Financial Statements Consolidated Statements of Financial Position ............................................................................... 3 Consolidated Statements of Activities ........................................................................................ 4–5 Consolidated Statements of Cash Flows .......................................................................................... 6 Notes to Consolidated Financial Statements ............................................................................. 7–59 Report of Independent Auditors To the Board of Trustees Drexel University We have audited the accompanying consolidated financial statements of Drexel University and its subsidiaries (the “University”), which comprise the consolidated statements of financial position as of June 30, 2019 and 2018, and the related consolidated statements of activities and of cash flows for the years then ended. Management's Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, -

Military Ball to Be in February

THE DREXEL TRIANGLE 'ol. II. No. 6 DREXEL INSTITUTE. DECEMBER 15, 1926 Single Copies, 5c FRESHMEN ENGINEERS QUAKERS PLAY FOR R. 0 . T. C. MILITARY BALL TO BEGIN ORGANIZATION DREXEL BOWS TO During the last drill of the Winter ‘CAP AND BELLS’ TO term, the Drexel R. O. T. C. cadets saw Although no real organizing has been the Philadelphia “Quakers,” coached by BE IN FEBRUARY done in the Freshman class, and is not PENN QUINTET Bob Folwell, practice in the Cavalry BE GIVEN IN FEB. likely to be done until after the holidays, Armory, Thirty-third and Lancaster there has been formed around J. Rob Keeps the Red and Blae Ruiming Avenue. The stars that beat “Red” Will Be Third Annual Production Will Be Held in Elks’ Club erts, ’27, the Freshman student advisor, to Last Minute of Play Grange were snapping the ball back and Under the Direction of the some tangible arrangement by which running into formation. It was easy to The Annual Military Ball will be held any important questions which may arise Christian Associations Last Saturday, December 11th, Drexel see that these men were not ordinary in February this year, instead of May. can be settled. played one of the finest basketball games players, many of them actually having Last week a committee composed of The present plans as arranged by Ed The forming of this semi-organization in its athletic history, but was finally been members of the mythical All- members of the combined Christian ward Qark, Chairman of the Ball Com was a sample matter, since the class had overpowered by an avalanche of new American teams. -

Francis Martin Drexel (1792-1863), Artist Turned Financier ©Jay Robert Stiefel [email protected] All Rights Reserved

Francis Martin Drexel (1792-1863), Artist Turned Financier ©Jay Robert Stiefel [email protected] All rights reserved. Appeared in Maine Antique Digest (May 2003), p. 44-D. The transformation of Paul Gauguin (1848-1903) from stockbroker to painter illustrates a not uncommon occurrence in the life of many a wealthy professional. Beggaring even Maugham’s masterful fictional portrait of Gauguin in A Moon and Sixpence, however, is the tempestuous life of another man who accomplished the reverse, turning from art to finance. Whereas Gauguin found his greatest achievement as a painter, and is now considered a leading exponent of Post-impressionism, Francis Martin Drexel (1792-1863) - to the extent he is remembered at all - is respected as the founder of one of America’s greatest merchant banks, Drexel & Company. Drexel’s story, even more so than Gauguin’s, is one of insatiable Wanderlust and requited daring. Drexel admitted to having been partial to art since infancy. Perhaps this was fostered by the romantic setting of his birth on April 7, 1792, in Dornbirn, in the far western Austrian alpine province of the Voralberg. Drexel demonstrated no early interest in commerce, despite the encouragement of his father, one of Dornbirn’s most successful merchants. On New Year’s Day, 1806, Francis was apprenticed to a painter in the village of Wolfurt, five miles to the north of Dornbirn. (This was the area of the Bregenzer Wald, which had earlier produced another noted artist, Angelica Kauffmann, whose altarpiece graces the parish church at Schwarzenburg.) These studies were disrupted by the failed 1809 Tyrolese rising against the Napoleonic occupation of Austria, which nearly impoverished the elder Drexel, one of the insurgency’s leaders.