11/12 Point Square, Dublin 1 Grade a Office Space to Let

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Environmental Impact Assessment Report Non-Technical Summary

Volume 1 ENVIRONMENTAL IMPACT ASSESSMENT REPORT NON-TECHNICAL SUMMARY MP2 PROJECT DUBLIN PORT COMPANY EIAR NON-TECHNICAL SUMMARY MP2 PROJECT NON-TECHNICAL SUMMARY CONTENTS 1 INTRODUCTION .......................................................................................................................... 2 2 NEED FOR THE MP2 PROJECT ................................................................................................ 6 3 PROJECT DESCRIPTION ......................................................................................................... 26 4 ASSESSMENT OF ALTERNATIVES ........................................................................................ 60 5 PROJECT CONSULTATION & SCOPING ............................................................................... 67 6 RISK OF MAJOR ACCIDENTS & DISASTERS ....................................................................... 76 7 BIODIVERSITY, FLORA & FAUNA .......................................................................................... 78 8 SOILS, GEOLOGY AND HYDROGEOLOGY ........................................................................... 85 9 WATER QUALITY & FLOOD RISK ASSESSMENT ................................................................ 86 9.1 Water Quality .............................................................................................................................. 86 9.2 Flood Risk Assessment .............................................................................................................. 88 10 AIR QUALITY -

THE CASE for HEAVY RAIL Dublin Is in the Process of Finally Deciding the Structure of Its Public Transport System, in Particular

DECIDING ON DUBLIN'S INTEGRATED TRANSPORT POLICY THE CASE FOR HEAVY RAIL MARTIN ROGERS DUBLIN INSTITUTE OF TECHNOLOGY 1. B A C K G R O U N D Dublin is in the process of finally deciding the structure of its public transport system, in particular the form of rail-based transport to be employed in the capital. This process has been ongoing since the early nineties when the Dublin Transport Initiative (DTI) was established to put together a transportation plan for the Greater Dublin Area to the year 2011, publishing its final report in 1995 (DTI, 1995). The problem of resolving the public transport needs for the capital city has its basis in the recommendations of this report. This paper examines the data used to formulate the initial Core Strategy of projects contained within the DTI Final Report which dealt with all surface transport (road, rail, bus, cycling and walking), and examined transport in an integrated sense, inter-relating it with policies such as economic development, employment and the environment. This paper discusses whether the judgements made by the decision-makere within DTI Phase 2 regarding the most appropriate transport strategy for the region were, in retrospect, the correct ones. In particular, this report, in the opinion of the author, did not pick the correct suburban rail option for Dublin as part of its chosen core strategy. It also asks whether any suitable corrective action has been taken in the intervening years as part of the DTI review process to adjust the strategy, where appropriate, and whether the proposed strategy update corrects, to any extent, the original errors committed. -

Annual Report and Accounts 2018 Annual Report and Accounts - Contents

Annual Report and Accounts 2018 Annual Report and Accounts - Contents Contents Chief Executive’s Foreword 2 Annex to Foreword 4 Part 1 The Role of Waterways Ireland 6 Our Strategy 7 Our Key Performance Indicators 8 Working in Partnership 12 Part 2 Our Strategic Performance Maintaining World Class Waterways Corridors 14 Safeguarding our Environment and Heritage 16 Increasing Public Participation and Unlocking Opportunities 17 Ulster Canal 19 Ulstr Canal Greenway 19 Education and Legacy 20 World Canals Conference 20 Growing our Income 21 Corporate Governance 21 Part 3 Appendix 1 Waterways Ireland Organisational Structure 23 Appendix 2 Our People and Contact Details 24 Part 4 Accounts for the year ended 31st December 2018 25 1 Annual Report and Accounts - Chief Executive’s Foreword Chief Executive’s Foreword It has been a privilege to be the second Chief Executive of Waterways Ireland, a role I will leave at the end of January 2019. As an organisation we look after some of the island’s most valuable outdoor recreation resources and as an all island body have a clear challenge to demonstrate that working together we can deliver more for people across the island than working separately. The past five years have been challenging, a change in focus, moving from our customers being primarily boat owners to a much broader customer base and new opportunities for growing use of the waterways. Thanks to the skills and experience of our operational teams, despite greatly reduced funding, we have been able to respond to infrastructure failures, commenced lock gate manufacture and replacement, and maintained the hundreds of recreational and amenity sites across the waterways. -

Vebraalto.Com

62 Pakenham House, Spencer Dock, Dublin 1 D01TK72 No. 62 is a luxury, light filled 3 bedroom, 3 bathroom apartment located on the 2nd floor of this prestigious development and enjoys two large balconies with dual views over the landscaped courtyard and across the cityscape. Spencer Dock is a well managed development of modern apartment blocks each set around landscaped courtyards and is located on the north bank of the River Liffey, adjacent to the IFSC. Residents have the benefit of dedicated concierge together with a large underground carpark offering car and bicycle parking. This very spacious (96sqm/1033sq.ft) apartment benefits from high ceilings, contemporary fully fitted kitchen, energy efficient centralised heating system, luxury bathrooms and one designated parking space. The accommodation briefly comprises: entrance hallway, utility, open plan living/dining/kitchen, three-double bedrooms, two with en-suite bathrooms and a separate shower room. The living room has floor to ceiling windows and access to the large corner balcony. This is a central location in the heart of the Dublin Docklands with a superb range of amenities in the area. There is an assortment of bars, cafes, restaurants and shops are all on the doorstep. Spencer Dock is within a stroll of the Dublin Convention Centre, The Three Arena and the Bord Gáis Energy Theatre. Spencer Dock is exceptionally well connected with a range of transport options on your doorstep including Rail, Dart and LUAS plus the proposed DART underground station. There is also a choice of bicycle stations close by. The Dublin Port and the Port Tunnel with direct access to the airport just a few minutes’ drive away. -

Sustainability Report Company 2014 1

DUBLIN PORT SUSTAINABILITY REPORT COMPANY 2014 1 Sustainability Report 2014 Our route to a greener port SUSTAINABILITY REPORT DUBLIN PORT 2014 COMPANY Sustainability: Good for the Economy, Good for the Environment and Good for Society. DUBLIN PORT SUSTAINABILITY REPORT COMPANY 2014 1 What Sustainability, the Environment and Corporate Social Responsibility mean to DPC: Foreword by the CEO 2 To say Dublin Port Company (DPC) is a sustainable Port implies we have the ability and How did we perform? 3 capacity to operate the Port within the means of our natural systems (environment), without harming other people (society and culture) and to remediate legacy environmental Shipping Routes 4 problems. Key Events in 2014 7 Sustainability to Dublin Port means ensuring that the Port can exist and operate at a rate Economic Performance 12 which meets present human needs and demands and can expand to meet future needs Our Map to a Greener Port 18 while preserving the environment and remediating environmental problems of the past to enable the existence and operation of the Port to continue into the future. DPC together Dublin Port Masterplan Review 2014 20 with our stakeholders’ participation, including port users, works towards ensuring a Sustainable Relationships 22 sustainable port constructed on sustainable operations, activities and developments. Environment 24 To DPC there are three elements considered when talking about the Environment: Social Contribution 30 Anthropogenic impact on the environment, ecology and preservation of the environment. Key Figures 34 The Port has an important and long standing commitment, firstly, to mitigate the negative 2015 Initiatives 35 environmental effects of Port operations and, secondly, to contribute to improving the Glossary of Terms 36 environment. -

Inspector's Report ABP300446-17

Inspector’s Report ABP300446-17 Development Demolition of former post office garage/depot and the construction of a new office building with all ancillary works. Location Sandwith Street Upper, Dublin 2. Planning Authority Dublin City Council. Planning Authority Reg. Ref. 4177/16. Applicant Rails Investment Limited (in Trust). Type of Application Permission. Planning Authority Decision Refuse. Type of Appeal First Party -v- Refusal. Appellant Rails Investment Limited (in trust). Observers (i) Geraldine Byrne, (ii) Zonda Properties Limited, (iii) Carmel McCormack, (iv) Transport Infrastructure Ireland, (v) Irish Rail. Date of Site Inspection 6th April, 2018. Inspector Paul Caprani. ABP300446-17 Inspector’s Report Page 1 of 26 Contents 1.0 Introduction .......................................................................................................... 3 2.0 Site Location and Description .............................................................................. 3 3.0 Proposed Development ....................................................................................... 4 4.0 Planning Authority Assessment ........................................................................... 5 5.0 Additional Information Response ....................................................................... 10 6.0 Planning History ................................................................................................. 12 7.0 Grounds of Appeal ............................................................................................ -

DUBLIN PORT YEARBOOK 2017 Contact Alec Colvin, General Manager, Dublin Ferryport Terminals, Container Terminal, Breakwater Road, Dublin 1

DUBLIN PORT YEARBOOK 2017 Contact Alec Colvin, General Manager, Dublin Ferryport Terminals, Container Terminal, Breakwater Road, Dublin 1. Tel: 00353 1 6075713 Fax: 00353 1 6075623 Email: [email protected] Web: www.icg.ie Dublin Port Yearbook 2017 5 14 26 32 38 44 Contents 2 Message From The Chief 26 Alexandra Basin 53 Seafarers’ Centre Executive Redevelopment Dublin Port’s new €500,000 Eamonn O’Reilly, Dublin Port Work is continuing to progress on Seafarers’ Centre turned part of the Company Chief Executive, welcomes Dublin Port Company’s €227 million old Odlums mill into a welcoming you to this year’s publication. Alexandra Basin Redevelopment area for sailors docking in the port. Programme. 4 The Year In Review 56 Reviewing The Masterplan Some of the highlights of 2016, 32 Harbour Master Interview Dublin Port Company recently including the launch of Cruise Dublin, Dublin Port’s brand new Harbour announced the first review of its Dublin Port Company’s new cruise Master, Michael McKenna, talks us Masterplan 2012-2040, coinciding tourism development and marketing through how much he is enjoying a with the news that full trade figures agency, as well as Disney Cruise new voyage. for 2016 reveal increased cargo Line’s Disney Magic’s maiden voyage volumes of 6.3%, the fourth to Irish shores, Riverfest 2016 and 38 Soft Values Programme successive year of growth. the announcement that Dublin is to Dublin Port Company’s Soft Values become a home port for the first time project is aimed at integrating the port 58 Map of Dublin Port in 2018. -

Forbes Street / Blood Stoney Road Bridge Location Review

DUBLIN DOCKLANDS AREA OPENING BRIDGES FORBES STREET / BLOOD STONEY ROAD BRIDGE LOCATION REVIEW Final Report DDA-BSB-REP-107-v03.docx 18 December 2018 A RPS COWI Joint Venture Working with: Dublin Docklands Area Opening Bridges Document Control Sheet Rev. Status Date By Check Approved 01 1st Draft 12/12/18 CNAS/OLSS OLSS PASS 02 Final 17/12/18 OLSS CNAS PASS 03 Minor amendments 18/12/18 OLSS CNAS OLSS Document prepared and controlled by: COWI UK Ltd. Bevis Marks House 24 Bevis Marks London EC3A 7JB Tel: +44 (0)20 7940 7600 Email [email protected] Web: www.cowiuk.com RPS COWI West Pier Business Campus Bevis Marks House Dun Laoghaire 24 Bevis Marks Co Dublin London EC3A 7JB Ireland Tel: +353 1488 2900 Tel: +44 (0)20 7940 7600 Email [email protected] Email: [email protected] Web: www.rpsgroup.com Web: www.cowiuk.com - www.cowi.com Copyright RPS COWI Joint Venture. All rights reserved. The report has been prepared for the exclusive use of our client and unless otherwise agreed in writing by RPS Group Limited or COWI UK Limited no other party may use, make use of or rely on the contents of this report. The report has been compiled using the resources agreed with the client and in accordance with the scope of work agreed with the client. No liability is accepted by RPS Group Limited or COWI UK Limited for any use of this report, other than the purpose for which it was prepared. RPS Group Limited and COWI UK Limited accepts no responsibility for any documents or information supplied to RPS Group Limited or COWI UK Limited by others and no legal liability arising from the use by others of opinions or data contained in this report. -

A Strategic Framework for Investment in Land Transport Background

Investing In Our Transport Future: A Strategic Framework for Investment in Land Transport Background Paper Eight Impact of Previous Transport Investment in Ireland Issued by: Economic and Financial Evaluation Unit Department Of Transport, Tourism and Sport Leeson Lane Dublin 2 Ireland Background Paper Impacts of Previous Major Projects Over the last decade land transport investment in Ireland formed a key part of programmes for government and development strategies. These strategies1 prioritised significant investment in roads and public transport. The main drivers of this investment were reducing travel times, improving environmental conditions, increasing safety and the obvious links between transport investment and economic growth2 - in particular in terms of increasing our competitiveness. These priorities saw transport investment increase from an average of 1.02% of GDP (1953 - 1997) to an average of 1.43% of GDP (1998 - 2008). In real terms this meant the scale of capital formation increasing from, for example, €838m (2012 prices) in 1996 to €2.6bn (2012 Prices) by 2006. A great deal of this increased investment came as a result of the National Development Plans 2000-2006 and 2007-2012. The following sections give an overview of some of the major transport infrastructure projects that have been completed in the past decade. A brief summary of major projects under the categories of road, heavy rail, light rail and bus are provided. Following this, there will be an in-depth analysis of two major infrastructure projects; the M4/M6 and the LUAS. 1. Road A key part of transport strategy was to upgrade the road network, particularly national roads, as illustrated by investment in this area of approximately €9.1 billion between 2006 and 2010. -

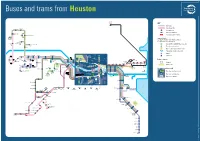

Buses and Trams from Heuston

67x 25. 67. 67 67x 67x 25a 25a 25a.25b 25x. 67x 67x 25. 67. 67 67x 67x 25a 25a 25a.25b 25x. 67x Buses and trams from Heuston Dublin Airport KEY 747 Bus route Collinstown Tram (Luas) line Blakestown (Intel) Principal stop 66x 25 Bus route terminus Maynooth 67 Easton Louisa Bridge Tram (Luas) line terminus 66 Maynooth 66x (Kingsbury) Transfer Points 66 66x Locations where it is possible to change Leixlip to a different form of transport (Castletown- Salesian Hewlett Packard) College 66b 66a Rail (DART, COMMUTER or Intercity) 67x Leixlip (Captain’s Hill) 66a Tram (Luas Green line) Leixlip Bus coach (regional or intercity) Park & Ride (larger car parks) Airport 25 Lucan Village Esker Hill Ballyowen Palmerstown Phoenix Park Ferry Port 67x Backweston 26 and Zoo 66 25.26 M 66.66a 25 26 66 ONTP 66a 66x 1473 ELIE Ballyoulster Lucan Road 66b.67.69 R HI 67 Chapelizod 66a 66b 67 69 LL 66b Points of Interest Aghards (Liffey Valley) 67 Dodsboro Lucan 67x Palmerstown Connolly Celbridge 25 25x Bypass Cemetery 69 O’Connell 26 PARKG Street Ballydowd ATE STR 1474 Hospital 67x 25a Esker Ballyfermot EET Four Abbey Manor Island- 1449 Busáras George’s Mayor Spencer The Lucan Meadow bridge Museum Smithfield Courts Jervis Street Dock Square Dock Point (Esker Church) Public Park 25a 25a Le Fanu 25 25 26 66 Park 26 66a 66b 67 69 7078 The O2/ 79 Kilmainham 66 O’Connell North Wall Point Depot Finnstown Finnstown Griffeen Foxborough Bridge (Beckett Bridge) Abbey Avenue Spiddal Park Cherry 66a R 25a 25b Geographic map inset only Fonthill Road ive 747 90 Orchard 69 66b r Liffe 25x 51d 69x 67 y 51x 66x 4319 Adamstown Station Inchicore 69 1473 25b 67x 69x Dublin Port Bus stop and stop number Cherry 79 79a 4320 145 25a.25b Heuston Arran/Ushers Ormond/ Orchard Heuston 79a Avenue 25x.51d 4413 Quay Essex Quay 66x.67x Station 4425 90 26 Bus route serving stop Parkwest & 69x.79 Cherry Orchard 79a Aston Quay Hawkins Street ST JOHNS ROAD WEST 79 79a 69 69x 145 Bus route terminus S T E Lock View E 2637 V D E 2638 A N O S R 25a 25b 25x ’ Dr. -

Annual Report 2013 at the Heart of Your Community Financial and Operating Highlights 2013

Annual Report 2013 At the Heart of Your Community Financial and Operating Highlights 2013 Operating Revenue Total Revenue EBITDA €289.93m 2013 €324.30m 2013 €6.9m 2013 €286.33m 2012 €323.21m 2012 (€0.22m) 2012 Number of Customer Number of Employees Payroll and Related Journeys 2,486 2013 Costs 78.27m 2013 2,551 2012 €124.92m 2013 77.17m 2012 €131.79m 2012 Vehicle Kilometres Surplus/(Deficit) Contribution to including Contractors for the Year Exchequer in Taxes 169.43m 2013 €0.4m 2013 €51.96m 2013 172.45m 2012 (€6.2m) 2012 €53.70m 2012 Schools Served Children Carried Daily Special Need Nationally on Schools Services Children Carried Approx 3,000 114,000 9,000+ Contents Operations Review 3 Directors and Other Information 28 Directors’ Report 31 Statement of Directors’ Responsibilities 35 Independent Auditors’ Report 36 Principal Accounting Policies 38 Profit and Loss Account 40 Balance Sheet 41 Cash Flow Statement 42 Notes to the Financial Statements 43 Bus Éireann would like to acknowledge funding on major projects from the National Transport Authority. Bus Éireann Annual Report and Financial Statements 2013 1 providing the best public transport bus service 2 Bus Éireann Annual Report and Financial Statements 2013 Operations Review Our Mission l To drive customer advocacy for our services by continuing to improve customer satisfaction levels for every experience we deliver. l Bus Éireann is fully committed to meeting the needs of our customers by providing excellent bus services l To maintain our market-leading position in a changing through a committed and hard-working team. -

Cruise Consultation Report

Cruise Consultation Report April 2020 1. Introduction 1 2. Response to Consultation 3 2.1 Private Individuals 3 2.1.1 Opposed to the development 3 2.1.2 In favour of the development 4 2.1.3 Conditional support for the development 5 2.2 Public Representatives 6 377m AREA TO BE 2.3 Companies / Organisations 7 DEMOLISHED 23,467m2 DREDGING 500m TO -10m CD 2.3.1 Representative Bodies 7 c276,000m2 100m 678m 2.3.2 Coach Operators 9 222m 2.3.3 Retailers 9 MARINA WALL 2.3.4 Public Bodies 10 HV ESB cable 2.3.5 Tour Guides 10 2.3.6 Port Operators 11 2.3.7 Cruise Excursion Operators 11 2.3.8 Cruise Lines 12 2.3.9 Miscellaneous 12 3. Issues 13 3.1 Masterplan objective for cruise and changes over the past eight years 13 3.2 DPC should review the existing proposals 13 3.3 Environmental impacts of the proposed development 14 3.4 Move cargo to other ports 14 3.5 DPC should take a lead role in developing a cruise management plan 15 3.6 DPC should seek funding from the State and from the EU 15 3.7 Berth allocation 16 4. Conclusions 17 Appendix - Respondents 18 1. Introduction 01 “ DPC proposed in the Masterplan to develop new berths at North Wall Quay Extension (NWQE) suitable for cruise ships and this 377m proposal was explicitly AREA TO BE DEMOLISHED 23,467m2 DREDGING 500m in support of the second TO -10m CD c276,000m2 100m Masterplan objective of re- 678m integrating the Port 222m MARINA WALL with the City.