Dr. Pepper Complaint NDCA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Keurig to Acquire Dr Pepper Snapple for $18.7Bn in Cash

Find our latest analyses and trade ideas on bsic.it Coffee and Soda: Keurig to acquire Dr Pepper Snapple for $18.7bn in cash Dr Pepper Snapple Group (NYSE:DPS) – market cap as of 17/02/2018: $28.78bn Introduction On January 29, 2018, Keurig Green Mountain, the coffee group owned by JAB Holding, announced the acquisition of soda maker Dr Pepper Snapple Group. Under the terms of the reverse takeover, Keurig will pay $103.75 per share in a special cash dividend to Dr Pepper shareholders, who will also retain 13 percent of the combined company. The deal will pay $18.7bn in cash to shareholders in total and create a massive beverage distribution network in the U.S. About Dr Pepper Snapple Group Incorporated in 2007 and headquartered in Plano (Texas), Dr Pepper Snapple Group, Inc. manufactures and distributes non-alcoholic beverages in the United States, Mexico and the Caribbean, and Canada. The company operates through three segments: Beverage Concentrates, Packaged Beverages, and Latin America Beverages. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, mineral and coconut water, and mixers, as well as manufactures and sells Mott's apple sauces. The company sells its flavored CSD products primarily under the Dr Pepper, Canada Dry, Peñafiel, Squirt, 7UP, Crush, A&W, Sunkist soda, Schweppes, RC Cola, Big Red, Vernors, Venom, IBC, Diet Rite, and Sun Drop; and NCB products primarily under the Snapple, Hawaiian Punch, Mott's, FIJI, Clamato, Bai, Yoo- Hoo, Deja Blue, ReaLemon, AriZona tea, Vita Coco, BODYARMOR, Mr & Mrs T mixers, Nantucket Nectars, Garden Cocktail, Mistic, and Rose's brand names. -

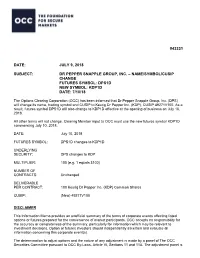

Dr Pepper Snapple Group, Inc. – Name/Symbol/Cusip Change Futures Symbol: Dps1d New Symbol: Kdp1d Date: 7/10/18

#43331 DATE: JULY 9, 2018 SUBJECT: DR PEPPER SNAPPLE GROUP, INC. – NAME/SYMBOL/CUSIP CHANGE FUTURES SYMBOL: DPS1D NEW SYMBOL: KDP1D DATE: 7/10/18 The Options Clearing Corporation (OCC) has been informed that Dr Pepper Snapple Group, Inc. (DPS) will change its name, trading symbol and CUSIP to Keurig Dr Pepper Inc. (KDP), CUSIP 49271V100. As a result, futures symbol DPS1D will also change to KDP1D effective at the opening of business on July 10, 2018. All other terms will not change. Clearing Member input to OCC must use the new futures symbol KDP1D commencing July 10, 2018. DATE: July 10, 2018 FUTURES SYMBOL: DPS1D changes to KDP1D UNDERLYING SECURITY: DPS changes to KDP MULTIPLIER: 100 (e.g. 1 equals $100) NUMBER OF CONTRACTS: Unchanged DELIVERABLE PER CONTRACT: 100 Keurig Dr Pepper Inc. (KDP) Common Shares CUSIP: (New) 49271V100 DISCLAIMER This Information Memo provides an unofficial summary of the terms of corporate events affecting listed options or futures prepared for the convenience of market participants. OCC accepts no responsibility for the accuracy or completeness of the summary, particularly for information which may be relevant to investment decisions. Option or futures investors should independently ascertain and evaluate all information concerning this corporate event(s). The determination to adjust options and the nature of any adjustment is made by a panel of The OCC Securities Committee pursuant to OCC By-Laws, Article VI, Sections 11 and 11A. The adjustment panel is comprised of representatives from OCC and each exchange which trades the affected option. The determination to adjust futures and the nature of any adjustment is made by OCC pursuant to OCC By- Laws, Article XII, Sections 3, 4, or 4A, as applicable. -

Jaimesen Heins Keurig Dr Pepper Waterbury, Vermont As Senior

Jaimesen Heins Keurig Dr Pepper Waterbury, Vermont As Senior Counsel – Operations & Commercial Litigation to Keurig Dr Pepper, Mr. Heins supports global commercial operations matters for the business, with a focus on commercial litigation, contract negotiation and advisory responsibilities. Mr. Heins provides strategic business advice and partners with company leaders to meet the needs of Keurig Dr Pepper’s business. Mr. Heins previously served as General Counsel to Burton Snowboards, overseeing all legal affairs of the company, including corporate governance, commercial transactions, intellectual property, brand licensing, real estate, employment, regulatory and litigation matters. Keurig Dr Pepper (NYSE: KDP) is a leading coffee and beverage company in North America, with annual revenue in excess of $11 billion. Formed in 2018 with the merger of Keurig Green Mountain and Dr Pepper Snapple Group, we have leadership positions in soft drinks, specialty coffee and tea, water, juice and juice drinks and mixers, and we market the #1 single serve coffee brewing system in the U.S. We have an unrivaled distribution system that enables our portfolio of more than 125 owned, licensed and partner brands to be available nearly everywhere people shop and consume beverages. With a wide range of hot and cold beverages that meet virtually any consumer need, KDP key brands include Keurig®, Dr Pepper®, Green Mountain Coffee Roasters®, Canada Dry®, Snapple®, Bai®, Mott’s® and The Original Donut Shop®. We have more than 25,000 employees and more than 120 offices, manufacturing plants, warehouses and distribution centers across North America. . -

Introducing Keurig Dr Pepper

Introducing Keurig Dr Pepper Investor Presentation Creating a New Challenger In the Beverage Industry Highly Confidential January 2018 Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of applicable securities laws and regulations. These forward-looking statements can generally be identified by the use of words such as “anticipate,” “expect,” “believe,” “could,” “estimate,” “feel,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will,” “would,” and similar words, phrases or expressions and variations or negatives of these words, although not all forward-looking statements contain these identifying words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results of the combined company following the proposed merger, the anticipated benefits of the proposed merger, including estimated synergies, the expected timing of completion of the proposed merger and related transactions and other statements that are not historical facts. These statements are based on the current expectations of Keurig Green Mountain Parent Holdings Corp. and Dr Pepper Snapple Group, Inc. management and are not predictions of actual performance. These forward-looking statements are subject to a number of risks and uncertainties regarding the combined company’s business and the proposed merger and actual results may differ materially. These risks and uncertainties -

Dr Pepper Shareholders Denied Appraisal in $21B Keurig Deal by Vince Sullivan

Portfolio Media. Inc. | 111 West 19th Street, 5th Floor | New York, NY 10011 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | [email protected] Dr Pepper Shareholders Denied Appraisal In $21B Keurig Deal By Vince Sullivan Law360 (June 1, 2018, 8:46 PM EDT) -- Shareholders of Dr Pepper Snapple Group Inc. do not have appraisal rights in the proposed $21 billion merger of the company with Keurig Green Mountain Inc., after a Delaware Chancery Court judge ruled Friday that Dr Pepper itself is not a party to the deal. In an opinion issued by Chancellor Andre G. Bouchard, the court ruled that appraisal rights afforded to shareholders of a company that is a party to a merger do not apply in this transaction because Dr Pepper is merely the parent of Salt Merger Sub Inc., a subsidiary created to merge with the parent company of Keurig. Section 262 of the Delaware General Corporation Law provides shareholders with a right to seek a court determination of the fair value of their shares in a company after a merger is announced. The court has the authority to award the petitioning shareholders the difference between the deal price and the appraised value under certain conditions. Chancellor Bouchard said that Section 262 requires a petitioning shareholder to hold stock in a constituent corporation, which requires the company to be one “actually being merged or combined.” “Based on that construction, the court concludes that Dr Pepper’s stockholders do not have a statutory right to appraisal under Section 262(b) because Dr Pepper is not a constituent corporation,” the opinion said. -

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance NORTH AMERICA’S LEADING FLAVORED BEVERAGE COMPANY More than 50 brands of juices, teas and carbonated soft drinks with a heritage of more than 200 years NINE OF OUR 12 LEADING BRANDS ARE NO. 1 IN THEIR FLAVOR CATEGORIES Named Company of the Year in 2010 by Beverage World magazine CEO LARRY D. YOUNG NAMED 2010 BEVERAGE EXECUTIVE OF THE YEAR BY BEVERAGE INDUSTRY MAGAZINE OUR VISION: Be the Best Beverage Business in the Americas STOCK PRICE PERFORMANCE PRIMARY SOURCES & USES OF CASH VS. S&P 500 TWO-YEAR CUMULATIVE TOTAL ’09–’10 JAN ’10 MAR JUN SEP DEC ’10 $3.4B $3.3B 40% DPS Pepsi/Coke 30% Share Repurchases S&P Licensing Agreements 20% Dividends Net Repayment 10% of Credit Facility Operations & Notes 0% Capital Spending -10% SOURCES USES 2010 FINANCIAL SNAPSHOT (MILLIONS, EXCEPT EARNINGS PER SHARE) CONTENTS 2010 $5,636 NET SALES +2% 2009 $5,531 $ 1, 3 21 SEGMENT +1% Letter to Stockholders 1 OPERATING PROFIT $ 1, 310 Build Our Brands 4 $2.40 DILUTED EARNINGS +22% PER SHARE* $1.97 Grow Per Caps 7 Rapid Continuous Improvement 10 *2010 diluted earnings per share (EPS) excludes a loss on early extinguishment of debt and certain tax-related items, which totaled Innovation Spotlight 23 cents per share. 2009 diluted EPS excludes a net gain on certain 12 distribution agreement changes and tax-related items, which totaled 20 cents per share. See page 13 for a detailed reconciliation of the Stockholder Information 12 7 excluded items and the rationale for the exclusion. -

2019 Corporate Responsibility Report Executive Letter

2019 Corporate Responsibility Report Executive Letter We compile this report to reflect on our progress toward our corporate responsibility goals amidst an extraordinary global health crisis and as our nation tackles issues of equality and justice. During these tumultuous times we reaffirm our commitment to listening, learning, revising and responding to the changing needs of the many stakeholders across our value chain. Against this backdrop, we are proud of how We are also focused on reducing our carbon quickly and effectively our 26,000 employees footprint. New to our corporate responsibility have united to keep each other safe and healthy, platform this year is the unveiling of our deliver for our customers and consumers and science-based carbon-reduction goals. The new provide for our communities. Our response commitments have been validated by the Science reflects our commitment to harness the collective Based Targets initiative, ensuring that we are power of our business to make a positive impact doing our part to mitigate climate change by in the lives we touch. reducing carbon emissions across our value chain. In 2019, we introduced our new corporate During this past year we became inaugural responsibility platform, Drink Well. Do Good. members of Business For Inclusive Growth Through this platform we established multi- (B4IG), a coalition of 40 leading international year goals and initiatives for our supply chain, companies committed to business action to the environment, health and wellbeing and advance human rights, build inclusive workplaces our communities. To meet these ambitious and strengthen inclusion across company value commitments, we designed a comprehensive and chains. -

Dr Pepper Snapple Group Inc DPS (XNYS)

Morningstar Equity Analyst Report | Report as of 24 Oct 2014 | Page 1 of 8 Dr Pepper Snapple Group Inc DPS (XNYS) Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQ 66.69 USD 52.00 USD 1.39 2.40 13.06 Beverages - Soft Drinks Standard 24 Oct 2014 24 Oct 2014 24 Oct 2014 24 Oct 2014 Morningstar Pillars Analyst Quantitative Economic Moat Narrow Wide Dr Pepper's continued productivity initiatives should help offset end- Valuation QQ Overvalued Uncertainty Medium Medium market headwinds. Financial Health BBB+ Strong Adam Fleck, CFA, 24 October 2014 repurchases. Source: Morningstar Equity Research Investment Thesis Quantitative Valuation Dr Pepper Snapple’s (DPS) brands enjoy solid positions Adam Fleck, CFA, 23 October 2014 DPS USA s within their particular markets, but limited geographic Analyst Note reach, partial reliance on competitors for bottling and After reviewing narrow-moat Dr Pepper Snapple's Undervalued Fairly Valued Overvalued distribution, and an overall trailing position constrain our third-quarter results, we will probably raise our $48 per Current 5-Yr Avg Sector Country moat rating to narrow. share fair value estimate 5% to 10% to account for Price/Quant Fair Value 1.18 1.05 0.94 0.86 continued solid execution. Cost control remained strong Price/Earnings 18.5 14.9 19.3 20.0 Following its split from parent company Cadbury in the quarter. Core operating margins rose 70 basis points Forward P/E 17.7 — 16.9 15.0 Price/Cash Flow 13.3 11.0 12.0 12.0 Schweppes in 2008, DPS retained the U.S., Canadian, year over year to 20.1%, and combined with a slightly Price/Free Cash Flow 16.1 16.8 20.5 20.4 Mexican, and Caribbean rights to its core brands; outside lower expected tax rate and a beneficial raw material cost Dividend Yield % 2.40 2.47 1.97 2.08 these regions, competitors such as Coca-Cola and PepsiCo environment, management raised its full-year earnings Source: Morningstar own the rights. -

Becerra V. Dr Pepper/Seven Up, Inc., Slip Copy (2018) 2018 WL 1569697

Becerra v. Dr Pepper/Seven Up, Inc., Slip Copy (2018) 2018 WL 1569697 Pepper/Seven Up, Inc. (“Dr Pepper”) from marketing its Diet Dr Pepper product as “diet.” While Dr Pepper moves 2018 WL 1569697 Only the Westlaw citation is currently available. to transfer this action to the United States District Court United States District Court, N.D. California. for the Eastern District of Texas pursuant to 28 U.S.C. § 1404(a), the case belongs here—it has a California Shana BECERRA, Plaintiff, plaintiff who was injured in California and chose this v. venue. Dr Pepper also moves to dismiss plaintiff’s Second DR PEPPER/SEVEN UP, INC., Defendant. Amended Complaint (“SAC”) in its entirety, and I agree with its contention that it is not plausible that a reasonable Case No. 17-cv-05921-WHO consumer would believe that drinking Diet Dr Pepper | would assist in weight loss, beyond the fact that it has no Signed 03/30/2018 calories. Accordingly, I DENY Dr Pepper’s motion to transfer venue but GRANT its motion to dismiss with leave to amend Attorneys and Law Firms . Jack Fitzgerald, Melanie Rae Persinger, Trevor Matthew Flynn, The Law Office of Jack Fitzgerald, PC, San Diego, CA, Andrew B. Sacks, John K. Weston, John Kerry Weston, Sacks Weston Diamond, LLC, Philadelphia, PA, for Plaintiff. BACKGROUND Ariel D. House, Baker Botts LLP, Palo Alto, CA, Jessica Dr Pepper is a Delaware corporation with its principal Elaine Underwood, Monica Hughes Smith, Baker Botts place of business in Plano, Texas. SAC ¶ 7. It first L.L.P., Dallas, TX, Stuart Christopher Plunkett, Baker introduced Diet Dr Pepper, a soft drink product, in 1962. -

2020 Corporate Responsibility Report Table of Contents

2020 Corporate Responsibility Report Table of Contents OVERVIEW 3 PEOPLE & COMMUNITIES 32 A Letter from our Chairman & CEO and CSO 3 Employee Health & Safety 33 About This Report Our Company 4 Employee Engagement & Development 35 Keurig Dr Pepper (KDP) has reported on Key Highlights 5 Diversity & Inclusion 37 its corporate responsibility program since Our Corporate Responsibility Strategy 6 Community Engagement 39 the Company was formed in July 2018. This progress report focuses on the goals, Stakeholder Engagement & Materiality 8 programs and initiatives that encompass our key corporate responsibility efforts for Goals & Progress 9 GOVERNANCE 41 2020. In addition, we have created a Data Responding to COVID-19 10 Summary, which can be found at the end Board Management & Oversight 42 of this report. Unless otherwise noted, this report covers data and activities for calendar Ethics & Compliance 43 year 2020 from KDP’s wholly owned ENVIRONMENT 11 operations, which are primarily located in the Human Rights 44 U.S., Canada and Mexico. The content covers Product Design & Circular Economy 12 the parts of our business in which we have operational control and does not include Resource Use & Conservation 15 APPENDIX joint ventures, franchised or outsourced 45 operations, except where noted. Selected Water Efficiency & Stewardship 16 Data Summary 45 data and information on our global supply Climate, Emissions & Energy 18 chain activities are also included. Goal Methodology 52 We have expanded the scope of independent Stakeholder Engagement 58 verification for 2020 to include more SUPPLY CHAIN 20 environmental metrics, assurance on the Reporting Framework Indices (GRI, SASB, TCFD) 61 Environmental and Supply Chain sections Responsible Sourcing 21 of the report, and assurance for applicable Sustainability Accounting Standards Improving Livelihoods 23 Board (SASB) standards. -

Dr Pepper Snapple Group, Inc Annual Report 2018

Dr Pepper Snapple Group, Inc Annual Report 2018 Form 10-K (NYSE:DPS) Published: February 14th, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 Form 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to C ommission file number 001-33829 (Exact name of Registrant as specified in its charter) Delaware 98-0517725 (State or other jurisdiction of (I.R.S. employer incorporation or organization) identification number) 5301 Legacy Drive, Plano, Texas 75024 (Address of principal executive offices) (Zip code) Registrant's telephone number, including area code: (972) 673-7000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered COMMON STOCK, $0.01 PAR VALUE NEW YORK STOCK EXCHANGE Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yesx No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Drinks That Eat Your Teeth

Drinks That Eat Your Teeth Drink Acid (pH) Sugar (tsp in 12oz) Caffeine (grams) Calories (in 12oz) Battery Acid 1.00 0 0 0 Stomach Acid 2.00 0 0 0 Lime Juice 2.00 0 0 1 Lemon Juice 2.20 0 0 12 Cranberry Juice 2.30 11 0 205 Gatorade-Clear 2.40 5.5 0 75 Sunny Delight 2.40 6.3 0 120 Vinegar 2.40 0 0 3 Pepsi 2.49 9.8 37 150 Lemonade (Country Time) 2.50 5.4 0 90 RC Cola 2.50 0 0 160 SoBo Tropical Sugarfree 2.50 0 0 0 Coke-Cherry 2.52 8.9 34 150 Coke-Classic 2.53 9.3 34 140 Capri Sun 2.60 5.5 0 200 SoBe Strawberry-Grape 2.60 6.5 0 60 Fruit Punch (Hi-C Blast) 2.70 5.5 0 150 Lemonade (Hi-C) 2.70 5.5 0 210 Orange Crush 2.70 10.5 0 240 Tang 2.70 5.1 0 180 Powerade 2.75 4 0 115 Coke-diet,Cherry 2.80 0 34 0 Grape Juice White (Welch's) 2.80 7.8 0 240 Mellow Yellow 2.80 10.1 51 177 Mr. Pibb 2.80 0 40 150 Orange Soda (Minute Maid) 2.80 11.2 0 180 Fruit Punch (Hawaiian) 2.82 10.2 0 120 Squirt 2.85 9.5 0 0 Tea-iced (Lipton Brisk) 2.87 7 9 50 7 up-Upside Down 2.90 6.3 0 200 Cranberry Juice-White 2.90 5.5 0 175 Dr Pepper 2.92 9.5 40 160 Gatorade 2.95 5.5 0 75 Tea-iced (Lemon sweetened Nestea) 2.97 9 16.6 90 Ginger Ale (Canada Dry) 3.00 8.25 0 120 Grape White (Diet Rite) 3.00 0 0 0 Grapefruit Juice 3.00 8.75 0 150 Kool-Aid Jammers-Cherry 3.00 5.1 0 160 Sierra Mist 3.00 5.5 0 140 Surge 3.02 10 51 170 Tea-Green (Nestea) 3.04 5 11-26 120 Pepsi One 3.05 0 36 1.5 Mountain Dew-diet, Code Red 3.10 0 0 0 Pepsi-Wild Cherry 3.10 5.7 0 240 V8 Splash-Berry Blend 3.10 5.5 0 105 Vinegar, cider 3.10 0 0 0 Fresca 3.20 0 0 0 Orange Strawberry Banana (Dole) 3.20 6.3 0 180 Propel 3.20 0.4 0 0 Tea-iced (Snapple) 3.20 7.6 31.5 120 Tea-iced (Diet Snapple ) 3.20 0 0 0 Jim Muenzenberger, D.D.S.