Download 2018 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

400 Refreshing Punch Recipes

TABLE OF CONTENTS 1. Yellow Fruit Punch 2. Zesty Punch Sipper 3. Wassail Punch 4. Watermelon Punch 5. What Hit Me Punch 6. Whisky Punch 7. White Grape~ Tangerine~ & Asti-Spumante Punch 8. White House Pink Fruit Punch (En) 9. White Sangria Punch (Nonalcholic) 10. "No Punch" Champagne 11. "Sting-Like-A-Bee" Punch 12. 1, 2, 3, Punch 13. 4-Fruit Wedding Punch 14. 7-Up Punch 15. Alkoholfreier Planter`s Punch 16. Aloha Fruit Punch 17. Amber Cider Punch 18. Amelia Island Punch 19. Angelfrost Punch 20. Annie's Rosemary Fruit Punch 21. Apple Orchard Punch 22. Apple Slush Punch 23. Apricot Punch 24. Apricot Mist Punch 25. Artillery Punch 26. Artillerymen's Punch 27. Atlanta Coffee Ice Cream Punch 28. Aunt Cindy's Punch 29. Aunt Louise's Wassail Punch 30. Autumn Apple Punch 31. Autumn Punch 32. Aztec Punch 33. Banana Punch 34. Banana-Orange-Pineapple Punch 35. Becky's Wedding Punch 36. Bernice's Holiday Punch 37. Berry Colada Punch 38. Billy Clude Punch 39. Brandy Milk Punch 40. Bridal Fruit Punch (Non-Alcholic) 41. Bridal Sweet Punch 42. Brides Lunch Punch 43. Brown Cow Punch 44. Bubbling Jade Punch 45. Canadian Punch 46. Caribbean Guava Punch 47. Champagne Fruit Punch 48. Champagne Punch 49. Chatham Artillery Punch 50. Cheery Cherry Punch 51. Cherry Tea Punch 52. Chocolate Punch 53. Christmas Cherry Berry Punch 54. Christmas Cranberry Punch 55. Christmas Party Punch 56. Christmas Rum Punch 57. Christmas Snow Punch 58. Cider And Brandy Punch 59. Cider Fruit Punch A La Normande 60. Cider Punch 61. -

Keurig to Acquire Dr Pepper Snapple for $18.7Bn in Cash

Find our latest analyses and trade ideas on bsic.it Coffee and Soda: Keurig to acquire Dr Pepper Snapple for $18.7bn in cash Dr Pepper Snapple Group (NYSE:DPS) – market cap as of 17/02/2018: $28.78bn Introduction On January 29, 2018, Keurig Green Mountain, the coffee group owned by JAB Holding, announced the acquisition of soda maker Dr Pepper Snapple Group. Under the terms of the reverse takeover, Keurig will pay $103.75 per share in a special cash dividend to Dr Pepper shareholders, who will also retain 13 percent of the combined company. The deal will pay $18.7bn in cash to shareholders in total and create a massive beverage distribution network in the U.S. About Dr Pepper Snapple Group Incorporated in 2007 and headquartered in Plano (Texas), Dr Pepper Snapple Group, Inc. manufactures and distributes non-alcoholic beverages in the United States, Mexico and the Caribbean, and Canada. The company operates through three segments: Beverage Concentrates, Packaged Beverages, and Latin America Beverages. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, mineral and coconut water, and mixers, as well as manufactures and sells Mott's apple sauces. The company sells its flavored CSD products primarily under the Dr Pepper, Canada Dry, Peñafiel, Squirt, 7UP, Crush, A&W, Sunkist soda, Schweppes, RC Cola, Big Red, Vernors, Venom, IBC, Diet Rite, and Sun Drop; and NCB products primarily under the Snapple, Hawaiian Punch, Mott's, FIJI, Clamato, Bai, Yoo- Hoo, Deja Blue, ReaLemon, AriZona tea, Vita Coco, BODYARMOR, Mr & Mrs T mixers, Nantucket Nectars, Garden Cocktail, Mistic, and Rose's brand names. -

Fund Holdings As of 6/30/2021 Massmutual Balanced Fund Invesco Prior to 5/1/2021, the Fund Name Was Massmutual Premier Balanced Fund

Fund Holdings As of 6/30/2021 MassMutual Balanced Fund Invesco Prior to 5/1/2021, the Fund name was MassMutual Premier Balanced Fund. Fund Shares or Par Position Market Security Name Ticker CUSIP Weighting % Amount Value Apple Inc AAPL 037833100 3.91 48,433 6,633,384 Microsoft Corp MSFT 594918104 3.45 21,552 5,838,437 USTREAS T-Bill Auction Ave 3 Mon 1.69 2,862,977 JPMorgan Chase & Co JPM 46625H100 1.56 16,948 2,636,092 Verizon Communications Inc VZ 92343V104 1.45 43,768 2,452,321 The Home Depot Inc HD 437076102 1.42 7,556 2,409,533 Intel Corp INTC 458140100 1.29 38,961 2,187,271 Procter & Gamble Co PG 742718109 1.04 13,105 1,768,258 Cisco Systems Inc CSCO 17275R102 1.03 32,830 1,739,990 UnitedHealth Group Inc UNH 91324P102 1.00 4,215 1,687,855 Comcast Corp Class A CMCSA 20030N101 0.94 28,021 1,597,757 AT&T Inc T 00206R102 0.91 53,587 1,542,234 Oracle Corp ORCL 68389X105 0.83 18,031 1,403,533 Deere & Co DE 244199105 0.76 3,635 1,282,101 Accenture PLC Class A ACN G1151C101 0.74 4,237 1,249,025 Johnson Controls International PLC JCI G51502105 0.74 18,185 1,248,037 Visa Inc Class A V 92826C839 0.71 5,152 1,204,641 Texas Instruments Inc TXN 882508104 0.70 6,128 1,178,414 Costco Wholesale Corp COST 22160K105 0.67 2,850 1,127,660 Bank of America Corp BAC 060505104 0.64 26,192 1,079,896 Broadcom Inc AVGO 11135F101 0.63 2,223 1,060,015 Abbott Laboratories ABT 002824100 0.57 8,348 967,784 Target Corp TGT 87612E106 0.56 3,949 954,631 Honeywell International Inc HON 438516106 0.56 4,324 948,469 Goldman Sachs Group Inc GS 38141G104 0.53 2,374 901,004 -

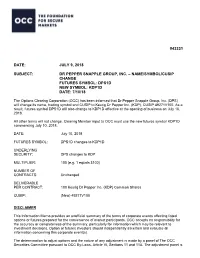

Dr Pepper Snapple Group, Inc. – Name/Symbol/Cusip Change Futures Symbol: Dps1d New Symbol: Kdp1d Date: 7/10/18

#43331 DATE: JULY 9, 2018 SUBJECT: DR PEPPER SNAPPLE GROUP, INC. – NAME/SYMBOL/CUSIP CHANGE FUTURES SYMBOL: DPS1D NEW SYMBOL: KDP1D DATE: 7/10/18 The Options Clearing Corporation (OCC) has been informed that Dr Pepper Snapple Group, Inc. (DPS) will change its name, trading symbol and CUSIP to Keurig Dr Pepper Inc. (KDP), CUSIP 49271V100. As a result, futures symbol DPS1D will also change to KDP1D effective at the opening of business on July 10, 2018. All other terms will not change. Clearing Member input to OCC must use the new futures symbol KDP1D commencing July 10, 2018. DATE: July 10, 2018 FUTURES SYMBOL: DPS1D changes to KDP1D UNDERLYING SECURITY: DPS changes to KDP MULTIPLIER: 100 (e.g. 1 equals $100) NUMBER OF CONTRACTS: Unchanged DELIVERABLE PER CONTRACT: 100 Keurig Dr Pepper Inc. (KDP) Common Shares CUSIP: (New) 49271V100 DISCLAIMER This Information Memo provides an unofficial summary of the terms of corporate events affecting listed options or futures prepared for the convenience of market participants. OCC accepts no responsibility for the accuracy or completeness of the summary, particularly for information which may be relevant to investment decisions. Option or futures investors should independently ascertain and evaluate all information concerning this corporate event(s). The determination to adjust options and the nature of any adjustment is made by a panel of The OCC Securities Committee pursuant to OCC By-Laws, Article VI, Sections 11 and 11A. The adjustment panel is comprised of representatives from OCC and each exchange which trades the affected option. The determination to adjust futures and the nature of any adjustment is made by OCC pursuant to OCC By- Laws, Article XII, Sections 3, 4, or 4A, as applicable. -

Product Differentiation and Mergers in the Carbonated Soft Drink Industry

Product Differentiation and Mergers in the Carbonated Soft Drink Industry JEAN-PIERRE DUBE´ University of Chicago Graduate School of Business Chicago, IL 60637 [email protected] I simulate the competitive impact of several soft drink mergers from the 1980s on equilibrium prices and quantities. An unusual feature of soft drink demand is that, at the individual purchase level, households regularly select a variety of soft drink products. Specifically, on a given trip households may select multiple soft drink products and multiple units of each. A concern is that using a standard discrete choice model that assumes single unit purchases may understate the price elasticity of demand. Tomodel the sophisticated choice behavior generating this multiple discreteness,Iuse a household-level scanner data set. Market demand is then computed by aggregating the household estimates. Combining the aggregate demand estimates with a model of static oligopoly, I then run the merger simulations. Despite moderate price increases, I find substantial welfare losses from the proposed merger between Coca-Cola and Dr. Pepper. I also find large price increases and corresponding welfare losses from the proposed merger between Pepsi and 7 UP and, more notably, between Coca-Cola and Pepsi. 1. Introduction With the advent of aggregate brand-level data collected at supermarket checkout scanners, researchers have begun to use structural econo- metric models for policy analysis. The rich content of scanner data enables the estimation of demand systems and their corresponding cross-price elasticities. The areas of merger and antitrust policy have been strong beneficiaries of these improved data. Recent advances in structural approaches to empirical merger analysis consist of combining Iamvery grateful to my thesis committee: David Besanko, Tim Conley, Sachin Gupta, and Rob Porter. -

Van Houtte® 100 Celebrate Like Masters Official

VAN HOUTTE® 100TH CELEBRATE LIKE MASTERS OFFICIAL CONTEST RULES AND REGULATIONS IMPORTANT: PLEASE READ THESE OFFICIAL RULES AND REGULATIONS BEFORE ENTERING THE VAN HOUTTE CELEBRATE LIKE MASTERS CONTEST (THE "CONTEST"). BY ENTERING THE CONTEST, AN ENTRANT REPRESENTS THAT HE OR SHE SATISFIES ALL OF THE ELIGIBILITY REQUIREMENTS BELOW AND AGREES TO BE BOUND UNCONDITIONALLY BY THESE OFFICIAL RULES AND REGULATIONS AND ALL DECISIONS OF THE CONTEST ORGANIZER (defined below) AND THE CONTEST OPERATOR (defined below). NO PURCHASE NECESSARY. By entering this Contest (defined below), entrants agree to abide by these Official Rules and Regulations (the “Official Rules”). The decisions of the Organizer and the independent contest organization with respect to all aspects of the Contest are final and binding without right of appeal. The information you provide will only be used to administer the Contest in accordance with the Organizer’s privacy policy. 1. CONTEST PERIOD The Van Houtte® 100th Celebrate Like Masters Contest (the “Contest”) is organized by Keurig Canada Inc. (the “Contest Organizer”). The Contest begins on April 1st, 2019 (12:00:00 a.m. ET) and ends August 31, 2019 (11:59:59 p.m. ET) (the “Contest Period”). 2. ELIGIBILITY: NO PURCHASE NECESSARY. The Contest is open to all residents of Canada who have reached the age of majority at the time of Contest entry. Employees, agents and representatives of the Contest Organizers, and their respective affiliated companies, subsidiaries, and affiliated agencies, advertising and promotional agencies, suppliers of prizes, materials and services for the Contest, employees of participating establishments, or any other party directly associated with the holding of the Contest, as well as members of their immediate family, are excluded. -

OLSTEIN ALL CAP VALUE FUND SCHEDULE of INVESTMENTS March 31, 2021 (Unaudited) COMMON STOCKS - 84.7% Shares Value Advertising Agencies - 1.4% Omnicom Group, Inc

OLSTEIN ALL CAP VALUE FUND SCHEDULE OF INVESTMENTS March 31, 2021 (Unaudited) COMMON STOCKS - 84.7% Shares Value Advertising Agencies - 1.4% Omnicom Group, Inc. 140,000 $ 10,381,000 Aerospace & Defense - 1.9% L3Harris Technologies, Inc. 39,000 7,904,520 Raytheon Technologies Corporation 77,000 5,949,790 13,854,310 Air Delivery & Freight Services - 2.4% FedEx Corporation 35,000 9,941,400 United Parcel Service, Inc. - Class B 45,000 7,649,550 17,590,950 Airlines - 2.1% Delta Air Lines, Inc. (a) 158,000 7,628,240 JetBlue Airways Corporation (a) 353,000 7,180,020 14,808,260 Auto Manufacturers - 1.0% General Motors Company (a) 129,000 7,412,340 Beverages - 0.6% Keurig Dr Pepper, Inc. (b) 124,000 4,261,880 Building Products - 1.2% Carrier Global Corporation 198,000 8,359,560 Capital Markets - 1.4% Goldman Sachs Group, Inc. 31,500 10,300,500 Chemicals - 1.8% Corteva, Inc. 201,000 9,370,620 Eastman Chemical Company 31,000 3,413,720 12,784,340 Commercial Banks - 5.8% Citizens Financial Group, Inc. 154,000 6,799,100 Fifth Third Bancorp 228,000 8,538,600 Prosperity Bancshares, Inc. 68,000 5,092,520 U.S. Bancorp 181,000 10,011,110 Wells Fargo & Company 280,000 10,939,600 41,380,930 Commercial Services - 1.6% Moody's Corporation 18,500 5,524,285 S&P Global, Inc. 17,000 5,998,790 11,523,075 Communications Equipment - 1.9% Cisco Systems, Inc. 266,000 13,754,860 Computers - 1.9% Apple, Inc. -

Carbonated Soft Drinks in the US Through 2025

Carbonated Soft Drinks in the U.S. through 2025: Market Essentials 2021 Edition (To be published September 2021. Data through 2020. Market projections through 2025.) More than 120 Excel tables plus an executive summary detailing trends and comprehensive profiles of leading companies, their brands and their strategies. his comprehensive market research report on the number-two T beverage category examines trends and top companies' For A Full strategies. It provides up-to-date statistics on leading brands, Catalog of packaging, quarterly growth and channels of distribution. It also Reports and offers data on regional markets, pricing, demographics, Databases, advertising, five-year growth projections and more. Go To The report presents the data in Excel spreadsheets, which it supplements with a concise executive summary highlighting key bmcreports.com developments including the impact of the coronavirus pandemic as well as a detailed discussion of the leading carbonated soft drink (CSD) companies. INSIDE: REPORT OVERVIEW A brief discussion of key AVAILABLE FORMAT & features of this report. 2 PRICING TABLE OF CONTENTS Direct Download A detailed outline of this Excel sheets, PDF, PowerPoint & Word report’s contents and data tables. 7 $4,395 To learn more, to place an advance order or to inquire about SAMPLE TEXT AND additional user licenses call: Charlene Harvey +1 212.688.7640 INFOGRAPHICS ext. 1962 [email protected] A few examples of this report’s text, data content layout and style. 13 HAVE Contact Charlene Harvey: 212-688-7640 x 1962 QUESTIONS? [email protected] Beverage Marketing Corporation 850 Third Avenue, 13th Floor, New York, NY 10022 Tel: 212-688-7640 Fax: 212-826-1255 The answers you need Carbonated Soft Drinks in the U.S. -

Strategic Analysis of the Coca-Cola Company

STRATEGIC ANALYSIS OF THE COCA-COLA COMPANY Dinesh Puravankara B Sc (Dairy Technology) Gujarat Agricultural UniversityJ 991 M Sc (Dairy Chemistry) Gujarat Agricultural University, 1994 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Executive MBA O Dinesh Puravankara 2007 SIMON FRASER UNIVERSITY Summer 2007 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author APPROVAL Name: Dinesh Puravankara Degree: Master of Business Administration Title of Project: Strategic Analysis of The Coca-Cola Company. Supervisory Committee: Mark Wexler Senior Supervisor Professor Neil R. Abramson Supervisor Associate Professor Date Approved: SIMON FRASER UNIVEliSITY LIBRARY Declaration of Partial Copyright Licence The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection (currently available to the public at the "lnstitutional Repository" link of the SFU Library website <www.lib.sfu.ca> at: ~http:llir.lib.sfu.calhandle/l8921112>)and, without changing the content, to translate the thesislproject or extended essays, if technically possible, to any medium or format for the purpose of preservation of the digital work. -

Introducing Keurig Dr Pepper

Introducing Keurig Dr Pepper Investor Presentation Creating a New Challenger In the Beverage Industry Highly Confidential January 2018 Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of applicable securities laws and regulations. These forward-looking statements can generally be identified by the use of words such as “anticipate,” “expect,” “believe,” “could,” “estimate,” “feel,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will,” “would,” and similar words, phrases or expressions and variations or negatives of these words, although not all forward-looking statements contain these identifying words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results of the combined company following the proposed merger, the anticipated benefits of the proposed merger, including estimated synergies, the expected timing of completion of the proposed merger and related transactions and other statements that are not historical facts. These statements are based on the current expectations of Keurig Green Mountain Parent Holdings Corp. and Dr Pepper Snapple Group, Inc. management and are not predictions of actual performance. These forward-looking statements are subject to a number of risks and uncertainties regarding the combined company’s business and the proposed merger and actual results may differ materially. These risks and uncertainties -

GMCR) Harrison Freund September 23, 2010 Agenda

McIntire Investment Institute At the University of Virginia Green Mountain Coffee Roasters (NASDAQ: GMCR) Harrison Freund September 23, 2010 Agenda • Business Description • Thesis/Key Points • Misperceptions • Risks/What Signs Would Indicate We Are Wrong? • How It Plays Out • Recommendations – VAR will be included in various parts throughout Business Description • GMCR sells the Keurig/K-Cup system for coffee, tea, and coca. – 200 Types of drinks offered in K-Cups – Sold to the AH (At home, though department stores, 19,000*) and AFH (Away from Home, sold to office supply stores) • Specialty Coffee Business Unit (SCBU) sells coffee beans and grounds to retail stores and Keurig products to supermarkets (13,450) • GMCR hedges part of is coffee—As of June 26, 2010 58% was fixed • Vertical integration Thesis PointBusinessPatent 2: Add expiration Description in Patent Expiration • The Keurig and specifically the high margin K-Cups account for a large part of Green Mountain’s revenue. Net sales (in millions) 2009 2008 2007 • SCBU . $382.4 $285.9 $230.5 • Keurig . $420.6 $214.4 $111.2 • Total Company . $803.0 $500.3 $341.7 Business Model—Razor and Blade Zero-Margin Keurig coffee maker Very high-margin K-Cups, try to sell many. ThesisSelf Point defeating 1: Self Defeating business Business strategy Strategy • The business models works as follows: sell the Keurig units close to cost and then mark up the K-Cups with only GMCR’s coffee. (Razor and blade) Thesis Point 1: Self Defeating Business Strategy • The higher income, more “green” customers actually prefers the less waste of the reusable cup and ability to use their own coffee. -

Adams & Brooks Unveils New Hawaiian Punch® Candy

FOR IMMEDIATE RELEASE ADAMS & BROOKS UNVEILS NEW HAWAIIAN PUNCH® CANDY JELLIES; A Fun and Delicious New Way to Punch Up Non-Chocolate Chewy Sales! LOS ANGELES, May 23, 2017 - Adams & Brooks invites you to punch up your non-chocolate chewy sales with an exciting addition to its successful Hawaiian Punch line: NEW Hawaiian Punch® Candy Jellies. These new soft, round jellies are made with top Hawaiian Punch® flavors and packaged in high impact bags. “Hawaiian Punch® is one of those great cross-generational brands that everyone has grown up with, knows and loves … from Boomers to Millennials and even Generation Z,” says Shelly Clarey, Vice President of Marketing and Sales for Adams & Brooks. “The Hawaiian Punch® brand and flavors are perfect for chewy candy.” The Candy Jellies are a new addition to Adams & Brooks line of Hawaiian Punch confections. “Launched last year, our Hawaiian Punch® Candy Chews have done exceptionally well,” says Clarey. “Both the Chews and new Jellies are an ideal way to cater to consumer interest in non-chocolate chewy candy which has been on fire. IRI data shows non-chocolate chewy candy outperforming both chocolate and total candy/gum sales. Recent IRI data also shows candy jellies growing five times faster than other chewy categories.” The new Hawaiian Punch® Candy Jellies will feature five flavors: Fruit Juicy Red™, Orange Ocean™, Lemon Berry Squeeze™, Berry Blue Typhoon™ and Green Berry Rush™. Launching summer of 2017, the jellies will be available in four pack types: Standard Count Good, King Size Count Good, Peg bag and Stand Up Pouch Bag.