116873 Project Temple Intro

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

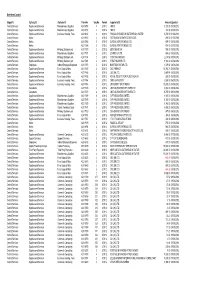

Body Name Body Expense Area Expense Type Expense Code Date Paid Transaction Number Amount Category Supplier Name Registration Nu

Transaction Registration Body Name Body Expense Area Expense Type Expense Code Date Paid Amount Category Supplier Name Supplier ID Number Number North Lincolnshire Council http://data.ordnancesurvey.co.uk/id/7000000000025623 Childrens & Education Payments To Private Orgs 6002 08/04/2015 4917918 4,479.90 REVENUE Aamina Homecare ISF0001F North Lincolnshire Council http://data.ordnancesurvey.co.uk/id/7000000000025623 Adult Social Care Payments To Private Orgs 6002 10/04/2015 4917900 570.40 REVENUE Abbey Health & Social Care Group Ltd 04738023 ABB0054B North Lincolnshire Council http://data.ordnancesurvey.co.uk/id/7000000000025623 Childrens & Education Payments To Private Orgs 6002 08/04/2015 4917921 18,657.03 REVENUE Abbey Health & Social Care Group Ltd ISF0004F North Lincolnshire Council http://data.ordnancesurvey.co.uk/id/7000000000025623 Childrens & Education Payments To Private Orgs 6002 10/04/2015 4917900 12,305.55 REVENUE Abbey Health & Social Care Group Ltd 04738023 ABB0054B North Lincolnshire Council http://data.ordnancesurvey.co.uk/id/7000000000025623 Culture,Env,Reg & Planning Cap Other Costs A085 17/04/2015 4922809 1,159,720.06 CAPITAL Able Humber Ports Ltd ABL0020L North Lincolnshire Council http://data.ordnancesurvey.co.uk/id/7000000000025623 Corporate And Democratic Core It Software-Maintenance 5053 23/04/2015 4915666 999.00 REVENUE Acenseo Ltd ACE0064E North Lincolnshire Council http://data.ordnancesurvey.co.uk/id/7000000000025623 Adult Social Care Payments To Voluntary Orgs 6001 23/04/2015 4923967 19,283.64 REVENUE Action -

Mary Rose Trust 2013 Annual Report

Annual Review 2013 Learning Conservation Heritage Mary Rose Annual Review 2013_v11.indd 1 20/06/2013 15:49 2 www.maryrose.org Annual Review 2013 Mary Rose Annual Review 2013_v11.indd 2 20/06/2013 15:49 Annual Review 2013 www.maryrose.org 3 Mary Rose Annual Review 2013_v11.indd 3 20/06/2013 15:49 4 www.maryrose.org Annual Review 2013 Mary Rose Annual Review 2013_v11.indd 4 20/06/2013 15:50 Chairman & Chief Executive Foreword This last year has been momentous for the Mary Rose Trust, In tandem with this, much research is opening up to the Trust and the achievements have been of national and international and is now higher in our priorities. The human remains, importance. The Mary Rose Project has been an exemplar now boldly explained more fully in our exhibition, can be of both excavation and conservation over its thirty plus year studied scientifically for the secrets they can reveal. Medical history, but experts from afar now declare the new museum research is included within our ambitions and we will be to be the exemplar of exhibition for future generations. New working with leading universities in this area. Similarly, standards have been set, and the success of our ambition has our Head of Collections is already involved in pioneering been confirmed by the early comments being received. work in new forms of conservation techniques, which could revolutionise the affordability and timescales of future Elsewhere in this review you will read more about the projects. These are just two examples of a number of areas challenges that were met in reaching this point. -

OFFICIAL RFI2947 - Annex A

RFI2947 - Annex A List of suppliers, subcontractors and consultants that have or will be involved with the construction of Northstowe New Town ABM Maintenance Ltd Actavo Aecom Infrastructure & Environment Uk Ltd Aggregate Industries All Pump Solutions LLP Allies and Morrison Urban Practitioners Alpheus Environmental Ltd Andrew Mcewan Anglian Water Services Ltd Arcadis Consulting (UK) Limited Aristocaters Arup Ashlea Limited Atkins Ltd Attol Blue Ltd Avison Young (UK) Ltd Dr Andrew Batey Barcham Trees Plc F.R. Barton & Son Batth Contracts Limited Berrys Bidwells BioMarsh Environmental Ltd British Telecoms G.M. Briton (Public Works) Ltd BRC Limited Brookfield Contracting & Farming Ltd Bryan Lecoche Ltd Bunzl UK Limited t/a Lee Brothers OFFICIAL RFI2947 - Annex A Bureau Veritas UK Ltd WS Atkins Avison Young Bains Civil Engineering Ltd British Gas Business Bryan Cave Leighton Paisner Buildbase Camline Cambridge Limited Cambridge Archaeological Unit Cambridge Printing Solutions Cambridge Water Business Cambridgeshire County Council Camfaud Concrete Pumps Ltd Campbell Reith Cardinalis Concrete Carmichael Site Services Carter Jonas Chris Blandford Associates C-Elect Associates Ltd CET Structures Limited CgMs Heritage Civils & Lintels Clarke Demolition Company Cleankill Clerkin Civils CMP (UK) Ltd Colin Warnock Associates Ltd Collins Leisure and CL Travel Commission Air Communique Complete Ground Management Ltd OFFICIAL RFI2947 - Annex A Cosmo Services Ltd CPM Surveys Limited Craft Services Group Ltd Creative Concern Currie and Brown Ltd Cushman & Wakefield Debenham Tie Leung CTS Bridges Limited Dayfold Ltd Deloitte LLP Decipher Programme Management Limited Demomaster Design Council CABE The Drainage Office Drivers Joan DTZ DWF LLP C P Dynes Dyno-Rod Dynniq UK Limited Eastern Concrete Ecologia Environmental Solutions Ltd. -

Spend Over £500 March 2020

Spend Over £500 for the month of March 2020 Date of Expenditure Department Beneficiary Purpose of Expenditure Amount (net) Merchant Category 20-Mar-20 Asset Asset Management M B H INDUSTRIAL SERVICES LTD Bldgs - Planned Maintenance 1,850.00 PREMISES RELATED EXPENDITURE 20-Mar-20 Asset Asset Management M B H INDUSTRIAL SERVICES LTD Bldgs - Planned Maintenance 550.00 PREMISES RELATED EXPENDITURE 25-Mar-20 Asset Asset Management M B H INDUSTRIAL SERVICES LTD Bldgs - Plumbing 714.00 PREMISES RELATED EXPENDITURE 27-Mar-20 Asset Asset Management T & C ELECTRICAL CONTRACTORS LTD Bldgs - Compliance Costs 1,249.87 PREMISES RELATED EXPENDITURE 11-Mar-20 Improvements HRA T & C ELECTRICAL CONTRACTORS LTD Refurbishment 5,785.00 CAPITAL 13-Mar-20 Asset Asset Management T & C ELECTRICAL CONTRACTORS LTD Bldgs - Electrical Repairs 6,710.73 PREMISES RELATED EXPENDITURE 13-Mar-20 Asset Asset Management T & C ELECTRICAL CONTRACTORS LTD Bldgs - Electrical Repairs 8,972.68 PREMISES RELATED EXPENDITURE 13-Mar-20 Asset Asset Management T & C ELECTRICAL CONTRACTORS LTD Bldgs - Electrical Repairs 11,450.13 PREMISES RELATED EXPENDITURE 13-Mar-20 Asset Asset Management T & C ELECTRICAL CONTRACTORS LTD Bldgs - Compliance Costs 2,250.00 PREMISES RELATED EXPENDITURE 13-Mar-20 HRA, Grounds, Nursery T & C ELECTRICAL CONTRACTORS LTD Bldgs - Compliance Costs 560.08 PREMISES RELATED EXPENDITURE 18-Mar-20 Improvements HRA T & C ELECTRICAL CONTRACTORS LTD Refurbishment 2,763.09 CAPITAL 18-Mar-20 Tenant - Extra Care T & C ELECTRICAL CONTRACTORS LTD Bldgs - Planned Maintenance -

Operations Manual Brands Hatch 16 - 18 October Round 6

2020 OPERATIONS MANUAL BRANDS HATCH 16 - 18 OCTOBER ROUND 6 QUATTRO GROUP ROUND BRANDS HATCH GP 16.17.18 OCTOBER 2020 OPERATIONS MANUAL Contents • Summarised timetable • Minute by minute timetable • 2020 Incident Protocol incorporating COVID risk mitigation - COVID Trackside Protocol Race - COVID BSB MT Protocol • Communications • Track/Emergency Services plans • TK data and turns numbering • Teams final instructions – FULL • TV Production • Pre-event sign plan • Photographer “red-zone” plan • MCRCB permits and authorisations • Race entry lists QUATTRO GROUP ROUND BRANDS HATCH GP – 16.17.18 OCTOBER 2020 TIMETABLE FRIDAY 09.30 – 09.45 Santander Salt International Sidecar Superprix + Molson Group British Sidecars Free Practice 1 10.00 – 10.25 Honda British Talent Cup Free Practice 1 10.35 – 11.00 Pirelli National Superstock 600 in association with Black Horse Free Practice 1 11.10 – 11.35 Quattro Group British Supersport/British GP2 Free Practice 1 11.45 – 12.10 Pirelli National Superstock 1000 in association with Black Horse Free Practice 1 12.20 – 12.40 Ducati Performance TriOptions Cup Free Practice 12.50 – 13.10 // Santander Salt International Sidecar Superprix + Molson Group British Sidecars Free Practice 2 13.25 – 13.50 Pirelli National Superstock 600 in association with Black Horse Free Practice 2 14.00 – 14.25 Quatrro Group British Supersport/British GP2 Free Practice 2 14.35 – 15.05 Honda British Talent Cup Free Practice 2 15.15 – 16.00 BENNETTS BRITISH SUPERBIKES IN ASSOCIATION WITH PIRELLI Free Practice 1 16.10 – 16.35 Pirelli -

Download Report

Business Superbrands 2015 Top 20 Business Superbrands BRAND CATEGORY British Airways 1 Travel - Airlines Apple 2 Technology - Hardware & Equipment Virgin Atlantic 3 Travel - Airlines Microsoft 4 Information Technology - General Visa 5 Financial - Credit Cards & Payment Solutions MasterCard 6 Financial - Credit Cards & Payment Solutions Google 7 Advertising Solutions FedEx 8 Courier, Delivery & Postal Services IBM 9 Information Technology - General Samsung 10 Technology - Hardware & Equipment Johnson & Johnson 11 Pharmaceuticals & Medical Equipment BT 12 Telecommunications - General Rolls-Royce Group 13 Aerospace & Defence American Express 14 Financial - Credit Cards & Payment Solutions Royal Mail 15 Courier, Delivery & Postal Services PayPal 16 Financial - Credit Cards & Payment Solutions BP 17 Oil & Gas - General Shell 18 Oil & Gas - General Bosch 19 Construction - Tools & Equipment Manufacturers Boeing 20 Aerospace & Defence Category Winners BRAND CATEGORY Deloitte Accountancy & Business Services Google Advertising Solutions Rolls-Royce Group Aerospace & Defence Tate & Lyle Agribusiness BMA (British Medical Association) Associations & Accreditations BASF Chemicals Haymarket Conferences & Events - Owners & Organisers NEC Conferences & Events - Venues Wickes Construction - Builders Merchants & Distributors Balfour Beatty Construction - Consultancy, Design, Build & Management Pilkington Construction - Materials HSS Hire Construction - Plant & Tool Hire Bosch Construction - Tools & Equipment Manufacturers FedEx Courier, Delivery & Postal -

Annual Procurement Report 2018/2019

FALKIRK COUNCIL ANNUAL PROCUREMENT REPORT 1 April 2018 – 31 March 2019 CONTENTS 1. INTRODUCTION...................................................................................................... 3 2. ANNUAL PROCUREMENT REPORT OWNERSHIP .............................................. 3 3. SUMMARY OF REGULATED PROCUREMENTS COMPLETED........................... 4 4. REVIEW OF REGULATED PROCUREMENT COMPLIANCE ................................ 4 5. FUTURE REGULATED PROCUREMENTS SUMMARY ........................................ 6 6. LOCAL SUPPLIERS, SMES & THIRD SECTOR .................................................... 6 7. COLLABORATION .................................................................................................. 8 8. COMMUNITY BENEFIT SUMMARY ..................................................................... 10 9. SUPPORTED BUSINESSES SUMMARY ............................................................. 11 10. PROCURING FOR THE FUTURE ......................................................................... 12 11. PROCUREMENT SAVINGS & BENEFITS ............................................................ 13 12. CONCLUSION ....................................................................................................... 13 APPENDIX A – GLOSSARY OF PROCUREMENT TERMINOLOGY ............................ 14 APPENDIX B – SUMMARY OF COMPLETED REGULATED PROCUREMENTS AND / OR CONTRACTS >=£50,000 .......................................................................................... 18 APPENDIX C – PROCUREMENT STRATEGY -

Building Progress Together

Grafton Group plc Grafton Group Annual Report and Accounts 2020 Building Progress Together Grafton Group plc Annual Report and Accounts 2020 Introduction Building Progress Together Our Business Operating Safely During We demonstrated the strength and resilience Covid-19 of our organisation by responding to the Health and safety is a fundamental priority. challenges of 2020 while continuing to Our branches, stores and manufacturing locations evolve our business and strategy. continue to operate to the highest health and safety standards in line with Covid-19 guidance. More information on page 30 More information on page 29 1 In This Report Overview Grafton Group plc is an 2020 Highlights 2 At a Glance 4 international distributor of Our Top Brands 6 Our Story 8 building materials to trade Our Purpose and Values 10 Investment Case 12 customers and has leading Sustainability Summary 14 Stakeholder Engagement 16 positions in its markets in the Strategic Report UK, Ireland and the Netherlands. Chairman’s Statement 20 Business Model 24 Grafton is also the market Our Strategy 26 Chief Executive Officer’s Review 30 leader in the DIY, Home and Key Performance Indicators 34 Sectoral and Strategic Review 38 Garden market in Ireland and is – Distribution 38 – Retail 48 the largest manufacturer of dry – Manufacturing 50 Financial Review 52 mortar in the UK. Risk Management 56 Sustainability 66 Corporate Governance Board of Directors and Secretary 78 Directors’ Report on Corporate Governance 80 Audit and Risk Committee Report 88 Nomination Committee -

December 2015

Gateshead Council Strgrpcc(T) Cipfsubj(T) Cipfsubs(T) TransNo Sequence noPeriod Supplier ID(T) Amount Updated Communities & Environment Supplies and ServicesComms & Computing148018018 37 201509 O2 (UK) LTD 39 09/12/2015 Communities & Environment Supplies and ServicesCatering & Provisions41138289 1 201509 BATLEYS LTD 523.66 14/12/2015 Communities & Environment Supplies and ServicesCatering & Provisions41138289 2 201509 BATLEYS LTD 236 14/12/2015 Communities & Environment Supplies and ServicesCatering & Provisions41139560 1 201509 BATLEYS LTD 228.18 23/12/2015 Communities & Environment Supplies and ServicesCatering & Provisions41139560 2 201509 BATLEYS LTD 347.66 23/12/2015 Communities & Environment Supplies and ServicesComms & Computing148018259 1 201509 SITELINK COMMUNICATIONS LTD 352 30/12/2015 Communities & Environment Supplies and ServicesFurn, Equip & Mats 41137239 1 201509 ING LEASE UK LTD -428 04/12/2015 Communities & Environment Income: Fees and ChargesCharges, Fees & Income43880522 1 201509 REDACTED - Personal Information 736.25 07/12/2015 Communities & Environment Income: Fees and ChargesCharges, Fees & Income147023789 1 201509 GATESHEAD LEAM LANE ABC 1,169.00 16/12/2015 Communities & Environment Supplies and ServicesFurn, Equip & Mats 41137174 1 201509 BUNZL CLEANING & HYGIENE SUPPLIES486.38 07/12/2015 Communities & Environment Supplies and ServicesFurn, Equip & Mats 41137684 1 201509 BRENNTAG UK LTD 689.26 07/12/2015 Communities & Environment Supplies and ServicesFurn, Equip & Mats 41137175 1 201509 ING LEASE UK LTD -450 07/12/2015 -

Read PDF Version Here

VOLUME 23 | 5 MAY 2015 FACILITIES MANAGEMENT JOURNAL WHO ARE RICS' TEN FACES IN FACILITIES MANAGEMENT? Pest Control – How can you prevent pest problems? 22 32 40 READY, STEADY VENDING HEALTH AND SHOW... What is the future SAFETY Looking ahead to of the vending industry? The most ridiculous London’s FM show. H&S tales. FMJ.CO.UK EDITORIAL COMMENT this month... comment EDITORIAL SALES During the last few weeks everyone has been Editor [email protected] bombarded by propaganda from across the Charlie Kortens Tel: 01322 662289 [email protected] Sales Manager Mob: 07867 418830 Danny Grange Tel: 01322 476817 [email protected] is the cure all for Britain’s woes, particularly Assistant Editor & Social Mob: 07867 418994 the economy. Media Development ACCOUNTS Sarah O’Beirne Trish Boakes [email protected] A [email protected] Tel: 01322 476815 Consultant GROUP MD When you go to tender everyone submitting a bid has the answer for Cathy Hayward Nigel Copp you. The sales people (business development if you prefer) have entire [email protected] [email protected] With the Facilities Show coming up there will be rows upon rows of Mob: 07971 400332 Tel: 01322 662289 stands set up to sell you a product or service. So what do you need to PRODUCTION do to choose the right option for you? General Manager & Designer people notice, but that doesn’t mean that it is always the most Warren Knight important thing. [email protected] FMs will obviously have a budget that they work to but what are the Speak to FMs, service providers and other people from the industry PUBLISHER kpm media Unit 5, Gateway 20/25 Trading Estate, advocate every method of tendering from silent auctions to face to London Road, Swanley, Kent BR8 8GA face presentations. -

Supplier Price Increases

SUPPLIER PRICE INCREASES We actively work to reduce and minimise the level of price increases from our manufacturer and supplier base, but inevitably, to maintain availability and product quality, price increases occur. Please note these increases are for guidance only. PRICE CHANGE SUPPLIERS % CHANGE DATE Excel Composites (non-notified) Specific 05/01/2021 Bostik Ltd 7.0% - 13.0% 01/04/2021 Exitex Ltd 7.0% -10.0% 01/04/2021 Molan UK 6.0% - 25.0% 01/04/2021 Omega Flex Ltd (TracPipe) 6.0% 01/04/2021 Retford Wallcoverings Ltd 15.0% 12/04/2021 Eurocell Building Plastics Ltd 7.0% 01/05/2021 Pump House Pumps Ltd 3.7% 01/05/2021 Breedon Aggregates England Ltd Specific 03/05/2021 Fillcrete Ltd (non-notified) Specific 26/05/2021 Anglian Roofing Supplies 15.0% 14/06/2021 Bond It Ltd 5.0% - 15.0% 14/06/2021 East Ferry Timber Specific 14/06/2021 H&V Insulation Supplies 8.00% 14/06/2021 Karndean International Ltd Specific 14/06/2021 Norseal 5.0% - 9.5% 14/06/2021 TruSeal Plastics 10.0% 14/06/2021 Walsall Wheelbarrow Co Ltd 25.0% 14/06/2021 Forest Garden MM Timber 8.0% - 13.0% 16/06/2021 Alexander Cleghorn 6.0% - 10.0% 17/06/2021 SUPPLIER PRICE INCREASES We actively work to reduce and minimise the level of price increases from our manufacturer and supplier base, but inevitably, to maintain availability and product quality, price increases occur. Please note these increases are for guidance only. PRICE CHANGE SUPPLIERS % CHANGE DATE Centurion Europe Ltd 0.5% - 7.1% 21/06/2021 Draka Specific 21/06/2021 Gallagher Aggregates Specific 21/06/2021 Jaylow -

Gateshead Council Strgrp(T) Cipfsubj(T) Cipfsubs(T) Transno Seq No Period Supplier Id(T) Amount Updated Central Services Supplie

Gateshead Council Strgrp(T) Cipfsubj(T) Cipfsubs(T) TransNo Seq No Period Supplier id(T) Amount Updated Central Services Supplies and Services Miscellaneous Supplies 42316797 3 201112 HMCS 3,129.00 01/03/2012 Central Services Supplies and Services Miscellaneous Supplies 42316797 4 201112 HMCS 162.00 01/03/2012 Central Services Supplies and Services Licenses, Housing, Fees 42316814 2 201112 PINNACLE SCHOOLS (GATESHEAD) LIMITED 1,700.00 01/03/2012 Central Services Works 42316912 2 201112 PATTINSON SCIENTIFIC SERVICES 495.00 01/03/2012 Central Services Works 42317255 2 201112 BUREAU VERITAS HS&E LTD 899.00 05/03/2012 Central Services Works 42317258 2 201112 BUREAU VERITAS HS&E LTD 614.00 05/03/2012 Central Services Supplies and Services Printing, Stationery etc 42317309 2 201112 LEXIS NEXIS UK 995.00 05/03/2012 Central Services Supplies and Services Miscellaneous Supplies 42317311 2 201112 LOOMIS UK LTD 464.63 05/03/2012 Central Services Supplies and Services Printing, Stationery etc 42317314 2 201112 CUSTOM CARD IBS 2,233.50 05/03/2012 Central Services Supplies and Services Printing, Stationery etc 42317331 2 201112 PITNEY BOWES LTD 1,160.00 05/03/2012 Central Services Employees Indirect Employee Expenses 42317397 2 201112 BOURTON GROUP LTD 3,329.54 06/03/2012 Central Services Supplies and Services Furn, Equip & Mats 42317405 2 201112 OCE FINANCE 16,394.73 06/03/2012 Central Services Supplies and Services Furn, Equip & Mats 42317408 2 201112 OCE UK LTD 2,849.94 06/03/2012 Central Services Supplies and Services Furn, Equip & Mats 42317436