Building Assets, Unlocking Access

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

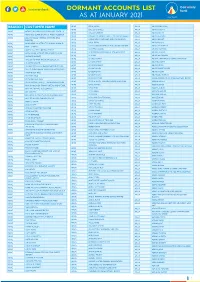

1612517024List of Dormant Accounts.Pdf

DORMANT ACCOUNTS LIST AS AT JANUARY 2021 BRANCH CUSTOMER NAME APAC OKAE JASPER ARUA ABIRIGA ABUNASA APAC OKELLO CHARLES ARUA ABIRIGA AGATA APAC ACHOLI INN BMU CO.OPERATIVE SOCIETY APAC OKELLO ERIAKIM ARUA ABIRIGA JOHN APAC ADONGO EUNICE KAY ITF ACEN REBECCA . APAC OKELLO PATRICK IN TRUST FOR OGORO ISAIAH . ARUA ABIRU BEATRICE APAC ADUKU ROAD VEHICLE OWNERS AND OKIBA NELSON GEORGE AND OMODI JAMES . ABIRU KNIGHT DRIVERS APAC ARUA OKOL DENIS ABIYO BOSCO APAC AKAKI BENSON INTRUST FOR AKAKI RONALD . APAC ARUA OKONO DAUDI INTRUST FOR OKONO LAKANA . ABRAHAM WAFULA APAC AKELLO ANNA APAC ARUA OKWERA LAKANA ABUDALLA MUSA APAC AKETO YOUTH IN DEVELOPMENT APAC ARUA OLELPEK PRIMARY SCHOOL PTA ACCOUNT ABUKO ONGUA APAC AKOL SARAH IN TRUST FOR AYANG PIUS JOB . APAC ARUA OLIK RAY ABUKUAM IBRAHIM APAC AKONGO HARRIET APAC ARUA OLOBO TONNY ABUMA STEPHEN ITO ASIBAZU PATIENCE . APAC AKULLU KEVIN IN TRUST OF OLAL SILAS . APAC ARUA OMARA CHRIST ABUME JOSEPH APAC ALABA ROZOLINE APAC ARUA OMARA RONALD ABURA ISMAIL APAC ALFRED OMARA I.T.F GERALD EBONG OMARA . APAC ARUA OMING LAMEX ABURE CHRISTOPHER APAC ALUPO CHRISTINE IN TRUST FOR ELOYU JOVIN . APAC ARUA ONGOM JIMMY ABURE YASSIN APAC AMONG BEATRICE APAC ARUA ONGOM SILVIA ABUTALIBU AYIMANI APAC ANAM PATRICK APAC ARUA ONONO SIMON ACABE WANDI POULTRY DEVELPMENT GROUP APAC ANYANGO BEATRASE APAC ARUA ONOTE IRWOT VILLAGE SAVINGS AND LOAN ACEMA ASSAFU APAC ANYANZO MICHEAL ITF TIZA BRENDA EVELYN . APAC ARUA OPIO JASPHER ACEMA DAVID APAC APAC BODABODA TRANSPORTERS AND SPECIAL APAC ARUA OPIO MARY ACEMA ZUBEIR APAC APALIKA FARMERS ASSOCIATION APAC ARUA OPIO RIGAN ACHEMA ALAHAI APAC APILI JUDITH APAC ARUA OPIO SAM ACHIDRI RASULU APAC APIO BENA IN TRUST OF ODUR JONAN AKOC . -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

Banking Sector Liberalisation in Uganda Process, Results and Policy Options

Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report Editors: Madhyam & SOMO December 2010 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report By: Lawrence Bategeka & Luka Jovita Okumu (Economic Policy Research Centre, Uganda) Editors: Kavaljit Singh (Madhyam), Myriam Vander Stichele (SOMO) December 2010 SOMO is an independent research organisation. In 1973, SOMO was founded to provide civil society organizations with knowledge on the structure and organisation of multinationals by conducting independent research. SOMO has built up considerable expertise in among others the following areas: corporate accountability, financial and trade regulation and the position of developing countries regarding the financial industry and trade agreements. Furthermore, SOMO has built up knowledge of many different business fields by conducting sector studies. 2 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Colophon Banking Sector Liberalisation in Uganda: Process, Results and Policy Options Research report December 2010 Authors: Lawrence Bategeka and Luka Jovita Okumu (EPRC) Editors: Kavaljit Singh (Madhyam) and Myriam Vander Stichele (SOMO) Layout design: Annelies Vlasblom ISBN: 978-90-71284-76-2 Financed by: This publication has been produced with the financial assistance of the Dutch Ministry of Foreign Affairs. The contents of this publication are the sole responsibility of SOMO and the authors, and can under no circumstances be regarded as reflecting the position of the Dutch Ministry of Foreign Affairs. Published by: Stichting Onderzoek Multinationale Ondernemingen Centre for Research on Multinational Corporations Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl Madhyam 142 Maitri Apartments, Plot No. -

Centenary Bank Uganda Strategy

Addressing Economic Strengthening for Vulnerable Girls: The Centenary Bank Uganda Strategy Nabakadde Sylivia, B.Com Accounting Manager Centenary Bank Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” 1 Summary Centenary Bank: Overview Role of women/girls in economic development Key issues affecting women/girls in Uganda Centenary Bank strategies to address the above issues Challenges & Way forward Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. 2 Centenary Bank: Overview Started as trust in 1985 & became full commercial bank in 1993. Currently the leading microfinance service provider in Uganda. Mission: To provide appropriate financial services especially microfinance to all people in Uganda, particularly in rural areas, in a sustainable manner and in accordance with the law. Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. 3 Overview Continued Network: The bank has its headquarters in Kampala with 67 networked branches countrywide Over160 ATMs, 62 of which are located offsite. Correspondent banks in US, UK, China, Kenya and Sudan. Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. 4 Role of women/girls in economic strengthening Women are: Training Managers (educating a child right from inception) Operations/finance Managers (major planners in the home) Relationship Managers (known to be at peace with all) Human Resource Managers (in charge of discipline and overall family welfare) Communication Managers Lawyers (take charge of the mishappenings in the home) Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. -

Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD

CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 2 Centenary Bank Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 We aim to provide appropriate financial services especially microfinance to all the people of Uganda particularly in rural areas. We are therefore at the forefront of increasing financial inclusion and reaching out to the unbanked population. Read our Chaiman’s Statement on page 8 Centenary Bank 3 Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 TABLE OF CONTENTS List of Acronyms 5 Vision, Mission and Ownership 6 Chairman’s Statement 8 Board of Directors 10 Managing Director’s Review 11 The Executive Management 13 Corporate Governance 14 Operational and financial review 23 Directors’ Report 30 Directors’ Responsibility For Financial Reporting 31 Report of Independent Auditors 32 Financial Statements 33 Statement of Comprehensive Income 33 Statement of Financial Position 34 Statement of Changes In Equity 35 Statement of Cash Flows 35 Notes To The Financial Statements 36 Sustainability Report 81 Bank Contact Information 98 4 Centenary Bank Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 LIST OF ACRONYMS ABI aBi Finance Ltd ACF Agricultural Credit Facility ALCO Asset and Liability Committee ATM Automated -

PBU AGENTS Central Region

PBU AGENTS Central Region Name of Agent or Outlet Place of Business District Abusha Junior (U) Ltd Bombo Luweero Parmer Financial Services Ltd Kapeeka Nakaseke Q&A Education and Management Consultancy Bombo Luweero Holy Saints Uganda Limited Bombo T/C Luweero Danortry Financial Link (U) Ltd Opposite PostBank Bombo Branch Luwero Dithcom Trading Co. Limited Opposite Centenary Bank ATM Luwero Glarison Technologies Limited Near the Barracks Luwero Nasu Express Outlet Bombo, near SR Fuel Station Luwero Nasu Express Outlet Opposite Bombo UPDF Play ground Luwero Uganda Post Limited Kyambogo Kampala Uganda Post Limited Nakawa Kampala NIK Tel Traders Nakawa Kampala Prime Secretarial Services Luzira Stage 6 Kampala ESSIE. RE Classic Fashions Biina Mutungo Kampala Nandudu Babra Kireka Wakiso Blessed Mina General Merchandise Kireka Wakiso Niktel Traders Pioneer Mall Kampala 6 GS Money Point Kireka Kampala Cinemax General Hardware Bweyogerere Wakiso Ariong Enterprises Mutungo Kampala Isip Connections Ltd Bugolobi Kampala Kireka BodaBoda Police Stage Co-Operative Kireka Kampala Savings and Credit Society Limited Chelanasta Cash Point Solutions Jinja Highway, Mukono Mukono Milly's Laundry Opposite UCU Main Gate Mukono Rana Phones 83 Enterprises Opp Kirinya Shopping Centre Wakiso Boadaph Financial Services Limited Sports Pro Hostel. Kampala Jeba (U) Limited Cwa 2 Street Kampala Tusaboomu Enterprises Ltd URA building, Nakawa Kampala Alpha Immanuel's Cash Point Najeera Road, Bweyogerere Wakiso Beulah Business Center Biina Road, Kunya Stage Kampala Kyobe -

Annual Report 2015

1 ANNUAL REPORT 2015 Annual Report & Financial Statements l 2015 2 Annual Report & Financial Statements l 2015 3 TABLE OF CONTENTS LIST OF ACRONYMS 4 FINANCIAL DEFINITIONS 5 BANK CONTACT INFORMATION 6 CHAIRMAN BOARD OF DIRECTORS’ STATEMENT 11 MANAGING DIRECTOR’S STATEMENT 14 STATEMENT OF CORPORATE GOVERNANCE AND RISK MANAGEMENT 18 SUSTAINABILITY REPORTING STATEMENT 33 FINANCIAL REVIEW 47 AUDITED FINANCIAL STATEMENTS Directors’ Report 54 Directors’ Responsibility for Financial Reporting 56 Report of Independent Auditors 57 Statement of Comprehensive income 59 Statement of Financial Position 60 Statement of changes in equity 61 Statement of Cash flow 62 Notes to the Financial Statements 63 BANK AND ATM NETWORK 117 Annual Report & Financial Statements l 2015 4 LIST OF ACRONYMS aBi Agriculture Business Initiative Finance Limited aBi Trust Agriculture Business Initiative Trust ACF Agricultural Credit Facility ALCO Asset and Liability Committee ATM Automated Teller Machines BCP Business Continuity Plan BCM Business Continuity Management BCMT Business Continuity Management Team BOD Board of Directors BOU Bank of Uganda CBS Core Banking System EaR Earnings at Risk EIB EAC MF Loan European Investment Bank East African Community Microfinance Loan EIB PEFF European Investment Bank Private Enterprise Finance Facility ERM Enterprise Risk Management FAMOS Female and Male Operated Small enterprises HR Human Resource HRD Human Resource Division IAS International Accounting Standards ICT Information and Communication Technology IFRS International Financial -

Directory of Development Organizations

EDITION 2010 VOLUME I.B / AFRICA DIRECTORY OF DEVELOPMENT ORGANIZATIONS GUIDE TO INTERNATIONAL ORGANIZATIONS, GOVERNMENTS, PRIVATE SECTOR DEVELOPMENT AGENCIES, CIVIL SOCIETY, UNIVERSITIES, GRANTMAKERS, BANKS, MICROFINANCE INSTITUTIONS AND DEVELOPMENT CONSULTING FIRMS Resource Guide to Development Organizations and the Internet Introduction Welcome to the directory of development organizations 2010, Volume I: Africa The directory of development organizations, listing 63.350 development organizations, has been prepared to facilitate international cooperation and knowledge sharing in development work, both among civil society organizations, research institutions, governments and the private sector. The directory aims to promote interaction and active partnerships among key development organisations in civil society, including NGOs, trade unions, faith-based organizations, indigenous peoples movements, foundations and research centres. In creating opportunities for dialogue with governments and private sector, civil society organizations are helping to amplify the voices of the poorest people in the decisions that affect their lives, improve development effectiveness and sustainability and hold governments and policymakers publicly accountable. In particular, the directory is intended to provide a comprehensive source of reference for development practitioners, researchers, donor employees, and policymakers who are committed to good governance, sustainable development and poverty reduction, through: the financial sector and microfinance, -

Housing Finance in Kampala, Uganda: to Borrow Or Not to Borrow

Housing Finance in Kampala, Uganda: To Borrow or Not to Borrow ANNIKA NILSSON Doctoral Thesis Stockholm, Sweden 2017 KTH Centre for Banking and Finance Dept. of Real Estate and Construction Management TRITA FOB-DT-2017:2 SE-100 44 Stockholm ISBN 978-91-85783-75-5 SWEDEN Akademisk avhandling som med tillstånd av Kungl Tekniska högskolan framlägges till offentlig granskning för avläggande av teknologie doktorsexamen i Fastigheter och byggande tisdagen den 28:e mars 2017 kl 13:00 i rum F3, Lindstedtsvägen 26, Kungliga Tekniska högskolan, Stockholm. © Annika Nilsson, februari 2017 Tryck: Universitetsservice US AB Abstract Housing is an important part of development processes and typically re- quires long-term finance. Without long-term financial instruments, it is difficult for households to smooth income over time by investing in housing. However, in developing countries the use of long-term loans is limited, particularly among the middle-class and lower income individuals. Most people in developing coun- tries build their houses incrementally over time without long-term loans. The limited use of long-term loans is generally seen as a symptom of market failures and policy distortions. This thesis empirically explores constraints to increase housing loans and factors that determinate the demand for different types of loans for investment in land and residential housing. The study is conducted in Kampala, the capital of Uganda. The thesis looks at supply and demand of loans. Most of the data on the supply side is collected through interviews and literature studies. The demand side is investigated through questionnaires to household where data is collected in four surveys targeting different household groups. -

Annual Report 2016

TABLE OF CONTENTS LIST OF ACRONYMS 4 FINANCIAL DEFINITIONS 5 BANK CONTACT INFORMATION 6 CHAIRMAN BOARD OF DIRECTORS’ STATEMENT 11 MANAGING DIRECTOR’S STATEMENT 14 STATEMENT OF CORPORATE GOVERNANCE 18 RISK MANAGEMENT AND CONTROL 28 SUSTAINABILITY REPORTING STATEMENT 34 FINANCIAL REVIEW 49 AUDITED FINANCIAL STATEMENTS Directors’ Report 56 Directors’ Responsibility for Financial Reporting 58 Report of Independent Auditors 59 Statement of Comprehensive Income 61 Statement of Financial Position 62 Statement of Changes in Equity 63 Statement of Cash flow 64 Notes to the Financial Statements 65 BANK AND ATM NETWORK 127 CENTENARY BANK l Annual Report & Financial Statements 2016 3 LIST OF ACRONYMS aBi Finance Agriculture Business Initiative Finance Limited aBi Trust Agriculture Business Initiative Trust ACF Agricultural Credit Facility AGM Annual General Meeting ALCO Asset and Liability Committee ATM Automated Teller Machines BCP Business Continuity Plan BCM Business Continuity Management BCMT Business Continuity Management Team BOD Board of Directors BOU Bank of Uganda CBS Core Banking System CSI Corporate Social Investment CSR Corporate Social Responsibility EaR Earnings at Risk EIB EAC MF Loan European Investment Bank East African Community Microfinance Loan EIB PEFF European Investment Bank Private Enterprise Finance Facility EIR Effective Interest Rate ERM Enterprise Risk Management FAMOS Female and Male Operated Small enterprises HR Human Resource HRD Human Resource Division IAS International Accounting Standards ICT Information and Communication -

Annual Report 2012

Centenary Bank Annual Report 2012 ANNUAL REPORT 2012 1 CENTENARY BANK WAS VOTED AS THE BEST BANK IN THE TOP FIFTY BRANDS IN UGANDA BY THE PUBLIC 2012 ANNUAL REPORT & FINANCIAL STATEMENTS Centenary Bank Annual Report 2012 CONTENTS VISION, MISSION, STRATEGY AND OWNERSHIP 5 BOARD OF DIRECTORS 8 CORPORATE GOVERNANCE 12 PERFORMANCE AGAINST FINANCIAL OBJECTIVES 19 FINANCIAL HIGHLIGHTS 20 OPERATIONAL AND FINANCIAL REVIEW 21 DIRECTORS` REPORT 30 DIRECTORS` RESPONSIBILITY FOR FINANCIAL REPORTING 32 CHAIRMAN`S STATEMENT 33 REPORT OF INDEPENDENT AUDITORS 35 FINANCIAL STATEMENTS 37 SUSTAINABILITY REPORT 100 BANK CONTACT INFORMATION 122 EXECUTIVE MANAGEMENT 123 BRANCH NETWORK 125 4 Centenary Bank Annual Report 2012 1. VISION, MISSION AND STRATEGY Our Vision: “To be the best provider of Financial Services, especially Microfinance in Uganda.” Our Mission Statement: “To provide appropriate financial services especially microfinance to all people in Uganda, particularly in rural areas, in a sustainable manner and in accordance with the law.” Our Values • Superior customer service • Integrity • Teamwork • Professionalism • Leadership • Excellence • Competence 5 Centenary Bank Annual Report 2012 Strategy Centenary Bank has continued its growth in terms of profitability and total assets. This has been realized through its continued focus on provision of microfinance. The provision of Micro finance has been and will remain the focus of Centenary Bank. However, to reduce business risks, the Bank has diversified her activities to include lending to small and medium enterprises and large corporations to reach the middle and higher-end markets in order to pro- vide services to sectors that are complimentary to its target market and customers. The Bank put in place the infrastructure to promote efficiency and improve customer service. -

The Wave Newsletter

THEWAVE ISSUE 02 - AUGUST - 2020 A NEW DAWN VOICES OF ROTARY ROTARIANS WORLD OVER District 9211 August 2020 The Wave | 1 Inside the Wave THE VIRTUAL o5 Editor’s Note Another exciting edition - The August Issue ROTARY CANCER RUN o7 President Rotary International’s Message Holger Knaack o8 District Governor’s Message Rosetti Nabbumba Nayenga 10 Demystifying Membership PAG Ronald Kawaddwa 12 Rethinking Membership IPP Peter Mukuru 26 18 The Rotary Roses ...Keep Running PAG Flavia Serugo 20 The Ace In The Deck AG Christine Kyeyune Kawooya 22 Fitness and Nutrition Campaign SUNDAY Maina Wamunyu 28 21 Fan Chair Rolls Out The Fan Plan PAG Mebra Lubwaayi 30 28 A Tale Of Two Cities, Two Clubs And Two Diplomats AUGUST PE Henry Rugamba 2020 25 The Boy I Once Knew PDG Emmanuel Katongole 32 DG’s Visits For The Month Of August 20 17 The Itinerary 33 Spinning Rotary’s Wheel 38 Digital Mentorship 44 District 9211: Our Life Story IPP Godfrey Kayitarama and Induction PE Henry Rugamba Wear your Cancer Run Kit. Run from your neighbourhood. Ednar Nyakaisiki 36 The Elevated Rotaractor 46 Celebrating Rotary Post a photo or video to your pages and groups. Sharon Kirabo Nakimera 36 Transforming Bududa’s in Tanzania (Pictorial) Vulnerable Communities 37 Impact of Covid-19 Louis Kasekende 48 District Officials Contribute towards construction of the bunkers at Nsambya. on The Youth Assistant Governors Deposit on the Rotary Cancer Run Account: 3100023145 Centenary Bank. Dora Teddy Msuga 42 DG’s Club Project Visits Club Project Visits BUY A ROTARY CANCER RUN FACEMASK AT 10,000/= FROM Rotary Office 9th Floor NIC Building • Centenary Bank Kampala branches • All Capital Shoppers Outlets 34 9 Parliament August 2020 | 3 of Uganda The Wave Editor’s Note Dear Rotarians, Rotaractors and friends Welcome to yet another exciting edition of The Wave.