Annual Report 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Project Information

KfW Development Bank Project Information Implemented by: Project approach Tax System Reform – Uganda The project financed by KfW Development Bank aims at the implementation of an information technology appli- cation to improve public financial management in Implementing new technologies to increase reve- nues to the state budget Uganda. Precisely, it encompasses the establishment of a data warehouse. In addition, newly introduced The collection of taxes and other duties from citi- software allows for the analysis of the pooled data and zens plays a vital role in the consolidation of gov- the generation of reports as well as improved forecast- ernment budgets. The state can use the money ing. Along with these measures, the respective busi- from the tax payers to invest in public services and ness processes are optimised and the staff receives infrastructure. Such government spending sup- training in the use of the data warehouse. ports the achievement of the sustainable devel- opment goals and the reduction of poverty. Well- Relevant data on taxes and customs is so far being fed functioning and efficient tax and customs systems into several different systems, so that comprehensive can strengthen the ownership of governments and analyses are challenging. The data warehouse however thus have a positive impact on good financial gov- ernance. With a healthy budget, partner countries become more independent from financial contribu- Project name Support for Tax System Reform tions by donors in order to finance their national development agendas. Despite substantial reforms in the recent past, the tax collection level in Ugan- Commissioned German Federal Ministry for da is among the lowest in Eastern Africa. -

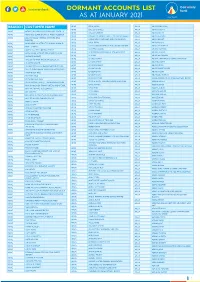

1612517024List of Dormant Accounts.Pdf

DORMANT ACCOUNTS LIST AS AT JANUARY 2021 BRANCH CUSTOMER NAME APAC OKAE JASPER ARUA ABIRIGA ABUNASA APAC OKELLO CHARLES ARUA ABIRIGA AGATA APAC ACHOLI INN BMU CO.OPERATIVE SOCIETY APAC OKELLO ERIAKIM ARUA ABIRIGA JOHN APAC ADONGO EUNICE KAY ITF ACEN REBECCA . APAC OKELLO PATRICK IN TRUST FOR OGORO ISAIAH . ARUA ABIRU BEATRICE APAC ADUKU ROAD VEHICLE OWNERS AND OKIBA NELSON GEORGE AND OMODI JAMES . ABIRU KNIGHT DRIVERS APAC ARUA OKOL DENIS ABIYO BOSCO APAC AKAKI BENSON INTRUST FOR AKAKI RONALD . APAC ARUA OKONO DAUDI INTRUST FOR OKONO LAKANA . ABRAHAM WAFULA APAC AKELLO ANNA APAC ARUA OKWERA LAKANA ABUDALLA MUSA APAC AKETO YOUTH IN DEVELOPMENT APAC ARUA OLELPEK PRIMARY SCHOOL PTA ACCOUNT ABUKO ONGUA APAC AKOL SARAH IN TRUST FOR AYANG PIUS JOB . APAC ARUA OLIK RAY ABUKUAM IBRAHIM APAC AKONGO HARRIET APAC ARUA OLOBO TONNY ABUMA STEPHEN ITO ASIBAZU PATIENCE . APAC AKULLU KEVIN IN TRUST OF OLAL SILAS . APAC ARUA OMARA CHRIST ABUME JOSEPH APAC ALABA ROZOLINE APAC ARUA OMARA RONALD ABURA ISMAIL APAC ALFRED OMARA I.T.F GERALD EBONG OMARA . APAC ARUA OMING LAMEX ABURE CHRISTOPHER APAC ALUPO CHRISTINE IN TRUST FOR ELOYU JOVIN . APAC ARUA ONGOM JIMMY ABURE YASSIN APAC AMONG BEATRICE APAC ARUA ONGOM SILVIA ABUTALIBU AYIMANI APAC ANAM PATRICK APAC ARUA ONONO SIMON ACABE WANDI POULTRY DEVELPMENT GROUP APAC ANYANGO BEATRASE APAC ARUA ONOTE IRWOT VILLAGE SAVINGS AND LOAN ACEMA ASSAFU APAC ANYANZO MICHEAL ITF TIZA BRENDA EVELYN . APAC ARUA OPIO JASPHER ACEMA DAVID APAC APAC BODABODA TRANSPORTERS AND SPECIAL APAC ARUA OPIO MARY ACEMA ZUBEIR APAC APALIKA FARMERS ASSOCIATION APAC ARUA OPIO RIGAN ACHEMA ALAHAI APAC APILI JUDITH APAC ARUA OPIO SAM ACHIDRI RASULU APAC APIO BENA IN TRUST OF ODUR JONAN AKOC . -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

List of URA Service Offices Callcenter Toll Free Line: 0800117000 Email: [email protected] Facebook: @Urapage Twitter: @Urauganda

List of URA Service Offices Callcenter Toll free line: 0800117000 Email: [email protected] Facebook: @URApage Twitter: @URAuganda CENTRAL REGION ( Kampala, Wakiso, Entebbe, Mukono) s/n Station Location Tax Heads URA Head URA Tower , plot M 193/4 Nakawa Industrial Ara, 1 Domestic Taxes/Customs Office P.O. Box 7279, Kampala 2 Katwe Branch Finance Trust Bank, Plot No 115 & 121. Domestic Taxes 3 Bwaise Branch Diamond Trust Bank,Bombo Road Domestic Taxes 4 William Street Post Bank, Plot 68/70 Domestic Taxes Nakivubo 5 Diamond Trust Bank,Ham Shopping Domestic Taxes Branch United Bank of Africa- Aponye Hotel Building Plot 6 William Street Domestic Taxes 17 7 Kampala Road Diamond Trust Building opposite Cham Towers Domestic Taxes 8 Mukono Mukono T.C Domestic Taxes 9 Entebbe Entebbe Kitooro Domestic Taxes 10 Entebbe Entebbe Arrivals section, Airport Customs Nansana T.C, Katonda ya bigera House Block 203 11 Nansana Domestic Taxes Nansana Hoima road Plot 125; Next to new police station 12 Natete Domestic Taxes Natete Birus Mall Plot 1667; KyaliwajalaNamugongoKira Road - 13 Kyaliwajala Domestic Taxes Martyrs Mall. NORTHERN REGION ( East Nile and West Nile) s/n Station Location Tax Heads 1 Vurra Vurra (UG/DRC-Border) Customs 2 Pakwach Pakwach TC Customs 3 Goli Goli (UG/DRC- Border) Customs 4 Padea Padea (UG/DRC- Border) Customs 5 Lia Lia (UG/DRC - Border) Customs 6 Oraba Oraba (UG/S Sudan-Border) Customs 7 Afogi Afogi (UG/S Sudan – Border) Customs 8 Elegu Elegu (UG/S Sudan – Border) Customs 9 Madi-opei Kitgum S/Sudan - Border Customs 10 Kamdini Corner -

Banking Sector Liberalisation in Uganda Process, Results and Policy Options

Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report Editors: Madhyam & SOMO December 2010 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report By: Lawrence Bategeka & Luka Jovita Okumu (Economic Policy Research Centre, Uganda) Editors: Kavaljit Singh (Madhyam), Myriam Vander Stichele (SOMO) December 2010 SOMO is an independent research organisation. In 1973, SOMO was founded to provide civil society organizations with knowledge on the structure and organisation of multinationals by conducting independent research. SOMO has built up considerable expertise in among others the following areas: corporate accountability, financial and trade regulation and the position of developing countries regarding the financial industry and trade agreements. Furthermore, SOMO has built up knowledge of many different business fields by conducting sector studies. 2 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Colophon Banking Sector Liberalisation in Uganda: Process, Results and Policy Options Research report December 2010 Authors: Lawrence Bategeka and Luka Jovita Okumu (EPRC) Editors: Kavaljit Singh (Madhyam) and Myriam Vander Stichele (SOMO) Layout design: Annelies Vlasblom ISBN: 978-90-71284-76-2 Financed by: This publication has been produced with the financial assistance of the Dutch Ministry of Foreign Affairs. The contents of this publication are the sole responsibility of SOMO and the authors, and can under no circumstances be regarded as reflecting the position of the Dutch Ministry of Foreign Affairs. Published by: Stichting Onderzoek Multinationale Ondernemingen Centre for Research on Multinational Corporations Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl Madhyam 142 Maitri Apartments, Plot No. -

Water Safety Plans for Utilities in Developing Countries - a Case Study from Kampala, Uganda

Water Safety Plans for Utilities in Developing Countries - A case study from Kampala, Uganda Sam Godfrey, Charles Niwagaba, Guy Howard, Sarah Tibatemwa 1 Acknowledgements The editor would like to thank the following for their valuable contribution to this publication: Frank Kizito, Geographical Information Section (GIS), ONDEO Services, Kampala, Uganda Christopher Kanyesigye, Quality Control Manager National Water and Sewerage (NWSC), Kampala, Uganda Alex Gisagara, Planning and Capital Development Manager, National Water and Sewerage (NWSC), Kampala, Uganda Godfrey Arwata, Analyst Microbiology National Water and Sewerage (NWSC), Kampala, Uganda Maimuna Nalubega, Public Health and Environmental Engineering Laboratory, Department of Civil Engineering, Makerere University, Kampala, Uganda Rukia Haruna, Public Health and Environmental Engineering Laboratory, Department of Civil Engineering, Makerere University, Kampala, Uganda Steve Pedley, Robens Centre for Public and Environmental Health, University of Surrey, UK Kali Johal, Robens Centre for Public and Environmental Health, University of Surrey, UK Roger Few, Faculty of the Built Environment, South Bank University, London, UK The photograph on the front cover shows a water supply main crossing a low lying hazardous area in Kampala, Uganda (Source: Sam Godfrey) 2 TABLE OF CONTENTS: WATER SAFETY PLANS FOR UTILITIES IN DEVELOPING COUNTRIES.1 - A CASE STUDY FROM KAMPALA, UGANDA..................................................1 Acknowledgements.................................................................................................2 -

Centenary Bank Uganda Strategy

Addressing Economic Strengthening for Vulnerable Girls: The Centenary Bank Uganda Strategy Nabakadde Sylivia, B.Com Accounting Manager Centenary Bank Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” 1 Summary Centenary Bank: Overview Role of women/girls in economic development Key issues affecting women/girls in Uganda Centenary Bank strategies to address the above issues Challenges & Way forward Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. 2 Centenary Bank: Overview Started as trust in 1985 & became full commercial bank in 1993. Currently the leading microfinance service provider in Uganda. Mission: To provide appropriate financial services especially microfinance to all people in Uganda, particularly in rural areas, in a sustainable manner and in accordance with the law. Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. 3 Overview Continued Network: The bank has its headquarters in Kampala with 67 networked branches countrywide Over160 ATMs, 62 of which are located offsite. Correspondent banks in US, UK, China, Kenya and Sudan. Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. 4 Role of women/girls in economic strengthening Women are: Training Managers (educating a child right from inception) Operations/finance Managers (major planners in the home) Relationship Managers (known to be at peace with all) Human Resource Managers (in charge of discipline and overall family welfare) Communication Managers Lawyers (take charge of the mishappenings in the home) Centenary Rural Development Bank, 2016 – “Changing lives through affordable banking services” This document has been classified as CONFIDENTIAL by Centenary Bank. -

Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD

CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 2 Centenary Bank Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 We aim to provide appropriate financial services especially microfinance to all the people of Uganda particularly in rural areas. We are therefore at the forefront of increasing financial inclusion and reaching out to the unbanked population. Read our Chaiman’s Statement on page 8 Centenary Bank 3 Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 TABLE OF CONTENTS List of Acronyms 5 Vision, Mission and Ownership 6 Chairman’s Statement 8 Board of Directors 10 Managing Director’s Review 11 The Executive Management 13 Corporate Governance 14 Operational and financial review 23 Directors’ Report 30 Directors’ Responsibility For Financial Reporting 31 Report of Independent Auditors 32 Financial Statements 33 Statement of Comprehensive Income 33 Statement of Financial Position 34 Statement of Changes In Equity 35 Statement of Cash Flows 35 Notes To The Financial Statements 36 Sustainability Report 81 Bank Contact Information 98 4 Centenary Bank Annual Report 2014 CENTENARY RURAL DEVELOPMENT BANK LTD FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2014 LIST OF ACRONYMS ABI aBi Finance Ltd ACF Agricultural Credit Facility ALCO Asset and Liability Committee ATM Automated -

Licensed Commercial Banks As at July 01, 2020

LICENSED COMMERCIAL BANKS AS AT JULY 01, 2020 S/N NAME ADDRESS OF PHONE FAX SWIFT CODE E-MAIL AND WEBSITE HEADQUARTERS 1. ABC Capital Bank Plot 4 Pilkington Road, +256-414-345- +256-414-258- ABCFUGKA [email protected] Uganda Limited Colline House – Kampala 200 310 P.O. BOX 21091 Kampala [email protected] +256-200-516- 600 https://www.abccapitalbank.co.ug/ 2. Absa Bank Uganda Plot 16 Kampala Road, +256-312-218- +256-312-218- BARCUGKX [email protected] Limited P.O. Box 2971, Kampala, 348 393 Uganda +256-312-218- https://www.absa.co.ug/ 300/317 +256-417-122- 408 3. Afriland First Bank - - - - https://www.afrilandfirstgroup.com/ Uganda Limited 4. Bank of Africa Plot 45, Jinja Road. +256-414-302- +256-414-230- AFRIUGKA [email protected] Uganda Limited P.O. Box 2750, Kampala. 001 902 [email protected] +256-414-302- 111 https://boauganda.com/ 5. Bank of Baroda 18, Kampala Road, +256-414-233- +256-414-230- BARBUGKA Uganda Limited Kampala, Uganda. 680 781 [email protected] P.O. Box 7197, Kampala +256-414-345- https://www.bankofbaroda.ug/ 196 6. Bank of India Picfare House, Plot +256 200 422 +256 414 341 BKIDUGKA Uganda Limited No.37,(Next to NWSC 223 880 [email protected] Head Offices) Jinja Road, Kampala + 256 200 422 https://www.boiuganda.co.ug P.O. Box 7332, Kampala, 224 Uganda + 256 313 400 S/N NAME ADDRESS OF PHONE FAX SWIFT CODE E-MAIL AND WEBSITE HEADQUARTERS 437 7. Cairo International Greenland Towers, Plot +256 (0) 414 +256 (0) 414 CAIEUGKA Bank Limited 30 Kampala Road, 230 132/6/7 230 130 [email protected] Kampala P.O.Box 7052 Kampala, +256 (0) 417 Uganda 230 105 https://www.cib.co.ug/ +256 (0) 414 230 141 8. -

Ethical Standards and Financial Performance of Banking Institutions

ETHICAL STANDARDS AND FINANCIAL PERFORMANCE OF BANKING INSTITUTIONS. A CASE STUDY OF CENTENARY BANK MUKONO BRANCH. BY LUKOWE KELUDIA 1163-05014-07715 A RESEARCH REPORT SUBMITTED TO THE COLLEGE OF ECONOMICS AND MANAGEMENT IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF A BACHELOR’S DEGREE IN BUSINESS ADMINISTRATION OF KAMPALA INTERNATIONAL UNIVERSITY AUGUST, 2019 DECLARATION I, Lukowe Keludia do hereby declare that this work is original and has never been submitted to any other institution for a ward of any Degree or Diploma. Where the work of others has been used, reference has been made there of. ~Ib kC~I SIGNED: ~ DATE:..’ ~ ~-~‘S LUKOWE KELUDIA 1163-05014-07715 APPROVAL This report titled “Ethical standards and financial performance of banking institutions. A case study of centenary bank Mukono branch.” has been submitted by Lukowe Keludia for examination with my approval as the University Supervisor, and it’s now ready for presentation. SIGNED~ DATE: .. .~~ DR. MABONGA ERIC (SUPERVISOR) DEDICKflON I dedicate this piece of work to my parents Mr. Waniala Peter and Mrs. Nyakecho Manjeri sister Naluwenda Mifly sisters and brothers who have fought their deliberations to have comage and fortitude and kept struggling inspite of odds in seeing my dreams ofeducation fblly realized. it’ ACKNOWLEDGEMENT First and foremost, I pass a word of thanks to the Heavenly Lord for being there for me always in my academic career for this success I count on today. I extend a vote of thanks to a number of people who unreservedly, contributed towards the accomplishment of this research work. 1 also would like to acknowledge the assistance and role played by the following personalities to the successful completion of this study. -

The Status of Social Security Systems in Uganda: Challenges and Opportunities

THE STATUS OF SOCIAL SECURITY SYSTEMS IN UGANDA: CHALLENGES AND OPPORTUNITIES Paul Bukuluki John-Bosco Mubiru REALITY CHECK THE STATUS OF SOCIAL SECURITY SYSTEMS IN UGANDA: CHALLENGES AND OPPORTUNITIES Paul Bukuluki John-Bosco Mubiru Makerere University School of Social Sciences, College of Humanities and Social Sciences,Makerere University, Kampala, Uganda November 2014 The views expressed in this publication do not necessarily reflect the views of the Konrad-Adenauer-Stiftung but rather those of the author. CHALLENGES AND OPPORTUNITIES i REALITY CHECK THE STATUS OF SOCIAL SECURITY SYSTEMS IN UGANDA: CHALLENGES AND OPPORTUNITIES ISBN: 978 9970 477 03 6 Authors Paul Bukuluki John-Bosco Mubiru Konrad-Adenauer-Stiftung, Uganda Programme 51A, Prince Charles Drive, Kololo P.O. Box 647, Kampala Tel. +256 414 25 46 11 www.kas.de © Konrad-Adenauer-Stiftung e.V. 2014 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, without prior written permission on the Konrad-Adenauer- Stiftung. ii THE STATUS OF SOCIAL SECURITY SYSTEMS IN UGANDA CONTENTS Foreword ............................................................................ vi List of acronyms and abbreviations ................................... vii 1.0.Introduction ..................................................................1 1.1.Background about Uganda ................................................ 2 1.2.Poverty and Vulnerability Context in Uganda ........................ 4 1.2.1.Income inequality -

Annual Report 2015

1 ANNUAL REPORT 2015 Annual Report & Financial Statements l 2015 2 Annual Report & Financial Statements l 2015 3 TABLE OF CONTENTS LIST OF ACRONYMS 4 FINANCIAL DEFINITIONS 5 BANK CONTACT INFORMATION 6 CHAIRMAN BOARD OF DIRECTORS’ STATEMENT 11 MANAGING DIRECTOR’S STATEMENT 14 STATEMENT OF CORPORATE GOVERNANCE AND RISK MANAGEMENT 18 SUSTAINABILITY REPORTING STATEMENT 33 FINANCIAL REVIEW 47 AUDITED FINANCIAL STATEMENTS Directors’ Report 54 Directors’ Responsibility for Financial Reporting 56 Report of Independent Auditors 57 Statement of Comprehensive income 59 Statement of Financial Position 60 Statement of changes in equity 61 Statement of Cash flow 62 Notes to the Financial Statements 63 BANK AND ATM NETWORK 117 Annual Report & Financial Statements l 2015 4 LIST OF ACRONYMS aBi Agriculture Business Initiative Finance Limited aBi Trust Agriculture Business Initiative Trust ACF Agricultural Credit Facility ALCO Asset and Liability Committee ATM Automated Teller Machines BCP Business Continuity Plan BCM Business Continuity Management BCMT Business Continuity Management Team BOD Board of Directors BOU Bank of Uganda CBS Core Banking System EaR Earnings at Risk EIB EAC MF Loan European Investment Bank East African Community Microfinance Loan EIB PEFF European Investment Bank Private Enterprise Finance Facility ERM Enterprise Risk Management FAMOS Female and Male Operated Small enterprises HR Human Resource HRD Human Resource Division IAS International Accounting Standards ICT Information and Communication Technology IFRS International Financial