How Will the Economic Policies of South Korea's New Administration

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interbrand-Best-Korean-Brands-2015

Contents 02 Introduction 04 The future of business is personal 06 The Age of You: key questions answered 10 Best Korea Brands 2015 Top50 46 Best Korea Brands 2015 Analysis 54 Authors & Contributors 1 engage customers and generate genuine result, each of us will become our own 2015 will provide the insights you need value for the business. marketplace or “Mecosystem.” to drive your organization forward—and Introduction new inspiration to push creative thought The need to create brand experiences In our report, Jez Frampton, Global CEO Jihun Moon and innovation in these changing times. that are seamless and more holistic has of Interbrand, will elaborate on this new been precipitated by sector convergence era, which we at Interbrand refer to as Congratulations to all of Korea’s Best The origin of the term “branding” was and the rise of Big Data. Harnessing the the “Age of You”—the move from brand Global Brands—in particular those whose lit¬erally to burn one’s name onto prop- potential of Big Data isn’t just for tech as monologue, to brand as dialogue, leadership skills have earned them a erty as a crude mark of ownership. But companies anymore—it offers huge to brand as a communal experience, to place among the nation’s top brands. it’s only in our relatively recent history opportunities for all brands. By collecting brand as a truly personal and curated ex- that branding has become recognized as To your continued success, and analyzing customer data and honing perience created around each and every a business discipline. -

South Korea Product Profiles Download the Report

Market opportunities for Queensland agribusiness from FTA with South Korea FINAL REPORT 1 Executive summary Background Australia recently signed Free Trade Agreements (FTAs) with China (June 2015), Japan (July 2014) and South Korea (April 2014). These agreements substantially reduce or remove tariffs on a range of Australian food and agribusiness export products including beef, grains, horticulture, seafood and processed foods, which together represent a large share of Queensland’s total agricultural production and exports. Deloitte Access Economics has been engaged by Trade & Investment Queensland (TIQ) and the Queensland Department of Agriculture and Fisheries (DAF) to identify opportunities and barriers within Queensland agribusiness sectors arising from the FTAs. The project has been undertaken in two stages. Stage 1 highlighted the commodities which showed the most promise for increased trade and investment between China, Japan and South Korea. These commodities were identified through analysis of tariff reductions, Queensland production, exports, consumption trends and major competitors as well as consultation with Queensland agribusiness stakeholders. Stage 2 (this report) profiles these identified commodities in more detail to identify any non-tariff barriers, supply chain constraints, market operation and their Strengths, Weaknesses, Opportunities and Threats (SWOT). This profiling was informed through further consultation with Queensland Government, industry associations, traders and selected in-market contacts in China, Japan -

Restaurants for a Global Meeting

Restaurants for A Global Meeting Date Revision Description Author(s) 2016.09.24 Creation Sang-Yun Lee 2018.01.18 Revision Jihye Hwang # 76 Information #111 • Cafés smallcafe on 1st floor Pascucci # 62-1 • Restaurants st nd Seodanggol(1 & 2 floor) • Paris baguette • Lotteria(Buger)/ 休 Gimbap # 19 #65 Hoam Faculty House Astronomy Faculty house Rear Gate To Nakseongdae Subway 62-1 Gate 5 #137-2 Tenkaippin # 38 • BBQ(International) • Rakgujung(락구정) # 109 • Cafeteria # 75-1 • Jahayon • Dure-midam (Korean) # 101 Gamgol (Vegetarian Buffet) # 30-2 # 500,501 • TooGood (Chinese) • A Twosome Place Main Gate • 샤반 (Korean) # 63 Student Restaurants Cafeteria Information • Cafés VEGAN • Restaurants #38 International 6,000~3 11:00~ #63 Coffee, 2,500~5 BBQ Fluid 1F (chicken) 5,000 21:00 1F Apple pie ,000 #38 Korean 7,000~2 11:30~ 11:30~ 1 Rakgujung B1 5,000 20:30 #75-1 Student Cafeteria 3,000~4 3:30 Set Menu (3F/4F) s ,000 17:00~ 1 9:00 7,000~1 08:00~ #30-2 TooGood Chinese 5,000 20:30 #75-1 5,500~3 10:00~ 2 #62-1 1,500~1 Dure- midam Korean 1:00 Gimbap Korean (5F) 5,000 1F 休 1,000 11:00~1 #62-1 Burger 1,000~1 08:00~ #101 Vegetarian 4:00 Lotteria Gamgol 7,000 1F Fast Food 5,000 22:00 1F Buffet 17:00~1 8:00 #62-1 1,000~1 07:00~ Paris baguette Bakery 1F 5,000 22:00 #109 08:00~1 2F 7,000~1 9:00 Jahayon Set Menu Coffee, 2,500~1 08:00~ 2,000 11:00~1 #111 Pascucci Cake 0,000 22:00 3F 9:00 08:30~1 Coffee, 2,500~5 #200 BeLePi #109 Take Out Cafeteri Coffee, waff 500~ 9:00 Cake ,000 2F/3F a le 20,000 6,500~8 10:00~ 08:00~2 #137-2 Tenkaippin Japanese Coffee, Cak 2,500~3 -

My No.1 牛排餐厅VIPS(味愛普思)

VIPS是Very ImPortant PerSon’S SocIety的缩写, 代表将 “ 每位顾客奉为贵宾” 的精诚之心。 VIPS CJ FOODVILLE MY NO.1 STEAK HOUSE www.ivips.co.kr | www.cjfoodville.co.kr My No.1 牛排餐厅 VIPS(味愛普思) 韩国本土品牌 VIPS于 1997年登村1号店开业以来, 不断发展壮大, 其精品牛排和四季丰盛新鲜的沙拉吧, 深受男女老少顾客的喜爱。 2000年品牌上市仅三年,顾客已突破百万, 2010年, VIPS 对正宗牛 排菜品和室内装潢进行了进一步升级, 成功转型为, “精品牛排餐厅”。 目前, 精品牛排餐厅VIPS作为一家韩国本土品牌, 独占家庭餐厅行业 龙头地位, 成为引领 cJ Foodville发展的代表品牌。 目前,VIPS拥有十九种牛排菜品,数量居家庭餐厅之首。VIPS推出 韩国家庭餐厅前所未有的正宗牛排,采用与众不同的烹饪方式,深得 顾客的喜爱。还将原本高档牛排餐厅专用的Dry ageD rIb eye精 品牛排,Porter HouSe等高档菜品大众化,成为家庭餐厅行业的 龙头品牌。 1997年,VIPS在上市当时引进了,“沙拉吧” 的新概念,打造了VIPS 独特的亮点。又相继推出健康养生概念菜品,大马哈鱼和虾等普通餐 厅里不多见的高档菜单,深受顾客好评。十五年间,VIPS沙拉吧共 推出了两千多种菜品,不断追求健康,新鲜和丰富多彩。VIPS不满 足于在韩国取得的成果,计划进军国际市场。VIPS将以2012年进入 中国市场为起点,发展成为全球化的国际品牌。 touS les JourS 在法语中意为 “每天每日(everyday)”, 是一家从选材起与众不同的健康面包店。 TOUS LES JOURS CJ FOODVILLE AUTHENTIC BAKERY www.tlj.co.kr | www.cjfoodville.co.kr 从选材起与众不同的健康面包房 TouS les JourS (多乐之日) touS les JourS 在法语中意为 “每天每日(everyday)”, 是精选面 粉, 盐和糖等基本原料而制作美味面包的一家健康面包房, 亦是韩国首 家在卖场里直接烤制并出售的新鲜烘焙面包店。touS les JourS 对材料不做特别添加, 保持其原本风味。还精选面包专用面粉, 天日盐 和木糖, 充分考虑健康要素, 以母爱般的精诚, 制作新鲜, 正直的面包和 蛋糕。touS les JourS 坚守 “用天然材料和传统方式精诚制作健 康面包” 的承诺, 与韩国连锁面包房的历史共同成长。 2008年 7月 touS les JourS连锁店逾千家, 通过不断提高无可替 代的技术和系统实力, 引领面包店产业的发展。同时美国, 日本, 中国, 新加坡, 泰国和印度尼西亚等地注册商标, 为开拓全球化事业奠定良好 基础。 未来, touS les JourS 将继续致力于从选材起与众不同的健康产 品供应, 树立连锁面包店品牌的领先地位。预计到2017年,touS les JourS 的海外店铺数将增至二千家以上,成为全球化连锁面包 品牌。欢迎体验 touS les JourS 每天精选天然材料并精诚制作的 健康面包。 “bIbIgo” 是韩语 “bIbIDa(拌)” 与 “to-go(包装)” 的合成词, 是一个用拌饭让全球顾客着迷的全球化韩餐品牌。 BIBIGO CJ FOODVILLE KOREAN HEALTHY FRESH KITCHEN www.bibigo.co.kr | www.cjfoodville.co.kr -

Copyrighted Material

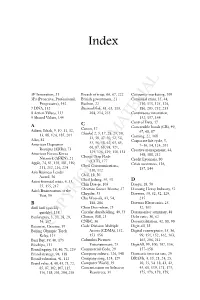

Index 3P Innovation, 31 Breach of trust, 66, 67, 222 Consumer marketing, 109 3Ps (Proactive, Professional, British government, 21 Continual crisis, 35, 44, Progressive), 142 Buchon, 22 110, 113, 125, 126, 7 DNA, 132 BusinessWeek, 43, 63, 113, 186, 205, 232, 233 8 Action Values, 133 204, 214, 235 Continuous innovation, 9 Shared Values, 144 132, 137, 144 Control Data, 17 A C Canon, 17 Convertible bonds (CB), 49, Adizes, Ichak, 9, 10, 11, 12, 67, 68, 87 13, 88, 124, 185, 201 Chaebol, 2, 5, 17, 28, 29, 30, 32, 38, 47–50, 52, 54, Corning, 22, 168 Aibo, 81 Corporate life cycle, 5, American Depositor 55, 56, 58, 62, 63, 65, 66, 67, 68, 94, 121, 7–16, 34, 124, 201 Receipts (ADRs), 73 Creative management, 44, American Forces Korea 124, 126, 129, 130, 131 Charge Trap Flash 148, 188, 212 Network (AFKN), 21 Credit Lyonnais, 80 Apple, 74, 83, 158, 181, 189, (CTF), 177 Cheil Communications, Crisis awareness, 136, 211, 212, 216, 224 137, 144 Asia Business Leader 110, 112 Award, 36 Cheil, 18, 50 Asian financial crisis, 6, 33, Cheil Jedang, 50, 53 D 55, 155, 217 Chin Dae-je, 103 Daegu, 18, 50 Asia’s Businessman of the Christian Science Monitor, 27 Daesung Heavy Industry, 52 Year, 36 Chrysler, 53 Daewoo, 30, 32, 52, 129, Chu Woo-sik, 43, 54, 215 B 188, 206 Daewoo Electronics, 25, Balli balli (quickly Chun Doo-whan, 23 32, 101 quickly), 138 Circular shareholding, 49, 53 Datamonitor summary, 48 Bankruptcy, 3, 20, 28, 29, Clinton, Bill, 21 Debt ratio, 30, 62 54, 107 CNBC, 36 Decentralization, 42, 88, 90 Bateman, Graeme,COPYRIGHTED 39 Code Division Multiple -

Cafeteria Services VISION

No. 1 food supply distributor IR Material(2012) 0 Vision & Holding Structure Summary The SYSCO of Asia, No.1 domestic food supply distributor and leader in the paradigm shift of cafeteria services VISION To become the sole leader in the domestic food supply distribution market in terms of scale and capability, and become the Sysco of Asia through globalization "2016 sales of W5tn, OP W150bn" History Holding Structure . 1988, established Samil Agriculture Fishery(material processing) . 1996, transferred to CJ CJ affiliation Other . 10,798,900 outstanding shares . 1999, began food supply distrubution . Market cap W270bn ITC + corporate (Dec 31, 2011 standard) . 2001, listed on Kosdaq 11.1% . 2007, received first HACCP for hospital catering . 2009, selected as hygiene inspection institution by KFDA . 2010, opened largest domestic distribution center (Icheon) Treasury shares 7.3% 1 Business Structure(Food supply distribution) Overview Leading the food supply distribution market with its simplified process via direct-sourcing from the producer and thorough health control, No.1 domestic food supply distributor with the best SCM and products in the industry CJ Agency Freshway (wholesale) Dining • 317 Sales personnel Maker • 109 MD personnel Cafeteria Affiliates • 20,000+ SKU Producer/ • 9 distribution centers Food Global • 39 food safety center processing personnel Dining Cafeteria Food processing • SamCheongGak • STX Catering • CJ Foodvill • Pizza Hut • Kuksundang • CJ CJ • Pho Mein • Harim • Saempyo • Beer Cabin • Dongyang Magic • Samlip Foods • Bon Juk 2 Business Structure(Cafeteria) Overview Secured various clients in businesses, hospitals, colleges with endless R&D for tastier and healthier food CJ Freshway Business/ Public Menu development & Hygiene & safety Customer satisfaction cooking Hospitals . -

THE NEXT PHASE the NEXT PHASE Samsung Annual Report 2003

Samsung Annual Report 2003 THE NEXT PHASE THE NEXT PHASE Samsung Annual Report 2003 THE NEXT PHASE MOTIVATION To understand where we’re going, it helps to take a look at what’s driving us there. 9 COLLABORATION Successful companies no longer always go it alone. 23 EXPECTATION Customers are all about expectations. 35 DEMONSTRATION It is important to demonstrate that our standards, values and goals are indeed real. 44 COMPUTATION 61 All Samsung products and services mentioned in this publication are the property of Samsung. ORGANIZATION Published by Samsung in coordination with Cheil Communications Inc. The power of Samsung as a brand is tied Printed by Samsung Moonwha Printing Co., Seoul, Korea to the strength of its organizations. Written by Denis Jakuc 65 Principal Photography by Ashton Worthington Created by The Corporate Agenda: www.corporateagenda.com TEN YEARS AGO, Samsung launched its New Management initiative, with the ultimate goal of becoming one of the world’s premier companies. 1993 June Samsung adopts New Management initiative 1994 1995 1996 February January January January July Chairman Kun-Hee Lee holds Japanese headquarters opens Samsung opens headquarters Samsung Electronics begins Samsung Everland opens Carribean electronics products comparison in USA, Europe and China mass production of 64Mb DRAMs Bay, world’s first indoor and outdoor and evaluation conference July water park in Los Angeles, California, USA Samsung Corporation is the February March first Korean company to reach Samsung Electronics completes Samsung Electronics -

Global Attractions Attendance Report COVER: © Disneyland at Disneyland Resort®, Anaheim, CA, U.S

2015 2015 Global Attractions Attendance Report COVER: © Disneyland at Disneyland Resort®, Anaheim, CA, U.S. CREDITS TEA/AECOM 2015 Theme Index and Museum Index: The Global Attractions Attendance Report Publisher: Themed Entertainment Association (TEA) Research: Economics practice at AECOM Editor: Judith Rubin Publication team: Tsz Yin (Gigi) Au, Beth Chang, Linda Cheu, Bethanie Finney, Kathleen LaClair, Jodie Lock, Sarah Linford, Erik Miller, Jennie Nevin, Margreet Papamichael, Jeff Pincus, John Robinett, Judith Rubin, Brian Sands, Will Selby, Matt Timmins, Feliz Ventura, Chris Yoshii ©2016 TEA/AECOM. All rights reserved. CONTACTS For further information about the contents of this report and about the Economics practice at AECOM, contact the following: John Robinett Chris Yoshii Senior Vice President, Americas Vice President, Asia-Pacific [email protected] [email protected] T +1 213 593 8785 T +852 3922 9000 Brian Sands, AICP Margreet Papamichael Vice President, Americas Director, EMEA [email protected] [email protected] T +1 202 821 7281 T +44 20 3009 2283 Linda Cheu aecom.com/economics Vice President, Americas [email protected] T +1 415 955 2928 For information about TEA (Themed Entertainment Association): Judith Rubin Jennie Nevin TEA Publications, PR & Social Media TEA Chief Operating Officer [email protected] [email protected] T +1 314 853 5210 T +1 818 843 8497 teaconnect.org 2015 2015 The definitive annual attendance study for the themed entertainment and museum industries. Published by the Themed Entertainment Association (TEA) and the Economics practice at AECOM. Global Attractions Attendance Report 3 CONTENTS THE BIG PICTURE 6 2015 THEME INDEX 22 The Americas 22 Asia-Pacific 42 Europe, Middle East and Africa (EMEA) 52 © Aquaventure Water Park, Dubai, U.A.E. -

Interim Business Report for the Quarter Ended September 30, 2014

SAMSUNG ELECTRONICS Co., Ltd. Interim Business Report For the quarter ended September 30, 2014 Note about forward-looking statements Certain statements in the document, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our financial reports available on our website. Samsung Electronics 2014 Interim Business Report 1 / 152 Table of Contents Certification ........................................................................................................................................................................... 3 I. Corporate Overview .................................................................................................................................................... 4 II. Businesses Overview ................................................................................................................................................ 20 III. Management Discussion and Analysis ................................................................................................................... -

The Restaurant Association of Singapore Matchmaking Mission to Korea 9 – 13 April 2018 Final Report

THE RESTAURANT ASSOCIATION OF SINGAPORE MATCHMAKING MISSION TO KOREA 9 – 13 APRIL 2018 FINAL REPORT INTRODUCTION The Restaurant Association of Singapore (RAS), established in 1980, has more than 350 members representing 600 brands and 3,000 outlets. The RAS’s goal is to propel the industry forward through various programs aimed at driving business success. One of the programs is to regularly visit countries in the region to learn about the country and to interact with food service companies in that country. The RAS coordinated with IRC, a business development consultancy in Korea to implement the mission. IRC’s remit was to prepare a four-day Korea visit program and to anchor it with an agreed food related exhibition or show. PROGRAM: The RAS elected to anchor the program around the International Food Service Industry Show and the visit was scheduled for 9 to 13 April 2018 accordingly. PROGRAM HIGHLIGHTS: During the program, the RAS delegation experienced: • 5 Workshops pertinent to working in the restaurant business in Korea • 3 meetings with large food service companies: CJ Freshway, Lotte GRS and SPC • 6 site visits to entrepreneur restaurants • 1-on-1 meetings with 12 Korean food service companies • Participation in the International Food Service Industry Show (FISK) • Meeting with 9 executives of food service companies at FISK PROGRAM DETAILS: Day 1: AM, Workshops • Korean Business Culture, Peter Underwood, Managing Partner of IRC Consulting • Restaurant Industry in Korea, Kim, Sung-yoon, Senior Staff Writer, Food & Travel, Chosunilbo -

The Steak House by VIPS CJ FOODVILLE Ultimate Steak Experience |

VIPS is an abbreviation for ‘Very Important Person’s Society’ and strives to ‘treat each and every customer as a VIP guest’. VIPS CJ FOODVILLE MY NO.1 STEAK HOUSE www.ivips.co.kr | www.cjfoodville.co.kr My No.1 Steakhouse After establishing its first store Deungchon branch in 1997, Ko- rea’s homegrown brand VIPS has been steadily loved by all age groups by providing premium steak and salad bar with various dishes and seasonal menus. As a result, 1 million customers had visited just in 3 years af- ter its launch, and 100 millions had visited in 2012 after VIPS’s successful transformation into a ‘premium steakhouse’ by strengthening its traditional steak menu and interior in 2010. A premium steakhouse VIPS is currently standing as the leader of the family restaurant industry in Korea and is one of the most well known brands in CJ Foodville as well. Currently, VIPS has the most various steak items among all fam- ily restaurants, with 19 different kinds of steak, and is loved for its traditional steak and differentiated cooking method which none of Korean family restaurant could provide. By popular- izing premium steak such as dry-aged steak and porterhouse steak, which could be tasted only in high-end steakhouse, VIPS is fully performing its role as the No.1 brand in Korean family restaurant industry. Also, VIPS introduced a new concept of ‘salad bar’ in 1997 when launched, creating its differentiated point. VIPS has been loved for its menus with a concept of ‘health’ and ‘well-being’ and for premium menus including salmon and shrimp, which wasn’t easy to meet in regular restaurant. -

Samsung Press Information

Company Overview History of Samsung Samsung's history dates to 1938 when "Samsung General Stores" opened in North Kyung- sang Province, Korea. The company conducted its trade business until the 1950s when it became a producer of basic commodities such as sugar and wool. In 1958, Samsung be- came involved in the insurance industry by incorporating a local fire & marine insurance company. During the 1960s, Samsung became one of the first Korean companies to actively expand its overseas trade. The group consolidated its manufacturing base by adding paper and fer- tilizer businesses. Samsung continued with expansion into the life insurance business, strengthened its retail operations and then moved into the communications sector, success- fully establishing a newspaper and a broadcasting company. The 1970s were a crucial period in shaping present-day Samsung. Its strengths in the semi- conductor, information and telecommunications industries grew from the significant in- vestments made during this period. Samsung also took a meaningful step toward heavy industries by venturing into aircraft manufacturing, shipbuilding and construction, as well as chemical industries. In the 1980s, Samsung expanded its efforts into exploring the larger markets overseas. The group began contributing to foreign economies by building facilities in the US, the UK and Portugal. Samsung also invested considerable resources into fostering Korea's rich heritage by supporting a wide range of cultural and artistic activities. The final decade of the 20th century saw the evolution of Samsung's new approach to management. Chairman Kun-Hee Lee's insightful vision and the introduction of the "New Management" in 1993 acknowledged the need to transform management philosophy in or- der to keep up with a rapidly changing global economy.