11 Carbon Markets, 2011-2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

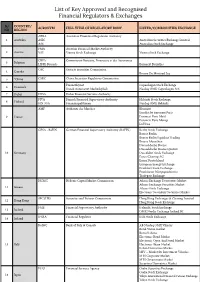

List of Key Approved and Recognised Financial Regulators & Exchanges

List of Key Approved and Recognised Financial Regulators & Exchanges S/ COUNTRY/ ACRONYM FULL TITLE OF REGULATORY BODY LISTED/COMMODITIES EXCHANGE NO REGION APRA Australian Prudential Regulation Authority 1 Australia ASIC Australian Securities Exchange Limited ASE Australian Stock Exchange FMA Austrian Financial Market Authority 2 Austria VSE Vienna Stock Exchange Vienna Stock Exchange CBFA Commission Bancaire, Financiere et des Assurances 3 Belgium LIFFE Brussels Euronext Bruxelles OSC Ontario Securities Commission 4 Canada Bourse De Montreal Inc 5 *China CSRC China Securities Regulatory Commission Finanstilsynet Copenhagen Stock Exchange 6 Denmark Dansk Autoriseret Markedsplads Nasdaq OMX Copenhagen A/S 7 Dubai DFSA Dubai Financial Services Authority FIVA Finnish Financial Supervisory Authority Helsinki Stock Exchange 8 Finland FIN-FSA Finansinspektionen Nasdaq OMX Helsinki AMF Authorite des Marches Bluenext Eurolist by Euronext Paris 9 France Euronext Paris Matif Euronext Paris Monep LCH SA GFSA - BaFIN German Financial Supervisory Authority (BAFIN) Berlin Stock Exchange Boerse Berlin Boerse Berlin Equiduct Trading Boerse Muenchen Duesseldorfer Boerse Duesseldorfer Boerse Quotrix 10 Germany Dusseldorf Stock Exchange Eurex Clearing AG Eurex Deutschland European Energy Exchange Frankfurt Stock Exchange Frankfurter Wertpapierboerse Tradegate Exchange HCMC Hellenic Capital Market Commission Athens Exchange Derivatives Market Athens Exchange Securities Market 11 Greece Athens Stock Exchange Electronic Secondary Securities Market SFC (HK) -

Annotated Presentation of Regulated Markets and National Provisions

15.7.2011 EN Official Journal of the European Union C 209/21 Annotated presentation of regulated markets and national provisions implementing relevant requirements of MiFID (Directive 2004/39/EC of the European Parliament and of the Council) (2011/C 209/13) Article 47 of the Markets in Financial Instruments Directive (Directive 2004/39/EC, OJ L 145, 30.4.2004) authorises each Member State to confer the status of ‘regulated market’ on those markets constituted on its territory and which comply with its regulations. Article 4, paragraph 1, point 14 of Directive 2004/39/EC defines a ‘regulated market’ as a multilateral system operated and/or managed by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments — in the system and in accordance with its non-discretionary rules — in a way that results in a contract, in respect of the financial instruments admitted to trading under its rules and/or systems, and which is authorised and functions regularly and in accordance with the provisions of Title III of Directive 2004/39/EC. Article 47 of Directive 2004/39/EC requires that each Member State maintains an updated list of regulated markets authorised by it. This information should be communicated to other Member States and the European Commission. Under the same article (Article 47 of Directive 2004/39/EC), the Commission is required to publish a list of regulated markets, notified to it, on a yearly basis in the Official Journal of the European Union. The present list has been compiled pursuant to this requirement. -

EU Emissions Trading the Role Of

School of Management and Law EU Emissions Trading: The Role of Banks and Other Financial Actors Insights from the EU Transaction Log and Interviews SML Working Paper No. 12 Johanna Cludius, Regina Betz ZHAW School of Management and Law St.-Georgen-Platz 2 P.O. Box 8401 Winterthur Switzerland Department of Business Law www.zhaw.ch/abl Author/Contact Johanna Cludius [email protected] Regina Betz [email protected] March 2016 ISSN 2296-5025 Copyright © 2016 Department of Business Law, ZHAW School of Management and Law All rights reserved. Nothing from this publication may be reproduced, stored in computerized systems, or published in any form or in any manner, including electronic, mechanical, reprographic, or photographic, without prior written permission from the publisher. 3 Abstract This paper is an empirical investigation of the role of the financial sector in the EU Emissions Trading Scheme (EU ETS). This topic is of particular interest because non-regulated entities are likely to have played an important part in increasing the efficiency of the EU ETS by reducing trading transaction costs and providing other services. Due to various reasons (new rules and regulations, reduced return prospects, VAT fraud investigations) banks have reduced their engagement in EU Emissions Trading and it is unclear how this will impact on the functioning of the carbon market. Our regression analysis based on data from the EU Transaction Log shows that large companies and companies with extensive trading experience are more likely to interact with the financial sector, which is why we expect banks’ pulling out of the EU ETS to affect larger companies more significantly. -

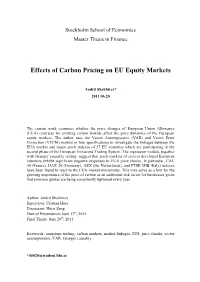

Effects of Carbon Pricing on EU Equity Markets

Stockholm School of Economics Master Thesis in Finance Effects of Carbon Pricing on EU Equity Markets Andrii Shekhirev* 2011.06.20 The current work examines whether the price changes of European Union Allowance (EUA) contracts for emitting carbon dioxide affect the price dynamics of the European equity markets. The author uses the Vector Autoregressive (VAR) and Vector Error Correction (VECM) models in four specifications to investigate the linkages between the EUA market and major stock indexes of 27 EU countries which are participating in the second phase of the European Emissions Trading System. The regression models, together with Granger causality testing, suggest that stock markets of several developed European countries exhibit significant negative responses to EUA price shocks. In particular, CAC 40 (France), DAX 30 (Germany), AEX (the Netherlands), and FTSE MIB (Italy) indexes have been found to react to the EUA market movements. This may serve as a hint for the growing importance of the price of carbon as an additional risk factor for businesses given that emission quotas are being consistently tightened every year. Author: Andrii Shekhirev Supervisor: Cristian Huse Discussant: Huizi Zeng Date of Presentation: June 13th, 2011 Final Thesis: June 20th, 2011 Keywords: emissions trading, carbon markets, market linkages, ETS, price shocks, vector autoregression, VAR, Granger causality *[email protected] Andrii Shekhirev Effects of Carbon Pricing on EU Equity Markets Table of Contents 1. Introduction ......................................................................................................................... -

CHAPTER 1: EU ETS: Origins, Description and Markets in Europe

CO2 Markets Maria Mansanet Bataller Motivation Climate Change Importance Increasingly Kyoto Protocol: International Response to Climate Change Flexibility Mechanisms EMISSIONS TRADING CARBON MARKETS The presentation is organized as follows… Carbon Trading Origins. Carbon Trading in Europe : the EU ETS. Carbon Markets in Europe. Linking with UN Carbon Markets. Conclusion and final remarks The presentation is organized as follows… Carbon Trading Origins. Carbon Trading in Europe : the EU ETS. Carbon Markets in Europe. Linking with UN Carbon Markets. Conclusion and final remarks Origins of the EU ETS Kyoto Protocol ( UNFCCC). 1997 & 2005 55 Parts of the Convention including the developed countries representing 55% of their total emissions. Global emissions by 5% from 1990. Commitment period 2008 - 2012. 6 GHG: CO2, CH4, N2O, HFCs, PFCs, and SF6. ol Canada otoc r Liechtenstein oto P y New he K Zealand to t e Australia anc t s i D Japan ) Switzerland % United States 2005 ( Norway ange 1990- h Monaco c ons i s s Croatia i em al e Iceland R Russian et Federation g r a Ukraine o T ot y K 0 0 0 0 0 0 0 10 Commitments by Country 40 30 20 -1 -5 -2 -3 -4 -6 Spain Austria ol oc ot Luxembourg r Italy o P ot y Portugal he K Denmark t o Ireland e t anc Slovenia t EU-15 Dis Belgium Netherlands ) % Germany Greece 2005 ( France Finland United Kingdom hange 1990- Sweden c ons Czech Rep. i s Slovakia is Poland Hungary Real em Romania Bulgaria get r Estonia a Lithuania o T ot y Latvia K 0 0 0 0 0 0 0 60 50 40 30 20 10 -1 -2 -3 -4 -5 -6 Commitments in Europe Kyoto Flexibility Mechanisms Realization Emission Reduction Projects Joint Implementation (art. -

2015 Registration Document | 02

2015 REGISTRATION DOCUMENT | 02 CONTENTS Risks 2 5 Operating and fi nancial review 75 Strategic Risks 3 5.1 Overview 76 Financial Risks 5 5.2 Material contracts and related party Operational Risks 6 Transactions 96 5.3 Legal Proceedings 98 5.4 Insurance 100 Presentation of the Group 9 1 5.5 Liquidity and Capital Resources 101 1.1 Company Profi le 10 5.6 Tangible Fixed Assets 102 1.2 Strategy 12 1.3 Description of the Business 13 Financial Statements 103 1.4 Regulation 25 6 6.1 Consolidated Income Statement 104 6.2 Consolidated Statement Corporate Governance 29 2 of Comprehensive Income 105 2.1 Corporate Governance 30 6.3 Consolidated Balance Sheet 106 2.2 Management & Control Structure 32 6.4 Consolidated Statement of Cash Flows 107 2.3 Report of the Supervisory Board 43 6.5 Consolidated Statement of Changes 2.4 Remuneration report 45 in Parent’s Net Investment 2.5 Corporate Social Responsibility 50 and Shareholders’ Equity 108 6.6 Notes to the Consolidated Financial Statements 110 3 Selected historical combined fi nancial 6.7 Euronext N.V. Company Financial Statements information and other fi nancial for the year ended 31 December 2015 151 information 57 6.8 Notes to Euronext N.V. Financial Statements 153 6.9 Other information 167 4 General description of the Company and its share capital 61 Glossary 169 4.1 Legal Information on the Company 62 G 4.2 Share Capital 62 4.3 Shareholder structure 64 4.4 Share Classes and Major Shareholders 64 4.5 General Meeting of Shareholders and Voting Rights 69 4.6 Anti-Takeover Provisions 70 4.7 Obligations of Shareholders and Members of the Managing Board to Disclose Holdings 70 4.8 Short Positions 71 4.9 Market Abuse Regime 72 4.10 Transparency Directive 72 4.11 Dutch Financial Reporting Supervision Act 73 4.12 Dividends and Other Distributions 73 4.13 Financial Calendar 74 - 2015 Registration document 2015 Registration Document including the Annual Financial Report Euronext N.V. -

NYSE Euronext and APX to Establish NYSE Bluetm, a Joint Venture Targeting Global Environmental Markets

NYSE Euronext and APX to Establish NYSE BlueTM, a Joint Venture Targeting Global Environmental Markets • NYSE Euronext will contribute its ownership in BlueNext in return for a majority interest in the joint venture; • APX, a leading provider of operational infrastructure and services for the environmental and energy markets, will contribute its business in return for a minority interest in the venture; • NYSE Blue will focus on environmental and sustainable energy initiatives, and will further NYSE Euronext’s efforts to increase its presence in environmental markets globally while attracting new partners and customers. New York, September 7, 2010 -- NYSE Euronext (NYX) today announced plans to create NYSE BlueTM, a joint venture that will focus exclusively on environmental and sustainable energy markets. NYSE Blue will include NYSE Euronext’s existing investment in BlueNext, the world’s leading spot market in carbon credits, and APX, Inc., a leading provider of regulatory infrastructure and services for the environmental and sustainable energy markets. NYSE Euronext will be a majority owner of NYSE Blue and will consolidate its results. Shareholders of APX, which include Goldman Sachs, MissionPoint Capital Partners, and ONSET Ventures, will take a minority stake in NYSE Blue in return for their shares in APX. Subject to customary closing conditions, including APX shareholder approval and regulatory approvals, the APX transaction is expected to close by the end of 2010. NYSE Blue will provide a broad offering of services and solutions including integrated pre-trade and post-trade platforms, environmental registry services, a front-end solution for accessing the markets and managing environmental portfolios, environmental markets reference data, and the BlueNext trading platform. -

Deriving the Economic Impact of Derivatives

Deriving the Economic Impact of Derivatives Growth Through Risk Management March 2014 Deriving the Economic Impact of Derivatives Growth Through Risk Management Apanard (Penny) Prabha, Keith Savard, and Heather Wickramarachi Research Support Stephen Lin, Donald Markwardt, and Nan Zhang Project Directors Ross DeVol and Perry Wong March 2014 ACKNOWLEDGMENTS This project evolved from discussions with various stakeholders of the Milken Institute who encouraged us to examine derivatives markets in the aftermath of the financial crisis and Great Recession. It was made possible through the support of the CME Group. The views expressed in the report, however, are solely those of the Milken Institute. The Milken Institute would like to give special thanks to the research department of the CME Group for their valuable suggestions, feedback, and overall leadership throughout the research process. The authors appreciate the indispensable efforts of Milken Institute Managing Director Mindy Silverstein in securing the resources required to convert a methodological outline into a final product. Additionally, we appreciate the encouragement provided by Milken Institute CEO Michael Klowden in this undertaking. The Milken Institute Research team is grateful for the advice, counsel, and expertise provided by reviewers Richard Sandor, chairman and CEO of Environmental Financial Products LLC; Ross Levine, Willis H. Booth Chair in Banking and Finance at the Haas School of Business, University of California at Berkeley; and James Barth, the Lowder Eminent Scholar in Finance at Auburn University. All are Senior Fellows of the Milken Institute. Richard Sandor is a true financial innovator known as the “father of financial futures.” Ross Levine is among the most highly regarded researchers in the operations of financial systems and functioning of the economy. -

Evidence from Phase II of the European Emission Trading Scheme by Wilfried Rickels, Dennis Görlich, Gerrit Oberst, Sonja Peterson

Carbon Price Dynamics – Evidence from Phase II of the European Emission Trading Scheme by Wilfried Rickels, Dennis Görlich, Gerrit Oberst, Sonja Peterson No. 1804| November 2012 Kiel Institute for the World Economy, Hindenburgufer 66, 24105 Kiel, Germany Kiel Working Paper No. 1804 | November 2012 Explaining European Emission Allowance Price Dynamics: Evidence from Phase II Wilfried Rickels, Dennis Görlich, Gerrit Oberst, Sonja Peterson In this paper we empirically investigate potential determinants of allowance (EUA) price dynamics in the European Union Emission Trading Scheme (EU ETS) during Phase II. In contrast to previous papers, we analyze a significantly longer time series, place particular emphasis on the importance of price variable selection, and include an extensive data of renewable energy feed-in in Europe. We show (i) that results are extremely sensitive to choosing different price series of potential determinants, such as coal and gas prices, (ii) that EUA price dynamics are only marginally influenced by renewable energy provision in Europe, and iii) that EUA prices currently do not reflect marginal abatement costs across Europe. We conclude that the expectation of a more mature allowance market in Phase II cannot be confirmed. Keywords: Carbon emission trading, EU ETS, Carbon price influence factors, Fuel switching JEL classification: C22, G14, Q54 Wilfried Rickels Gerrit Oberst Kiel Institute for the World Economy Friedrich-Alexander Universität Nürnberg- 24105 Kiel, Germany Erlangen 90403 Nürnberg, Germany E-mail: [email protected] E-mail: [email protected] Dennis Görlich Sonja Peterson Kiel Institute for the World Economy Kiel Institute for the World Economy 24105 Kiel, Germany 24105 Kiel, Germany E-mail: [email protected] E-mail: [email protected] ____________________________________ The responsibility for the contents of the working papers rests with the author, not the Institute. -

Listing Fees for the NYSE Euronext's European Markets Comprise

Listing fees for the NYSE Euronext’s European markets comprise admission fees paid by issuers to list securities on the cash market, annual fees paid by companies whose financial instruments are listed on the cash market, and corporate activity and other fees, consisting primarily of fees charged by Euronext Paris and Euronext Lisbon for centralizing shares in IPOs and tender offers. Revenues from annual listing fees relate to the number of shares outstanding and the market capitalization of the listed company. In general, Euronext Paris, Euronext Amsterdam, Euronext Brussels and Euronext Lisbon have adopted a common set of listing fees. Under the harmonized fee book, domestic issuers (i.e., those from France, the Netherlands, Belgium and Portugal) pay admission fees to list their securities based on the market capitalization of the respective issuer. Subsequent listings of securities receive a 50% discount on admission fees. Non-domestic companies listing in connection with raising capital are charged admission and annual fees on a similar basis, although they are charged lower maximum admission fees and annual fees. Euronext Paris and Euronext Lisbon also charge centralization fees for collecting and allocating retail investor orders in IPOs and tender offers. The revenue the NYSE Euronext derives from listing fees is primarily dependent on the number and size of new company listings as well as the level of other corporate-related activity of existing listed issuers. The number and size of new company listings and other corporate-related activity in any period depend primarily on factors outside of the NYSE Euronext’s control, including general economic conditions in Europe and the United States (in particular, stock market conditions) and the success of competing stock exchanges in attracting and retaining listed companies. -

Working Papers in Responsible Banking & Finance

Liquidity and Market Working efficiency: European Papers in Evidence from the World’s Largest Carbon Exchange Responsible Banking & By Gbenga Ibikunle, Andros Gregoriou, Andreas G. F. Finance Hoepner and Mark Rhodes Abstract: We apply Chordia et al.’s (2008) conception of short-horizon return predictability as inverse indicator of market efficiency to the analysis of instruments on the world’s largest carbon exchange, ICE’s ECX. We find strong relationship between liquidity and market efficiency such that when spreads narrow, return predictability diminishes. This is more pronounced for the highest WP Nº 12-004 trading carbon futures and during periods of low liquidity. Since the start of trading in the Kyoto commitment period th of the EU Emissions Trading Scheme (EU-ETS) prices 4 Quarter 2012 continuously moved nearer to unity with random walk benchmarks, and this improves from year to year. Overall, our findings suggest trading quality in the EU-ETS has improved markedly and matures over the 2008-2011 compliance years. These findings are significant for global climate change policy. Liquidity and Market efficiency: European Evidence from the World’s Largest Carbon Exchange Gbenga Ibikunle Corresponding Author University of Edinburgh Business School University of Edinburgh 29 Buccleuch Place Edinburgh, EH8 9JS [email protected] Tel: +44 (0) 1316515186 Andros Gregoriou Hull University Business School University of Hull Hull, HU6 7RX [email protected] Andreas G. F. Hoepner School of Management University of St. Andrews St Andrews, KY16 9RJ [email protected] Mark Rhodes Hull University Business School University of Hull Hull, HU6 7RX [email protected] 1 Liquidity and Market efficiency: European Evidence from the World’s Largest Carbon Exchange Abstract We apply Chordia et al.’s (2008) conception of short-horizon return predictability as inverse indicator of market efficiency to the analysis of instruments on the world’s largest carbon exchange, ICE’s ECX. -

Nyse Euronext Announces Fourth Quarter and Full-Year 2012 Financial Results

INVESTORS NYSE EURONEXT ANNOUNCES FOURTH QUARTER AND FULL-YEAR 2012 FINANCIAL RESULTS Released : 05 February 2013 February 5, 2013 -- Fourth Quarter GAAP Diluted EPS of $0.12 vs. $0.43 in Prior Year -- -- Non-GAAP Diluted EPS of $0.43 vs. $0.50 Excluding Merger Expenses, Exit Costs and Other Discrete Items -- -- Global Leader in IPOs in 2012 for Second Consecutive Year -- -- Announced Acquisition by ICE Presents Opportunity to Create Global Player and Risk Management Leader -- -- Separate Clearing Agreement with ICE Designed to Ease Transition for Clients -- -- $115 Million in Project 14 Savings Achieved in 2012 -- Financial and Operating Highlights1, 2 • Diluted EPS of $0.43, down from $0.50 in 4Q11 • Net revenue of $562 million, down 11%, including $4 million negative FX impact • Fixed operating expenses of $392 million, down 9% on a constant dollar / portfolio basis • Operating income of $170 million, down 20%, including $3 million negative FX impact • Repurchased 1.1 million shares at average price of $24.67 in 4Q12 and 17.0 million shares in FY 2012 • Board declares first quarter 2013 cash dividend of $0.30 per share 1 All comparisons versus 4Q11 unless otherwise stated. Excludes merger expenses, exit costs and other discrete items. 2 A full reconciliation of our non-GAAP results to our GAAP results is included in the attached tables. See also our statement on non- GAAP financial measures at the end of this earnings release. NEW YORK--(BUSINESS WIRE)--Feb. 5, 2013-- NYSE Euronext (NYX) today reported net income of $28 million, or $0.12 per diluted share, for the fourth quarter of 2012, compared to net income of $110 million, or $0.43 per diluted share, for the fourth quarter of 2011.