Srei Equipment Finance Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

India Capital Markets Experience

Dorsey’s Indian Capital Markets Capabilities March 2020 OVERVIEW Dorsey’s capital markets team has the practical wisdom and depth of experience necessary to help you succeed, even in the most challenging markets. Founded in 1912, Dorsey is an international firm with over 600 lawyers in 19 offices worldwide. Our involvement in Asia began in 1995. We now cover Asia from our offices in Hong Kong, Shanghai and Beijing. We collaborate across practice areas and across our international and U.S. offices to assemble the best team for our clients. Dorsey offers a full service capital markets practice in key domestic and international financial centers. Companies turn to Dorsey for all types of equity offerings, including IPOs, secondary offerings (including QIPs and OFSs) and debt offerings, including investment grade, high-yield and MTN programs. Our capital markets clients globally range from emerging companies, Fortune 500 seasoned issuers, and venture capital and private equity sponsors to the underwriting and advisory teams of investment banks. India has emerged as one of Dorsey’s most important international practice areas and we view India as a significant market for our clients, both in and outside of India. Dorsey has become a key player in the Indian market, working with major global and local investment banks and Indian companies on a range of international securities offerings. Dorsey is recognized for having a market-leading India capital markets practice, as well as ample international M&A and capital markets experience in the United States, Asia and Europe. Dorsey’s experience in Indian capital markets is deep and spans more than 15 years. -

PARALYZED ECONOMY? Restructure Your Investments Amid Gloomy Economy with Reduced Interest Rates

Outlook Money - Conclave pg 54 Interview: Prashant Kumar, Yes Bank pg 44 APRIL 2020, ` 50 OUTLOOKMONEY.COM C VID-19 PARALYZED ECONOMY? Restructure your investments amid gloomy economy with reduced interest rates 8 904150 800027 0 4 Contents April 2020 ■ Volume 19 ■ issue 4 pg 10 pg 10 pgpg 54 43 Cultivating OutlookOLM Conclave Money ConclaveReports and insights from the third Stalwartsedition of share the Outlook insights Moneyon India’s valour goalConclave to achieve a $5-trillion economy Investors can look out for stock Pick a definite recovery point 36 Management34 stock strategies Pick of Jubilant in the market scenario, FoodWorksHighlighting and the Crompton management Greaves strategies of considering India’s already ConsumerJUBL and ElectricalsCGCE slow economic growth 4038 Morningstar Morningstar InIn focus: focus: HDFC HDFC short short term term debt, debt, HDFC HDFC smallsmall cap cap fund fund and and Axis Axis long long term term equity equity Gold Markets 4658 Yes Yes Bank Bank c irisisnterview Real EstateInsuracne AT1Unfair bonds treatment write-off meted leaves out investors to the AT1 in a Mutual FundsCommodities shock,bondholders exposes in gaps the inresolution our rating scheme system 5266 My My Plan Plan COVID-19: DedicatedHow dedicated SIPs can SIPs help can bring bring financial financial Volatile Markets disciplinediscipline in in your your life lives Investors need to diversify and 6 Talk Back Regulars : 6 Talk Back restructure portfolios to stay invested Regulars : and sail through these choppy waters AjayColumnsAjayColumns Bagga, Bagga, SS Naren,Naren, :: Farzana Farzana SuriSuri CoverCover Design: Vinay VINAY D DOMINICOMinic HeadHead Office Office AB-10, AB-10, S.J. -

A. Semi-Annual Review

Date: February 22, 2016 PRESS RELEASE Semi-annual Review of Indices Mumbai: The Index Maintenance Sub-Committee has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 1, 2016 (close of March 31, 2016). A. Semi-Annual Review: 1) Nifty 50 Index The following scrips are being excluded: Sr. No. Scrip Name Symbol 1 Cairn India Ltd. CAIRN 2 Punjab National Bank PNB 3 Vedanta Ltd. VEDL The following scrips are being included: Sr. No. Scrip Name Symbol 1 Aurobindo Pharma Ltd. AUROPHARMA 2 Bharti Infratel Ltd. INFRATEL 3 Eicher Motors Ltd. EICHERMOT 4 Tata Motors Ltd. (DVR) * TATAMTRDVR * As per the decision of the Index Policy Committee, equity shares with differential voting rights shall be eligible to be included in the indices as an additional security subject to the fulfilment of eligibility criteria. On account of inclusion of Tata Motors Ltd. (DVR), the Nifty 50 index shall have 51 securities. 2) Nifty100 Liquid 15 Index The following scrips are being excluded: Sr. No. Scrip Name Symbol 1 Hero MotoCorp Ltd. HEROMOTOCO 2 Tech Mahindra Ltd. TECHM The following scrips are being included: Sr. No. Scrip Name Symbol 1 Aurobindo Pharma Ltd. AUROPHARMA 2 LIC Housing Finance Ltd. LICHSGFIN 1 3) Nifty Midcap Liquid 15 Index ** The following scrips are being excluded: Sr. No. Scrip Name Symbol 1 Bharat Electronics Ltd. BEL 2 Glenmark Pharmaceuticals Ltd. GLENMARK 3 Hindustan Petroleum Corporation Ltd. HINDPETRO 4 Power Finance Corporation Ltd. PFC 5 Rural Electrification Corporation Ltd. RECLTD 6 Tata Global Beverages Ltd. -

S.No. Broker Code Broker Name Contact Person Phone No. Mobile

Broker S.no. Broker Name Contact Person Phone No. Mobile No. Add 1 Add 2 Add 3 Pin Email Code [email protected]; RUCHIKA RAINA SINGH, 9899636606, 25, C BLOCK [email protected]; 011-45675504, 1 001 SPA CAPITAL ADVISORS LTD. VARUN KAUSHIK, 9873486360, COMMUNITY JANAK PURI NEW DELHI 110058 [email protected]; 45675588,45675528 SANJAY JAIN 9910234032 CENTRE [email protected]; [email protected]; HARISH 9999114500, SABHARWAL 5TH 97, NEHRU [email protected];aparnarazdan@ba 2 002 BAJAJ CAPITAL LTD. HARISH SABHARWAL 011-41693000 NEW DELHI 110019 9811121101 FLOOR, BAJAJ PLACE jajcapital.com HOUSE [email protected]; [email protected]; J. M. FINANCIAL SERVICES PRADYUMNA 022-30877349, PALM COURT, 4TH LINK ROAD [email protected]; 3 003 MUMBAI 400064 PVT LTD SATPATHY 30877000, 67617000 FLOOR, M WING MALAD WEST [email protected]; [email protected]; [email protected] 105-108, CONNAUGHT [email protected]; 011-61127438, 040- 9989836349, 19, BARAKHAMBA 4 004 KARVY STOCK BROKING LTD. B V R NAIDU ARUNACHAL PLACE, NEW 110001 [email protected]; [email protected]; 44677536 9177401508 ROAD BUILDING DELHI [email protected] R. R. FINANCIAL RAJEEV SAXENA, S K 47 M M ROAD, RANI [email protected]; [email protected]; 5 005 011-23636362-63 9717553830 JHANDEWALAN NEW DELHI 110055 CONSULTANTS LTD. SINGH JHANSI MARG [email protected] [email protected]; HSBC SECURITIES AND 52/60 M. G. ROAD [email protected]; 6 006 SHWETANK DEV 022-40854280 9811374741 MUMBAI 400001 CAPITAL MARKETS (I) P LTD FORT [email protected]; [email protected] MR. -

Factsheet Jan 2014.Indd

Factsheet January 2014 Strengthen your portfolio with Religare Invesco. Equity Funds Debt Funds Religare Invesco Tax Plan Religare Invesco Liquid Fund Religare Invesco PSU Equity Fund Religare Invesco Ultra Short Term Fund Religare Invesco Contra Fund Religare Invesco Short Term Fund Religare Invesco Mid Cap Fund Religare Invesco Credit Opportunities Fund Religare Invesco Arbitrage Fund Religare Invesco Medium Term Bond Fund Religare Invesco Growth Fund Religare Invesco Active Income Fund Religare Invesco Equity Fund Religare Invesco Bank Debt Fund Religare Invesco Overnight Fund Religare Invesco Banking Fund Religare Invesco Gilt Fund Religare Invesco Business Leaders Fund Religare Invesco Infrastructure Fund Fund of Funds Religare Invesco Mid N Small Cap Fund Religare Invesco Gold Fund Hybrid Funds Exchange Traded Funds Religare Invesco Monthly Income Plan (MIP) Plus Religare Invesco Gold Exchange Traded Fund Religare Invesco Monthly Income Plan Religare Invesco Nifty Exchange Traded Fund Average Assets Under Management for the quarter ending December 2013: `13,706.16 Crores 1 Performance of Schemes Scheme / Benchmark NAV as on Dec. 31, 2012 - Dec. 30, 2011 - Dec. 31, 2010 - Since Inception Dec. 31, 2013 Dec. 31, 2013 Dec. 31, 2012 Dec. 30, 2011 (CAGR ) Current Value (`) (Absolute ) (Absolute ) (Absolute ) of `10,000 Fund Manager : Sujoy Das Religare Invesco Short Term Fund 1663.5623 6.57% 10.76% 9.60% 7.79% 16,636 Religare Invesco Short Term Fund - Plan B 1657.2822 6.22% 10.13% 9.13% 7.73% 16,573 CRISIL Short Term Bond Fund Index - -

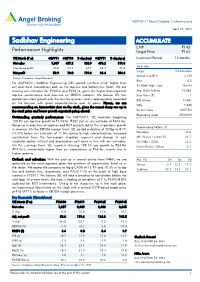

Sadbhav Engineering a CCUMULATE CMP `143 Performance Highlights Target Price `161

4QFY2011 Result Update | Infrastructure April 23, 2011 Sadbhav Engineering A CCUMULATE CMP `143 Performance Highlights Target Price `161 Y/E March (` cr) 4QFY11 4QFY10 % chg (yoy) 3QFY11 % chg (qoq) Investment Period 12 Months Net sales 1,047 457.2 128.9 476.2 119.8 Stock Info Operating profit 90.8 54.4 67.1 52.9 71.8 Sector Infrastructure Net profit 53.9 18.0 199.3 26.4 104.4 Market Cap (` cr) 2,140 Source: Company, Angel Research Beta 0.5 For 4QFY2011, Sadbhav Engineering (SEL) posted numbers much higher than our and street expectations both on the top-line and bottom-line fronts. We are 52 Week High / Low 164/94 revising our estimates for FY2012 and FY2013, given the higher-than-expected Avg. Daily Volume 19,468 top-line performance and pressure on EBITDA margins. We believe SEL has Face Value (` ) 1 posted consistent growth over the last few quarters and is appropriately rewarded BSE Sensex 19,602 on the bourses with great outperformance over its peers. Hence, we are Nifty 5,885 recommending an Accumulate view on the stock, given the recent sharp run up in the stock price and lower growth expected going ahead. Reuters Code SADE.BO Bloomberg Code SADE@IN Outstanding quarterly performance: For 4QFY2011, SEL reported staggering 128.9% yoy top-line growth to `1,047cr (`457.2cr) vs. our estimate of `603.6cr. Ramp-up in execution of captive road BOT projects led to this stupendous growth Shareholding Pattern (%) in revenue. On the EBITDA margin front, SEL posted a decline of 320bp to 8.7% (11.9%) below our estimates of 11.5%, owing to high subcontracting, increased Promoters 47.6 contribution from the low-margin irrigation segment and change in cost MF / Banks / Indian Fls 26.7 escalation policy. -

Inventure Growth NRI FORM.Pmd

C K THIS BOOK CONSISTS OF 16 PAGES INCLUDING FORM 2A, PLEASE ENSURE THAT YOU GET ALL PAGES 100% BOOK BID CUM APPLICATION FORM BUILT ISSUE FOR ELIGIBLE NRIs, APPLYING ON INVENTURE GROWTH & SECURITIES LIMITED A REPATRIATION BASIS Our Company was incorporated at Mumbai on June 22, 1995 as “Inventure Growth & Securities Limited” under the Companies Act, 1956, with registration number 11-89838 of 1995. The corporate identification number of our Company is BID/ISSUE OPENS ON : WEDNESDAY, JULY 20, 2011 U65990MH1995PLC089838. Registered Office: Viraj Towers, 201, 2nd Floor, Near Landmark, Western Express Highway, Andheri BID/ISSUE CLOSES ON : FRIDAY, JULY 22, 2011 (E), Mumbai – 400 069, Maharashtra, India. Website: www.inventuregrowth.com; Company Secretary and Compliance Officer: Ms. Bhavi Gandhi; Tel No.: +91 22 3954 8500; Fax No.: +91 22 4075 1535; E-mail:[email protected]. For further details of our Bid cum Application Company and changes in our Registered Office, please refer to the chapter titled ‘History and Certain Corporate Matters’ beginning Form No. on page 131 of the Red Herring Prospectus. (PLEASE READ THE INSTRUCTIONS CAREFULLY BEFORE FILLING THIS FORM) Date : ________________, 2011 PUBLIC ISSUE OF 70,00,000 EQUITY SHARES OF ` 10 EACH OF INVENTURE GROWTH & SECURITIES LIMITED (‘IGSL’ OR THE ‘COMPANY’ OR THE ‘ISSUER’) FOR CASH AT A PRICE OF ` [] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF ` [] PER EQUITY SHARE) AGGREGATING TO ` [] LAKHS (THE ‘ISSUE’). THE ISSUE WILL CONSTITUTE 33.33% OF THE FULLY DILUTED POST ISSUE PAID UP CAPITAL OF THE COMPANY. Capitalised terms used and not specifically defined shall have the same meaning assigned to them in the Red Herring Prospectus (“RHP”). -

Newspaper Publication

GSTIN : O8AAACV6864A1ZD = GQ Un ited Wiay Solvex Corporate I d e n t i f i c a t i o n Number : L15142RJ1987PLC004232 Regd. O f f i c e : Bhagwati S a d a n , S.D. Marg, A L W A R - 301001 Factory : Old Industrial Area, I t a r a n a Road, ALWAR - 3 0 1 0 0 1 Date: September 9, 2020 To, Bombay Stock Exchange Limited Corporate Relationship Department, 1* Floor, New Trading Ring, Rotunda Building, P.J. Towers, Dalal Street, Mumbai-400 001. Ref: Company Code - 531069 Sub: Publication of Notice of Board Meeting. Dear Sir/Madam, In compliance of p r o v i s i o n s of Regulation 4 7 of the S E B I (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are e n c l o s i n g h e r e w i t h t h e newspaper copies of the Mint ( E n g l i s h Daily) and Business R e m e d i e s (Hindi Daily) dated 8” September, 2020, in which notices for i n t i m a t i o n of Board Meeting scheduled to be h e l d on Tuesday the 1 5 " day of September, 2020, inter a l i a , t o consider and approve t h e Un-audited S t a n d a l o n e and Consolidated Financial Results of t h e Company for the quarter ended June 30, 2 0 2 0 , have b e e n p u b l i s h e d . -

Leveraging the Fintech Opportunities in India

January 2017 ` ` ` ` Leveraging ` ` ` the FinTech Opportunities in India Financial Foresights Editorial Team Contents Jyoti Vij [email protected] 1. PREFACE . 2 Anshuman Khanna 2. INDUSTRY INSIGHTS . 3 [email protected] n Leveraging FinTech: Digital Payments Gaining Ground in India . 5 Bhaskar Som, Country Head, India Ratings & Research Advisory Services Supriya Bagrawat Soumyajit Niyogi, Associate Director - Credit and Market Research, [email protected] India Ratings & Research Advisory Services n FinTechs in India: Drivers of Digital Banking? . 8 Amit Kumar Tripathi Dr. A. S. Ramasastri, Director, IDBRT [email protected] n The FinTech Revolution - Transforming Financial Services . 11 Kumar Abhishek, Founder & CEO, ToneTag n The New Sector on the Block. 13 About FICCI Mukesh Bubna, Founder & CEO, Monexo n Blockchain and FinTech: A Debate and a Promise. 15 FICCI is the voice of India's Varun Dua, Co-founder & CEO, Coverfox.com Devendra Rane, CTO and Co-founder, Coverfox.com business and industry. n In 2017, Can FinTech Make Everything About Money Easy? . 18 Established in 1927, it is Rajat Gandhi, Founder & CEO, Faircent.com India's oldest and largest n Path to the Ultimate FinTech Offering . 20 apex business organization. Jitendra Gupta, MD/Founder, Citrus Payment FICCI is in the forefront in Anurag Pandey, AVP, Product & Strategy, PayU India articulating the views and n The Evolving FinTech Landscape in India . 23 Gaurav Hinduja, Co-Founder & Managing Director, Capital Float concerns of industry. It n Taking on the Indian Financial Goliath - The story of the FinTech David . 27 services its members from the Harsh Vardhan Lunia, Co-Founder & CEO, Lendingkart Technologies Pvt. -

Idbi Bank Limited

Private & Confidential – Not for Circulation THIS DISCLOSURE DOCUMENT HAS BEEN PREPARED IN CONFORMITY WITH FORM PAS-4 PRESCRIBED UNDER SECTION 42 OF COMPANIES ACT, 2013 AND RULE 14(1) OF COMPANIES (PROSPECTUS AND ALLOTMENT OF SECURITIES) RULES, 2014 AND SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE AND LISTING OF DEBT SECURITIES) REGULATIONS, 2008, AS AMENDED VIDE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE AND LISTING OF DEBT SECURITIES) (AMENDMENT) REGULATIONS, 2012 ISSUED VIDE CIRCULAR NO. LAD-NRO/GN/2012-13/19/5392 DATED OCTOBER 12, 2012 & SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE AND LISTING OF DEBT SECURITIES) (AMENDMENT) REGULATIONS, 2014 ISSUED VIDE CIRCULAR NO. LAD-NRO/GN/2013-14/43/207 DATED JANUARY 31, 2014 IDBI BANK LIMITED A company incorporated and registered under the Companies Act, 1956 (1 of 1956) and a banking company within the meaning of Section 5 (c) of the Banking Regulation Act, 1949 (10 of 1949) Regd.Office: IDBI Tower, WTC Complex, Cuffe Parade, Mumbai 400 005 Tel: (022) 66553355/22189111 Fax: (022) 2218 8137 Website: www.idbi.com Disclosure Document for 10,000 Unsecured Redeemable Non-Convertible Long Term Bonds (in the nature of debentures) of `10,00,000 each for cash at par, amounting to `1,000 crore on private placement basis General Risk: For taking an investment decision, investors must rely on their own examination of the Issuer and the Offer including the risks involved. The Bonds have not been recommended or approved by the Securities and Exchange Board of India (SEBI) nor does SEBI guarantee the accuracy or adequacy of this Disclosure Document. -

Barclays Hurun India Rich List 2018

Rank Name Wealth INR crore Company Name Industry Residence 1 Mukesh Ambani 371,000 Reliance Industries Diversified Mumbai 2 SP Hinduja & family 159,000 Hinduja Diversified London 3 LN Mittal & family 114,500 ArcelorMittal Metals & Mining London 4 Azim Premji 96,100 Wipro Software & Services Bengaluru 5 Dilip Shanghvi 89,700 Sun Pharmaceutical Industries Pharmaceuticals Mumbai 6 Uday Kotak 78,600 Kotak Mahindra Bank Financial Services Mumbai 7 Cyrus S Poonawalla 73,000 Serum Institute of India Pharmaceuticals Pune 8 Gautam Adani & family 71,200 Adani Enterprises Diversified Ahmedabad 9 Cyrus Pallonji Mistry 69,400 Shapoorji Pallonji Investments Mumbai 9 Shapoor Pallonji Mistry 69,400 Shapoorji Pallonji Investments Monaco 11 Acharya Balkrishna 57,000 Patanjali Ayurved FMCG Haridwar 12 Nusli Wadia & family 56,100 Britannia Industries FMCG Mumbai 13 Rahul Bajaj & family 55,300 Bajaj Auto Automobile & Auto Components Pune 14 Sri Prakash Lohia 46,700 Indorama Chemicals & Petrochemicals London 15 Kumar Mangalam Birla 46,300 Aditya Birla Diversified Mumbai 15 Radhakishan Damani 46,300 Avenue Supermarts Retailing Mumbai 17 Adi Godrej 44,600 Godrej Consumer Durables Mumbai 17 Jamshyd Godrej 44,600 Godrej Consumer Durables Mumbai 17 Nadir Godrej 44,600 Godrej Consumer Durables Mumbai 17 Rishad Naoroji 44,600 Godrej Consumer Durables Mumbai 17 Smita V Crishna 44,600 Godrej Consumer Durables Mumbai 22 Benu Gopal Bangur & family 41,100 Shree Cement Cement & Cement Products Kolkata 23 Yusuff Ali MA 39,200 Lulu Retailing Abu Dhabi 24 Ajay Piramal 38,900 -

Annual Report 2015-2016

27th Annual Report 2015-2016 ShapingShaping thethe Nation’sNation’s Growth!Growth! SADBHAV ENGINEERING LIMITED There’s never been a better time to Faster | Stronger | Smarter CONTENTS 01 About us 04 Corporate Information 06 Chairman’s Message 09 Notice 18 Directors’ Report 39 Report on Corporate Governance 49 Management Discussion & Analysis 52 Independent Auditor’s Report 56 Financial Statements 84 Consolidated Financial Statements Salient Features of Financial Statements of 131 Subsidiary/Associates/Joint Ventures 135 Attendance Slip & Proxy form Financial Highlights SADBHAV ENGINEERING LIMITED Annual Report 2015-2016 “ Commitment is what transforms a promise into reality.” - Abraham Lincoln Sadbhav Engineering Limited (SEL) is committed to commence a new era in the Indian Infrastructure industry with its landmark infrastructure projects enhancing the quality of life for people across the country. SEL’s pledge to perform better and for the betterment of the nation is reflected in all its endeavours. Strongly adhering to the ‘Make in India’ oath, the company is taking a proactive approach towards quality upgradation, business diversification and environment protection. Synonymous with ethical business practices, SEL has earned a repute of one of the most trusted companies in the industry. With its strong, determined and multi-disciplinary teams capable of dealing with any challenge, SEL always achieves the desired results. The Objective : Being FASTER to foster growth. Adhering to the values of integrity, stability & quality and focusing on the strategic expansion and diversification plans, SEL is determined to accelerate its development. Increasing client satisfaction & timely completion of projects is one of the main objectives of SEL. The Vision : Remain STRONGER to strengthen commitments.